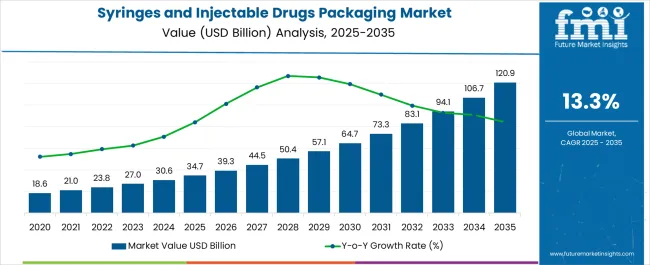

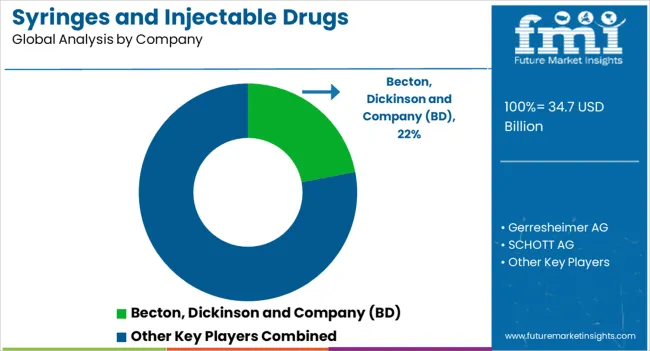

The syringes and injectable drugs packaging market is estimated to be valued at USD 34.7 billion in 2025 and is projected to reach USD 120.9 billion by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period.

The market maturity curve shows early adoption during 2020–2024, with growth from USD 18.6 billion in 2020 to USD 30.6 billion in 2024, driven by rising demand for safe injectable drug delivery and expanding pharmaceutical production. By 2025, adoption enters the scaling phase as manufacturers increase production capacity, streamline supply chains, and standardize packaging solutions. Between 2025–2030, the market grows from USD 34.7 billion to USD 64.7 billion, reflecting widespread adoption across global markets. During the 2030–2035 consolidation phase, the market expands from USD 73.3 billion in 2030 to USD 120.9 billion by 2035, as leading suppliers capture a larger share of demand and optimize distribution networks.

Growth moderates as procurement stabilizes across hospitals, clinics, and pharmaceutical companies. The adoption lifecycle reflects a clear progression: early adoption (2020–2024) with experimental and pilot deployments, scaling (2025–2030) with rapid market expansion, and consolidation (2030–2035) where established players dominate, logistics and supply chains are refined, and predictable demand patterns support operational efficiency.

| Metric | Value |

|---|---|

| Syringes and Injectable Drugs Packaging Market Estimated Value in (2025 E) | USD 34.7 billion |

| Syringes and Injectable Drugs Packaging Market Forecast Value in (2035 F) | USD 120.9 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

Seasonality in the syringes and injectable drugs packaging market is influenced by healthcare demand cycles, vaccination campaigns, and pharmaceutical production schedules. Data shows that Q3 and Q4 typically account for 35–40% of annual procurement, coinciding with peak vaccination drives, seasonal disease outbreaks, and year-end hospital inventory replenishments.

Conversely, Q1 often records 10–15% lower activity, as hospitals and clinics adjust budgets and stock levels after year-end. Short-term spikes of 10–15% above baseline demand are observed during emergency health campaigns or sudden outbreaks, requiring suppliers to synchronize production, packaging, and distribution to ensure uninterrupted supply across healthcare facilities. Cyclicality reflects broader investment and capacity expansion trends in pharmaceutical packaging. Facilities producing syringes and injectable drug packaging generally follow 5–7 year upgrade or expansion cycles, generating periodic surges in demand that can increase annual market size by USD 5–10 billion. Regulatory changes, introduction of new injectable therapies, or sudden global health events can temporarily accelerate procurement, producing short-term spikes of 5–10% above projected growth. These cycles overlay the underlying CAGR of 13.3%, creating alternating periods of rapid expansion and moderate stabilization, allowing suppliers to optimize production, inventory, and distribution planning efficiently.

The market is witnessing significant expansion, driven by the rising demand for advanced drug delivery solutions and the increasing prevalence of chronic diseases requiring injectable therapies. The shift toward prefilled and safety syringes, combined with stringent regulatory guidelines on drug packaging integrity, has encouraged innovation in both product design and materials used.

Growth is further supported by the adoption of injectable biologics and biosimilars, which require specialized packaging to maintain product stability and sterility. The industry is also benefiting from the rising number of vaccination programs, as well as the growing emphasis on single-use and tamper-evident packaging to reduce contamination risks.

Advances in automation and smart manufacturing technologies are enabling high-volume, precision production, reducing costs and improving quality consistency As healthcare infrastructure continues to expand globally, coupled with the increasing acceptance of home-based treatments, demand for safe, efficient, and compliant syringes and packaging solutions is expected to strengthen, ensuring sustained market growth in the coming years.

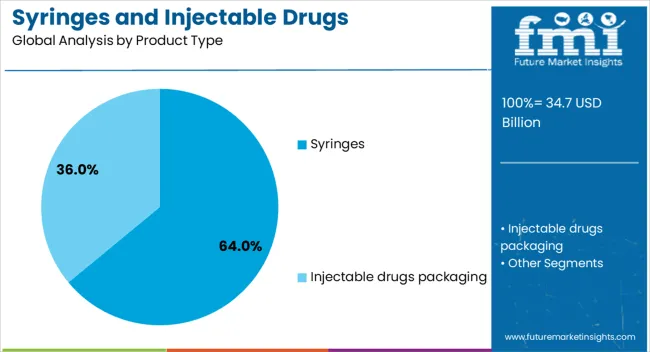

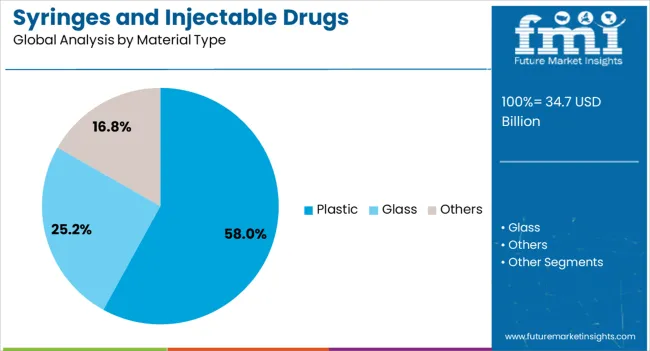

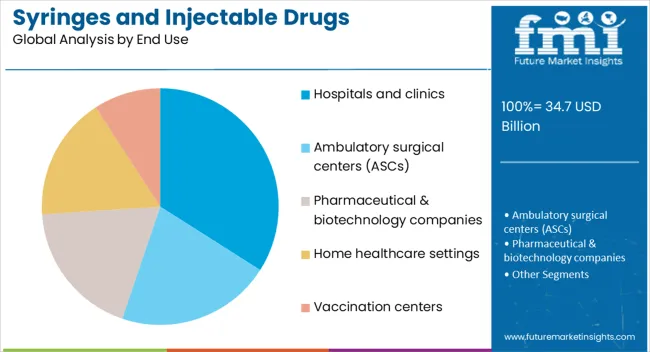

The syringes and injectable drugs packaging market is segmented by product type, material type, end use, and geographic regions. By product type, syringes and injectable drugs packaging market is divided into syringes and injectable drugs packaging. In terms of material type, syringes and injectable drugs packaging market is classified into plastic, glass, and others. Based on end use, syringes and injectable drugs packaging market is segmented into hospitals and clinics, ambulatory surgical centers (ASCs), pharmaceutical & biotechnology companies, home healthcare settings, and vaccination centers. Regionally, the syringes and injectable drugs packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The syringes segment is projected to account for 64% of the syringes and injectable drugs packaging market revenue share in 2025, making it the dominant product type. This leadership position has been driven by the widespread use of syringes in vaccination, chronic disease management, and emergency medical care. The growing shift toward disposable and safety syringes, aimed at reducing the risk of needlestick injuries and cross-contamination, has further reinforced demand. The compatibility of syringes with a wide range of injectable formulations, including vaccines, biologics, and small molecule drugs, has enhanced their market presence. Technological advancements in syringe manufacturing, including precision molding and integrated safety mechanisms, have improved reliability and ease of use. Additionally, increased adoption in both hospital and homecare settings, coupled with large-scale government immunization programs, has solidified the segment’s position as the preferred choice for injectable drug delivery.

The plastic material type segment is anticipated to hold 58% of the market revenue share in 2025, maintaining its dominance over alternative materials. This growth is supported by the versatility, durability, and lightweight properties of plastic, making it ideal for mass production and global distribution. Plastics such as polypropylene and polyethylene have been preferred due to their chemical resistance, cost efficiency, and compatibility with sterilization processes. The ability to mold plastics into complex shapes and integrate features such as tamper-evidence and safety locks has expanded their application range. Additionally, plastic packaging supports single-use formats, aligning with infection control protocols in healthcare facilities. Continuous innovation in medical-grade plastics that meet stringent regulatory requirements, along with advancements in sustainable and recyclable materials, is further boosting adoption The scalability and cost advantages of plastic production ensure its continued prominence in the packaging of syringes and injectable drugs.

The hospitals and clinics segment is expected to represent 34% of the market revenue share in 2025, positioning it as the leading end-use category. This dominance is attributed to the high patient turnover and consistent demand for injectable therapies in these healthcare facilities. Hospitals and clinics require large volumes of sterile, ready-to-use syringes and secure packaging solutions to support treatments, surgeries, and emergency care. The segment’s growth is reinforced by the ongoing expansion of healthcare infrastructure, increased investment in medical equipment, and the rising number of in-patient and out-patient services. Compliance with strict regulatory standards for drug administration and infection control has encouraged the adoption of advanced syringe and packaging technologies in these settings. Additionally, the integration of safety-engineered devices in hospital protocols has enhanced the demand for specialized packaging that ensures both product integrity and patient safety This strong and sustained demand base is expected to maintain the segment’s leadership position over the forecast period.

The syringes and injectable drugs packaging market is growing due to demand for prefilled syringes, auto-injectors, and safe administration in hospitals and home-care settings. Key players such as BD, Gerresheimer, Schott AG, Nipro Corporation, and West Pharmaceutical Services drive growth through innovation, regulatory compliance, and global distribution. Adoption is highest in North America and Europe, with Asia-Pacific emerging rapidly. Market growth is fueled by patient safety, dosage accuracy, sterility, and convenience. Until alternative solutions reduce cost and contamination risk, this segment remains high-value and specialized.

Hospitals and clinics are major consumers of syringes and injectable drug packaging, including prefilled syringes, vials, and ampoules. Prefilled syringes enhance patient safety, reduce medication errors, and improve workflow efficiency. Companies like BD (Becton Dickinson) and Gerresheimer provide sterile, ready-to-use packaging for vaccines, biologics, and high-value injectable drugs. Adoption is highest in North America and Europe due to regulatory compliance, strict sterility standards, and advanced healthcare infrastructure. Hospitals prioritize packaging that ensures dosage accuracy, reduces contamination risk, and simplifies administration. Asia-Pacific is gradually increasing adoption, especially for vaccination programs and large-scale immunization campaigns. Challenges include cold-chain logistics for temperature-sensitive injectables, material compatibility, and biohazard disposal management. Until alternative delivery systems or reusable solutions mature, hospitals and clinics will continue to rely on high-quality prefilled syringes and vials for safe and efficient drug administration.

Prefilled syringes and auto-injectors are driving growth by providing convenience, sterility, and reduced handling errors in both hospital and home-care settings. Companies like West Pharmaceutical Services and Nipro Corporation specialize in advanced polymer and glass packaging to maintain stability and prevent contamination. These devices are essential for biologics, vaccines, and high-value injectable medications. The market is strongest in North America and Europe due to high patient awareness, established regulatory frameworks, and reimbursement support, while Asia-Pacific is emerging as vaccination and chronic disease treatment expand. Key challenges include ensuring material compatibility with drugs, maintaining sterility during transport, and achieving regulatory approvals. Until innovative designs lower manufacturing costs and improve patient usability, prefilled syringes and auto-injectors will remain premium solutions, providing healthcare providers and patients with reliable, safe, and efficient injectable drug administration.

Regulatory compliance and sterility are critical in the syringes and injectable packaging market. North America follows FDA and USP guidelines, while Europe adheres to EMA and ISO standards. Companies like Schott AG and BD maintain rigorous quality control, ensuring that glass vials, prefilled syringes, and polymer components meet sterility, stability, and compatibility standards. Emerging markets are increasingly adopting these regulations, though implementation may vary. Regulatory compliance affects material selection, sterilization methods, and labeling requirements. Packaging must also prevent contamination, maintain cold-chain integrity for temperature-sensitive injectables, and be compatible with auto-injector devices. Until global harmonization improves, manufacturers must navigate diverse regional regulations while ensuring product safety. Companies with validated systems, robust testing, and certified production facilities gain a competitive edge and are more likely to secure contracts with pharmaceutical and healthcare clients.

Leading companies differentiate through innovative materials, prefilled syringe designs, and comprehensive packaging solutions. BD focuses on global prefilled syringe systems, Gerresheimer emphasizes glass and polymer vials, West Pharmaceutical Services provides advanced components for auto-injectors, and Nipro Corporation offers complete injectable packaging solutions. Strategies include partnerships with pharmaceutical manufacturers, integrated cold-chain logistics, and regulatory consulting services. Regional players often compete on cost but may lack the R&D and regulatory capabilities of multinationals. Companies invest in patient-centric designs, enhanced sterility, and automation compatibility to strengthen market positioning. Until alternative delivery systems or reusable packaging gain acceptance, established players maintain leadership through reliability, innovation, and global distribution networks, addressing both hospital and home-care markets for injectable drugs.

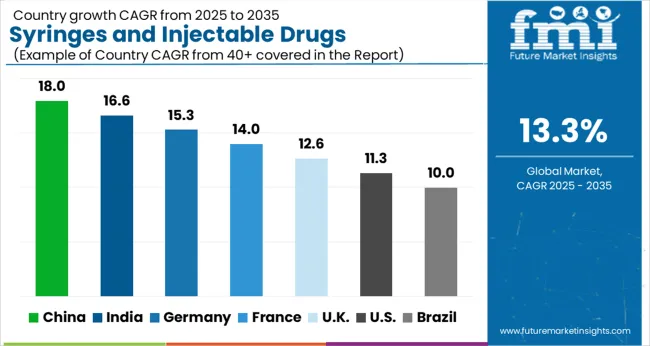

| Country | CAGR |

|---|---|

| China | 18.0% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14.0% |

| UK | 12.6% |

| USA | 11.3% |

| Brazil | 10.0% |

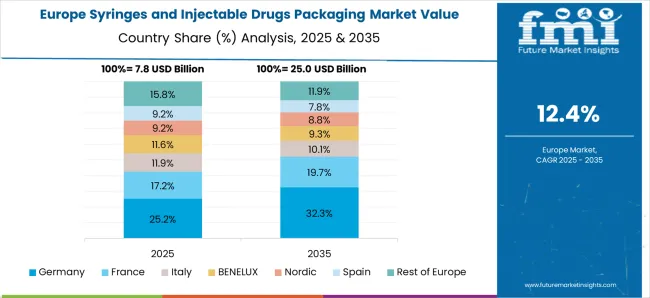

The global syringes and injectable drugs packaging market is projected to grow at a CAGR of 13.3% through 2035, supported by increasing demand across pharmaceutical, healthcare, and hospital applications. Among BRICS nations, China has been recorded with 18.0% growth, driven by large-scale production and deployment in sterile packaging and injectable drug delivery systems, while India has been observed at 16.6%, supported by rising utilization in hospitals, clinics, and pharmaceutical manufacturing. In the OECD region, Germany has been measured at 15.3%, where production and adoption for medical, hospital, and pharmaceutical packaging applications have been steadily maintained. The United Kingdom has been noted at 12.6%, reflecting consistent use in healthcare and pharmaceutical sectors, while the USA has been recorded at 11.3%, with production and utilization across injectable drug delivery and hospital applications being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The syringes and injectable drugs packaging market in China is growing at a CAGR of 18.0%, driven by rising demand for injectable drugs and the need for safe, sterile packaging solutions. Hospitals, clinics, and pharmaceutical manufacturers are increasing adoption of prefilled syringes, vials, and ampoules to ensure safety, reduce contamination risks, and maintain drug stability. Regulatory standards for drug packaging and increasing government healthcare spending support market expansion. The market benefits from a strong pharmaceutical manufacturing base and the growth of biologics and vaccines, which require specialized packaging. Efficient supply chains, advanced sterilization processes, and robust quality control measures are crucial to meet market demand. Growing awareness of patient safety and hygiene, along with rising healthcare infrastructure investment, further propels growth in China’s syringes and injectable drugs packaging market.

The syringes and injectable drugs packaging market in India is expanding at a CAGR of 16.6%, supported by increasing production and consumption of injectable drugs, vaccines, and biologics. Pharmaceutical companies are investing in prefilled syringes, vials, and ampoules to improve safety, accuracy, and shelf life. Hospitals, clinics, and vaccination programs are major end-users, creating steady demand. Regulatory authorities emphasize sterile, tamper-proof packaging to ensure patient safety. Growing government healthcare expenditure and focus on immunization programs increase the need for reliable injectable drug packaging. The market also benefits from investments in advanced sterilization and packaging equipment. Rising awareness of hygiene and safety standards among healthcare providers and patients further supports market growth. India’s pharmaceutical manufacturing capabilities position the syringes and injectable drugs packaging segment for continued expansion.

The syringes and injectable drugs packaging market in Germany is growing at a CAGR of 15.3%, driven by the pharmaceutical and healthcare sectors’ focus on patient safety and quality packaging. Hospitals, clinics, and pharmaceutical manufacturers increasingly adopt prefilled syringes, vials, and ampoules to reduce contamination risks and ensure accurate drug delivery. Strict regulatory requirements mandate sterile, tamper-evident, and high-quality packaging for injectable drugs, supporting market stability. Germany’s strong pharmaceutical manufacturing infrastructure and increasing production of vaccines and biologics enhance the demand for specialized packaging solutions. Manufacturers prioritize advanced sterilization, quality control, and secure transport to maintain product integrity. The combination of regulatory compliance, high healthcare standards, and growing injectable drug consumption drives consistent market growth in Germany.

The syringes and injectable drugs packaging market in the United Kingdom is expanding at a CAGR of 12.6%, supported by growing demand for injectable medications, vaccines, and biologics. Hospitals, clinics, and pharmaceutical companies are investing in prefilled syringes and tamper-proof packaging to enhance safety, prevent contamination, and ensure accurate dosing. Government healthcare initiatives, vaccination campaigns, and stringent regulatory requirements encourage adoption of high-quality injectable packaging solutions. Sterilization, quality control, and secure supply chains are critical factors in meeting market demand. Rising awareness among healthcare providers and patients about safe injection practices further drives growth. The combination of pharmaceutical production, healthcare spending, and focus on patient safety ensures steady expansion of the syringes and injectable drugs packaging market in the UK.

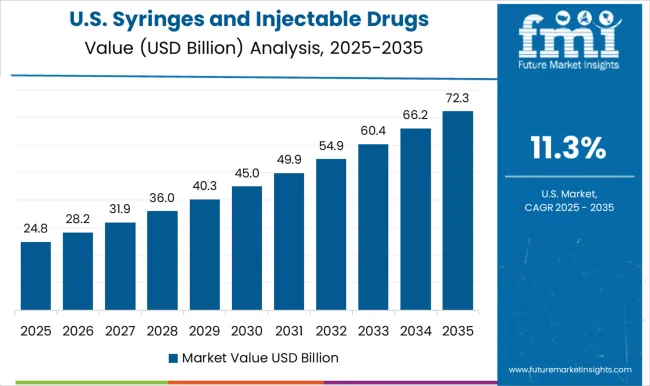

The syringes and injectable drugs packaging market in the United States is growing at a CAGR of 11.3%, driven by rising demand for injectable medications, vaccines, and biologics. Hospitals, clinics, and pharmaceutical manufacturers are adopting prefilled syringes, vials, and ampoules to ensure safety, reduce contamination risks, and improve dosing accuracy. Regulatory authorities emphasize sterile, tamper-evident packaging, supporting consistent market growth. Investments in advanced packaging machinery, sterilization processes, and quality control systems enhance operational efficiency. Expanding vaccination programs, biologics production, and growing healthcare infrastructure contribute to market expansion. Awareness of patient safety and hygiene standards among healthcare providers and consumers further drives adoption. The USA market continues to see steady growth as injectable drugs packaging remains critical for healthcare delivery and pharmaceutical operations.

The syringes and injectable drugs packaging market is a critical segment of the pharmaceutical industry, supporting the safe and effective delivery of injectable therapies. Growing demand for biologics, vaccines, and specialty injectable drugs, combined with stringent regulatory requirements for sterility and safety, has fueled market expansion. Packaging solutions focus on protecting drug integrity, preventing contamination, and enhancing patient convenience. Trends such as prefilled syringes, autoinjectors, and safety-engineered devices are reshaping the market landscape. Becton, Dickinson and Company (BD) is a global leader, known for its innovative syringe and injectable drug delivery systems with a strong emphasis on safety and compliance.

Gerresheimer AG specializes in high-quality glass and plastic packaging solutions for injectable drugs, serving pharmaceutical companies worldwide. SCHOTT AG provides advanced glass vials and prefillable syringes, combining reliability with precision manufacturing. West Pharmaceutical Services, Inc. offers a wide range of packaging components, including stoppers, seals, and delivery systems, enhancing drug stability and patient safety. Terumo Corporation and Nipro Corporation are prominent Asian players, providing integrated solutions from syringes to delivery devices, while Stevanato Group focuses on prefillable glass syringes and high-quality packaging for specialty drugs. The market growth is driven by increasing global demand for vaccines, biologics, and self-administered therapies, alongside innovations in prefilled and safety-engineered packaging. Companies are also prioritizing sustainability and advanced materials to reduce environmental impact while maintaining strict pharmaceutical standards, making this sector both vital and rapidly evolving in the healthcare supply chain.

| Item | Value |

|---|---|

| Quantitative Units | USD 34.7 billion |

| Product Type | Syringes and Injectable drugs packaging |

| Material Type | Plastic, Glass, and Others |

| End Use | Hospitals and clinics, Ambulatory surgical centers (ASCs), Pharmaceutical & biotechnology companies, Home healthcare settings, and Vaccination centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Becton, Dickinson and Company (BD), Gerresheimer AG, SCHOTT AG, West Pharmaceutical Services, Inc., Terumo Corporation, Nipro Corporation, Stevanato Group, and Other regional / local players |

| Additional Attributes | Dollar sales by type including prefilled syringes, vials, ampoules, and cartridges, application across hospitals, clinics, and pharmaceutical manufacturing, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for safe and convenient drug delivery, increasing injectable drug usage, and stringent regulatory requirements for packaging safety. |

The global syringes and injectable drugs packaging market is estimated to be valued at USD 34.7 billion in 2025.

The market size for the syringes and injectable drugs packaging market is projected to reach USD 120.9 billion by 2035.

The syringes and injectable drugs packaging market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in syringes and injectable drugs packaging market are syringes, _prefilled syringes, _conventional syringes, injectable drugs packaging, _vials, _ampoules, _cartridges and _bottles.

In terms of material type, plastic segment to command 58.0% share in the syringes and injectable drugs packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Syringes Market Analysis - Growth & Demand 2025 to 2035

BFS Syringes Market Analysis - Size & Growth Forecast 2025 to 2035

MENA Syringes & Cannula Market Size and Share Forecast Outlook 2025 to 2035

Hypodermic Syringes Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Hypodermic Syringes Market Share & Industry Leaders

Veterinary Syringes Market

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Latin America Hypodermic Syringes and Needles Market Analysis & Forecast by Type, End Users, and Region Through 2035

Retractable Needle Safety Syringes Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Olefin Polymers (COP) Polymer Syringes Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA