The cardiovascular needle market is projected to grow at a steady pace between 2025 and 2035, supported by an increase in cardiovascular procedures, a growing geriatric population, and technological advancements in surgical instruments.

Cardiovascular needles are essential tools used during open-heart surgeries, valve repairs, and coronary artery bypass grafting (CABG), where precision, durability, and safety are paramount. The demand for these specialized needles is further fueled by the rising prevalence of cardiovascular diseases (CVDs), which remain the leading cause of mortality worldwide.

Increasing investments in cardiac care infrastructure and improvements in suture material technologies are also contributing to market growth. Although the shift toward minimally invasive procedures present a potential challenge, the overall surgical volume and advancements in cardiovascular interventions ensure sustained demand for high-quality cardiovascular needles.

Key Market Metrics

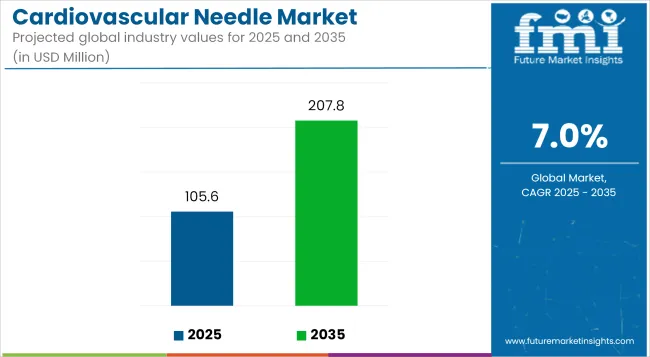

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 105.6 Million |

| Projected Market Size in 2035 | USD 207.8 Million |

| CAGR (2025 to 2035) | 7.0% |

In 2025, the cardiovascular needle market is estimated at USD 105.6 million, and it is projected to reach USD 207.8 million by 2035, growing at a CAGR of 7.0%. This growth reflects rising surgical volumes and the need for precision-driven cardiac tools across global healthcare systems.

North America is a leading market for cardiovascular needles, due to the presence of a well-established healthcare infrastructure, high occurrence of cardiac diseases, and extensive access to advanced surgical treatment facilities in the region. The USA is still the exclusionary regional growth leader despite robust innovation in cardiovascular devices and a healthy demand for durable surgical instruments in public and health system solutions.

In Europe, the demand for cardiovascular needles remains steady due to an aging population along with the increasing number of cardiac surgeries in countries such as Germany, France and the United Kingdom. The region has a rich foundation of cardiac care delivery systems, supportive healthcare reimbursement policies, and investments in less invasive cardiac surgical approaches that still require accurate needle placements.

The Asia-Pacific is the fastest-growing market due to the rising healthcare expenditure, increasing burden of cardiovascular disease, and increasing access to cardiac surgery in developing markets. Major contributor countries such as China, India and Japan as well as a growing hospital network, increase in medical tourism and increasing adoption of advanced surgical technologies. Regional demand and use of cardiovascular needles is anticipated to be high as the country's government efforts target improvement of cardiac care facilitie.

Challenge: Product Standardization, Surgical Precision Demands, and Procurement Constraints

The cardiovascular needle market is limited by the high precision and quality demands associated with cardiac surgeries, vascular graft procedures, and minimally invasive interventions. Hospitals and surgical facilities require consistent penetration profiles, corrosion resistance, and high wet strength of suture needles, all of which translate into significant entry barriers for new entrants on both needle quality and regulatory approval fronts.

Furthermore, the wide variation in surgical techniques and preferences among cardiovascular surgeons makes standardization of needle design difficult, especially in emerging markets. In cost-sensitive regions, or publicly funded healthcare systems, the procurement price pressure often curbs conversion to premium or advanced suture needle systems. Production timelines have been affected by supply chain disruptions, particularly in stainless steel and tungsten alloys.

Opportunity: Cardiac Procedure Growth, Minimally Invasive Surgery (MIS), and Technological Innovation

With the growing incidence of cardiovascular disease (CVD) worldwide, the number of surgeries, such as coronary artery bypass graft (CABG) surgeries, valve replacement and vascular interventions, has soared. This trend is driving the increasing procedural volume in need of requisite and custom designed dedicated cardiac needles.

The evolution in surgical procedures towards minimally invasive and robotic techniques is driving demand for smaller gauge, precision manufactured needles, often with coated or laser etched finishes to enhance visibility in robotic surgical fields.

OEMs have the opportunity to differentiate themselves with innovations, including ergonomic designs for needle holders, anti-corrosive alloys for needle manufacturing and double-armed needles that are specifically designed for vessel anastomosis. The growing number of cardiac centers of excellence across APAC, Latin America, and Eastern Europe are also among the factors driving needle demand, particularly disposable, procedure-specific kits.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | FDA, CE, and ISO 13485-based conformity, sterility testing |

| Technology Innovations | Standard taper point and curved needles |

| Market Adoption | Cardiac surgery centers, public hospitals |

| Sustainability Trends | Focus on reusable steel instruments |

| Market Competition | Ethicon, Medtronic, Teleflex, B.Braun |

| User Experience Trends | Surgeon preference-driven selection |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increased adoption of UDI (Unique Device Identification), AI-based quality inspection |

| Technology Innovations | Coated, laser-etched, robotic-compatible needles; micro-needles for MIS |

| Market Adoption | Expansion to ambulatory surgery centers, robotic cardiac labs, global tele-surgery sites |

| Sustainability Trends | Rise of biodegradable packaging, recyclable trays, and green sterilization materials |

| Market Competition | Entry of OEM private label manufacturers, APAC-based low-cost precision needle suppliers |

| User Experience Trends | AI-assisted feedback loops on needle performance in robotic surgery suites |

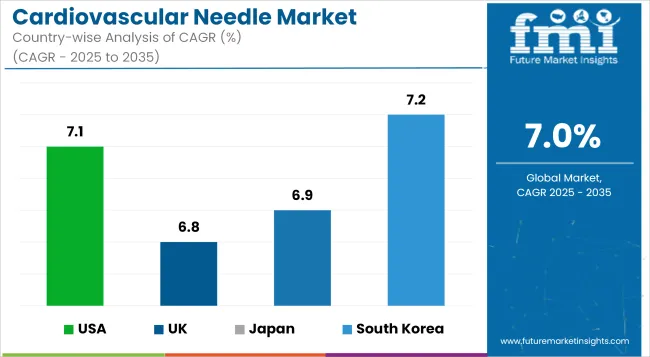

The USA is registering world-leading growth in the cardiovascular needle market with a greater number of cardiovascular surgeries performed in the country each year. The escalating incidence rate of coronary artery diseases has also boosted the demand for Cardiovascular Needle.

The need for high-performance cardiovascular needles stemming from advances in minimally invasive and robotic-assisted cardiac procedures Moreover, the availability of advanced cardiac care infrastructure and continuous evolution of suture-needle technologies is propelling the growth of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

Due to the increasing burden of heart conditions, increasing amount of coronary ambulance surgery and increasing demand for minimally invasive surgical tools, The Cardiovascular Needle segment is growing rapidly in the United Kingdom. The attention given to modernization of the healthcare segment along with favorable regulations for surgical performance is promoting the use of high-precision cardiovascular needles in public as well as private healthcare systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

The cardiovascular needle market has been steadily expanding in the European Union region over the years, thanks to strong adoption of advanced surgical instruments in cardiac surgeries, the rising geriatric population, and greater availability of specialty cardiovascular services. Besides these factors, investments for the enhancement of hospital infrastructure and the establishment of hybrid operating rooms are boosting the adoption of technologically advanced cardiovascular needles.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.0% |

Japan cardiovascular needle market is witnessing moderate growth, which is primarily driven by these aforementioned factors including high numbers of hypertension and cardiac diseases patients in the country and a favorable preference for precision-assisted surgical tools. Minimally invasive treatment of cardiovascular disorders has gained wide acceptance, along with government initiatives to enhance elderly healthcare services, elevating the growth trend of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

In South Korea, Cardiovascular Needle demand is surging owing to increasing number of heart surgery procedures, advancements in hospitals, and increased awareness regarding cardiovascular danger. Increasing national health insurance coverage of heart surgeries and the rising number of cardiac care units in the nation are driving the adoption of quality cardiovascular needles.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

Growing global prevalence of cardiovascular diseases (CVDs) and rising number of cardiac surgeries are prominent drivers for the growth of cardiovascular needle market. These surgical needles are used in critical heart procedures where precision, minimal trauma, and tissue penetration are essential for all of the cardiac patients.

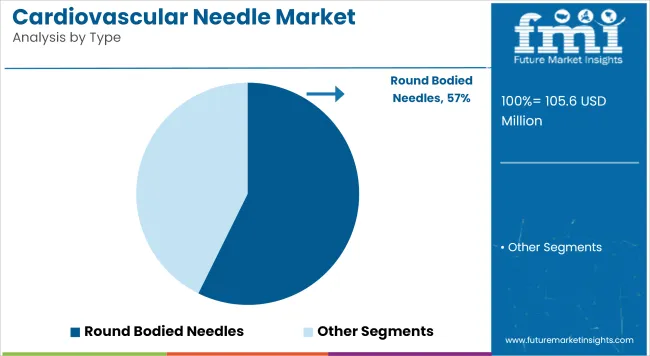

Due to the continuous improvements in surgical methodologies such as minimally invasive fixation and suturing techniques, the need for more controllable, safer and compatible needles with different kinds of suturing materials is increasing. It is further divided by Type (Round Bodied Needles, Cutting Needles) and Application (Open-heart Surgery, Coronary Artery Bypass Graft Surgery, Cardiac Valve Procedures, Heart Transplant, Others).

Round Bodied Needles Lead by Type Due to Minimal Tissue Trauma and Smooth Penetration

| Type | Market Share (2025) |

|---|---|

| Round Bodied Needles | 57.3% |

The round bodied needles are expected to account for the largest share in the market with around 57.3% of global market share by 2025. One of the most common applications for these needles is in cardiovascular procedures where atraumatic tissue penetration is a requirement, such as during valve repair, vessel suturing, and delicate myocardial operations.

Their shape is blunt, allowing for gel tissue separation instead of cutting, minimizing the risk of torn soft tissues and ensuring optimal healing. In which precision and safety are prime surgical goals, the round bodied needle has gained wide acceptance among cardiac surgeons across the globe.

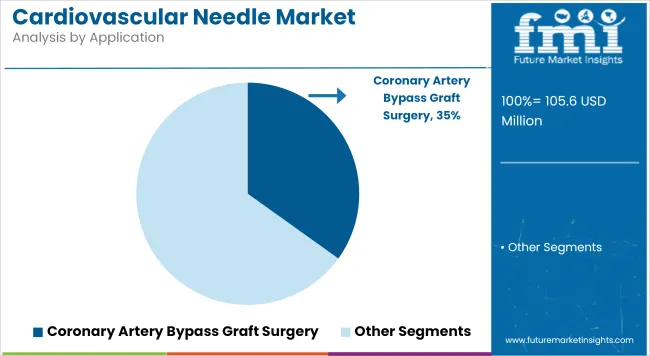

Coronary Artery Bypass Graft (CABG) Surgery Dominates the Application Segment Due to High Procedural Volume

| Application | Market Share (2025) |

|---|---|

| Coronary Artery Bypass Graft Surgery | 34.9% |

Coronary Artery Bypass Graft (CABG) Surgery is also anticipated to dominate application segment with 34.9% global cardiovascular needle market share in 2025. This procedure, which restores blood flow to the heart by bypassing blocked arteries, is still one of the most commonly performed heart surgeries around the world.

As a burgeoning aging population manifests, the rising burden of atherosclerosis continues to increase and lifestyle-related cardiovascular diseases remain high, CABG procedures are poised to grow steadily in number, fueling steady demand for high-performance cardiovascular suturing solutions.

With the increasing global incidents of cardiovascular surgeries such as coronary artery bypass grafting (CABG), valve repair, angioplasty, and heart transplant, the cardiovascular needle market is increasing. These needles play a crucial role in delicate heart and vascular procedures that demand accurate tissue penetration, limited trauma, and solid suturing.

Needle geometry, needle strength, and the ability of needles to match synthetic and absorbable sutures will drive competitive trends. Focus to maintain high demand stems from the expansion of cardiothoracic surgeries, growing senescent populace & modernization of hospital setups, especially in Northeast Asia & North America.

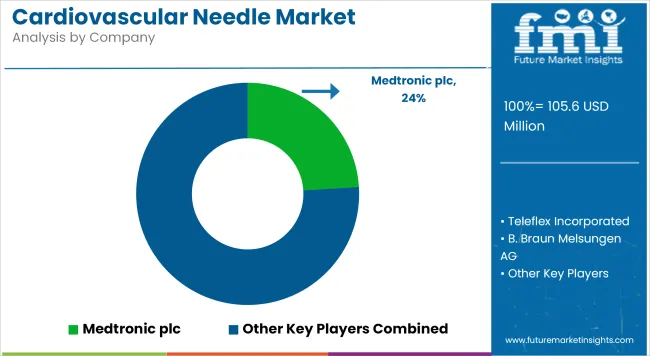

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic plc | 20-24% |

| Teleflex Incorporated | 14-18% |

| B. Braun Melsungen AG | 10-14% |

| Peters Surgical | 8-12% |

| MANI, Inc. | 6-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | In 2024, expanded its Cardiopoint ™ needle series with atraumatic, tapered cardiovascular needles.In 2025, introduced coated suture-compatible needles for minimal tissue drag and faster wound closure. |

| Teleflex Incorporated | In 2024, launched high-tensile strength surgical needles for valve and vascular repairs. In 2025, integrated ergonomic needle designs with better grip support for robotic-assisted surgery teams. |

| B. Braun Melsungen AG | In 2024, updated its Aesculap® line with double-armed cardiovascular needles.In 2025, focused on high-performance stainless steel alloys for reduced breakage during prolonged surgical sessions. |

| Peters Surgical | In 2024, offered preloaded cardiovascular needle-suture combinations tailored for open-heart procedures. In 2025, partnered with cardiac centers in Asia for clinical validation of curved needle enhancements. |

| MANI, Inc. | In 2024, released ultra-fine curved needles for pediatric cardiac surgery. In 2025, developed micro-polished precision points with reduced surgeon hand fatigue in long-duration vascular operations. |

Key Company Insights

Medtronic plc (20-24%)

Medtronic leads with its comprehensive cardiovascular surgical tools, including high-durability needles that integrate seamlessly with its suture systems. The company emphasizes tissue integrity, surgeon handling, and global clinical support.

Teleflex Incorporated (14-18%)

Teleflex delivers performance-driven cardiovascular needles with a focus on procedural accuracy and surgical efficiency, supplying a wide range of vascular closure and cardiac repair applications.

B. Braun Melsungen AG (10-14%)

B. Braun’s Aesculap® cardiovascular needles are valued for precision-engineered tips, durable stainless steel construction, and compatibility with minimally invasive techniques.

Peters Surgical (8-12%)

Peters Surgical offers ready-to-use, surgeon-friendly cardiovascular needle kits, especially suited for CABG and valve surgeries, with growing presence in Europe and Asia-Pacific cardiac surgery units.

MANI, Inc. (6-9%)

MANI specializes in high-precision needles manufactured under ultra-clean conditions, making them ideal for delicate, small-scale cardiovascular procedures, including pediatric and microvascular repairs.

Other Key Players (25-30% Combined)

The overall market size for the cardiovascular needle market was USD 105.6 Million in 2025.

The cardiovascular needle market is expected to reach USD 207.8 Million in 2035.

Growth is driven by the increasing number of cardiovascular surgeries worldwide and growing demand for precision instruments in cardiac procedures.

The top 5 countries driving the development of the cardiovascular needle market are the USA, China, Germany, Japan, and India.

Round Bodied Needles and Coronary Artery Bypass Graft Surgery are expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Needle Gripper Market Size and Share Forecast Outlook 2025 to 2035

Needle Free Allergy Therapy Market Size and Share Forecast Outlook 2025 to 2035

Needle-Free Injection System Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Surgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Devices Market Size and Share Forecast Outlook 2025 to 2035

Needle Coke Market Size and Share Forecast Outlook 2025 to 2035

Needleloom Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Needle Nose Pliers Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Prosthetic Devices Market Size and Share Forecast Outlook 2025 to 2035

Needle Destroyer Market Size and Share Forecast Outlook 2025 to 2035

Needle-Free Injectors Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Ultrasound Market - Demand & Innovations 2025 to 2035

Cardiovascular Enterprise Viewer Market Insights – Growth & Forecast 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Needlecraft Patterns Market Analysis - Growth & Demand 2025 to 2035

Cardiovascular Repair & Reconstruction Devices Market – Growth & Trends 2025 to 2035

Needle-Free Vaccine Injectors Market – Demand & Forecast 2024-2034

Jet Needle-free Injectors Market Size and Share Forecast Outlook 2025 to 2035

Pen Needles Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA