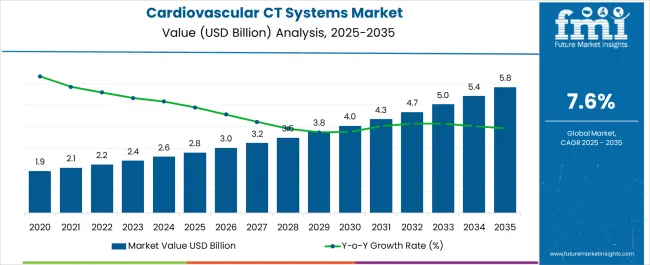

The Cardiovascular CT Systems Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Cardiovascular CT Systems Market Estimated Value in (2025 E) | USD 2.8 billion |

| Cardiovascular CT Systems Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The Cardiovascular CT Systems market is experiencing steady growth due to the increasing prevalence of cardiovascular diseases and the rising demand for early diagnosis and precise imaging solutions. The market is being influenced by technological advancements in computed tomography systems, including enhanced imaging resolution, faster scan speeds, and reduced radiation exposure. Hospitals and diagnostic centers are increasingly adopting cardiovascular CT systems to improve patient outcomes, streamline workflow, and support advanced cardiac care programs.

Investments in healthcare infrastructure, particularly in emerging economies, are supporting broader adoption, while growing awareness of non-invasive imaging techniques is driving demand in developed regions. Integration of AI-assisted imaging and post-processing tools is enabling better visualization, analysis, and reporting of cardiac anomalies.

Additionally, healthcare providers are seeking scalable and upgradeable CT platforms that can adapt to evolving clinical needs These factors collectively position cardiovascular CT systems as essential diagnostic tools, with continued growth potential anticipated as the global population ages and cardiovascular healthcare demands expand.

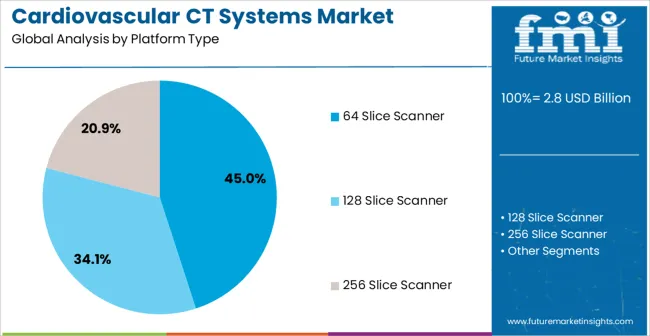

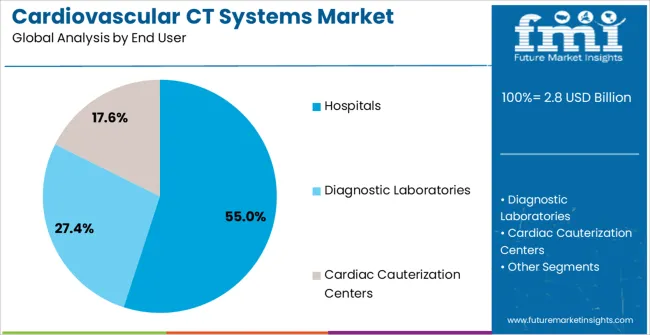

The cardiovascular ct systems market is segmented by platform type, end user, and geographic regions. By platform type, cardiovascular ct systems market is divided into 64 Slice Scanner, 128 Slice Scanner, and 256 Slice Scanner. In terms of end user, cardiovascular ct systems market is classified into Hospitals, Diagnostic Laboratories, and Cardiac Cauterization Centers. Regionally, the cardiovascular ct systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 64 Slice Scanner platform type is projected to hold 45.0% of the Cardiovascular CT Systems market revenue share in 2025, making it the leading platform type. This prominence is being driven by the scanner’s ability to provide high-resolution, multi-phase cardiac imaging with relatively fast acquisition times.

Its adoption has been accelerated by hospitals and imaging centers that require reliable detection of coronary artery disease, structural heart abnormalities, and other cardiovascular conditions. The flexibility of 64 slice scanners to integrate with advanced post-processing software and AI-based analysis tools has further enhanced their utility, enabling clinicians to make accurate diagnoses with minimal patient discomfort.

Additionally, the system’s capability to handle both cardiac and non-cardiac imaging tasks efficiently has reinforced its widespread deployment The combination of superior image quality, improved workflow efficiency, and long-term scalability has positioned the 64 Slice Scanner as the preferred choice in cardiovascular imaging, supporting its dominant market share and future growth prospects.

Hospitals are expected to account for 55.0% of the Cardiovascular CT Systems market revenue share in 2025, establishing them as the primary end-use segment. This leadership is being attributed to hospitals’ high patient volumes, comprehensive cardiovascular care programs, and their role in early diagnosis and treatment of cardiac diseases.

The adoption of advanced CT systems in hospitals is driven by the need to offer precise and timely diagnostics for complex cardiac conditions, while also improving patient outcomes. Hospitals benefit from the scalability of modern CT platforms, which allow software upgrades and integration with electronic health records and PACS systems.

In addition, hospital administrators prioritize imaging solutions that optimize workflow, reduce scan times, and support multi-department use, making cardiovascular CT systems highly valuable The focus on preventive cardiology, regulatory emphasis on diagnostic accuracy, and increasing investment in healthcare infrastructure continue to bolster hospitals’ adoption, reinforcing their leading position in the market and sustaining growth for advanced cardiovascular imaging solutions.

Cardiovascular CT systems is medical device which is dedicated for cardiac imaging. Cardiovascular CT systems is an advances version of CT scanner which is specially designed for cardiac imaging. The advancement in the technology has led the development of Cardiovascular CT systems which provide imaging of heart with more improved temporal and spatial resolution.

Cardiovascular CT systems provide this more improved cardiac imaging in shorter span of time than a regular CT scanner. Also, Cardiovascular CT systems show high resolution three dimensional images heart and blood vessels which allows to understand the cardiac anatomy in much better way.

Moreover, Cardiovascular CT systems enable the non-invasive evaluation of anatomy which includes arteries, veins and coronary chambers. The assessment of abnormalities of cardiac chamber can be diagnosed by Cardiovascular CT systems. The cardiac imaging of patients suffering from calcium deficiency is commonly performed with Cardiovascular CT systems.

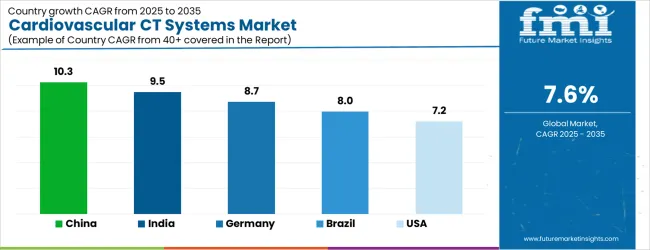

| Country | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| Brazil | 8.0% |

| USA | 7.2% |

| UK | 6.5% |

| Japan | 5.7% |

The Cardiovascular CT Systems Market is expected to register a CAGR of 7.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.3%, followed by India at 9.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.7%, yet still underscores a broadly positive trajectory for the global Cardiovascular CT Systems Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.7%. The USA Cardiovascular CT Systems Market is estimated to be valued at USD 956.2 million in 2025 and is anticipated to reach a valuation of USD 956.2 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 144.0 million and USD 88.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Platform Type | 64 Slice Scanner, 128 Slice Scanner, and 256 Slice Scanner |

| End User | Hospitals, Diagnostic Laboratories, and Cardiac Cauterization Centers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

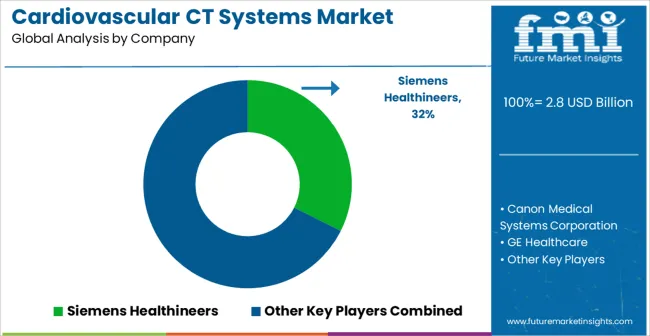

| Key Companies Profiled | Siemens Healthineers, Canon Medical Systems Corporation, GE Healthcare, Koninklijke Philips N.V., Fujifilm Holdings Corporation, United Imaging Healthcare, NeuroLogica Corporation, and Neusoft Medical Systems Co. Ltd. |

The global cardiovascular CT systems market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the cardiovascular CT systems market is projected to reach USD 5.8 billion by 2035.

The cardiovascular CT systems market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in cardiovascular CT systems market are 64 slice scanner, 128 slice scanner and 256 slice scanner.

In terms of end user, hospitals segment to command 55.0% share in the cardiovascular CT systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Powertrain Systems Market Size and Share Forecast Outlook 2025 to 2035

Long-acting Depot Systems Market Size and Share Forecast Outlook 2025 to 2035

Smart Dictation Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Bioelectrochemical Systems For Wastewater Treatment Market Size and Share Forecast Outlook 2025 to 2035

Anorectal Manometry Systems Market Trends - Growth & Forecast 2025 to 2035

Manufacturing Test Systems Market

Fire Protection Systems for Industrial Cooking Market Growth - Trends & Forecast 2025 to 2035

Rib Fracture Repair Systems Market Size and Share Forecast Outlook 2025 to 2035

Threat Detection Systems Market

Ductless Heating & Cooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Nanoelectromechanical Systems (NEMS) Market - Trends & Forecast 2025 to 2035

Manufacturing Execution Systems (MES) Market Analysis - Growth, Demand & Forecast 2025 to 2035

Pathogen Reduction Systems Market

Cardiovascular Repair & Reconstruction Devices Market – Growth & Trends 2025 to 2035

Cylinder Deactivation Systems Market Size and Share Forecast Outlook 2025 to 2035

Micro-Electro Mechanical Systems Market Size and Share Forecast Outlook 2025 to 2035

Contact-Free Sleep Monitoring Systems Market Trends - Growth & Forecast 2025 to 2035

Directed Energy-Based Surgical Systems Market Growth – Forecast 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA