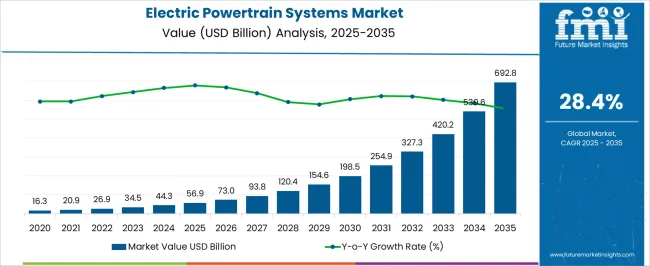

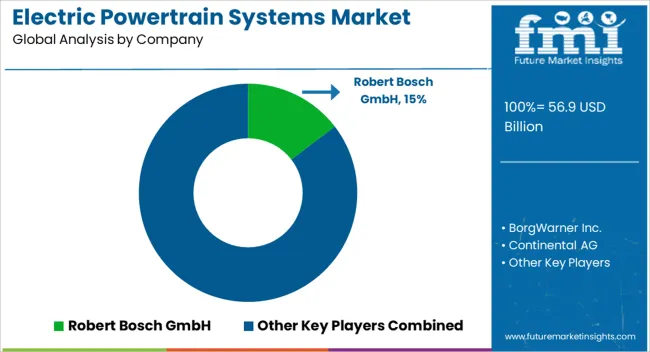

The electric powertrain systems market is estimated to be valued at USD 56.9 billion in 2025 and is projected to reach USD 692.8 billion by 2035, registering a compound annual growth rate (CAGR) of 28.4% over the forecast period. This sharp upward trajectory indicates strong technology-driven contributions shaping the market landscape. Battery systems are expected to dominate contribution share, given the falling cost of lithium-ion and advanced chemistries, while solid-state innovations begin influencing the latter half of the forecast period.

Electric motors contribute significantly through higher efficiency architectures, particularly permanent magnet synchronous motors that enhance energy utilization. Power electronics, including inverters and converters, remain pivotal enablers as they manage energy flow between battery, motor, and grid interfaces, directly influencing system efficiency and range. Charging infrastructure integration technologies also represent a growing contributor. Bidirectional charging, vehicle-to-grid solutions, and ultra-fast chargers enhance ecosystem viability, boosting consumer adoption. Control software and electronic control units add value through optimization of power delivery, regenerative braking, and diagnostics, creating differentiation among manufacturers. The progression of contributions shows a technology stack evolution.

Early growth will be battery-centric, but by 2030, balanced contributions from motors, power electronics, and control systems will define competitiveness. The market is driven not by a single component but by synergistic advancement across all technology layers, ensuring performance, reliability, and scalability.

| Metric | Value |

|---|---|

| Electric Powertrain Systems Market Estimated Value in (2025 E) | USD 56.9 billion |

| Electric Powertrain Systems Market Forecast Value in (2035 F) | USD 692.8 billion |

| Forecast CAGR (2025 to 2035) | 28.4% |

Growing regulatory pressure on emissions reduction and fuel efficiency is encouraging automakers to accelerate investments in electrified vehicle architecture. Government-backed incentives, subsidies, and infrastructure development for EVs have been strengthening market adoption across regions.

Industry publications and corporate press releases have highlighted that advancements in power electronics, thermal management systems, and battery technologies are allowing electric powertrains to deliver superior range and performance. Investor communications from automotive OEMs further indicate that strategic collaborations and vertical integration efforts are aimed at optimizing the efficiency, scalability, and cost-effectiveness of these systems.

As countries strengthen their net-zero commitments, demand is also rising for local sourcing of powertrain components to ensure energy independence and supply chain resilience. These structural shifts are expected to create robust growth pathways for the electric powertrain systems market in the years ahead.

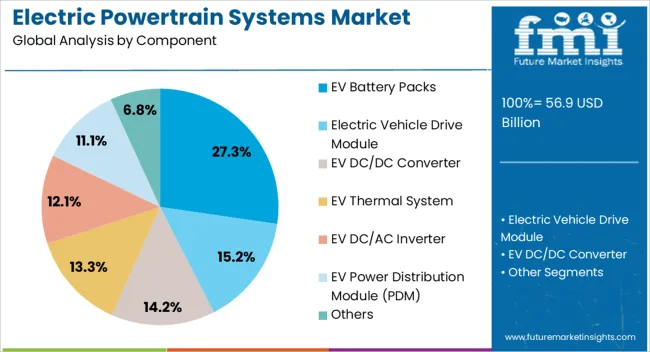

The electric powertrain systems market is segmented by component, vehicle type, sales channel, and geographic regions. By component, the electric powertrain systems market is divided into EV Battery Packs, Electric Vehicle Drive Module, EV DC/DC Converter, EV Thermal System, EV DC/AC Inverter, EV Power Distribution Module (PDM), and Others.

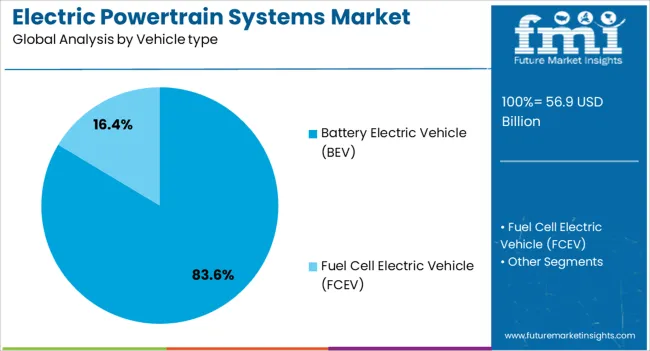

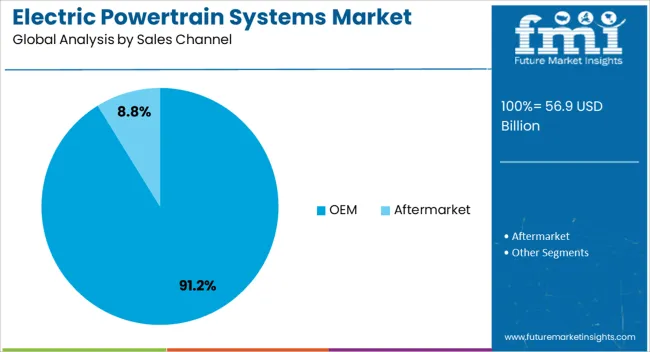

In terms of vehicle type, the electric powertrain systems market is classified into Battery Electric Vehicle (BEV) and Fuel Cell Electric Vehicle (FCEV). Based on sales channel, the electric powertrain systems market is segmented into OEM and Aftermarket. Regionally, the electric powertrain systems industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The EV battery packs component segment is projected to account for 27.3% of the Electric Powertrain Systems market revenue share in 2025, making it the largest segment by component. This leadership is being driven by the battery's central role in determining vehicle range, efficiency, and overall performance.

It has been observed that automakers are prioritizing battery innovation as part of their electrification strategy, with increased investments in high-density lithium-ion and solid-state battery technologies. Technical publications have emphasized that the modularity and energy management capabilities of modern battery packs are enabling more flexible vehicle designs while improving thermal and safety performance.

Press releases from automotive suppliers have outlined efforts to enhance energy efficiency and extend battery lifespan through software-defined battery management systems. These advancements, along with growing consumer preference for longer-range vehicles and declining battery costs, have reinforced the segment’s leading position in the market.

The battery electric vehicle (BEV) segment is anticipated to hold 83.6% of the Electric Powertrain Systems market revenue share in 2025, positioning it as the dominant vehicle type. This growth has been enabled by the absence of internal combustion components, allowing for simplified architecture, lower maintenance requirements, and improved energy efficiency. Automotive OEMs have increasingly aligned their product roadmaps around BEVs, as indicated in corporate announcements and electrification strategy updates.

Global policy shifts toward zero-emission transport, alongside rapid charging infrastructure expansion, have further accelerated BEV adoption. Industry news has noted that declining battery prices and enhanced energy density are improving BEV affordability and driving mass-market availability.

Additionally, BEVs are benefiting from dedicated government support and regulatory incentives that specifically target all-electric models. These factors collectively ensure that the BEV segment remains at the forefront of electric powertrain system integration.

The OEM segment is forecasted to capture 91.2% of the Electric Powertrain Systems market revenue share in 2025, solidifying its position as the primary sales channel. This dominance has been supported by an increase in in-house development and integration of electric powertrain systems by global automotive manufacturers.

OEMs have been investing heavily in R&D and forming strategic alliances with technology providers to secure proprietary electric drivetrain solutions that align with their brand and performance objectives. Public disclosures and investor briefings reveal that automakers are prioritizing complete control over system architecture to meet evolving regulatory standards and customer expectations.

Furthermore, OEMs are benefiting from economies of scale and supply chain integration, allowing them to offer cost-competitive electric vehicles with advanced powertrain configurations. The vertical integration of electric motor, inverter, and battery technologies has enabled OEMs to deliver optimized and highly efficient systems directly through factory-installed platforms, ensuring sustained market dominance through 2025.

The market has been reshaped by the accelerated adoption of battery electric vehicles and hybrid models across global automotive industries. Automakers have invested heavily in electrification strategies, driven by emission standards and technological advancements in motors, inverters, and battery management systems. Regulatory incentives have supported the adoption of electric mobility while supply chain players have expanded their roles in producing advanced components. With the transition away from conventional combustion engines, electric powertrain systems have become central to vehicle innovation, efficiency, and long-term industry growth.

The progress of electric powertrain systems has been closely linked with improvements in lithium-ion batteries and electric motors. Higher energy density, faster charging, and extended lifecycle of batteries have enhanced the performance of electric vehicles. Similarly, advanced permanent magnet synchronous motors and induction motors have been developed to optimize efficiency. Power electronics such as inverters and converters have played an essential role in controlling current flow, thereby improving torque and energy use. Research has focused on solid-state battery technologies that promise even greater energy efficiency and lower charging times. Automakers have integrated these innovations into new platforms designed exclusively for electric mobility. As performance barriers have been reduced, consumer confidence in electric vehicles has strengthened, accelerating market growth. These advancements have been instrumental in establishing electric powertrain systems as reliable and sustainable alternatives to internal combustion engine-based platforms.

Regulatory frameworks across North America, Europe, and Asia have played a decisive role in expanding electric powertrain adoption. Stringent emission reduction targets have pushed automakers to accelerate their electrification timelines. Governments have implemented tax credits, rebates, and infrastructure subsidies to encourage both manufacturers and consumers. Mandates on zero-emission vehicle sales have reinforced the adoption of electric powertrains in passenger cars and commercial fleets. Energy efficiency standards have also driven suppliers to innovate lightweight materials and efficient thermal management solutions. The alignment of national policies with long-term climate goals has ensured steady support for electrification. As regulatory pressure continues to intensify, automotive manufacturers have been compelled to increase investments in research and development. This regulatory environment has not only accelerated product launches but also facilitated global competition among automakers, thereby shaping the growth trajectory of the electric powertrain systems market.

The growth of the electric powertrain systems market has been heavily dependent on the availability of robust charging infrastructure. Public and private investments have been directed toward installing fast-charging stations along highways, urban centers, and commercial hubs. The emergence of vehicle-to-grid technology has enabled bidirectional charging, adding resilience to energy networks. Automakers and energy companies have collaborated to create integrated charging ecosystems that complement electric powertrain capabilities. Standardization of charging protocols has been pursued to ensure compatibility across vehicle models and regions. Enhanced accessibility of charging stations has mitigated consumer concerns about range anxiety, thereby encouraging adoption. Utility companies have also played an active role by deploying smart grid solutions that balance charging loads. These combined efforts have created a supportive ecosystem where electric powertrain systems can operate efficiently, thereby reinforcing market demand and ensuring a smoother transition from combustion-based vehicles to electrified platforms.

The application of electric powertrain systems has expanded beyond passenger vehicles into buses, trucks, and other heavy-duty segments. Logistics and fleet operators have increasingly adopted electrified powertrains to reduce operational costs and comply with emission regulations. Advanced battery packs with higher capacity have been developed to support long-distance transport requirements. Electric buses have been deployed in several regions as part of public transport modernization initiatives. Similarly, electric delivery vans and trucks have been adopted by e-commerce and logistics firms to lower carbon emissions in last-mile delivery. The demand for high-torque motors and advanced power electronics has risen in line with these applications. Additionally, hydrogen fuel cell-based powertrains have been explored for long-haul transport, expanding the scope of electrification. The adoption in commercial fleets has provided a strong impetus for industry growth, broadening the role of electric powertrain systems in global mobility solutions.

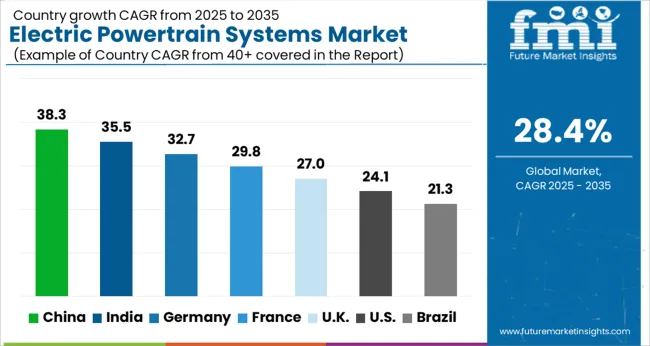

The market is projected to expand at a CAGR of 28.4% between 2025 and 2035, driven by rising electric vehicle adoption, technological progress in batteries, and strict emission regulations. China, with a 38.3% CAGR, advances through large-scale EV production and battery innovation leadership. India follows at 35.5%, scaling rapidly with government-backed electrification programs and increasing local manufacturing capacity. Germany grows at 32.7%, supported by strong automotive engineering and investments in next-generation EV platforms. The UK, at 27.0%, innovates through R&D in lightweight components and charging infrastructure. The USA, at 24.1%, witnesses consistent momentum from federal incentives and major EV automakers. This report covers 40+ countries, with the top markets highlighted here for reference.

China is expected to witness a CAGR of 38.3% in the market between 2025 and 2035. Favorable government initiatives, expanding EV production, and rapid technological integration are the main factors influencing demand. Strong battery manufacturing capacity and large-scale EV adoption are strengthening China’s leadership in this segment. Automakers are increasingly investing in advanced power electronics and lightweight materials to improve performance and efficiency. With large consumer acceptance of electric vehicles and robust industrial support, China is set to remain the global hub for electric powertrain systems.

India is projected to record a CAGR of 35.5% in the market from 2025 to 2035. Increasing EV penetration, favorable policy frameworks, and rapid charging infrastructure expansion are boosting adoption. Local automakers and startups are focusing on integrating indigenous battery packs and electric drivetrains to reduce dependency on imports. Growing urban demand for affordable EVs and supportive government subsidies are driving significant market opportunities. Continuous R&D activities, particularly in thermal management and lightweight materials, are likely to improve overall efficiency and adoption rates across the country.

Germany is expected to achieve a CAGR of 32.7% in the market during 2025 to 2035. Strong presence of global automotive manufacturers and advancements in drivetrain technology are supporting growth. Government initiatives promoting EV sales and infrastructure development are accelerating adoption rates. Focus on high-efficiency electric motors and next-generation power electronics is reshaping the country’s market landscape. With increasing consumer preference for sustainable mobility, Germany is positioned to remain one of Europe’s most influential contributors to electric powertrain development.

The United Kingdom is anticipated to grow at a CAGR of 27.0% in the market through 2025 to 2035. Policy support for zero-emission vehicles, expansion of charging networks, and consumer interest in EV ownership are fueling adoption. Collaborations between technology firms and automakers are improving performance efficiency and reducing costs. Growth in battery innovation and the focus on lightweight materials are further enhancing system integration. With continued emphasis on emission reduction and electrification targets, the UK market is expected to show strong momentum over the forecast period.

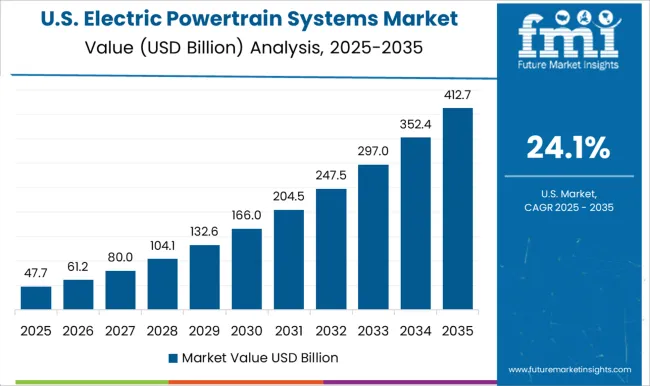

The United States is projected to expand at a CAGR of 24.1% in the market between 2025 and 2035. Supportive regulatory measures, EV incentives, and expansion of domestic manufacturing capacity are key drivers. Automakers are actively integrating high-performance motors and advanced control units to meet growing consumer demand. Strategic alliances with battery producers and investments in charging infrastructure are strengthening market penetration. With rising adoption of EVs across consumer and commercial segments, the US is expected to remain an important market in this industry.

The market is witnessing strong growth as leading automotive and component manufacturers expand electrification portfolios to meet regulatory requirements and consumer demand. Robert Bosch GmbH, Continental AG, and BorgWarner Inc. hold significant positions through advanced motor, inverter, and transmission solutions, offering integrated systems for hybrid and battery electric vehicles. Cummins Inc. and Eaton are leveraging expertise in power solutions and drivetrains to enter the electric mobility domain with scalable technologies for both passenger and commercial vehicles. Delta Electronics, Inc. and Mitsubishi Electric Corporation contribute power electronics and energy-efficient control systems, ensuring reliable performance across global markets.

GKN PLC and Magna International Inc. are recognized for e-drive modules and lightweight driveline innovations that improve efficiency and vehicle range. Hitachi Astemo Americas, Inc. and Marelli Holdings Co., Ltd. support global automakers with compact, high-performance propulsion components. Major automakers, including Hyundai Motor Company, Nissan Motor Co., Ltd., and Volkswagen, are actively advancing in-house powertrain capabilities while integrating supplier partnerships to accelerate electrification strategies. Sigma Powertrain, Inc. strengthens niche innovation with modular and flexible electric drivetrains. Together, these providers represent a mix of tier-one suppliers and OEMs driving industry transformation. Their combined expertise in software integration, lightweight materials, and energy optimization is shaping the future of sustainable vehicle propulsion.

| Item | Value |

|---|---|

| Quantitative Units | USD 56.9 Billion |

| Component | EV Battery Packs, Electric Vehicle Drive Module, EV DC/DC Converter, EV Thermal System, EV DC/AC Inverter, EV Power Distribution Module (PDM), and Others |

| Vehicle type | Battery Electric Vehicle (BEV) and Fuel Cell Electric Vehicle (FCEV) |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch GmbH, BorgWarner Inc., Continental AG, Cummins Inc., Delta Electronics, Inc., Eaton, GKN PLC, Hitachi Astemo Americas, Inc., Hyundai Motor Company, Magna International Inc., Marelli Holdings Co., Ltd., Mitsubishi Electric Corporation, Nissan Motor Co., Ltd., Sigma Powertrain, Inc., and Volkswagen |

| Additional Attributes | Dollar sales by component type and vehicle category, demand dynamics across battery electric, plug in hybrid, and fuel cell vehicles, regional trends in adoption of electrified drivetrains, innovation in power electronics and thermal management, environmental impact of lithium ion battery production and recycling, and emerging use cases in heavy duty trucks, two wheelers, and off highway electrification. |

The global electric powertrain systems market is estimated to be valued at USD 56.9 billion in 2025.

The market size for the electric powertrain systems market is projected to reach USD 692.8 billion by 2035.

The electric powertrain systems market is expected to grow at a 28.4% CAGR between 2025 and 2035.

The key product types in electric powertrain systems market are ev battery packs, electric vehicle drive module, ev dc/dc converter, ev thermal system, ev dc/ac inverter, ev power distribution module (pdm) and others.

In terms of vehicle type, battery electric vehicle (bev) segment to command 83.6% share in the electric powertrain systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA