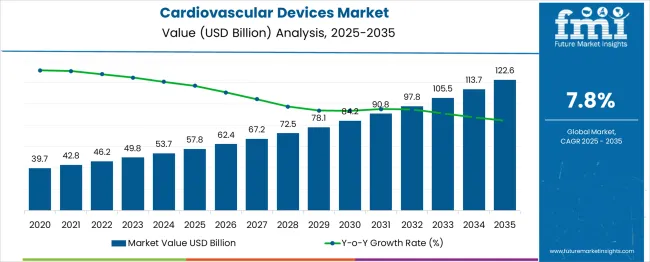

The global cardiovascular devices market is likely to reach USD 57.8 billion in 2025 and expand to USD 122.6 billion by 2035, expanding at a CAGR of 7.8% and an absolute increase of USD 64.8 billion over the forecast period. The year-on-year (YoY) growth pattern highlights steady market expansion, starting from USD 39.7 billion in 2020, USD 42.8 billion in 2021, USD 46.2 billion in 2022, USD 49.8 billion in 2023, USD 53.7 billion in 2024, and reaching USD 57.8 billion in 2025. Post-2025, revenues are expected to increase to USD 62.4 billion in 2026, USD 67.2 billion in 2027, USD 72.5 billion in 2028, USD 78.1 billion in 2029, and USD 84.2 billion in 2030. The latter half of the forecast period anticipates further growth to USD 90.8 billion in 2031, USD 97.8 billion in 2032, USD 105.5 billion in 2033, USD 113.7 billion in 2034, and USD 122.6 billion in 2035. This YoY trend is consistent adoption of advanced cardiovascular solutions, driven by rising prevalence of heart disease, aging populations, and increasing preference for minimally invasive procedures.

Between 2025 and 2030, the market is expected to grow from USD 57.8 billion to USD 84.2 billion, contributing USD 26.4 billion in growth, which accounts for 40.7% of the ten-year expansion. This phase is primarily influenced by increasing incidence of coronary artery disease and heart failure, adoption of transcatheter interventions, and broader penetration of cardiac rhythm management and structural heart devices. Medical device manufacturers are anticipated to expand their portfolios with next-generation, minimally invasive technologies, addressing rising clinical demands and supporting hospital and outpatient adoption. YoY growth during this period ranges between 7% and 8%, signaling stable market momentum with steady risk exposure.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 57.8 billion |

| Forecast Value in (2035F) | USD 122.6 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

From 2030 to 2035, the market is projected to accelerate, growing from USD 84.2 billion to USD 122.6 billion, contributing USD 38.4 billion to the total forecast expansion, representing 59.3% of the decade-long growth. This stage is expected to be shaped by the integration of digital health solutions, AI-enabled cardiac devices, and personalized therapeutic interventions. Remote monitoring and smart connectivity are likely to drive higher adoption, particularly in developed healthcare systems. This period also introduces potential sensitivity factors, including regulatory approvals, reimbursement policy changes, and technology adoption barriers in emerging markets, which could influence market expansion rates.

Risk and sensitivity analysis of the cardiovascular devices market suggests that while long-term growth remains promising, the market is sensitive to factors such as reimbursement constraints, price pressures from competitive device manufacturers, and stringent regulatory compliance requirements. Regional healthcare infrastructure disparities, slow adoption of advanced technologies in certain geographies, and economic uncertainties could create fluctuations in YoY growth. Mitigation strategies include investing in clinical validation studies, expanding service networks, pursuing strategic partnerships, and diversifying product portfolios to maintain steady growth and reduce risk exposure across both mature and emerging markets.

Market expansion is being supported by the increasing global prevalence of cardiovascular diseases and the corresponding demand for advanced medical devices that can provide effective treatment options for complex cardiac conditions. Modern healthcare systems are increasingly focused on improving patient outcomes while reducing procedural risks through minimally invasive approaches and advanced device technologies. Cardiovascular devices' proven ability to treat life-threatening conditions while enabling shorter recovery times and improved quality of life makes them essential components of comprehensive cardiac care and interventional cardiology practices.

The growing focus on preventive cardiology and early intervention is driving demand for cardiovascular devices that can diagnose cardiac conditions early and provide therapeutic interventions before significant disease progression. Healthcare providers' preference for devices that combine clinical efficacy with procedural efficiency is creating opportunities for innovative cardiovascular device implementations. The rising influence of aging population demographics and increasing lifestyle-related cardiovascular risk factors is also contributing to expanded adoption of cardiac rhythm management devices, coronary interventions, and structural heart therapies.

The market is segmented by product and region. By product, the market is divided into surgical devices and diagnostic & monitoring devices. Surgical devices include cardiac resynchronization therapy (CRT), implantable cardioverter defibrillators (ICDs), pacemakers, coronary stents, catheters, guidewires, cannula, valves, and occlusion devices. Diagnostic & monitoring devices encompass ECG, implantable cardiac monitors, holter monitors, mobile cardiac telemetry, MRI, cardiovascular ultrasound, cardiac diagnostic catheters, and PET scanners. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The surgical devices segment is projected to account for 69% of the cardiovascular devices market in 2025, reaffirming its position as the dominant product category. Healthcare providers increasingly rely on cardiovascular surgical devices for their ability to provide definitive therapeutic interventions for complex cardiac conditions, including coronary artery disease, heart failure, and structural heart abnormalities. Surgical devices' critical role in life-saving procedures and their proven clinical efficacy directly address patient needs for effective cardiac treatment and improved quality of life.

This product category forms the foundation of interventional cardiology and cardiac surgery, representing the primary therapeutic tools required for treating cardiovascular diseases across diverse patient populations and clinical scenarios. Healthcare provider investments in advanced surgical technologies and ongoing development of minimally invasive approaches continue to strengthen the adoption of cardiovascular surgical devices. With healthcare systems prioritizing patient outcomes and procedural safety, surgical devices align with both clinical effectiveness requirements and quality care objectives, making them the central component of comprehensive cardiovascular treatment strategies.

The cardiovascular devices market is advancing steadily due to increasing cardiovascular disease prevalence and growing demand for advanced therapeutic interventions that can improve patient outcomes while reducing procedural risks. The market faces challenges, including high device costs and reimbursement constraints, regulatory complexity for device approvals, and technical challenges associated with device implantation and patient management. Innovation in minimally invasive technologies and smart device connectivity continues to influence product development and market expansion patterns.

The growing adoption of minimally invasive cardiac procedures is enabling healthcare providers to treat complex cardiovascular conditions through transcatheter approaches that reduce patient trauma and recovery times. Minimally invasive techniques offer clinical advantages while improving patient experiences and reducing healthcare costs through shorter hospital stays. Cardiovascular device manufacturers are increasingly developing specialized devices optimized for transcatheter delivery and minimally invasive procedures.

Modern cardiovascular device manufacturers are incorporating digital health technologies, wireless connectivity, and remote monitoring capabilities that enable continuous patient management and real-time clinical decision support. These technologies improve patient outcomes while providing healthcare providers with comprehensive data for optimizing device performance and patient care. Advanced digital integration also enables predictive analytics and personalized therapy adjustments that enhance long-term patient management and clinical outcomes.

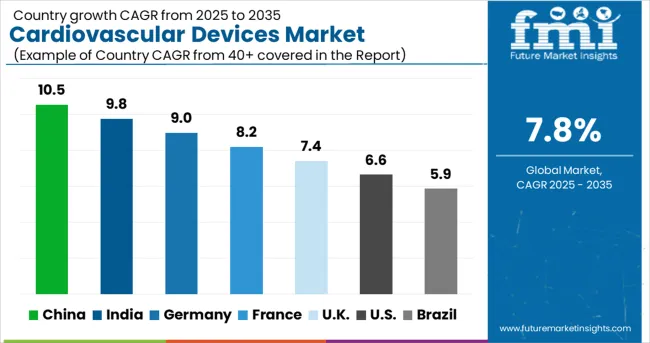

| Countries | CAGR (2025-2035) |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The global cardiovascular devices market is projected to grow at a CAGR of 8% between 2025 and 2035. China leads at a 10.5% CAGR through 2035, driven by a rapidly aging population, increasing cardiovascular disease prevalence, and expanding healthcare infrastructure supporting advanced cardiac care. India follows at 9.8%, supported by rising healthcare access, growing awareness of cardiovascular health, and higher adoption of interventional cardiology procedures. Germany shows growth at 9%, emphasizing cardiovascular excellence and medical device innovation. France records 8.2%, focusing on cardiac research and healthcare advancement. The UK grows at 7.4%, prioritizing NHS cardiovascular programs and cardiac care excellence, while the USA stands at 6.6% and Brazil follows at 5.9%.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

China cardiovascular devices market is projected to grow at a CAGR of 10.5% from 2025 to 2035, reflecting rapid adoption of advanced cardiac care solutions driven by a rising prevalence of heart disease, an aging population, and an expanding healthcare infrastructure. Hospitals, specialty cardiac centers, and diagnostic clinics are increasingly deploying pacemakers, stents, valve devices, and implantable cardioverter defibrillators (ICDs) to improve patient outcomes. Investments in domestic manufacturing are enhancing device availability, reducing dependence on imports, and improving affordability. Integration of AI-assisted diagnostics and remote monitoring platforms is transforming patient care and follow-up efficiency. Government policies supporting faster medical device approvals and healthcare funding are encouraging innovation. The growing awareness of preventive care among patients and caregivers is further boosting demand. International and domestic manufacturers compete by introducing technologically advanced, durable, and minimally invasive devices, strengthening China’s position as a leading growth market for cardiovascular solutions.

India cardiovascular devices market is expected to grow at a CAGR of 9.8% from 2025 to 2035, driven by rising cardiovascular disease prevalence, urbanization of healthcare services, and growing patient awareness of heart health. Hospitals and cardiac clinics are increasingly adopting pacemakers, ICDs, coronary stents, and minimally invasive valve devices. Import of high-quality international devices complements domestic offerings, ensuring access to advanced therapies. Government programs and insurance schemes aim to improve affordability and penetration in urban and semi-urban regions. Telemedicine and digital monitoring solutions are supporting early diagnosis and long-term follow-up. Training programs for cardiac surgeons and specialized healthcare staff are improving procedural success rates. Private and public healthcare investments are expanding infrastructure to meet growing patient demand. Awareness campaigns emphasizing lifestyle modification and preventive care are encouraging device adoption.

Germany cardiovascular devices market is projected to grow at a CAGR of 9.0% from 2025 to 2035, supported by advanced healthcare infrastructure, high adoption of innovative devices, and a well-established reimbursement system. Hospitals, outpatient clinics, and specialty cardiac centers are widely equipped with pacemakers, ICDs, coronary stents, and heart valve devices. Regulatory frameworks and comprehensive insurance coverage ensure high device accessibility. Germany’s strong focus on medical research and innovation enables the development of next-generation devices with enhanced longevity, connectivity, and minimally invasive features. An aging population contributes significantly to rising demand for cardiovascular therapies. Hospitals implement advanced monitoring and follow-up systems to improve patient outcomes. Market competition drives differentiation based on technological features, reliability, and patient safety, making Germany a mature and technologically advanced cardiovascular devices market in Europe.

France cardiovascular devices market is expected to grow at a CAGR of 8.2% from 2025 to 2035, shaped by preventive care programs, public-private partnerships, and patient-centric healthcare approaches. Hospitals and cardiac specialty centers are increasingly adopting pacemakers, coronary stents, heart valves, and ICDs to manage heart disease effectively. Government programs emphasizing early diagnosis, chronic disease management, and hospital infrastructure development support device uptake. Collaboration between public and private healthcare providers enhances accessibility, particularly in semi-urban and rural regions. The adoption of minimally invasive devices and digital monitoring systems improves patient outcomes and reduces procedural risks. Manufacturers compete by introducing technologically advanced and reliable devices that cater to patient safety and clinical efficiency. Awareness campaigns and preventive care initiatives are driving long-term growth, making France a steadily expanding market for cardiovascular devices.

The UK cardiovascular devices market is projected to grow at a CAGR of 7.4% from 2025 to 2035, influenced by National Health Service (NHS) investments, digital health integration, and advanced cardiac care infrastructure. Hospitals and cardiac clinics are increasingly implementing pacemakers, ICDs, stents, and minimally invasive valve devices to improve patient outcomes. Telemedicine platforms and remote patient monitoring are enhancing continuity of care and follow-up efficiency. NHS funding for cardiac healthcare infrastructure supports adoption of advanced therapies. Updated clinical guidelines promote consistent utilization of cardiovascular devices across care settings. Rising awareness of cardiovascular disease prevention and early diagnosis is encouraging broader adoption. Market competition between domestic and international manufacturers fosters innovation, device miniaturization, and improved procedural safety. The integration of digital monitoring technologies continues to enhance the UK’s cardiovascular care landscape.

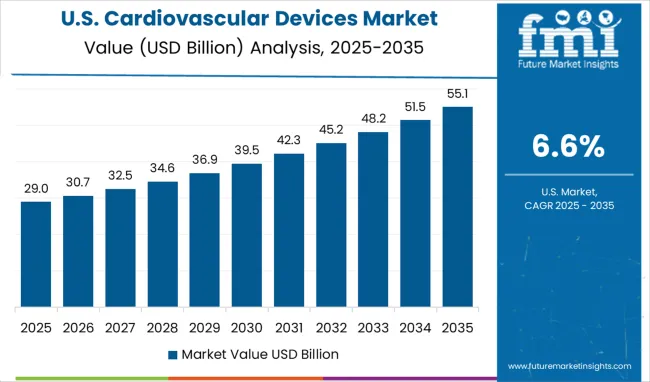

The USA cardiovascular devices market is expected to grow at a CAGR of 6.6% from 2025 to 2035, remaining the largest globally due to high healthcare spending, advanced technology adoption, and a diverse patient population. Hospitals, outpatient clinics, and specialty cardiac centers are equipped with pacemakers, ICDs, stents, and heart valve devices. Insurance coverage and reimbursement systems enable patient access to high-cost therapies. Continuous investment in research and development drives technological innovations, including device miniaturization, remote monitoring, and enhanced connectivity. Competition among domestic and international manufacturers encourages differentiation and higher-quality solutions. Growing patient awareness of preventive care, early diagnosis, and lifestyle management increases the adoption of advanced devices. Telemedicine and AI-assisted diagnostics further improve patient management and long-term outcomes. The USA market continues to set global benchmarks for cardiovascular device technology and clinical efficiency.

Brazil cardiovascular devices market is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by increasing healthcare infrastructure investments, rising prevalence of heart disease, and growing awareness of cardiovascular health. Hospitals and specialty cardiac centers are expanding the use of pacemakers, ICDs, stents, and valve devices. Public and private healthcare investments are improving access and device availability across urban and semi-urban regions. Chronic disease prevalence and an aging population are expanding the patient base for cardiovascular solutions. International and domestic manufacturers compete to offer reliable, minimally invasive, and durable devices. Telemedicine integration and preventive care programs are increasing patient awareness and adherence. Government initiatives targeting healthcare accessibility and insurance coverage are supporting market expansion, making Brazil a growing market in Latin America for advanced cardiovascular therapies.

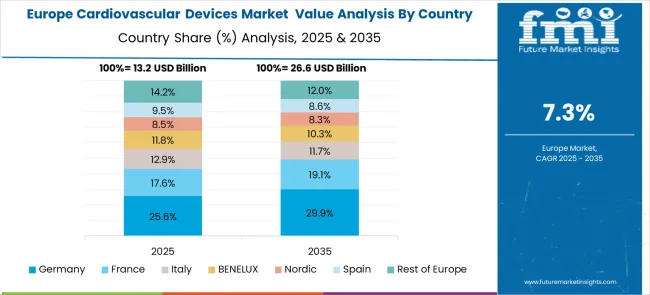

The cardiovascular devices market in Europe demonstrates mature development across major economies, with Germany showing a strong presence through its advanced healthcare system and focus on cardiovascular excellence and medical device innovation, supported by healthcare providers leveraging clinical expertise to implement comprehensive cardiovascular device solutions that emphasize patient outcomes, procedural safety, and technological advancement across cardiology and cardiac surgery specialties. France represents a significant market driven by its healthcare system excellence and sophisticated understanding of cardiovascular disease management, with healthcare providers focusing on advanced cardiovascular device approaches that combine French medical expertise with cutting-edge cardiac technologies for enhanced patient care and clinical outcomes in hospitals and specialized cardiac centers.

The UK exhibits considerable growth through its focus on National Health Service cardiovascular programs and cardiac research excellence, with strong adoption of cardiovascular devices across NHS hospitals, cardiac centers, and specialized interventional cardiology services. Germany and France show expanding interest in transcatheter and minimally invasive applications, particularly in structural heart interventions and advanced cardiac rhythm management. BENELUX countries contribute through their focus on healthcare innovation and advanced cardiac care delivery. At the same time, Eastern Europe and Nordic regions display growing potential driven by increasing healthcare investment and expanding cardiovascular care capabilities.

The cardiovascular devices market is highly competitive, driven by established medical device manufacturers, specialized cardiovascular technology providers, and emerging developers focused on cardiac innovation. Companies are prioritizing investments in clinical research, regulatory compliance, and product development to deliver cardiovascular solutions that are safe, effective, and clinically validated. Development of minimally invasive procedures, digital health integration, and personalized cardiac therapies has become central to gaining market share and enhancing adoption by healthcare providers. Continuous innovation in device design, patient monitoring technologies, and procedural efficiency is shaping the market landscape, while partnerships with hospitals and healthcare systems strengthen clinical support and market penetration.

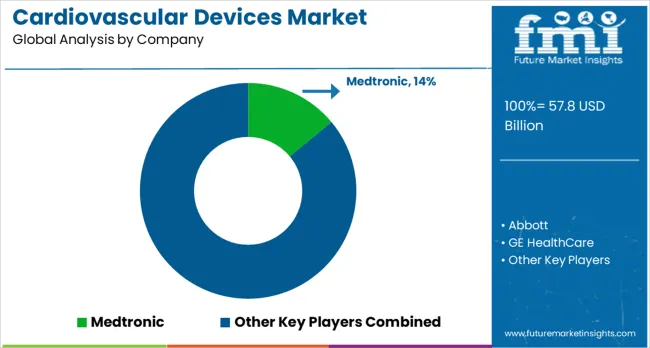

Medtronic maintains a leading position in the cardiovascular devices market, offering a broad portfolio that spans cardiac rhythm management, coronary intervention devices, and structural heart therapies. The company emphasizes clinical innovation, patient outcome optimization, and integrated therapeutic solutions. Abbott focuses on interventional cardiology and cardiac electrophysiology, providing devices that support both minimally invasive procedures and long-term patient management. GE HealthCare delivers a range of cardiovascular imaging, monitoring, and diagnostic systems, supporting hospitals in improving procedural accuracy and patient outcomes. Edwards Lifesciences Corporation specializes in structural heart therapies, with a strong focus on transcatheter valve technologies, which address both high-risk and intermediate-risk patient populations.

W. L. Gore & Associates Inc. provides advanced materials and solutions for cardiovascular devices, emphasizing device durability and clinical performance. Siemens Healthcare GmbH supports cardiovascular care with imaging and diagnostic technologies designed for accurate assessment and treatment planning. BIOTRONIK SE & Co. KG concentrates on cardiac rhythm management and interventional cardiology, offering devices that integrate remote monitoring and data-driven clinical insights. Canon Medical Systems Asia Pte. Ltd., B. Braun SE, LivaNova PLC, Cardinal Health, and Boston Scientific Corporation provide extensive cardiovascular portfolios across multiple specialties, including electrophysiology, coronary intervention, and structural heart solutions, supporting hospitals and healthcare providers in delivering optimized patient care. The market remains highly dynamic, with competition centered on technological innovation, clinical validation, and comprehensive service support.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 57.8 billion |

| Product | Surgical Devices (Cardiac Resynchronization Therapy (CRT), Implantable Cardioverter Defibrillators (ICDs), Pacemakers, Coronary Stents, Catheters, Guidewires, Cannula, Valves, Occlusion Devices), Diagnostic & Monitoring Devices (ECG, Implantable Cardiac Monitors, Holter Monitors, Mobile Cardiac Telemetry, MRI, Cardiovascular Ultrasound, Cardiac Diagnostic Catheters, PET Scanner) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Medtronic, Abbott, GE HealthCare, Edwards Lifesciences Corporation, W. L. Gore & Associates Inc., Siemens Healthcare GmbH, BIOTRONIK SE & Co. KG, Canon Medical Systems Asia Pte. Ltd., B. Braun SE, LivaNova PLC, Cardinal Health, and Boston Scientific Corporation |

| Additional Attributes | Dollar sales by device type category, regional demand trends, competitive landscape, buyer preferences for surgical versus diagnostic devices, integration with minimally invasive procedures, innovations in transcatheter technologies, digital health connectivity, and personalized cardiac therapy development |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global cardiovascular devices market is estimated to be valued at USD 57.8 billion in 2025.

The market size for the cardiovascular devices market is projected to reach USD 122.6 billion by 2035.

The cardiovascular devices market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in cardiovascular devices market are surgical devices, _cardiac resynchronization therapy (crt), _implantable cardioverter defibrillators (icds), _pacemakers, _coronary stents, _catheters, _guidewires, _cannula, _valves, _occlusion devices, diagnostic & monitoring devices, _ecg, _implantable cardiac monitors, _holter monitors, _mobile cardiac telemetry, _mri, _cardiovascular ultrasound, _cardiac diagnostic catheters and _pet scanner.

In terms of , segment to command 0.0% share in the cardiovascular devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardiovascular Surgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Prosthetic Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Repair & Reconstruction Devices Market – Growth & Trends 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Ultrasound Market - Demand & Innovations 2025 to 2035

Cardiovascular Enterprise Viewer Market Insights – Growth & Forecast 2025 to 2035

Cardiovascular Needle Market – Growth & Forecast 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA