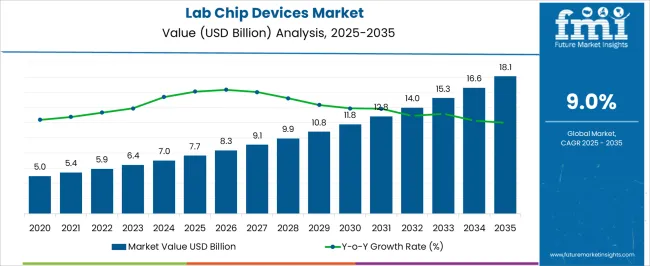

The Lab Chip Devices Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 18.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Lab Chip Devices Market Estimated Value in (2025 E) | USD 7.7 billion |

| Lab Chip Devices Market Forecast Value in (2035 F) | USD 18.1 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The lab chip devices market is witnessing consistent growth, driven by the increasing demand for miniaturized diagnostic and analytical platforms that provide faster, more accurate, and cost-effective results. The adoption of lab-on-chip technologies is being supported by the rising focus on point-of-care testing, personalized medicine, and high-throughput screening across clinical, pharmaceutical, and biotechnology sectors.

Growing investments in microfluidics research and integration of automation with digital platforms are further enhancing device capabilities, enabling multifunctional analysis on a single chip. Regulatory bodies are emphasizing rapid and reliable testing solutions to address emerging healthcare challenges, which is boosting adoption in both developed and emerging economies.

Additionally, the growing prevalence of chronic diseases and the need for early disease detection are influencing laboratories and healthcare providers to adopt lab chip devices as efficient alternatives to traditional methods As research institutions and companies continue to innovate with improved chip designs and materials, the market outlook remains favorable, with strong opportunities for expansion across clinical diagnostics, biotechnology, and industrial applications.

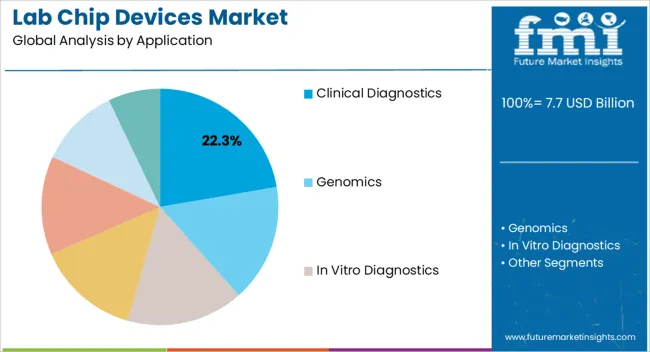

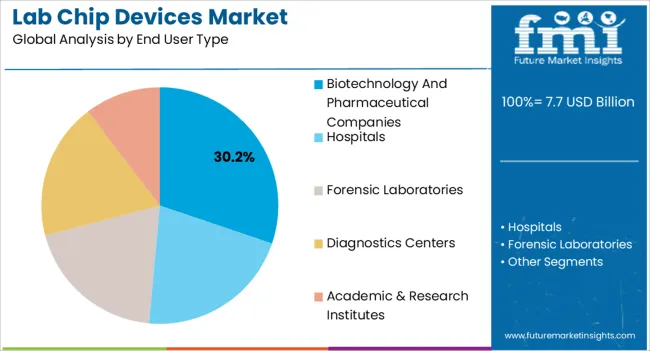

The lab chip devices market is segmented by application, end user type, and geographic regions. By application, lab chip devices market is divided into Clinical Diagnostics, Genomics, In Vitro Diagnostics, Point Of Care Diagnostics, Proteomics, Drug Discovery, and Others (Biodefense, Food Pathogen Identification, And Environmental Contamination). In terms of end user type, lab chip devices market is classified into Biotechnology And Pharmaceutical Companies, Hospitals, Forensic Laboratories, Diagnostics Centers, and Academic & Research Institutes. Regionally, the lab chip devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The clinical diagnostics segment is expected to account for 22.3% of the lab chip devices market revenue share in 2025, establishing itself as one of the leading application areas. Its prominence is being driven by the rising global demand for rapid and accurate diagnostic tools that can be deployed at the point of care. The ability of lab chip devices to analyze small sample volumes while delivering precise results within minutes is significantly improving patient outcomes and reducing laboratory workloads.

Clinical diagnostics are benefiting from advancements in microfluidics and bio-sensing technologies, which have enabled detection of complex biomarkers and pathogens with high sensitivity and specificity. The segment is also supported by growing adoption in infectious disease testing, oncology, and genetic screening, where rapid diagnostics are critical for treatment decisions.

Cost efficiency, portability, and reduced reagent consumption are additional factors reinforcing the segment’s position As healthcare systems worldwide focus on enhancing efficiency and accessibility, lab chip devices in clinical diagnostics are anticipated to remain a central driver of market growth.

The biotechnology and pharmaceutical companies segment is projected to hold 30.2% of the lab chip devices market revenue share in 2025, making it the dominant end-user category. Its leadership is attributed to the increasing reliance on lab-on-chip platforms for drug discovery, development, and quality control processes. These companies are adopting lab chip devices to accelerate research timelines by enabling high-throughput screening, rapid compound testing, and real-time monitoring of cellular and molecular interactions.

The segment is also being propelled by the growing emphasis on precision medicine and personalized therapeutics, which require advanced tools for analyzing genetic and biochemical data. Enhanced reproducibility, scalability, and integration with automated laboratory systems are providing further advantages, making lab chip devices indispensable in modern pharmaceutical workflows.

In addition, significant investments by large biotechnology firms in microfluidics research and collaborations with technology providers are strengthening adoption As the pharmaceutical pipeline continues to expand and regulatory requirements for efficient testing intensify, the biotechnology and pharmaceutical companies segment is expected to maintain its leading share in the market.

The global lab chip devices market size is anticipated to be worth US$ 5.91 Bn in 2025. During the projection period of 2025 to 2035, the market is predicted to grow at a CAGR of 9.00%, with a valuation of US$ 13.99 Bn by 2035.

| Attributes | Details |

|---|---|

| Lab Chip Devices Market Value (2025) | US$ 5.91 Billion |

| Lab Chip Devices Market Forecast Value (2035) | US$ 13.99 Billion |

| Lab Chip Devices Market CAGR (2025 to 2035) | 9.00% |

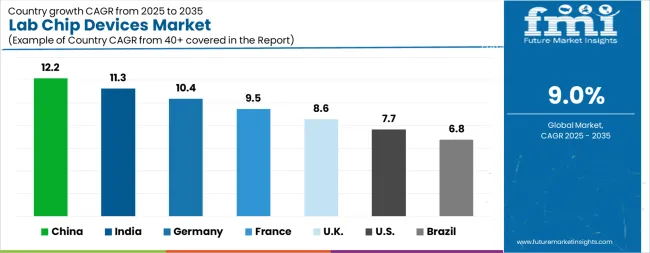

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The Lab Chip Devices Market is expected to register a CAGR of 9.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.2%, followed by India at 11.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA. is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.8%, yet still underscores a broadly positive trajectory for the global Lab Chip Devices Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.4%. The USA. Lab Chip Devices Market is estimated to be valued at USD 2.8 billion in 2025 and is anticipated to reach a valuation of USD 5.9 billion by 2035. Sales are projected to rise at a CAGR of 7.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 420.8 million and USD 267.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Application | Clinical Diagnostics, Genomics, In Vitro Diagnostics, Point Of Care Diagnostics, Proteomics, Drug Discovery, and Others (Biodefense, Food Pathogen Identification, And Environmental Contamination) |

| End User Type | Biotechnology And Pharmaceutical Companies, Hospitals, Forensic Laboratories, Diagnostics Centers, and Academic & Research Institutes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

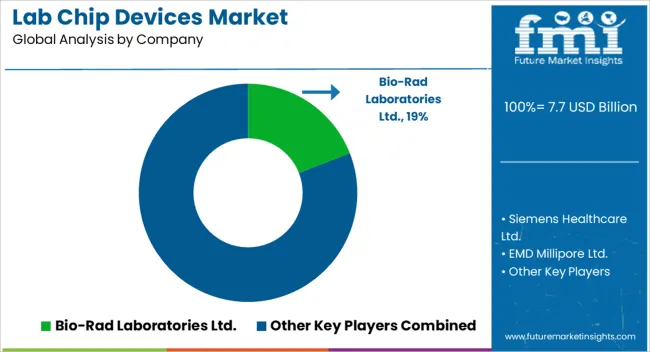

| Key Companies Profiled | Bio-Rad Laboratories Ltd., Siemens Healthcare Ltd., EMD Millipore Ltd., Danaher Corporation, Abbott Laboratories, Hoffman La Roche AG, and Life Technologies Corporation (Thermo Fisher Scientific) |

The global lab chip devices market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the lab chip devices market is projected to reach USD 18.1 billion by 2035.

The lab chip devices market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in lab chip devices market are clinical diagnostics, genomics, in vitro diagnostics, point of care diagnostics, proteomics, drug discovery and others (biodefense, food pathogen identification, and environmental contamination).

In terms of end user type, biotechnology and pharmaceutical companies segment to command 30.2% share in the lab chip devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lab Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Labels Market Forecast and Outlook 2025 to 2035

Laboratory Information System Market Forecast and Outlook 2025 to 2035

Label Applicators Market Size and Share Forecast Outlook 2025 to 2035

Lab Mailers Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Centrifuge & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Lab Centrifuges Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Washers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Rockers and Shakers Market Size and Share Forecast Outlook 2025 to 2035

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laboratory and Medical Scale Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Furnaces Market Analysis - Size, Share, and Forecast 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Supplies Market Size and Share Forecast Outlook 2025 to 2035

Labeling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lab Trays Market Size and Share Forecast Outlook 2025 to 2035

Label Printers Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA