The labeling equipment industry is estimated at USD 4.1 billion in 2025 and is expected to reach USD 6.6 billion by 2035, growing at a CAGR of 4.9%. OEM production lines in East Asia and Europe are operating at 78-82% capacity, limited by sourcing constraints in servo drives and sensors.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 4.1 billion |

| Forecast Value (2035) | USD 6.6 billion |

| CAGR (2025 to 2035) | 4.9% |

About 25% of current installations serve co-packers and private-label producers dealing with frequent SKU turnover. Modular systems are replacing fully customized units, allowing faster changeovers and lower installation costs. North American and ASEAN suppliers are relocating final-stage assembly closer to regional hubs.

On June 25, 2025, Pascale Wautelet, Vice President of Global R&D and Sustainability at Avery Dennison Materials Group, stated that RFID technology is essential for the effective management of modern supply chains, supporting brands with greater inventory visibility, product traceability, and loss prevention.

APR’s recognition marks a pivotal step forward in advancing circular packaging and supporting the global transition to recyclable material use. As consumer goods companies set increasingly ambitious recycling targets, Avery Dennison remains committed to helping our customers reduce waste by investing in innovation and designing products that can be effectively recycled.

The market accounts for approximately 15-20% of the global packaging machinery market. Within the broader industrial automation equipment segment, labeling systems contribute around 1-2%, as the category competes with robotics, conveyors, and inspection technologies. In the global printing equipment market, label-specific machinery including thermal and print-and-apply systems represents about 5-7% of total value.

For the food, beverage, and pharmaceutical packaging industry, labeling equipment captures roughly 4-6% due to its role in regulatory and traceability applications. Within the overarching automation and packaging solutions market, labeling machinery holds a 2-3% share, driven by its integration into end-of-line processes across consumer goods and logistics sectors.

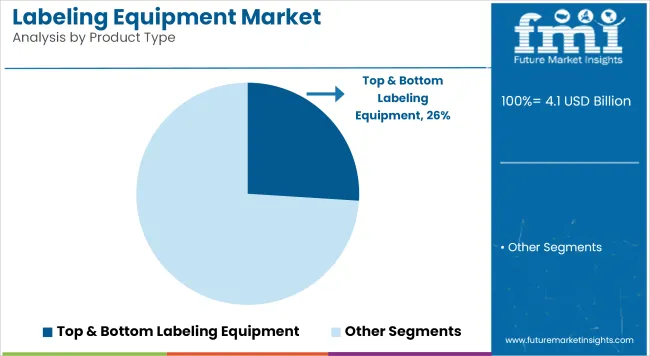

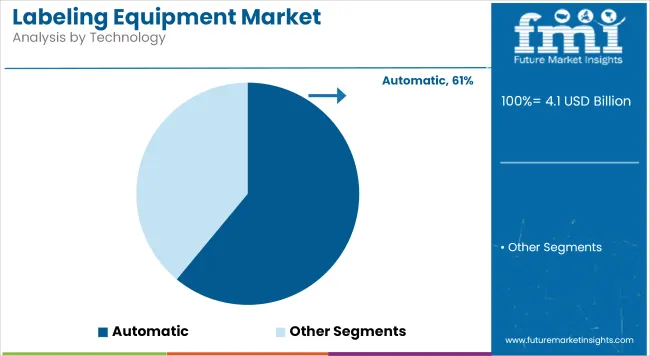

The industry is segmented by product type into top labeling, bottom labeling, top & bottom labeling, wrap labeling, front & back labeling, and full-body sleeve labeling equipment. By technology, it includes automatic, semi-automatic, and manual systems.

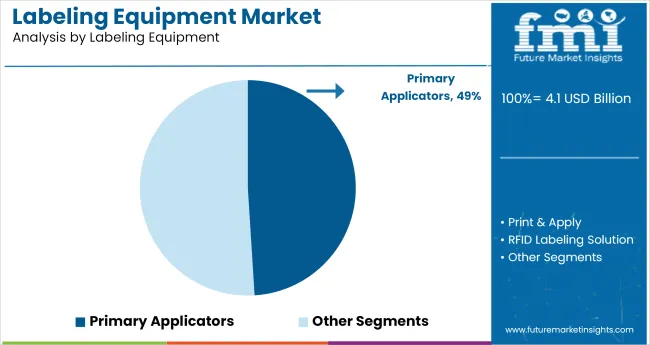

Labeling equipment types comprise primary applicators, print & apply, and RFID solutions. The market spans industries such as food & beverages, healthcare, cosmetics, automotive, and e-commerce, with regional segmentation across North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Top & bottom equipment is projected to hold 26% of the industry share in 2025. This product type is especially prominent in industries like food & beverage and pharmaceuticals. Companies such as Coca-Cola and PepsiCo use these systems for labeling bottles on both sides, while pharmaceutical manufacturers rely on this equipment to meet regulatory requirements. The demand for efficient, high-volume production lines is driving the widespread use of top & bottom labeling systems.

Automatic equipment is projected to capture 61% of the industry share in 2025. The growing need for high-speed and high-precision production is driving the demand for automatic systems. Automatic equipment is essential in industries like food & beverage, where labeling needs to be fast, accurate, and diverse. Companies like Sidel and Pack Leader Machinery are key players, offering high-speed systems suitable for large-scale production lines.

Primary applicators are projected to hold 49% of the industry share in 2025. These machines are essential for high-speed, bulk labeling applications, especially in industries such as food & beverage, pharmaceuticals, and consumer goods. Primary applicators are known for their simplicity, cost-efficiency, and reliability in large-scale production environments. For example, companies like HERMA and Videojet Technologies provide robust primary applicator systems that enable rapid and consistent label application.

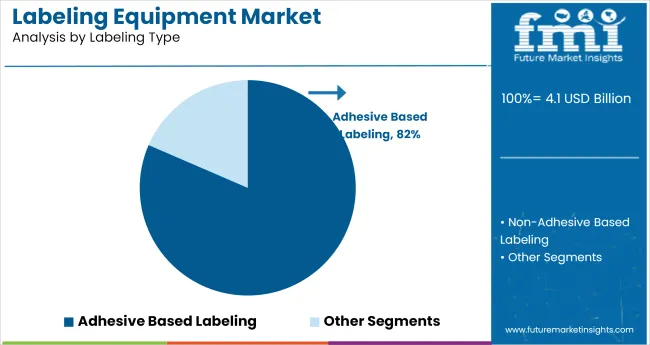

Adhesive-based labeling is projected to capture 81.5% of the industry share in 2025. This method is widely used due to its versatility and durability across packaging materials like glass, plastic, and metal. Leading companies such as Avery Dennison and UPM Raflatac are at the forefront, providing durable and versatile labeling solutions for industries like food & beverage, where product integrity and regulatory compliance are essential.

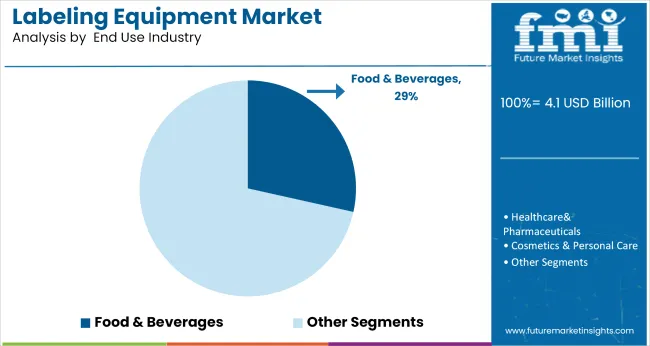

The food & beverage industry is expected to hold 28.5% of the industry share in 2025. This sector is the largest contributor to the labeling equipment industry due to the need for regulatory compliance, nutritional transparency, and branding. Companies like Coca-Cola and Unilever rely on labeling solutions for product differentiation and accurate labeling. The demand for ready-to-eat meals and packaged beverages continues to drive the growth of labeling systems in this sector.

The industry is experiencing growth, driven by the demand for more efficient and automated solutions in packaging industries. Increased focus on product traceability and regulatory compliance is contributing to the demand for advanced labeling technologies. However, challenges like high initial investment costs and the complexity of integrating these systems with existing production lines are restraining growth.

Drivers of Growth in Labeling Equipment

Growth is supported by the rising need for automation across manufacturing sectors, including food & beverage, pharmaceuticals, and personal care. Enhanced product safety regulations are pushing manufacturers to invest in labeling solutions that ensure clear, accurate product information. The increasing consumer preference for eco-friendly and recyclable labels is also driving innovation in the industry. Furthermore, advancements in smart labeling technologies, such as QR codes and RFID, are promoting growth.

Challenges Hindering Labeling Equipment Growth

Despite growth, challenges include the high upfront cost of modern labeling equipment, which can be a barrier for small and mid-sized manufacturers. Additionally, the complexity of integrating advanced labeling systems with legacy production lines is creating hurdles. The fluctuating prices of raw materials, including paper and plastics, are also impacting the overall costs and profitability of labeling solutions.

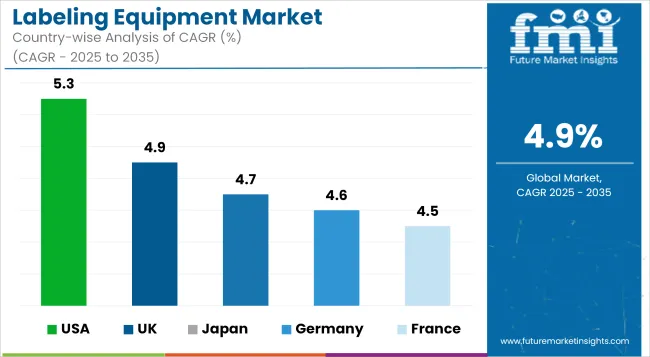

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

| UK | 4.9% |

| Japan | 4.7% |

| Germany | 4.6% |

| France | 4.5% |

The global labeling equipment industry is forecast to grow at a 4.9% CAGR between 2025 and 2035. Among profiled economies, the United States leads at 5.3%, outperforming the global average by 0.4 percentage points.

This reflects ongoing capital spending across logistics hubs, automation upgrades in CPG plants, and widespread RFID adoption in pharmaceutical packaging lines. In contrast, Japan and Germany, both OECD members, trail at 4.7% and 4.6% respectively, due to legacy equipment cycles and higher replacement costs in medium-scale facilities.

The United Kingdom matches the global average at 4.9%, supported by demand in beverage and e-commerce fulfillment sectors but offset by cost pressures limiting new installations in smaller manufacturing units. France records the lowest growth at 4.5%, showing a 0.4 percentage point lag, shaped by slower adoption of serialization mandates and limited access to modular mid-range systems. Regional gaps reflect differences in asset utilization, technology refresh rates, and compliance-driven automation spending.

The report covers detailed analysis of over 40 countries, and the top five have been shared as a reference.

Sales of labeling equipment in the United States are growing at a 5.3% CAGR from 2025 to 2035. Growth is driven by strong demand from industries such as food & beverage, pharmaceuticals, and consumer goods, which rely on advanced labeling solutions to meet regulatory requirements and enhance brand differentiation.

Government policies, such as the FDA’s regulations on food labeling and packaging, continue to push the demand for accurate, automated labeling systems. The USA government’s investments in manufacturing automation also play a key role in expanding the industry.

Demand for labeling equipment in the United Kingdom is expanding at a 4.9% CAGR from 2025 to 2035. The food & beverage and healthcare industries are major contributors to this growth, with strict labeling regulations driving demand for high-precision labeling systems.

Government policies in the UK, including the Food Information Regulations and environmental packaging standards, continue to shape the industry. These policies push companies to adopt more advanced, automated labeling solutions to comply with packaging and labeling requirements.

The labeling equipment market in Japan is forecasted to grow at a 4.7% CAGR from 2025 to 2035. The primary demand comes from the food & beverage and pharmaceutical industries, where high standards of labeling accuracy and compliance are required.

Japan’s government policies, including food labeling regulations enforced by the Ministry of Health, Labor and Welfare (MHLW), are critical in shaping the demand for labeling systems. Policies encouraging the traceability of products and information transparency also contribute to the industry expansion in Japan.

Demand for labeling equipment in Germany is projected to grow at a 4.6% CAGR from 2025 to 2035. The growth is supported by demand from industries such as food & beverage, pharmaceuticals, and chemicals. Government policies, including the European Union's regulations on food labeling, play a significant role in promoting the need for accurate, compliant labeling systems. Germany’s focus on industrial efficiency and transparency in product labeling is also contributing to the increased adoption of automated labeling solutions.

The labeling equipment market in France is projected to expand at a 4.5% CAGR from 2025 to 2035. The food & beverage, pharmaceuticals, and cosmetics sectors are the largest contributors to this demand. French government policies, such as those outlined in the French Consumer Code and packaging regulations, ensure that products meet strict labeling standards.

These regulations promote the adoption of more advanced labeling systems. Furthermore, France’s focus on sustainability in packaging, including extended producer responsibility (EPR), influences the demand for innovative labeling solutions.

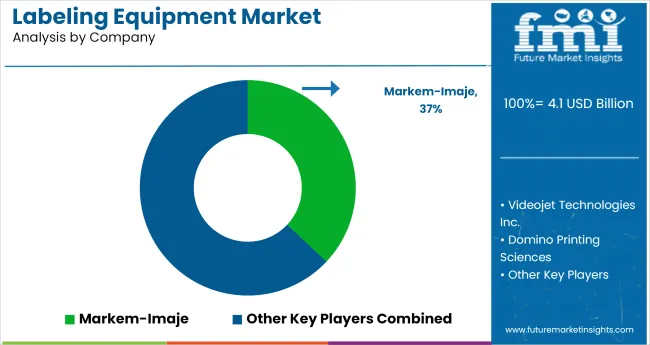

In the labeling equipment market, leading companies are advancing through innovation in automation, regulatory compliance, and integration with smart packaging ecosystems. Brands like MarkemImaje, Herma GmbH, and Videojet Technologies are expanding globally by delivering high-speed print-and-apply systems, automated inspection modules, and traceability solutions, often positioned within regulated sectors like pharmaceuticals, food, and electronics.

Their strategies lean on existing production-line partnerships, enabling rapid deployment of 2D-barcoded, RFID-capable applications without major capital investment. Component suppliers such as Avery Dennison and SATO strengthen this ecosystem by offering pressure-sensitive labels and tags that support scalable RFID and smart-label setups across Europe and North America.

Regional innovators like BROTHER Industries and Domino Printing Sciences are growing in premium segments by emphasizing compact modular units, UV-curable ink options, and digital connectivity for automated changeover.

Leading Company - MarkemImaje

Industry Share - 37% Recent Labeling Equipment Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 4.1 billion |

| Projected Industry Size (2035) | USD 6.6 billion |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand units for volume |

| Product Types Analyzed (Segment 1) | Top Labeling Equipment, Bottom Labeling Machines, Top & Bottom Labeling Equipment, Wrap Labeling Equipment, Front & Back Labeling Equipment, Full Body Sleeve Labeling Equipment |

| Technologies Analyzed (Segment 2) | Automatic, Semi-Automatic, Manual Systems |

| Labeling Equipment Types Analyzed (Segment 3) | Primary Applicators, Print & Apply Systems, RFID Labeling Solutions |

| Labeling Types Analyzed (Segment 4) | Adhesive-Based Labeling, Non-Adhesive-Based Labeling |

| End Use Industries Analyzed (Segment 5) | Food & Beverages, Healthcare & Pharmaceuticals, Cosmetics & Personal Care, Electricals & Electronics, E-commerce, Automotive, Homecare, Others |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Markem-Imaje, Videojet Technologies Inc., Domino Printing Sciences, Weber Packaging Solutions, ProMach Inc., HERMA GmbH, Avery Dennison Corporation, Sato Holdings Corporation, Cab Produkttechnik GmbH & Co. KG, Brother Industries, Ltd., Other Emerging Players |

| Additional Attributes | Dollar sales, share by equipment and technology type, RFID and print & apply innovations, growth in food and e-commerce packaging, demand for multi-surface labeling systems, adoption across automated filling and packaging lines |

The industry includes top labeling equipment, bottom labeling machines, top & bottom labeling equipment, wrap labeling equipment, front & back labeling equipment, and full body sleeve labeling equipment.

The industry is segmented into automatic, semi-automatic, and manual systems.

This includes primary applicators, print & apply systems, and RFID labeling solutions.

Segmentation covers adhesive-based labeling and non-adhesive-based labeling.

The industry serves food & beverages, healthcare & pharmaceuticals, cosmetics & personal care, electricals & electronics, e-commerce, automotive, homecare, and other industries.

The industry is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

The market is projected to reach USD 6.6 billion by 2035.

The expected CAGR is 4.9% between 2025 and 2035.

Automatic labeling equipment is projected to dominate with 61% share in 2025.

The market is estimated to be valued at USD 4.1 billion in 2025.

The United States is expected to lead growth with a CAGR of 5.3% during the forecast period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Labeling Equipment Providers

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Labeling Equipment Market

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Labeling Software Market Growth - Trends & Forecast through 2034

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Slide Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA