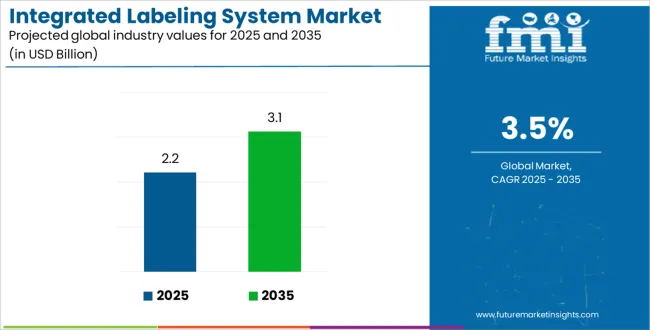

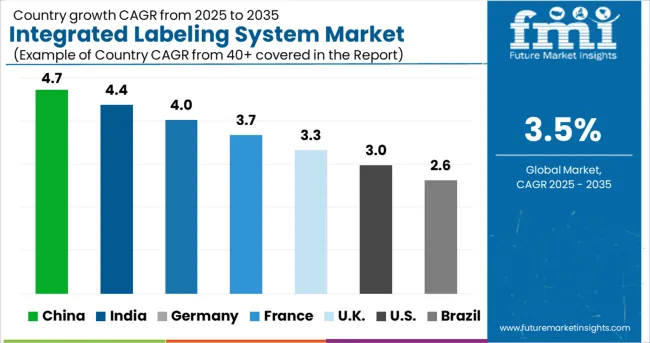

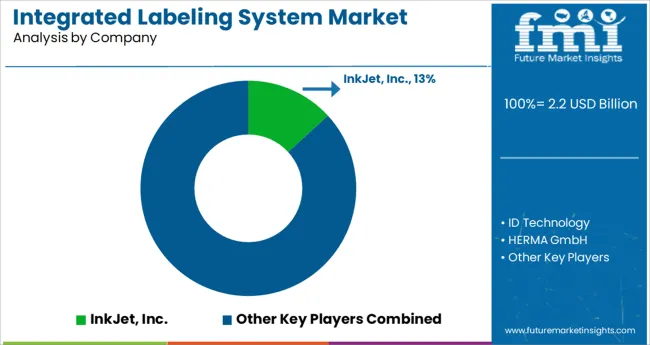

The Integrated Labeling System Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The integrated labeling system market is progressing rapidly, supported by the increasing demand for automated, high-speed identification and traceability in packaging and industrial operations. Manufacturers are enhancing label accuracy and throughput by adopting systems that integrate print-and-apply functions, barcode verification, and vision inspection technologies.

Growth has been further fueled by the evolving compliance landscape across sectors such as food, healthcare, and electronics, where product serialization and safety labeling have become non-negotiable. Compact system footprints and modular configurations are allowing deployment in both greenfield and brownfield facilities, driving demand in both developed and emerging markets.

Future opportunities are expected to emerge through the convergence of labeling platforms with robotics, cloud analytics, and digital twin technologies, enabling real-time traceability, efficiency improvements, and regulatory alignment. As sustainability initiatives advance, labeling solutions are also being tailored for recyclable materials and reduced adhesive usage, positioning the market for broader adoption across environmentally sensitive supply chains.

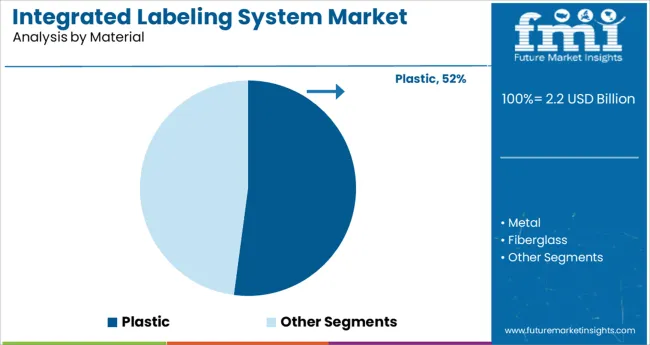

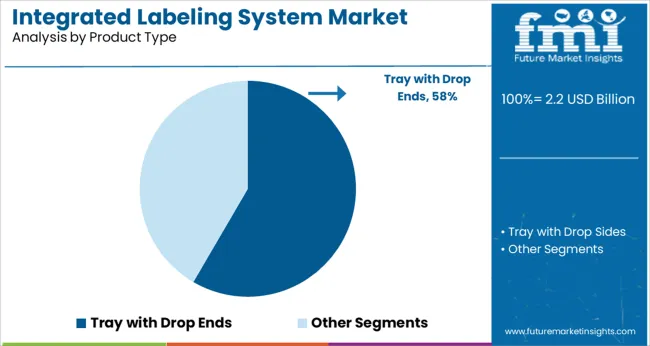

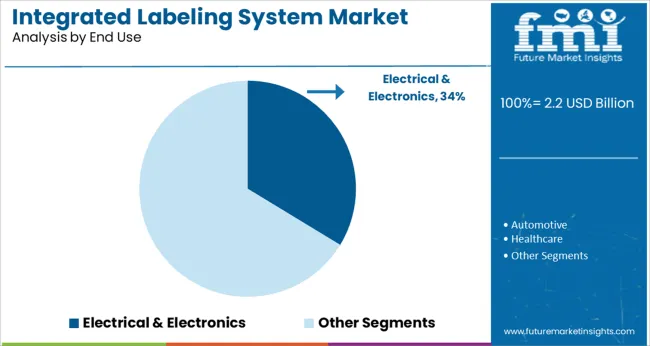

The market is segmented by Material, Product Type, and End Use and region. By Material, the market is divided into Plastic, Metal, and Fiberglass. In terms of Product Type, the market is classified into Tray with Drop Ends and Tray with Drop Sides. Based on End Use, the market is segmented into Electrical & Electronics, Automotive, Healthcare, Aerospace, and Others (Defence & Military, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastic is anticipated to contribute 52.1% of total revenue in the material category in 2025, making it the leading material used in integrated labeling systems. This dominance is driven by plastic’s versatility, durability, and compatibility with a wide range of label adhesives and print technologies.

Its resistance to moisture, chemicals, and mechanical stress has positioned it as a preferred substrate in high-volume labeling operations, especially in logistics, consumer goods, and industrial packaging. Lightweight and cost-effective characteristics have supported its scalability across automated lines.

Additionally, continuous development of recyclable and bio-based plastic variants is aligning the material with sustainability directives while retaining its functional benefits, further solidifying its share in the integrated labeling system market.

Tray with drop ends is expected to account for 58.4% of revenue in the product type segment in 2025, establishing it as the dominant design. This preference is being reinforced by the tray’s ergonomic advantage in automated handling, stacking, and seamless label application.

The drop-end configuration facilitates better label visibility and positioning, which enhances scanning accuracy in downstream logistics and retail environments. Its structural compatibility with both flat and curved surfaces allows for consistent label adhesion across varied product shapes.

The format has also become integral in high-speed lines where minimal product repositioning is critical, supporting efficiency gains. These attributes have led to widespread adoption in packaging operations requiring stability, repeatability, and throughput, securing the tray with drop ends segment as the preferred format.

The electrical and electronics segment is projected to contribute 33.7% of revenue in the integrated labeling system market in 2025, positioning it as the top end-use category. This leadership is being propelled by rising demand for component traceability, safety compliance, and brand protection across a growing range of electronic devices.

Integrated labeling systems are being employed to ensure consistent identification of circuit boards, wire harnesses, control panels, and consumer electronics, where space constraints and material sensitivity require precision application. Regulatory standards around CE marking, RoHS compliance, and batch traceability are further driving adoption of high-accuracy labelers.

Manufacturers in this segment are prioritizing systems with variable data printing, anti-counterfeit features, and high-resolution coding, which has significantly expanded the role of integrated labeling in quality assurance and inventory control. As electronics production scales to meet global demand, integrated labeling will remain critical to operational efficiency and regulatory conformity.

The demand for integrated labeling system is projected to rise as they are efficient labeling solutions that maintain consistently high pasting accuracy even when production speed and labeling material vary. This is one of the important factors contributing to the growth of the global integrated labeling systems market share.

Furthermore, the sales of integrated labeling system is rising as they deliver high-quality label pasting, avoid waste and downtime, and also allow for optimal throughput.

The demand for integrated labeling system is anticipated to rise as enterprises all over the world are looking for more dependable technology to create long-lasting automated labeling equipment for packaging.

Manufacturers are shifting to an integrated labeling system in order to improve accuracy, which is expected to fuel the sales of integrated labeling system. The high-cost system, on the other hand, is predicted to stifle the global market for integrated labeling systems.

The integrated labeling system market size is projected to expand as demand for automated integrated packaging solutions grows around the world. Other factors such as changing consumer perceptions of packaged goods, rising manufacturer demand for integrated labeling systems to improve accuracy and reduce labour costs, and rising awareness about the benefits of integrated labeling systems is likely to boost the sales of integrated labeling system during the forecast period (2025 to 2035).

During the projected period, the sales of integrated labeling system in North America is expected to rise rapidly. North America is mostly concerned with packaged goods. Furthermore, rising markets like India and China are likely to make a significant contribution to the market growth for integrated labeling systems.

Due to the advancement of packaging materials and demand for automated integrated labeling solutions, the sales of integrated labeling system is likely to increase during the forecast period.

Taiwan and China are also the leading exporters of an automatic integrated labeling system in the APAC area. As a result, Asia-Pacific is predicted to dominate the global integrated labeling system market in terms of market value.

Labeling System, LLC, Quadrel Labeling Systems, In-Line Labeling Equipment, Inc., Harland Machine Systems Ltd., Label-Aire, Inc., Weiler Labeling Systems, LLC, CTM Labeling Systems, Inc., MPI Label Systems, Inc., Newman Labelling Systems Ltd., and CVC Technologies Inc. are some of the companies operating in the integrated labeling system market. The integrated labeling system market is projected to be dominated by local and unorganised players.

Recent Developments

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 3.5% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2014 to 2020 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Product type, Automation, Labeling, End Use, Region |

| Regional scope | North America; Western Europe, Eastern Europe, Middle East, Africa, ASEAN, South Asia, Rest of Asia, Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK., France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Labeling System; LLC; Quadrel Labeling Systems; In-Line Labeling Equipment; Inc.; Harland Machine Systems Ltd.; Label-Aire; Inc.; Weiler Labeling Systems; LLC; CTM Labeling Systems; Inc.; MPI Label Systems; Inc.; Newman Labelling Systems Ltd.; and CVC Technologies Inc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global integrated labeling system market is estimated to be valued at USD 2.2 billion in 2025.

It is projected to reach USD 3.1 billion by 2035.

The market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types are plastic, metal and fiberglass.

tray with drop ends segment is expected to dominate with a 58.4% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Integrated Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Integrated Motor Protector Market Size and Share Forecast Outlook 2025 to 2035

Integrated Universal Integrated Circuit Card (iUICC) Modules Market Size and Share Forecast Outlook 2025 to 2035

Integrated SIM (iSIM) Market Size and Share Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Integrated UPS Market Size and Share Forecast Outlook 2025 to 2035

Integrated Quantum Optical Circuits Market Size and Share Forecast Outlook 2025 to 2035

Integrated Graphics Chipset Market Analysis by Device Type, Industry Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Integrated Food Ingredients Market Analysis -Size, Share & Forecast 2025 to 2035

Integrated Passive Devices (IPDs) Market

Integrated CMOS Tri-gate Transistor Market

Integrated Gas System Market Growth – Trends & Forecast 2025 to 2035

Integrated Traffic System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Chemistry Systems Market Size and Share Forecast Outlook 2025 to 2035

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

AI-Integrated Blood Analyzers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Power Integrated Modules Market Trends – Growth & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA