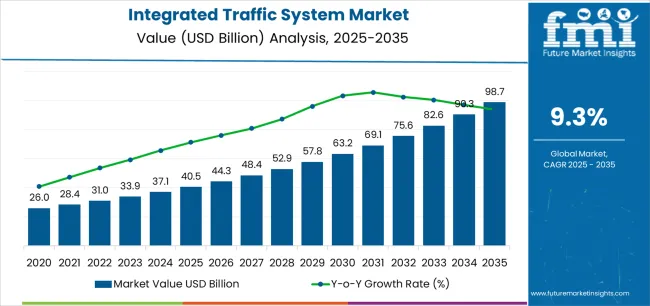

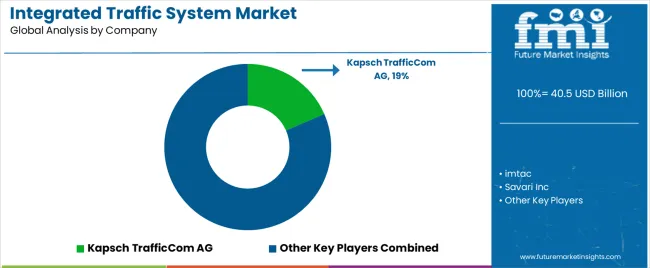

The Integrated Traffic System Market is estimated to be valued at USD 40.5 billion in 2025 and is projected to reach USD 98.7 billion by 2035, registering a compound annual growth rate (CAGR) of 9.3% over the forecast period.

The integrated traffic system market is experiencing robust growth driven by rapid urbanization, increasing vehicle volumes, and the rising need for intelligent mobility management. Governments and city planners are prioritizing the deployment of smart traffic solutions to optimize road safety, reduce congestion, and improve overall transportation efficiency. Technological advancements in sensor networks, data analytics, and real-time monitoring systems are enabling more responsive and adaptive traffic control frameworks.

Current adoption trends reflect growing investments in infrastructure modernization and the integration of IoT-enabled communication platforms within transportation ecosystems. The future outlook is strongly supported by initiatives focused on sustainable mobility, efficient public transit management, and the reduction of carbon emissions through optimized traffic flow.

Growth rationale is anchored on the convergence of automation, digitalization, and analytics that enhance situational awareness and operational responsiveness Continuous innovation in hardware and sensor technologies is expected to strengthen system interoperability and ensure scalable deployment across both developed and emerging urban centers.

| Metric | Value |

|---|---|

| Integrated Traffic System Market Estimated Value in (2025 E) | USD 40.5 billion |

| Integrated Traffic System Market Forecast Value in (2035 F) | USD 98.7 billion |

| Forecast CAGR (2025 to 2035) | 9.3% |

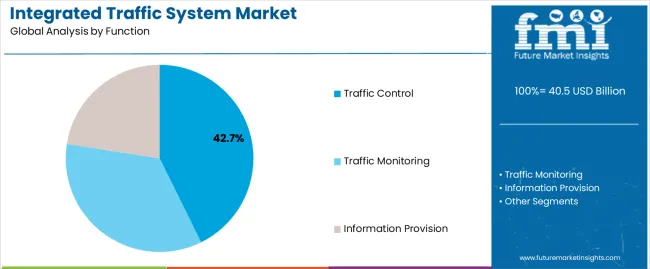

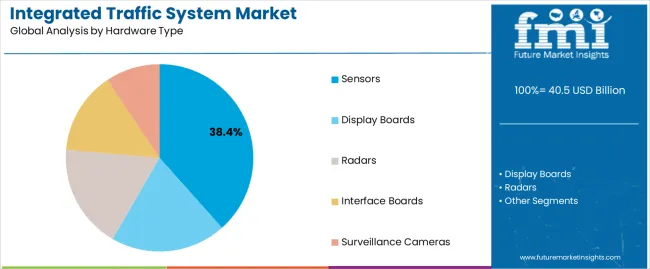

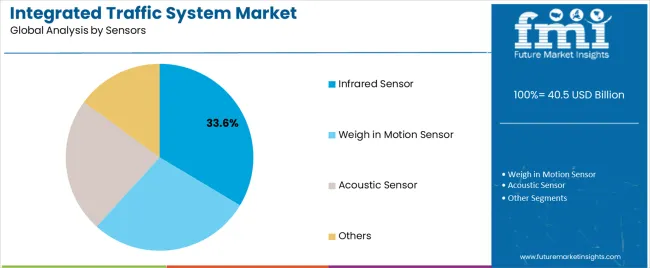

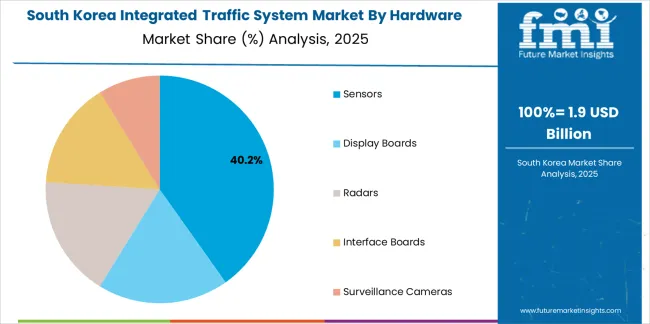

The market is segmented by Function, Hardware Type, Sensors, and Application and region. By Function, the market is divided into Traffic Control, Traffic Monitoring, and Information Provision. In terms of Hardware Type, the market is classified into Sensors, Display Boards, Radars, Interface Boards, and Surveillance Cameras. Based on Sensors, the market is segmented into Infrared Sensor, Weigh in Motion Sensor, Acoustic Sensor, and Others. By Application, the market is divided into Urban Traffic and Expressway. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The traffic control segment, accounting for 42.70% of the function category, has been leading the market due to its essential role in managing signal operations, traffic flow optimization, and congestion mitigation. Its dominance is being supported by widespread adoption of adaptive signal control systems and centralized management platforms that enable real-time adjustments based on traffic density.

Municipal authorities are increasingly investing in digital traffic control infrastructure to reduce delays and enhance commuter safety. The integration of AI-based predictive algorithms has improved decision-making accuracy, ensuring smoother mobility across interconnected urban corridors.

Upgrades in communication technologies and data exchange protocols have enhanced coordination between control centers and field equipment Continuous funding in smart city initiatives and traffic digitization projects is expected to maintain the segment’s leadership and expand its application scope across global transportation networks.

The sensors segment, holding 38.40% of the hardware type category, has emerged as the primary hardware component due to its critical function in data collection and real-time monitoring. Market growth has been reinforced by the increasing reliance on sensor-based feedback for decision-making in adaptive traffic management systems.

Continuous improvements in durability, accuracy, and data transmission capabilities have enhanced system reliability under diverse environmental conditions. The growing integration of multi-sensor arrays within road infrastructure has optimized vehicle detection and traffic pattern analysis.

Demand has been further boosted by infrastructure digitization programs and smart corridor development projects across metropolitan regions As sensor technologies become more compact and cost-efficient, their role in supporting autonomous and connected transportation ecosystems is expected to expand, ensuring sustained dominance of this segment.

The infrared sensor segment, representing 33.60% of the sensors category, has maintained leadership due to its proven reliability in vehicle detection, motion sensing, and adaptive traffic control applications. Its performance in low-visibility and variable weather conditions has made it a preferred choice for outdoor installations.

The ability to provide accurate, non-intrusive detection without requiring pavement modifications has further increased its operational appeal. Deployment has been accelerated by advancements in signal processing and energy-efficient designs that reduce maintenance costs while improving detection precision.

Infrared sensors have become integral to smart intersections, automated signal systems, and pedestrian safety applications Continued investment in sensor calibration, energy optimization, and system integration is expected to sustain market share and support broader adoption across next-generation traffic management infrastructures.

The scope for integrated traffic system rose at a 12.3% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 9.8% over the forecast period 2025 to 2035.

Advancements in technology, including IoT, AI, and data analytics, enabled the development of more sophisticated integrated traffic management systems, during the historical period, improving efficiency and safety on roadways.

Many governments and municipalities implemented initiatives aimed at improving transportation infrastructure, enhancing road safety, and reducing carbon emissions, which contributed to the adoption of integrated traffic management solutions.

The concept of smart cities gained traction during this period, with cities investing in technologies to improve urban living conditions, including integrated traffic systems as part of broader urban planning strategies.

The deployment of autonomous vehicles is anticipated to increase during the forecast period, necessitating advanced traffic management solutions to accommodate and integrate these vehicles into existing transportation networks.

The use of real time data and predictive analytics will become more prevalent, enabling transportation agencies and urban planners to make informed decisions and optimize traffic flow based on dynamic conditions.

Continued investments in transportation infrastructure by governments and private entities will create opportunities for the deployment of integrated traffic management solutions, particularly in regions experiencing rapid urban development and population growth.

Advances in technology, including the Internet of Things, artificial intelligence, machine learning, and data analytics, have enabled the development of more sophisticated integrated traffic systems that can optimize traffic flow, enhance safety, and reduce emissions.

The implementation of integrated traffic systems often requires substantial upfront investment in infrastructure, technology, and software, which can be a barrier for many municipalities and transportation agencies, particularly those with limited budgets.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 10.1% |

| The United Kingdom | 11.0% |

| China | 10.6% |

| Japan | 11.4% |

| Korea | 12.0% |

The integrated traffic system market in the United States expected to expand at a CAGR of 10.1% through 2035. The government in the country has shown a commitment to investing in infrastructure improvement projects, including transportation systems. Funding initiatives at federal, state, and local levels support the development and implementation of integrated traffic management systems.

Many cities across the United States are investing in smart city initiatives aimed at leveraging technology to enhance urban infrastructure and services. Integrated traffic management is a key component of these initiatives, driving the adoption of advanced traffic management systems.

The integrated traffic system market in the United Kingdom is anticipated to expand at a CAGR of 11.0% through 2035. Continuous advancements in technology, including IoT, artificial intelligence, machine learning, and data analytics, drive innovation in traffic management systems. Advanced technologies enable real time monitoring, analysis, and optimization of traffic flow, leading to improved efficiency and reduced congestion on United Kingdom roadways.

Improving road safety is a priority for transportation authorities in the country. Integrated traffic systems incorporate features such as real time incident detection, adaptive signal control, and dynamic route guidance to enhance safety for drivers, pedestrians, and cyclists on the roads in the country.

Integrated traffic system trends in China are taking a turn for the better. A 10.6% CAGR is forecast for the country from 2025 to 2035. Chinese transportation authorities leverage big data analytics and real time traffic data to make informed decisions for traffic management and planning. Integrated traffic systems use advanced analytics tools to optimize traffic flow, predict traffic patterns, and improve transportation efficiency based on data driven insights.

Collaboration between government agencies, private sector companies, and technology providers drives innovation and investment in integrated traffic management solutions in China. Public private partnerships play a crucial role in funding, deploying, and operating integrated traffic systems to address the evolving transportation needs of Chinese cities.

The integrated traffic system market in Japan is poised to expand at a CAGR of 11.4% through 2035. Japan has a highly developed public transportation network, including trains, buses, and subways. Integrated traffic systems in Japan focus on integrating public transportation modes with road traffic management to provide seamless and efficient multi modal transportation solutions for commuters.

Japan places a strong emphasis on safety and disaster management, particularly in the context of natural disasters such as earthquakes and tsunamis. Integrated traffic systems incorporate features for real time incident detection, emergency response coordination, and evacuation route planning to enhance safety and resilience during emergencies.

The integrated traffic system market in Korea is anticipated to expand at a CAGR of 12.0% through 2035. Korea places a strong emphasis on building smart infrastructure to support economic growth, improve quality of life, and enhance competitiveness on the global stage. Integrated traffic systems are integral components of smart infrastructure projects, contributing to the modernization and efficiency of transportation networks.

Korea has implemented measures to reduce traffic accidents and fatalities, including stricter enforcement of traffic laws, public awareness campaigns, and investments in road safety infrastructure. Integrated traffic systems play a crucial role in enhancing road safety by detecting and mitigating potential hazards, improving visibility, and optimizing traffic flow to minimize the risk of accidents.

The below table highlights how traffic monitoring segment is projected to lead the market in terms of function, and is expected to account for a CAGR of 9.6% through 2035. Based on hardware type, the display boards segment is expected to account for a CAGR of 9.4% through 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Traffic Monitoring | 9.6% |

| Display Boards | 9.4% |

Based on function, the traffic monitoring segment is expected to continue dominating the integrated traffic system market. Continuous advancements in technology, including sensors, cameras, IoT devices, and data analytics, enable the development of sophisticated traffic monitoring solutions.

The technologies provide real time insights into traffic flow, congestion levels, and incidents, allowing transportation authorities to make informed decisions and take proactive measures to manage traffic effectively.

Traffic monitoring systems contribute to enhancing road safety and security by detecting traffic violations, accidents, and suspicious activities in real time. The systems help authorities respond promptly to incidents, minimize traffic disruptions, and ensure the safety of road users.

In terms of hardware type, the display boards segment is expected to continue dominating the integrated traffic system market, attributed to several key factors. Display boards play a crucial role in communicating real time traffic information, road conditions, alerts, and other relevant messages to motorists, pedestrians, and cyclists.

The need for effective communication to improve road safety, manage traffic congestion, and provide timely information to road users drives the demand for display boards in integrated traffic systems.

Display boards are essential components of traffic management and control systems, providing visual cues, instructions, and warnings to guide drivers, regulate traffic flow, and facilitate safe navigation through roadways, intersections, and construction zones. The ability to dynamically adjust messages and display relevant information based on changing traffic conditions enhances the efficiency and effectiveness of traffic management efforts.

The competitive landscape of the integrated traffic system market is characterized by the presence of several key players, each offering a range of solutions and services aimed at optimizing traffic flow, enhancing road safety, and improving transportation efficiency.

The market encompasses a variety of integrated traffic management systems, including hardware components, software platforms, and service offerings designed to address the evolving needs of urban transportation networks worldwide.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 36.9 billion |

| Projected Market Valuation in 2035 | USD 94.0 billion |

| Value-based CAGR 2025 to 2035 | 9.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD Billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Function, Hardware Type, Sensors, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | imtac; Savari Inc; Thales Group; TransCore; EFKON India; Iteris Inc; Cubic Corporation; Intelvision Technologies Limited; Nuance Communication Inc; Citilog; Kapsch TrafficCom AG |

The global integrated traffic system market is estimated to be valued at USD 40.5 billion in 2025.

The market size for the integrated traffic system market is projected to reach USD 98.7 billion by 2035.

The integrated traffic system market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in integrated traffic system market are traffic control, traffic monitoring and information provision.

In terms of hardware type, sensors segment to command 38.4% share in the integrated traffic system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Integrated Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Integrated Motor Protector Market Size and Share Forecast Outlook 2025 to 2035

Integrated Universal Integrated Circuit Card (iUICC) Modules Market Size and Share Forecast Outlook 2025 to 2035

Integrated SIM (iSIM) Market Size and Share Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Integrated UPS Market Size and Share Forecast Outlook 2025 to 2035

Integrated Quantum Optical Circuits Market Size and Share Forecast Outlook 2025 to 2035

Integrated Graphics Chipset Market Analysis by Device Type, Industry Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Integrated Food Ingredients Market Analysis -Size, Share & Forecast 2025 to 2035

Integrated Passive Devices (IPDs) Market

Integrated CMOS Tri-gate Transistor Market

Integrated Gas System Market Growth – Trends & Forecast 2025 to 2035

Integrated Labeling System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Chemistry Systems Market Size and Share Forecast Outlook 2025 to 2035

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

AI-Integrated Blood Analyzers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Power Integrated Modules Market Trends – Growth & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA