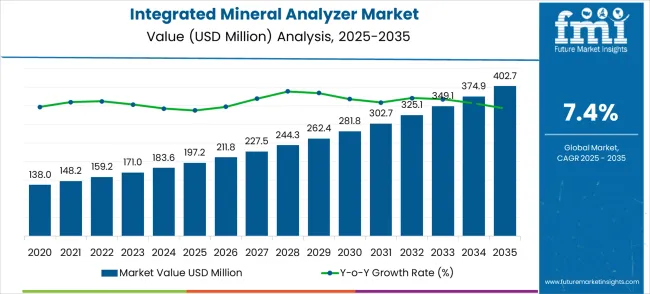

The integrated mineral analyzer market is poised for significant growth between 2025 and 2035, with the market value projected to increase from USD 197.2 million in 2025 to USD 402.7 million by 2035, representing a forecasted CAGR of 7.4%. This expansion is driven by the rising demand for precise and rapid mineral composition analysis across industries such as mining, metallurgy, and materials research. Integrated analyzers, which combine multiple analytical techniques into a single system, are increasingly being adopted due to their ability to deliver accurate results, reduce operational time, and optimize resource utilization.

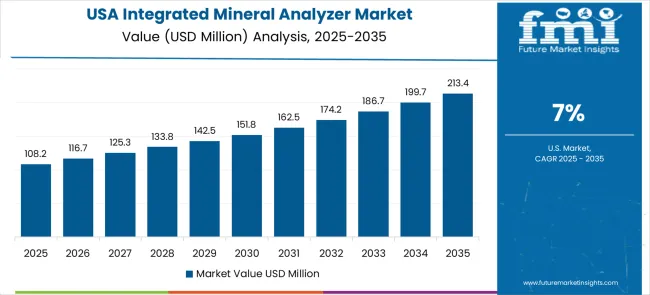

The market trajectory indicates that investments in automated and high-throughput systems are being prioritized by organizations seeking efficiency in mineral detection and quality control processes. Year-on-year growth patterns suggest that steady adoption across key industrial segments will contribute to sustained market expansion, with higher adoption rates in regions with active mining and mineral processing operations.

Further market analysis reveals that the integrated mineral analyzer market is influenced by both industrial demand and regulatory requirements for material quality verification. The deployment of these analyzers in mining and metallurgical plants is expected to increase as companies focus on minimizing material wastage and improving processing efficiency. Educational and research institutions are also anticipated to contribute to market growth through the procurement of integrated analyzers for laboratory applications and mineral research.

As industries recognize the cost and efficiency benefits of using integrated analyzers over conventional single-method instruments, the market is projected to maintain steady momentum. The 7.4% CAGR underscores a robust and sustained growth pattern, driven by increasing reliance on analytical accuracy, automation, and operational optimization within the global mineral analysis sector.

Between 2025 and 2030, the integrated mineral analyzer market is projected to expand from USD 197.2 million to USD 281.8 million, resulting in a value increase of USD 84.6 million, which represents 41.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for advanced analytical capabilities in materials research, product innovation in 3D imaging technology and automated analysis systems, and expanding applications across earth sciences and life sciences sectors. Companies are establishing competitive positions through investment in precision instrumentation development, strategic technology partnerships, and market expansion across academic institutions, industrial laboratories, and emerging research facilities.

From 2030 to 2035, the market is forecast to grow from USD 281.8 million to USD 402.7 million, adding another USD 120.9 million, which constitutes 58.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized analytical solutions, including multi-modal imaging systems and AI-integrated analysis platforms tailored for specific research applications, strategic collaborations between instrument manufacturers and software developers, and enhanced integration with digital laboratory workflows and data management systems. The growing emphasis on sustainable materials research and environmental monitoring will drive demand for advanced mineral analysis capabilities across diverse industrial and academic applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 197.2 million |

| Market Forecast Value (2035) | USD 402.7 million |

| Forecast CAGR (2025-2035) | 7.4% |

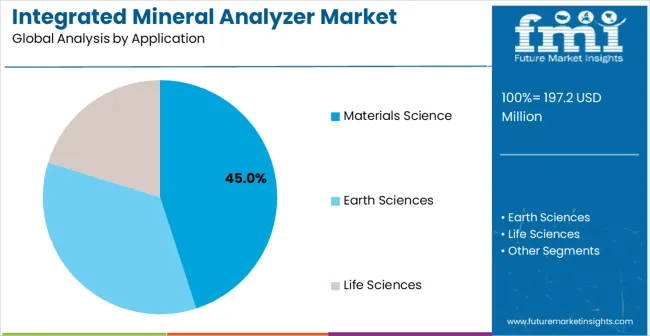

The integrated mineral analyzer market grows by enabling researchers and industrial analysts to obtain precise mineral composition data that reduces analysis time and improves research accuracy. Demand drivers include expanding materials science research requiring detailed mineral characterization, increasing earth sciences applications for geological surveys and resource exploration, and growing adoption in life sciences for biomedical research applications. Priority segments include materials science laboratories and earth sciences research institutions, with China and India representing key growth geographies due to expanding industrial research capabilities. Market growth faces constraints from high initial equipment investments and the need for specialized technical expertise to operate advanced analytical systems.

The Integrated Mineral Analyzer market is entering a new phase of growth, driven by demand for advanced materials characterization, expanding research infrastructure, and evolving precision analysis standards across industries. By 2035, these pathways together can unlock USD 850-1,100 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Materials Science Leadership (Advanced Materials Characterization) The materials science segment already holds the largest share due to its critical role in advanced manufacturing and research applications. Expanding precision analysis capabilities, automated workflow integration, and multi-modal imaging can consolidate leadership. Opportunity pool: USD 280-350 million.

Pathway B -- 3D Analysis Technology Dominance (Volumetric Imaging Platforms) 3D analysis applications account for significant market demand. Growing requirements for three-dimensional mineral mapping, especially in automotive and aerospace sectors, will drive higher adoption of advanced volumetric analysis systems. Opportunity pool: USD 220-280 million.

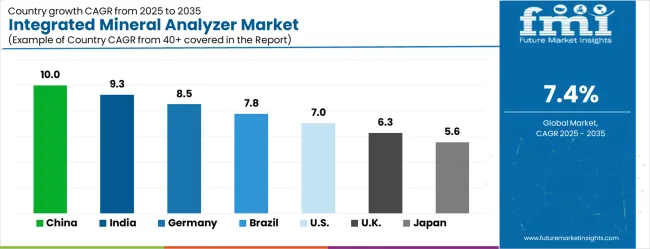

Pathway C -- Asia-Pacific Market Expansion (China & India Growth) China and India present the highest growth potential with CAGRs of 10.0% and 9.3% respectively. Targeting expanding research institutions and government-funded infrastructure projects will accelerate adoption. Opportunity pool: USD 180-230 million.

Pathway D -- Earth Sciences Applications (Geological & Mining Sectors) Earth sciences and geological survey applications represent significant growth potential with increasing mineral exploration needs. Systems optimized for field analysis and resource characterization can capture substantial growth. Opportunity pool: USD 120-150 million.

Pathway E -- Automation & AI Integration With increasing demand for automated analysis workflows, there is an opportunity to promote AI-integrated platforms optimized for precision analysis and data interpretation. Opportunity pool: USD 80-110 million.

Pathway F -- Life Sciences Expansion (Biomedical Applications) Systems optimized for biomedical research, pharmaceutical development, and specialized life sciences applications offer premium positioning for emerging research sectors. Opportunity pool: USD 60-80 million.

Pathway G -- Service & Technical Support Revenue Recurring revenue from equipment maintenance, operator training, and system integration services creates long-term revenue streams across global markets. Opportunity pool: USD 45-60 million.

Pathway H -- Digital Laboratory Integration Advanced data management systems, cloud connectivity, and digital laboratory workflow integration can elevate mineral analyzers into comprehensive analytical ecosystem platforms. Opportunity pool: USD 30-45 million.

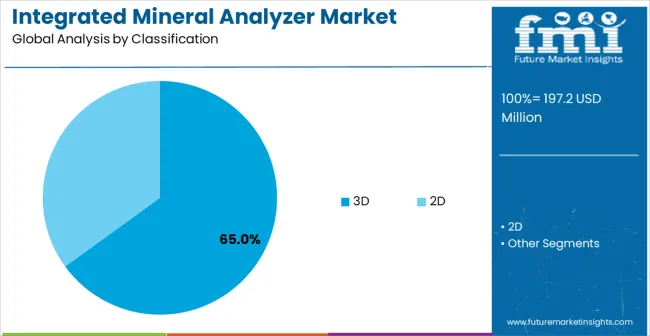

The market is segmented by analysis type, application, end-user, technology, and region. By analysis type, the market is divided into 2D analysis and 3D analysis. Based on application, the market is categorized into Materials Science, Earth Sciences, and Life Sciences. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

3D analysis is projected to account for a substantial portion of 45% of the integrated mineral analyzer market in 2025. This share is supported by superior depth resolution capabilities and comprehensive volumetric data generation. 3D analysis technology provides detailed three-dimensional mineral distribution mapping that enables researchers to understand complex mineral structures and compositions within samples. The segment enables stakeholders to benefit from enhanced spatial resolution and improved analytical precision for advanced research applications.

Key factors supporting 3D analysis adoption:

Materials science applications are expected to represent the largest share of 65% of the integrated mineral analyzer applications in 2025. This dominant share reflects the critical need for precise mineral analysis in advanced materials development that appeals to research institutions and industrial laboratories. The segment provides essential analytical support for new material characterization and quality control processes in manufacturing environments. Growing demand for advanced materials in electronics, aerospace, and renewable energy sectors drives adoption in this application area.

Materials Science segment advantages include:

Market drivers include expanding research activities across materials science requiring precise mineral composition analysis, increasing earth sciences applications for geological surveys and resource exploration projects, and growing adoption in life sciences for biomedical research where mineral analysis supports advanced therapeutic development. These drivers reflect direct buyer outcomes including reduced analysis time, improved data accuracy, and enhanced research productivity across multiple application areas.

Market restraints encompass high initial equipment costs that limit adoption among smaller research institutions, technical complexity requiring specialized operator training and expertise, and long replacement cycles for analytical instruments that slow market penetration. Additional constraints include integration challenges with existing laboratory workflows and the need for ongoing maintenance and calibration services that increase total cost of ownership.

Key trends show adoption accelerating in China and India where expanding industrial research capabilities drive demand, while design shifts toward automated analysis systems and AI-integrated platforms enable broader market access. Technology advancement focuses on enhanced imaging resolution and multi-modal analysis capabilities that expand application possibilities. Market thesis faces risk from alternative analytical technologies that could provide similar results at lower costs or with simplified operation requirements.

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| Brazil | 7.8% |

| USA | 7.0% |

| UK | 6.3% |

| Japan | 5.6% |

The integrated mineral analyzer market shows varied growth dynamics across key countries from 2025–2035. China leads globally with a CAGR of 10.0%, fueled by government-backed research programs, industrial modernization, and expanding adoption in academic and industrial labs. India follows closely at 9.3%, driven by geological survey applications, industrial R&D, and strong academic-industry collaborations. Germany remains Europe’s growth engine with 8.5%, leveraging its advanced manufacturing sector, especially in automotive and aerospace quality control. Brazil records 7.8%, reflecting opportunities in mining and environmental monitoring despite infrastructure challenges. The United States maintains steady expansion at 7.0%, supported by robust academic and government research ecosystems. Growth in the United Kingdom (6.3%) and Japan (5.6%) remains stable, backed by established institutions and domestic instrument manufacturers, though comparatively slower.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The integrated mineral analyzer market in China demonstrates the strongest growth potential in the integrated mineral analyzer market with its expanding industrial research capabilities and substantial government investment in advanced analytical technologies. The market is projected to grow at a CAGR of 10.0% through 2035, driven by increasing materials science research programs, expanding geological survey activities, and growing adoption across academic institutions in Beijing, Shanghai, and Shenzhen. Chinese research institutions are adopting integrated mineral analyzers for advanced materials development and quality control applications, with particular emphasis on precision analysis and automated workflow integration. Government support for high-tech research infrastructure and industrial modernization programs expand development in materials characterization and environmental monitoring sectors.

The integrated mineral analyzer market in India reflects strong potential based on expanding research infrastructure and increasing industrial laboratory investments. The market is projected to grow at a CAGR of 9.3% through 2035, with growth accelerating through cost-per-outcome compression under compliance and reliability constraints, particularly in geological survey applications and materials testing laboratories in Mumbai, Bangalore, and Chennai. Indian research institutions and industrial laboratories are adopting integrated mineral analyzers for earth sciences applications and materials characterization projects, with growing emphasis on precision analysis capabilities. Academic partnerships with international instrument manufacturers expand access to advanced analytical technologies and technical support services.

The integrated mineral analyzer market in Germany demonstrates established strength in the integrated mineral analyzer market through its advanced manufacturing sector and robust research infrastructure. The market shows steady growth at a CAGR of 8.5% through 2035, with established analytical instrument companies and research institutions driving demand in Berlin, Munich, and Stuttgart. German industrial laboratories focus on precision materials analysis and quality control applications, particularly in automotive and aerospace sectors requiring detailed mineral composition data. The country's strong engineering capabilities and established supplier relationships support consistent market development across multiple application areas.

The integrated mineral analyzer market in Brazil shows moderate growth potential at a CAGR of 7.8% through 2035, driven by expanding mineral exploration activities and environmental monitoring requirements. The market benefits from increasing geological survey programs and industrial research initiatives, with particular strength in mining sector applications. Brazilian research institutions and government agencies adopt integrated mineral analyzers for resource characterization and environmental assessment projects, addressing both commercial and regulatory requirements. Market development faces challenges from economic conditions and infrastructure limitations that affect equipment procurement and technical support availability.

The integrated mineral analyzer market in the United States maintains steady growth in the integrated mineral analyzer market through its established research infrastructure and industrial laboratory network. Market expansion at a CAGR of 7.0% through 2035 reflects consistent demand from academic institutions, government research facilities, and industrial laboratories requiring advanced analytical capabilities. American research organizations utilize integrated mineral analyzers across materials science, earth sciences, and life sciences applications, with particular emphasis on innovation and technology development. The country's strong research funding and established supplier networks support stable market conditions and continued technology advancement.

The integrated mineral analyzer market in the United Kingdom demonstrates consistent progress in the integrated mineral analyzer market with a CAGR of 6.3% through 2035, supported by established research institutions and industrial laboratory networks. British universities and research centers adopt integrated mineral analyzers for materials characterization and geological research applications, with particular focus on precision analysis and data integration capabilities. The market benefits from strong academic-industrial partnerships and established relationships with international instrument suppliers. Development remains steady across multiple application areas despite economic uncertainties affecting capital equipment investments.

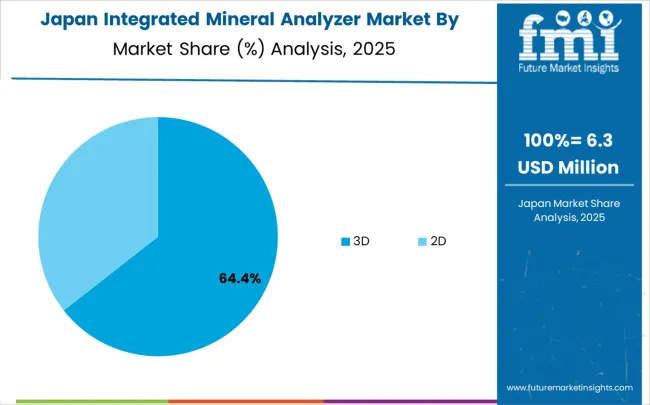

The integrated mineral analyzer market in Japan shows steady development with a CAGR of 5.6% through 2035, as established technology companies and research institutions maintain consistent demand. Market growth reflects mature market conditions and established analytical capabilities across industrial and academic sectors. Japanese companies and research organizations utilize integrated mineral analyzers for precision materials analysis and quality control applications, particularly in electronics and manufacturing industries. The market benefits from domestic instrument manufacturing capabilities and strong technical support infrastructure, though growth remains moderate compared to emerging markets.

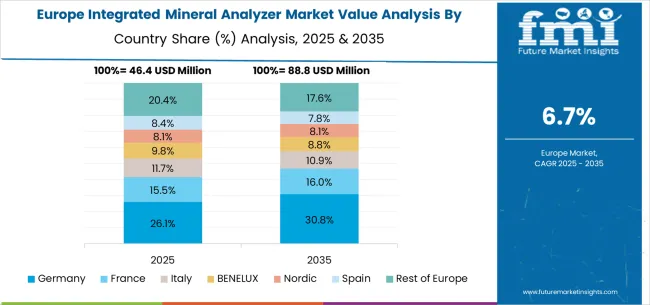

The integrated mineral analyzer market in Europe is forecast to expand from USD 48.3 million in 2025 to USD 95.8 million by 2035, registering a CAGR of 7.1%. Germany will remain the largest market, holding 28.5% share in 2025, easing to 28.0% by 2035, supported by strong research infrastructure and advanced materials science programs. The United Kingdom follows, rising from 22.0% in 2025 to 22.5% by 2035, driven by university research expansion and geological survey modernization. France is expected to grow from 16.5% to 17.0%, reflecting increased research facility investment. Italy maintains growth at around 12.0% to 12.5%, supported by academic research programs and industrial materials testing, while Spain grows from 8.0% to 8.5% with expanding research infrastructure and mining industry development. Nordic markets rise from 7.0% to 7.5%, while the remainder of Europe hovers near 6.0%-6.0%, balancing emerging Eastern European research growth against established Western markets.

In Japan, the integrated mineral analyzer market is largely driven by the 3D analysis segment, which accounts for 62% of total service revenues in 2025. The advanced imaging requirements in the domestic electronics manufacturing sector and the sophisticated materials characterization needs are key contributing factors. 2D analysis systems follow with a 28% share, primarily in quality control applications that integrate production monitoring and research validation systems. Hybrid analysis platforms contribute only 10% as multi-modal integration adoption is still in early stages.

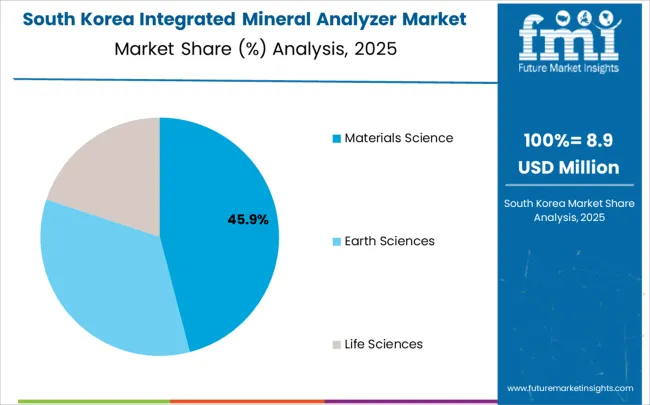

In South Korea, the market is expected to remain dominated by commercial laboratories, which hold a 45% share in 2025. These facilities are typically specialized analytical service providers where advanced characterization requirements require comprehensive analytical capabilities. Research institutions and mining companies each hold 25% market share, with growing emphasis on in-house analytical capabilities. Government laboratories account for the remaining 5%, but are gradually gaining traction in environmental monitoring services due to regulatory compliance requirements and expanded geological survey programs.

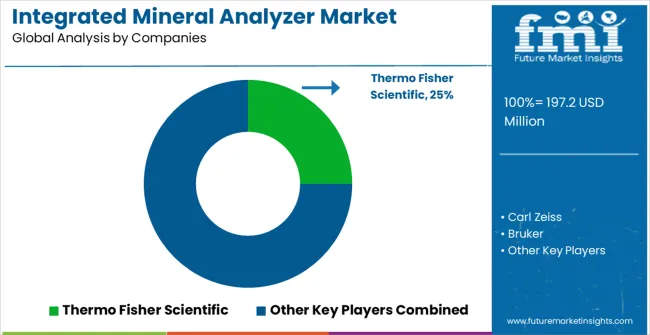

The integrated mineral analyzer market operates with a concentrated structure featuring approximately 15-20 players, with the top five companies holding roughly 65-70% market share. Competition centers on technological capabilities, product reliability, and comprehensive service support rather than price competition alone. Market leaders include Thermo Fisher Scientific, Carl Zeiss, and Bruker, which maintain competitive positions through established distribution networks, comprehensive product portfolios, and strong research and development capabilities. These companies benefit from scale advantages in manufacturing, extensive technical support networks, and established relationships with key research institutions and industrial laboratories worldwide.

Challenger companies include TESCAN and JEOL Ltd., which compete through specialized product offerings and regional market focus, particularly in specific application areas or geographic regions. These companies differentiate through innovative features, competitive pricing strategies, and targeted customer service approaches. Hitachi represents another significant player with established presence in analytical instrumentation markets and strong technical capabilities in imaging and analysis technologies.

Competition intensifies around product innovation, with companies investing in automated analysis capabilities, enhanced imaging resolution, and integrated software platforms that improve user experience and analytical productivity. Market dynamics reflect the importance of technical support services, training programs, and ongoing maintenance capabilities that influence customer purchasing decisions. Geographic expansion strategies and strategic partnerships with research institutions and distribution partners shape competitive positioning across different regional markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 197.2 million |

| Analysis Type | 2D Analysis, 3D Analysis |

| Application | Materials Science, Earth Sciences, Life Sciences |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ additional countries |

| Key Companies Profiled | Thermo Fisher Scientific, Carl Zeiss, Bruker, TESCAN, JEOL Ltd., Hitachi |

| Additional Attributes | Dollar sales by application categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging companies, adoption patterns across research institutions and industrial laboratories, integration with automated laboratory workflows and data management systems, innovations in 3D imaging technology and AI-assisted analysis, and development of multi-modal analytical platforms with enhanced precision capabilities. |

The global integrated mineral analyzer market is estimated to be valued at USD 197.2 million in 2025.

The market size for the integrated mineral analyzer market is projected to reach USD 402.7 million by 2035.

The integrated mineral analyzer market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in integrated mineral analyzer market are 3D and 2d.

In terms of application, materials science segment to command 45.0% share in the integrated mineral analyzer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Traffic System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Chemistry Systems Market Size and Share Forecast Outlook 2025 to 2035

Integrated Motor Protector Market Size and Share Forecast Outlook 2025 to 2035

Integrated Universal Integrated Circuit Card (iUICC) Modules Market Size and Share Forecast Outlook 2025 to 2035

Integrated SIM (iSIM) Market Size and Share Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Integrated UPS Market Size and Share Forecast Outlook 2025 to 2035

Integrated Labeling System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Quantum Optical Circuits Market Size and Share Forecast Outlook 2025 to 2035

Integrated Graphics Chipset Market Analysis by Device Type, Industry Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Integrated Food Ingredients Market Analysis -Size, Share & Forecast 2025 to 2035

Integrated Gas System Market Growth – Trends & Forecast 2025 to 2035

Integrated Passive Devices (IPDs) Market

Integrated CMOS Tri-gate Transistor Market

AI-Integrated Blood Analyzers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Power Integrated Modules Market Trends – Growth & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA