The Integrated Food Ingredients Market is poised for consistent growth as the food and beverage industry increasingly turns to integrated solutions that combine multiple functionalities into a single ingredient. These multi-purpose ingredients streamline production processes, enhance product consistency, and improve flavor, texture, and shelf-life.

With rising consumer demand for clean-label, minimally processed, and healthier food products, integrated food ingredients are becoming a preferred choice for manufacturers seeking to meet evolving market preferences while reducing complexity in formulations.

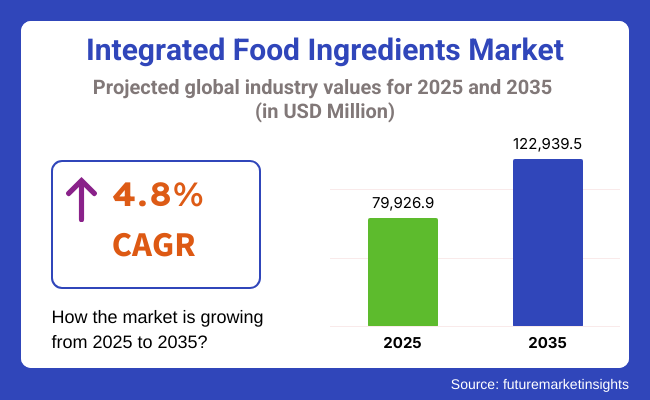

As innovation in natural and functional ingredient blends continues, the market is expected to expand steadily through 2035. In 2025, the global integrated food ingredients market is estimated at approximately USD 76,926.9 Million. By 2035, it is projected to grow to around USD 122,939.5 Million, reflecting a compound annual growth rate (CAGR) of 4.8%.

North America accounted for a significant segment in the integrated food ingredients industry, due to food processing being one of the largest sectors, coupled with a high demand for clean-label products and innovations in the plant-based and functional food segments. Ingredient solutions that simplify formulations and improve product quality are seeing steady growth in the United States and Canada, especially in convenience foods, beverages and bakery items.

Europe is a key market with a developed food industry, strong regulatory requirements, and customer preference for natural and sustainable ingredients. Integration of ingredient solutions, especially organic and gluten free product categories, is more common in premium countries like Germany, France and The United Kingdom.

Emerging food processing companies in the region and the proliferating retail chains are other factors propelling the integrated ingredient solutions market, thus making Asia-Pacific an important contributor to the global market's growth.

Challenges

Stringent Regulations, High Production Costs, and Supply Chain Disruptions

The integrated food ingredients market is increasingly being threatened due to stringent food safety & regulations (FDA (USA), EFSA (Europe), and FSSAI (India)) which requires food manufacturers to follow strict quality control, safety measures, product traceability and compliance to labeling guidelines.

These rules raise manufacturers’ research-and-development (R&D) and testing expenses. The high production costs are another considerable challenge, since there are specialized blends of ingredients (functional proteins, stabilizers, and emulsifiers) that demand advanced processing, specialized formulations, and sustainable sourcing. Supply chain challenges, such as varying availability of raw materials, transportation bottlenecks, and changing consumer behavior are also influencing pricing and access to ingredients for manufacturers.

Opportunities

Growth in Clean Label Products, AI-Powered Ingredient Optimization, and Functional Nutrition

Despite the challenges, the Integrated Food Ingredients Market holds promising growth opportunities driven by growing demand for clean-label products, ingredient innovation via AI, and the demand for functional nutrition. Driven by consumer demand for natural, non-GMO and minimally processed food ingredients, manufacturers are turning to plant-based proteins, natural sweeteners and organic stabilizers.

AI-powered systems for ingredient formulation also support aromatization, improving texture or increasing shelf life to develop more powerful taste and palates and shorten development times and costs. Claims of health are fuelling market growth in the health and wellness space, driven by the demand for functional foods and prebiotic fibre blends, omega-enriched emulsifiers and gut health-enhancing ingredients, among others.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, FSSAI, and organic certification standards for food safety and labeling. |

| Consumer Trends | Demand for natural preservatives, plant-based stabilizers, and sugar alternatives. |

| Industry Adoption | High use in processed foods, dairy, bakery, and beverage formulations. |

| Supply Chain and Sourcing | Dependence on natural extracts, artificial flavor compounds, and protein isolates. |

| Market Competition | Dominated by food additive manufacturers, flavor houses, and functional ingredient suppliers. |

| Market Growth Drivers | Growth fueled by demand for longer shelf-life, clean-label food, and alternative protein sources. |

| Sustainability and Environmental Impact | Moderate adoption of sustainable sourcing and organic food ingredient production. |

| Integration of Smart Technologies | Early adoption of AI-assisted food processing, IoT-based ingredient tracking, and digitalized supply chains. |

| Advancements in Ingredient Innovation | Development of high-fiber prebiotic blends, emulsifier-free dairy stabilizers, and natural sweeteners. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-powered quality control tracking, blockchain-based ingredient authentication, and carbon-neutral production mandates. |

| Consumer Trends | Growth in AI-optimized functional ingredient blends, microbiome-enhancing food additives, and bioengineered flavor enhancers. |

| Industry Adoption | Expansion into AI-driven precision nutrition, functional personalized food ingredients, and 3D-printed food formulations. |

| Supply Chain and Sourcing | Shift toward sustainable plant-based sourcing, AI-assisted ingredient traceability, and biotech-engineered food compounds. |

| Market Competition | Entry of AI-driven ingredient formulation startups, biotechnology-based food component developers, and sustainable food ingredient disruptors. |

| Market Growth Drivers | Accelerated by AI-enhanced taste optimization, personalized dietary ingredient formulations, and gut-health-focused food innovation. |

| Sustainability and Environmental Impact | Large-scale shift toward zero-carbon food production, regenerative agriculture-based ingredient sourcing, and AI-driven waste reduction. |

| Integration of Smart Technologies | Expansion into AI-powered food safety monitoring, blockchain-secured food traceability, and lab-grown functional food ingredients. |

| Advancements in Ingredient Innovation | Evolution toward AI-customized ingredient synergies, protein-enhanced plant-based additives, and precision-fermented bioactive ingredients. |

The USA integrated food ingredients market is poised to experience steady growth, as demand for clean-label, functional, and natural food ingredients is increasing rapidly in the country. Demand for the market is driven by growing consumption of processed and convenience food, increasing focus on plant-based ingredients, and technological advancements in food fortification. Reinforcing growth in the US food industry is also regulatory segues for food safety and the transparency of clean-labels.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

The integrated food ingredients market in the United Kingdom is motivated by increasing demand for natural preservatives, rising adoption of functional food ingredients, and growing consumer preference for organic and non-GMO (genetically modified organism) food products. Market demand is being driven by the growth of plant-based diets, fortified foods, and sustainable food production. On the other hand, regulatory standards that prompt food transparency and allergen-free labeling s are currently guiding the trends in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

The integrated food ingredients market in the European Union is becoming successful due to increasing food fortification-based investments, new applications of integrated ingredient solutions in dairy and bakery products, and the introduction of clean-label and functional food formulations. Moreover, the growing adoption of EU regulations, which is anticipated to promote food safety, sustainability, and plant-based innovations, is expected to strengthen the market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

There is moderate growth in the integrated food ingredients market in Japan which is propelled by the need for functional and fortified foods, growing interest in umami-enhancing ingredients, and the continued preference for natural and fermented food ingredients. There is an increasing demand for low-sodium, low-sugar, and high-fiber food ingredients. Moreover, advancement in nutrition and food innovations with health benefits, led by government initiatives, are affecting the growth of market in the future.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The integrated food ingredients market in South Korea is gaining momentum fueled by rising consumer awareness of functional foods, increasing demand for probiotic and prebiotic ingredients, and growing adoption of natural flavor enhancers. Increase in the consumption of convenience food with the help of accompanying cut-throat food safety and nutritional enrichment is driving the market growth. Moreover, the high demand for K-food has been further accelerated through more innovative K-foods using integrated natural ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The extensive integration of functional, clean-label, and sustainable ingredients, aimed at improving taste, texture, nutrition, and shelf life, is driving the growth of the Integrated Food Ingredients Market, especially in the food and beverages sector.

As consumers increasingly demand healthier choices, vegan and plant-based diets, and natural formulations, manufacturers are moving toward microbial-fermented, plant-derived, and seaweed-based ingredients for various food applications. It comprises Source (Microbial & Fermented, Artificial, Animal, Plant, and Seaweed) and Product Type (Sweeteners, Vegetable Fats & Oils, Food Hydrocolloids, Food Enzymes, Food Colors and Flavors).

Plant-Based segment dominates the market, owing to growing consumers' inclination towards natural, sustainable, and plant-based food ingredients. Natural sweeteners, food hydrocolloids, vegetable fats & oils among others derive from plant-based sources such as legumes, fruits & botanical extracts.

The increasing awareness of vegan diet along with clean-label products and plant-based functional foods have created the need for integrated food ingredients/plant-based ingredients as a result, the market for such ingredients are rising.

Microbial & fermented segment is also in the phase of high demand, especially in natural food preservatives, probiotics and food enzymes. Fermented ingredients obtained from yeasts, bacteria and fungi are widely incorporated into the functional dairy products, meat analogs and processed foods to enhance flavor, texture and digestibility advantages. Microbial-based food ingredients are anticipated to gain even more momentum in next-generation food formulations, advances in biotechnology and precision fermentation.

The integrated food ingredients market has the highest share of the Sweeteners segment, as the consumers are looking for sugar alternatives and natural sweetening solutions. Fearing diabetes, obesity and artificial sugar intake, manufacturers now resort to stevia, monk fruit extract and sugar alcohols as healthier alternatives to conventional sugar. With both natural and functional sweeteners with fewer calories almost universal, demand for both are on the rise throughout all forms of beverage, baked good, dairy product and confectionery.

Apart from that, the food hydrocolloids segment is highly demanded in texture modification, stabilization and moisture retention in processed food. Hydrocolloids can be derived from seaweeds (agar, carrageenan), plants (pectin, gum Arabic) and even microbial fermentation (xanthan gum, gellan gum) and have found a multitude of applications in dairy alternatives, sauces, and frozen food and meat analogs. The growing trend towards clean-label emulsifiers, plant-based thickeners, and natural gelling agents has led to the increasing demand for food hydrocolloids across various food sectors.

Increasing demand for functional food ingredients, clean-label products, and customized flavor solutions across several industries such as bakery, confectionery, dairy, beverages, and processed foods are expected to boost the integrated food ingredients market during the forecast period. AI Driven Food Innovation, Natural Ingredient Development & the Health-Conscious Consumption Trend drive accelerated growth. From sustainable sourcing to AI-enhanced ingredient blending to personalized nutrition solutions, companies are stepping forward to improve the taste, texture, and nutritional value of the food in your baskets.

Market Share Analysis by Key Players & Integrated Food Ingredient Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 18-22% |

| Archer Daniels Midland (ADM) Company | 12-16% |

| Kerry Group plc | 10-14% |

| Tate & Lyle plc | 8-12% |

| Givaudan SA | 5-9% |

| Other Integrated Food Ingredient Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | Develops AI-driven ingredient blending, plant-based functional ingredients, and natural sweeteners for food formulations. |

| Archer Daniels Midland (ADM) Company | Specializes in AI-assisted flavor enhancement, clean-label emulsifiers, and functional proteins for health-focused food products. |

| Kerry Group plc | Provides next-generation taste solutions, AI-powered texture optimization, and sustainable food ingredient innovation. |

| Tate & Lyle plc | Focuses on high-performance sweeteners, AI-enhanced starch applications, and fiber-rich nutritional ingredient development. |

| Givaudan SA | Offers AI-driven natural flavor systems, botanical extracts, and plant-based ingredient solutions for food manufacturers. |

Key Market Insights

Cargill, Incorporated (18-22%)

Cargill leads the integrated food ingredients market, offering AI-enhanced ingredient processing, functional blends for clean-label foods, and next-generation plant-based solutions.

Archer Daniels Midland (ADM) Company (12-16%)

ADM specializes in natural emulsifiers, AI-powered food ingredient formulation, and health-boosting plant-based proteins.

Kerry Group plc (10-14%)

Kerry provides AI-optimized taste enhancement solutions, customized texture modification, and functional ingredient innovation.

Tate & Lyle plc (8-12%)

Tate & Lyle focuses on high-performance sweeteners and AI-assisted starch optimization for improved food formulation.

Givaudan SA (5-9%)

Givaudan develops AI-driven natural flavor systems, sustainable botanical extracts, and innovative plant-based food ingredients.

Other Key Players (30-40% Combined)

Several food ingredient manufacturers, biotech firms, and specialty flavor houses contribute to next-generation food ingredient innovations, AI-powered formulation advancements, and sustainable clean-label solutions. These include:

The overall market size for the integrated food ingredients market was USD 76,926.9 Million in 2025.

The integrated food ingredients market is expected to reach USD 122,939.5 Million in 2035.

Growth is driven by the rising demand for natural and clean-label ingredients, increasing use of functional additives in food processing, advancements in food preservation technologies, and growing consumer preference for fortified and nutritionally enriched food products.

The top 5 countries driving the development of the integrated food ingredients market are the USA, China, Germany, India, and Japan.

Plant-Based Sources and Sweeteners are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Source, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by End-Use, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Functionality, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 26: Global Market Attractiveness by Source, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 29: Global Market Attractiveness by Functionality, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 56: North America Market Attractiveness by Source, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 59: North America Market Attractiveness by Functionality, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Functionality, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Functionality, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Functionality, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Functionality, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Functionality, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Functionality, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by End-Use, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Functionality, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Integrated Traffic System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Chemistry Systems Market Size and Share Forecast Outlook 2025 to 2035

Integrated Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Integrated Motor Protector Market Size and Share Forecast Outlook 2025 to 2035

Integrated Universal Integrated Circuit Card (iUICC) Modules Market Size and Share Forecast Outlook 2025 to 2035

Integrated SIM (iSIM) Market Size and Share Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Integrated UPS Market Size and Share Forecast Outlook 2025 to 2035

Integrated Labeling System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Quantum Optical Circuits Market Size and Share Forecast Outlook 2025 to 2035

Integrated Graphics Chipset Market Analysis by Device Type, Industry Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Integrated Gas System Market Growth – Trends & Forecast 2025 to 2035

Integrated Passive Devices (IPDs) Market

Integrated CMOS Tri-gate Transistor Market

AI-Integrated Blood Analyzers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Power Integrated Modules Market Trends – Growth & Forecast through 2034

Memory Integrated Circuits (IC) Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA