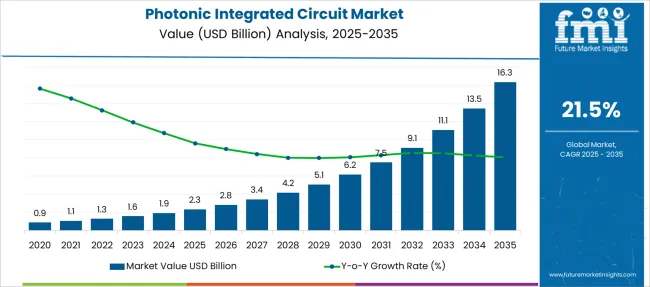

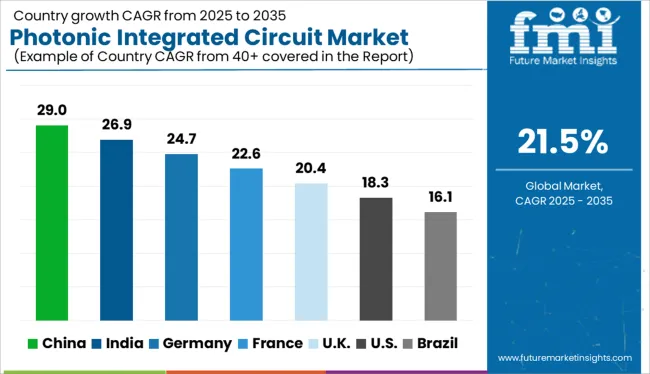

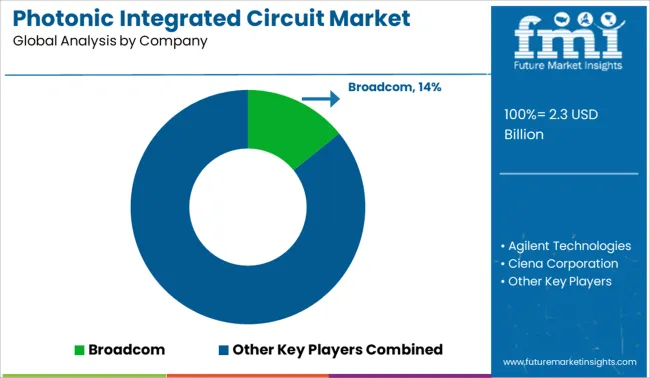

The Photonic Integrated Circuit Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 16.3 billion by 2035, registering a compound annual growth rate (CAGR) of 21.5% over the forecast period.

| Metric | Value |

|---|---|

| Photonic Integrated Circuit Market Estimated Value in (2025 E) | USD 2.3 billion |

| Photonic Integrated Circuit Market Forecast Value in (2035 F) | USD 16.3 billion |

| Forecast CAGR (2025 to 2035) | 21.5% |

The photonic integrated circuit market is expanding rapidly due to the growing need for faster and more efficient data transmission across communication networks. Advances in optical technologies have enabled integration of multiple photonic functions onto a single chip, reducing cost and improving performance.

The rise in global data traffic and cloud computing demands has accelerated adoption of integrated photonics in telecommunications. Engineering innovations have improved chip design, enabling higher bandwidth and energy efficiency while minimizing signal loss.

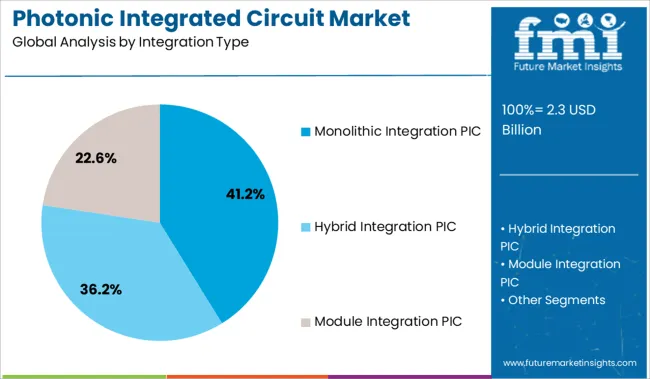

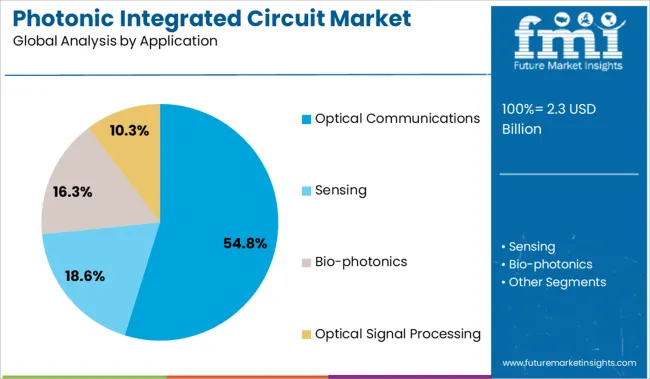

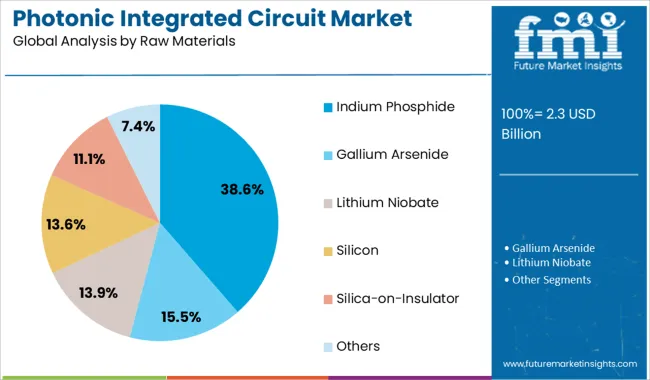

Increasing investments in next-generation optical communication infrastructure and the rollout of 5G networks have further propelled the market. Future growth will be supported by new applications in data centers, sensing, and quantum computing. Segmental growth is anticipated to be led by Monolithic Integration PIC for its compactness and performance, Optical Communications as the primary application, and Indium Phosphide as the preferred raw material for its favorable optoelectronic properties.

The market is segmented by Integration Type, Application, Raw Materials, and Components and region. By Integration Type, the market is divided into Monolithic Integration PIC, Hybrid Integration PIC, and Module Integration PIC. In terms of Application, the market is classified into Optical Communications, Sensing, Bio-photonics, and Optical Signal Processing. Based on Raw Materials, the market is segmented into Indium Phosphide, Gallium Arsenide, Lithium Niobate, Silicon, Silica-on-Insulator, and Others. By Components, the market is divided into Lasers, Modulators, Detectors, Attenuators, MUX/DEMUX, and Optical Amplifiers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Monolithic Integration PIC segment is projected to hold 41.2% of the photonic integrated circuit market revenue in 2025, leading integration types. Its growth stems from the ability to integrate multiple photonic components on a single substrate, enhancing performance and reducing assembly complexity.

This approach supports miniaturization and improved reliability which are critical for advanced optical systems. Manufacturers and system designers favor monolithic integration for applications requiring high density and low power consumption.

The segment benefits from ongoing research in fabrication techniques that improve yield and scalability. As data demands intensify and systems require more complex functions on-chip, monolithic integration will continue to gain traction.

The Optical Communications segment is expected to account for 54.8% of the market revenue in 2025, maintaining its dominance as the main application area. This segment is driven by the exponential growth in internet traffic and demand for high-speed data transfer.

Optical communications rely heavily on photonic integrated circuits to enhance signal processing and transmission efficiency. Network operators are upgrading infrastructure to support greater bandwidths and longer transmission distances.

The segment’s growth is further fueled by the deployment of fiber optic networks and data center interconnects. With continuing advancements in optical networking technologies, this application will remain a primary driver of market expansion.

The Indium Phosphide segment is projected to contribute 38.6% of the photonic integrated circuit market revenue in 2025, positioning it as the leading raw material category. Indium Phosphide is favored for its excellent optoelectronic properties including high electron mobility and direct bandgap, making it suitable for laser and photodetector integration.

Its ability to operate efficiently at high frequencies and temperatures has made it ideal for telecom and datacom applications. The material supports the integration of active components, which enhances device functionality.

Continuous improvements in material quality and fabrication processes have helped reduce costs and increase adoption. Given its performance advantages, Indium Phosphide is expected to remain a cornerstone material for photonic integrated circuits.

As per the Photonic Integrated Circuits (PIC) Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Photonic Integrated Circuits (PIC) Market increased at around 25.5% CAGR.

The factors driving the growth of the photonic integrated circuit market are the downsizing of gadgets and the increase in the level of integration. This circuit supports high-speed data transfer, making it suitable for a wide range of applications in the industrial, aerospace, communications, utilities, and energy sectors, all of which are the key drivers of the photonic IC industry.

Photonic integrated circuits are in high demand for quantum computing and optical fiber sensing applications. Photonic integrated circuit corporations provide advantages such as simple photonic integrated circuit design with reduced energy consumption, smaller and faster goods, and efficient and eco-friendly products. When compared to traditional ICs, photonic integrated circuits have lower costs due to downsizing, a smaller size due to merging a large number of components and functions on a single chip, and enhanced power efficiency.

Photonics and fiber optics market growth is being accelerated by sophisticated breakthroughs and innovations. The growing need for high-speed and efficient data transmission in data centers presents growth prospects to the market. The rising demand for enhanced communication and processing needs, as well as flexible, downsized, and power-efficient circuits, are factors that will drive the growth of the photonic IC industry.

Communication between the photonic integration industry and potential end consumers might be challenging at times. While telecom has traditionally been the largest market for PICs, and the background for such applications is well understood, this is not always the case when dealing with other photonic integration solutions, such as quantum, sensing, or medical optics, where the technical background and language of customers can vary largely.

The demand for Photonic Integrated Circuits is propelling due to a variety of factors like minimal cost, compact size, increased power optimization, and increased level of integration and functionality.

Photonic integrated circuits (ICs) make equipment design easier. The minimization of difficult production procedures aids in expanding manufacturing capacity and reduction in cost, making it attractive to users. Photonic integrated circuits allow a vast number of components and functionalities to be combined on a single chip. As a consequence, the number of components utilized is reduced, and the component's size is reduced as well.

When compared to photonic ICs, the number of functionalities packed into a single chip in electronic ICs is comparatively minimal. PICs acquire various advantages due to their high degree of integration, including size reduction, easy design, low cost, minimum heat dissipation, and power optimization. When compared to electrical ICs, photonic ICs have greater power efficiency. PICs generate significantly low heat during operation, thus resulting in increased power efficiency.

The use of Photonic Integrated Circuits (PIC) in optical communications is becoming more common, with a predicted CAGR of 21.5%. A rise in data traffic owing to increasing internet usage, an increase in the number of data centers, and an increase in the adoption of cloud-based and virtualization services are all driving the industry forward. The COVID-19 pandemic boosted demand for advanced networking equipment, propelling the market ahead during the forecast period.

Modern data center networks employ optical communication and networking equipment to meet their high bandwidth and extensible needs. Only optical communication technology has demonstrated capabilities of 40 GB/s, and greater across long distances. As a result, an increasing number of data centers throughout the world use interconnects to offer crucial communications connections between several servers, computing, and memory resources.

As more devices are being linked and new apps are developed, the volume of information going across the internet continues to expand. In 2024, IP data traffic is projected to witness 278,108 PB per month. Furthermore, with the growth in the number of smartphone users, internet usage will also grow, consequently leading to demand build-up for the PIC market.

North America is the most lucrative region with double-digit projected growth. In North America, demand for photonic integrated circuits (PIC)-based devices is being driven by data centers and internet applications of fiber optic communication. The growing demand for high-speed data transmission has raised cloud computing data traffic, and the increasing adoption of IoT has resulted in a potential boom in the photonic integrated circuit market in the region.

Mobile, video and cloud-based apps are increasing bandwidth usage, placing strain on service providers. Companies are expected to construct their optical networks around the PIC, propelling the sector ahead.

The requirement for high data transmission has raised cloud computing, and data traffic, and the increasing adoption of the Internet of Things has resulted in a potential boom in the photonic integrated circuit market in the region.

The United States is expected to have the highest market share of USD 16.3 Billion by the end of 2035 and account for approximately 30% of the global revenue. Increased demand for smart device integration and a favorable regulatory environment for the development of medium and small enterprises are expected to boost the US market.

Mobile, video and cloud-based applications are driving up bandwidth consumption, which is putting pressure on service providers. According to industry estimates, the number of Amazon Prime subscribers in the United States will exceed 2.3 Million in 2025, up from 1.9 Million in 2024. While this is a small proportion of the end–use market in the USA., the overall market in the USA. is significantly larger.

The Hybrid Integration segment is forecasted to grow at the highest CAGR of over 21.5% from 2025 to 2035. Hybrid integration provides a lot of revenue for companies in the photonic integrated circuits (PIC) industry. Most quantum applications require monolithic photonic systems to fulfill rigorous criteria. To circumvent the limitations of monolithic photonic circuits, companies are developing hybrid platforms that incorporate many photonic technologies into a single functional unit.

For product developers, hybrid integration provides yet another benefit. A complicated microsystem can be divided into several separate parts. After that, each unit is allocated to a different process engineer or group. Before integration, each unit may be designed and completely defined individually. To reduce fabrication costs, units of the same kind can be manufactured at the maximum spatial density on a single substrate.

Monolithic manufacturing provides advantages for devices with basic architectures, such as compact layouts and facile encapsulation. However, since several manufacturing procedures and materials are incompatible, microdevices with complicated functions or structures must be built using the hybrid integration of several components from various fabrication processes.

The leading PIC Market players are Agilent Technologies, Broadcom, Ciena Corporation, Enablence, II-VI Inc., Hewlett Packard, Huawei Technologies Co., Ltd., Infinera Corporation, Intel Corporation, Broadex Technologies Co., Ltd., Cisco Systems, Inc., MACOM, Mellanox Technologies, NeoPhotonics Corporation, Oclaro, Inc., TE Connectivity, Uniphase Inc., VLC Photonics S.L. and POET Technologies. To gain a competitive advantage in the industry, these players are investing in product launches, partnerships, mergers and acquisitions, and expansions.

Some of the key recent developments in the Global PIC Market are as follows:

In February 2025, Ayar Labs, a photonic chip provider with circuits that carry data between processors significantly faster than typical metal interconnects, announced a "multi-year strategic agreement" with Hewlett Packard Enterprise.

In October 2024, Sanan IC, the world's largest LED manufacturer announced that it has inked a USD 50 Million Joint Venture Agreement with POET Technologies. Super Photonics Xiamen Co., Ltd, the company's subsidiary, has also applied for registration. This is expected to offer transceiver module makers, systems vendors, data center operators, and network providers throughout the world a new generation of cost-effective, high-performance optical engines.

In May 2025, to increase reliability and performance across all operating scenarios, Cisco announced that it has combined new predictive technologies with its comprehensive portfolio of observability, visibility, and intelligence capabilities.

Similarly, recent developments related to companies in Photonic Integrated Circuits (PIC) services have been tracked by the team at Future Market Insights, which are available in the full report.

The global photonic integrated circuit market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the photonic integrated circuit market is projected to reach USD 16.3 billion by 2035.

The photonic integrated circuit market is expected to grow at a 21.5% CAGR between 2025 and 2035.

The key product types in photonic integrated circuit market are monolithic integration pic, hybrid integration pic and module integration pic.

In terms of application, optical communications segment to command 54.8% share in the photonic integrated circuit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Photonic Crystal Displays Market Size and Share Forecast Outlook 2025 to 2035

Photonics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Photonic Sensor Market - Trends & Forecast 2025 to 2035

Photonic Sensors & Detectors Market Insights - Growth & Forecast 2024 to 2034

Biophotonics Market Growth - Trends & Forecast 2025 to 2035

Quantum Photonics Market Size and Share Forecast Outlook 2025 to 2035

Silicon Photonics – High-Speed Data & Optical Innovations

Integrated Traffic System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Chemistry Systems Market Size and Share Forecast Outlook 2025 to 2035

Integrated Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Integrated Motor Protector Market Size and Share Forecast Outlook 2025 to 2035

Integrated SIM (iSIM) Market Size and Share Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Integrated UPS Market Size and Share Forecast Outlook 2025 to 2035

Integrated Labeling System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Graphics Chipset Market Analysis by Device Type, Industry Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Integrated Food Ingredients Market Analysis -Size, Share & Forecast 2025 to 2035

Integrated Gas System Market Growth – Trends & Forecast 2025 to 2035

Integrated Passive Devices (IPDs) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA