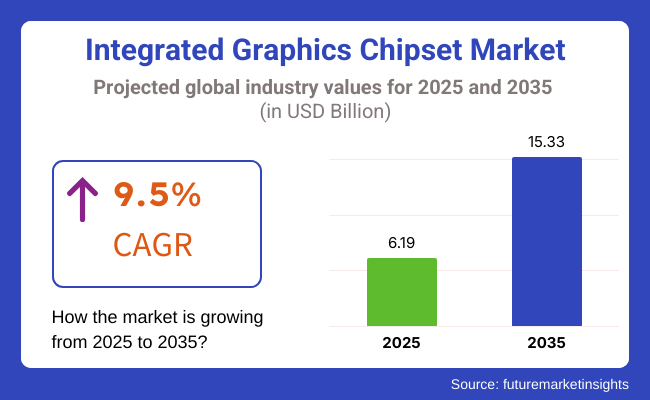

The integrated graphics chipsets market is going to benefit from the impressive growth in the design embedded graphic chips segment, which has an estimated worth of USD 6.19 billion in 2025 and will reach USD 15.33 billion in 2035, according to the projections. The sector is expected to grow at a rate of 9.5% annually from 2025 until 2035, which will result in an overall increase in the use of energy-saving computers and compact devices, as well as the improvement of integrated GPU technology.

The main motive behind such rapid development is the yearning for light, power-efficient computing systems. In the conditions where laptops, ultrabooks, and compact desktops become preferable, integrated graphics chipsets are chosen instead of dedicated GPUs, which are not so supplied by means of electricity and costs effectively.

Despite some challenges, like the performance compared to standalone GPUs and limited memory bandwidth, growth is still seen. The integrated circuits have been promising. However, they still struggle to satisfy high-end needs such as 3D gaming, 3D rendering, or very complicated machine learning. Plus, the competition among independent GPU manufacturers continues to depress integrated chip manufacturing companies for creativity and performance enhancement.

The integration of AI-driven graphics acceleration is turning into an opportunity, along with semiconductor manufacturing advancements. The rise of AI workloads has led to integrated chipsets being designed with features such as enhanced processing capabilities to support machine learning and real-time rendering.

Besides, the collaboration of chipset manufacturers with cloud service providers is paving new paths by providing high-performance computing in remote and virtual environments. The increase in the number of integrated chips used in automotive infotainment systems, edge computing devices, and IoT devices expands possibilities.

Among the prominent trends that influence the integrated graphics chipset sector, the shift toward ARM-based processors is fundamental. This process is combined through the implementation of the processing unit and module, i.e., the advanced GPU's low power consumption and the weight of the ultra-mobile devices.

Another contributor to growth is the improved graphics in smart TVs, game consoles, and VR headsets. Also, the innovations brought by chipset-based GPU architectures and 3Dstacked memory can contribute in a way that they will increase the power efficiency and functionality of integrated graphics. Hence, it will be possible to compete better with standalone GPUs.

The industry is growing briskly with improved processing power and energy efficiency. Consumer notebooks show high demand, with price sensitivity and battery life as key requirements, whereas gaming desktops call for performance-grade chipsets with AI-aided capabilities. Business PCs require cost-effective and stable solutions, whereas embedded systems rely on low-power but effective graphics processors for industrial and IoT applications.

With the advent of mass adoption of AI-driven computing and multimedia offloading, chip designers prioritize performance with efficiency. Sustainability trends necessitate lower power consumption, especially for mobile and edge computing systems. Intel and AMD are currently the key leaders, with ARM-based solutions gaining traction in power-limited fields.

Future advancements will likely be based on AI-powered graphics processing, improved ray tracing, cloud gaming, and AR/VR-optimized architecture. With more industries embracing advanced visual computing, high-efficiency integrated graphics chipsets will be in greater demand.

Between 2020 and 2024, there were significant advancements due to increasing demand, technological innovations, and shifting consumer preferences. Companies such as industry leaders introduced new products and solutions that enhanced efficiency, performance, and affordability. Growth was driven by trends like rising adoption in strategic industries, regulatory reforms, and shifting customer expectations.

However, factors like supply chain shocks, high-cost production, and rivalry from alternative solutions posed impediments to long-term growth. Despite adversity, growth persisted in varied applications, including mainstream and specialty segments.

Between 2025 and 2035, the next-generation technologies will evolve, and automation will be integrated in industries. Innovations in the future will focus on sustainability, efficiency, and saving costs. Companies will utilize artificialwill utilize artificial intelligence, automation, and higher industry demands.

Adoption will spread to new emerging applications, giving rise to new growth areas. The industry will shift towards more intelligent, efficient, and highly adaptable solutions by 2035, making the product more available and widely incorporated into daily activities.

Comparative Market Shift Analysis from 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing demand for performance and effectiveness. Supply chain disruption impacts production. | Merger of automation and AI-driven innovations. Venturing into new sectors. |

| Increase in processing power and smart features. Early adopters' acceptance of AI-driven capabilities. | Widespread application of auto-learning and automation systems. Integration with next-generation computing and connectivity. |

| High cost of production and substitution by substitutes. Limited scalability in some applications. | Reforms in regulations and changing industry standards. Requirement for sustainable and green alternatives. |

| Transition from conventional substitutes to new, energy-saving replacements. More research and development investments. | Large-scale adoption of intelligent and responsive technologies. Shift towards market strategies on the basis of sustainability. |

| Deployment mainly in high-tech sectors and niches. Gradually growing consumer consciousness and integration. | Infiltration into mass industries with broad consumer acceptability. Wider availability and affordability across all sectors. |

The sector of integrated graphics chipsets proves to be essential for computing devices due to their capacity to deliver energy-efficient graphics processing at a very affordable amount. With innovations happening within the fields of gaming, artificial intelligence, and ultra-high-definition displays, there is a noticeable increase in the requirement for integrated GPUs.

Conversely, the sector also harbors a number of risks that, if not properly addressed, could impact its sales growth and the competitiveness of existing models.

One of the main issues is the inherent technical constraints faced by the practical implementations. The low-cost chipsets that are incorporated into the device largely serve as an alternative to discrete graphics cards. However, they are beneath the chip cards in performance.

This is particularly important regarding the use of such technologies in advanced gaming, video editing, and apprenticeship-based AI. The incessant enhancements in the chips to get more power and efficiency are when the manufacturer of every product must run through the process.

Trade restrictions and regulations are also factors that affect the industry. Government tariffs, product banning, and legal cases on intellectual property can threaten share growth and alter production expenses. The ever-changing cyber security and environmental rules also need to be observed, which causes the companies to become more complex in their operations.

Notwithstanding these troubles, the integrated graphics chipset is a flourishing field that is steered by the aspiration toward the availability of pocket-sized, energy-efficient computers. Companies must navigate cutting-edge technology, competitive pressure, supply-chain vulnerability, and regulatory hurdles to ensure the planned growth and product innovation in this sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

| UK | 5.5% |

| France | 5.3% |

| Germany | 5.7% |

| Italy | 4.8% |

| South Korea | 6.5% |

| Japan | 5.2% |

| China | 7.0% |

| Australia | 4.6% |

| New Zealand | 4.2% |

The USA integrated graphics chipset market is expected to register a satisfactory growth rate of 6.1% over the forecast period. There will be an increasing adoption of artificial intelligence (AI), cloud computing, and edge computing-based solutions.

Demand for high-performance laptops and gaming platform popularity propels demand for integrated graphics offerings. Besides, huge investments in semiconductor production, led by industry giants Intel and AMD at the pinnacle of technologies, are fueling growth. Growing numbers of businesses and users migrating towards lower-power and cost-effective computing products are also further supporting the development.

The UK would grow at a CAGR of 5.5% from 2025 to 2035. Digital transformation is one of the most significant growth drivers, and it is emerging, especially in the banking and education sectors. The growing demand for low-cost computing solutions in the context of students and professionals is fueling the growth of integrated graphics chipsets. In addition, government efforts to promote semiconductor R&D and partnerships with European chip makers will drive the industry.

France will grow at a CAGR of 5.3% over the forecast period. The increasing focus of the nation on smart city solutions and the rising use of AI-based applications in various industry verticals are propelling opportunities. Increasing demand for power efficiency in the computing process in the automotive sector, especially in electric and autonomous vehicles, further propels the demand.

Public subsidy programs for encouraging domestic production of semiconductors and AI computing hardware should drive long-term sales expansion.

Germany will have a CAGR of 5.7% in the period from 2025 to 2035. Germany's robust manufacturing capability and focus on smart manufacturing and automation are promoting the industry. Growth in industrial computing and robot applications, as well as the demand for integrated graphics, is driving consistent expansion. In addition, Germany's leadership in automobile technology, moving towards autonomous and connected cars, is propelling demand for powerful but power-lean integrated graphics chipsets.

Italy is forecast to grow at a CAGR of 4.8% during the forecast period. Public service and business digitalization are prime growth drivers. The need for low-cost computing devices among SMEs also stimulates growth. In addition, the growing uptake of cloud applications and work-from-home is stimulating demand for low-cost office computing devices and laptops with built-in graphics. The increasingly growing need in Italy's gaming industry is also one of the key drivers of growth.

South Korea will also witness a growth rate of 6.5% between 2025 and 2035. The extremely developed semiconductor sector, which is dominated by monopolies such as Samsung and SK Hynix in South Korea, is a key industry driver. The exponential increase in 5G networks and rising applications of AI-based services for gaming and multimedia are also favorable to growth. Apart from that, the speed of self-sufficiency aimed at local production of semiconductors guarantees regular innovations, which supports the nation's industry position.

Japan is anticipated to grow at a CAGR of 5.2% during the forecast period. Japan leads in consumer electronics, robotics, and auto markets. The growing adoption of integrated graphics in electric vehicles (EVs) and autonomous driving technology also fuels demand. Additionally, Japan's emphasis on AI-driven computing solutions and smart city projects is anticipated to fuel consistent investment in the industry.

China will lead the integrated graphics chipsets market with a CAGR of 7.0% during the forecast period. The country's high investments in semiconductor manufacturing and AI research are major growth drivers. High usage of cloud gaming, 5G-based products, and AI-based solutions is fueling growth. Government initiatives to reduce foreign dependence on chip manufacturers and promote local semiconductor production will also propel China's growth.

Australia is anticipated to expand at 4.6% CAGR during the years 2025 to 2035. The growing adoption of cloud computing solutions and digital learning products is propelling the growth. Also, growing requests for energy-conserving laptops, as well as slim and light-based computing solutions among students and industries, are propelling the demand. Besides, gaming in Australia, powered by the emergence of a growing esports culture, is propelling sustained adoption of these chipsets.

New Zealand is also projected to log a CAGR of 4.2% throughout the forecast period. Increased adoption of cloud solutions and remote work solutions is a key driver. Increased demand for low-cost computing solutions by educational institutions and small and medium-sized enterprises also drives growth. New Zealand's digitalization drives and AI deployments within different verticals are also expected to fuel growing combined graphics chipset adoption in consumer and enterprise computing solutions.

Computers are estimated to account for 40.5%, and smartphones will contribute to a 28.7% share.

With performance and efficiency improving with each iteration, computers, which include laptops and desktops, take up the largest chunk of the market. Intel, AMD, and Apple dominate this space, with highly integrated GPUs tuned for general-purpose processing, gaming, and professional end-use. Intel's Iris Xe and AMD's Radeon Vega line-ups boost graphics for business and games Das Laptops and reduce dependence on discrete GPUs. Apple’s M-series chip packs high-performance GPUs on the inside of the processor itself, bringing longer battery life and boosted graphics rendering to MacBooks and iMacs.

Smartphones (28.7%) - Smartphones support built-in GPUs for gaming, AR, and high-def video applications. Qualcomm (Adreno), Apple (A-series GPUs), and MediaTek (Mali GPUs) lead the field in this department, especially with Game Mode providing performance-oriented and more efficient built-in graphics. The booming of mobile gaming and streaming services has increased the demand for high-performance smartphone GPUs.

The chipsets are being used in computers and smartphones. This will continue to drive their demand. The advent of cloud gaming, increased demand for AI workload, and the widespread adoption of high-resolution displays early on in developing IGCs only strengthen the industry.

The Media & Entertainment industry will dominate in 2025, accounting for a 38.2% share, followed by IT & Telecommunication (30.5%)

Most of the media & entertainment industry players rely heavily on utilizing integrated graphics chipsets (IGCs) for video editing, animation, content creation, and gaming. In addition, AMD, Intel, and NVIDIA, as industry leaders in development, offer powerful integrated GPUs tailored for creative professionals using applications such as Adobe Premiere Pro, DaVinci Resolve, and Blender.

The proliferation of 4K and 8K video editing has increased the demand for powerful IGCs. In addition, integrated GPUs serve the gaming space, including casual and cloud gaming, to meet the needs for graphics without the cost of discrete graphics cards.

IT & Telecommunication account for 30.5% of the market in infrastructure around data centers, enterprise applications, and networking. AI-optimized GPUs, which are being integrated into processors from Intel (Xe Graphics) and AMD (Radeon Famieduver, Vega, and RDNA-based IGCs), are making an impact in real-time analytics, cloud computing , and virtualization.

With organizations migrating to cloud-ready remote work systems and virtual desktops, integrated GPUs are key to driving web applications that include video conference and collaborative applications.

Both industries are set for continuous innovation with the rise of AI-enabling processing, accelerating cloud growth, and improvements in integrated graphics capability, further fuelling demand for power-efficient, high-performance integrated chipsets.

The integrated graphics chipset industry is a competitive landscape, with a few big companies leading towards better performance, power efficiency, and compatibility with different computing needs. These large silicon companies hold a good position by utilizing cutting-edge manufacturing technologies, AI-enhanced optimizations, and next-gen GPU architectures.

The top OEMs compete to offer high-performance graphics embedded within CPUs for mainstream laptops, desktops, and compact computing. This has resulted in an especially fierce competition for all those engaged in developments such as AI graphics acceleration, ray tracing, power efficiency, and creative and professional workstations. Chipset optimizations for emerging workloads- such as cloud gaming, AI inferencing, and real-time rendering- will also be of interest to those engaged.

Meanwhile, new competitors and niche suppliers concentrate on graphics solutions for embedded applications such as low power for IoT, automotive, and industrial computing. Partnerships with OEMs, software developers, and cloud service providers are of paramount importance to boost industry penetration. Meanwhile, open-source drivers, the developer ecosystem, and software compatibility significantly influence brand loyalty and adoption.

Ongoing developments in semiconductor fabrication settings are also of relevance, with semiconductor corporations being pushed to adopt smaller node technologies for improved performance-per-watt metrics. With integrated GPUs being a rival to entry-level discrete graphics solutions, innovation in architecture design, thermal design, and AI-enhanced development will prove to be an immediate requirement for maintaining competitiveness.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Intel Corporation | 55-60% |

| Advanced Micro Devices (AMD) | 20-25% |

| Apple Inc. | 10-15% |

| NVIDIA Corporation | 5-8% |

| Other Key Players | 5-10% |

| Company Name | Key Offerings & Industry Focus |

|---|---|

| Intel Corporation | Intel UHD and Iris Xe graphics are integrated into core processors, focusing on power efficiency and AI-enhanced computing. |

| AMD (Advanced Micro Devices) | Radeon-integrated GPUs within Ryzen APUs; superior gaming and multimedia performance compared to competitors. |

| Apple Inc. | Integrated GPU in Apple Silicon (M-series chips); optimized for macOS with high power efficiency and Metal API performance. |

| NVIDIA Corporation | ARM-based Tegra and integrated solutions for automotive, cloud, and emerging AI applications. |

Key Company Insights

Intel Corporation (55-60%)

Intel dominates the industry, as it supplies chipsets across a vast range of consumer and enterprise devices. Its Iris Xe graphics have improved multimedia and gaming capabilities, while upcoming AI-accelerated graphics optimizations further enhance competitiveness.

AMD (20-25%)

AMD’s Radeon iGPU solutions within Ryzen processors have positioned the company as a strong competitor, particularly in gaming and content creation. Ryzen APUs deliver superior graphics performance in mainstream laptops and desktops compared to Intel’s offerings.

Apple Inc. (10-15%)

Apple’s integrated GPU, embedded within M-series chips, has set new standards for power efficiency and graphical performance, enabling high-end content creation and gaming on MacBooks while reducing reliance on discrete GPUs.

NVIDIA Corporation (5-8%)

While traditionally dominant in discrete GPUs, NVIDIA has ventured into integrated graphics via ARM-based solutions for automotive, cloud, and mobile computing. Its Tegra processors power AI-driven applications and autonomous vehicle platforms.

Other Key Players (5-10% Combined)

The segmentation is into Integrated Graphics Chipsets for Computers, Tablets, Smartphones, and Other Devices.

The segmentation is into Media & Entertainment, IT & Telecommunication, Defense & Intelligence, and Other Industry Verticals.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa (MEA).

The industry is expected to reach USD 6.19 billion in 2025.

The market is projected to grow to USD 15.33 billion by 2035.

China is expected to experience significant growth, with a CAGR of 7.0% during the forecast period.

The Computers segment is one of the most popular categories in the market.

Leading companies include Intel Corporation, Advanced Micro Devices (AMD), Apple Inc., NVIDIA Corporation, Qualcomm, MediaTek, Samsung, Imagination Technologies, and VIA Technologies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Industry Vertical, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Industry Vertical, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Industry Vertical, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Industry Vertical, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Industry Vertical, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Industry Vertical, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Industry Vertical, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Device Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Device Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Industry Vertical, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Industry Vertical, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Industry Vertical, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 16: Global Market Attractiveness by Device Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Industry Vertical, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 34: North America Market Attractiveness by Device Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Industry Vertical, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Device Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Industry Vertical, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Device Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Industry Vertical, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Device Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Industry Vertical, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Device Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Industry Vertical, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Device Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Industry Vertical, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Device Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Device Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Industry Vertical, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Industry Vertical, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry Vertical, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry Vertical, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Device Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Industry Vertical, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Integrated Traffic System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Chemistry Systems Market Size and Share Forecast Outlook 2025 to 2035

Integrated Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Integrated Motor Protector Market Size and Share Forecast Outlook 2025 to 2035

Integrated Universal Integrated Circuit Card (iUICC) Modules Market Size and Share Forecast Outlook 2025 to 2035

Integrated SIM (iSIM) Market Size and Share Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Integrated UPS Market Size and Share Forecast Outlook 2025 to 2035

Integrated Labeling System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Quantum Optical Circuits Market Size and Share Forecast Outlook 2025 to 2035

Integrated Food Ingredients Market Analysis -Size, Share & Forecast 2025 to 2035

Integrated Gas System Market Growth – Trends & Forecast 2025 to 2035

Integrated Passive Devices (IPDs) Market

Integrated CMOS Tri-gate Transistor Market

AI-Integrated Blood Analyzers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Power Integrated Modules Market Trends – Growth & Forecast through 2034

Memory Integrated Circuits (IC) Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA