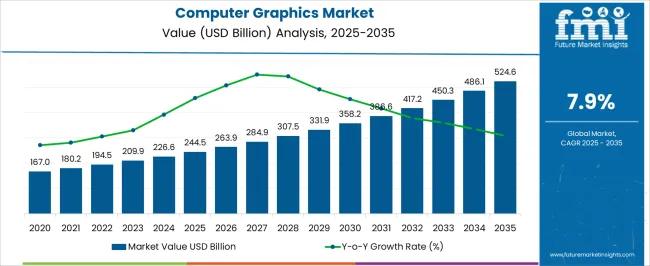

The Computer Graphics Market is estimated to be valued at USD 244.5 billion in 2025 and is projected to reach USD 524.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

| Metric | Value |

|---|---|

| Computer Graphics Market Estimated Value in (2025 E) | USD 244.5 billion |

| Computer Graphics Market Forecast Value in (2035 F) | USD 524.6 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The computer graphics market is experiencing rapid development fueled by advances in visualization technologies, increased adoption of 3D design tools, and the rising demand for immersive digital experiences. Growing reliance on graphics for engineering design, entertainment, simulation, and virtual collaboration has significantly expanded the scope of applications.

Hardware innovation including high performance GPUs, interactive displays, and advanced rendering processors has strengthened market capabilities. Parallelly, the integration of artificial intelligence and cloud platforms has enabled faster rendering speeds and enhanced accessibility across industries.

Expanding use cases in product design, medical imaging, and entertainment content creation continue to drive long term growth. With digital transformation initiatives accelerating globally, the market is poised for sustained expansion supported by investments in high fidelity visualization and real time computing solutions.

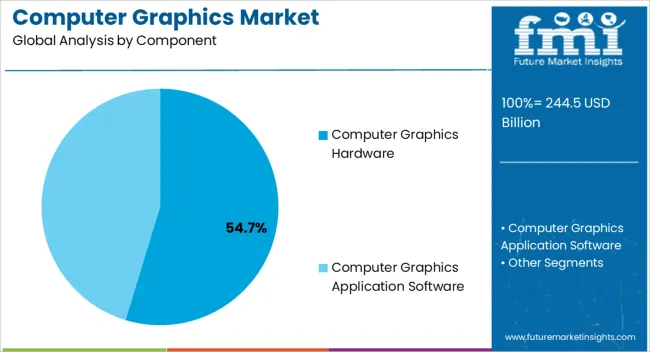

The computer graphics hardware segment is projected to contribute 54.70% of total market revenue by 2025 within the component category, establishing it as the leading segment. Growth is supported by continuous demand for advanced graphic processors, high resolution displays, and specialized visualization hardware across professional and consumer markets.

The ability of modern hardware to deliver faster performance, real time rendering, and energy efficiency has strengthened adoption in engineering design, gaming, and media production. Additionally, growing reliance on hardware for supporting augmented reality, virtual reality, and artificial intelligence enhanced applications has reinforced its position.

As industries seek robust and scalable solutions to handle complex visual data, computer graphics hardware remains at the forefront of market growth.

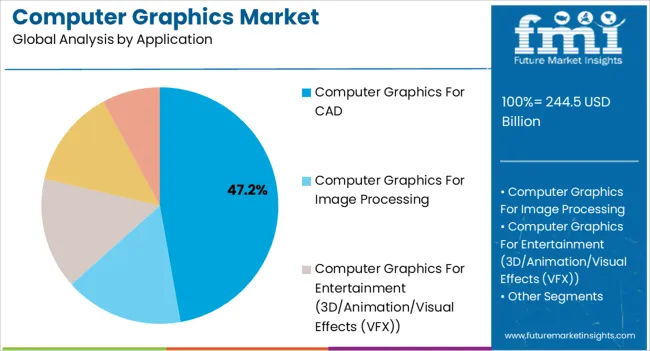

The computer graphics for CAD segment is expected to account for 47.20% of total market revenue by 2025 within the application category, making it the dominant application. The rising adoption of CAD tools in engineering, manufacturing, and architecture has been a primary growth driver.

The capability to produce precise visual models, enhance product design accuracy, and streamline prototyping processes has reinforced CAD’s importance. Integration of computer graphics into CAD platforms has enabled faster design iterations, collaborative workflows, and reduced time to market for new products.

Furthermore, the increasing complexity of design requirements in industries such as automotive, aerospace, and construction has propelled demand for high quality visualization tools. This convergence of accuracy, efficiency, and innovation continues to strengthen the leadership of computer graphics in CAD applications.

| Segment | Component |

|---|---|

| Sub-segment | Application Software |

| Value Share | 55.5% |

| Segment | Application |

|---|---|

| Sub-segment | Computer Graphics for CAD |

| Value Share | 34.3% |

As per the FMI study, the application software component was predicted to garner a value share of 55.5% on a global level in 2025.

Application software components stimulate market growth in computer graphics through their ability to enhance functionality, provide specialized tools, and cater to diverse industry needs.

By offering a wide range of features and capabilities, application software components enable users to create, edit, and manipulate graphics with greater ease and efficiency. This stimulates market growth by attracting more users and businesses to adopt computer graphics solutions.

Specialized tools within application software components enable professionals in filmmaking, advertising, architecture, and design. To leverage advanced techniques and achieve high-quality results, driving market growth as industries recognize the value of computer graphics.

Overall, the continuous development and innovation of application software components play a vital role in expanding the computer graphics industry and fueling its growth.

The impact of computer graphics for computer-aided design (CAD) on the computer graphics industry is substantial, contributing to its value share of 34.3% in 2025.

CAD relies heavily on computer graphics technology to create, visualize, and manipulate complex designs and models in various industries such as architecture, engineering, manufacturing, and construction.

The integration of computer graphics in CAD systems revolutionizes design by enabling efficient and accurate representation of 2D and 3D models. It empowers designers and engineers to visualize concepts, simulate real-world scenarios, and identify issues early, leading to cost reduction, increased productivity, and improved design quality.

The growing demand for CAD software and the increasing adoption of computer graphics for CAD applications directly contribute to the expansion of the computer graphics industry.

As more industries recognize the benefits of computer-aided design and its impact on productivity and innovation, the demand for computer graphics technologies and solutions continues to rise.

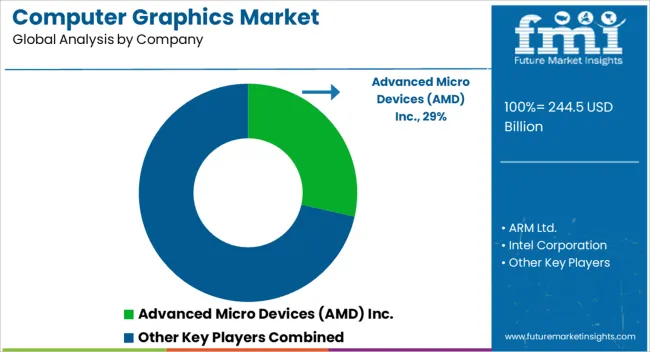

Due to the presence of several local manufacturing companies in nations like the United States of America and Canada, the North American region of the global market is anticipated to grow at a rapid pace over the projected period when compared to other regions, contributing to the region’s value share of 27.4% in 2025.

The market for computer graphics in the United States of America garnered a value share of 17.2% on a global level in 2025. Owing to the growing presence of key companies, including Walt Disney Animation Studios, Warner Bros Animation, and DreamWorks Animation.

The region serves as a center for vendors who produce computer graphics hardware components and applications software, including Adobe Systems Inc., Autodesk Inc., Siemens PLM Software, Microsoft Corporation, etc. Moreover, the significant growth of the computer graphics market in the region has been attributed to the existence of government programs that support the film entertainment industry in the market.

As per the FMI study, the market for computer graphics in Europe amassed a value share of 24.3% in 2025 as European industries, including gaming, media and entertainment, architecture, engineering, and manufacturing, are increasingly recognizing the value and potential of computer graphics.

During the forecast period, the computer graphics market in the United Kingdom is expected to grow at a compound annual growth rate of 6.5%. The rising presence of manufacturers of computer hardware components in this region has boosted market growth for computer graphics.

Germany market for computer graphics garnered a value share of 8.2% in 2025 globally on account of its thriving gaming and entertainment industry.

Technological advances in GPUs are expected to boost the growth of the market in the region. In addition, the growth of smart TVs and the surge in demand for video games are driving the growth and expansion of computer graphics in the market.

Through strategic partnerships, manufacturers can increase production and meet consumer demand, increasing both their revenues and market share. The introduction of new products and technologies allows end-users to reap the benefits of new technologies. Increasing the company's production capacity is one of the potential benefits of a strategic partnership.

Recent Developments in the Computer Graphics Market:

The global computer graphics market is estimated to be valued at USD 244.5 billion in 2025.

The market size for the computer graphics market is projected to reach USD 524.6 billion by 2035.

The computer graphics market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in computer graphics market are computer graphics hardware and computer graphics application software.

In terms of application, computer graphics for cad segment to command 47.2% share in the computer graphics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Computer Vision in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Computer Keyboard Market Size and Share Forecast Outlook 2025 to 2035

Computer Aided Facility Management (CAFM) Market Size and Share Forecast Outlook 2025 to 2035

Computerized Physician Order Entry (CPOE) Market Size and Share Forecast Outlook 2025 to 2035

Computer Keyboard Industry Analysis in East Asia Size and Share Forecast Outlook 2025 to 2035

Computer Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Computer-aided Design (CAD) Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Computer Microchips Market Size and Share Forecast Outlook 2025 to 2035

Computer-aided Engineering Market Analysis - Size, Share, and Forecast 2025 to 2035

Computerized Maintenance Management Systems (CMMS) Market Trends – Size, Share & Growth 2025–2035

Computer Assisted Coding Software Market Analysis by Solution, Deployment, Application, and Region Through 2035

Graphics Processing Unit Market - Growth, Demand & Forecast 2025 to 2035

Computer Vision Market Insights – Trends & Forecast 2025 to 2035

Computer Aided Trauma Fixators Market

Computer-To-Plate And Computer-To-Press Systems Market

Dive Computer Market Forecast and Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Demand for Computer Keyboard in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Computer Keyboard in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA