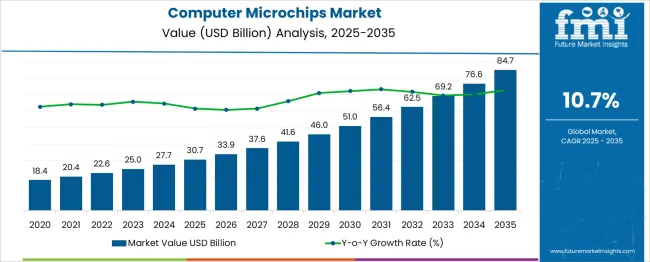

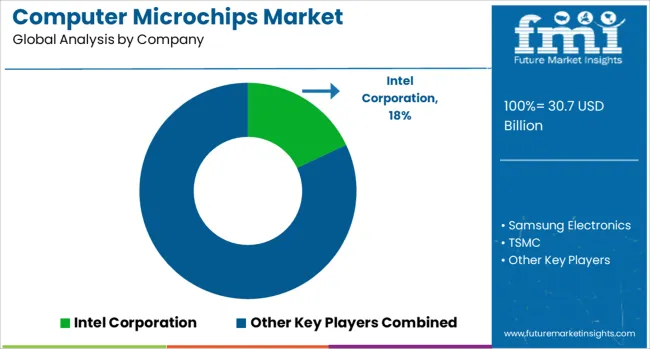

The Computer Microchips Market is estimated to be valued at USD 30.7 billion in 2025 and is projected to reach USD 84.7 billion by 2035, registering a compound annual growth rate (CAGR) of 10.7% over the forecast period. In the first five-year phase (2025–2030), the market rises from USD 30.7 billion to USD 51.0 billion, delivering an incremental gain of USD 20.3 billion, which accounts for 37.6% of the total growth opportunity. This early phase is driven by expanding demand for high-performance chips in cloud computing, AI acceleration, and 5G infrastructure, supported by large-scale data center expansions and edge computing deployments. The second half (2030–2035) will contribute USD 33.7 billion, or 62.4% of incremental growth, signaling stronger momentum as advanced nodes (<3nm), heterogeneous integration, and chiplet architectures dominate semiconductor design. YOY increments during the initial phase average USD 4 billion per year, while later years accelerate as next-generation applications like autonomous mobility, quantum computing, and industrial AI create exponential chip requirements. Manufacturers focusing on EUV lithography readiness, energy-efficient designs, and fab capacity scaling will be best positioned to capitalize on this USD 54 billion growth window, reinforcing the strategic importance of microchips in digital transformation and emerging technologies.

| Metric | Value |

|---|---|

| Computer Microchips Market Estimated Value in (2025 E) | USD 30.7 billion |

| Computer Microchips Market Forecast Value in (2035 F) | USD 84.7 billion |

| Forecast CAGR (2025 to 2035) | 10.7% |

The computer microchips market holds a dominant role within several technology and semiconductor-related sectors. In the semiconductor market, its share is approximately 20–22%, as microchips for computing represent a major segment alongside memory, sensors, and power devices. Within the integrated circuits (IC) market, the contribution is about 30–32%, given that microprocessors, microcontrollers, and logic ICs are core components for computing systems. In the computer hardware components market, its share is significant at nearly 35–40%, as microchips form the backbone of CPUs, GPUs, and motherboards. For the consumer electronics components market, it accounts for roughly 8–10%, since this category also includes chips for smartphones, wearables, and home appliances. In the data processing and computing devices market, the share stands at 12–14%, reflecting their critical role in desktops, laptops, and data servers.

Growth is driven by increasing demand for high-performance computing, AI-driven workloads, cloud infrastructure, and edge devices. Technological innovations such as advanced node architectures, chiplet designs, and energy-efficient processors further accelerate adoption. With the rise of quantum computing, autonomous systems, and IoT applications, computer microchips are expected to maintain a dominant and expanding position across these parent markets, reinforcing their status as a fundamental driver of the global technology ecosystem.

The increasing need for efficient processing power in consumer electronics, data centers, and enterprise infrastructure has fueled rapid advancements in chip design and miniaturization. Technological shifts toward system-on-chip integration and chiplet architectures are enabling more scalable and energy-efficient solutions.

Strategic investments by semiconductor manufacturers, coupled with a strong push from national governments to localize chip production, are supporting supply chain resilience and long-term growth. The transition to smaller nodes, along with the increasing application of machine learning workloads and edge computing, is expected to reshape microchip requirements.

As performance-per-watt becomes a key benchmark, the market is poised to benefit from both architectural innovation and volume demand from next-generation computing platforms. The sector is also experiencing robust collaboration between foundries and fabless design firms, ensuring sustained momentum through research-driven innovation and diversified product pipelines..

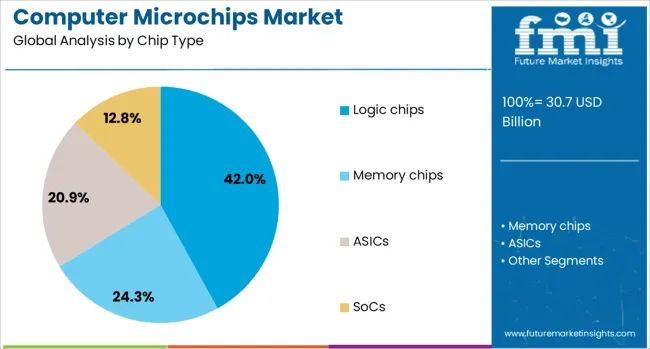

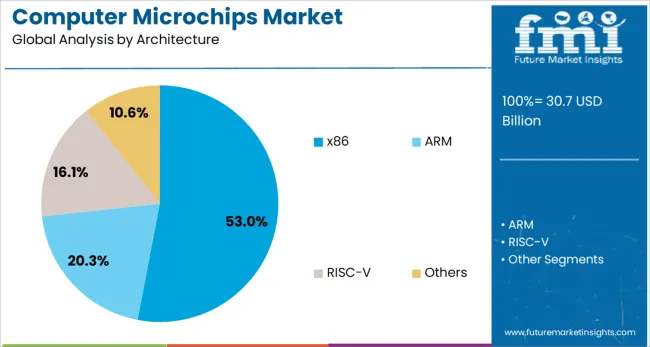

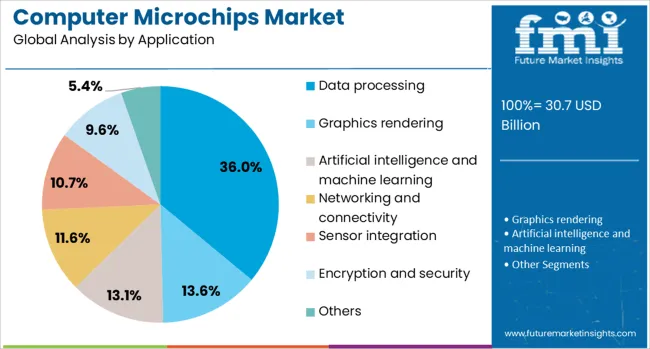

The computer microchips market is segmented by chip type, architecture, application, end-use, and geographic regions. The computer microchips market is divided by chip type into Logic chips, Memory chips, ASICs, and SoCs. The architecture of the computer microchips market is classified into x86, ARM, RISC-V, and Others. Based on the application of the computer microchips market, it is segmented into Data processing, Graphics rendering, Artificial intelligence and machine learning, Networking and connectivity, Sensor integration, Encryption and security, and Others. The end-use of the computer microchips market is segmented into Servers and data centers, Personal computers, Smartphones and tablets, Gaming consoles, and Others. Regionally, the computer microchips industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The logic chips chip type segment is projected to hold 42% of the Computer Microchips market revenue share in 2025, positioning it as the leading chip type. This dominance has been attributed to the essential role logic chips play in central and graphical processing across computing platforms. These chips have served as the core enabler of data computation, software execution, and instruction-level processing, all of which are fundamental to a wide array of devices.

The increased deployment of cloud infrastructure and artificial intelligence systems has demanded higher throughput and multitasking capabilities, which logic chips are uniquely designed to support. Additionally, advancements in transistor density and power management have enhanced the scalability and efficiency of these chips.

Their integration into mobile devices, servers, and embedded systems has further elevated their market penetration. Ongoing innovation in logic chip fabrication, supported by strategic partnerships and R&D investments, is reinforcing their critical role in shaping future digital infrastructure..

The x86 architecture segment is expected to account for 53% of the Computer Microchips market revenue share in 2025, maintaining its leadership among architectural formats. The segment’s strength has been sustained by the widespread compatibility of x86-based systems across personal computers, enterprise servers, and cloud computing platforms.

Its longevity in the market has allowed for continuous optimization and extensive developer support, which have collectively ensured seamless performance, backward compatibility, and robust software ecosystems. As demand increases for scalable compute resources, the x86 architecture has remained preferred for its mature instruction set, efficient virtualization capabilities, and ability to support general-purpose workloads.

Strategic refinements in fabrication processes have further enhanced the architecture’s performance per watt, contributing to improved power efficiency and operational cost reduction. Strong alliances between chipset designers and hardware manufacturers have reinforced the x86 architecture’s presence across a broad array of commercial and consumer applications, enabling sustained relevance in modern computing environments..

The data processing application segment is projected to capture 36% of the Computer Microchips market revenue share in 2025, emerging as the most significant application area. This leadership position has been shaped by the exponential growth in data volumes generated by enterprises, cloud services, and edge devices.

The need to perform complex data computation, real-time analytics, and machine learning inference has placed immense pressure on computing systems, which has in turn accelerated demand for highly optimized microchips. Data centers, financial institutions, research laboratories, and telecom operators have increasingly integrated advanced microchips to improve operational efficiency, reduce latency, and enable secure processing.

Energy efficiency and parallel processing capabilities have become crucial design considerations, leading to the adoption of architectures specifically tailored for high-volume data workloads. The segment’s continued expansion is being supported by global digitization trends and the proliferation of AI-powered platforms, ensuring that data processing remains a foundational driver of microchip innovation and deployment..

The computer microchips market is expanding rapidly due to rising demand for high-performance processors, increased adoption of AI-driven systems, and growth in data center infrastructure. Opportunities have emerged in specialized chips for quantum computing, autonomous vehicles, and edge computing. Trends include the adoption of chiplet-based architectures, 3D stacking, and energy-efficient designs for next-generation computing systems. However, constraints such as supply chain disruptions, high fabrication costs, and shortages of advanced semiconductor nodes continue to challenge manufacturers. The market outlook reflects strong potential driven by computing power requirements and integrated circuit design innovation.

The primary growth driver is the surge in computing-intensive applications such as AI workloads, gaming systems, and cloud computing platforms. In 2024 and 2025, major chipmakers introduced advanced processors with sub-5nm architecture to enhance speed and reduce power consumption. Data center operators increased procurement of microchips optimized for parallel processing and multi-core configurations to manage expanding storage and compute requirements. Consumer electronics also witnessed accelerated adoption of high-speed processors in laptops and gaming consoles. These factors indicate that microchip demand will remain strongly tied to processing capability and efficient system integration.

Significant opportunities exist in the development of microchips for specialized computing segments. In 2025, edge computing and autonomous vehicle technologies drove demand for chips optimized for real-time processing and low-latency response. AI accelerators and GPUs designed for machine learning models gained prominence in healthcare diagnostics and financial analytics. Quantum computing pilot programs in North America and Europe created additional openings for custom chip designs. Suppliers focusing on domain-specific architectures and power-efficient designs for portable devices are well-positioned to secure long-term contracts across industries adopting advanced digital infrastructure.

Emerging trends in the computer microchips market highlight the shift toward chiplet architecture and 3D packaging solutions. In 2024, leading manufacturers launched modular chips enabling faster production cycles and cost optimization for high-end processors. Energy efficiency became a top priority, resulting in designs focused on minimizing thermal output in high-performance environments. AI-driven predictive maintenance of semiconductor fabs was also adopted to reduce downtime and enhance yield rates. These trends underscore the industry’s pivot toward scalable architectures and process optimization, shaping the next wave of computing performance improvements.

Key restraints include escalating fabrication costs for advanced semiconductor nodes and recurring supply chain challenges. In 2024 and 2025, several chip producers faced delays in 3nm production lines due to equipment shortages and geopolitical constraints. The capital-intensive nature of semiconductor manufacturing restricted market entry for smaller firms, consolidating dominance among major foundries. Additionally, fluctuations in raw material pricing and dependency on limited suppliers for photolithography equipment increased vulnerability. These limitations emphasize the need for diversified sourcing strategies and collaborative manufacturing ecosystems to sustain market stability.

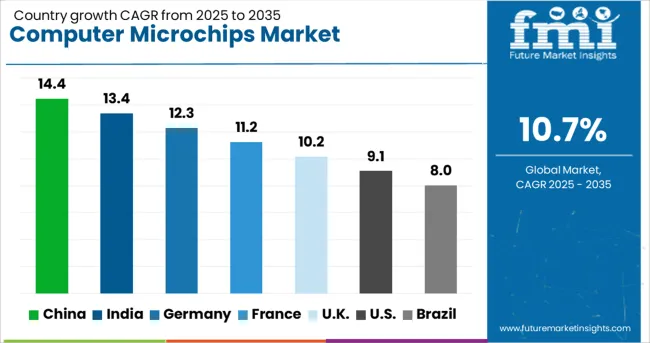

| Country | CAGR |

|---|---|

| China | 14.4% |

| India | 13.4% |

| Germany | 12.3% |

| France | 11.2% |

| UK | 10.2% |

| USA | 9.1% |

| Brazil | 8.0% |

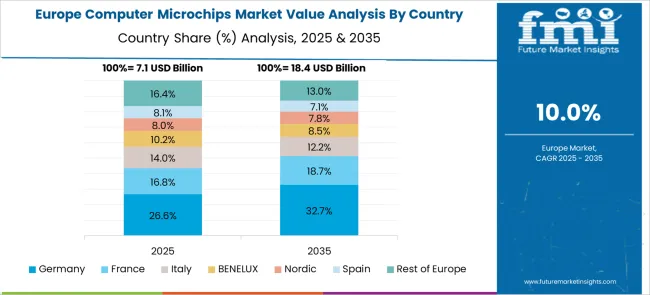

The global computer microchips market is expected to expand at 10.7% CAGR between 2025 and 2035. China leads with 14.4% CAGR, driven by massive semiconductor investments and localization strategies for chip manufacturing. India follows at 13.4%, supported by government incentives for domestic fabrication and design ecosystems. France records 11.2% CAGR, fueled by advanced semiconductor R&D and EU-backed initiatives. The UK posts 10.2%, while the United States grows at 9.1%, reflecting strong demand but limited fabrication capacity amid reshoring efforts. Asia-Pacific dominates due to aggressive policy frameworks and large-scale fab expansions, whereas Western economies focus on advanced nodes, AI-driven chipsets, and supply chain resilience.

China is projected to grow at 14.4% CAGR, the fastest globally, as it ramps up domestic production to reduce dependency on imports. Strategic investments under the "Made in China 2025" program and national semiconductor funds are accelerating the construction of advanced fabs for 7nm and below technologies. Demand from AI applications, 5G infrastructure, and consumer electronics further strengthens the microchip ecosystem. Local firms collaborate with global players for IP licensing and advanced lithography solutions, while R&D in 3D chip packaging and power-efficient designs gains momentum.

The computer microchips market in India is forecasted to grow at 13.4% CAGR, driven by ambitious government initiatives under the "Semicon India" program and the Production Linked Incentive (PLI) scheme. The focus on creating a domestic semiconductor ecosystem includes design hubs, fabless companies, and assembly units. Rising demand for microchips in automotive electronics, smartphones, and IoT devices accelerates market expansion. Partnerships between domestic firms and global leaders are shaping investments in state-of-the-art fabrication facilities, while talent development in VLSI design ensures long-term competitiveness.

France posts 11.2% CAGR, supported by EU semiconductor strategies promoting sovereignty in chip manufacturing. The country invests heavily in R&D for AI-optimized processors, photonics-based chips, and energy-efficient designs. Government-backed funding under the European Chips Act ensures local manufacturing capacity for advanced nodes. Demand from aerospace, automotive, and industrial automation sectors further boosts adoption. French companies collaborate with global foundries for high-performance computing and edge AI solutions, while innovation in advanced packaging technologies positions France as a critical hub for next-gen microchip production.

The United Kingdom market is forecasted to grow at 10.2% CAGR, driven by high-value semiconductor design expertise and strategic investments in compound semiconductors. Adoption of AI processors, IoT chips, and advanced photonic devices strengthens demand across data centers, defense systems, and communication networks. The government’s semiconductor strategy emphasizes R&D and supply chain resilience rather than large-scale fabrication, creating opportunities for fabless companies. Partnerships with academic institutions foster breakthroughs in low-power chip architectures and quantum computing technologies.

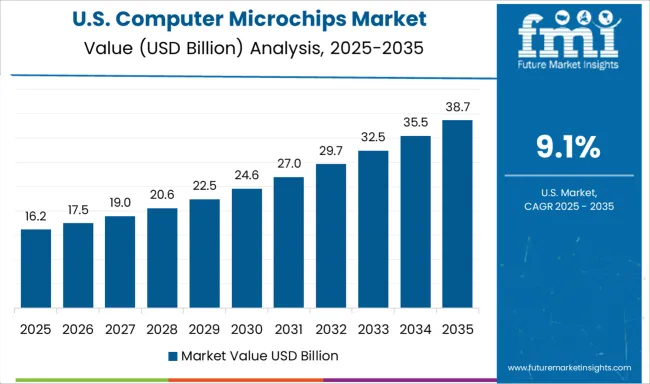

The USA market grows at 9.1% CAGR, reflecting steady demand across consumer electronics, cloud computing, and automotive sectors. Federal funding under the CHIPS and Science Act drives reshoring of fabrication plants, with large-scale investments from Intel, TSMC, and Samsung for advanced node production. AI and high-performance computing drive adoption of next-gen microchips, while local suppliers focus on chiplet-based architectures for scalability. The defense sector also pushes secure chip development to mitigate supply chain vulnerabilities, while collaborations between tech giants and fabless firms accelerate commercialization.

The computer microchips market is moderately consolidated, with Intel Corporation recognized as a leading player owing to its dominance in central processing units (CPUs) and expanding presence in AI, data center, and edge computing applications. Intel’s continuous innovation in advanced semiconductor architectures and manufacturing processes secures its strong global position.

Key players include Samsung Electronics, TSMC, AMD, Qualcomm Technologies, and NVIDIA Corporation. These companies cater to a diverse range of applications including consumer electronics, high-performance computing, graphics processing, and mobile devices. TSMC leads in contract chip manufacturing with cutting-edge nodes, while NVIDIA and AMD focus on GPU and CPU solutions for gaming, AI, and data-intensive tasks. Qualcomm remains strong in mobile chipsets, and Samsung combines memory and logic chip production for a balanced market share.

Market growth is driven by rising demand for advanced computing power in cloud services, AI, IoT, and autonomous vehicles. Leading manufacturers are investing heavily in next-generation nodes like 3nm and 2nm, chiplet-based designs, and advanced packaging to boost performance and energy efficiency. Emerging trends include the integration of AI accelerators, adoption of heterogeneous computing architectures, and development of specialized microchips for quantum computing. Asia-Pacific, particularly Taiwan and South Korea, dominates production, while North America leads in design innovation and ecosystem development.

| Item | Value |

|---|---|

| Quantitative Units | USD 30.7 Billion |

| Chip Type | Logic chips, Memory chips, ASICs, and SoCs |

| Architecture | x86, ARM, RISC-V, and Others |

| Application | Data processing, Graphics rendering, Artificial intelligence and machine learning, Networking and connectivity, Sensor integration, Encryption and security, and Others |

| End-use | Servers and data centers, Personal computers, Smartphones and tablets, Gaming consoles, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Intel Corporation, Samsung Electronics, TSMC, AMD, Qualcomm Technologies, and NVIDIA Corporation |

| Additional Attributes | Dollar sales by architecture (x86, ARM, RISC‑V, custom), chip type (logic, memory, analog), and process node (legacy vs advanced). North America leads market share, Asia‑Pacific posts fastest growth. Buyers seek IoT- and AI-ready chips with energy-efficient packaging and edge integration. Innovations include RISC‑V adoption, heterogeneous integration, and neuromorphic chip designs. |

The global computer microchips market is estimated to be valued at USD 30.7 billion in 2025.

The market size for the computer microchips market is projected to reach USD 84.7 billion by 2035.

The computer microchips market is expected to grow at a 10.7% CAGR between 2025 and 2035.

The key product types in computer microchips market are logic chips, memory chips, asics and socs.

In terms of architecture, x86 segment to command 53.0% share in the computer microchips market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Computer Vision in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Computer Keyboard Market Size and Share Forecast Outlook 2025 to 2035

Computer Aided Facility Management (CAFM) Market Size and Share Forecast Outlook 2025 to 2035

Computerized Physician Order Entry (CPOE) Market Size and Share Forecast Outlook 2025 to 2035

Computer Keyboard Industry Analysis in East Asia Size and Share Forecast Outlook 2025 to 2035

Computer Graphics Market Size and Share Forecast Outlook 2025 to 2035

Computer Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Computer-aided Design (CAD) Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Computer-aided Engineering Market Analysis - Size, Share, and Forecast 2025 to 2035

Computerized Maintenance Management Systems (CMMS) Market Trends – Size, Share & Growth 2025–2035

Computer Assisted Coding Software Market Analysis by Solution, Deployment, Application, and Region Through 2035

Computer Vision Market Insights – Trends & Forecast 2025 to 2035

Computer Aided Trauma Fixators Market

Computer-To-Plate And Computer-To-Press Systems Market

Dive Computer Market Forecast and Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Demand for Computer Keyboard in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Computer Keyboard in USA Size and Share Forecast Outlook 2025 to 2035

Veterinary Microchips Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA