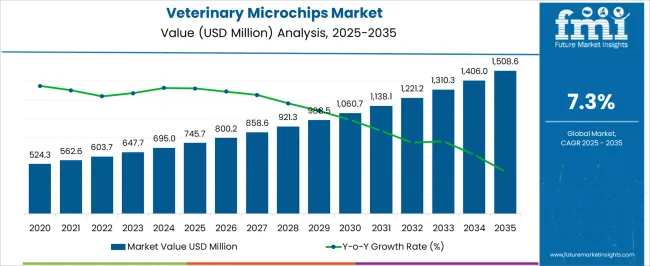

The veterinary microchips market is estimated to be valued at USD 745.7 million in 2025 and is projected to reach USD 1508.6 million by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

Between 2025 and 2030, the market is expected to rise from USD 745.7 million to USD 1,060.7 million, indicating a steady and gradual upward curve. The growth pattern suggests consistent adoption of animal identification and tracking solutions, driven by increasing pet ownership and stricter regulations on livestock monitoring. Veterinary microchips are being increasingly preferred due to their reliability, permanence, and ability to store essential data, making them a practical choice compared to conventional identification methods.

From 2030 to 2035, the market is forecast to continue its upward climb, expanding from USD 1,060.7 million to USD 1,508.6 million. This second half of the growth curve highlights a sustained rise in adoption, supported by higher awareness of animal welfare, enhanced veterinary practices, and the expanding role of microchips in integrating with digital health records. The curve demonstrates a smooth, incremental trajectory without sharp spikes, reflecting stable demand across both companion animals and livestock. The steady curve shape signifies a resilient market, with stakeholders benefitting from consistent regulatory support, ongoing demand from pet owners, and integration of identification systems into broader veterinary care frameworks.

| Metric | Value |

|---|---|

| Veterinary Microchips Market Estimated Value in (2025 E) | USD 745.7 million |

| Veterinary Microchips Market Forecast Value in (2035 F) | USD 1508.6 million |

| Forecast CAGR (2025 to 2035) | 7.3% |

The veterinary microchips market represents a sub-segment of several broader markets, with its share varying based on the scope and application of each. Within the animal identification and tracking systems market, veterinary microchips form approximately 25% of the segment, signifying their key role in pet and animal tracking technologies. In the veterinary electronic health and monitoring devices market, which includes a wider array of digital diagnostic and monitoring tools, microchips account for about 15%, as they increasingly complement health-tracking systems. Within the pet safety and recovery products market, where items like ID tags, GPS trackers, and alert systems coexist, veterinary microchips make up around 20%, reflecting their growing preference due to reliability and lifetime identification.

In the larger animal health and diagnostics market, which spans medications, imaging, and laboratory tests, veterinary microchips contribute roughly 5%, indicating a modest but important presence in pet health practices. Finally, within the livestock management and traceability market, veterinary microchips represent near 10%, as they support tracking, health records, and regulatory compliance for farm animals. Together, these percentages illustrate that veterinary microchips maintain stronger footprints within specialized identification and safety-oriented markets, where their unique benefits align closely with sector needs, while they occupy a smaller share of broader veterinary health or livestock management domains.

The market is experiencing steady growth, driven by increasing pet ownership, rising awareness about animal identification, and the growing emphasis on compliance with pet registration regulations. The adoption of microchipping solutions is being accelerated by advancements in chip technology, which now offer improved data storage, durability, and ease of implantation. Regulatory mandates in several regions are further supporting market expansion by making permanent identification compulsory for certain animal categories.

The rising incidence of lost or stolen pets, coupled with the demand for quick and reliable reunification, has created a strong foundation for continued adoption. In livestock and companion animal care, integration with veterinary health records and tracking systems is enhancing operational efficiency.

As the pet care industry evolves towards more technology-enabled solutions, the role of microchips in ensuring safety, security, and traceability is set to grow Ongoing product innovations and increasing availability through veterinary clinics and shelters are expected to sustain market momentum in the coming years.

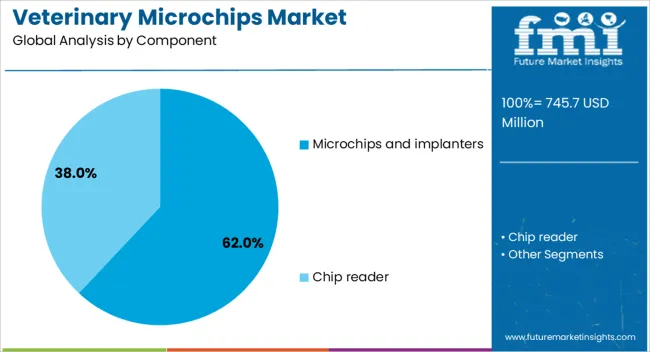

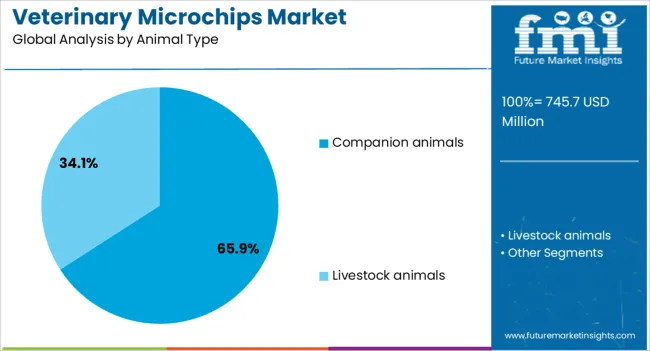

The veterinary microchips market is segmented by component, animal type, type (frequency), end use, and geographic regions. By component, veterinary microchips market is divided into microchips and implanters, RFID chip and implanter (device), and chip reader. In terms of animal type, veterinary microchips market is classified into companion animals and livestock animals. Based on type (frequency), veterinary microchips market is segmented into 134.2 kHz, 125 kHz, and 128 kHz. By end use, veterinary microchips market is segmented into veterinary hospitals and clinics, animal shelters, pet owners, and other end use. Regionally, the veterinary microchips industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The microchips and implanters segment is projected to account for 62% of the veterinary microchips market revenue share in 2025, making it the leading component category. This dominance has been supported by the critical role these devices play in ensuring accurate, permanent animal identification. Microchips offer a unique digital code that can be linked to a pet owner’s contact information, enabling efficient reunification in cases of loss.

The growing availability of easy-to-use implanter devices has simplified the implantation process for veterinary professionals, thereby encouraging higher adoption rates. Advances in microchip miniaturization and biocompatibility have further increased acceptance among pet owners.

Additionally, the longevity of microchips, which often function for the entire lifetime of the animal without the need for replacement, has reinforced their cost-effectiveness The ability to integrate with national and regional animal databases, combined with rising public awareness campaigns, has ensured that microchips and implanters remain indispensable in the veterinary identification ecosystem.

The companion animals segment is estimated to hold 65.90% of the market revenue share in 2025, representing the dominant animal type category. Growth in this segment has been driven by increasing global pet ownership and heightened awareness regarding the importance of permanent identification for pets. Dogs and cats, in particular, have seen higher microchipping rates due to their close human interaction and higher risk of loss or theft.

Veterinary clinics, shelters, and animal welfare organizations have actively promoted microchipping as part of responsible pet ownership, which has boosted adoption rates. The emotional and financial value attached to companion animals has encouraged owners to invest in reliable identification methods.

Regulatory measures in certain countries mandating microchipping for pet registration have further accelerated growth in this category Additionally, the integration of microchip data with online pet recovery services has enhanced efficiency in locating lost pets, ensuring sustained demand for companion animal microchipping solutions.

.webp)

The 134.2 kHz segment is expected to account for 46% of the market revenue share in 2025, making it the most widely adopted frequency type. This frequency has gained preference due to its compliance with ISO standards for animal identification, ensuring interoperability across different scanning devices globally. The use of 134.2 kHz microchips enables efficient reading at longer distances and with minimal interference, which is particularly important in busy veterinary and shelter environments.

Adoption has also been driven by its suitability for both companion animals and livestock, offering a versatile solution for various identification needs. The ability to store a globally unique identification number enhances traceability and data consistency in centralized databases.

Furthermore, manufacturers have focused on developing high-quality, biocompatible microchips operating at this frequency, which has increased durability and reduced the risk of failure Growing awareness among veterinarians and pet owners about the benefits of standard-compliant frequencies has ensured the continued leadership of the 134.2 kHz category.

The veterinary microchips market is advancing as secure animal identification becomes central to pet safety, livestock traceability, and regulatory compliance. Opportunities are strengthening in livestock and equine management, while trends focus on database integration, interoperability, and global standards. Key challenges remain in affordability, standardization, and awareness gaps. In my opinion, market leaders who address these concerns by offering cost-effective, universally compatible, and easily accessible microchipping solutions will hold the strongest advantage, ensuring long-term adoption across both companion animals and agricultural sectors worldwide.

Demand for veterinary microchips has been fueled by the growing need for secure and permanent identification of pets and livestock. These chips provide lifetime traceability, helping reunite lost animals with their owners and ensuring compliance with regulatory requirements in several countries. Veterinary clinics, shelters, and breeders are increasingly adopting microchipping as a standard practice. In my opinion, demand will continue to rise as pet ownership grows globally and authorities strengthen animal registration mandates, making microchips an essential tool in responsible animal care and management.

Opportunities are expanding in livestock and equine management, where traceability and disease control are critical. Microchips are being adopted to monitor breeding records, vaccination histories, and animal movement across borders. Governments in export-focused regions are encouraging livestock identification systems to meet international trade requirements. Equine owners are also using microchips for tournament registrations and breeding documentation. I believe companies offering advanced microchips with data integration capabilities for herd and equine management will capture significant opportunities, as agricultural and equestrian sectors adopt modern solutions for better monitoring and compliance.

Trends in the veterinary microchips market emphasize integration with centralized databases and compatibility with international scanning standards. Governments and animal welfare organizations are building interconnected systems that allow veterinarians and shelters to quickly access animal details. Another trend is the adoption of universal scanners capable of reading multiple chip formats, improving efficiency in identification. In my opinion, these developments highlight that future growth will rely heavily on interoperability and standardization, as global trade and animal movement require seamless data sharing across borders and organizations.

Challenges in this market include cost concerns, particularly for multi-pet households and livestock farmers in low-income regions. Variations in microchip standards create issues in global interoperability, leading to difficulties in cross-border animal identification. Lack of awareness among some pet owners also limits adoption, as many underestimate the importance of permanent identification. In my assessment, success will depend on reducing costs, harmonizing international standards, and running awareness programs to educate owners and farmers. Without addressing these barriers, widespread adoption of veterinary microchips may remain inconsistent across global regions.

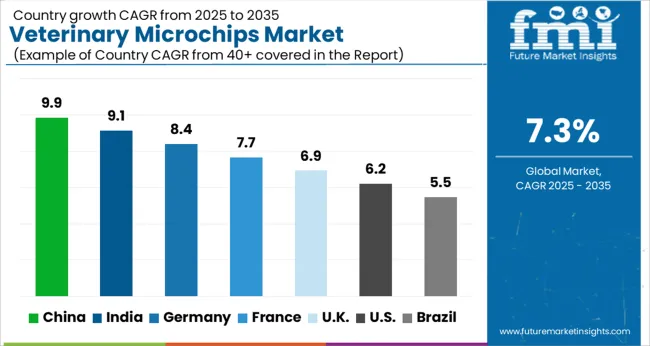

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

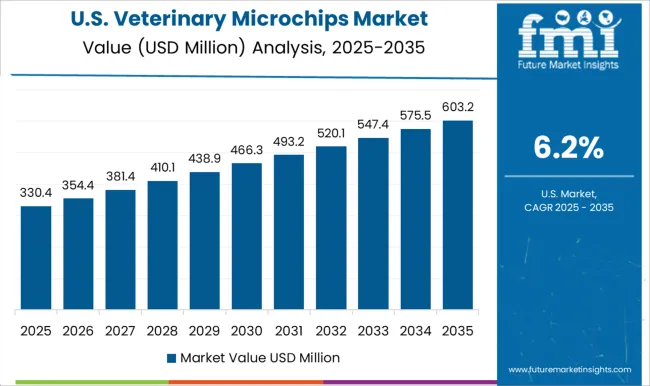

| USA | 6.2% |

| Brazil | 5.5% |

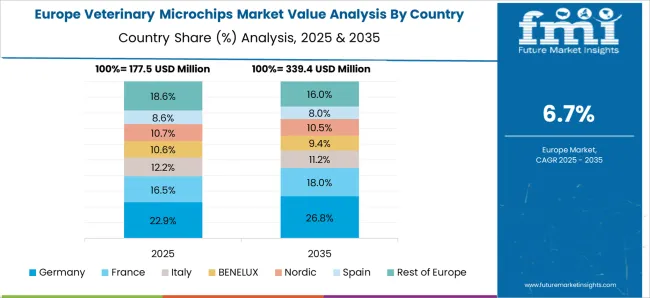

The global veterinary microchips market is projected to grow at a CAGR of 7.3% from 2025 to 2035. China leads with a growth rate of 9.9%, followed by India at 9.1%, and Germany at 8.4%. The United Kingdom records a growth rate of 6.9%, while the United States shows the slowest growth at 6.2%. Market expansion is fueled by increasing pet ownership, stricter animal identification regulations, and rising awareness of animal health and safety. Emerging economies such as China and India are driving faster adoption due to expanding pet populations and supportive government policies, while developed economies such as the USA and UK emphasize regulatory compliance, pet recovery systems, and technological integration in veterinary practices.

The veterinary microchips market in China is projected to grow at a CAGR of 9.9%. Rapid growth in pet ownership, particularly among urban populations, is fueling demand for reliable identification systems. Local governments are implementing stricter policies for pet registration, accelerating the adoption of microchips. Expanding veterinary infrastructure, coupled with the rising popularity of premium pet services, further supports growth. Increased collaborations between domestic manufacturers and global players are also enhancing accessibility and affordability of veterinary microchips in the country.

The veterinary microchips market in India is expected to grow at a CAGR of 9.1%. Expansion of the urban middle class, increasing pet ownership, and rising awareness about animal safety are driving growth. The country’s veterinary services sector is expanding, with greater availability of advanced diagnostic and identification tools. Pet owners are showing growing interest in microchips as a reliable method of tracking and recovery. Government initiatives promoting animal identification in livestock and companion animals further contribute to adoption, presenting significant opportunities for local manufacturers and international suppliers.

The veterinary microchips market in Germany is projected to grow at a CAGR of 8.4%. Germany’s strong regulatory framework and pet ownership culture are the main drivers of growth. Mandatory identification of pets in several regions, combined with strict compliance standards, ensures steady adoption of microchips. Veterinary clinics and shelters are increasingly equipped with microchip scanners, boosting usage rates. Furthermore, German consumers show strong preference for reliable and technology-driven pet care solutions, creating a favorable market for advanced microchip products.

The veterinary microchips market in the UK is projected to grow at a CAGR of 6.9%. The country has one of the most structured regulatory frameworks for animal identification, with microchipping mandatory for dogs and increasingly extended to cats. Widespread veterinary coverage and organized pet welfare systems ensure consistent market demand. Growing consumer interest in integrating microchips with digital pet tracking apps is also boosting innovation. Although growth is moderate, regulatory enforcement and a strong pet welfare culture ensure steady adoption of veterinary microchips in the UK

The veterinary microchips market in the USA is projected to grow at a CAGR of 6.2%. While growth is slower compared to emerging markets, steady demand persists due to strong pet ownership rates and well-developed veterinary infrastructure. Microchips are widely used for pet identification, recovery, and compliance with adoption programs. Innovation in microchip technology, including GPS-enabled solutions, is enhancing consumer interest. Pet insurance policies and veterinary associations continue to promote microchipping as a standard, ensuring sustained adoption. Despite mature market conditions, incremental innovation and rising emphasis on pet safety keep growth steady.

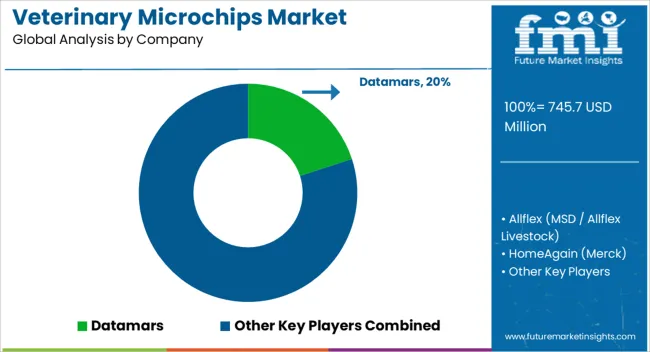

Competition in the veterinary microchips market has been defined by a mix of multinational corporations and specialized identification technology providers. Datamars has been recognized as a global leader, with strong expertise in companion animal identification and livestock tracking. Its reach has been reinforced through robust distribution networks and integration with registry databases. Allflex, operating under MSD Animal Health, has been directing its strategy toward livestock identification systems, ensuring traceability and compliance across large-scale herds while also expanding its companion animal segment. HomeAgain, backed by Merck, has been positioned as a trusted provider for pet owners, combining microchip technology with extensive reunification services and databases, which has strengthened consumer confidence.

Avid Identification has been credited with pioneering early implantable microchip solutions, establishing strong brand familiarity among veterinary practices and shelters. Virbac and Elanco have been competing by leveraging their veterinary expertise, offering microchip systems as part of broader animal health portfolios. Trovan has been gaining attention with technology-driven offerings in RFID microchips, emphasizing accuracy and reliability. Collectively, these firms have been shaping the landscape by balancing hardware quality with registry infrastructure and end-user confidence. Strategies pursued by these companies have varied, with competition centered on product reliability, registration services, and cross-border compatibility. Datamars and Allflex have been dominant in scaling livestock solutions, where regulatory traceability has created strong demand. HomeAgain has been leading in the pet microchip segment, where reunification services have given it an edge.

Avid has been benefiting from its early presence and trusted name recognition in the veterinary community. Virbac and Elanco have been integrating microchips into their wider animal health frameworks, presenting them as complementary solutions. Trovan has been maintaining a reputation for innovation in RFID microchips, appealing to both companion animal and livestock users. Competitive positioning has therefore been shaped by a firm’s ability to combine durable microchip technology with registry services that instill trust among veterinarians, shelters, and pet owners. Brands that successfully provide both reliable identification tools and seamless reunification services have been regarded as long-term leaders in this evolving segment.

| Item | Value |

|---|---|

| Quantitative Units | USD 745.7 million |

| Component | Microchips and implanters, RFID chip and implanter (device), and Chip reader |

| Animal Type | Companion animals and Livestock animals |

| Type (Frequency) | 134.2 kHz, 125 kHz, and 128 kHz |

| End Use | Veterinary hospitals and clinics, Animal shelters, Pet owners, and Other end use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Datamars, Allflex, HomeAgain (Merck), Identification, Virbac, Elanco, Trovan |

| Additional Attributes | Dollar sales by product type (implantable microchips vs external identification tags), Dollar sales by species application (canine, feline, equine, others), Trends in pet identification and animal traceability, Use in companion animal recovery and livestock management, Growth in universal scanning compliance, Regional adoption patterns across North America, Europe, and Asia-Pacific. |

The global veterinary microchips market is estimated to be valued at USD 745.7 million in 2025.

The market size for the veterinary microchips market is projected to reach USD 1,508.6 million by 2035.

The veterinary microchips market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in veterinary microchips market are microchips and implanters, _rfid chip and implanter (device) and chip reader.

In terms of animal type, companion animals segment to command 65.9% share in the veterinary microchips market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA