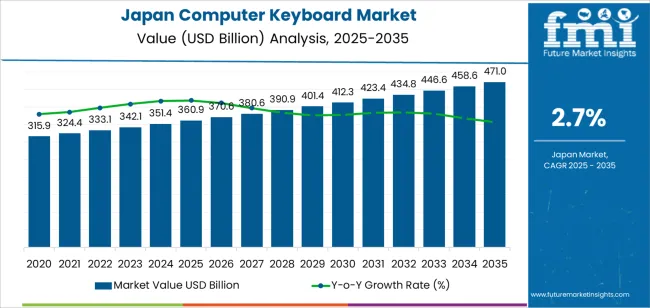

The demand for computer keyboards in Japan is projected to grow from USD 360.9 billion in 2025 to USD 471 billion by 2035, reflecting a CAGR of 2.7%. The continued demand for personal computers, laptops, and gaming peripherals is driving growth in the computer keyboard industry in Japan. Despite the increasing popularity of mobile devices, keyboards remain essential for productivity, gaming, and advanced computing systems. Moreover, the rise of remote work, e-learning, and the expanding gaming industry continues to drive demand for high-quality, ergonomic, and innovative keyboard solutions.

The industry for computer keyboards will benefit from innovations in mechanical keyboards, smart keyboards, and customizable designs for specialized applications. Additionally, advancements in wireless technology, Bluetooth connectivity, and multi-device compatibility are expected to drive growth. As Japan’s tech-savvy population continues to demand advanced and comfortable computing accessories, the market for computer keyboards will remain steady throughout the forecast period, with demand from both consumers and businesses continuing to shape the market landscape.

The compound absolute growth analysis for the computer keyboard market in Japan shows that over the forecast period from 2025 to 2035, the market will experience a steady increase in demand, from USD 360.9 billion in 2025 to USD 471 billion by 2035, contributing an absolute growth of USD 110.1 billion.

From 2025 to 2030, the market will grow from USD 360.9 billion to USD 412.3 billion, contributing USD 51.4 billion in growth. This early growth reflects the ongoing demand for traditional computing devices and the increased adoption of wireless and ergonomic keyboards as consumers and businesses focus on comfort and productivity. The expansion of the gaming industry in Japan, along with the shift to remote work and e-learning, will further push demand.

From 2030 to 2035, the market will grow from USD 412.3 billion to USD 471 billion, adding USD 58.7 billion in value. This phase of growth will be driven by continued innovation in keyboard technology, including AI integration, smart features, and improved ergonomics. As multi-device compatibility and gaming accessories continue to rise in popularity, the market will experience stronger growth in this period. The overall trend shows steady expansion, driven by consistent demand for high-performance and customized keyboard solutions across various sectors in Japan.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 360.9 billion |

| Forecast Value (2035) | USD 471 billion |

| Forecast CAGR (2025-2035) | 2.7% |

Demand for computer keyboards in Japan is growing as remote work and hybrid office models become more common, and consumers seek improved input devices for productivity, gaming, and digital creation. The market is expected to grow at a compound annual growth rate (CAGR) of around 2.7% from 2025 to 2035. Key drivers include the increasing popularity of gaming and esports, growing preference for wireless and mechanical keyboards, and upgrade cycles prompted by new PC purchases and peripherals in both enterprise and consumer segments.

Another factor supporting demand is the trend for ergonomic designs, customizable layouts, and high-precision keyboards tailored for professional and enthusiast users. Japanese consumers place strong value on build quality, long lifecycle, and compact layouts suitable for limited desk space. The shift toward e-commerce and online retail channels also expands options and exposure for niche and premium models. On the other hand, some challenges exist, such as domestic production cost pressures, manufacturer dependence on imports, and slower adaptation for lower-cost membrane keyboards. Nonetheless, demand for computer keyboards in Japan is expected to remain steady and gradually increase as both home and professional computing continue to evolve.

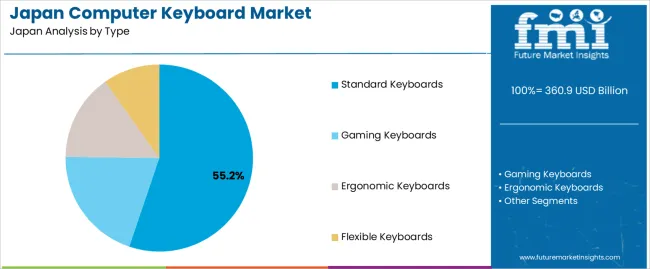

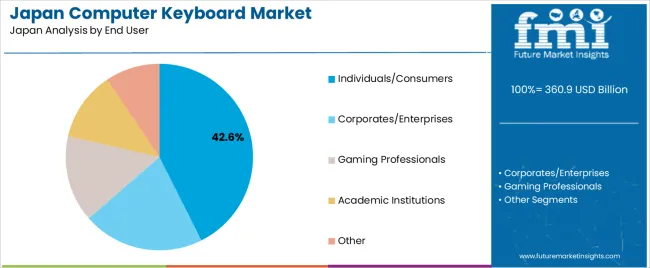

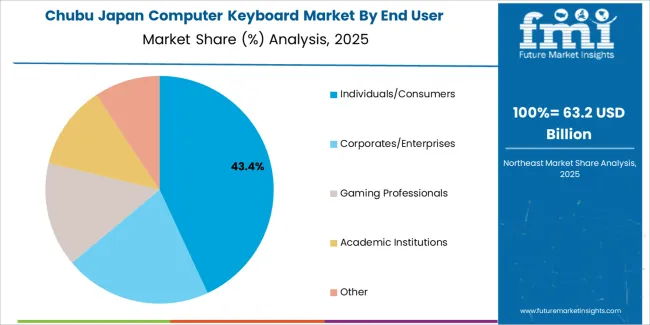

The demand for computer keyboards in Japan is influenced by two primary factors: type and end user. Standard keyboards lead the market, capturing 55% of the demand, while individuals/consumers represent the largest end-user segment, accounting for 42.6%. The rise of gaming and the increasing demand for ergonomic solutions in office and home settings have also contributed to the expanding market. As work-from-home trends continue and the gaming industry grows, demand for specialized keyboard types like gaming and ergonomic models also rises, shaping the market’s growth trajectory in Japan.

Standard keyboards are the leading type in the Japanese market, holding 55% of the demand. Standard keyboards, which typically feature a traditional layout without advanced features like mechanical switches or specialized designs, remain the most commonly used keyboards in both personal and office environments. They are the preferred option for general computing tasks such as typing, browsing, and office work due to their simplicity, affordability, and wide compatibility with various devices.

The sustained dominance of standard keyboards is also due to their reliability, cost-effectiveness, and the increasing trend of remote work and hybrid work models, which rely heavily on traditional input devices for everyday computing tasks. While specialized keyboards like gaming and ergonomic models are growing, standard keyboards remain the go-to option for general-purpose use in homes and offices. Their ability to meet the needs of a broad range of users from casual typists to professionals ensures that they continue to capture the majority of the market share in Japan.

The individuals/consumers segment holds the largest share in the computer keyboard market in Japan, accounting for 42.6% of the demand. This end-user category includes home users, casual gamers, and professionals working remotely. With the growing emphasis on personal computing and digital communication, consumers increasingly rely on high-quality, comfortable, and reliable keyboards for their daily tasks. This segment's demand is driven by the need for keyboards for basic computing, online communication, entertainment, and gaming.

The increase in remote working, e-learning, and digital entertainment has further fueled the demand for computer keyboards in homes across Japan. As individuals seek more comfortable, durable, and aesthetically pleasing options for their home setups, the demand for specialized keyboards like ergonomic and gaming models has also risen. Additionally, the growing trend of customizable and high-performance keyboards in the consumer segment has contributed to the diversification of the market. As personal computing continues to play a pivotal role in everyday life, the individuals/consumers segment will remain a significant driver of the computer keyboard market in Japan.

The computer keyboard market in Japan is shaped by a combination of workplace digitisation, the growth of gaming and e-sports, and an ongoing demand for high-precision, compact accessories tailored to Japanese layouts. At the same time, structural factors such as an ageing workforce, smaller living and working spaces, and strong preference for quality over low cost influence purchase behaviour and design emphasis.

Several drivers support growth in Japan. First, the shift toward hybrid working and increased home-office setups generates demand for keyboards that are ergonomic, wireless and compatible with multiple devices. Second, the popularity of gaming, streaming and e-sports among Japanese consumers boosts interest in mechanical keyboards, high-precision key switches and custom layouts. Third, the premiumisation of computer accessories in Japan means consumers and corporate buyers are willing to invest in high-quality, durable keyboards rather than entry-level budget models. Finally, localisation needs (Japanese JIS layouts) and speciality formats (compact/portable keyboards for small desks or mobile use) further drive tailored product demand.

Despite favourable trends, there are constraints. Japan’s total PC accessory market is relatively mature, which limits rapid expansion in base demand. Price sensitivity remains in some segments, particularly among general consumers who may settle for bundled or built-in keyboards rather than standalone upgrades. Moreover, strong preference for established brands and layouts creates switching inertia, which can slow introduction of new form-factors or unconventional designs. Supply-chain disruptions or component cost fluctuations, especially for mechanical switches or wireless modules, also pose risks.

Key trends in Japan include rising demand for mechanical keyboards with customisable switches, RGB lighting and high-end build quality. The wireless and multi-device connectivity segment is growing as consumers use laptops, tablets and smartphones interchangeably. Compact "60%" and "75%" layout keyboards are gaining traction in Japan due to space constraints and minimalist workstations. There is also increased interest in ergonomic layouts and quieter switch mechanisms suited to shared living spaces. Finally, a growing DIY and enthusiast keyboard culture in Japan supports niche demand for custom keycaps, switch kits and small-batch premium models helping drive higher-unit-value sales in the keyboard market.

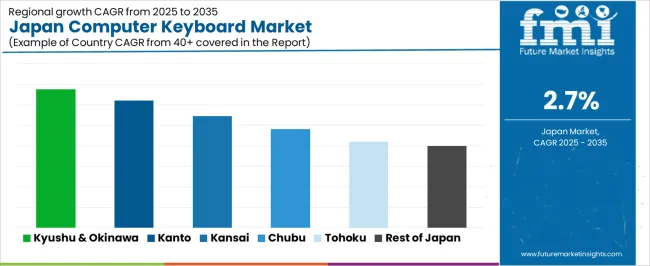

The demand for computer keyboards in Japan is growing as both personal and professional use of computers continues to rise. Keyboards are essential for productivity in business, education, gaming, and entertainment, driving consistent demand across different regions. Japan's advanced technology sector, strong gaming community, and increasing use of digital tools across industries are contributing to the growth in keyboard demand. The demand varies by region based on population density, industrial presence, and technological adoption. The Kyushu & Okinawa region leads in demand due to strong e-commerce and manufacturing industries, while other regions like Kanto and Kinki follow with steady growth. This analysis explores the factors shaping the demand for computer keyboards in different regions of Japan.

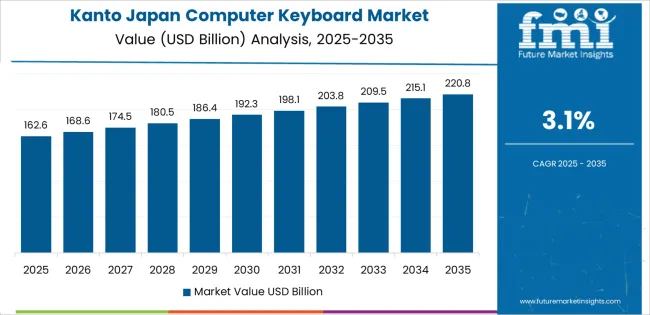

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 3.4% |

| Kanto | 3.1% |

| Kinki | 2.7% |

| Chubu | 2.4% |

| Tohoku | 2.1% |

| Rest of Japan | 2% |

Kyushu & Okinawa leads Japan in the demand for computer keyboards with a CAGR of 3.4%. This region has a strong presence in industries such as manufacturing, agriculture, and education, all of which contribute to a steady demand for keyboards. The region's increasing reliance on digital technologies, particularly in the educational and business sectors, is fueling the growth in demand.

Kyushu & Okinawa also has a growing e-commerce market, which drives the need for computer peripherals like keyboards for both consumer and business use. Additionally, the gaming community in Okinawa is expanding, contributing to increased demand for specialized gaming keyboards. As businesses and consumers continue to adopt digital technologies, Kyushu & Okinawa will maintain a strong demand for computer keyboards.

The Kanto region shows a strong demand for computer keyboards with a CAGR of 3.1%. As Japan’s largest economic and technological hub, Kanto, which includes Tokyo, is a major center for industries like technology, finance, and entertainment. The region’s reliance on digital tools for work and entertainment continues to drive the demand for high-quality computer peripherals.

The growing number of businesses in the region, especially in sectors such as IT, finance, and media, contributes to the demand for keyboards, both for professional and personal use. Additionally, Kanto's large gaming community, combined with its growing e-commerce industry, further increases demand for specialized and ergonomic keyboards. With the rise of smart homes and integrated devices, the demand for computer keyboards in Kanto will continue to grow steadily.

The Kinki region demonstrates steady demand for computer keyboards with a CAGR of 2.7%. Kinki, which includes Osaka and Kyoto, has a strong manufacturing base, with industries ranging from electronics to textiles, all of which require computer peripherals like keyboards. The region's emphasis on digitalization and automation across its industrial sectors continues to drive steady keyboard demand.

Kinki also has a large consumer base for personal computing and entertainment, with a focus on both professional and home-use products. The region's growing interest in e-commerce, coupled with increasing demand for gaming and multimedia devices, further boosts keyboard sales. While growth is steady compared to Kyushu & Okinawa and Kanto, Kinki's well-developed infrastructure ensures continued demand for computer keyboards.

The Chubu region shows moderate growth in the demand for computer keyboards, with a CAGR of 2.4%. Chubu, home to industrial hubs like Nagoya, has a strong focus on manufacturing and automotive industries, where computers and digital tools are widely used. This contributes to a steady demand for keyboards in commercial and professional environments.

As the region continues to modernize and integrate more advanced technologies in sectors like electronics, automotive manufacturing, and logistics, demand for computer keyboards remains stable. Additionally, Chubu’s growing consumer market and interest in digital gaming and entertainment further support the need for quality keyboards. While demand is moderate compared to other regions, Chubu's industrial base ensures a consistent market for computer peripherals.

Tohoku shows a CAGR of 2.1%, while the Rest of Japan follows with 2.0%. These regions experience slower growth in the demand for computer keyboards compared to more urbanized areas like Kyushu & Okinawa and Kanto. However, steady demand persists due to the increasing use of digital tools in education, business, and entertainment.

In Tohoku, the demand for computer keyboards is driven by agricultural businesses, local manufacturers, and educational institutions adopting digital technologies. Similarly, the Rest of Japan experiences slower growth due to its more rural characteristics and smaller urban populations, but the shift toward digitalization across sectors like agriculture and manufacturing continues to drive demand. As e-commerce and digital adoption increase in these regions, keyboard demand will maintain gradual growth.

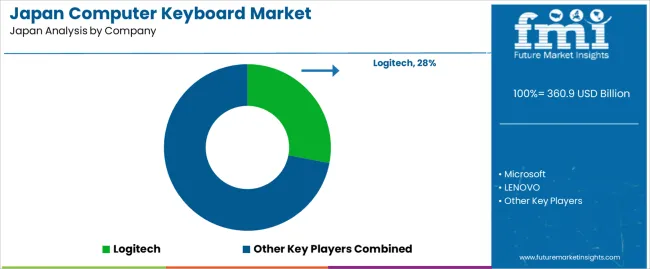

Demand for computer keyboards in Japan remains strong due to the continuous growth in both the personal computing and gaming sectors. Companies such as Logitech (holding around 28% market share), Microsoft, Lenovo, Chicony Global Inc., and Dell Inc. are key players in this market. The increasing adoption of remote work, e-commerce, and gaming in Japan contributes to the sustained demand for high-quality, ergonomic, and customizable computer keyboards. Japanese consumers place a premium on comfort, functionality, and design, which has driven innovation in mechanical switches, wireless connectivity, and compact layouts.

Competition in the Japanese keyboard market is driven by product performance, design innovation, and user experience. A significant focus is on developing keyboards with features such as mechanical key switches, customizable keys, and enhanced durability for both office and gaming applications. The gaming market, in particular, has spurred the development of high-performance keyboards with advanced features such as RGB lighting, programmable keys, and low-latency wireless options.

Additionally, ergonomic keyboards designed to reduce strain during long hours of typing are gaining traction in the corporate and personal computing sectors. Marketing materials typically highlight factors such as typing feel, connectivity options (wired or wireless), customization capabilities, and product durability. By aligning their products with the growing demand for both functionality and comfort, these companies aim to maintain their leadership in the Japanese computer keyboard market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Type | Standard Keyboards, Gaming Keyboards, Ergonomic Keyboards, Flexible Keyboards |

| End-User | Individuals/Consumers, Corporates/Enterprises, Gaming Professionals, Academic Institutions, Other |

| Key Companies Profiled | Logitech, Microsoft, LENOVO, CHICONY GLOBAL INC., Dell Inc. |

| Additional Attributes | The market analysis includes dollar sales by keyboard type and end-user categories. It also covers regional demand trends in Japan, driven by growth in gaming, remote work, and education sectors. The competitive landscape highlights key manufacturers innovating in both gaming and ergonomic keyboards. Trends in the increasing adoption of wireless, mechanical, and customizable keyboards are explored, along with advancements in smart technologies and integration with digital platforms. |

The global demand for computer keyboard in Japan is estimated to be valued at USD 360.9 billion in 2025.

The demand for computer keyboard in Japan is projected to reach USD 471.0 billion by 2035.

The demand for computer keyboard in Japan is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types are standard keyboards, gaming keyboards, ergonomic keyboards and flexible keyboards.

In terms of end user, the individual/consumer segment is expected to command 42.6% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA