The Computer Vision in Healthcare Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 30.8 billion by 2035, registering a compound annual growth rate (CAGR) of 24.6% over the forecast period.

The computer vision in healthcare market is advancing rapidly, propelled by growing integration of artificial intelligence and imaging analytics in clinical workflows. The technology’s ability to automate image interpretation, enhance diagnostic precision, and optimize patient monitoring has positioned it as a transformative tool in medical diagnostics and treatment planning.

Rising demand for early disease detection, coupled with the expansion of digital health infrastructure, has further driven adoption. The current market scenario reflects increasing collaboration between healthcare providers and technology firms to develop robust, compliant computer vision solutions.

Enhanced imaging quality, reduced diagnostic errors, and improved data processing speeds are strengthening confidence in AI-based tools. As healthcare systems continue to digitalize and data-driven medicine gains momentum, computer vision is expected to remain central to efficiency and innovation in clinical operations..

| Metric | Value |

|---|---|

| Computer Vision in Healthcare Market Estimated Value in (2025 E) | USD 3.4 billion |

| Computer Vision in Healthcare Market Forecast Value in (2035 F) | USD 30.8 billion |

| Forecast CAGR (2025 to 2035) | 24.6% |

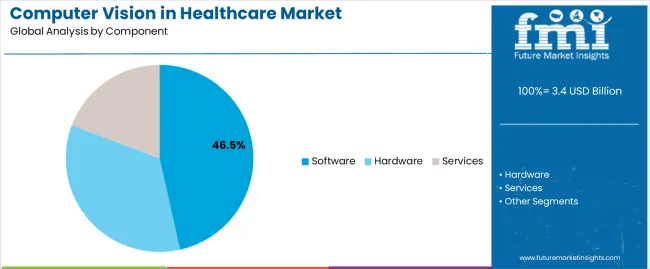

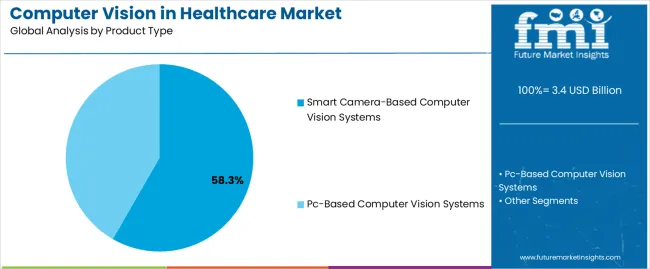

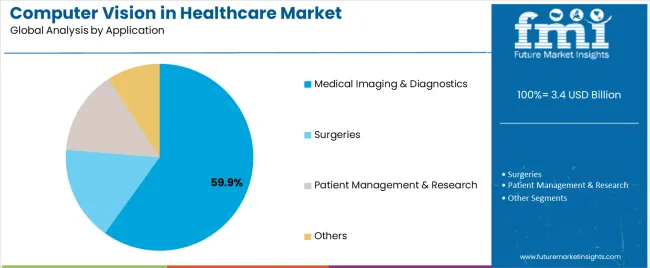

The market is segmented by Component, Product Type, Application, and End User and region. By Component, the market is divided into Software, Hardware, and Services. In terms of Product Type, the market is classified into Smart Camera-Based Computer Vision Systems and Pc-Based Computer Vision Systems. Based on Application, the market is segmented into Medical Imaging & Diagnostics, Surgeries, Patient Management & Research, and Others. By End User, the market is divided into Healthcare Providers, Diagnostic Centers, Academic Research Institutes, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment leads the component category with approximately 46.50% share, driven by the growing deployment of AI-powered diagnostic and image processing platforms. This segment benefits from advancements in deep learning algorithms that enable rapid image classification and anomaly detection across large datasets.

The scalability and adaptability of software solutions have made them integral to clinical decision-support systems and imaging centers. Cloud-based analytics and integration with hospital information systems further enhance usability and interoperability.

The segment’s expansion is supported by ongoing research collaborations aimed at improving algorithm accuracy and regulatory compliance. As healthcare providers increasingly adopt digital diagnostics, the software segment is expected to maintain its leadership through continuous innovation and widespread clinical acceptance..

The smart camera-based computer vision systems segment dominates the product type category with approximately 58.30% share, reflecting its critical role in real-time medical imaging and patient monitoring. These systems enable direct visual data acquisition and processing at the source, reducing latency and enhancing diagnostic accuracy.

Integration with edge computing and embedded AI capabilities allows for faster analysis and reduced data transmission requirements. Hospitals and diagnostic centers are adopting these systems for applications such as surgical navigation, automated monitoring, and pathology imaging.

Compact designs and high-resolution imaging capabilities further drive adoption. With continuous technological advancements and increasing use in both diagnostic and therapeutic contexts, the segment is expected to sustain its leading position in the forecast period..

The medical imaging & diagnostics segment holds approximately 59.90% share in the application category, highlighting its dominant influence on the computer vision in healthcare market. The use of AI-assisted imaging for radiology, oncology, and cardiology diagnostics has transformed data interpretation accuracy and clinical efficiency.

Computer vision enhances lesion detection, segmentation, and classification, reducing human error and improving patient outcomes. The segment’s growth is reinforced by increasing volumes of medical imaging data and the need for faster analysis to support timely clinical decisions.

Integration with picture archiving and communication systems (PACS) and advanced visualization tools further boosts adoption. With ongoing technological innovation and regulatory support for AI-based healthcare solutions, this segment is expected to remain the largest contributor to market expansion..

The diverse use of technology illustrates how well computer vision supports thorough healthcare assessments and improves medical decision-making procedures.

The global computer vision in healthcare sales grew at a CAGR of 38.4% from 2020 to 2025. The growth of computer vision in healthcare from 2020 to 2025 can be attributed to a convergence of factors:

The table below shows the estimated growth rates of the top five countries. South Korea, the United Kingdom, and Japan are set to record high CAGRs of 37.9%, 37.5%, and 37.2%, respectively, through 2035.

| Countries | Projected CAGR (2035) |

|---|---|

| United States | 36.8% |

| United Kingdom | 37.5% |

| China | 36.9% |

| South Korea | 37.9% |

| Japan | 37.2% |

The table below explains the computer vision in the healthcare market size of the leading five countries for 2035. Among them, the United States is anticipated to remain at the forefront by reaching a valuation of USD 30.8 billion. Japan is expected to reach around USD 5.6 billion by 2035, less than China's USD 8.2 billion.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 30.8 billion |

| United Kingdom | USD 2.2 billion |

| China | USD 8.2 billion |

| South Korea | USD 3.7 billion |

| Japan | USD 5.6 billion |

The United States computer vision in the healthcare industry is poised to exhibit a CAGR of 36.8% during the assessment period. In 2035, the United States market is expected to reach USD 30.8 billion. The key factors supporting the market growth are:

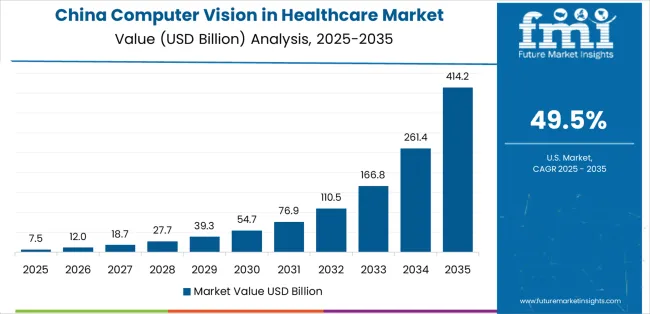

China is anticipated to rise at a steady CAGR of 36.9% during the forecast period. This is attributable to a combination of factors, including:

Japan's computer vision in the healthcare market is expected to reach a valuation of around USD 5.6 billion by 2035. Top factors supporting the market expansion in the country include:

The demand for computer vision in healthcare is increasing in the United Kingdom, with a projected CAGR of 37.5% through 2035. Emerging patterns in the United Kingdom’s market are as follows:

The computer vision in healthcare market is projected to increase in South Korea at a CAGR of 37.9% through 2035. The factors driving the market growth are as follows:

The section below shows the hardware segment dominated by components. It is predicted to surge at a CAGR of 36.5% by 2035. Based on product type, the smart camera-based computer vision systems segment is anticipated to generate a dominant share through 2025. It is set to rise at 36.4% CAGR by 2035.

| Segment | Projected CAGR (2035) |

|---|---|

| Hardware (Component) | 36.5% |

| Smart Camera-based Computer Vision Systems (Product Type) | 36.4% |

Based on components, demand for hardware is expected to remain high during the valuation period.

Based on product type, smart camera-based computer vision systems are expected to surge at 36.4% CAGR by 2035.

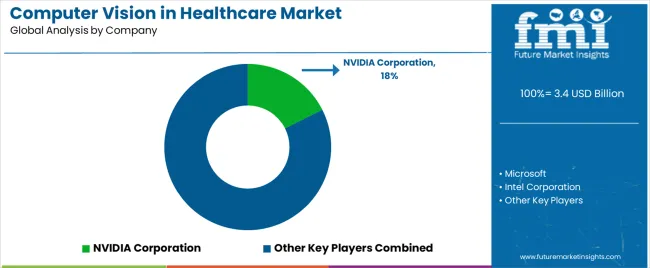

Leading companies have increased their market share primarily through product launches and developments, which are followed by expansions, mergers & acquisitions, contracts, agreements, partnerships, and collaborations. Key companies are employing several strategies to improve market penetration and strengthen their position in the cutthroat sector.

For instance:

The global computer vision in healthcare market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the computer vision in healthcare market is projected to reach USD 30.8 billion by 2035.

The computer vision in healthcare market is expected to grow at a 24.6% CAGR between 2025 and 2035.

The key product types in computer vision in healthcare market are software, hardware and services.

In terms of product type, smart camera-based computer vision systems segment to command 58.3% share in the computer vision in healthcare market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Computer Keyboard Market Size and Share Forecast Outlook 2025 to 2035

Computer Aided Facility Management (CAFM) Market Size and Share Forecast Outlook 2025 to 2035

Computerized Physician Order Entry (CPOE) Market Size and Share Forecast Outlook 2025 to 2035

Computer Graphics Market Size and Share Forecast Outlook 2025 to 2035

Computer Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Computer-aided Design (CAD) Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Computer Microchips Market Size and Share Forecast Outlook 2025 to 2035

Computer Aided Trauma Fixators Market

Computer-To-Plate And Computer-To-Press Systems Market

Computerized Maintenance Management Systems (CMMS) Market Trends – Size, Share & Growth 2025–2035

Computer Keyboard Industry Analysis in East Asia Size and Share Forecast Outlook 2025 to 2035

Computer-aided Engineering Market Analysis - Size, Share, and Forecast 2025 to 2035

Computer Assisted Coding Software Market Analysis by Solution, Deployment, Application, and Region Through 2035

Computer Vision Market Insights – Trends & Forecast 2025 to 2035

Dive Computer Market Forecast and Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Refurbished Computers and Laptops Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA