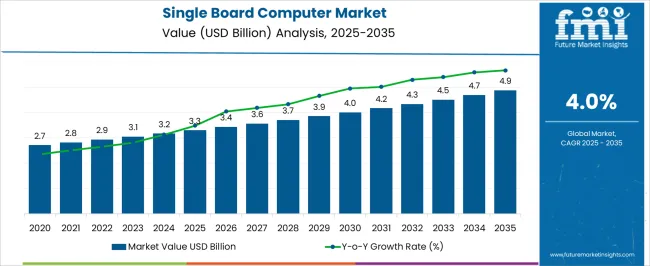

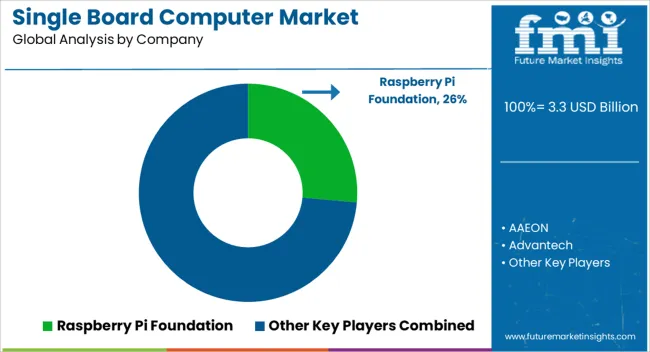

The single board computer (SBC) market is projected to expand steadily, valued at USD 3.3 billion in 2025 and expected to reach USD 4.9 billion by 2035, growing at a CAGR of 4.0% during the forecast period.

Growth in this market is influenced by the increasing adoption of compact and low-cost computing platforms across industries such as education, healthcare, industrial automation, and consumer electronics. SBCs are widely used in IoT devices, robotics, and edge computing applications, where small form factors and energy efficiency are critical. The rise of maker communities, coupled with growing demand for embedded computing in smart devices, is further stimulating market adoption.

Technological advancements in ARM-based processors, AI integration, and enhanced connectivity options such as Wi-Fi 6 and 5G are expanding SBC capabilities, making them suitable for more sophisticated use cases. Education and research institutions are also adopting SBCs for cost-effective computing and experimentation. However, challenges such as performance limitations compared to traditional PCs and competition from alternative modular computing systems may temper growth. The market trajectory mirrors a technology adoption curve, beginning with low-cost educational and entry-level boards, transitioning into more advanced and specialized systems, and ultimately consolidating into high-performance, intelligent computing platforms that serve as core enablers of modern connected ecosystems. Overall, the single board computer market’s expansion is supported by rising edge AI workloads, demand for compact computing solutions, and the versatility required across both industrial and consumer-oriented applications.

| Metric | Value |

|---|---|

| Single Board Computer Market Estimated Value in (2025 E) | USD 3.3 billion |

| Single Board Computer Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The single board computer market is expanding rapidly due to increasing demand for compact and efficient computing solutions across various industries. Industrial automation has been a significant driver, where reliable and customizable computing platforms are essential for controlling complex machinery and processes.

Innovations in processor technology have made single board computers more powerful and energy-efficient, enabling wider adoption. The open-source nature of certain operating systems has facilitated development flexibility and cost reduction.

Growing adoption of IoT and edge computing technologies has also fueled market expansion as these boards serve as crucial components for data acquisition and real-time processing. With industries seeking to optimize operations and reduce downtime, single board computers are becoming vital tools. Segmental growth is expected to be led by ARM processors due to their energy efficiency and performance, industrial automation as the key application area, and Linux as the preferred operating system for its robustness and flexibility.

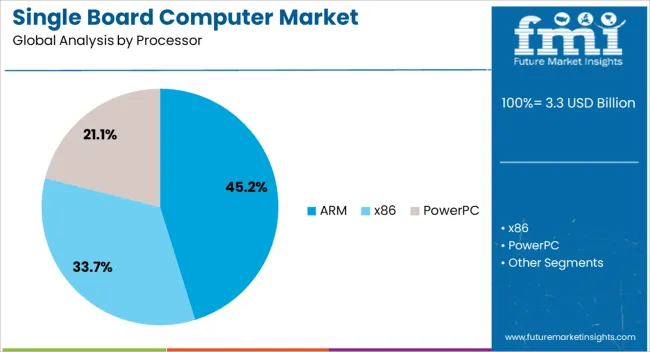

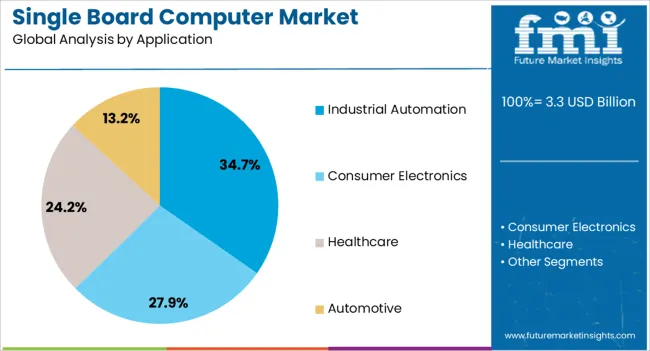

The single board computer market is segmented by processor, application, operating systemconnectivity, and geographic regions. By processor of the single board computer market is divided into ARM, x86, and PowerPC. In terms of application of the single board computer market is classified into Industrial Automation, Consumer Electronics, Healthcare, Automotive, Education and Research, Telecommunications, and Others.

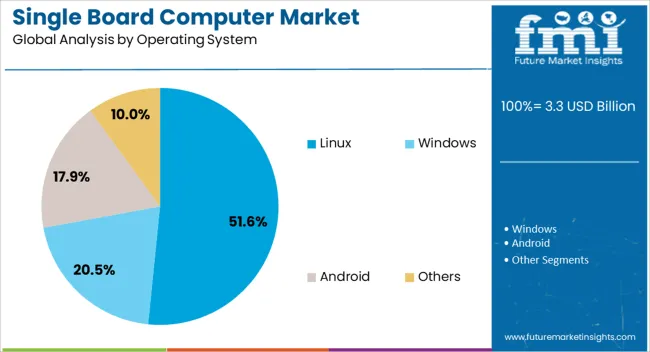

Based on operating system of the single board computer market is segmented into Linux, Windows, Android, and Others. By connectivity of the single board computer market is segmented into Wired and Wireless. Regionally, the single board computer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ARM processor segment is projected to hold 45.2% of the single board computer market revenue in 2025, maintaining its leadership in processor technology. This segment has gained traction because ARM processors offer high energy efficiency combined with strong computational power, making them ideal for embedded applications.

Their scalable architecture supports a wide range of industrial use cases, from simple control tasks to complex automation systems. The increasing emphasis on low power consumption devices and longer operational life has made ARM the preferred choice among manufacturers and end users.

Additionally, ARM's extensive ecosystem and developer support facilitate rapid innovation and deployment, helping maintain its dominant position.

The industrial automation segment is expected to contribute 34.7% of the market revenue in 2025, establishing itself as the primary application area. Growth in this segment is driven by the need for reliable and versatile computing platforms that can operate in harsh industrial environments.

Single board computers are widely used for real-time process control, monitoring, and automation in manufacturing plants and facilities. Increasing adoption of Industry 4.0 principles and smart factory initiatives has accelerated the demand for embedded computing solutions.

The ability of single board computers to integrate with sensors, actuators, and communication networks has made them indispensable in modern automation. This trend is anticipated to continue as industries pursue greater efficiency and digital transformation.

The Linux operating system segment is projected to hold 51.6% of the single board computer market revenue in 2025, leading the OS category. Linux's open-source nature allows for customization and flexibility, making it highly attractive for developers in industrial and embedded applications.

The wide availability of software packages and community support facilitates the rapid development and deployment of tailored solutions. Linux also offers stability and security features essential for mission-critical systems used in automation and IoT.

Its compatibility with ARM processors further strengthens its position in the market. As demand grows for adaptable and secure operating systems, Linux is expected to maintain its dominance in single board computer deployments.

Single board computers are expanding rapidly across industrial, consumer, automotive, and healthcare segments. Their compact design, affordability, and adaptability continue to strengthen their role in diverse computing ecosystems.

The single board computer market has gained significant traction in industrial automation and control systems, as enterprises look for compact yet powerful computing solutions to support manufacturing operations. SBCs are used in robotics, machine vision, and industrial IoT gateways, offering flexibility at a lower cost than traditional servers or PCs. Their small footprint and energy efficiency make them ideal for environments with limited space. Companies are deploying SBCs to integrate sensors, collect real-time data, and streamline factory processes. This integration strengthens productivity, enhances predictive maintenance, and reduces downtime. Their adaptability across various industrial protocols ensures SBCs are becoming an essential component for long-term automation strategies.

Consumer electronics have emerged as a strong avenue for SBC growth, as they power educational kits, gaming systems, media players, and DIY computing projects. Their affordability and accessibility attract students, hobbyists, and developers, creating a robust base of end users worldwide. Compact boards like Raspberry Pi and Arduino have broadened awareness, making SBCs synonymous with accessible computing power. This ecosystem promotes innovation and fosters a generation of skilLED developers who extend SBC usage into practical solutions. As consumer demand shifts toward low-cost, multipurpose devices, SBCs are being integrated into smart displays, portable devices, and entertainment systems. This consumer-driven momentum significantly enhances their global market presence.

The automotive industry has become an important driver of SBC adoption, where compact computing boards are widely used in infotainment, telematics, and advanced driver assistance systems. Automakers prefer SBCs for their balance of cost efficiency, reliability, and processing performance in vehicle electronic control units. These systems support seamless navigation, multimedia features, and connectivity for modern vehicles. With rising demand for connected cars, SBCs are playing a larger role in delivering real-time data processing and connectivity between sensors, onboard devices, and external infrastructure. Their adaptability to custom automotive requirements ensures SBC integration in both high-end and mass-market vehicles, driving sustained adoption in the sector.

Healthcare technology has increasingly relied on single board computers to power diagnostic devices, imaging systems, and portable patient monitoring equipment. Their lightweight design, modularity, and cost effectiveness allow healthcare providers to expand diagnostic capabilities in resource-limited settings. Edge computing applications also represent a fast-growing area, as SBCs provide localized data processing for telecom base stations, smart surveillance, and IoT endpoints. The combination of healthcare and edge use cases highlights their versatility across mission-critical tasks. With advancements in chip design, improved connectivity options, and better thermal performance, SBCs are strengthening their position in areas where compact computing power is vital for operational efficiency.

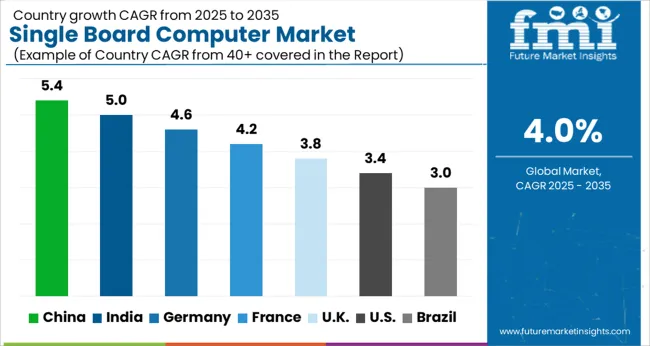

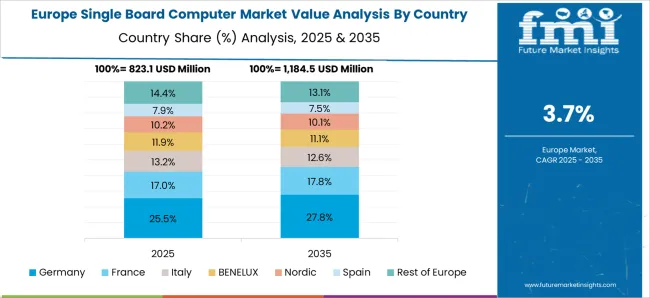

The single board computer market is projected to grow globally at a CAGR of 4.0% from 2025 to 2035, supported by widespread adoption across industrial automation, consumer electronics, and automotive electronics. China leads with a CAGR of 5.4%, driven by large-scale manufacturing, domestic demand for edge computing, and integration into industrial IoT applications. India follows at 5.0%, benefiting from rising investments in electronics manufacturing, educational adoption of SBC kits, and expanding digital infrastructure.

France records 4.2% CAGR, supported by growing integration of SBCs into healthcare devices and smart applications. The UK achieves 3.8%, driven by demand for connected automotive solutions and academic projects, while the USA maintains a 3.4% growth rate, reflecting a mature but steady market where demand is centered on embedded applications, edge computing, and selective industrial upgrades.

The CAGR for the single board computer market in China was 4.7% during 2020-2024 and progressed to 5.4% for 2025-2035, surpassing the 4.0% global baseline. Earlier momentum was shaped by educational adoption, strong developer communities, and low-cost domestic production. The later acceleration is explained by integration into industrial IoT systems, automation platforms, and edge computing hardware. Chinese manufacturers have scaled supply chains to meet both domestic and export demand, while government-backed initiatives in semiconductors and electronics production created favorable conditions. SBCs have also penetrated robotics, AI-based devices, and smart infrastructure, raising the scope for mass adoption across sectors.

The CAGR for the single board computer market in India was 4.3% during 2020-2024 and then advanced to 5.0% for 2025-2035. The earlier rate was supported by rising educational kits, DIY computing projects, and entry-level automation. The later lift is explained by national policies promoting electronics manufacturing, increased local assembly of computing components, and strong digital infrastructure growth. Indian start-ups and academic institutions are leveraging SBCs for affordable computing platforms, while industries employ them for control systems and lightweight monitoring. Cost competitiveness and favorable regulations have made SBCs more accessible, allowing both commercial and consumer applications to expand.

The CAGR for the single board computer market in France was 3.7% during 2020-2024 and improved to 4.2% for 2025-2035. The earlier phase was guided by moderate adoption in consumer electronics and academic research projects. The later acceleration is explained by increased reliance on SBCs in healthcare diagnostic devices, portable monitoring equipment, and smart home applications. Regulatory support for digitization and preference for energy-efficient electronics have supported steady deployment. Small-scale industrial integration has also begun to expand, with compact computing systems applied in automation and robotics. This measured but clear progression highlights how France is transitioning SBCs into more mission-critical roles.

The CAGR for the single board computer market in the UK was 3.2% during 2020-2024 and rose to 3.8% in 2025-2035, just under the 4.0% global baseline. The earlier years were marked by limited but consistent demand in academic computing projects and niche DIY electronics. The later improvement is explained by stronger integration into automotive electronics, household automation, and embedded monitoring systems. Universities and research hubs continue to support adoption, while hybrid projects combining SBCs with edge-based data processing are widening demand. This gradual increase reflects how affordability, compact size, and adaptability position SBCs as viable tools in both consumer and industrial contexts.

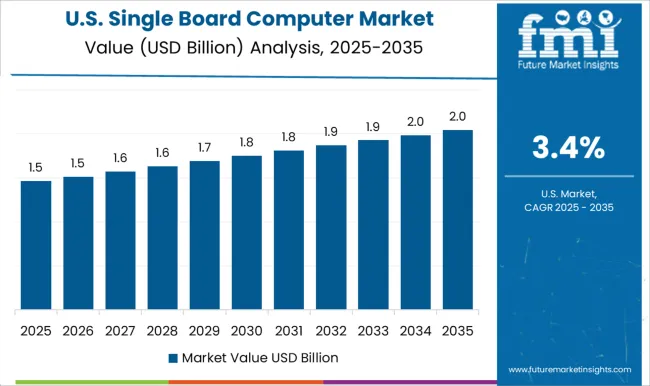

The CAGR for the single board computer market in the USA was 2.9% during 2020-2024 and moved upward to 3.4% in 2025-2035. The earlier trend was influenced by a mature market where SBC adoption focused mainly on DIY developers and consumer applications. The improvement is explained by selective adoption in industrial automation, healthcare devices, and edge processing systems. USA enterprises are gradually incorporating SBCs into specialized embedded systems and pilot AI-driven projects. Replacement cycles for educational kits and long-standing community support ensure steady demand. While growth remains below emerging regions, the USA continues to sustain adoption through its advanced R&D ecosystem and specialized applications.

The single board computer market is defined by a mix of global leaders and specialized foundations that influence affordability, accessibility, and performance across applications. Raspberry Pi Foundation remains the most recognized player, driving mass adoption with affordable computing boards for education, hobbyists, and industrial prototyping. AAEON, backed by ASUS, emphasizes industrial-grade SBCs, delivering ruggedized solutions for automation, AI at the edge, and embedded systems. Advantech commands strong presence with its focus on high-performance boards tailored for healthcare, transportation, and industrial IoT environments.

Arduino has carved its niche in maker communities and academic institutions, offering simplified hardware platforms for prototyping and lightweight computing applications. ASUS leverages its hardware expertise to provide versatile SBCs suited for multimedia, personal computing, and robotics. BeagleBoard.org Foundation is recognized for open-source hardware platforms, enabling innovation and experimentation among developers and engineers.

Intel Corporation drives premium performance segments with x86-based SBCs, supporting advanced edge computing, AI workloads, and mission-critical applications. Differentiation in this competitive environment is shaped by performance scalability, ecosystem support, pricing strategies, and integration with cloud and edge applications. The competitive field highlights a balance between low-cost, community-driven solutions and enterprise-grade, high-performance boards designed for critical industries worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Processor | ARM, x86, and PowerPC |

| Application | Industrial Automation, Consumer Electronics, Healthcare, Automotive, Education and Research, Telecommunications, and Others |

| Operating System | Linux, Windows, Android, and Others |

| Connectivity | Wired and Wireless |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Raspberry Pi Foundation, AAEON, Advantech, Arduino, ASUS, BeagleBoard.org Foundation, and Intel Corporation |

| Additional Attributes | Dollar sales, share, demand by application, competitive positioning, regional growth hotspots, pricing trends, component supply risks, and adoption across industrial, automotive, and consumer segments. |

The global single board computer market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the single board computer market is projected to reach USD 4.9 billion by 2035.

The single board computer market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in single board computer market are arm, x86 and powerpc.

In terms of application, industrial automation segment to command 34.7% share in the single board computer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Machine Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Single Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA