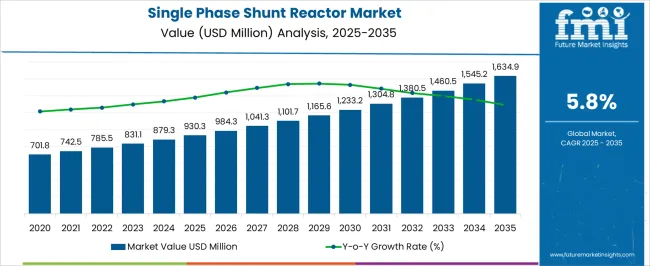

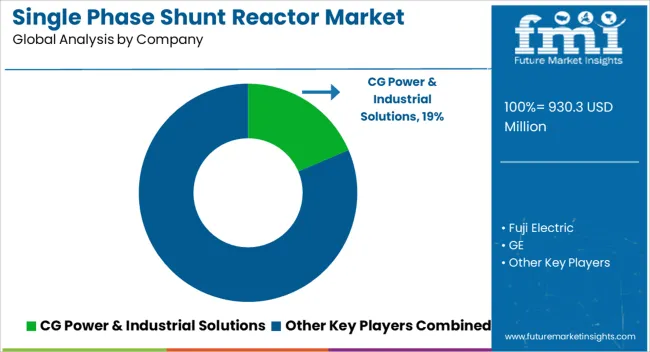

The single phase shunt reactor market is projected to reach 930.3 million dollars in 2025 and 1,634.9 million dollars in 2035, growing at a CAGR of 5.8% between 2025 and 2035. During the early adoption phase from 2020 to 2024, demand was primarily driven by pilot installations in transmission and distribution networks, as utilities tested reactor performance for voltage stabilization and reactive power compensation.

Manufacturers increase production capacity, optimize supply chains, and secure long-term contracts, while repeat installations drive steady revenue growth. From 2030 to 2035, the market enters the consolidation phase, characterized by leading manufacturers reinforcing market share through strategic partnerships, regional expansions, and multi-year supply agreements. Smaller vendors either focus on niche applications or exit. Most transmission and distribution networks have integrated reactors by this stage, leading to stabilized adoption.

Companies emphasize operational efficiency, cost-effectiveness, and after-sales support. By 2035, the market exhibits predictable growth, mature competition, and standardized installation and maintenance practices, creating a structured and well-established global market environment.

| Metric | Value |

|---|---|

| Single Phase Shunt Reactor Market Estimated Value in (2025 E) | USD 930.3 million |

| Single Phase Shunt Reactor Market Forecast Value in (2035 F) | USD 1634.9 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The single phase shunt reactor market is driven by demand across various end-use sectors within the power transmission and distribution ecosystem. Electric Utilities – Transmission Networks dominate with approximately 35% of the market, requiring reactors for voltage stabilization, reactive power management, and grid reliability. Distribution Companies contribute 20%, integrating reactors in substation networks to maintain consistent voltage and improve operational efficiency.

Industrial Power Consumers hold around 15%, including large manufacturing plants and process industries that use reactors to stabilize high-voltage systems. Renewable Energy Plants account for 10%, where reactors are deployed to manage voltage fluctuations in solar and wind farms. Railway Electrification Systems contribute 8%, ensuring stable supply for overhead catenary networks. Oil & Gas and Petrochemical Facilities represent 5%, using reactors for high-voltage process equipment and distribution. Electrical Equipment Manufacturers hold 4%, incorporating reactors into turnkey solutions for clients. Smaller segments, including Research and Development Centers and Defense Infrastructure, make up 3%, focusing on experimental or specialized applications.

Revenue growth mirrors sector adoption, increasing from 701.8 million dollars in 2020 to 930.3 million in 2025 and projected to reach 1,634.9 million by 2035 at a CAGR of 5.8%. Transmission and distribution networks remain primary drivers, while industrial and renewable sectors show steady incremental growth, supporting the market’s long-term expansion.

The single phase shunt reactor market is experiencing steady growth driven by the need for reactive power compensation, voltage stabilization, and efficient transmission in modern power grids. Increasing integration of renewable energy sources and expansion of long distance transmission networks are creating higher demand for shunt reactors to ensure system reliability and reduce losses.

Advancements in reactor design and insulation technologies are improving operational efficiency and lifespan, making them a preferred choice for utilities seeking cost effective grid stabilization solutions. Regulatory requirements for power quality and energy efficiency are further supporting adoption across developed and developing regions.

The outlook remains positive as utilities and industrial users prioritize infrastructure upgrades and grid modernization to meet evolving energy demands.

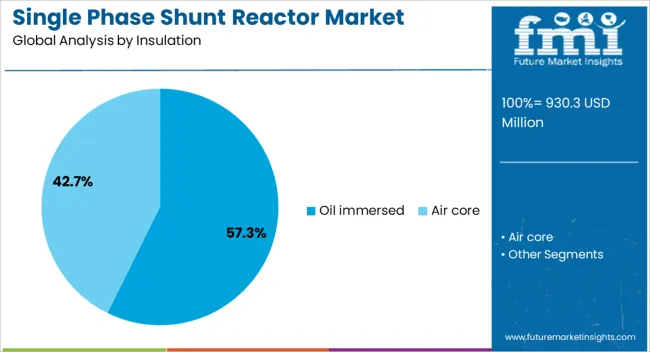

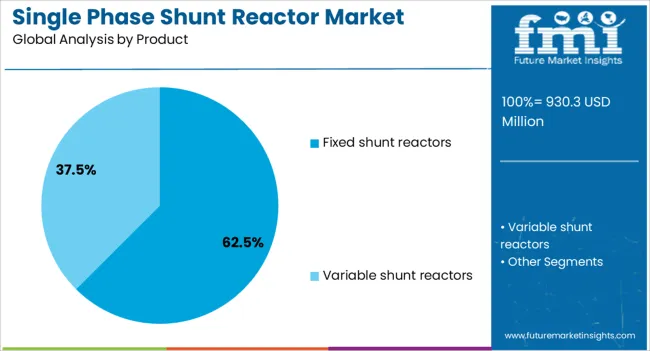

The single phase shunt reactor market is segmented by insulation, product, end use, and geographic regions. By insulation, single phase shunt reactor market is divided into Oil immersed and Air core. In terms of product, single phase shunt reactor market is classified into Fixed shunt reactors and Variable shunt reactors.

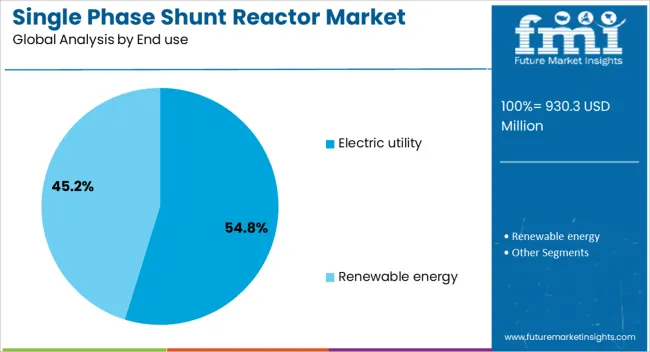

Based on end use, single phase shunt reactor market is segmented into Electric utility and Renewable energy. Regionally, the single phase shunt reactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil immersed insulation segment is expected to hold 57.30% of total market revenue by 2025 within the insulation category, making it the most dominant type. Its leadership is attributed to high dielectric strength, superior cooling capabilities, and reliable long term performance under high voltage conditions.

Oil immersed designs are valued for their cost efficiency, low maintenance requirements, and proven track record in diverse environmental conditions.

Utilities favor this insulation type for its robustness and ability to handle voltage fluctuations effectively, which has reinforced its market position.

The fixed shunt reactors segment is projected to account for 62.50% of market revenue by 2025 in the product category, establishing it as the leading segment. This dominance is supported by the segment’s ability to provide consistent reactive power compensation, improve voltage stability, and reduce transmission line losses.

Fixed designs are preferred in applications where stable and continuous operation is required, particularly in large scale grid networks.

Their operational simplicity, durability, and cost effectiveness have made them the primary choice for many utilities and industrial facilities.

The electric utility segment is expected to capture 54.80% of total market revenue by 2025 within the end use category, making it the leading consumer group. This is driven by the increasing demand for grid stability, expansion of high voltage transmission lines, and the integration of renewable energy sources into national grids.

Utilities are investing heavily in shunt reactors to manage reactive power, prevent overvoltage, and optimize energy efficiency.

The sector’s focus on modernizing infrastructure and complying with stringent power quality regulations continues to strengthen the dominance of the electric utility segment in the market.

The single phase shunt reactor market is growing due to rising demand for voltage stabilization, reactive power compensation, and efficient medium-voltage distribution systems. North America and Europe lead with high-performance, low-loss reactors integrated into smart grids and industrial substations.

Asia-Pacific shows rapid growth driven by grid expansion, renewable integration, and industrial electrification. Manufacturers differentiate through compact design, low maintenance, high thermal stability, and advanced insulation technology. Regional variations in grid infrastructure, regulatory standards, and operational environments strongly influence adoption, deployment, and competitiveness globally.

Adoption of single phase shunt reactors is primarily driven by the need to stabilize voltage and manage reactive power in medium-voltage distribution networks. North America and Europe prioritize low-loss reactors capable of handling fluctuating load conditions in industrial, utility, and renewable-integrated grids. Asia-Pacific markets adopt cost-efficient reactors to address rapid grid expansion and increasing load variability. Differences in voltage stabilization requirements, load profiles, and reactive power compensation needs affect reactor design, size, and integration complexity. Leading suppliers provide compact, high-efficiency reactors with advanced insulation and minimal maintenance requirements, while regional players focus on practical, budget-friendly solutions. Grid stabilization contrasts shape adoption, operational reliability, and competitiveness in global markets.

Reactor compactness and thermal performance significantly influence market adoption. North America and Europe favor reactors with optimized core design, high thermal stability, and low heat loss for space-constrained substations and industrial installations. Asia-Pacific markets emphasize compact and cost-effective reactors suitable for urban substations and expanding grids. Differences in design efficiency, thermal management, and insulation technology affect operational lifespan, cooling requirements, and installation feasibility. Leading suppliers provide high-performance reactors with enhanced core materials, low-loss coils, and reliable insulation, while regional players focus on robust, practical designs. Design and thermal performance contrasts shape adoption, maintenance efficiency, and competitive positioning globally.

Reliability, durability, and ease of maintenance are critical for single phase shunt reactor adoption. North America and Europe deploy reactors with high mechanical strength, fault tolerance, and low maintenance schedules to ensure uninterrupted operation in industrial and utility networks. Asia-Pacific markets focus on rugged, reliable reactors that can operate under varying environmental conditions while keeping service costs low. Differences in reliability expectations, maintenance practices, and lifecycle performance affect adoption, operational continuity, and total cost of ownership. Leading suppliers offer reactors with predictive maintenance features, high-quality insulation, and durable components, while regional manufacturers provide practical, cost-efficient alternatives. Reliability contrasts drive adoption, operational security, and competitiveness.

Compliance with grid standards, voltage classifications, and safety certifications strongly influences market adoption. North America and Europe follow IEEE, IEC, and local utility standards to ensure reactor performance, safety, and compatibility with smart grids and industrial networks. Asia-Pacific regulations vary, with advanced regions adopting international norms while emerging economies apply domestic guidelines emphasizing cost-effectiveness. Differences in regulatory rigor, grid compatibility requirements, and certification timelines affect procurement decisions, installation speed, and operational confidence. Leading suppliers offer certified, standard-compliant reactors suitable for various applications, while regional players provide locally approved, cost-effective solutions. Regulatory and compatibility contrasts shape adoption, credibility, and competitive positioning globally.

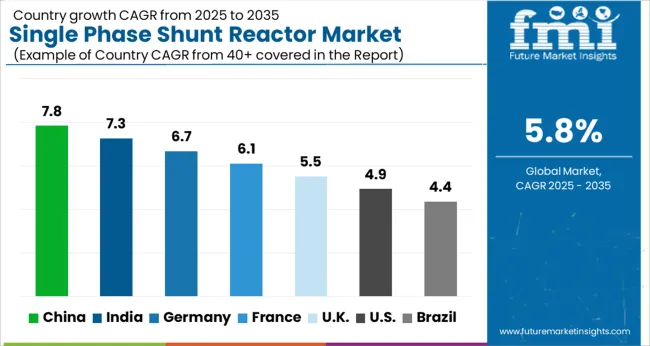

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global single phase shunt reactor market is projected to grow at a 5.8% CAGR through 2035, driven by demand in power distribution, industrial networks, and utility applications. Among BRICS nations, China led with 7.8% growth as large-scale production and deployment facilities were commissioned and compliance with electrical standards was ensured, while India at 7.3% growth expanded manufacturing and installation capacities to meet rising regional requirements. In the OECD region, Germany at 6.7% maintained steady output under stringent regulatory frameworks, while the United Kingdom at 5.5% operated moderate-scale production units supporting commercial and industrial networks. The USA, growing at 4.9%, supported consistent adoption across power distribution and industrial applications, adhering to federal and state-level safety and quality regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The single phase shunt reactor market in China is projected to grow at a CAGR of 7.8% due to rising investments in power transmission and distribution infrastructure. Adoption is being driven by reactors that provide voltage stabilization, reactive power compensation, and improved grid efficiency. Manufacturers are being encouraged to supply high quality, durable, and technologically advanced reactors. Distribution through utilities, power generation companies, and authorized suppliers is being strengthened. Research in enhanced efficiency, thermal management, and compact design is being conducted. Expansion of electricity networks, increasing industrial consumption, and modernization of transmission systems are considered key factors supporting the single phase shunt reactor market in China.

The single phase shunt reactor market in India is expected to grow at a CAGR of 7.3%, driven by expansion of transmission lines and demand for grid stability. Adoption is being strengthened by reactors that improve voltage control, reduce reactive power losses, and support efficient power flow. Manufacturers are being encouraged to deliver cost effective, reliable, and high performance solutions. Distribution through utilities, energy companies, and authorized dealers is being expanded. Training programs and technical workshops are being conducted to ensure proper installation and operation. Growth in electricity demand, grid modernization projects, and industrial expansion are recognized as primary drivers of the single phase shunt reactor market in India.

Germany is experiencing growth in the single phase shunt reactor market at a CAGR of 6.7%, supported by adoption in transmission and distribution networks requiring voltage regulation and reactive power management. Adoption is being strengthened by reactors that enhance grid reliability, efficiency, and operational stability. Manufacturers are being encouraged to supply technologically advanced, durable, and high quality reactors. Distribution through utilities, energy suppliers, and authorized contractors is being maintained. Research in compact design, improved cooling, and efficiency optimization is being conducted. Expansion of renewable integration, increasing electricity demand, and emphasis on grid reliability are considered key contributors to the single phase shunt reactor market in Germany.

The single phase shunt reactor market in the United Kingdom is expected to grow at a CAGR of 5.5% due to increasing investments in power transmission infrastructure and voltage regulation solutions. Adoption is being emphasized for reactors that stabilize voltage, compensate reactive power, and improve grid efficiency. Manufacturers are being encouraged to provide safe, reliable, and high quality equipment. Distribution through utilities, energy service providers, and authorized dealers is being strengthened. Awareness programs and technical training sessions are being conducted to ensure proper operation and maintenance. Expansion of transmission networks, industrial electricity demand, and integration of renewable sources are recognized as key factors supporting the single phase shunt reactor market in the United Kingdom.

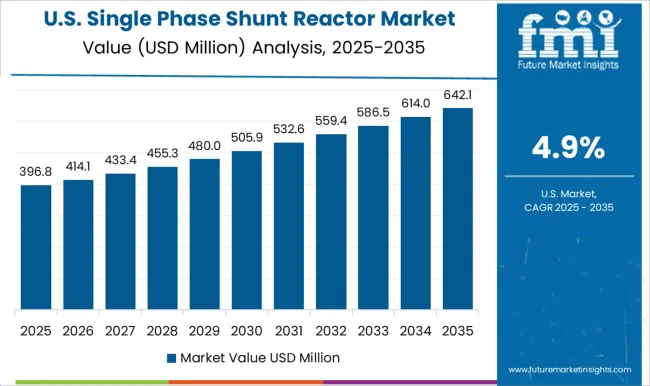

The single phase shunt reactor market in the United States is projected to grow at a CAGR of 4.9%, driven by increasing need for voltage regulation and reactive power compensation in transmission networks. Adoption is being supported by reactors that enhance grid stability, efficiency, and operational reliability. Manufacturers are being encouraged to supply durable, high quality, and technologically advanced reactors. Distribution through utilities, power companies, and authorized service providers is being maintained. Research in efficiency optimization, thermal management, and compact design is being conducted. Expansion of electricity grids, integration of renewable energy, and rising industrial consumption are considered key drivers of the single phase shunt reactor market in the United States.

Leading players such as ABB, Siemens, Schneider Electric, and Toshiba maintain strong positions by offering diversified portfolios of single phase shunt reactors designed for voltage stabilization, reactive power compensation, and grid reliability in transmission and distribution networks. Competitive differentiation is driven by reactor efficiency, thermal performance, compact design, and compliance with international grid standards.

Regional manufacturers, particularly in Asia-Pacific and Europe, compete by providing cost-effective solutions and localized support for utilities, industrial facilities, and renewable energy integration projects. Strategic partnerships with power utilities, EPC contractors, and grid operators help expand market reach and facilitate turnkey project implementation. Innovation in low-loss core materials, modular designs, and high-voltage insulation technology further strengthens market positioning. Companies prioritizing product quality, technical support, and adherence to environmental and safety regulations are well-positioned to capture significant market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 930.3 Million |

| Insulation | Oil immersed and Air core |

| Product | Fixed shunt reactors and Variable shunt reactors |

| End use | Electric utility and Renewable energy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CG Power & Industrial Solutions, Fuji Electric, GE, GBE, GETRA, HICO America, Hitachi Energy, Hyosung Heavy Industries, Nissin Electric, SGB SMIT, Siemens Energy, Shrihans Electricals, Toshiba Energy Systems & Solutions, TMC Transformers Manufacturing Company, and WEG |

| Additional Attributes | Dollar sales vary by reactor type, including air-core and iron-core single-phase reactors; by application, such as transmission lines, distribution networks, and reactive power compensation; by end-use, spanning utilities, industrial power systems, and renewable integration projects; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by grid stabilization needs, rising electricity demand, and renewable energy integration. |

The global single phase shunt reactor market is estimated to be valued at USD 930.3 million in 2025.

The market size for the single phase shunt reactor market is projected to reach USD 1,634.9 million by 2035.

The single phase shunt reactor market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in single phase shunt reactor market are oil immersed and air core.

In terms of product, fixed shunt reactors segment to command 62.5% share in the single phase shunt reactor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Phase Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single-Mode Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Single-Coated Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Single Superphosphate (SSP) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Electron Transistor Market Size and Share Forecast Outlook 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Use Pallet Market Size and Share Forecast Outlook 2025 to 2035

Single Serve Coffee Container Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA