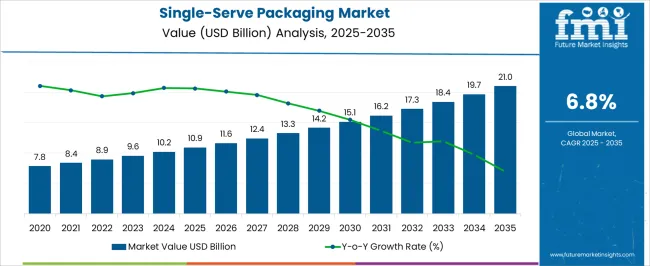

The single-serve packaging market is estimated to be valued at USD 10.9 billion in 2025 and is projected to reach USD 21.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

Between 2021 and 2025, the market grows from USD 7.8 billion to USD 10.9 billion, with annual increments from USD 8.4 billion, 8.9 billion, 9.6 billion, and 10.2 billion. This steady growth is driven by the increasing demand for convenient, portion-controlled packaging solutions across various sectors, including food and beverage, personal care, and pharmaceuticals. As consumer preferences shift towards smaller, on-the-go packaging formats, the market benefits from the growing trend of single-use products. Between 2026 and 2030, the market continues its upward trajectory, advancing from USD 10.9 billion to USD 16.2 billion. Values progress from USD 11.6 billion to USD 12.4 billion, 13.3 billion, 14.2 billion, and 15.1 billion.

This period sees the market benefiting from the expansion of e-commerce and food delivery services, which increase demand for single-serve packaging for convenience and hygiene. From 2031 to 2035, the market reaches USD 21.0 billion, with intermediate values of USD 16.2 billion, 17.3 billion, 18.4 billion, and 19.7 billion. This growth is driven by ongoing innovation in packaging materials, improved sustainability, and increasing consumer demand for ready-to-eat products. The rolling CAGR reflects consistent expansion as the market matures.

| Metric | Value |

|---|---|

| Single-Serve Packaging Market Estimated Value in (2025 E) | USD 10.9 billion |

| Single-Serve Packaging Market Forecast Value in (2035 F) | USD 21.0 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The packaging industry market is a major contributor, accounting for approximately 25-30%, as single-serve packaging plays a critical role in meeting the increasing demand for convenience, portability, and portion control across various sectors. The food and beverage industry market is another significant driver, contributing around 30-35%, with single-serve packaging being widely used for beverages, snacks, ready-to-eat meals, and dairy products, catering to consumer preferences for smaller, more convenient portions. The consumer goods market also plays a role, contributing about 15-20%, driven by the rising demand for individually packaged personal care, cleaning, and healthcare products, which offer ease of use and convenience.

Additionally, the retail and e-commerce market influences the demand for single-serve packaging, contributing around 10-12%, as single-serve products are highly favored for their convenience in transportation, storage, and accessibility in both online and brick-and-mortar retail. Lastly, the health and wellness market contributes approximately 8-10%, with the growing consumer focus on portion control and dietary management fueling the demand for single-serve packaging in health-related products like supplements, snacks, and health-focused beverages. These parent markets collectively highlight the widespread appeal of single-serve packaging, driven by trends in convenience, health, and retail consumption.

The single-serve packaging market is experiencing notable growth driven by shifting consumer lifestyles, increased demand for convenience, and growing awareness of portion control and food waste reduction. The rise in urbanization and the expanding base of working professionals have led to a surge in demand for ready-to-consume, on-the-go products, significantly influencing the adoption of single-serve formats across food, beverage, pharmaceutical, and personal care sectors.

Manufacturers are increasingly focusing on product safety, shelf life extension, and consumer convenience, all of which are being enabled through innovations in packaging materials and designs. Regulatory emphasis on hygiene, traceability, and sustainable packaging is also contributing to the transition toward single-use formats that can be individually tracked and sealed.

Advancements in flexible packaging technology, along with the emergence of smart packaging features, are enhancing product appeal and functionality As e-commerce penetration grows and consumer behavior continues to shift toward health-conscious and time-efficient consumption habits, the market is expected to maintain strong upward momentum, with companies focusing on both performance and environmental impact of packaging solutions.

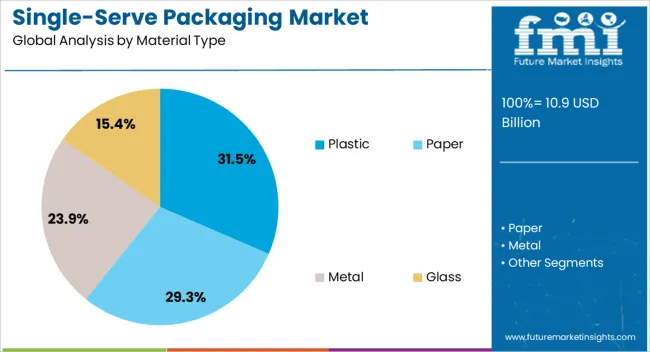

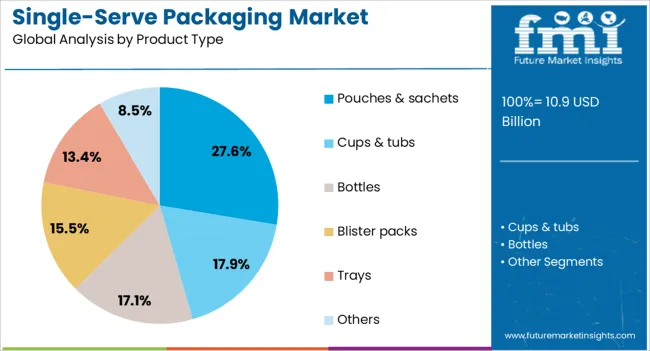

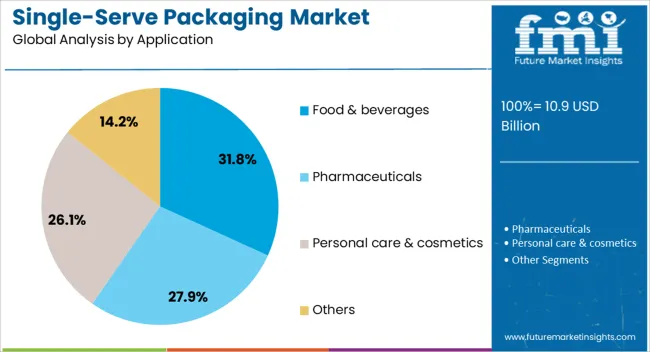

The single-serve packaging market is segmented by material type, product type, application, and geographic regions. By material type, single-serve packaging market is divided into plastic, paper, metal, and glass. In terms of product type, single-serve packaging market is classified into pouches & sachets, cups & tubs, bottles, blister packs, trays, and others. Based on application, single-serve packaging market is segmented into food & beverages, pharmaceuticals, personal care & cosmetics, and others. Regionally, the single-serve packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment is projected to hold 31.5% of the single-serve packaging market revenue share in 2025, making it the leading material type. Its leadership is being reinforced by the material’s lightweight nature, flexibility, and adaptability for various single-use packaging formats. Plastic offers excellent barrier properties that help preserve product freshness and protect against contamination, making it ideal for perishable goods.

Its cost-effectiveness, scalability in production, and compatibility with high-speed filling and sealing machinery further enhance its suitability for mass-market applications. In sectors such as food and beverages, pharmaceuticals, and personal care, plastic enables designs that improve user experience while minimizing spillage and waste.

The continued development of recyclable and biodegradable plastic variants is also helping address environmental concerns, thereby maintaining its relevance in sustainability-focused markets As consumer demand for convenient, safe, and portable packaging grows, the plastic material type is expected to remain dominant, supported by ongoing innovations and increasing investments in circular economy initiatives by packaging manufacturers.

The pouches and sachets segment is expected to account for 27.6% of the single-serve packaging market revenue share in 2025, making it the leading product type. This dominance is attributed to their cost-efficiency, versatility, and convenience for both manufacturers and consumers. Pouches and sachets require less material and energy to produce compared to rigid formats, making them an environmentally and economically favorable choice.

Their lightweight and compact design enhances storage, transportation efficiency, and product shelf appeal. These formats are widely used in food, beverage, personal care, and pharmaceutical applications due to their ability to offer precise portioning, effective sealing, and extended product shelf life.

Technological improvements in barrier films and sealing techniques have further enhanced the protective qualities of pouches and sachets, enabling longer preservation of freshness and flavor As brands continue to invest in attractive and functional single-serve options to align with consumer preferences, the segment is expected to maintain a strong position, particularly in high-volume retail and e-commerce channels.

The food and beverages segment is projected to capture 31.8% of the single-serve packaging market revenue share in 2025, making it the leading application area. This segment’s growth is being driven by changing consumption patterns, rising health consciousness, and the increasing demand for on-the-go meals and drinks. Single-serve packaging in this category enables better portion control, freshness, and portability, all of which are highly valued by today’s fast-paced consumers.

The food service industry, including quick service restaurants, convenience stores, and online delivery platforms, is increasingly adopting single-serve formats to improve hygiene and operational efficiency. Additionally, the expanding market for functional beverages, dairy products, snacks, and meal replacements is reinforcing demand for single-use packaging that supports both convenience and safety.

Technological advancements in printing and customization are allowing brands to use single-serve packages for targeted marketing and seasonal promotions As food safety regulations tighten and consumers seek greater transparency, the food and beverages segment is expected to continue leading the market, supported by both innovation and regulatory compliance.

The single-serve packaging market is experiencing rapid growth driven by the increasing demand for convenient, portion-controlled, and on-the-go packaging solutions in the food and beverage industry. As consumer preferences shift toward convenience and health-consciousness, brands are focusing on offering smaller, ready-to-consume portions that reduce food waste and promote portion control. The rising popularity of single-serve formats in snacks, beverages, dairy products, and condiments is fueling the market. Challenges include packaging waste concerns, material costs, and the need for innovation in eco-friendly alternatives. Opportunities are growing in sectors such as e-commerce, where the demand for individual servings, packaging customization, and premium products is rising. Trends include the development of innovative materials, more sustainable solutions, and the growth of direct-to-consumer models. Suppliers offering cost-effective, innovative, and eco-friendly single-serve packaging solutions are positioned to lead market growth.

The single-serve packaging market is driven by the increasing consumer demand for convenience, particularly in the food and beverage sector. With busy lifestyles and a preference for on-the-go consumption, single-serve packaging has become a popular choice for products such as snacks, drinks, ready meals, and dairy items. These packages offer the convenience of portion control, reducing food waste and providing a practical solution for consumers who seek quick and easy meals or snacks. Additionally, single-serve packaging meets the demand for hygiene and safety, ensuring that products are kept fresh and sealed until consumption. The growing trend toward healthier eating and meal portioning has further fueled the popularity of single-serve formats across a variety of product categories.

The single-serve packaging market faces several challenges, particularly regarding the cost of materials, which can be higher than bulk packaging options. The demand for premium packaging materials such as biodegradable plastics and multilayer films adds to the overall production cost. Additionally, there are growing concerns about the environmental impact of single-use packaging, leading to increased pressure from consumers, regulators, and governments to adopt more eco-friendly alternatives. Regulatory requirements for food safety, labeling, and packaging standards also add complexity to the production process. Manufacturers need to balance cost, functionality, and compliance with environmental and safety regulations to remain competitive in this evolving market. Innovations in packaging materials and technologies will be key to overcoming these challenges.

The rise of e-commerce presents significant opportunities for the single-serve packaging market, as online food and beverage sales continue to increase. Consumers purchasing products online often prefer individually packaged items for ease of consumption and freshness. E-commerce platforms are also providing brands with the ability to offer customized packaging solutions that cater to specific consumer preferences and demographics. The growth of direct-to-consumer models is encouraging brands to explore new, personalized packaging options that stand out in the market. Additionally, the expansion of subscription box services, which frequently use single-serve packages, is driving demand for individual packaging across various product categories, from snacks and beverages to skincare and health supplements.

The single-serve packaging market is witnessing a trend toward eco-friendly materials and innovative packaging solutions. With increasing consumer awareness of environmental issues, there is a growing demand for packaging made from recyclable, compostable, or biodegradable materials. Brands are focusing on developing sustainable packaging alternatives that align with consumer preferences for reducing plastic waste. Additionally, packaging innovation is playing a key role in enhancing convenience, such as easy-to-open packages, resealable designs, and formats that minimize product waste. The market is also seeing the rise of premium single-serve products, with more brands offering high-quality, portion-controlled items that cater to health-conscious and environmentally aware consumers. Suppliers that can combine innovation, sustainability, and high functionality are poised for success.

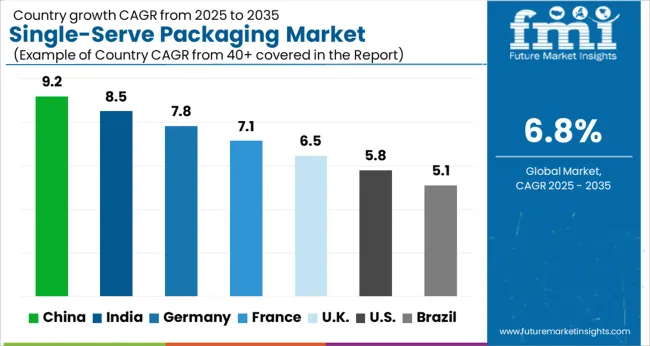

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The global single-serve packaging market is projected to grow at a CAGR of 6.8% from 2025 to 2035. China leads with a growth rate of 9.2%, followed by India at 8.5% and Germany at 7.8%. The UK and USA show more moderate growth rates of 6.5% and 5.8%, respectively. The market growth is driven by increasing demand for convenience, portion-controlled food and beverages, and the expanding e-commerce sector. Rising health-consciousness, busy urban lifestyles, and growing preference for on-the-go solutions are key factors shaping the market across these regions. The analysis includes over 40+ countries, with the leading markets detailed below.

The single-serve packaging market in China is expected to grow at a robust CAGR of 9.2% from 2025 to 2035. As one of the world’s largest consumer markets, China’s increasing demand for convenience products and portion-controlled packaging is a major driver of this growth. The country’s evolving lifestyle, particularly among the younger urban population, is creating a surge in demand for on-the-go food and beverage options, which require single-serve packaging solutions. The growth in the e-commerce sector, along with a shift toward online grocery shopping, is also playing a significant role in expanding the market for single-serve packaging. China’s expanding middle class, increased disposable income, and rising health-consciousness are contributing to the preference for single-serve packaging, as it allows for portion control, convenience, and freshness. The country’s large-scale manufacturing sector and efficient supply chains support the availability of cost-effective packaging solutions, making them more accessible to consumers.

The single-serve packaging market in India is projected to grow at a CAGR of 8.5% from 2025 to 2035. As India’s middle class expands and consumer purchasing power increases, there is a noticeable shift toward packaged goods, especially single-serve options. The growing demand for ready-to-eat and on-the-go food items, coupled with the increasing trend of nuclear families, is driving the need for single-serve packaging solutions. Moreover, India’s expanding retail and e-commerce sectors are playing a crucial role in making single-serve packaged products more accessible to a wider audience. The rise in demand for packaged beverages, snacks, and personal care products has further contributed to the growth of single-serve packaging in India. The increasing focus on hygiene and convenience, especially in urban areas, is propelling the demand for these types of packaging.

The single-serve packaging market in Germany is projected to expand at a CAGR of 7.8% from 2025 to 2035. Germany, known for its high demand for packaged food and beverages, is increasingly adopting single-serve packaging solutions. The growing trend of busy, on-the-go lifestyles in urban areas is contributing to the shift toward portion-controlled packaging. Additionally, there is a rising consumer preference for convenience foods and drinks, which are available in smaller, single-serve packages. The demand for such packaging is also being driven by the growing e-commerce sector, as consumers increasingly order packaged foods and beverages online. Germany’s robust packaging industry, with its advanced technological capabilities and focus on sustainability, is also contributing to the availability of high-quality, efficient, and cost-effective single-serve packaging solutions.

The UK single-serve packaging market is expected to grow at a CAGR of 6.5% from 2025 to 2035. With a rapidly evolving foodservice and retail sector, the demand for single-serve packaging has been on the rise. The growing popularity of take-away and ready-to-eat meals, along with the increase in on-the-go food consumption, is significantly boosting the market. Additionally, the UK is seeing a surge in health-conscious consumers who prefer single-serve packaging for portion control and convenience. The country’s thriving e-commerce market also plays an important role in increasing the availability and reach of single-serve packaged products. Further, as urban lifestyles become more fast-paced, the need for quick, portable, and easy-to-consume products has driven the adoption of single-serve packaging solutions. The UK’s focus on sustainability and reducing food waste has encouraged more manufacturers to invest in eco-friendly, single-serve packaging options.

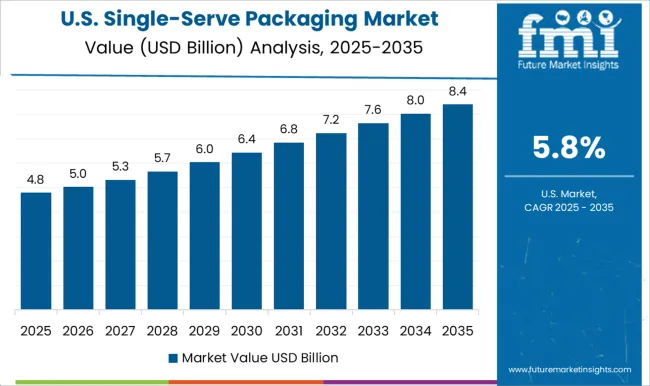

The USA single-serve packaging market is projected to grow at a CAGR of 5.8% from 2025 to 2035. The market is driven by the increasing demand for convenient food and beverage options, particularly in urban areas. The USA has seen a significant rise in single-serve products, as consumers increasingly seek convenient, portion-controlled, and on-the-go options. This trend is further supported by the rise of e-commerce platforms and online grocery stores that provide easy access to these products. As the focus on health and wellness increases, more consumers are opting for smaller, pre-packaged portions that help with portion control and managing their diet. The busy American lifestyle, coupled with the growing demand for convenience, has led to an increase in the consumption of single-serve food and beverages. Single-serve packaging is becoming more innovative, with new designs and materials that offer greater ease of use and sustainability.

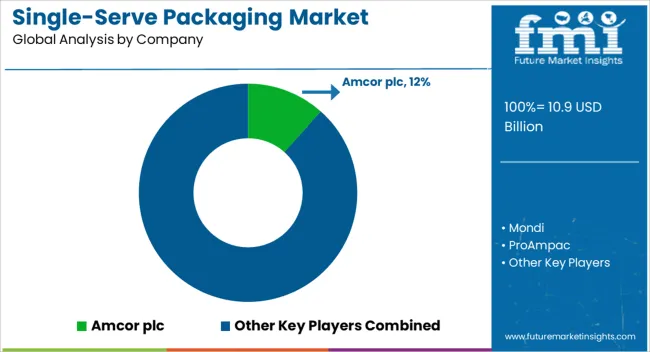

The single-serve packaging market is highly competitive, driven by the increasing demand for convenience, portion control, and sustainability in food and beverage packaging. Amcor plc is a global leader, offering a wide range of flexible packaging solutions for single-serve products, with an emphasis on innovation, product preservation, and eco-friendly materials. The company’s product lines cater to various industries, including food, beverages, and pharmaceuticals. Mondi, another major player, competes by providing high-performance, sustainable single-serve packaging solutions. Their focus is on reducing environmental impact while maintaining product freshness and extending shelf life, making them a popular choice for food and beverage manufacturers.

ProAmpac is a strong competitor, offering versatile single-serve packaging that includes stand-up pouches, sachets, and flexible films. The company’s emphasis on customizability and brand differentiation through innovative packaging designs gives it an edge in the market. Huhtamaki, known for its eco-friendly packaging solutions, provides single-serve packaging that meets sustainability standards while delivering superior performance. Constantia Flexibles also competes with high-quality single-serve packaging products, with a focus on food safety, convenience, and attractive packaging design for on-the-go consumers. Winpak Ltd. stands out for its advanced barrier packaging technologies, offering solutions that ensure product freshness and protection. IMA Group is known for its automated, high-speed packaging machines, catering to the growing demand for efficient and cost-effective single-serve packaging production.

Transcontinental Inc., American FlexPack, and RATTPACK focus on providing flexible, cost-effective packaging options for small portion sizes, with an emphasis on customization and branding. Smaller players like CarePac, Duropack Limited, and Polysack Flexible Packaging Ltd. offer specialized solutions for niche markets, including medical, nutraceutical, and personal care industries. Product brochures for these companies highlight key features such as enhanced barrier properties, resealability, ease of use, and sustainability, catering to the growing preference for single-serve convenience across various industries. Competitive strategies focus on product innovation, efficiency in production, and meeting evolving consumer preferences for convenience and sustainability.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.9 billion |

| Material Type | Plastic, Paper, Metal, and Glass |

| Product Type | Pouches & sachets, Cups & tubs, Bottles, Blister packs, Trays, and Others |

| Application | Food & beverages, Pharmaceuticals, Personal care & cosmetics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor plc, Mondi, ProAmpac, Huhtamaki, Constantia Flexibles, Winpak LTD., IMA Group, Transcontinental Inc., American FlexPack, RATTPACK, CarePac, Duropack Limited, Amber Packaging, RCP Ranstadt GmbH, CP Italy S.r.l., TIPA LTD, Polysack Flexible Packaging Ltd., Rain Nutrience, and Glenroy, Inc. |

| Additional Attributes | Dollar sales by packaging type (pouches, sachets, cups, bottles), material (plastic, paper, biodegradable), and application (food, beverages, pharmaceuticals, cosmetics). Demand dynamics are driven by the increasing preference for on-the-go consumption, rising demand for portion-controlled packaging, and the shift towards sustainable and eco-friendly solutions. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with increasing consumer interest in convenient, single-serve products and eco-conscious packaging options. |

The global single-serve packaging market is estimated to be valued at USD 10.9 billion in 2025.

The market size for the single-serve packaging market is projected to reach USD 21.0 billion by 2035.

The single-serve packaging market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in single-serve packaging market are plastic, paper, metal and glass.

In terms of product type, pouches & sachets segment to command 27.6% share in the single-serve packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA