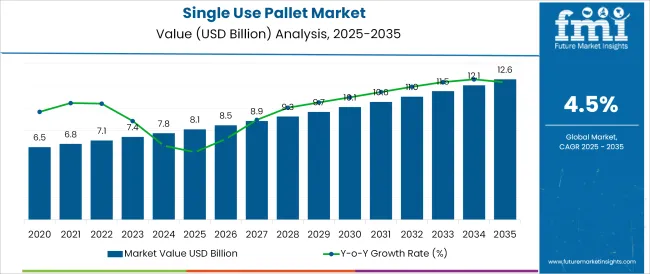

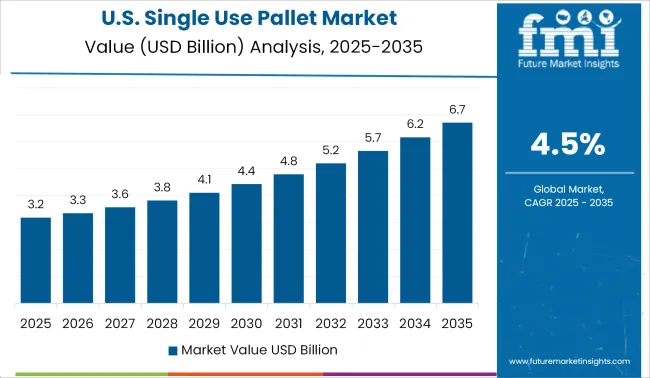

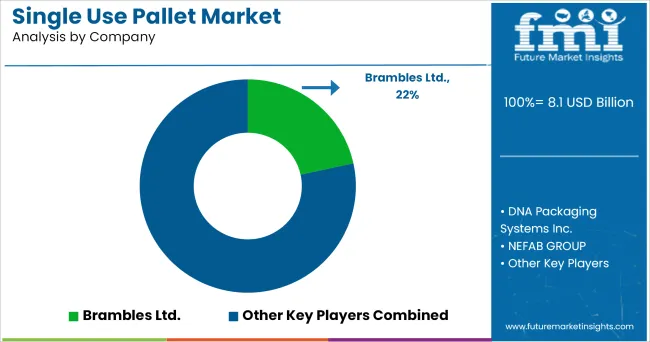

The Single Use Pallet Market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 12.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The single use pallet market is experiencing steady expansion, driven by increasing demand for lightweight, disposable logistics solutions that streamline cross-border shipments and reduce return logistics costs. As industries prioritize operational efficiency and compliance with international phytosanitary regulations, the adoption of single use pallets especially in export-driven sectors is accelerating.

These pallets reduce handling complexity, contamination risk, and inspection delays while aligning with safety standards in food, pharmaceuticals, and industrial chemicals. Advancements in material design and automated pallet manufacturing are improving structural integrity and load-bearing capacity, allowing single use pallets to support heavier loads with reduced environmental impact.

Additionally, increasing integration with smart tracking technologies is enhancing supply chain visibility. Growth is expected to continue as manufacturers seek standardized, recyclable pallet formats that meet evolving ESG targets and optimize total cost of ownership in global logistics operations.

The market is segmented by Application, Fabrication Material, and Configuration and region. By Application, the market is divided into Bulk Materials Logistics and Transportation, Retail Warehousing, Manufacturing Enterprise, Industrial Equipment and Machinery, and Cold Storage and Other Perishable Items. In terms of Fabrication Material, the market is classified into Wood and Plastic.

Based on Configuration, the market is segmented into Four-Way Pallets and Two-Way Pallets. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

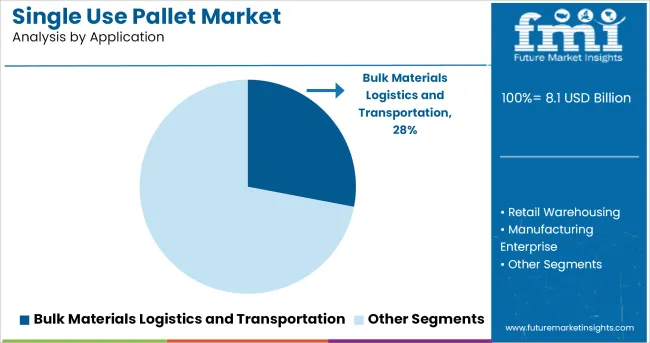

Bulk materials logistics and transportation is projected to contribute 28.0% of the total revenue share in the single use pallet market by 2025, making it a leading application segment. This leadership is being driven by the growing need to transport heavy, unpackaged, or semi-processed materials across long distances in a secure and cost-efficient manner.

Single use pallets offer a practical solution for bulk cargo by eliminating the complexities of return logistics, especially in one-way international shipments. Their role in minimizing contamination and complying with sector-specific hygiene standards has further reinforced their use in industrial and food-grade material movement.

Additionally, the adoption of these pallets in bulk handling helps optimize warehouse throughput and space utilization, especially where automation and rapid turnaround are critical. Their disposable nature also supports sustainability goals by enabling recycling and reducing long-term storage requirements.

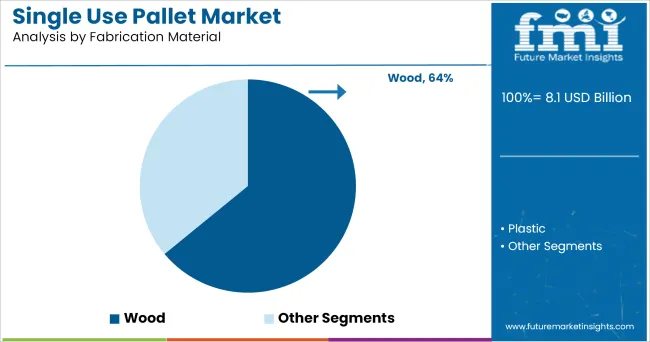

Wood is expected to dominate the single use pallet market with a 64.0% revenue share in 2025. This segment’s dominance is attributed to wood's wide availability, low cost, and robust mechanical properties, making it an ideal material for high-load, short-term transportation needs. Wooden pallets are particularly favored for their structural integrity and ease of customization to meet different shipment sizes and specifications.

The familiarity of wooden designs and compatibility with existing handling systems has supported widespread adoption across sectors. Furthermore, the ability to source heat-treated, ISPM-15 compliant wooden pallets enables hassle-free international shipments, especially in regulated markets.

The recyclability and biodegradability of wood also support environmental sustainability initiatives, encouraging continued usage even in single-use applications. As manufacturers seek a balance between performance, compliance, and cost-efficiency, wooden pallets remain the preferred material choice for large-scale disposable logistics operations.

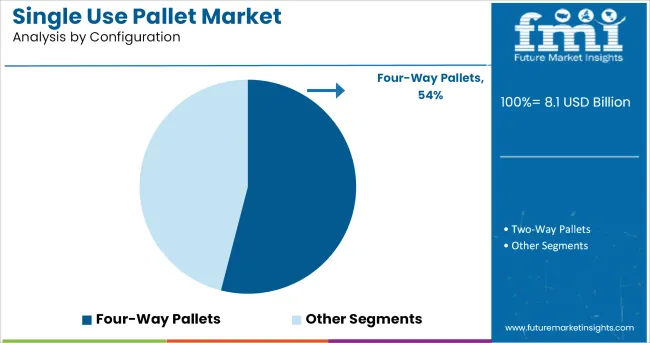

Four-way pallets are anticipated to hold 54.0% of the total market revenue share in 2025, emerging as the leading configuration within the single use pallet market. This dominance is being driven by their superior maneuverability, which allows forklift and pallet jack access from all four sides enabling streamlined operations in fast-paced distribution centers and warehouses.

The configuration significantly improves handling efficiency, especially in automated storage and retrieval systems (AS/RS), where multidirectional access enhances loading and unloading speeds. Four-way pallets also contribute to reduced labor costs and fewer handling errors, making them a preferred option for global supply chains.

Their structural design supports even weight distribution, which is critical when transporting bulk materials or fragile items. As logistics operations continue to prioritize efficiency, flexibility, and stackability, the four-way pallet configuration remains the preferred standard in high-volume, export-oriented shipment systems.

The need for logistics and warehousing services is expanding significantly as a result of rising consumer goods sales and bulk commercial cargo shipments, which is bolstering the expansion of the pallet market globally. Besides, pallets offsetting abrasions or physical trauma to shipment items and aiding during multiple platform shifts has found its patronage by the end users.

Further increasing export activities around the globe is also a prominent driver of the market. According to UNIDO in 2020, the global trade value of goods exported throughout the world amounted to approximately 19 trillion USA dollars at current prices.

In comparison, this figure stood at around USD 6.45 trillion in 2000. This rise in the value of goods exported around the world reflects developments in international trade, globalization, advances in technology and related products like this pallets.

Although in most sectors, switching from rigid to flexible packaging has been the standard. However, when it comes to shipping and transporting bigger consignments, rigid packaging still has its prominence. This pallets are the most typical examples. Even after the introduction of plastic pallets to the market, single use pallets still account for prominent share.

Single use pallets have a low cost and a long life cycle, making it appropriate for a wide range of applications especially for single use and storage. Its export advantage is that no return transport has to be organized or paid for it. The end customer can simply dispose of the pallets, which are made of 100% environmentally friendly materials. Thus, this pallets are extensively used in Warehouse and Logistics.

However, as the pallets currently accounts for such a big portion of the entire pallet industry, future growth prospects will continue to boost, and demand for these pallets will be surpassed by demand for plastic and metal pallets.

Plastic is becoming increasingly essential in the food and beverage industries, and pharmaceutical industry owing to its resistance to insects, fungus, and other forms of biological infestation

USA is one of the prominent markets for single use pallets globally. However with the current vaccination pace in the USA, Industrial and commercial activities is set to uplift. However even after fast vaccination the markets will take some time to get back on pre pandemic levels.

Similarly demand for this pallets in USA is set to gain track in next few quarters. The growth will be supported by increasing manufacturing activities leading to increase in storage, transportation and export activities.

Furthermore according to latest data from trade map USA export value is set to touch USD 1,500,000 Million mark in near future. This will have optimistic impact on market.

Increased imports of bulk commodities such as coal and mineral ores from Canada and Australia are projected to enhance lumber supply levels in Asia Pacific. End Users in Asia Pacific are increasingly inclined to use pallet pooling, which is anticipated to limit pallet growth in the short future.

In Asia Pacific region China has been an important market for single use pallets which can be backed by the fact that China is the prominent exporter around the globe and according to the latest make this trade map statistics china has crossed an export value of USD 2,500,000 Million.

Some of the leading manufacturers and suppliers of the product include

The market is perceived to be highly competitive with leading players touted to acquire around 15% share in the single use pallet market. Access to raw material and procurement price of the same is the key differentiator between the market participants in manufacturing and sales of the product. These companies offer the product of standard and custom dimensions for various application, like transportation of mechanical equipment, machines etc.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global single use pallet market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the single use pallet market is projected to reach USD 12.6 billion by 2035.

The single use pallet market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in single use pallet market are bulk materials logistics and transportation, retail warehousing, manufacturing enterprise, industrial equipment and machinery and cold storage and other perishable items.

In terms of fabrication material, wood segment to command 64.0% share in the single use pallet market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of Leading Single Use Pallet Providers

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Machine Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Single Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA