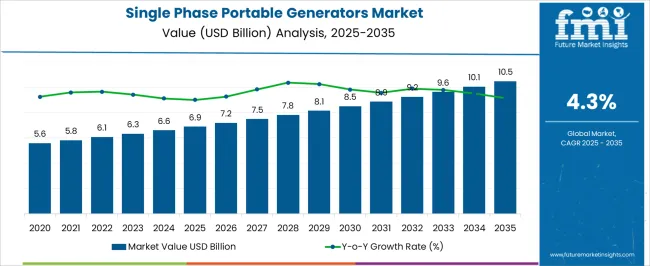

The single phase portable generators market, valued at USD 6.9 billion in 2025, is anticipated to reach USD 10.5 billion by 2035, progressing at a CAGR of 4.3%. This rise generates an absolute dollar opportunity of USD 3.6 billion during the assessment period. Early-stage expansion is steady, with the market growing from USD 7.2 billion in 2026 to USD 8.1 billion in 2029, setting a stable foundation. By 2031, it climbs to USD 8.9 billion, showing healthy mid-term demand. These increments present clear openings for suppliers and manufacturers to strengthen their foothold and capture consistent revenue growth. From a long-term perspective, the market delivers its most pronounced gains in the latter years, rising from USD 9.2 billion in 2030 to USD 10.5 billion in 2035.

This final stage accounts for over USD 1.3 billion of the total opportunity, with annual increments becoming increasingly significant. Steady increases across each year reflect expanding adoption across end-users, creating favorable conditions for capacity expansion.

| Metric | Value |

|---|---|

| Single Phase Portable Generators Market Estimated Value in (2025 E) | USD 6.9 billion |

| Single Phase Portable Generators Market Forecast Value in (2035 F) | USD 10.5 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

In the single phase portable generators market, the first clear breakpoint emerges between 2025 and 2028, when the market advances from USD 6.9 billion to USD 7.5 billion. This stage reflects steady but moderate increments of about USD 0.2 billion annually, setting the tone for predictable growth. The next breakpoint is reached by 2030, when values climb to USD 9.2 billion, supported by incremental gains of USD 0.3–0.4 billion. This period marks a transition from stable expansion to faster growth, highlighting a window where manufacturers can scale production and strengthen competitive positioning before the larger late-stage increments unfold.

The second major breakpoint occurs from 2031 to 2035, when the market jumps from USD 8.9 billion to USD 10.5 billion. This late-phase surge delivers nearly USD 1.6 billion in new revenue, representing the strongest absolute dollar growth within the forecast horizon. Intermediate benchmarks, such as USD 9.6 billion in 2033 and USD 10.1 billion in 2034, confirm a consistent upward trajectory before peaking in 2035.

The single phase portable generators market is experiencing robust growth due to increasing demand for reliable, mobile power sources across residential, commercial, and industrial applications. The market is shaped by rising power outages, expanding construction activities, and growing adoption in off-grid and emergency power supply scenarios.

Technological advancements focusing on fuel efficiency, noise reduction, and compact design are contributing to enhanced product appeal. Furthermore, the growing trend toward renewable energy integration and portable power solutions for outdoor activities and disaster preparedness is supporting market expansion.

Investment in infrastructure development and increasing power needs in emerging economies are expected to create additional opportunities. The market’s future outlook is strengthened by innovations in inverter technology and regulatory focus on environmental standards, which together drive demand for cleaner and more efficient portable generators.

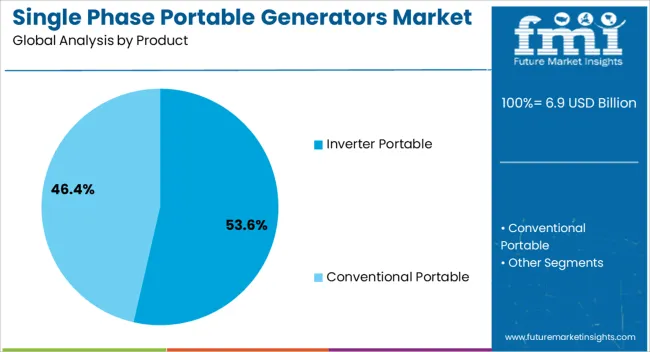

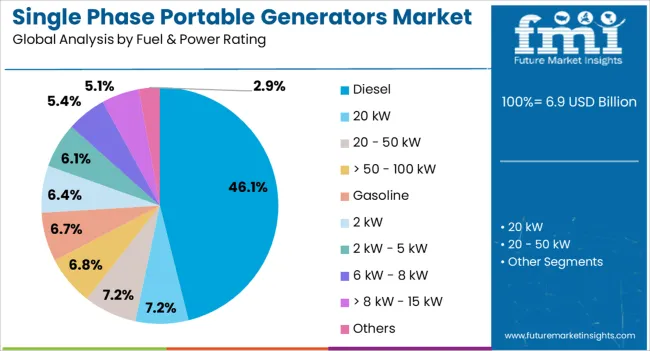

The single phase portable generators market is segmented by product, fuel & power rating, end use, and geographic regions. By product, single phase portable generators market is divided into Inverter Portable and Conventional Portable. In terms of fuel & power rating, single phase portable generators market is classified into Diesel, 20 kW, 20 - 50 kW, > 50 - 100 kW , Gasoline, 2 kW, 2 kW - 5 kW, 6 kW - 8 kW, > 8 kW - 15 kW, and Others.

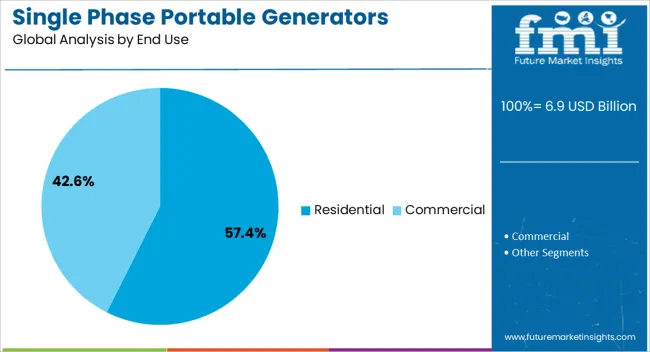

Based on end use, single phase portable generators market is segmented into Residential and Commercial. Regionally, the single phase portable generators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The inverter portable product segment is estimated to hold 53.6% of the market revenue in 2025, positioning it as the leading product type in the market. This prominence is attributed to its superior efficiency, compactness, and ability to provide clean and stable power output, which is crucial for sensitive electronic devices.

The portability and quieter operation compared to conventional generators have increased its adoption among residential users and outdoor enthusiasts. Additionally, advancements in inverter technology that allow seamless switching between power modes and enhanced fuel economy have further supported growth.

The segment benefits from consumer preference for user-friendly, lightweight, and low-maintenance power solutions that cater to both emergency backup and recreational power needs.

The diesel fuel and power rating segment accounts for approximately 46.1% of the market revenue share in 2025, reflecting its significant role in the market. The sustained preference for diesel-powered generators is due to their robustness, fuel efficiency, and longer operational life, making them suitable for heavy-duty and extended use scenarios.

The segment’s growth is bolstered by increasing demand from construction, industrial, and agricultural sectors where reliability and continuous power output are critical. Furthermore, diesel generators’ ability to handle higher load capacities and their compatibility with existing fuel infrastructure contribute to widespread adoption.

Ongoing improvements aimed at reducing emissions and enhancing engine performance are expected to strengthen the diesel segment’s market position further.

The residential end-use segment is forecasted to command 57.4% of the market revenue in 2025, marking it as the largest end-use category within the market. This leadership is driven by the rising need for backup power solutions in households facing frequent power outages and unreliable grid supply.

Increasing consumer awareness about energy security, coupled with the growing trend of smart homes and connected devices, has accelerated demand for portable generators that ensure uninterrupted power. The ease of use, safety features, and adaptability of single phase generators for residential applications have further contributed to this growth.

Additionally, government initiatives promoting rural electrification and subsidies for energy backup solutions have supported higher adoption rates in residential sectors globally.

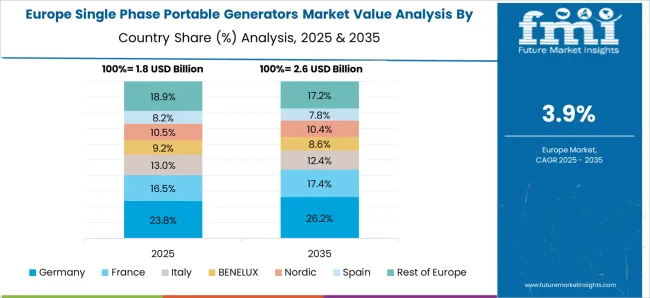

The single phase portable generators market is expanding as residential, commercial, and small-scale industrial users prioritize backup power solutions. North America and Europe lead adoption with high-efficiency, fuel-flexible generators supported by stricter emission standards and advanced safety features. Asia-Pacific demonstrates fast growth due to urbanization, unstable grids, and increasing outdoor activity needs. Manufacturers differentiate through runtime, noise reduction, portability, and compliance certifications. Regional variations in electricity reliability, fuel availability, and price sensitivity strongly shape adoption, marketing strategies, and competition.

Generator adoption heavily depends on power capacity and runtime suitability. North America and Europe favor high-performance units with extended runtime for residential and light commercial backup, ensuring seamless power continuity. Asia-Pacific markets focus on mid-range output suitable for small businesses, households, and rural areas, where affordability and basic functionality dominate purchase decisions. Differences in runtime and output shape reliability perceptions and end-use adoption. Premium suppliers invest in advanced engines and fuel-efficient systems, while regional firms emphasize cost-effective reliability. These contrasts define market segmentation and procurement patterns globally.

Fuel choice gasoline, diesel, propane, or dual-fuel plays a vital role in adoption. Europe and North America increasingly favor propane and hybrid fuel units due to stringent emission regulations and environmental awareness. Asia-Pacific markets lean toward gasoline-based units for affordability and easy availability, though diesel models remain common in commercial use. Regulatory differences drive design, compliance costs, and market readiness. Leading suppliers offering emission-certified, fuel-flexible systems capture premium buyers, while regional producers focus on accessible, fuel-specific solutions. These contrasts influence adoption, regulatory acceptance, and brand positioning worldwide.

Design features such as portability, noise levels, and ease of use are critical decision factors. North America and Europe emphasize lightweight, low-noise units with inverter technology, ergonomic handles, and compact designs for residential and recreational use. Asia-Pacific markets prioritize sturdy, affordable designs with basic portability features, balancing cost and practicality. Variations in design focus affect customer satisfaction, brand loyalty, and long-term adoption. Global manufacturers compete on advanced noise suppression and ergonomic innovation, while regional producers focus on robust, cost-effective designs. These contrasts guide user preference across outdoor, home, and small business applications.

Single phase portable generators are sold via e-commerce platforms, hardware retailers, dealerships, and OEM partnerships. North America and Europe emphasize multi-channel strategies with service support, promotional financing, and extended warranties. Asia-Pacific relies heavily on dealer networks and online marketplaces, targeting small households and businesses during seasonal demand peaks. Distribution contrasts affect market penetration, after-sales service, and adoption speed. Leading suppliers with strong dealer and service networks secure repeat customers, while regional players leverage price-driven bulk distribution. Seasonal and channel variations strongly shape sales cycles and long-term competitiveness.

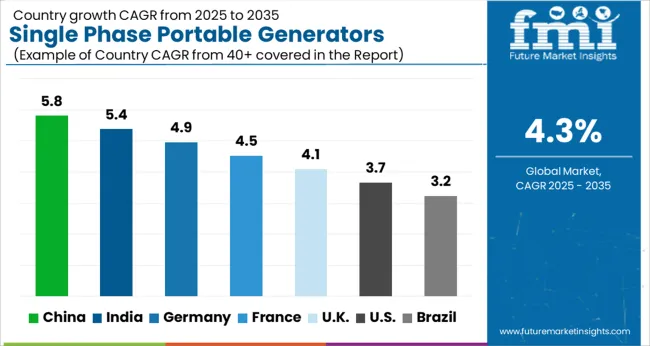

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The global single phase portable generators market was projected to grow at a 4.3% CAGR through 2035, driven by demand in residential, commercial, and small-scale backup power applications. Among BRICS nations, China recorded 5.8% growth as large-scale production and assembly facilities were commissioned and compliance with electrical and safety standards was enforced, while India at 5.4% growth saw expansion of manufacturing units to meet rising regional requirements. In the OECD region, Germany at 4.9% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom at 4.1% relied on moderate-scale operations for residential and commercial backup applications. The USA, expanding at 3.7%, remained a mature market with steady demand across home and small commercial segments, supported by adherence to federal and state-level safety and performance standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The single phase portable generators market in China is growing at a CAGR of 5.8% supported by rising demand from residential users, construction projects, and small businesses. These generators are widely used for backup power during outages, outdoor activities, and as a reliable power source for equipment on temporary sites. Growth is fueled by expansion in urban housing, increased need for portable energy solutions, and demand from rural areas with limited grid reliability. Suppliers provide generators in a wide range of capacities with improved fuel efficiency, compact design, and easy operation. Distribution through retail stores, equipment dealers, and e-commerce platforms ensures wide accessibility. Adoption is further supported by growth in residential energy demand and small-scale commercial applications. China remains a leading market due to its large population, expanding construction activity, and increasing reliance on portable energy systems.

India is expanding at a CAGR of 5.4% in the single phase portable generators market, driven by demand from residential users, construction sites, and small enterprises. These generators are widely adopted as backup solutions during frequent power cuts, as well as for outdoor and remote applications. Growth is supported by rising energy demand, rural electrification gaps, and the need for cost effective portable power. Suppliers provide compact, durable, and fuel efficient models suitable for both households and small businesses. Distribution through local dealers, retail outlets, and e-commerce platforms ensures broad accessibility across regions. Adoption is further boosted by growing reliance on temporary energy solutions for events, construction, and small workshops. India continues to see strong market momentum due to its large population, energy supply challenges, and demand for reliable portable power sources.

Germany is growing at a CAGR of 4.9% in the single phase portable generators market, supported by demand from households, construction projects, and small businesses. Portable generators are widely adopted as backup power solutions during outages and for applications in outdoor activities, workshops, and temporary sites. Growth is supported by demand for reliable power during emergencies, as well as the need for mobile energy in construction and events. Suppliers offer generators with advanced safety features, fuel efficiency, and compact designs suited for residential and light commercial use. Distribution is facilitated through equipment dealers, retail outlets, and e-commerce platforms. Adoption is further driven by growing demand for mobile power and reliability in diverse applications. Germany remains a key European market due to strong infrastructure development, residential adoption, and focus on portable energy solutions.

The United Kingdom market is expanding at a CAGR of 4.1% due to increasing adoption in residential, construction, and small commercial applications. Portable generators are commonly used for backup power, outdoor activities, and temporary energy supply at worksites and events. Growth is supported by rising demand for reliable and cost effective portable energy solutions, particularly in regions with occasional power interruptions. Suppliers provide compact, lightweight, and easy to operate generators designed for diverse user needs. Distribution through retail stores, specialized equipment dealers, and e-commerce platforms ensures widespread availability. Adoption is further driven by rising popularity of outdoor activities and growing reliance on backup energy for small businesses. The United Kingdom continues to see steady growth due to increasing consumer awareness and demand for portable and efficient power solutions.

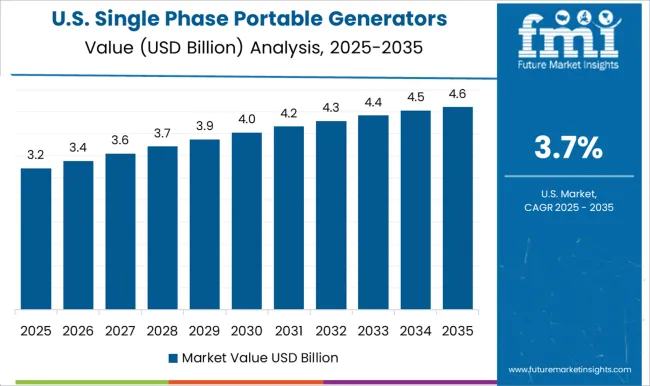

The United States market is growing at a CAGR of 3.7% supported by demand from residential households, construction sites, and small enterprises. Portable generators are widely used for emergency backup, outdoor activities, and temporary energy supply in rural and suburban areas. Growth is supported by rising energy demand, frequent weather-related outages, and increasing consumer interest in backup power solutions. Suppliers provide durable, fuel efficient, and compact models with advanced features for easy operation. Distribution channels include equipment dealers, retail outlets, and online platforms, ensuring broad market accessibility. Adoption is further boosted by demand from households seeking reliable emergency power and construction projects requiring mobile energy solutions. The United States remains a significant market due to its large population, exposure to extreme weather events, and widespread reliance on portable power equipment.

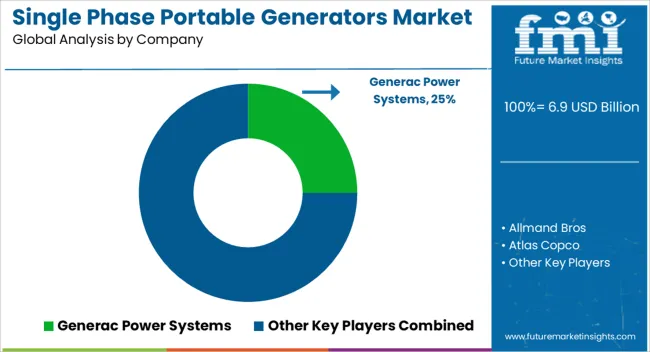

The single phase portable generators market is led by major suppliers such as Generac Power Systems, Allmand Bros, Atlas Copco, Briggs & Stratton, Caterpillar, Champion Power Equipment, Cummins, Deere & Company, DuroMax Power Equipment, FIRMAN Power Equipment, HIMOINSA, Honda India Power Products, Kirloskar, Rehlko, Wacker Neuson, Westinghouse Electric Corporation, Yamaha Motor, and YANMAR. These companies cater to a wide range of applications, including residential backup, outdoor recreational use, and small-scale commercial operations, with capacities that emphasize mobility, reliability, and user-friendliness. Manufacturers compete on fuel efficiency, noise reduction, portability, and digital monitoring features.

Generac, Honda, and Yamaha remain leaders in offering quiet, fuel-efficient models designed for households and outdoor enthusiasts, while Briggs & Stratton, Westinghouse, and Champion Power Equipment provide cost-effective, high-performance solutions for diverse end-users. Heavy equipment leaders like Caterpillar, Cummins, and Atlas Copco emphasize durability and integration with broader industrial power systems, while companies such as Kirloskar, HIMOINSA, and YANMAR bring strong regional manufacturing and distribution capabilities to emerging markets. Recent trends in the market show a shift towards hybrid and inverter-based portable generators that meet rising demand for stable, clean electricity compatible with sensitive electronics. Sustainability is also a growing factor, with suppliers investing in reduced-emission engines and alternative fuel options. Companies are strengthening their dealer networks and service offerings to capture customer loyalty, while integrating smart connectivity and IoT-enabled monitoring to provide real-time performance insights.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Product | Inverter Portable and Conventional Portable |

| Fuel & Power Rating | Diesel, 20 kW, 20 - 50 kW, > 50 - 100 kW , Gasoline, 2 kW, 2 kW - 5 kW, 6 kW - 8 kW, > 8 kW - 15 kW, and Others |

| End Use | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Generac Power Systems, Allmand Bros, Atlas Copco, Briggs & Stratton, Caterpillar, Champion Power Equipment, Cummins, Deere & Company, DuroMax Power Equipment, FIRMAN Power Equipment, HIMOINSA, Honda India Power Products, Kirloskar, Rehlko, Wacker Neuson, Westinghouse Electric Corporation, Yamaha Motor, and YANMAR |

| Additional Attributes | Dollar sales vary by fuel type, including gasoline, diesel, propane, and hybrid generators; by power rating, spanning below 2 kW, 2–5 kW, and above 5 kW; by application, such as residential backup, outdoor recreation, and small commercial use; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for backup power, outdoor activities, and affordable portable energy solutions. |

The global single phase portable generators market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the single phase portable generators market is projected to reach USD 10.5 billion by 2035.

The single phase portable generators market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in single phase portable generators market are inverter portable and conventional portable.

In terms of fuel & power rating, diesel segment to command 46.1% share in the single phase portable generators market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single-Mode Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Single-Coated Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Single Superphosphate (SSP) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Electron Transistor Market Size and Share Forecast Outlook 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Use Pallet Market Size and Share Forecast Outlook 2025 to 2035

Single Serve Coffee Container Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA