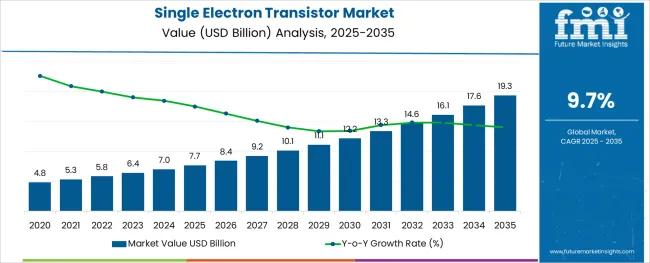

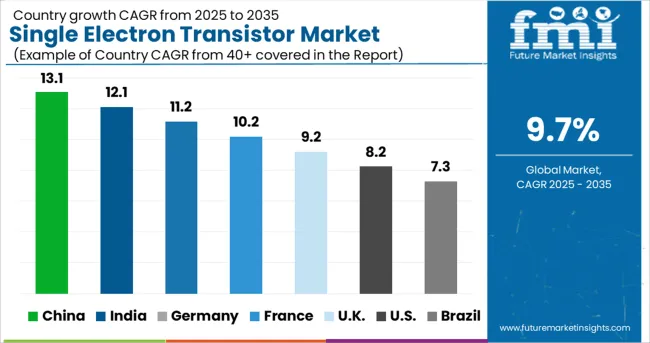

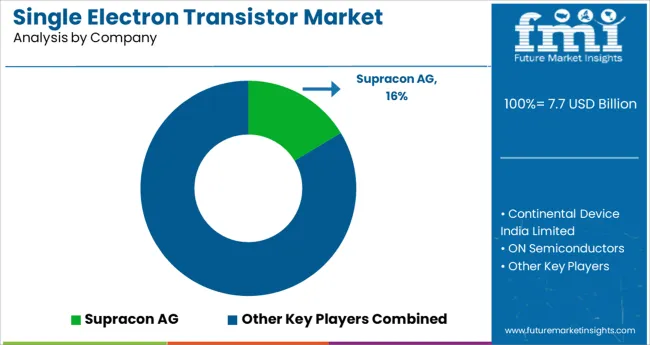

The Single Electron Transistor Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 19.3 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

The single electron transistor market is gaining strong momentum due to increasing demand for ultra-low power electronics and the continual scaling limitations of conventional transistor technologies. These devices are being explored for their ability to control electron flow at the quantum level, which enables operation at extremely low power thresholds and facilitates next-generation computing models.

Research institutions and semiconductor manufacturers are heavily investing in the development of single electron transistors for their potential use in quantum computing, cryogenic electronics, and neuromorphic architectures. Additionally, growing interest in non-traditional computing platforms and energy-efficient components is accelerating experimental deployments.

Metallic and silicon-based transistor prototypes are being validated for scalability, integration, and manufacturability, while advances in nanofabrication and electron tunneling dynamics are paving the way for future commercial viability. As the demand for high-density, low-energy circuits continues to rise, the single electron transistor market is expected to expand significantly, especially in specialized computing and research-driven environments.

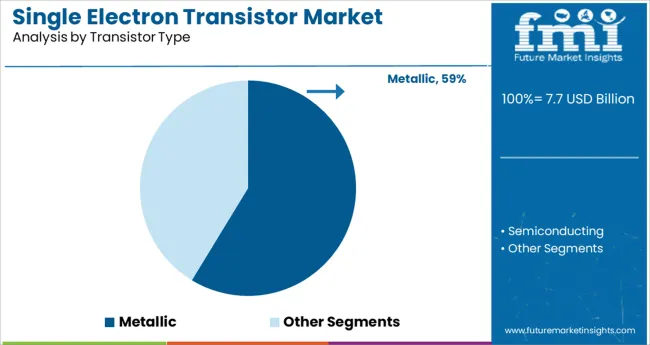

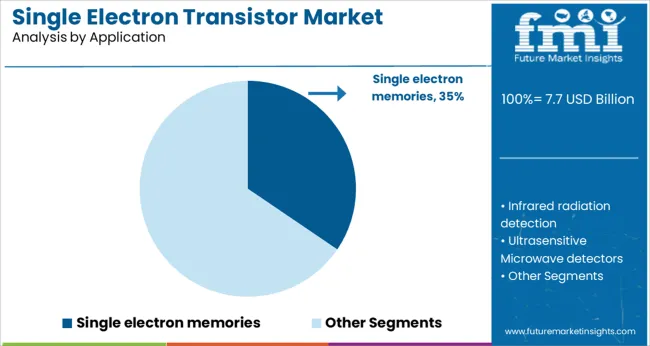

The market is segmented by Transistor Type and Application and region. By Transistor Type, the market is divided into Metallic and Semiconducting. In terms of Application, the market is classified into Single electron memories, Infrared radiation detection, Ultrasensitive Microwave detectors, and Supersensitive Electrometers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The metallic transistor type segment is anticipated to lead the single electron transistor market with a 58.7% revenue share in 2025. This dominance is driven by the favorable quantum confinement properties of metallic structures, which allow precise control of electron tunneling essential for single electron operation.

Metallic transistors have demonstrated higher sensitivity and stability in laboratory conditions, making them the preferred choice for experimental and low-temperature computing applications. Their relatively simpler fabrication process compared to semiconductor counterparts has enabled more rapid prototyping and integration into cryogenic circuits.

As metallic materials facilitate efficient Coulomb blockade behavior and reduced leakage currents, they are being increasingly incorporated in quantum research and academic innovation platforms. The reliability and reproducibility of metallic single electron transistors under defined conditions have supported their continued preference, maintaining leadership in this category.

In the application segment, single electron memories are projected to hold a 34.5% revenue share in 2025, marking them as the leading use case. This segment's prominence is attributed to the ability of single electron transistors to store information using the presence or absence of a single electron, which drastically reduces power consumption and increases memory density.

As data-intensive computing and AI workloads demand faster and more efficient memory technologies, research institutions and semiconductor developers are exploring single electron memories as a potential breakthrough in non-volatile memory design. Their ultra-low power requirements make them suitable for embedded systems, space-limited devices, and edge computing applications.

The integration of single electron memories into hybrid memory architectures is being studied for scalability and thermal stability, which has reinforced their position as a critical application area within the evolving transistor ecosystem.

The single electron transistor market stood at 9.3% before the COVID-19 pandemic. However, the single electron transistor market is growing smoothly at a moderate rate with a CAGR of 9.7% during the forecast period.

The major factor driving the adoption of single electron transistors is the rising need for an energy-saving single transistor for the Internet of Things. The Internet of Things is witnessing rapid growth as mini-computers are linked with electronic objects such as mobile phones. Another prominent growth driver for the market includes the

Improved power gain for a single-electron transistor for achieving better performance is another factor driving the market of single-electron transistors positively.

The major restraint faced by manufacturers is that the transistor is not suitable for implementation in a complex circuit. Due to the presence of fluctuations, the sales of single electron transistors are likely to decrease during the forecast period. Another challenge faced by manufacturers is that the device cannot work under normal room temperature it requires a specific room temperature.

Based on the transistor type, the single electron transistor is further categorized into metallic type and semiconducting type. Among these, the semiconducting type is likely to dominate the single electron transistor market share during the forecast period.

Due to the increase in the electronic market, demand for semiconducting type single electron transistors is likely to rise during the forecast period.

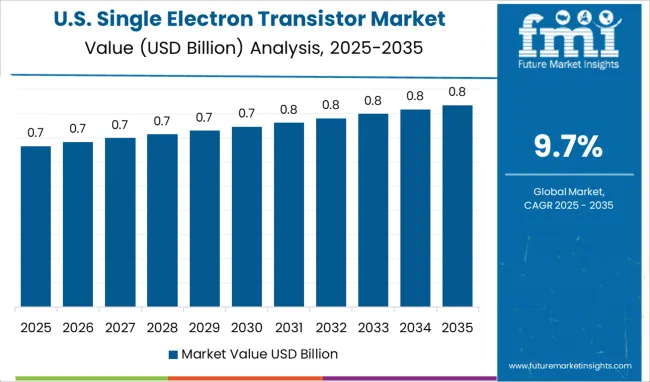

Based on geography, the single electron transistor market can be segmented into regions namely North America, Europe, Latin America, Asia Pacific, and MEA. The single electron transistor market in North America is expected to stay dominated by acquiring 34.5% of the share of the single electron transistor market in 2025.

Owing to a large number of semiconductor companies, there has been an escalating need for energy-saving transistors in the North American single-electron transistor market.

The Europe region is the second-largest single electron transistor market share acquiring 19.5% of the share during the forecast period.

The UK is growing at a significant pace, owing to the easy availability of silicon at a lower price. Huge numbers of manufacturers present in the region also contribute a prominent share of the single electron transistor market.

The Single electron transistor start-up companies are growing higher in the automotive industries. The start-up manufacturers experiment with several transistors and come up with their unique innovative ideas to grow the market.

They focus on single electron transistors to come up with advanced, more powerful memories, and to build blocks for the new transistor in the coming years.

The single electron transistor market is consolidated by the key prominent rival to expand their business all around the globe. These key players along with the manufacturers are making several marketing tactics to boost the single electron transistor market size during the forecast period.

Numerous strategies are implemented by market players to improve their position in the market. Some of these strategies include mergers, acquisitions, product launches, and partnerships among others to boost the single electron transistor market.

Recent Development in the Single Electron Transistor Market are:

The newly launched single electron transistor is beneficial to maintain the thermal power and keep the electron temperature below the Coulomb energy.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Transistor Type, Application, Region |

| Regions Covered | United States of America; Canada; Brazil; Argentina; Germany; United Kingdom; France; Spain; Italy; Nordics; BENELUX; Australia & New Zealand; China; India; ASIAN; GCC Countries; South Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Supracon AG; Continental Device India Limited; ON semiconductors; 4-star Electronics Pvt Ltd; Toshiba Schneider Inverter Corporation |

| Customization | Available Upon Request |

The global single electron transistor market is estimated to be valued at USD 7.7 billion in 2025.

It is projected to reach USD 19.3 billion by 2035.

The market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types are metallic and semiconducting.

single electron memories segment is expected to dominate with a 34.5% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Machine Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Single Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA