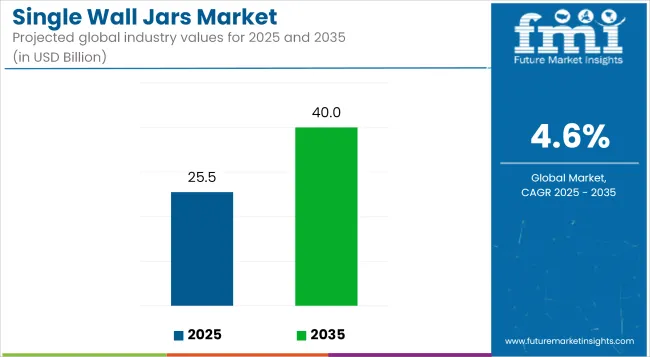

The single wall jars market is projected to grow from USD 25.5 billion in 2025 to USD 40.0 billion by 2035, registering a CAGR of 4.6% during the forecast period. Sales in 2024 reached USD 24.3 billion, driven by demand from the cosmetics, personal care, and nutraceutical industries.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 25.5 billion |

| Industry Value (2035F) | USD 40.0 billion |

| CAGR (2025 to 2035) | 4.6% |

Growth has been attributed to cost-effective production, increased shelf appeal, and rising adoption by direct-to-consumer skincare brands. The lightweight profile and reduced resin use of single wall jars have contributed to sustainability goals while maintaining visual aesthetics and functionality.

Packaging preferences across wellness and beauty sectors have favored jars that offer design flexibility and branding compatibility. Expansion in e-commerce distribution has also influenced demand for compact and protective packaging types.

Product development has been influenced by the growing prioritization of circular design and mono-material use in rigid containers. Key suppliers have advanced extrusion blow molding capabilities to produce PET and PP jars with seamless walls and minimized resin inputs.

Emerging R&D initiatives have emphasized reduced environmental impact through renewable materials and refillable formats. Integration of laser-etched labeling and direct printing has also gained traction for brand customization while limiting label waste.

Packaging assessments have focused on improving end-of-life recovery processes without compromising protective performance. Lifecycle audits are being conducted to verify carbon reductions and identify areas for further optimization. Consumer brands have begun to shift procurement policies toward verified sustainable containers, reinforcing the move toward lighter, recyclable single wall jar options.

The outlook for the single wall jars market remains optimistic, with global brands accelerating transitions toward recyclable primary packaging solutions. Market players are expected to focus on material standardization, product differentiation, and reduced logistics footprints.

Growth opportunities will be driven by the rise of indie brands, D2C models, and travel-compliant formats. The market is likely to benefit from regional regulatory shifts favoring minimal packaging and clear sustainability labeling.

Competitive positioning will depend on technological partnerships, fast prototyping abilities, and compliance with extended producer responsibility guidelines. Future expansion into medical-grade and nutraceutical packaging segments is anticipated, broadening the applications of single wall jars. Key players are also integrating automation and digital inspection systems to ensure efficiency and high throughput across operations.

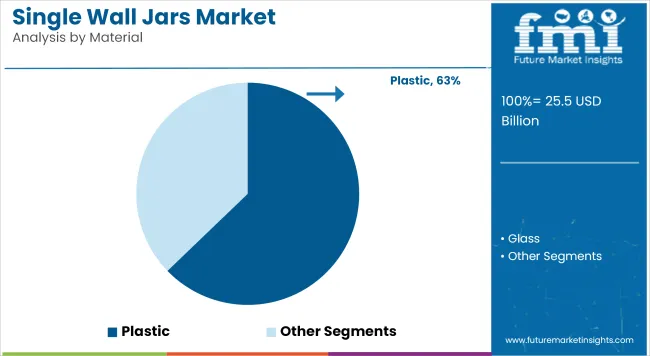

The market is segmented based on material, capacity, end use, distribution channel, and region. By material, the market includes metal, glass, and plastic. In terms of capacity, the market is categorized into less than 10 oz, 11-30 oz, 31-100 oz, and above 100 oz.

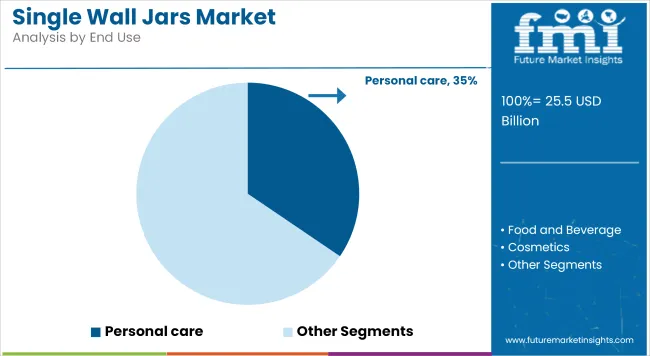

By end use, the market comprises personal care, food and beverage, cosmetics, pharmaceutical, and others including chemicals. Based on distribution channel, the market is segmented into B2B (direct sales and distributors) and B2C (online retail and offline retail). Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Plastic has been estimated to hold the largest share of the single wall jars market in 2025 at 62.8%, driven by its cost efficiency, mold ability, and resistance to breakage. Polypropylene (PP), PET, and HDPE have been used extensively due to their chemical resistance and clarity.

Lightweight construction has reduced transportation costs and made plastic jars ideal for e-commerce and retail packaging. Plastic jars have also been preferred for their compatibility with tamper-evident and child-resistant closures.

High customization potential has been enabled through blow molding and injection molding techniques. Transparent plastic jars have facilitated product visibility in cosmetics and food packaging. UV-resistant and airtight variants have been used for light- or air-sensitive products such as supplements and creams. Printability and label adhesion have enhanced their utility in branded applications.

Plastic jars have supported fast production cycles, contributing to rapid supply chain turnaround. Shatterproof characteristics have made them safer alternatives to glass in personal care and pharmaceuticals.

Barrier coatings and multilayer structures have been integrated to improve performance against moisture and oxygen ingress. Recycling-friendly mono-material designs have increasingly been adopted to meet sustainability targets. Demand for BPA-free and FDA-compliant plastics has been addressed through regulatory-compliant formulations.

Recycled plastic (rPET, rHDPE) usage has increased to align with circular economy standards. Global brands have invested in recycled-content plastic jar lines to meet ESG commitments. Plastic’s strength-to-weight ratio and shelf-ready design flexibility are expected to secure its leading position.

The personal care sector has been projected to account for 34.5% of the global demand for single wall jars in 2025, due to its need for hygienic, appealing, and portable packaging. Jars have been used to package creams, balms, scrubs, gels, and lotions requiring wide-mouth formats for easy application. Material selection has focused on sensory appeal, durability, and leak resistance.

Plastic and glass variants have both found preference across premium and mass-market product lines. Customization for brand identity has been prioritized through embossing, matte finishes, and specialty closures. Compact and travel-friendly jars have supported on-the-go product usage and sampler kits. Transparent and tinted jars have allowed consumers to visually assess product texture and quantity. Tamper-proof and resalable designs have enhanced product security and longevity.

Refillable and reusable jar options have gained popularity in clean beauty and sustainability-conscious consumers. Demand has also grown for mono-material jars that facilitate curbside recycling. Brands have leveraged personal care jars for value-added packaging through integrated applicators or dual-compartment formats.

Lightweight plastic jars have improved shipping efficiency for online personal care sales. Growth in skin care routines and product layering trends has expanded the range of jar-packed SKUs. Specialty product lines targeting niche concerns like anti-aging, hydration, and sensitive skin have further propelled demand.

Regulatory compliance with cosmetic packaging standards has remained critical for multinational product distribution. Personal care is expected to remain the core market for single wall jars with continued product diversification.

Limited Barrier Protection and Structural Fragility

The single wall jars market can be hindered by their inferior barrier properties and poor structural strength for applications requiring long shelf life or product protection. Unlike double-wall or multilayer jars, single wall jars provide limited insulation and are not expected to protect against exposure to moisture, UV light, or oxygen making them unsuitable for high-end skin care, pharmaceuticals, or perishable goods. '

Furthermore, such jars that are commonly produced from light-weight plastic or glass might not also be impact resistant and may break, warp, or deform during transport or while stacked. This limits their application in heavy duty packaging environments and lowers brand preference on premium positioning.

Demand for Lightweight, Cost-Effective, and Customizable Packaging

Single wall jars can offer an excellent opportunity in markets that are driven by cost-efficient storage, functional aesthetics, and earthy packaging formed from eco-friendly materials. These types of packaging are used for cosmetics, personal care, food storage, supplements and do-it-yourself products where product visibility and light weight packaging are major selling points.

Minimalist packaging, small-batch production and e-commerce brands are bolstering the popularity of these clear, stackable, label-friendly single wall jars. New recyclable plastics, UV-resistant additives, and post-consumer resins (PCR) give some plastics an added environmentally friendly appeal. Also, many manufacturers are now offering custom mold designs, colour variations, and matte finishes to allow brands to achieve unique aesthetics without additional complexity or cost.

Growing demand from personal care, food, and wellness industries in the United States single wall jars market is fuelling this growth. Perfect as packaging for creams, lotions, balms, powders, and condiments, these jars are a cost-effective and versatile packaging solution for big and small brands alike.

The growth of shelf small-batch beauty brands and natural skincare products represents an area of demand for PET and polypropylene single wall jars, particularly those customized for custom labelling, tamper-evident seals, and sustainability packaging initiatives. Recyclability, visibility and to drive further adoption across e-commerce and retail shelves in the USA.

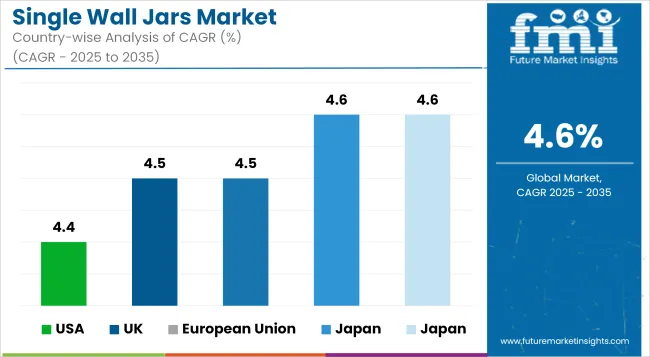

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

The UK singles wall jars market is growing at a stable rate due to the increasing trends of artisanal cosmetics, green food packaging, and do-it-yourself product manufacturing. Simple, recyclable jar formats that provide flexibility for branding and minimalistic aesthetics are in favour with consumers and businesses.

The UK is taking a harder stance on plastic waste and encouraging refillable beauty packaging, leading brands to choose mono-material jars from clear or frosted plastics. Producers of skincare, haircare, and organic food products find themselves favouring cost-efficient, ultra-lightweight single wall containers with easy-to-use closures.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

The European Union single wall jars market is experiencing steady growth, primarily due to stringent sustainable packaging regulations, growing applications spanning the nutraceutical and personal care industries, and a growing preference for minimalist packaging formats. Countries at the forefront of adopting single wall jars for creams, scrubs, dietary supplements, and condiments include Germany, France, and Spain.

At least a third of EU consumers want recyclable containers, free from BPA and harmful chemicals, as well as capable of being used in bulk and refill programs, as part of the bloc’s circular economy ambitions. To address the environmental concerns and compliance, manufacturers are also launching UV- resistant, biodegradable, and post-consumer recycled (PCR) jars.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

The Japan single wall jars market is moderately expanding due to the emphasis on packaging accuracy, optimizing storage solutions, and exciting consumer interests in design and functionality. You are equipped to cater to single wall jars that find applications in cosmetic samplers, health supplements, herbal creams, and specialty condiments where portability and aesthetic appeal is of paramount importance.

The Japanese manufacturers are exploring thin, transparent jars with excellent sealing property in small packaging formats. All these factors are conducive to the acceptance of polymer-based single wall jars in Japan as well, particularly the urban retail and personal care sectors emerging demand for refillable and recyclable containers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The South Korea single wall jars market is projected to grow at a steady rate, propelled by increasing K-beauty product exports, rising health and wellness packaging, and a shift toward minimalist, sustainable packaging designs. Skincare and cosmetic manufacturers prefer lightweight, stackable jars that improve shelf appeal with less material.

The local market trend is towards combination packs including kindred products, leading to greater use of mono layer jars out of recyclable plastic, and clear packaging solutions. These jars are also extensively used for herbal formulations, ointments, gels, and small-scale food things, and this emphasizes their versatility across the sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

Single wall jars are a large segment in the global packaging market driven by low-cost, durable, lightweight, and long-lasting containers used in personal care, cosmetics, pharmaceuticals, food packaging, etc which drives functionally led single wall jars market. Plastic screw jars are used for creams, powders, gels and dry foods, made mainly from PET, HDPE, PP and glass and offer reliable containment with easy screw or snap on lids.

Key players are working on sustainable resins, customizable formats, tamper-evident designs, and compatibility with automated filling lines. The market encompasses packaging specialists, plastic melding companies, and original container manufacturers, and supplies both original equipment manufacturers (OEMs) and private-label brands.

Other Key Players

The overall market size for the single wall jars market was USD 25.5 billion in 2025.

The single wall jars market is expected to reach USD 40.0 billion in 2035.

The increasing demand for lightweight and cost-effective packaging, rising use in personal care and cosmetic products, and growing preference for recyclable plastic containers fuel the single wall jars market during the forecast period.

The top 5 countries driving the development of the single wall jars market are the USA, UK, European Union, Japan, and South Korea.

Plastic-based single wall jars and cosmetics application lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Machine Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Single Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA