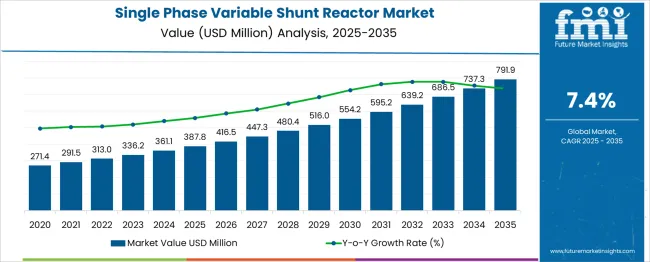

The single phase variable shunt reactor market is estimated to be valued at USD 387.8 million in 2025 and is projected to reach USD 791.9 million by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. Annual increments increase steadily, ranging from USD 28.7 million to USD 54.6 million, with no decline or alternating contraction across the timeline. The data presents a uniform upward trend, confirming the absence of short-term volatility, seasonal shifts, or cyclical compression. Markets influenced by seasonality often show repeated annual dips or spikes aligned with fiscal cycles, climate-linked demand, or consumption patterns.

Cyclical markets, by contrast, follow expansion and contraction phases linked to macroeconomic variables. This market does not show such behavior. Each year builds upon the previous one with progressively higher additions, indicating a low-risk, demand-stable environment. Long-cycle utility investments, smart grid upgrades, and substation voltage regulation projects primarily drive growth. These applications follow structured procurement plans and engineering schedules, independent of seasonal or short-term economic fluctuations. Based on the linear trend and continuous value accumulation, the single phase variable shunt reactor market does not exhibit seasonality or cyclicality. Growth remains anchored in infrastructure deployment timelines and grid modernization, providing consistent market performance throughout the forecast period.

| Metric | Value |

|---|---|

| Single Phase Variable Shunt Reactor Market Estimated Value in (2025 E) | USD 387.8 million |

| Single Phase Variable Shunt Reactor Market Forecast Value in (2035 F) | USD 791.9 million |

| Forecast CAGR (2025 to 2035) | 7.4% |

The market connects to five principal parent sectors, each influencing demand in unique ways. Power distribution systems account for roughly 32%, where reactors help utilities regulate voltage in medium-voltage lines. Close to 26% emerges from renewable energy integration, where grid-connected solar and wind installations require dynamic reactive power control. Industrial power networks contribute about 18%, using reactors to stabilize factory utility systems and motor loads.

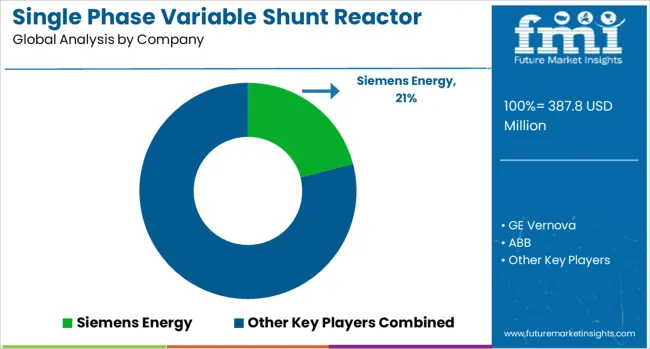

Substation control and protection market makes up approximately 14%, integrating reactor modules for fault suppression and voltage damping. The final 10% is linked to electrical infrastructure retrofit and smart grid modernization, where updating legacy substations with variable reactors improves flexibility and compliance with evolving grid codes. The single phase variable shunt reactor market is expanding as utilities seek advanced reactive power compensation for renewable rich grid systems. Leading providers include Hitachi Energy, Siemens Energy, General Electric, Toshiba Energy and Hyosung Heavy Industries.

These companies focus on modular reactor units designed for single phase switching applications integration with smart grid voltage regulation systems and real time control platforms. Asia Pacific leads growth due to rapid transmission expansion and decentralized renewable assets. Europe and North America invest in reactor solutions with predictive diagnostics and low loss coil materials to support grid stability and energy efficiency targets.

Increased integration of renewable energy sources and long-distance high-voltage power transmission systems has created greater demand for precise voltage control solutions. Variable shunt reactors are being increasingly deployed to manage voltage fluctuations and maintain power quality, especially under varying load conditions. The shift towards digital substations and intelligent grid infrastructure has further supported adoption, as real-time reactive power control becomes a critical component of grid performance.

Rising investments in transmission and distribution upgrades across developing regions are paving the way for significant future growth. Emphasis on reducing power losses, enhancing transmission capacity, and maintaining regulatory grid compliance is expected to reinforce the importance of advanced shunt reactor technologies, thereby solidifying market momentum in the coming years.

The single-phase variable shunt reactor market is segmented by insulation, end use, and geographic regions. The single-phase variable shunt reactor market is divided into oil-immersed and air-core. In terms of end use, the single-phase variable shunt reactor market is classified into Electric utility and Renewable energy. Regionally, the single-phase variable shunt reactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Its adoption has been further supported by its cost efficiency and reliability in outdoor substation environments where performance consistency is critical. Utilities have favored oil-immersed reactors due to their ease of maintenance and compatibility with traditional substation designs.

Moreover, advancements in oil purification and monitoring systems have enhanced operational safety and environmental compliance, enabling oil immersed reactors to remain the most trusted solution in high-demand grid applications. These factors collectively reinforce the leadership of this insulation segment within the overall market..

The adoption has also been influenced by the escalating integration of intermittent renewable sources such as wind and solar, which require advanced reactive compensation to stabilize output. Electric utilities have prioritized investment in flexible grid assets that enable real-time control, optimize transmission capacity, and reduce operational losses.

The regulatory push for improved power factor performance and grid modernization initiatives has further supported the inclusion of variable shunt reactors as a standard component in new and upgraded infrastructure. This sustained demand underscores the leading role of electric utilities in driving the expansion of this market.

Global interest in single phase variable shunt reactors (VSR) has increased as utilities and industrial sites pursue finer reactive power compensation with space-saving infrastructure. In 2024, approximately 34% of new reactive support projects in distribution networks utilized single phase VSR devices. Their compact footprint and single unit per feeder design offered flexibility in feeder-level voltage control. Adoption was strongest in Asia Pacific utilities seeking fast voltage stabilization, followed by Europe. Demand progressed in commercial and substation retrofit use cases where fixed reactors and capacitor banks were unable to match dynamic load variation.

Single phase VSR units were deployed to enhance voltage stability and reactive compensation on medium voltage distribution feeders. Approximately 38 % of utilities overseeing municipal grids installed these systems to manage variable renewable generation fluctuations. Units were able to auto-adjust inductance based on load changes, reducing network reactive load balancing time by up to 27 % versus manual switching. Electrical planners in utilities with high rooftop solar penetration specified them in nearly 44 % of substations for improved voltage ride-through performance. Rapid tap-changer response within single phase systems improved load profile control. These units were preferred where feeder unbalance or fluctuating current flows required phase-specific compensation without installing three-phase equipment per feeder.

Initial deployment of single phase variable shunt reactors faced capital cost premiums relative to fixed inductors, often exceeding 24 %. Additional investment was required for tap-changer motors, control relays, and protective automation devices. Installation complexity increased where integration with existing SCADA platforms or relay logic was needed, adding nearly 16 % to commissioning timelines. Skilled technical staff had to be deployed for calibration and programming of tap automation with voltage setpoints. Maintenance costs were elevated because each phase must be serviced individually. Debugging fault tap controllers was reported to cause delays in 8 % of projects. These factors slowed installation in utilities with limited staff or distributed rural feeders.

Opportunities are emerging as grid operators develop smart microgrid and feeder automation strategies integrating single phase VSRs at transformer RV points. Approximately 29 % of modern feeder automation programs now include phase-specific VAR support to maintain voltage stability. Pilot installations in commercial campuses, industrial zones, and solar parks have utilized single phase VSR designs as redundant reactive power options. Their modular form factor facilitated deployment within pad-mounted distribution cabinets. In hybrid urban feeders, these were used in combination with battery storage and capacitor banks to optimize power factor. Partnerships between automation integrators and utility companies are enabling standardized retrofit kits for phased feeder-level grid reinforcement.

Digital control panels with firmware-managed tap sequences were embedded in approximately 34 % of new single phase VSR units. Real-time monitoring of voltage, current, and reactive power enabled predictive fault detection in roughly 27 % of deployed systems. Remote firmware updates and online configuration interfaces were provided in 23 % of installations, reducing on-site service visits. Control logic automation allowed programmable sequences for adaptive reactive response to fault conditions. Compact skid-mounted units with plug-and-play interconnects lowered installation effort. Integration with advanced metering infrastructure was increasingly offered, improving system-wide coordination and remote operating efficiency in smart distribution projects.

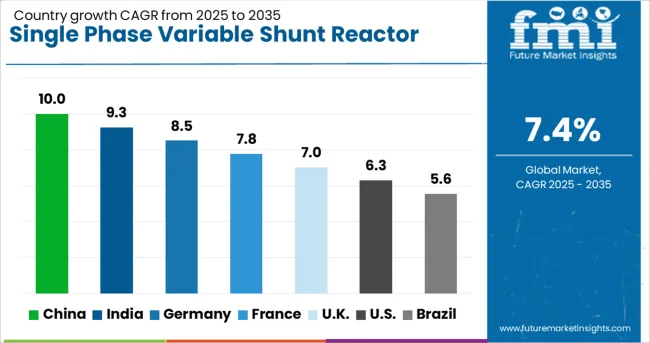

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

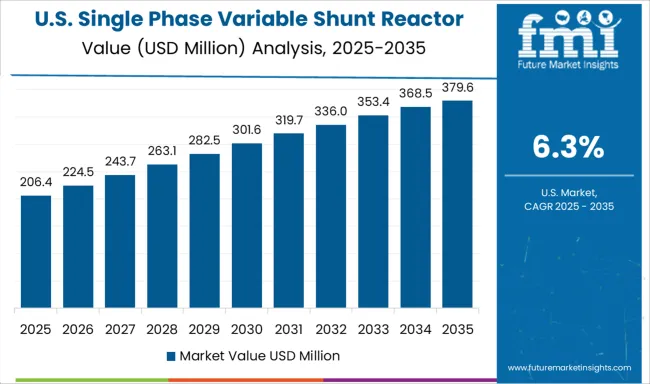

| USA | 6.3% |

| Brazil | 5.6% |

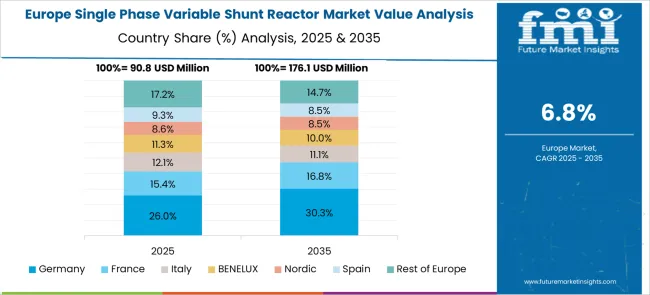

China, with a CAGR of 10.0%, is expanding at 35.1% above the global average due to increased grid modernization and voltage regulation efforts. India follows at 9.3%, performing 25.7% above the global trend, driven by electrification of remote regions and T&D infrastructure upgrades. Germany grows at 8.5%, about 14.9% faster than the global average, with energy transition policies fueling demand for reactive power compensation. The UK, at 7.0%, lags slightly behind the global rate by 5.4%, while the US, growing at 6.3%, trails by 14.9%. The report covers a detailed analysis of 40+ countries, with the top countries shared as a reference.

The market in China has gained traction due to large-scale grid modernization initiatives and heavy power transmission loads between the central and eastern provinces. State Grid Corporation and regional energy authorities have accelerated integration of shunt reactors in 220 kV and 500 kV lines to counteract reactive power imbalance during peak industrial demand. Local manufacturing bases, particularly in Jiangsu and Hunan, have adopted precision core-winding techniques and laminated insulation structures to improve performance reliability under voltage fluctuations. High-voltage R&D centers across the country have remained focused on cost-effective reactor designs capable of supporting load shedding without destabilizing substation parameters.

India has continued deploying variable shunt reactors in response to voltage regulation challenges in rural and inter-state grid corridors. Infrastructure upgrades under the Green Energy Corridor and Revamped Distribution Sector Scheme have created demand for modular and load-responsive reactor units in 132 kV to 400 kV ranges. Public sector utilities have issued tenders favoring units with real-time monitoring capabilities and dry-type insulation. Local manufacturers, particularly in Tamil Nadu and Gujarat, are developing compact variants tailored for substations with spatial limitations. Decentralized renewable energy projects in Rajasthan and Karnataka have triggered new opportunities for single phase reactive power management.

Germany has seen increased demand for high-efficiency single phase reactors due to ongoing energy transmission from wind-rich northern zones to industrial centers in the south. Operators of 380 kV lines are incorporating dynamic reactive power compensation to stabilize voltages under fluctuating wind feed-in. German engineering firms are focused on resin-insulated and self-cooled reactor systems for long-term deployment in decentralized substations. Integration of variable shunt reactors with advanced SCADA protocols is being pushed to improve grid response times and reduce system losses. System reliability mandates by Bundesnetzagentur have elevated performance benchmarks for reactor suppliers in both public and private tenders.

The United Kingdom has experienced measured growth in variable shunt reactor deployment across Scotland and northern England, primarily to manage voltage irregularities in wind-dominated energy corridors. Substation operators have shown preference for dual-core variable reactors designed to address reactive power absorption under fluctuating grid conditions. National Grid’s emphasis on grid decarbonization has prioritized smart-reactive compensation systems that seamlessly integrate with HVDC interconnectors. OEMs in the UK are advancing technologies focused on noise reduction and thermal stability for long-term installations. Retrofit projects in existing substations have also contributed to reactor demand as aging infrastructure is being gradually phased out.

In the United States, the market has been shaped by rising grid instability caused by uneven renewable power inflows across Western and Midwestern states. Investor-owned utilities and regional transmission operators have incorporated variable shunt reactors into voltage regulation schemes at 230 kV and 345 kV transmission levels. Emphasis has been placed on load-responsive units compatible with wide-area monitoring systems and PMU-supported dynamic analysis. Major USA manufacturers have focused on developing reactors with lower eddy-current losses and field-tuned air gaps to ensure real-time adaptability. Energy reliability programs under DOE have directed funding into testbeds for flexible grid hardware integration.

Manufacturers in the single phase variable shunt reactor market provide voltage control equipment used for reactive power compensation across transmission and sub-transmission networks. Siemens Energy offers single phase reactors designed for high-voltage applications, enabling real-time grid stabilization under fluctuating load conditions. The company supplies reactors with advanced tap changers for dynamic voltage regulation across long-distance transmission corridors. GE Vernova delivers field-proven single phase reactors integrated with remote monitoring capabilities, serving regional utilities that operate within mixed generation environments. ABB provides compact and high-efficiency shunt reactors supporting voltage balance and reduced transmission losses in high-load density regions.

These systems are used across Asia, Europe, and the Middle East in grids requiring stability under high renewable energy penetration. NR Electric manufactures reactors tailored for smart substation deployments, integrating digital control functions for precise voltage regulation. Fuji Electric offers low-loss designs compatible with compact substations in Japan and Southeast Asia. Nissin Electric produces reactors engineered for prolonged life cycles in humid or thermally dynamic conditions, while Hyosung Heavy Industries supplies robust single phase reactors to utilities across South Korea and the Middle East.

Between 2023 and mid-2025, the single-phase variable shunt reactor (VS SR) market progressed via large-grid contracts, product enhancements, and supply expansion by leading OEMs. Siemens Energy expanded compact, low-loss reactor modules suitable for urban substations and offshore wind corridors. GE Vernova won a major order to supply over 70 high-voltage reactors and transformers to India’s POWERGRID, with deliveries beginning in 2026.

ABB continued offering modular designs with digital monitoring for reactive power control. Hitachi Energy provided single-phase reactors to Europe’s grid operators as part of renewable integration projects. Hyosung Heavy Industries and Nissin Electric invested in Asia Pacific capacity expansions for voltage regulation systems. Coil Innovation brought space-saving, oil-immersed reactors tailored to distribution networks constrained by footprint. Manufacturers emphasized reliability, real-time control, and scalable deployment across evolving smart grids.

| Item | Value |

|---|---|

| Quantitative Units | USD 387.8 Million |

| Insulation | Oil immersed and Air core |

| End Use | Electric utility and Renewable energy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, GE Vernova, ABB, NR Electric, Fuji Electric, Nissin Electric, and Hyosung Heavy Industries |

| Additional Attributes | Dollar sales by reactor type (air-core, magnetic-core) and application (voltage regulation, harmonic filtering in distribution networks), demand from utilities, renewable-heavy grids, and industrial feeders; regional trends led by Asia Pacific with North America catching up, innovation in compact modular design, remote control via IoT, and environmental benefits through improved power quality, lower losses, and support for sustainable grid operations. |

The global single phase variable shunt reactor market is estimated to be valued at USD 387.8 million in 2025.

The market size for the single phase variable shunt reactor market is projected to reach USD 791.9 million by 2035.

The single phase variable shunt reactor market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in single phase variable shunt reactor market are oil immersed and air core.

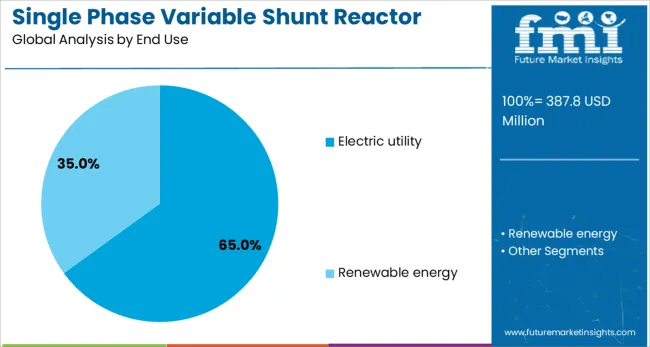

In terms of end use, electric utility segment to command 65.0% share in the single phase variable shunt reactor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single-Mode Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Single-Coated Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Single Superphosphate (SSP) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Electron Transistor Market Size and Share Forecast Outlook 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Use Pallet Market Size and Share Forecast Outlook 2025 to 2035

Single Serve Coffee Container Market Size, Share & Forecast 2025 to 2035

Single Wall Jars Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA