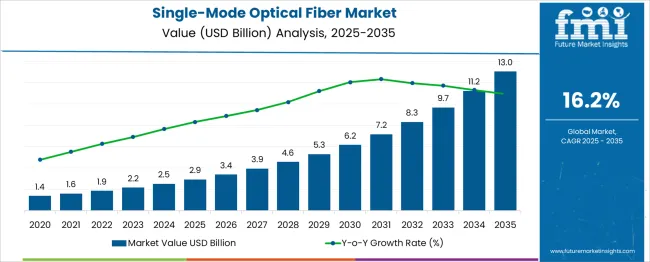

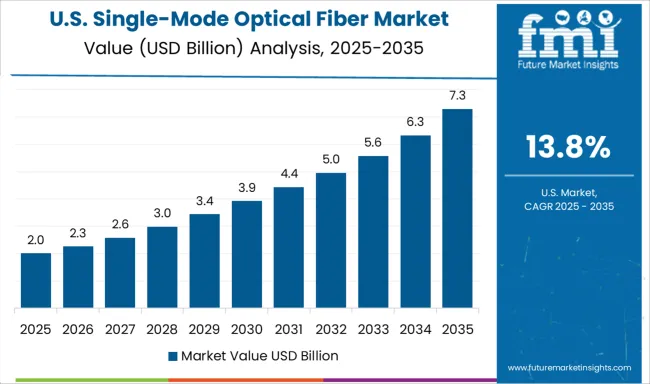

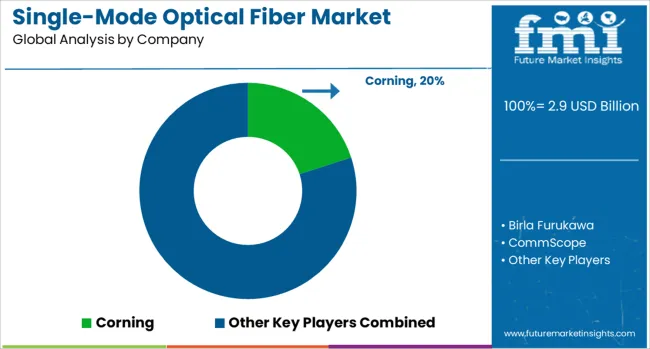

The Single-Mode Optical Fiber Market, valued at USD 2.9 billion in 2025, is projected to reach USD 13.0 billion by 2035, expanding at a CAGR of 16.2% over the decade. This strong trajectory highlights the critical role of single-mode fibers in supporting next-generation data transmission needs across telecom, cloud computing, and hyperscale data centers. The market’s year-over-year (YoY) growth between 2025 and 2030 underscores an accelerating demand pattern. From 2025 to 2026, the market grows from USD 2.9 billion to 3.4 billion, a YoY increase of 17.2%. In 2027, it rises to USD 3.9 billion (+14.7% YoY), followed by USD 4.6 billion in 2028 (+17.9%). Growth continues with USD 5.3 billion in 2029 (+15.2%) and reaches USD 6.2 billion in 2030, marking a 17.0% increase. These figures indicate strong annual momentum, consistently above 14%, reflecting escalating investments in 5G infrastructure, long-distance backbone networks, and high-bandwidth cloud services. As digital traffic surges globally, telecom operators and internet providers are expanding optical fiber installations to ensure low latency and high-capacity transmission. Single-mode fiber’s ability to carry signals over longer distances with minimal loss makes it essential for future-proof network architecture.

| Metric | Value |

|---|---|

| Single-Mode Optical Fiber Market Estimated Value in (2025 E) | USD 2.9 billion |

| Single-Mode Optical Fiber Market Forecast Value in (2035 F) | USD 13.0 billion |

| Forecast CAGR (2025 to 2035) | 16.2% |

The single mode optical fiber market is advancing steadily, propelled by surging demand for high bandwidth communication and long-distance data transmission capabilities. Adoption is being reinforced by the proliferation of 5G infrastructure, cloud computing, and hyperscale data centers which require low attenuation and high-speed connectivity.

Growing investments in fiber to the home projects and undersea cable installations are further accelerating the shift from legacy copper to optical fiber networks. Future growth is expected to be driven by innovations in fiber materials and installation techniques that lower costs while enhancing performance.

Regulatory initiatives aimed at improving digital infrastructure, coupled with the rising need for reliable and energy-efficient networks, are paving the way for broader deployment across emerging and developed economies alike. Continuous technological advancements in manufacturing and splicing techniques are also creating new opportunities for scale and efficiency.

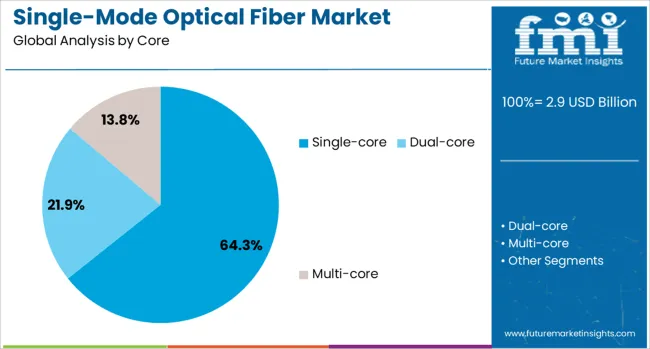

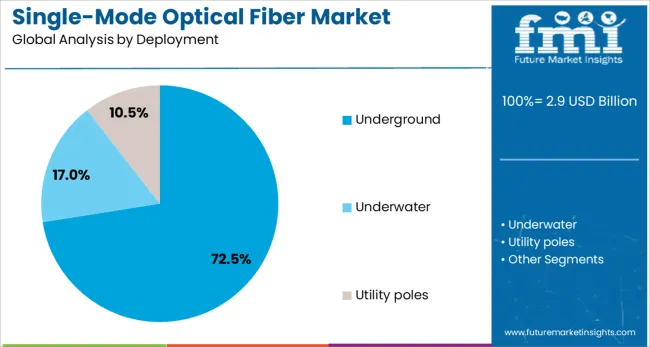

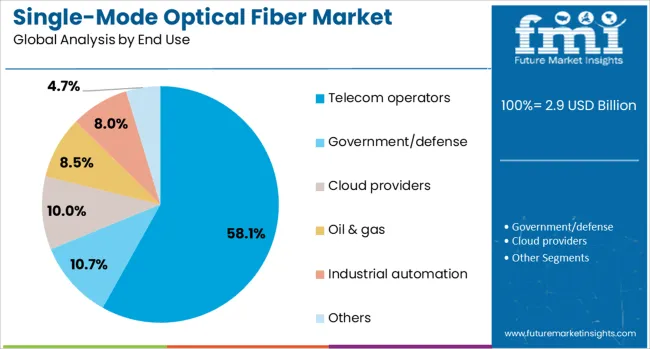

The single-mode optical fiber market is segmented by core, deployment, end use, and geographic regions. By core, the market is divided into single-core, dual-core, and multi-core. In terms of deployment, the market is classified into underground, underwater, and utility poles. Based on end use, the market is segmented into telecom operators, government & defense, cloud providers, oil & gas, industrial automation, and others. Regionally, the single-mode optical fiber industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by core, the single core segment is projected to hold 64.3% of the total market revenue in 2025, making it the dominant subsegment. This leadership has been supported by the simplicity and efficiency of single core designs in facilitating high-speed, long-distance signal transmission with minimal loss.

The ability to achieve superior performance in point-to-point communication links while minimizing cross-talk and interference has reinforced its adoption across large-scale networks. Enhanced durability and ease of integration into existing infrastructures have also been critical factors enabling widespread use.

Advances in manufacturing processes have allowed single core fibers to meet escalating demands of telecom and data center applications efficiently, solidifying their position as the preferred choice for most deployments.

By deployment, the underground segment is expected to account for 72.5% of the market revenue in 2025, establishing itself as the leading deployment method. This dominance has been shaped by its proven reliability and resilience against environmental factors, physical damage, and unauthorized access.

Underground installation has been increasingly preferred for its ability to ensure uninterrupted network performance while protecting fibers from weather, vandalism, and accidental cuts. The lower long-term maintenance costs and compliance with urban planning regulations have further strengthened its market position.

Enhanced trenching techniques and micro-duct innovations have facilitated faster and more cost-effective underground installations, making this deployment method the standard choice for high-capacity and mission-critical networks.

Segmented by end use, telecom operators are projected to capture 58.1% of the market revenue in 2025, positioning themselves as the largest end user segment. This leadership has been reinforced by their strategic focus on expanding fiber-based networks to support 5G, broadband, and enterprise connectivity.

Telecom operators have increasingly prioritized single mode optical fibers to meet rising bandwidth demands and deliver reliable services to both residential and commercial customers. Their ability to invest heavily in infrastructure, scale deployments rapidly, and leverage economies of scale has contributed significantly to the growth of this segment.

The focus on achieving competitive differentiation through superior network performance and future-ready infrastructure has further anchored telecom operators at the forefront of the market.

Single-mode optical fiber continues to see growing demand as global investments in 5G, data centers, and national broadband infrastructure intensify. Its superior transmission over long distances makes it ideal for backbone, fronthaul, and interconnect networks. Telecom and cloud providers are increasingly standardizing on single-mode for future-ready connectivity.

Telecom operators and hyperscale data centers continue to expand single-mode fiber deployments in long-haul and regional networks due to its lower attenuation and higher bandwidth over long distances. As 5G backhaul and high-speed broadband coverage grow, operators favor single-mode optical fiber for its ability to transmit signals efficiently over many kilometers with minimal signal degradation. Countries investing in nationwide fiber rollout, such as India, Brazil, and parts of Southeast Asia, are creating sustained demand. Network operators require fiber that supports high-density, low-latency connections for cloud infrastructure, content delivery, and IoT integration. Fiber manufacturers with high-volume production capacity and compliance with ITU-T G.652, G.654, and newer standards are well positioned. Government mandates to expand digital infrastructure and support for rural broadband connectivity also reinforce the adoption of single-mode fiber. Regional vendors partnering with telecom providers are gaining significant contracts, particularly where public-private fiber rollout models are active.

The rollout of 5G networks is increasing the demand for fiber-to-the-antenna (FTTA) connections, with single-mode optical fiber becoming a key component in linking radio units to baseband units. Due to the high-frequency and high-data-rate nature of 5G, fiber infrastructure must support dense fronthaul and backhaul connections with ultra-low latency and high reliability. Single-mode fiber provides the performance necessary for 5G radio access networks, particularly in urban zones where network densification is underway. Carriers are deploying thousands of small cell base stations, each requiring robust, interference-resistant fiber connections. This has led to increased orders for bend-insensitive, high-strength single-mode fibers that can be installed in tight urban pathways. Fiber producers offering pre-connectorized cable systems and micro-duct compatible designs are capturing share in this fast-moving segment. As operators seek to future-proof their mobile networks, the transition to all-fiber fronthaul and backhaul solutions remains a central strategy.

Global growth in hyperscale and edge data centers is accelerating the demand for high-performance single-mode optical fiber in interconnect and campus backbone applications. Data center operators require low-loss, high-bandwidth fiber to support massive data transfers across racks, buildings, and geographically dispersed facilities. Single-mode fiber allows for high-capacity links over long distances without repeaters, making it essential for connecting core, metro, and cloud infrastructure. As workloads increase due to AI, streaming, and big data, operators are upgrading to 100G, 400G, and 800G links, further fueling demand for OS2 and G.654.E fiber types. Pre-terminated cable assemblies and low-latency fiber routing systems are also seeing increased adoption. Fiber providers are tailoring solutions for hyperscalers by offering customized lengths, bend performance, and jacket materials suited for structured cabling environments. Investment in regional data hubs, especially in North America and Western Europe, continues to reinforce market stability for high-grade single-mode fiber.

Despite strong demand for single-mode fiber in national broadband and mobile backhaul projects, deployment in rural and hard-to-reach areas faces logistical and technical hurdles. Installation often involves trenching over large distances, navigating rough terrain, or dealing with limited infrastructure such as poles or conduits. These constraints increase the cost per kilometer for rural fiber rollout and delay project timelines. Additionally, skilled labor shortages in rural areas slow the deployment of high-performance optical networks. While wireless alternatives may suffice temporarily, operators prefer single-mode fiber for long-term bandwidth and reliability. Governments offering subsidies or low-interest financing for rural broadband expansion have spurred some progress, but the pace remains slower than in urban zones. Fiber manufacturers and service integrators are investing in aerial drop solutions, compact fiber spools, and rapid-deployment kits to address this issue. Continued innovation in installation techniques is critical to unlocking demand in under-connected regions.

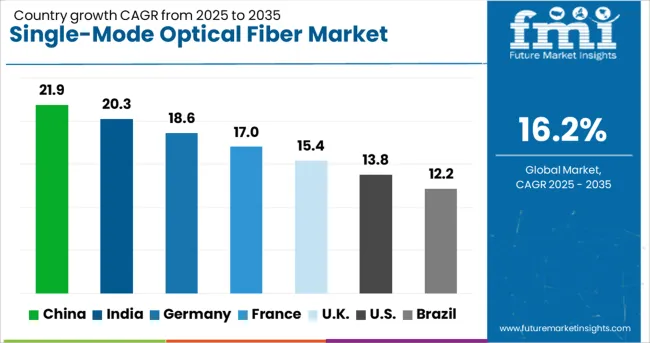

| Country | CAGR |

|---|---|

| China | 21.9% |

| India | 20.3% |

| Germany | 18.6% |

| France | 17.0% |

| UK | 15.4% |

| USA | 13.8% |

| Brazil | 12.2% |

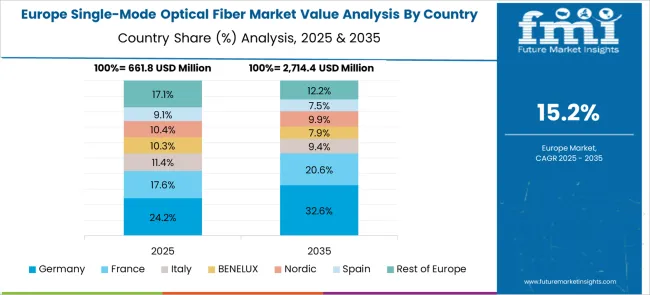

The global Single-Mode Optical Fiber Market is anticipated to grow at a CAGR of 16.2% through 2035, supported by rising deployment in telecommunications, data centers, and long-distance transmission networks. Among BRICS nations, China leads with 21.9% growth, driven by large-scale fiber rollout and public network upgrades. India follows at 20.3%, where nationwide connectivity programs and telecom expansions have boosted demand. In the OECD region, Germany reports 18.6% growth, supported by standard-compliant production and investments in fiber infrastructure. France, growing at 17.0%, has expanded its fiber-to-the-home (FTTH) coverage across urban and rural areas. The United Kingdom, at 15.4%, reflects ongoing installation in broadband backbones and enterprise networks. Market trends have been shaped by spectrum allocation rules, installation codes, and procurement requirements across public and private sectors. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Considerable momentum has been observed in China for single-mode optical fiber, with a robust CAGR of 21.9% driving deployments across telecom corridors and enterprise grids. Major cities have been outfitted with dense fiber rings to enable consistent traffic flow and bandwidth stability. Multi-region data centers have adopted zero dispersion fibers to reduce signal distortion across core layers. Construction of long-haul fiber routes has been supported by regional authorities to address rising data loads. Provincial networks have relied on single-mode infrastructure for scalable urban-to-rural access. High-volume domestic manufacturing has satisfied demand for G.652D and bend-insensitive variants. Industrial zones have utilized armored fiber for mechanical resilience in underground installations. State-led broadband programs have accelerated passive fiber integration for mass-scale coverage.

Growth in single-mode optical fiber across India has been reinforced by national connectivity targets and expanding digital infrastructure, registering a CAGR of 20.3%. Single-mode fiber has been integrated into 5G tower backhaul and rural telecom expansion programs. Government-backed schemes have prioritized low-attenuation fiber for uninterrupted transmission across long distances. Data requirements from educational and healthcare institutions have increased installations of G.657A fibers for consistent throughput. Metro rail corridors and smart public facilities have featured fiber links to support synchronized command systems. Enterprise parks have opted for ribbon fiber bundles to support multiple concurrent lines. Utility and grid networks have been embedded with OPGW systems for dual-use performance. Public-private partnerships have driven installation volumes in underserved areas.

Strategic deployment of single-mode optical fiber in Germany has been accelerating at a CAGR of 18.6%, aligned with infrastructure modernization and digital system integration. Edge data centers and cloud zones have migrated to low-loss fiber for stable transmission under dense workloads. Industrial automation corridors have employed ribbon cable systems to ensure synchronized operations between networked machines. Underground ducting along highway and rail routes has been updated with armored cable to maintain uninterrupted signal flow. Fixed-line broadband providers have used single-mode architecture for suburban expansion and urban upgrades. Cross-border telecom carriers have expanded interconnection capacity using zero water peak fibers. Residential access points have transitioned to FTTH connections with in-line splitters. Local government incentives have enabled multi-district fiber grid installations.

Implementation of single-mode optical fiber infrastructure across France has moved steadily forward at a CAGR of 17.0%, with activity centered in residential networks, business parks, and metro transport grids. Service providers have replaced outdated cabling with single-mode fiber for long-distance clarity and minimal loss. Dedicated connections have been provided to medical and academic facilities requiring real-time data transfer. Underground loops for rail and road systems have incorporated single-mode cable to support automated monitoring. Rollouts of passive optical networks have used dry-core fiber for moisture resistance in humid regions. Commercial properties have been linked with compact fiber assemblies to streamline building integration. Inter-regional bandwidth routing has been supported by high-durability single-mode cable. Deployment techniques have favored duct-in-duct architecture for flexibility.

Adoption of single-mode optical fiber in the United Kingdom has been progressing at a CAGR of 15.4%, guided by regional broadband programs and cloud facility interconnection. High-speed data corridors have been enhanced through single-mode backbones spanning business clusters and transport hubs. Underground fiber paths in flood-prone zones have used water-blocking cable variants for protection. Residential fiber installations have been managed through micro-trenching and modular enclosures for reduced disruption. Point-to-point fiber layouts have been favored in multi-tenant buildings and tech campuses. Strategic partnerships between telecom firms and housing developers have enabled pre-installed fiber frameworks. Legacy copper systems have been decommissioned and replaced with low-attenuation fiber for stability. Metro data exchange hubs have adopted bend-insensitive cable to reduce routing constraints.

The single-mode optical fiber market is driven by key global manufacturers offering high-performance fiber solutions for telecommunications, data centers, and broadband infrastructure. Corning stands as a dominant player, known for its pioneering innovations in low-loss optical fiber and extensive deployment across global networks. Fujikura, Furukawa, and Sumitomo Electric are also leading suppliers from Japan, providing advanced single-mode fiber solutions widely adopted in high-speed long-distance transmission and 5G backbone networks. Prysmian and Nexans, based in Europe, are key players delivering large-scale fiber optic cable systems tailored for telecom operators and enterprise networks. HTGD (Hengtong Group) and Yangtze Optical Fiber and Cable are among the most prominent suppliers in China, recognized for their significant production capacity and growing presence in international markets.

CommScope and LS Cable and System support global demand with reliable fiber connectivity solutions for both core and access networks. Birla Furukawa, a joint venture combining Indian and Japanese expertise, focuses on precision manufacturing of single-mode fibers used in both domestic and export markets. Humanetics and other emerging players contribute to niche applications and customized deployments, supporting market segments such as defense, medical imaging, and smart infrastructure. As global internet traffic grows and fiber-to-the-home (FTTH) initiatives expand, suppliers are focusing on consistent attenuation performance, bend-insensitive designs, and compatibility with high-density installations. The market is shaped by rising data consumption, the rollout of 5G, and investments in undersea and terrestrial fiber networks, demanding scalable and future-ready fiber solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Core | Single-core, Dual-core, and Multi-core |

| Deployment | Underground, Underwater, and Utility poles |

| End Use | Telecom operators, Government/defense, Cloud providers, Oil & gas, Industrial automation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Corning, Birla Furukawa, CommScope, Fujikura, Furukawa, HTGD, Humanetics, LS Cable and System, Nexans, Prysmian, Sumitomo Electric, and Yangtze Optical Fiber and Cable |

| Additional Attributes | Dollar sales by single-mode optical fiber type including G.652, G.653, G.654, and G.655 variants, by application in telecommunications, data centers, enterprise networks, and military and aerospace, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by 5G rollout, cloud computing expansion, and high-speed internet adoption; innovation in bend-insensitive fibers, ultra-low-loss transmission, and compact cable designs; costs influenced by raw material prices, fiber drawing technology, and deployment infrastructure; and emerging use cases in submarine communications, smart city grids, and next-gen IoT connectivity. |

The global single-mode optical fiber market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the single-mode optical fiber market is projected to reach USD 13.0 billion by 2035.

The single-mode optical fiber market is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types in single-mode optical fiber market are single-core, dual-core and multi-core.

In terms of deployment, underground segment to command 72.5% share in the single-mode optical fiber market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA