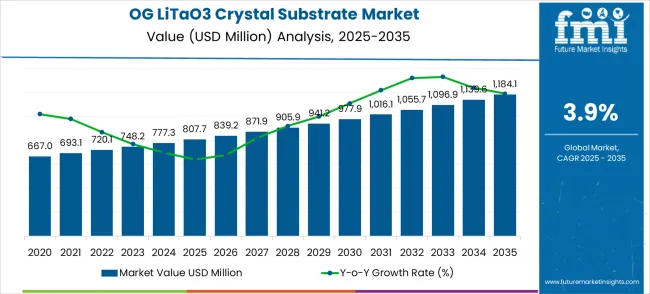

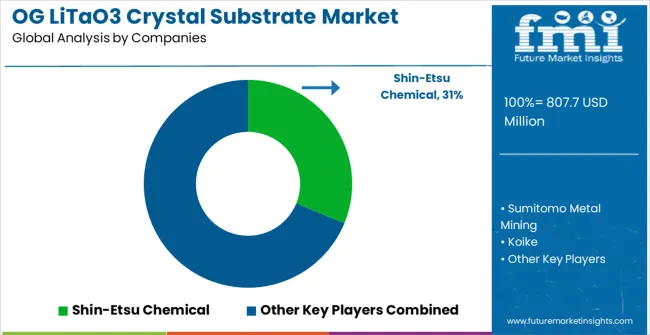

The optical grade LiTaO3 crystal substrate market is anticipated to grow from USD 807.7 million in 2025 to USD 1,184.1 million by 2035, registering a CAGR of 3.9%. The market exhibits a consistent growth trajectory, yet when examined through a rolling CAGR lens, variations in annualized growth rates provide deeper insights into market dynamics. The initial phase between 2025 and 2027 shows a slightly higher effective CAGR, driven by rising demand from the optical and photonics sectors. Technological advancements in optoelectronic devices and increasing adoption of LiTaO3 substrates in high-precision applications contribute to early momentum, creating a front-loaded growth pattern in the market’s first biennium.

From 2027 to 2030, the rolling CAGR demonstrates mild deceleration as the market value increases from approximately USD 856 million to USD 920 million. This phase reflects a temporary plateau where adoption slows due to supply constraints, pricing pressures from alternative crystal substrates, and cautious capital investments in new production facilities. Manufacturers focus on optimizing yield and reducing defect rates, which stabilizes market performance while slightly lowering the annualized growth rate. The rolling CAGR highlights that, despite slower expansion, the market maintains steady progression due to sustained demand in optical communications, surface acoustic wave devices, and laser-based instrumentation.

| Parameter | Value |

|---|---|

| Market Value (2025) | USD 807.7 million |

| Market Forecast Value (2035) | USD 1,184.1 million |

| Market Forecast CAGR | 3.9% |

The period from 2030 to 2033 marks a rebound in the rolling CAGR, as the market value climbs from around USD 988 million to USD 1,075 million. Accelerated growth during this phase is driven by the integration of LiTaO3 substrates in emerging applications such as terahertz photonics, quantum computing components, and next-generation optical modulators. The rolling CAGR illustrates that targeted innovation and strategic partnerships with device manufacturers enhance market expansion. Volume growth aligns with increased production capacity and reduced lead times, which collectively boost effective annual growth despite earlier slowdowns.

Finally, between 2033 and 2035, the market approaches USD 1,184.1 million, with rolling CAGR stabilizing near the overall 3.9% mark. This convergence indicates that while short-term fluctuations occur due to supply-demand dynamics and technological adoption cycles, the market retains a predictable long-term trajectory. The rolling CAGR analysis underscores the importance of monitoring intra-period growth rates to identify temporary accelerations and decelerations, enabling manufacturers and investors to optimize production planning and capital allocation in the market.

Optical Grade LiTaO3 Crystal Substrate Market Opportunity Pools

The Optical Grade LiTaO3 Crystal Substrate market is entering a new phase of growth, driven by demand for advanced telecommunications, semiconductor innovation expansion, and evolving 5G and photonics standards. By 2035, these pathways together can unlock USD 165-210 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- 5G Communication Leadership (Telecommunications Infrastructure) The 5G communication segment already holds the largest share due to its critical performance requirements and infrastructure expansion. Expanding network deployment, frequency optimization, and telecommunications partnerships can consolidate leadership. Opportunity pool: USD 55-75 million.

Pathway B -- 6-Inch Substrate Excellence (Manufacturing Optimization) 6-inch substrates account for the majority of demand. Growing semiconductor focus on production efficiency and yield optimization will drive higher adoption of advanced 6-inch crystal substrates. Opportunity pool: USD 45-60 million.

Pathway C -- Optoelectronic Device & Photonics Growth Advanced optoelectronic devices and photonic systems markets are expanding, especially in data center and optical communication applications. Substrates optimized for optical devices can capture significant growth. Opportunity pool: USD 25-35 million.

Pathway D -- Emerging Market Expansion Asia-Pacific, Middle East, and Latin America present growing demand due to rising telecommunications infrastructure and semiconductor manufacturing. Targeting production networks and technology partnerships will accelerate adoption. Opportunity pool: USD 20-30 million.

Pathway E -- SAW filters, others With advancing wireless technologies and IoT expansion, there is opportunity to develop specialized substrates for surface acoustic wave filters and radio frequency applications. Opportunity pool: USD 15-25 million.

Pathway F -- Large Format & Specialty Sizes 8-inch and 12-inch substrates offer premium positioning for advanced semiconductor fabrication and research applications requiring larger processing areas. Opportunity pool: USD 10-15 million.

Pathway G -- Advanced Crystal Quality & Processing Premium substrates with enhanced optical properties, ultra-low defect density, and specialized crystal orientations create high-value opportunities for cutting-edge applications. Opportunity pool: USD 8-12 million.

Pathway H -- Next-Generation Technologies & 6G Preparation Integration with future telecommunications technologies, quantum devices, and advanced photonic systems positions substrates for next-generation applications. Opportunity pool: USD 5-8 million.

Why is the Optical Grade LiTaO3 Crystal Substrate Market Growing?

Market expansion is being supported by the rapid increase in telecommunications infrastructure development worldwide and the corresponding need for high-performance crystal substrates that provide superior electro-optical performance and thermal stability. Modern telecommunications systems rely on consistent signal processing quality and component reliability to ensure optimal network performance including 5G base stations, optical communication systems, and advanced electronic devices. Even minor substrate quality variations can require comprehensive system protocol adjustments to maintain optimal signal integrity and operational performance.

The growing complexity of telecommunications technology requirements and increasing demand for high-frequency electronic solutions are driving demand for optical grade LiTaO3 crystal substrates from certified manufacturers with appropriate semiconductor capabilities and crystal growth expertise. Telecommunications equipment companies are increasingly requiring documented substrate quality and material performance to maintain system reliability and operational efficiency. Industry specifications and technical standards are establishing standardized crystal substrate procedures that require specialized growth technologies and trained semiconductor professionals.

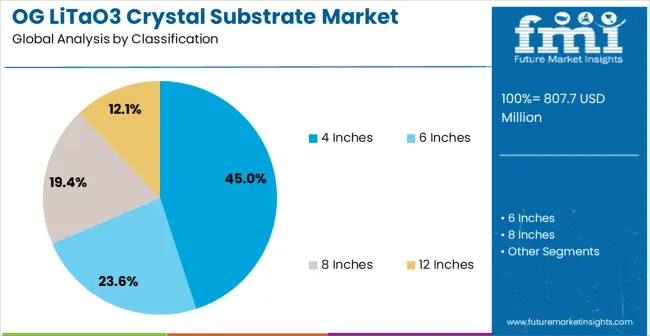

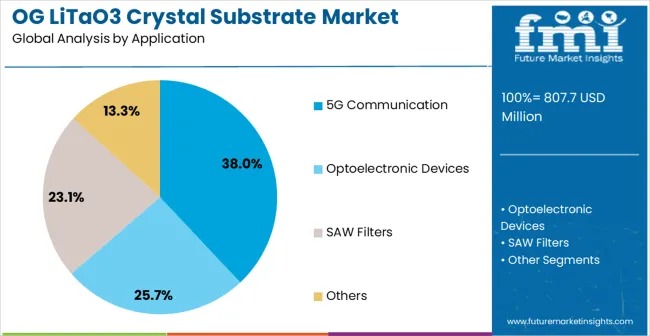

The market is segmented by substrate type, application, and region. By substrate type, the market is divided into 4 inches, 6 inches, 8 inches, and 12 inches. Based on application, the market is categorized into 5G communication, optoelectronic devices, SAW filters, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the 6 inches’ optical grade LiTaO3 crystal substrate segment is projected to capture around 45% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of medium-sized substrates that provide optimal manufacturing efficiency and device scalability, catering to a wide variety of telecommunications and optoelectronic applications. The 6-inch substrate is particularly favored for its ability to deliver cost-effective production volumes while maintaining high crystal quality and manufacturing yield, ensuring commercial viability. Semiconductor fabrication facilities, telecommunications equipment manufacturers, and optoelectronic device producers increasingly prefer this size, as it meets diverse production requirements without imposing excessive manufacturing complexity or equipment investment. The availability of well-established crystal growth processes, along with comprehensive quality control standards and technical support from leading substrate manufacturers, further reinforces the segment's market position. Additionally, this substrate size benefits from consistent demand across regions, as it is considered a versatile solution for manufacturers requiring reliable crystal substrates for medium to high-volume production. The combination of manufacturing efficiency, quality reliability, and cost-effectiveness makes 6-inch optical grade LiTaO3 crystal substrates a preferred choice, ensuring their continued dominance in the semiconductor substrate market.

The 5G communication segment is expected to represent 38% of optical grade LiTaO3 crystal substrate demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the critical role of lithium tantalate substrates in 5G telecommunications infrastructure, where precise electro-optical properties and high-frequency performance are essential to network functionality. 5G communication systems often require specialized components that enable optimal signal processing throughout various frequency bands and network configurations, requiring high-quality and reliable substrate materials. Optical grade LiTaO3 crystal substrates are particularly well-suited to 5G applications due to their excellent electro-optical coefficients and thermal stability, even in demanding high-frequency operating conditions. As 5G network deployment continues to expand globally and telecommunications companies emphasize improved network performance standards, the demand for optical grade LiTaO3 crystal substrates continues to rise. The segment also benefits from increased investment within the telecommunications industry, where operators are increasingly prioritizing component quality and system reliability as differentiators to deliver superior network performance and coverage. With telecommunications infrastructure requiring advanced materials technology and performance optimization, optical grade LiTaO3 crystal substrates provide an essential solution to maintain effective signal processing while enabling next-generation network capabilities. The growth of advanced 5G technologies, coupled with increased focus on network infrastructure development, ensures that 5G communication applications will remain the largest and most stable demand driver for optical grade LiTaO3 crystal substrates in the forecast period.

The market is advancing steadily due to increasing telecommunications infrastructure development and growing recognition of lithium tantalate crystal advantages over conventional substrate materials. However, the market faces challenges including higher material costs compared to standard substrates, need for specialized crystal growth equipment and expertise, and varying technical specifications across different high-tech applications. Quality assurance efforts and crystal technology advancement programs continue to influence substrate development and market adoption patterns.

The growing development of advanced crystal growth technologies is enabling superior substrate quality with improved optical clarity and enhanced material uniformity characteristics. Enhanced crystal growth processes and optimized manufacturing techniques provide high-quality substrates while maintaining consistent material properties. These technologies are particularly valuable for semiconductor manufacturers who require reliable substrate performance that can support demanding high-tech applications with consistent quality results.

Modern optical grade LiTaO3 crystal substrate manufacturers are incorporating advanced quality features and processing improvements that enhance semiconductor compatibility and device effectiveness. Integration of advanced quality control systems and optimized fabrication processes enables superior substrate consistency and comprehensive manufacturing capabilities. Advanced quality features support use in diverse high-tech environments while meeting various technical requirements and performance specifications.

| Country | CAGR (2025–2035) |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| Brazil | 4.1% |

| United States | 3.7% |

| United Kingdom | 3.3% |

| Japan | 2.9% |

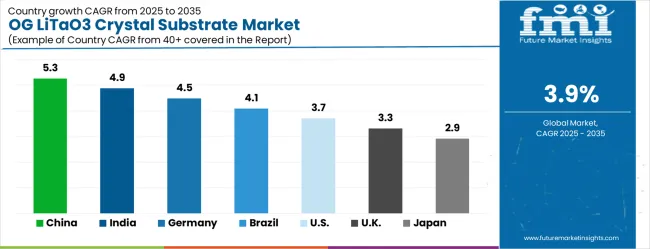

The market is growing steadily, with China leading at a 5.3% CAGR through 2035, driven by strong semiconductor manufacturing development and increasing adoption of advanced telecommunications infrastructure. India follows at 4.9%, supported by rising electronics manufacturing capabilities and growing awareness of high-performance substrate solutions. Germany grows steadily at 4.5%, integrating LiTaO3 crystal technology into its established semiconductor and telecommunications infrastructure. Brazil records 4.1%, emphasizing electronics industry modernization and telecommunications advancement initiatives. The United States shows solid growth at 3.7%, focusing on technological innovation and semiconductor manufacturing excellence. The United Kingdom demonstrates steady progress at 3.3%, maintaining established high-tech manufacturing applications. Japan records 2.9% growth, concentrating on technology advancement and crystal quality optimization.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China recorded a 5.3% CAGR, driven by rapid growth in photonics, optoelectronics, and telecommunication industries. Manufacturers focused on producing high-purity LiTaO3 crystal substrates with precise orientation, low defect density, and superior surface finishing for lasers, modulators, and optical sensors. Adoption was strongest among optical communication networks, industrial R&D labs, and defense electronics. Competitive strategies emphasized partnerships with optoelectronic firms, regional production expansion, and extensive research in crystal growth and post-processing techniques. Growth was further reinforced by government initiatives promoting advanced photonics infrastructure, domestic manufacturing, and export-oriented production. Manufacturers also targeted international standards compliance to strengthen global competitiveness while optimizing yield, cost efficiency, and substrate quality for high-demand applications across telecommunication, laser technologies, and industrial optics.

India demonstrated a 4.9% CAGR, supported by increasing investments in optical communication networks, photonics research, and laser-based applications. Manufacturers emphasized scalable, high-purity, and low-defect crystal substrates suitable for modulators, sensors, and precision optical devices. Adoption was highest in defense optics, telecom infrastructure, research labs, and industrial laser applications. Competitive strategies included collaborations with academic institutions and global suppliers, in-house R&D for improving crystal yield and surface finishing, and expansion of localized production. Government initiatives encouraging optical technology development and telecommunication modernization further strengthened market growth. Focus was also placed on cost-effective production, quality compliance, and export opportunities, enabling Indian manufacturers to expand across domestic and regional high-technology sectors while meeting growing demand for high-performance optical substrates.

Germany advanced at a 4.5% CAGR, driven by industrial laser, photonics, and high-precision optical device applications. Manufacturers emphasized high-quality substrates with exact orientation, low defect density, thermal stability, and superior optical performance. Adoption was highest among industrial R&D labs, photonics research centers, laser modulators, and sensor systems. Competitive strategies included partnerships with high-tech firms, investment in automation, and compliance with strict EU standards. Research focused on process optimization, crystal growth innovations, and defect reduction to improve yield and performance consistency. Germany’s strong emphasis on quality engineering, export potential, and industrial automation reinforced demand for reliable and advanced crystal substrates while supporting both domestic and global applications in telecommunications, lasers, and industrial optics.

Brazil recorded a 4.1% CAGR, supported by growing photonics research, industrial optics, and telecommunication infrastructure development. Manufacturers emphasized high-purity, defect-free crystal substrates for modulators, sensors, and laser applications. Adoption was strongest among research institutions, telecom companies, and industrial R&D facilities. Competitive strategies included collaborations with local universities, technology transfer agreements, regional manufacturing expansion, and process optimization to improve yield and surface quality. Growth was reinforced by government incentives for research and optical technology development, along with increasing industrial automation and defense optics requirements. Companies focused on cost-effective production, regional availability, and standard compliance to meet domestic and neighboring market demand for high-performance optical-grade LiTaO3 substrates.

The United States achieved a 3.7% CAGR, driven by advanced research in photonics, telecommunications, industrial lasers, and defense optics. Manufacturers invested in high-purity, low-defect substrates for modulators, sensors, and optoelectronic devices with strict performance standards. Adoption was strongest in industrial R&D, telecom networks, and defense research labs. Competitive strategies included partnerships with research institutions, process innovation, and compliance with domestic and international quality regulations. R&D focused on crystal growth precision, reproducibility, thermal stability, and surface finishing. Strong demand from communication infrastructure, defense optics, industrial lasers, and semiconductor applications reinforced market growth. Manufacturers emphasized high-quality production, operational efficiency, and integration with advanced photonic systems to meet high-performance requirements.

The United Kingdom expanded at a 3.3% CAGR, supported by growth in photonics research, industrial optics, and telecommunication projects. Manufacturers emphasized high-purity, low-defect substrates for modulators, sensors, and laser-based optical devices. Adoption was strongest in research institutions, telecom networks, industrial R&D, and defense optics. Competitive strategies included technology collaborations, process innovation, and compliance with UK and EU optical standards. R&D targeted reproducibility, thermal stability, and surface quality improvements. Government-funded research programs, industrial optics investments, and high-quality engineering requirements further reinforced adoption. Companies focused on operational efficiency, domestic manufacturing, and export potential to strengthen competitiveness in both research and industrial applications.

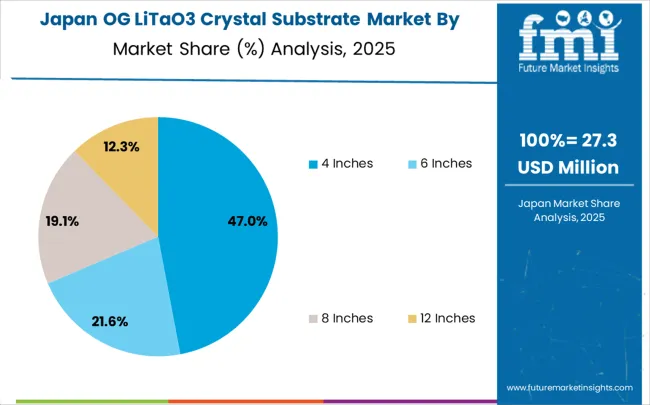

Japan grew at a 2.9% CAGR, influenced by optical communications, laser research, industrial photonics, and semiconductor applications. Manufacturers focused on producing thermally stable, low-defect, high-purity crystal substrates for modulators, sensors, and optoelectronic devices. Adoption was strongest in telecommunications networks, industrial R&D labs, and defense and precision optics sectors. Competitive strategies included advanced crystal growth methods, process innovation, and collaborations with domestic research institutions. R&D targeted surface finishing, defect minimization, reproducibility, and yield optimization. Japan’s strict quality standards, precision engineering culture, and high-end technology requirements reinforced consistent demand for reliable, high-performance optical-grade LiTaO3 substrates.

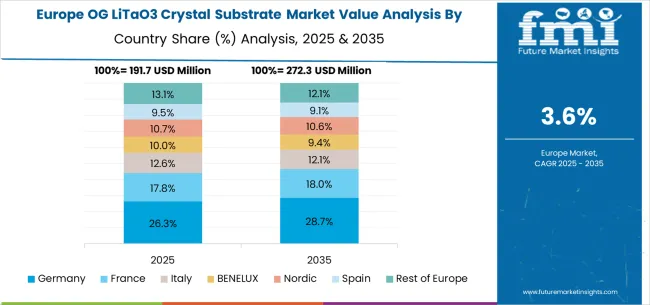

The optical grade LiTaO3 crystal substrate market in Europe is forecast to expand from USD 216.3 million in 2025 to USD 317.4 million by 2035, registering a CAGR of 3.9%. Germany will remain the largest market, holding 36.0% share in 2025, easing to 35.5% by 2035, supported by strong semiconductor infrastructure and advanced crystal technology systems. The United Kingdom follows, rising from 30.0% in 2025 to 30.5% by 2035, driven by electronics companies and technological innovation initiatives. France is expected to decline slightly from 25.0% to 24.5%, reflecting electronics industry consolidation. Italy maintains stability at around 6.0%, supported by technology facilities and semiconductor centers, while Spain grows from 2.5% to 3.0% with expanding electronics and high-tech manufacturing demand. BENELUX markets ease from 0.4% to 0.3%, while the remainder of Europe hovers near 0.1%--0.2%, balancing emerging Eastern European growth against mature Nordic markets.

The market is defined by competition among specialized crystal manufacturing companies, semiconductor material suppliers, and high-tech solution providers. Companies are investing in advanced crystal growth development, substrate quality optimization, manufacturing process improvements, and comprehensive technical support capabilities to deliver reliable, high-performance, and cost-effective crystal substrate solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and semiconductor presence.

Sumitomo Metal Mining offers comprehensive optical grade LiTaO3 crystal substrate solutions with established semiconductor expertise and industrial-scale crystal production capabilities. Shin-Etsu Chemical provides specialized semiconductor materials with focus on crystal quality and manufacturing precision. Koike delivers advanced crystal technology solutions with emphasis on substrate optimization and technical excellence. Korth Kristalle specializes in precision crystal manufacturing with advanced optical substrate technology integration.

Oxide offers professional-grade crystal substrates with comprehensive quality assurance capabilities. Tiantong delivers established crystal technology solutions with advanced growth technologies. Kaiju Technology Co., Ltd. provides specialized crystal manufacturing with focus on semiconductor precision optimization. Zhejiang MTCN Technology Co.,Ltd., HEFEI KEJING MATERIALS TECHNOLOGY CO.,LTD., Suzhou Nanzhi Core Materials Technology Co., Ltd., Hyperion Optics, Advanced Fiber Resources(Zhuhai),Ltd., Ostphotonics, and Shanghai Kingwin Technology Co.,Ltd. offer specialized manufacturing expertise, crystal reliability, and comprehensive product development across global and regional semiconductor market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 807.7 million |

| Substrate Type | 4 Inches, 6 Inches, 8 Inches, 12 Inches |

| Application | 5G Communication, Optoelectronic Devices, SAW Filters, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Sumitomo Metal Mining, Shin-Etsu Chemical, Koike, Korth Kristalle, Oxide, Tiantong, Kaiju Technology Co., Ltd., Zhejiang MTCN Technology Co.,Ltd., HEFEI KEJING MATERIALS TECHNOLOGY CO.,LTD., Suzhou Nanzhi Core Materials Technology Co., Ltd., Hyperion Optics, Advanced Fiber Resources (Zhuhai) Ltd., Ostphotonics, Shanghai Kingwin Technology Co.,Ltd., Crystal Technology |

| Additional Attributes | Dollar sales by substrate type and application segment, regional demand trends across major markets, competitive landscape with established crystal manufacturing companies and emerging substrate technology providers, customer preferences for different substrate sizes and telecommunications applications, integration with semiconductor manufacturing systems and device fabrication protocols, innovations in crystal growth effectiveness and optical quality technologies, and adoption of quality enhancement features with advanced material properties for improved semiconductor workflows. |

The global optical grade litao3 crystal substrate market is estimated to be valued at USD 807.7 million in 2025.

The market size for the optical grade litao3 crystal substrate market is projected to reach USD 1,184.1 million by 2035.

The optical grade litao3 crystal substrate market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in optical grade litao3 crystal substrate market are 4 inches, 6 inches, 8 inches and 12 inches.

In terms of application, 5g communication segment to command 38.0% share in the optical grade litao3 crystal substrate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA