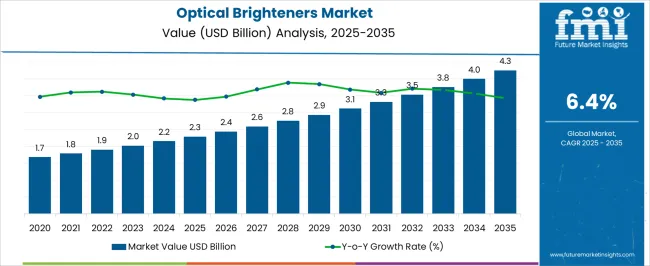

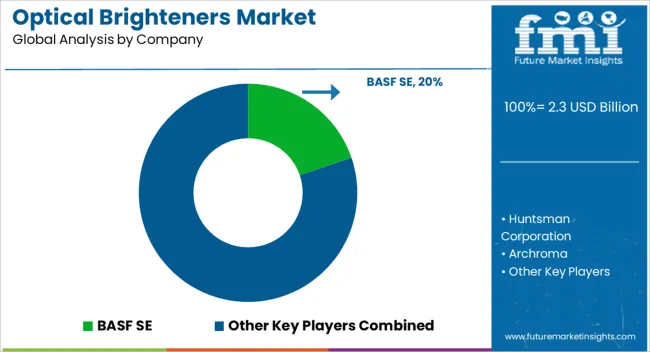

The optical brighteners market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The optical brighteners market is expected to grow from USD 2.3 billion in 2025 to USD 4.3 billion by 2035, recording a compound annual growth rate (CAGR) of 6.4%. Market expansion is being influenced by increasing demand for textile, detergent, and paper products where optical brightening agents are applied to enhance visual appeal and product quality. Between 2025 and 2030, the market is projected to rise steadily from USD 2.3 billion to approximately USD 3.1 billion as manufacturers increasingly integrate optical brighteners into production processes. Growth is being driven by the emphasis on aesthetic enhancements, performance consistency, and competitive differentiation in consumer goods, which are being prioritized by industry stakeholders.

Year-on-year growth reflects a consistent upward pattern, indicating steady adoption of optical brighteners across multiple industrial applications. Incremental increases in market value are being observed as demand for higher-quality textiles, packaging, and paper products expands globally. The optical brighteners market is being shaped by performance requirements, brand positioning, and regulatory compliance in end-use industries.

Suppliers offering high-purity, reliable, and customizable optical brighteners are being positioned to capture notable market share, while year-on-year analysis demonstrates that the market is being steadily strengthened through product innovation in chemical formulations and application techniques, catering to diverse industry needs and consumer expectations.

| Metric | Value |

|---|---|

| Optical Brighteners Market Estimated Value in (2025 E) | USD 2.3 billion |

| Optical Brighteners Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The optical brighteners market is estimated to occupy a notable proportion within its parent markets, representing approximately 7-8% of the specialty chemicals market, around 10-12% of the textile chemicals market, close to 6-7% of the paper and pulp chemicals market, about 5-6% of the detergent additives market, and roughly 3-4% of the industrial coatings and plastics additives market. Collectively, the cumulative share across these parent segments is observed in the range of 31-37%, indicating a substantial presence of optical brightening agents across multiple chemical and industrial domains.

The market has been driven by the growing need to enhance visual aesthetics, whiteness, and brightness in textiles, paper, plastics, and detergents, where performance consistency and chemical stability are highly prioritized. Adoption has been influenced by regulatory compliance, product efficacy, and cost efficiency, which guide procurement decisions across industrial and consumer applications. Market participants have focused on integrating high-performance brighteners that offer uniform dispersion, compatibility with other chemicals, and long-lasting results, enhancing the overall value proposition of the end products.

Consequently, the optical brighteners market has not only captured a strong position within its core textile and paper segments but has also influenced adjacent markets in detergents, plastics, and coatings, demonstrating its critical role in the broader chemical additives landscape.

The optical brighteners market is experiencing steady growth driven by increasing demand for enhanced visual appeal in consumer goods and industrial products. These additives are widely used to improve whiteness and brightness by absorbing ultraviolet light and re-emitting it as visible blue light, creating a cleaner and more vibrant appearance.

The rising consumption of detergents, textiles, and paper products in both developed and emerging economies has significantly contributed to market expansion. Advancements in chemical formulations have improved stability, compatibility, and performance across a range of applications, including synthetic fibers, plastics, and coatings.

Regulatory trends encouraging environmentally safer and high-performance ingredients are fostering innovation in bio-based and low-toxicity variants. The future outlook remains positive, supported by expanding manufacturing capacities and increasing awareness of product quality enhancement in consumer and industrial markets.

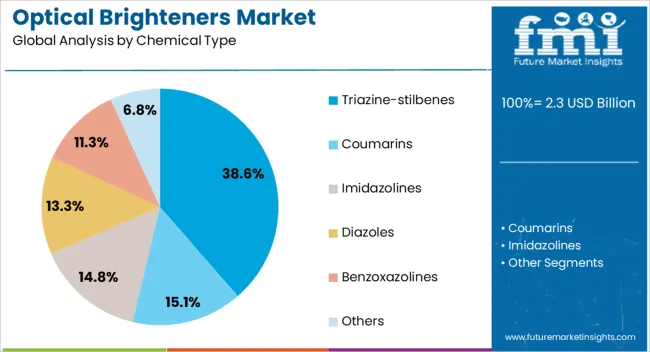

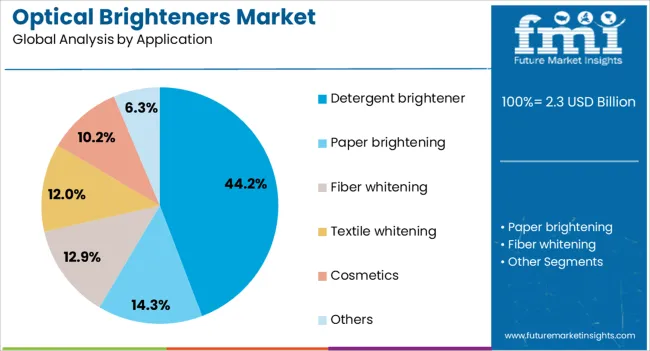

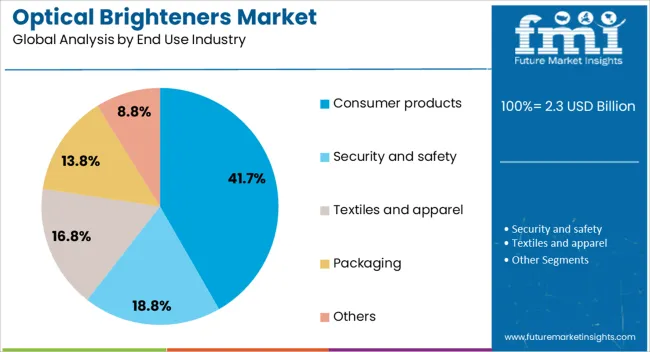

The optical brighteners market is segmented by chemical type, application, end use industry, and geographic regions. By chemical type, optical brighteners market is divided into triazine-stilbenes, coumarins, imidazolines, diazoles, benzoxazolines, and others. In terms of application, optical brighteners market is classified into detergent brightener, paper brightening, fiber whitening, textile whitening, cosmetics, and others. Based on end use industry, optical brighteners market is segmented into consumer products, security and safety, textiles and apparel, packaging, and others. Regionally, the optical brighteners industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The triazine-stilbenes segment is expected to account for 38.6% of total revenue by 2025 within the chemical type category, making it the leading segment. This growth is supported by its excellent whitening efficiency, strong lightfastness, and compatibility with multiple substrates.

Its stability in a variety of processing environments and cost-effectiveness compared to alternative chemical types has strengthened its adoption.

The versatility of triazine-stilbenes in detergents, paper, and textile applications has also enhanced its dominance, making it the preferred choice for manufacturers seeking high performance optical brightening solutions.

The detergent brightener segment is projected to hold 44.2% of the total market revenue by 2025, establishing it as the leading application category. This dominance is attributed to the widespread use of optical brighteners in laundry detergents to improve fabric whiteness and maintain brightness over repeated washes.

Increasing global detergent consumption, particularly in emerging economies, and the premium positioning of brightening-enhanced products have fueled demand.

The ability of detergent brighteners to deliver consistent visual improvement without damaging fabrics has reinforced their market leadership in this application segment.

The consumer products segment is anticipated to capture 41.7% of total market revenue by 2025 within the end use industry category, making it the most prominent segment. This growth is driven by rising consumer preference for visually appealing products in textiles, personal care, and household goods.

Manufacturers are increasingly using optical brighteners to differentiate products through enhanced appearance, contributing to stronger brand positioning and consumer loyalty.

The growing focus on premium-quality finishes across a variety of consumer goods has solidified the dominance of this segment.

The optical brighteners market is being driven by demand in textiles and paper products, while opportunities are emerging in detergents and personal care applications. Trends highlight the adoption of specialty and eco-friendly formulations to improve performance and durability. Challenges persist due to regulatory restrictions and raw material cost fluctuations. Despite these constraints, optical brighteners remain essential for achieving enhanced whiteness, brightness, and visual appeal across multiple industries, supporting steady market expansion and prompting manufacturers to develop high-performance solutions to meet evolving industrial and consumer expectations.

The demand for optical brighteners has been reinforced by the rising requirements of the textile and paper sectors. Their capacity to enhance whiteness, brightness, and overall appearance in fabrics and paper products has increased adoption across commercial and industrial applications. Textile manufacturers are utilizing optical brighteners to meet consumer expectations for vibrant and visually appealing garments, while paper producers rely on them to maintain consistent brightness in printing and packaging. This expanding usage, particularly in regions with strong manufacturing bases, continues to support sustained market growth and encourages producers to focus on high-performance formulations.

Significant opportunities have been created as optical brighteners find use in laundry detergents, fabric softeners, and personal care products. Their ability to improve visual brightness without altering chemical properties makes them attractive for household cleaning and hygiene applications. Detergent manufacturers are increasingly incorporating optical brighteners to achieve superior cleaning performance and aesthetic appeal, creating a steady demand pipeline. Growth potential is also seen in specialized formulations for premium personal care products, offering suppliers avenues to expand product portfolios and capture higher-value segments in global consumer markets.

A key trend observed in the market is the development and adoption of specialty optical brighteners with improved environmental profiles and performance characteristics. Manufacturers are introducing formulations compatible with various fiber types and detergent chemistries while minimizing unwanted residues and discoloration. In parallel, the shift toward multi-functional brighteners that provide stain resistance or enhanced durability in textiles is gaining traction. This trend is influencing both product innovation and marketing strategies, with suppliers positioning these brighteners as high-value, performance-enhancing ingredients that meet evolving industry and consumer requirements.

The market faces challenges due to stringent regulatory frameworks and cost sensitivity among end users. Limitations on chemical compositions and discharge standards in regions such as Europe and North America restrict certain optical brightener applications, requiring reformulations to comply with environmental and health regulations. Moreover, price fluctuations in raw materials can impact margins, particularly for smaller manufacturers. Cost pressures from competing alternatives and the need to maintain product performance while adhering to regulatory norms continue to challenge market players, demanding strategic sourcing, and efficient production practices to ensure sustained competitiveness.

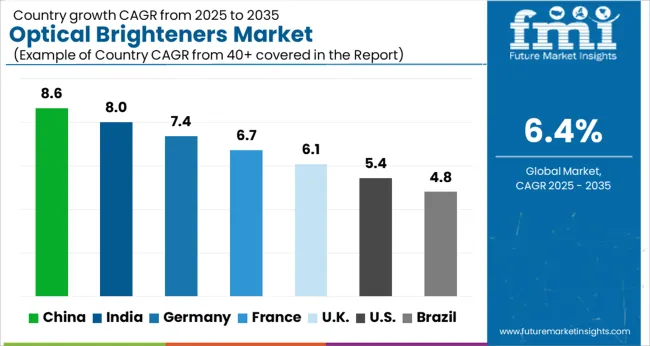

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

The global optical brighteners market is projected to grow at a CAGR of 6.4% from 2025 to 2035. China leads with a growth rate of 8.6%, followed by India at 8%, and France at 6.7%. The United Kingdom records a growth rate of 6.1%, while the United States shows the slowest growth at 5.4%. Rising demand for textile brightening, paper whitening, and detergent applications is driving growth worldwide. Emerging markets such as China and India experience higher adoption due to expanding textile and paper industries, growing consumer preference for high-quality products, and increasing industrial output. Developed markets like the USA, UK, and France see steady growth supported by regulatory compliance, focus on product quality enhancement, and established supply chains. This report includes insights on 40+ countries; the top markets are highlighted here for reference.

The optical brighteners market in China is projected to grow at a CAGR of 8.6%. Rapid industrialization, expanding textile and paper manufacturing sectors, and rising consumer awareness regarding product quality are primary drivers. Demand from detergent and packaging industries, along with increasing exports of finished goods, further boosts market growth. Investment in domestic chemical manufacturing, advanced formulations, and research into high-efficiency optical brighteners supports technological progress and reduces reliance on imports. Government policies promoting industrial output and quality standards also positively influence adoption rates. The market benefits from a combination of large-scale production capabilities, strong supplier networks, and growing domestic consumption.

The optical brighteners market in India is projected to grow at a CAGR of 8%. India’s expanding textile, detergent, and packaging industries are key drivers for market adoption. Rising domestic consumption, increasing awareness for high-quality finished products, and growing export-oriented manufacturing further stimulate demand. Investments in modern chemical manufacturing facilities, formulation improvements, and supply chain optimization are accelerating market growth. Industrial expansion across textile hubs and rising environmental regulations encouraging effective brightening agents also contribute to growth. The country’s focus on integrating high-efficiency optical brighteners into detergents, textiles, and paper applications ensures sustained market expansion and stronger adoption of innovative solutions.

The optical brighteners market in France is projected to grow at a CAGR of 6.7%. France’s established textile, detergent, and paper industries contribute to steady demand. Emphasis on maintaining product quality, complying with industrial and environmental standards, and developing efficient brightening solutions drives market expansion. Investments in research and development, high-performance formulations, and innovative production techniques strengthen the supply chain and adoption rate. The market also benefits from increasing consumer preference for visually appealing textiles and paper products, as well as growing demand from detergent manufacturers seeking effective whitening agents. Regulatory compliance and high-quality standards ensure consistent market growth in France.

The optical brighteners market in the United Kingdom is expected to grow at a CAGR of 6.1%. The UK’s focus on high-quality textile and detergent products drives demand for effective brightening solutions. Industrial applications in paper, packaging, and hygiene sectors further stimulate growth. Investments in advanced chemical formulations, production technologies, and supply chain efficiency support adoption rates. Rising consumer awareness for premium textiles, improved laundry outcomes, and visual appeal in paper products also contributes to market expansion. Regulatory standards ensuring safe chemical usage and environmental compliance strengthen the steady demand for optical brighteners across industrial and consumer applications in the UK

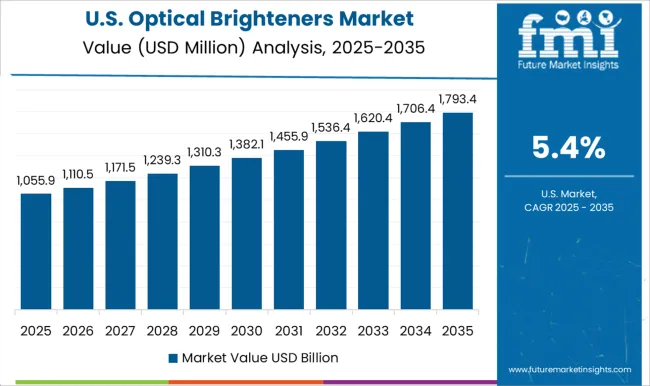

The optical brighteners market in the United States is projected to grow at a CAGR of 5.4%. USA demand is driven by well-established textile, paper, and detergent industries requiring high-performance brightening agents. Focus on product quality, operational efficiency, and compliance with chemical regulations supports steady market expansion. Investments in advanced formulations, innovative production techniques, and supply chain optimization enhance the adoption of optical brighteners. Consumer preferences for visually appealing textiles and cleaner, brighter laundry outcomes further stimulate demand. The mature market emphasizes sustainable production, reliability, and product consistency, ensuring steady growth in industrial and consumer applications across the USA

The optical brighteners market is characterized by competition among global chemical majors and regional specialty suppliers delivering fluorescence-enhancing additives for textiles, plastics, and paper applications. BASF SE, Huntsman Corporation, and Archroma lead with broad portfolios emphasizing performance, consistency, and color-enhancing properties. Their brochures highlight superior whiteness, durability, and compatibility with various substrates, appealing to manufacturers seeking premium visual effects.

Clariant AG and AkzoNobel N.V. focus on high-performance and environmentally compatible brighteners, positioning their products as solutions for efficiency and improved aesthetic appeal in end-use industries. Eastman Chemical Company emphasizes multi-industry applications, while Keystone Aniline Corporation targets specialty markets with custom formulations and technical support. Regional and emerging suppliers such as 3V Incorporation, Teh Fong Min International Co., Ltd., Aron Universal Limited, and Deepak Nitrite Limited compete on price, local availability, and flexible production capabilities.

Companies like Khyati Chemicals Private Limited, Kolor Jet Chemical Pvt. Ltd., and Paramount Minerals and Chemicals Limited highlight tailored solutions for small- to mid-scale manufacturers, often emphasizing ease of integration and compliance with regulatory standards. Competition centers on brightness performance, cost efficiency, substrate compatibility, and chemical stability. Marketing materials typically underscore product reliability, enhanced visual appeal, and operational benefits, reflecting the growing demand for high-quality optical brighteners across textile, paper, and polymer industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 billion |

| Chemical Type | Triazine-stilbenes, Coumarins, Imidazolines, Diazoles, Benzoxazolines, and Others |

| Application | Detergent brightener, Paper brightening, Fiber whitening, Textile whitening, Cosmetics, and Others |

| End Use Industry | Consumer products, Security and safety, Textiles and apparel, Packaging, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Huntsman Corporation, Archroma, Keystone Aniline Corporation, Clariant AG, AkzoNobel N.V., Eastman Chemical Company, 3V Incorporation, Teh Fong Min International Co., Ltd., Aron Universal Limited, RPM International Inc., Deepak Nitrite Limited, Khyati Chemicals Private Limited, Kolor Jet Chemical Pvt. Ltd., and Paramount Minerals and Chemicals Limited |

| Additional Attributes | Dollar sales by product type (fluorescent whitening agents, stilbene derivatives, coumarin derivatives) and application (textiles, paper, detergents, plastics) are key metrics. Trends include rising demand for enhanced brightness and whiteness, growth in textile and paper industries, and increasing adoption in detergents and personal care products. Regional adoption, regulatory compliance, and technological innovations are driving market growth. |

The global optical brighteners market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the optical brighteners market is projected to reach USD 4.3 billion by 2035.

The optical brighteners market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in optical brighteners market are triazine-stilbenes, coumarins, imidazolines, diazoles, benzoxazolines and others.

In terms of application, detergent brightener segment to command 44.2% share in the optical brighteners market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA