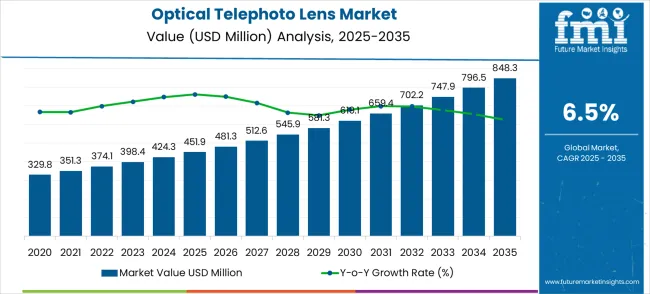

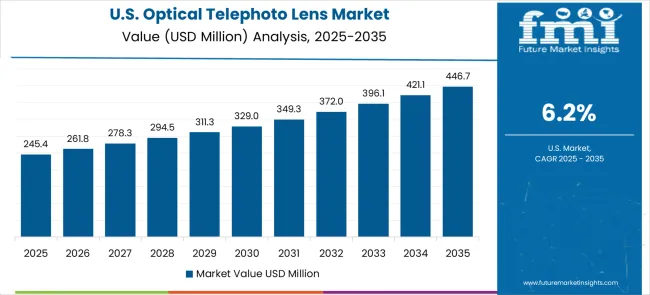

The optical telephoto lens market is set to experience steady growth, moving from USD 329.8 million in 2021 to USD 451.9 million in 2025, and reaching USD 848.3 million by 2035, growing at a CAGR of 6.5%. As the market progresses, it enters a saturation phase where growth begins to slow down as the demand for optical telephoto lenses reaches a more stable state, particularly in mature markets such as photography and videography industries. The first phase of growth, from 2021 to 2025, is marked by rapid increases in market value, driven by technological advancements and expanding use cases across sectors such as professional photography, security, and mobile devices.

From 2025 onwards, the market continues to expand, but the pace of growth starts to moderate, reflecting a potential saturation point in certain segments. By 2030, the market value reaches USD 702.2 million, with yearly increments slowing down. This shift toward stabilization can be attributed to factors such as the increased integration of telephoto lens technology into mobile phones, leading to a more widespread but less dramatic growth. In addition, competition in the market intensifies, and price sensitivity becomes more pronounced as consumers and businesses seek more affordable alternatives. As a result, by 2035, the market is expected to grow at a slower, more controlled rate, with its peak reached as it matures and stabilizes.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 451.9 million |

| Forecast Value in (2035F) | USD 848.3 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The camera and imaging equipment market is the largest contributor, accounting for approximately 40–45% of the market share. Optical telephoto lenses are widely used in digital cameras, DSLRs, and mirrorless cameras, which are essential for both professional photographers and hobbyists. The consumer electronics market plays a significant role, contributing around 20–25%, as optical telephoto lenses are increasingly used in smartphones for enhanced zoom capabilities, particularly in flagship models.

The sports and entertainment market also drives demand, with about 15–18% of the market share, as telephoto lenses are crucial for capturing long-distance action shots in sports events, wildlife photography, and film production. The security and surveillance market contributes around 10–12%, as optical telephoto lenses are employed in CCTV cameras and other surveillance equipment for long-range monitoring and detailed observation. The astronomy and space exploration market, contributing about 5–8%, relies on optical telephoto lenses for telescopes and other observational instruments that capture distant celestial objects.

Market expansion is being supported by the increasing global demand for mobile photography solutions and the corresponding need for advanced optical systems that can provide superior zoom capabilities and high image quality while maintaining compact design across various smartphone and surveillance applications. Modern mobile device manufacturers are increasingly focused on implementing optical solutions that can deliver professional-grade photography experiences, enable long-distance imaging capabilities, and provide consistent performance in challenging lighting conditions. Optical telephoto lenses' proven ability to deliver superior zoom performance, enhanced image quality, and versatile application compatibility make them essential components for contemporary mobile imaging and surveillance monitoring solutions.

The growing emphasis on social media content creation and professional mobile photography is driving demand for optical telephoto lenses that can support advanced zoom features, enable creative photography options, and provide reliable performance in mobile devices with space constraints and power limitations. Mobile technology processors' preference for optical components that combine performance excellence with miniaturization efficiency and cost-effectiveness is creating opportunities for innovative telephoto lens implementations. The rising influence of computational photography and AI-enhanced imaging trends is also contributing to increased adoption of telephoto lenses that can provide superior optical solutions without compromising mobile device design or battery performance.

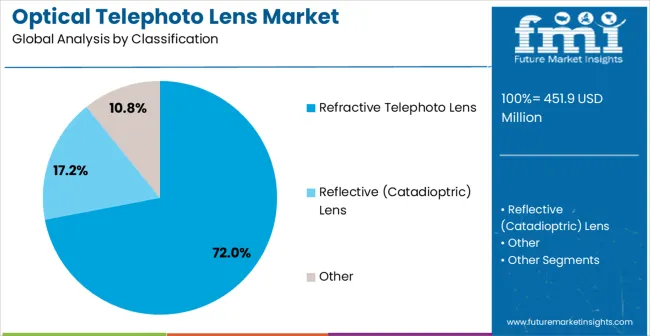

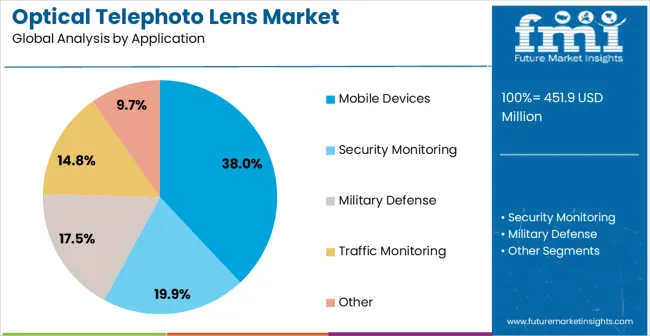

The market is segmented by classification, application, and region. By classification, the market is divided into refractive telephoto lens, reflective (catadioptric) lens, and other. Based on application, the market is categorized into mobile devices, security monitoring, military defense, traffic monitoring, and other. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

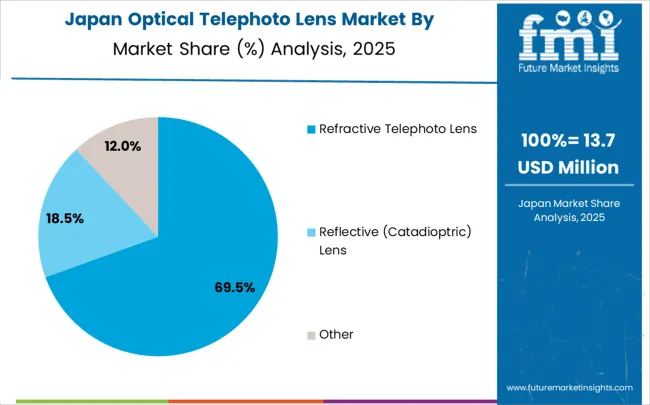

The refractive telephoto lens segment is set to capture 72% of the optical telephoto lens market in 2025, further solidifying its dominant position. These lenses are increasingly favored by optical manufacturers due to their exceptional image quality, design flexibility, and suitability for mobile device applications such as smartphones, cameras, and compact optical systems. Refractive lenses offer a balanced blend of performance and scalability, addressing the growing demand for reliable zoom capabilities in consumer electronics. The continuous investments in refractive lens technology, miniaturization, and production efficiency have made them indispensable in the mobile imaging market. Their ability to deliver high optical performance while meeting the mass production demands of mobile devices ensures their sustained market leadership, making refractive telephoto lenses a key component in advancing mobile imaging capabilities.

The mobile devices segment is expected to account for 38.0% of the optical telephoto lens market in 2025, making it the largest application category. Mobile device manufacturers prioritize optical telephoto lenses for their superior zoom capabilities, high image quality, and compact form factor that allows for advanced photography features in smartphones. These lenses are integral to enhancing the user experience by improving mobile photography performance while ensuring power efficiency and device compactness. The growing trend of smartphone camera innovation, with an emphasis on better zoom and imaging features, continues to drive demand for telephoto lenses. As the mobile photography industry advances, mobile devices will remain the primary market driver for optical telephoto lenses, with manufacturers increasingly investing in cutting-edge optical systems for differentiation and enhanced user satisfaction.

The optical telephoto lens market is advancing steadily due to increasing demand for mobile photography solutions and growing adoption of advanced optical technologies that provide enhanced zoom capabilities and superior image quality across diverse smartphone and surveillance applications. The market faces challenges, including miniaturization complexity, cost sensitivity in mass markets, and the need for continuous optical innovation investments. Innovation in computational photography integration and advanced optical coating technologies continues to influence product development and market expansion patterns.

The growing adoption of reflective (catadioptric) lens configurations and periscope telephoto designs is enabling optical manufacturers to produce premium telephoto lenses with superior zoom ranges, enhanced compactness, and advanced optical performance capabilities. Advanced optical systems provide improved imaging precision while allowing more efficient space utilization and consistent output across various mobile device form factors and application conditions. Manufacturers are increasingly recognizing the competitive advantages of advanced optical capabilities for product differentiation and premium market positioning in demanding mobile imaging segments.

Modern optical telephoto lens producers are incorporating AI-compatible optical designs and computational photography optimization to enhance image processing, improve zoom quality, and ensure consistent performance delivery to mobile device manufacturers and imaging system integrators. These technologies improve imaging capabilities while enabling new applications, including multi-frame zoom enhancement and intelligent scene recognition. Advanced AI integration also allows manufacturers to support premium positioning and user satisfaction beyond traditional optical lens capabilities.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| USA | 6.2% |

| UK | 5.5% |

| Japan | 4.9% |

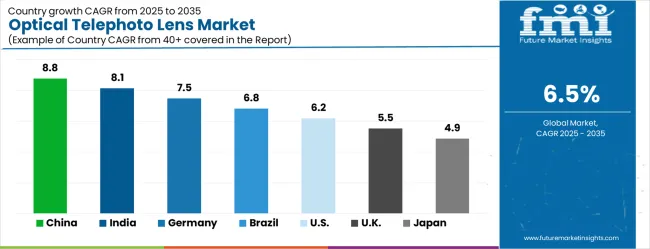

The optical telephoto lens market is experiencing strong growth globally, with China leading at an 8.8% CAGR through 2035, driven by the expanding smartphone manufacturing industry, growing mobile camera technology development, and significant investment in optical component infrastructure. India follows at 8.1%, supported by large-scale mobile device manufacturing, emerging optical production facilities, and growing domestic demand for advanced smartphone camera technologies. Germany shows growth at 7.5%, emphasizing optical innovation and premium lens development. Brazil records 6.8%, focusing on mobile device market expansion and optical technology adoption. The USA demonstrates 6.2% growth, prioritizing advanced optical technologies and high-performance imaging solutions. The UK exhibits 5.5% growth, emphasizing optical manufacturing capabilities and quality imaging system adoption. Japan shows 4.9% growth, supported by precision optical manufacturing excellence and advanced lens technology innovation.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

The optical telephoto lens market in China is projected to grow at an impressive CAGR of 8.8% from 2025 to 2035. The country’s market is expanding rapidly due to the growing demand for high-quality optical lenses in the consumer electronics, automotive, and security sectors. As China continues to be a major player in the production of smartphones, the demand for advanced telephoto lenses in mobile cameras is a key driver. The rise in demand for optical lenses in the automotive industry for advanced driver assistance systems (ADAS) and surveillance applications is also boosting market growth. Expanding e-commerce and digital content creation sectors, particularly in photography and video production, are contributing to the growing need for optical telephoto lenses. The increasing focus on technological innovation and the government's support for the electronics and optics industries further enhance market prospects.

The optical telephoto lens market in India is set to grow at a CAGR of 8.1% from 2025 to 2035, driven by the growing demand for smartphones, digital cameras, and security systems. With a large and increasing middle-class population, India is experiencing a rise in disposable income and consumer spending, particularly in technology and entertainment. As smartphones with advanced camera systems become more affordable, there is an increasing need for high-quality optical lenses, including telephoto lenses. India’s rapidly growing e-commerce and digital content creation industry is increasing the demand for superior photography and video production tools. The automotive industry is also exploring new opportunities to integrate optical telephoto lenses into advanced safety systems and driver assistance technologies, further driving market growth.

The optical telephoto lens market in Germany is expected to grow at a CAGR of 7.5% from 2025 to 2035, driven by technological advancements in the consumer electronics and automotive sectors. As one of Europe’s leading markets for photography equipment, Germany’s demand for high-quality optical lenses remains strong, with mobile photography, professional cameras, and video recording technologies being key growth areas. The automotive sector is also a significant contributor to the market, with the rise in demand for advanced driver assistance systems (ADAS) and the integration of cameras in vehicles. Germany’s leadership in industrial automation and robotics is also creating new opportunities for optical lenses in factory automation and monitoring systems. The country’s emphasis on environmental sustainability and technological innovation supports the adoption of energy-efficient optical lenses.

The optical telephoto lens market in Brazil is expected to grow at a CAGR of 6.8% from 2025 to 2035, driven by an increase in disposable income and the rising popularity of smartphones and digital cameras. As the consumer electronics market expands in Brazil, there is a growing demand for advanced imaging systems, especially in mobile phones. The popularity of professional photography and video production is encouraging the need for high-quality telephoto lenses. The automotive sector in Brazil is also starting to adopt telephoto lenses for vehicle security systems and advanced safety features. Brazil’s growing middle class and increasing access to technology are contributing to market growth, particularly in urban areas.

The optical telephoto lens market in the United States is projected to grow at a CAGR of 6.2% from 2025 to 2035. The USA market is driven by innovations in consumer electronics, with smartphones and digital cameras driving the adoption of telephoto lenses. The growing trend of professional photography and content creation, fueled by platforms like YouTube and Instagram, is propelling demand for high-performance imaging systems. The automotive industry in the USA is also a key driver, with increasing integration of telephoto lenses for advanced driver assistance systems (ADAS). The USA market is also witnessing significant growth in drone applications, where optical lenses are used for aerial photography and monitoring systems.

The optical telephoto lens market in the United Kingdom is projected to grow at a CAGR of 5.5% from 2025 to 2035. The UK has a robust consumer electronics market, and as mobile phones continue to advance, there is increasing demand for high-quality optical lenses for photography and video production. The rise in content creation and professional photography, fueled by the popularity of social media platforms, is also contributing to the growth of the optical telephoto lens market. The automotive sector in the UK is adopting telephoto lenses for advanced safety features such as parking sensors and lane-keeping systems. As smart city and surveillance projects gain traction, the demand for visual analytics solutions that rely on high-quality lenses is expected to increase.

The optical telephoto lens market in Japan is expected to grow at a CAGR of 4.9% from 2025 to 2035, driven by the country’s strong electronics and automotive industries. Japan is a leader in smartphone and digital camera technology, and as these devices continue to evolve, there is an increasing demand for advanced telephoto lenses. The adoption of optical lenses in automotive safety features, such as ADAS and parking cameras, is growing as the Japanese automotive sector integrates more intelligent systems into vehicles. Japan’s well-established consumer electronics market and demand for professional imaging systems are key factors driving market expansion. The government’s support for digital innovation and infrastructure projects further contributes to the market’s growth.

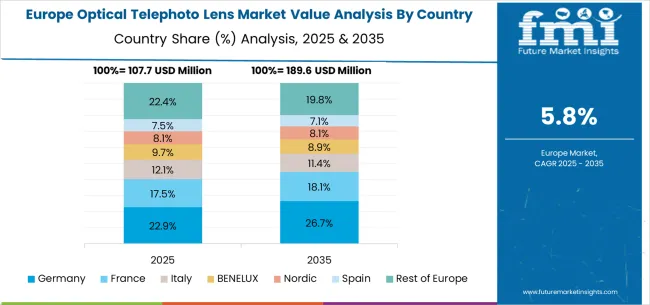

The optical telephoto lens market in Europe is projected to grow from USD 107.7 million in 2025 to USD 189.6 million by 2035, registering a CAGR of 5.8% over the forecast period. Germany will maintain its leadership, rising from 22.9% in 2025 to 26.7% by 2035, supported by its advanced lens manufacturing industry, precision optics facilities, and integration in imaging technology supply chains. France will account for 18.5% in 2025, edging up to 18.1% by 2035, reflecting stable demand from mobile device manufacturers and surveillance applications. Italy will represent 12.3% in 2025, declining slightly to 12.0% by 2035, reflecting steady but slower adoption in optical equipment sectors.

The BENELUX region will hold 8.1% in 2025, remaining stable at 8.1% by 2035, supported by specialized imaging technology hubs. The Nordic countries will represent 8.1% in 2025, easing slightly to 8.0% by 2035, with demand supported by industrial imaging and automotive safety applications. Spain will capture 7.5% in 2025, declining modestly to 7.1% by 2035, reflecting limited growth in imaging-related industries. Meanwhile, the Rest of Europe will decline from 22.4% in 2025 to 19.8% by 2035, reflecting slower adoption in smaller Eastern European markets compared to Western Europe.

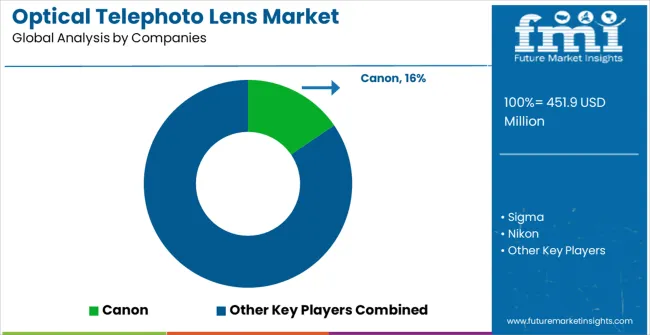

The optical telephoto lens market is characterized by competition among established optical manufacturers, specialized imaging component suppliers, and integrated camera system providers. Companies are investing in advanced optical technology research, lens design optimization, miniaturization development, and comprehensive product portfolios to deliver consistent, high-quality, and cost-effective optical telephoto lens solutions. Innovation in optical formulations, manufacturing precision, and mobile integration is central to strengthening market position and competitive advantage.

Canon leads the market with a strong market share, offering comprehensive optical solutions with a focus on mobile imaging applications and advanced lens systems. Sigma provides specialized optical capabilities with an emphasis on telephoto lens technologies and imaging excellence. Nikon delivers innovative optical solutions with a focus on professional photography and product versatility. Fujinon specializes in optical manufacturing and advanced lens solutions for mobile and surveillance markets. Panasonic focuses on optical technology and integrated imaging operations. Sony offers specialized optical components with emphasis on mobile device applications and consumer electronics.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 451.9 million |

| Classification | Refractive Telephoto Lens, Reflective (Catadioptric) Lens, Other |

| Application | Mobile Devices, Security Monitoring, Military Defense, Traffic Monitoring, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Canon, Sigma, Nikon, Fujinon, Panasonic, and Sony |

| Additional Attributes | Dollar sales by classification and application category, regional demand trends, competitive landscape, technological advancements in optical systems, lens innovation, miniaturization development, and mobile integration |

The global optical telephoto lens market is estimated to be valued at USD 451.9 million in 2025.

The market size for the optical telephoto lens market is projected to reach USD 848.3 million by 2035.

The optical telephoto lens market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in optical telephoto lens market are refractive telephoto lens, reflective (catadioptric) lens and other.

In terms of application, mobile devices segment to command 38.0% share in the optical telephoto lens market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refractor Type Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA