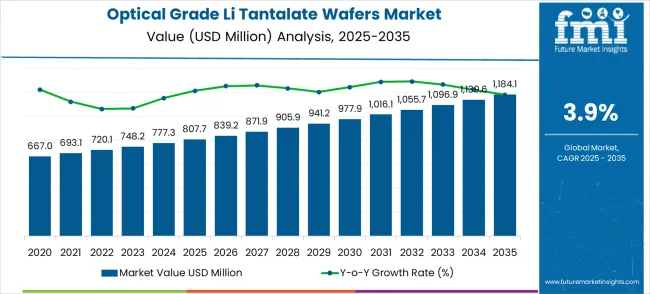

The optical grade lithium tantalate wafers market, valued at USD 807.7 million in 2025 and projected to reach USD 1,184.1 million by 2035 at a CAGR of 3.9%, exhibits measurable growth when analyzed across half-decade periods. From 2025 to 2030, the market shows an incremental increase from USD 807.7 million to approximately USD 941.2 million. This half-decade growth block captures early-stage adoption, reflecting rising demand in electronics, photonics, and piezoelectric applications. Annual increments during this period average around 3.8–4.0%, highlighting a steady momentum while manufacturers optimize wafer production and distribution to accommodate rising industrial requirements.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 807.7 million |

| Market Forecast Value (2035) | USD 1,184.1 million |

| Forecast CAGR (2025–2035) | 3.9% |

In the mid-decade phase from 2030 to 2035, revenues expand from USD 941.2 million to USD 1,184.1 million, demonstrating a higher absolute growth contribution relative to the earlier half-decade. Growth during this period is supported by increased deployment of lithium tantalate wafers in telecommunications, sensor technology, and advanced electronic devices. The weighted growth emphasizes the compounding effect of technology adoption across multiple sectors. Annual increments in this second half-decade average 3.9%, reflecting consistent market penetration, improved production efficiency, and broader industrial acceptance of high-performance wafers.

Analyzing the half-decade weighted growth offers insights into the temporal distribution of value accumulation and market dynamics. Early adoption stages prioritize establishing supply chains, technological validation, and niche market penetration, whereas the latter half-decade shows acceleration in revenues due to scale-up, higher-volume contracts, and expanded end-use adoption. Stakeholders can leverage these half-decade growth insights for strategic planning, aligning production capacity, R&D investment, and distribution strategies to capitalize on periods of maximum revenue contribution within the forecast horizon. This phased approach ensures optimized market positioning and sustainable growth across the 2025–2035 period.

Market expansion is being supported by the rapid telecommunications infrastructure development across global economies and the corresponding need for high-performance optical components in 5G communication systems, data centers, and advanced photonic applications. Modern telecommunications operations require superior optical materials with exceptional electro-optical properties to ensure optimal signal transmission and processing performance. The excellent optical, piezoelectric, and electro-optical characteristics of lithium tantalate make it an essential material in demanding applications where high-frequency performance and optical signal integrity are critical.

The growing emphasis on high-speed data transmission and network performance optimization is driving demand for advanced optical materials from certified manufacturers with proven track records of quality and consistency. Equipment manufacturers are increasingly investing in premium-grade wafer materials that offer superior optical properties and reliable performance over extended service periods. Technology requirements and performance standards are establishing material benchmarks that favor high-purity lithium tantalate solutions with advanced crystal properties and precise dimensional control.

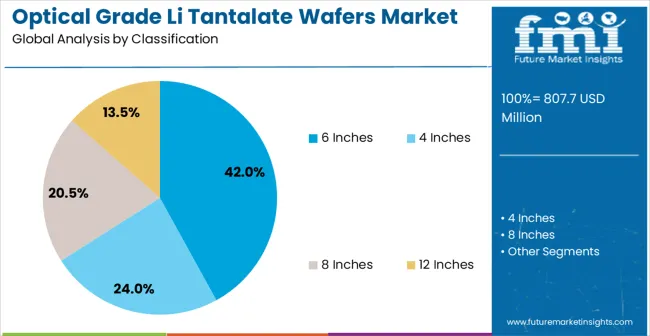

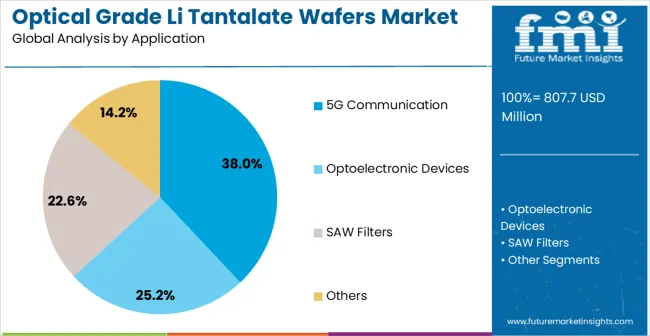

The market is segmented by wafer size, application, and region. By wafer diameter, the market is divided into 4 inches, 6 inches, 8 inches, and 12 inches configurations. Based on application, the market is categorized into 5G communication systems, optoelectronic devices, SAW (Surface Acoustic Wave) filters, and other optical applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

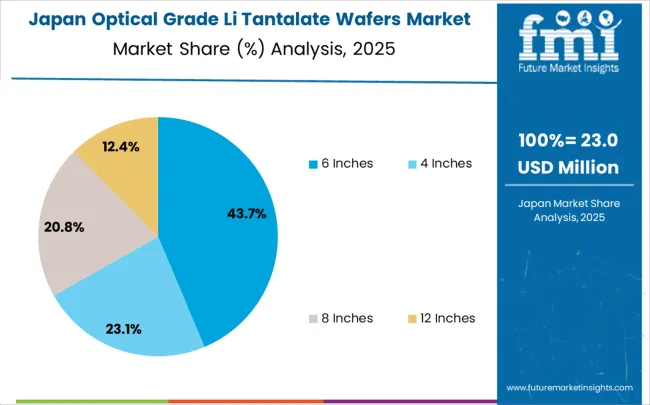

The 6-inch lithium tantalate wafer segment is projected to capture 42% of the optical grade lithium tantalate wafers market in 2025, securing a leading position. This dominance is driven by the optimal balance between manufacturing efficiency and device performance that 6-inch wafers provide for optical and telecommunications applications. These wafers offer cost-effectiveness for medium to high-volume production while maintaining superior optical properties, crystal uniformity, and structural integrity, making them suitable for 5G communication equipment, optical modulators, and advanced photonic devices. Technological advances in crystal growth, surface polishing, and quality control have improved dimensional precision, material consistency, and production yield while minimizing waste. The telecommunications and optoelectronics sectors are key demand drivers, as manufacturers require scalable, high-quality substrates for large-scale production. Integration of standardized processing and stringent quality control further reinforces the segment’s appeal, supporting consistent device performance, supply reliability, and cost-efficient manufacturing.

The 5G communication segment is expected to represent 38% of optical grade lithium tantalate wafer demand in 2025, making it the largest application. This dominance is supported by the essential role of lithium tantalate in 5G infrastructure components, including electro-optical modulators, optical switches, and high-frequency signal processing devices. These applications require optical materials with exceptional electro-optical performance, high-frequency stability, and reliability under continuous operation. The global deployment of 5G networks, combined with increasing requirements for advanced optical components, drives consistent demand. Key markets in Asia-Pacific, North America, and Europe contribute substantially as network operators invest in next-generation communication infrastructure. Trends such as enhanced mobile broadband, IoT connectivity, private 5G networks, and edge computing create further opportunities for lithium tantalate components. Adoption is reinforced by the need for high-performance, reliable optical systems that ensure signal integrity, efficient network operation, and long-term performance.

The optical grade lithium tantalate wafers market is advancing steadily due to increasing telecommunications infrastructure development and growing recognition of advanced optical material importance in high-frequency applications. However, the market faces challenges including high material costs compared to alternative substrates, complex crystal growth processes requiring specialized expertise, and varying quality requirements across different optical applications. Standardization efforts and quality assurance programs continue to influence material specifications and market development patterns.

The growing implementation of sophisticated crystal growth systems and comprehensive quality control programs is enabling enhanced material purity, crystal uniformity, and optical property consistency in lithium tantalate wafer production. Advanced crystal growth techniques provide precise control over crystal orientation, defect density, and optical properties while ensuring material reliability and extended device lifetimes. These technologies are particularly important for high-performance applications requiring exceptional optical quality and material consistency across large wafer areas.

Modern wafer manufacturers are incorporating advanced processing technologies and specialized crystal orientations that optimize optical properties for specific device applications and enable larger wafer sizes for improved manufacturing efficiency. Integration of application-specific crystal cuts and customized surface preparation enables enhanced device performance and significant cost advantages compared to standard wafer configurations. Advanced processing techniques and quality control systems also support development of ultra-low-loss wafers for demanding photonic applications requiring exceptional optical transparency and surface quality.

| Country | CAGR (2025–2035) |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| Brazil | 4.1% |

| United States | 3.7% |

| United Kingdom | 3.3% |

| Japan | 2.9% |

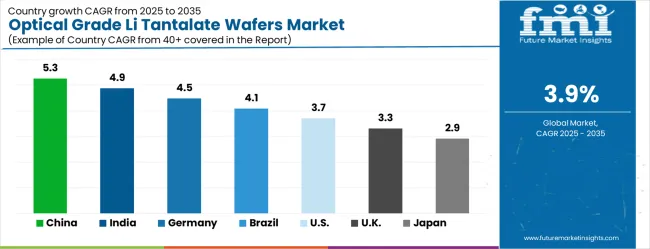

The optical grade lithium tantalate wafers market is growing rapidly, with China leading at a 5.3% CAGR through 2035, driven by massive telecommunications infrastructure expansion, 5G network deployment, and photonics industry development. India follows at 4.9%, supported by rising telecommunications modernization and increasing investments in optical communication infrastructure. Germany records strong growth at 4.5%, emphasizing precision optics manufacturing, quality standards, and advanced photonics capabilities. Brazil grows steadily at 4.1%, integrating optical components into expanding telecommunications and data center operations. The United States shows moderate growth at 3.7%, focusing on technology innovation and next-generation optical system development. The United Kingdom maintains steady expansion at 3.3%, supported by photonics research and telecommunications modernization programs. Japan demonstrates stable growth at 2.9%, emphasizing technological innovation and precision optical component manufacturing.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from optical grade lithium tantalate wafers systems in China is projected to grow at a CAGR of 5.3% through 2035, driven by rapid telecommunications infrastructure expansion and large-scale 5G deployment across metropolitan areas. The growing photonics industry and expanding optical communication equipment manufacturing are creating significant demand for high-quality lithium tantalate substrates. Major equipment manufacturers are implementing comprehensive wafer procurement programs to meet production and performance requirements. Government modernization programs and sector initiatives promote adoption of advanced optical materials, enhancing substrate reliability and electro-optical performance. Combined efforts support large-scale system deployment, optimal network performance, and integration of specialized wafer materials into high-demand telecommunications and photonics applications nationwide.

Revenue from optical grade lithium tantalate wafers systems in India is projected to expand at a CAGR of 4.9% through 2035, supported by telecommunications infrastructure modernization and growing investments in optical network development. The country’s expanding photonics and telecom equipment industries are driving demand for premium optical substrates that enable advanced device fabrication. Technology facilities are adopting high-quality wafer materials to improve device performance and meet international standards. Growth initiatives in telecom modernization and optical technology development are creating opportunities for advanced substrate adoption. Investment in reliable optical materials ensures enhanced network efficiency, reduced signal loss, and improved system durability, fostering adoption across major technology centers and strengthening India’s position in global photonics and telecommunications markets.

Demand for optical grade lithium tantalate wafers systems in Germany is projected to grow at a CAGR of 4.5% through 2035, supported by the country’s emphasis on precision optics manufacturing and advanced photonics capabilities. Optical equipment facilities are implementing high-quality substrate materials that meet stringent performance and optical quality standards. The market is characterized by focus on precision, material reliability, and compliance with industrial quality regulations. Photonics investments prioritize advanced optical materials to optimize device performance, reduce losses, and enhance manufacturing efficiency. Research and development initiatives support next-generation fiber and photonic systems, ensuring high-performance wafer integration. Germany’s approach strengthens technological innovation, quality assurance, and sustained adoption of high-grade optical substrates.

Revenue from optical grade lithium tantalate wafers systems in Brazil is projected to grow at a CAGR of 4.1% through 2035, driven by expanding telecommunications networks and data center development. The country’s developing optical communication sector is investing in advanced substrate materials to improve network performance, reliability, and service quality. Technology facilities are adopting high-quality optical materials to support increasing connectivity requirements. Infrastructure modernization and telecom growth initiatives promote the integration of premium substrates in critical network components. Adoption of high-performance wafer materials ensures reduced optical losses, enhanced signal fidelity, and scalable network deployment. Combined efforts support the evolution of Brazil’s telecommunications and data center ecosystems with reliable, performance-focused optical solutions.

Revenue from optical grade lithium tantalate wafers systems in the USA is projected to grow at a CAGR of 3.7% through 2035, driven by technology innovation and emphasis on next-generation optical system development. Photonics and telecommunications facilities are upgrading substrate materials for improved performance, reduced system costs, and compliance with rigorous standards. R&D and technology advancement programs encourage adoption of premium substrates that enhance device reliability and efficiency. The market benefits from integration of high-performance materials in critical communication and research applications. Adoption of advanced lithium tantalate wafers supports superior electro-optical properties, cost-effective production, and long-term system scalability across multiple photonics and telecom sectors in the United States.

Revenue from optical grade lithium tantalate wafers systems in the UK is projected to grow at a CAGR of 3.3% through 2035, supported by photonics research programs and telecommunications modernization initiatives. Research institutions and technology companies are investing in high-quality optical materials for consistent performance in experimental and industrial applications. Focus on material reliability, research quality, and compliance with academic and industrial standards drives adoption of premium wafers. Expansion of optical system development programs creates demand for specialized substrates in advanced photonics applications. Combined efforts ensure improved system performance, reproducibility, and reliability, fostering integration into both research and commercial telecommunications environments throughout the UK

Demand for optical grade lithium tantalate wafers systems in Japan is projected to grow at a CAGR of 2.9% through 2035, driven by technological innovation and precision optical manufacturing excellence. Japanese manufacturers are developing advanced optical devices using high-quality substrates with superior reliability and performance. Investments in continuous improvement and precision manufacturing enhance optical system efficiency, reduce losses, and optimize device functionality. Adoption of premium lithium tantalate wafers supports high-performance applications in photonics, telecommunications, and advanced instrumentation. Technology research programs and manufacturing excellence initiatives strengthen Japan’s position in precision optics, ensuring consistent quality, material reliability, and integration of advanced substrates across optical and communication systems.

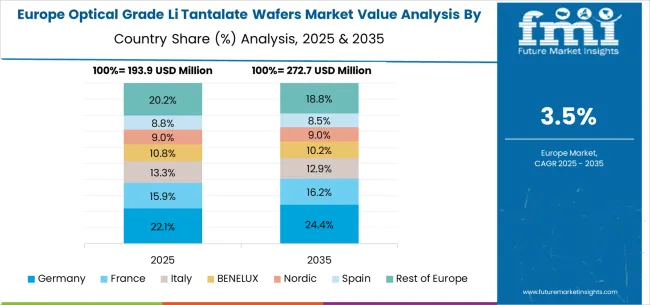

The optical grade lithium tantalate wafers market in Europe is projected to grow from USD 218.0 million in 2025 to USD 319.7 million by 2035, registering a CAGR of 3.9% over the forecast period. Germany is expected to maintain its leadership with a 32.1% share in 2025, supported by its strong photonics base and advanced optical manufacturing infrastructure. The United Kingdom follows with 18.3% market share, driven by photonics research and telecommunications development programs. France holds 15.6% of the European market, benefiting from optical technology investments and telecommunications modernization. Italy and Spain collectively represent 21.0% of regional demand, with growing focus on photonics and optical communication applications. The Rest of Europe region accounts for 13.0% of the market, supported by technology development in Eastern European countries and Nordic research institutions.

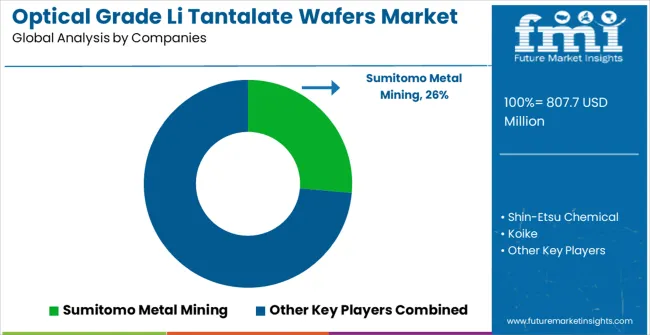

Competition in the optical grade lithium tantalate wafers market is defined by established materials manufacturers, specialized crystal producers, and technology-driven wafer suppliers. Sumitomo Metal Mining provides high-purity wafers with emphasis on optical performance, consistency, and reliability. Shin-Etsu Chemical delivers advanced lithium tantalate crystals with focus on precision, defect control, and material uniformity. Koike supplies wafers optimized for optical and piezoelectric applications with stringent quality standards. Korth Kristalle offers specialized crystal solutions with attention to purity, lattice structure, and performance stability.

Differentiation in the market is achieved through crystal quality, defect minimization, and process sophistication. Tiantong Kaiju Technology Co., Ltd. produces wafers with focus on advanced polishing techniques and dimensional consistency. Zhejiang MTCN Technology Co., Ltd. emphasizes high-performance materials for telecommunications and precision electronics. HEFEI KEJING MATERIALS TECHNOLOGY CO., LTD. delivers wafers tailored for piezoelectric and optical applications with validated performance. Suzhou Nanzhi Core Materials Technology Co., Ltd. applies rigorous quality assurance and process control to support reliable wafer production.

Additional players such as Hyperion Optics, Advanced Fiber Resources (Zhuhai), Ltd., and Bon-tek provide specialized crystal solutions, focusing on purity, uniformity, and regional supply capabilities. Product brochures highlight crystal orientation, optical transmittance, defect density, and dimensional accuracy. Technical specifications, material performance data, and application suitability are emphasized to reinforce trustworthiness. Each brochure functions as a demonstration of wafer quality, operational reliability, and competitive differentiation, collectively illustrating the market dynamics and strategic positioning of optical grade lithium tantalate wafer suppliers.

The optical grade lithium tantalate wafers market underpins telecommunications advancement, photonics innovation, optical system performance, and next-generation communication technologies. With performance mandates, stricter quality requirements, and demand for high-frequency optical components, the sector must balance cost competitiveness, material quality, and technological advancement. Coordinated contributions from governments, industry bodies, manufacturers/suppliers, research institutions, and investors will accelerate the transition toward high-performance, quality-assured, and cost-effective lithium tantalate wafer solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 807.7 Million |

| Classification Type | 4 Inches, 6 Inches, 8 Inches, 12 Inches |

| Application | 5G Communication, Optoelectronic Devices, SAW Filters, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Sumitomo Metal Mining, Shin-Etsu Chemical, Koike, Korth Kristalle, Tiantong Kaiju Technology Co., Ltd., Zhejiang MTCN Technology Co., Ltd., HEFEI KEJING MATERIALS TECHNOLOGY CO., LTD., Suzhou Nanzhi Core Materials Technology Co., Ltd., Hyperion Optics, Advanced Fiber Resources(Zhuhai),Ltd., Bon-tek |

| Additional Attributes | Dollar sales by wafer size and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established crystal growers and emerging suppliers, buyer preferences for different wafer sizes and crystal orientations, integration with advanced optical device fabrication technologies, innovations in crystal growth and wafer processing for enhanced optical quality and dimensional precision, and adoption of specialized wafer specifications with optimized electro-optical properties for high-performance telecommunications and photonics applications. |

The global optical grade lithium tantalate wafers market is estimated to be valued at USD 807.7 million in 2025.

The market size for the optical grade lithium tantalate wafers market is projected to reach USD 1,184.1 million by 2035.

The optical grade lithium tantalate wafers market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in optical grade lithium tantalate wafers market are 6 inches, 4 inches, 8 inches and 12 inches.

In terms of application, 5g communication segment to command 38.0% share in the optical grade lithium tantalate wafers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA