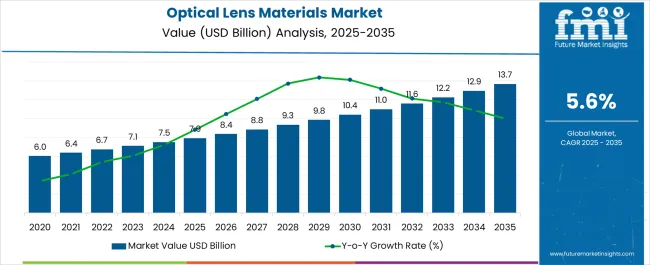

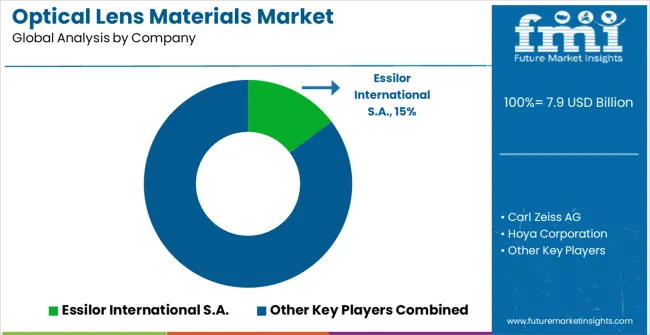

The Optical Lens Materials Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 13.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Optical Lens Materials Market Estimated Value in (2025 E) | USD 7.9 billion |

| Optical Lens Materials Market Forecast Value in (2035 F) | USD 13.7 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Optical Lens Materials market is experiencing substantial growth, driven by the increasing demand for vision correction and eye care products across both developed and emerging markets. Rising prevalence of refractive errors, including myopia, hyperopia, and astigmatism, is creating a strong need for high-performance lenses. Advancements in material science, including biocompatible polymers, lightweight composites, and high oxygen-permeable substances, are enhancing wearer comfort and visual clarity.

The adoption of technologically advanced lenses, such as silicone hydrogel and other specialty materials, has enabled longer wear time, reduced eye dryness, and improved overall ocular health. Growing awareness among consumers regarding eye care, combined with rising investments in optometry clinics and eye care infrastructure, is further supporting market expansion.

Additionally, the integration of lenses with advanced coatings for UV protection, anti-reflective properties, and durability has strengthened consumer preference As healthcare access and disposable incomes increase, demand for customized, comfortable, and high-performance optical lenses is expected to drive sustained market growth over the next decade.

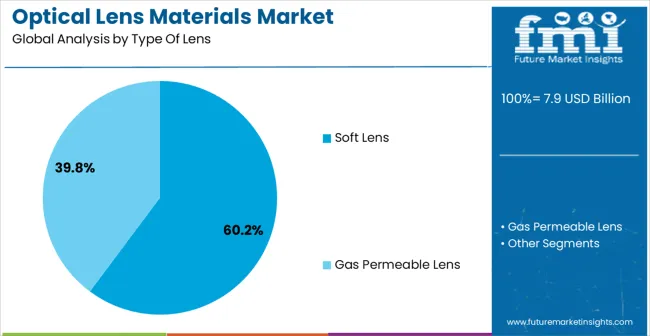

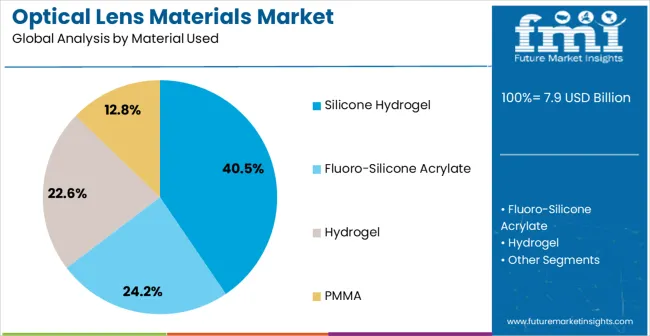

The optical lens materials market is segmented by type of lens, material used, and geographic regions. By type of lens, optical lens materials market is divided into Soft Lens and Gas Permeable Lens. In terms of material used, optical lens materials market is classified into Silicone Hydrogel, Fluoro-Silicone Acrylate, Hydrogel, and PMMA. Regionally, the optical lens materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soft lens segment is projected to hold 60.2% of the Optical Lens Materials market revenue in 2025, establishing it as the leading lens type. Its dominance is being driven by the high comfort, ease of use, and adaptability offered to users across different age groups and vision correction needs. Soft lenses provide better oxygen permeability and conform closely to the corneal surface, which reduces irritation and enhances wearer experience compared with rigid lenses.

The versatility of soft lenses enables incorporation of advanced materials, including silicone hydrogel, which further improves moisture retention and extended wear capabilities. Rising adoption among consumers for daily, extended, and disposable lens options has contributed to the segment’s growth. Technological improvements in lens design, coupled with increasing awareness about eye health and vision care, are strengthening market penetration.

The ability to customize lenses for specific prescriptions and lifestyles has enhanced preference among healthcare providers and end users As demand for comfortable and high-performance lenses continues to grow, the soft lens segment is expected to maintain its leadership position in the market.

The silicone hydrogel material segment is expected to account for 40.5% of the Optical Lens Materials market revenue in 2025, making it the leading material category. Growth in this segment is being driven by the superior oxygen permeability, moisture retention, and biocompatibility offered by silicone hydrogel, which significantly improves comfort and reduces complications such as dryness or irritation. This material enables longer daily and extended wear times compared with conventional hydrogel lenses, enhancing user satisfaction and compliance.

Technological advancements in polymer formulations and surface coatings have further improved the durability, wettability, and visual performance of silicone hydrogel lenses. Increasing preference by optometrists and healthcare providers for materials that combine high performance with safety has reinforced market leadership.

Rising consumer awareness about eye health and willingness to invest in premium lens materials have accelerated adoption As vision correction needs expand globally and eye care technology continues to advance, silicone hydrogel is expected to remain the preferred material for high-performance soft lenses, maintaining its market dominance and driving sustained growth in the segment.

The materials used to make optical lenses are known as optical lens materials. Optical lenses are made of different materials, such as Silicone Hydrogel, Fluoro-silicone Acrylate, Hydrogel and PMMA. Amongst these, optical lenses made of silicone hydrogel soft contact lenses are used mostly because they have high oxygen permeability providing comfort and ease to the lens.

These types of optical lens allow oxygen to pass through cornea thus making it possible to wear while sleeping. People suffering from presbyopia, astigmatism and other refractive errors generally use optical lenses made offluoro-silicone acrylate, which is thus fuelling the optical lens materials market.

The use of wide scleral lenses in future is expected to promote the growth of gas permeable lenses during the forecast period.

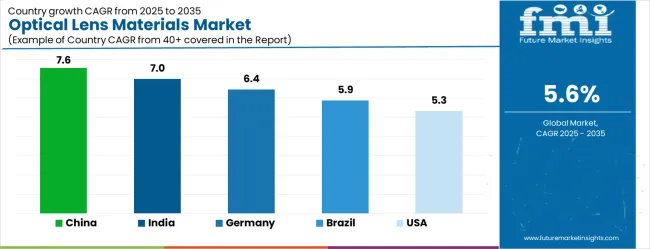

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| Brazil | 5.9% |

| USA | 5.3% |

| UK | 4.8% |

| Japan | 4.2% |

The Optical Lens Materials Market is expected to register a CAGR of 5.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.6%, followed by India at 7.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.2%, yet still underscores a broadly positive trajectory for the global Optical Lens Materials Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.4%. The USA Optical Lens Materials Market is estimated to be valued at USD 2.7 billion in 2025 and is anticipated to reach a valuation of USD 2.7 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 378.7 million and USD 260.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.9 Billion |

| Type Of Lens | Soft Lens and Gas Permeable Lens |

| Material Used | Silicone Hydrogel, Fluoro-Silicone Acrylate, Hydrogel, and PMMA |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Essilor International S.A., Carl Zeiss AG, Hoya Corporation, Nikon Corporation, Rodenstock GmbH, Seiko Optical Products Co., Ltd., Shamir Optical Industry Ltd., Tokai Optical Co., Ltd., Vision Ease Lens, Younger Optics, Mingyue Optical Lens Co., Ltd., Jiangsu Hongchen Group Co., Ltd., Wanxin Optical, and Chemi Lens Co., Ltd. |

The global optical lens materials market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the optical lens materials market is projected to reach USD 13.7 billion by 2035.

The optical lens materials market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in optical lens materials market are soft lens and gas permeable lens.

In terms of material used, silicone hydrogel segment to command 40.5% share in the optical lens materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Fiber Cold Joint Market Size and Share Forecast Outlook 2025 to 2035

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA