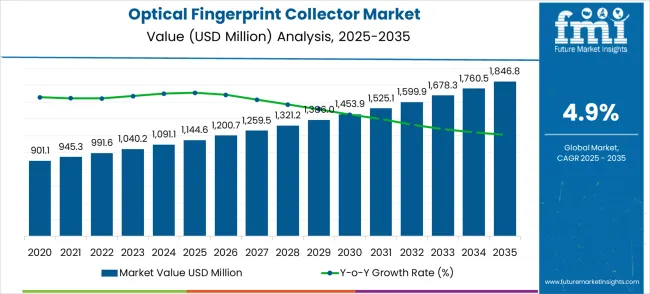

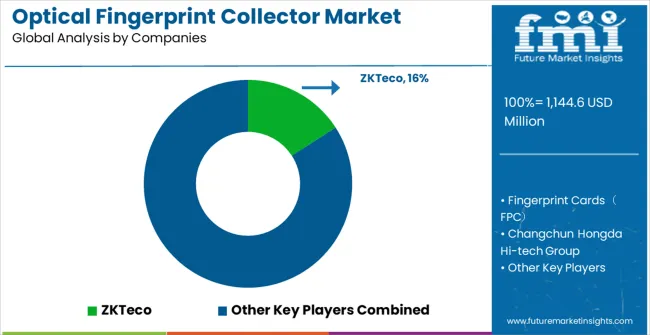

The optical fingerprint collector market is set to experience steady growth, with a forecasted compound annual growth rate (CAGR) of 4.9% from 2025 to 2035. The market value in 2025 is estimated at USD 1,144.6 million, with expectations to reach USD 1,846.8 million by 2035. The increasing adoption of biometric technologies for security applications, particularly in government, banking, and healthcare sectors, is driving the demand for optical fingerprint collection systems.

These systems offer high levels of security and ease of use, which have made them a preferred choice for authentication processes. As the need for secure identity verification continues to rise across various industries, the optical fingerprint collector market is poised to capitalize on this growing trend.

The growing focus on digital identity management and the shift toward contactless security systems are contributing factors to the optical fingerprint collector market's growth. These systems are increasingly used in critical infrastructure, including national security and financial transactions, where reliable, fast, and accurate identification is paramount.

The market is expected to expand as both public and private sector organizations invest in upgrading their security measures. With global concerns about privacy and security continuing to escalate, the demand for optical fingerprint collectors, which provide a non-intrusive and precise means of biometric identification, will continue to rise. The industry's future growth will be supported by these widespread security needs, particularly in regions with high volumes of transactions and sensitive data.

The optical fingerprint collector market holds around 12% of the share within the biometrics market, driven by its widespread use in identity verification and security systems. In the security systems market, it accounts for approximately 9%, reflecting its key role in enhancing security measures across various sectors. Within the identity verification solutions market, the share is about 10%, as optical fingerprint collectors are integral to systems ensuring safe and accurate identity validation.

The access control systems market sees roughly 8%, with optical fingerprint collectors being used for secure building and device access. In the law enforcement technology market, it captures about 7%, as optical fingerprint collection remains a critical tool in criminal identification and forensics. These figures demonstrate the growing demand for optical fingerprint collectors in ensuring security and effective identity management across multiple industries.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,144.6 million |

| Market Forecast Value (2035) | USD 1,846.8 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

Market expansion is being supported by the rapid advancement of digital security infrastructure across developing economies and the corresponding need for reliable biometric identification systems for access control and identity verification in security-sensitive facilities. Modern security operations require precise fingerprint capture and analysis to ensure optimal identification accuracy and operational security. The superior image quality and reliability characteristics of optical fingerprint collectors make them essential systems in demanding security environments where identification accuracy is critical.

The growing emphasis on cybersecurity and identity protection is driving demand for advanced fingerprint collection technologies from certified manufacturers with proven track records of reliability and accuracy. Security operators are increasingly investing in high-quality biometric systems that offer enhanced capture quality and reduced false rejection rates over extended operational periods. Security standards and compliance requirements are establishing performance benchmarks that favor precision-engineered optical fingerprint collector solutions with advanced image processing capabilities.

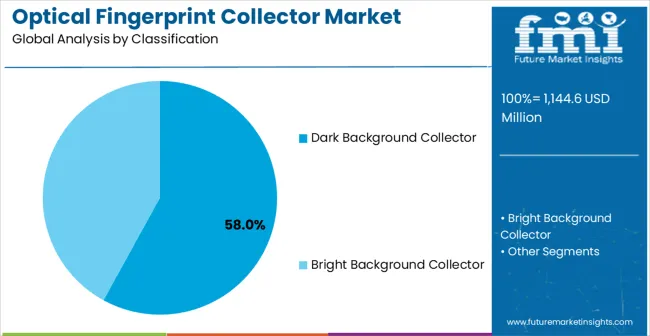

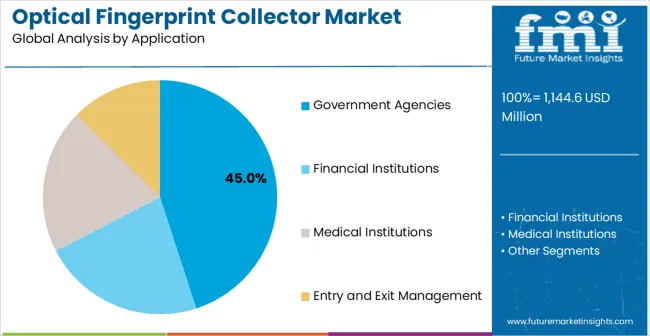

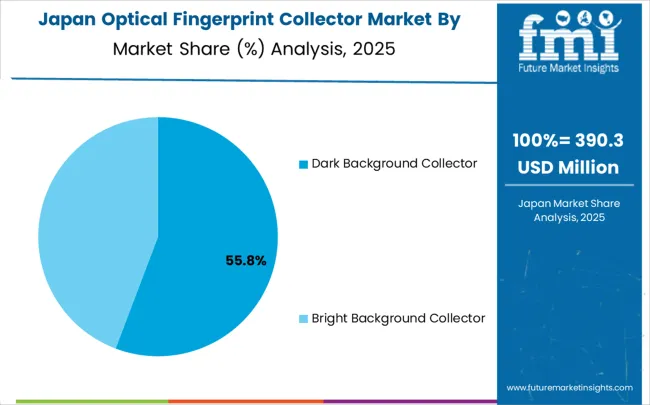

The market is segmented by product type, application, and region. By product type, the market is divided into dark background collector and bright background collector configurations. Based on application, the market is categorized into government agencies, financial institutions, medical institutions, and entry and exit management. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Dark background collector configurations are projected to account for 58% of the optical fingerprint collector market in 2025. This leading share is supported by the increasing demand for high-contrast fingerprint imaging in security applications and growing requirements for clear ridge pattern capture. Dark background collectors provide superior image contrast and pattern definition, making them the preferred choice for government security applications, law enforcement systems, and high-security access control installations. The segment benefits from technological advancements that have improved the image quality and processing speed of dark background collector systems while reducing operational complexity.

Modern dark background optical fingerprint collectors incorporate advanced LED illumination, high-resolution sensors, and sophisticated image enhancement algorithms that enable superior fingerprint capture quality and pattern recognition. These innovations have significantly improved identification accuracy while reducing total cost of ownership through enhanced reliability and elimination of false rejection costs. The government security and law enforcement sectors particularly drive demand for dark background collector solutions, as these industries require absolute identification precision to maintain security integrity and comply with stringent authentication standards.

Additionally, the border security industry increasingly adopts dark background collector solutions to ensure accurate identity verification and meet international security certifications. Operational reliability requirements and security compliance initiatives further accelerate market adoption, as dark background systems provide enhanced image quality while reducing identification errors and security vulnerabilities.

Government agencies applications are expected to represent 45% of optical fingerprint collector demand in 2025. This dominant share reflects the critical role of biometric identification in government security operations and the need for reliable fingerprint collection solutions capable of accurate identification in diverse operational conditions. Government facilities require effective and secure fingerprint collection systems for personnel access control, citizen identification, and security clearance verification. The segment benefits from ongoing expansion of digital identity programs in developing countries and increasing security requirements demanding enhanced biometric systems in government facilities.

Government security operations demand exceptional fingerprint collection performance to ensure identification accuracy and operational security. These applications require collectors capable of handling high-volume processing, various environmental conditions, and long-term reliable operation in critical security environments. The growing emphasis on national security standards, particularly in border control and citizen identification applications, drives consistent demand for high-performance optical fingerprint collection solutions. Emerging markets in Asia-Pacific, Latin America, and Middle East regions contribute significantly to market growth as governments invest in modern biometric technologies to improve security capabilities and administrative efficiency.

Additionally, the trend toward digital government services and e-governance initiatives creates opportunities for specialized fingerprint collection systems equipped with enhanced connectivity and integration capabilities features. The segment also benefits from increasing cybersecurity investments and identity verification programs driven by growing digital threats and compliance requirements.

The optical fingerprint collector market is advancing steadily due to increasing security concerns and growing recognition of biometric technology importance. However, the market faces challenges including privacy regulation compliance, need for specialized technical maintenance, and varying image quality requirements across different applications. Standardization efforts and certification programs continue to influence technology quality and market development patterns.

The growing deployment of AI-powered image processing and machine learning algorithms is enabling enhanced fingerprint analysis and automated quality assessment capabilities in optical fingerprint collection systems. Smart analytics and intelligent pattern recognition systems provide continuous learning from fingerprint data while optimizing capture parameters and extending identification accuracy. These technologies are particularly valuable for high-security facilities that require adaptive identification performance and minimal manual intervention.

Modern fingerprint collector manufacturers are incorporating multi-biometric capabilities and integrated security platforms that enable comprehensive identity verification while facilitating seamless integration with existing security infrastructure through connected access control systems. Integration of palm print recognition and advanced sensor technologies enables superior identification reliability and significant security enhancement compared to traditional single-factor authentication systems. Advanced connectivity solutions and cloud integration also support development of more scalable and centrally managed fingerprint collection architectures for demanding security environments.

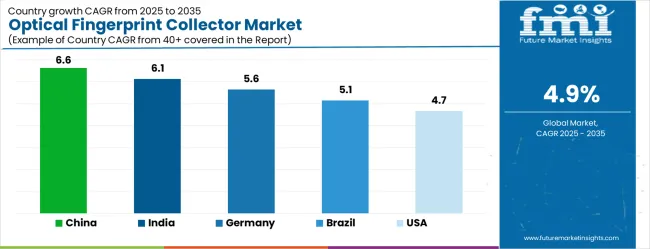

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| United States | 4.7% |

| United Kingdom | 4.2% |

| Japan | 3.7% |

The optical fingerprint collector market is growing rapidly, with China leading at a 6.6% CAGR through 2035, driven by massive digital identity infrastructure expansion, government security program development, and smart city initiatives. India follows at 6.1%, supported by rising biometric identification investments and increasing adoption of digital identity systems in government and financial applications.

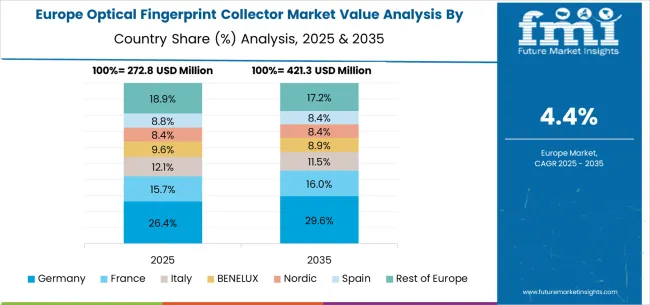

Germany records strong growth at 5.6%, emphasizing precision engineering, security technology excellence, and advanced biometric capabilities. Brazil grows steadily at 5.1%, integrating fingerprint collection systems into expanding government digitalization and financial security facilities.

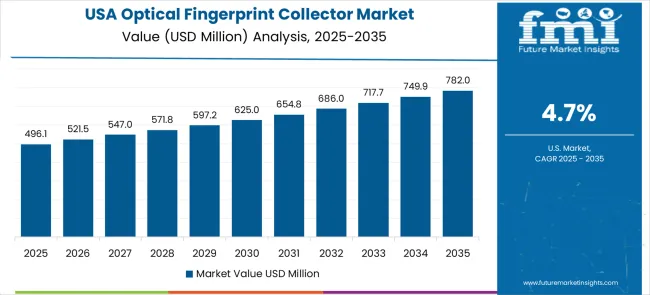

The United States shows moderate growth at 4.7%, focusing on security technology innovation and biometric system modernization improvements. The United Kingdom maintains steady expansion at 4.2%, supported by security infrastructure programs. Japan demonstrates stable growth at 3.7%, emphasizing technological innovation and security excellence.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The optical fingerprint collector market in China is projected to exhibit the highest growth rate with a CAGR of 6.6% through 2035, driven by rapid digital identity infrastructure expansion and massive government security program development across public sectors. The country's growing smart city initiatives and expanding biometric identification systems are creating significant demand for high-performance fingerprint collection systems. Major government agencies are establishing comprehensive biometric installations to support large-scale citizen identification operations and meet national security standards.

China's digital transformation sector continues expanding rapidly, with major investments in government digitalization, public security systems, and citizen identification programs. The country's position as a leader in digital governance drives substantial demand for reliable fingerprint collection solutions that ensure identification accuracy and operational security across diverse government applications.

The optical fingerprint collector market in India is expanding at a CAGR of 6.1%, supported by increasing biometric identification investments across government sectors and growing adoption of digital identity systems in government and financial applications. The country's expanding Aadhaar program and digital India initiatives are driving demand for specialized fingerprint collection systems capable of handling large-scale identification requirements. Government facilities are investing in advanced biometric technologies to improve service delivery and comply with digital identity standards.

India's digital identity development initiatives and biometric expansion create significant opportunities for optical fingerprint collector applications. The country's growing digital infrastructure drives demand for government services and financial inclusion programs, requiring reliable fingerprint collection solutions to maintain identification accuracy and program effectiveness.

The optical fingerprint collector market in Germany is projected to grow at a CAGR of 5.6%, supported by the country's emphasis on security technology excellence and advanced biometric capabilities. German security institutions are implementing high-performance fingerprint collection systems that meet stringent quality standards and operational reliability requirements. The market is characterized by focus on technological innovation, advanced engineering, and compliance with comprehensive security regulations.

Germany's advanced security sector and technology excellence capabilities drive demand for high-quality fingerprint collection solutions. The country's emphasis on security innovation, technological advancement, and identification precision creates opportunities for advanced biometric technologies that meet demanding security specifications.

The optical fingerprint collector market in Brazil is growing at a CAGR of 5.1%, driven by expanding government digitalization and increasing financial security system development across public sectors. The country's growing digital government initiatives are investing in advanced fingerprint collection systems to improve service quality and performance in modernizing administrative environments. Government facilities are adopting modern biometric technologies to support growing digitalization requirements and security standards.

Brazil's expanding digital infrastructure and government modernization create substantial opportunities for fingerprint collection applications. The country's growing public sector digitalization and financial security expansion drive investments in biometric solutions that enhance service competitiveness and operational efficiency.

The optical fingerprint collector market in the United States is expanding at a CAGR of 4.7%, driven by ongoing security technology innovation and increasing emphasis on biometric system modernization solutions. Security facilities are upgrading existing fingerprint collection systems with advanced technologies that provide improved performance and enhanced identification capabilities. The market benefits from replacement demand and facility modernization programs across multiple security sectors.

The United States market emphasizes security innovation, technology advancement, and identification improvement in biometric applications. Advanced research and development activities drive the adoption of next-generation fingerprint collection technologies that offer superior performance and operational reliability.

The optical fingerprint collector market in the United Kingdom is projected to grow at a CAGR of 4.2%, supported by ongoing security infrastructure programs and biometric system facility upgrades. Security operators are investing in reliable fingerprint collection systems that provide consistent performance and meet regulatory compliance requirements. The market is characterized by focus on system reliability, operational efficiency, and security compliance across diverse identification applications.

The United Kingdom's focus on security infrastructure and biometric excellence drives demand for high-performance fingerprint collection solutions. The country's emphasis on identification accuracy, operational efficiency, and security compliance creates opportunities for advanced biometric technologies.

The optical fingerprint collector market in Japan is expanding at a CAGR of 3.7%, driven by the country's emphasis on technological innovation and security excellence in biometric applications. Japanese manufacturers are developing advanced fingerprint collection technologies that incorporate precision engineering and efficiency-optimized design principles. The market benefits from focus on quality, reliability, and continuous improvement in biometric technology performance.

Japan's technological leadership and security expertise drive the development of advanced fingerprint collection solutions. The country's emphasis on innovation, quality control, and identification optimization creates opportunities for cutting-edge biometric technologies that set industry standards.

The optical fingerprint collector market is defined by competition among established biometric technology manufacturers, specialized fingerprint solution companies, and emerging security technology providers. Companies are investing in advanced sensor technologies, image processing innovation, standardized quality systems, and technical support capabilities to deliver reliable, accurate, and cost-effective fingerprint collection solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

ZKTeco, operating globally, offers comprehensive fingerprint collection solutions with focus on precision imaging, reliability, and technical support services. Fingerprint Cards (FPC), multinational manufacturer, provides advanced biometric systems with emphasis on sensor quality and application integration capabilities. Changchun Hongda Hi-tech Group, specialized provider, delivers innovative fingerprint collection solutions for security applications with focus on accuracy and durability. Aratek offers comprehensive biometric technologies with standardized procedures and technical service support.

Goodix Technology provides advanced fingerprint collection systems with emphasis on consumer and commercial applications and technical expertise. China-Vision delivers specialized biometric solutions with focus on high-performance security applications. Finger Up, HFSecurity offer comprehensive fingerprint collection technologies for demanding security environments with established development and service capabilities.

Qualcomm, SecuGen Corporation, Nitgen, Thales, and Coto provide advanced fingerprint collection systems with global technology capabilities, regional service networks, and specialized expertise across biometric technology and security solution sectors.

The optical fingerprint collector market underpins security infrastructure excellence, digital identity advancement, biometric authentication reliability, and secure access control implementation. With cybersecurity mandates, stricter identity verification requirements, and demand for accurate biometric systems, the sector must balance cost competitiveness, technology reliability, and privacy compliance. Coordinated contributions from governments, industry bodies, OEMs/technology integrators, suppliers, and investors will accelerate the transition toward AI-enhanced, privacy-compliant, and digitally integrated optical fingerprint collection systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,144.6 million |

| Product type | Dark Background Collector, Bright Background Collector |

| Application | Government Agencies, Financial Institutions, Medical Institutions, Entry and Exit Management |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | ZKTeco, Fingerprint Cards (FPC), Changchun Hongda Hi-tech Group, Aratek, Goodix Technology, China-Vision, Finger Up, HFSecurity, Qualcomm, SecuGen Corporation, Nitgen, Thales, Coto |

| Additional Attributes | Dollar sales by product type and application segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging technology suppliers, buyer preferences for high-accuracy versus cost-effective biometric systems, integration with digital identity and access control technologies, innovations in sensor technology and image processing for enhanced accuracy and reliability, and adoption of AI-enabled fingerprint collection solutions with embedded analytics and cloud connectivity capabilities for improved operational efficiency. |

The global optical EMI shielding adapters market is estimated to be valued at USD 54.6 million in 2025.

The market size for the optical EMI shielding adapters market is projected to reach USD 112.5 million by 2035.

The optical EMI shielding adapters market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in optical EMI shielding adapters market are lc adapters and sc adapters.

In terms of application, data centers segment to command 40.0% share in the optical EMI shielding adapters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Fiber Cold Joint Market Size and Share Forecast Outlook 2025 to 2035

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical EMI Shielding Adapters Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA