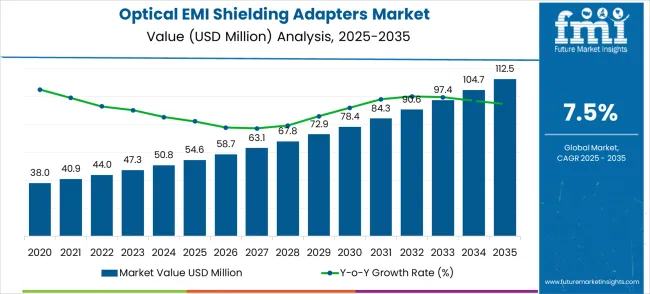

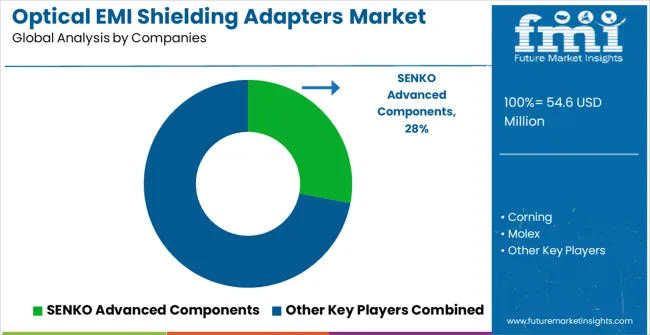

The global optical EMI shielding adapters market is projected to grow from USD 54.6 million in 2025 to approximately USD 112.5 million by 2035, recording an absolute increase of USD 57.9 million over the forecast period. This translates into a total growth of 106.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.5% between 2025 and 2035.

The overall market size is expected to grow by nearly 2.1X during the same period, supported by increasing demand for electromagnetic interference protection, growing data center infrastructure requirements, and rising adoption of fiber optic communication systems across the global telecommunications, defense, and industrial automation industries.

From 2030 to 2035, the market is forecast to grow from USD 78.4 million to USD 112.5 million, adding another USD 34.1 million, which constitutes 58.9% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced EMI protection technologies, the integration of next-generation fiber optic systems for premium optical EMI shielding adapter products, and the development of specialized adapter configurations for emerging applications. The growing emphasis on electromagnetic compatibility and signal integrity will drive demand for high-performance optical EMI shielding adapters with enhanced protection capabilities and improved connection reliability.

Between 2020 and 2024, the optical EMI shielding adapters market experienced robust growth, driven by increasing data center investments and growing recognition of EMI protection's critical importance across telecommunications and defense applications. The market developed as system integrators recognized the potential for EMI shielding adapters to enhance signal integrity while meeting stringent electromagnetic compatibility requirements. Technological advancement in shielding materials and connector design began emphasizing the critical importance of maintaining optical performance while providing effective electromagnetic interference protection.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 54.6 million |

| Forecast Value in (2035F) | USD 112.5 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

Market expansion is being supported by the increasing global demand for electromagnetic interference protection and the corresponding shift toward advanced fiber optic systems that can provide superior signal integrity while meeting industry requirements for reliable and protected optical connections.

Modern data centers and telecommunications facilities are increasingly focused on incorporating optical EMI shielding adapters to enhance system performance while satisfying demands for electromagnetic compatibility and signal protection. Optical EMI shielding adapters' proven ability to deliver superior EMI protection, signal integrity maintenance, and connection reliability makes them essential components for sensitive electronic environments and critical communication systems.

The growing emphasis on data center expansion and digital infrastructure development is driving demand for high-quality optical EMI shielding adapter products that can support distinctive protection capabilities and premium system positioning across telecommunications, defense, and industrial automation categories.

Equipment manufacturer preference for components that combine optical performance excellence with electromagnetic protection is creating opportunities for innovative EMI shielding adapter implementations in both traditional data center and emerging edge computing applications. The rising influence of 5G deployment and high-speed data transmission requirements is also contributing to increased adoption of premium optical EMI shielding adapter products that can provide authentic high-performance electromagnetic protection characteristics.

The optical EMI shielding adapters market represents a specialized niche within the fiber optic components sector, with the market projected to grow from USD 54.6 million in 2025 to USD 112.5 million by 2035 at a solid 7.5% CAGR 106% expansion driven by increasing data center density requirements, electromagnetic compatibility regulations, and the proliferation of sensitive electronic environments requiring protected fiber optic connections.

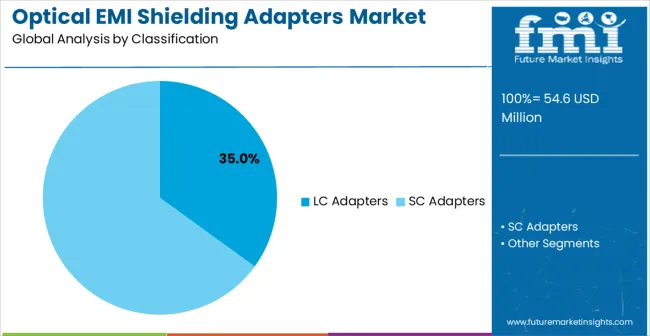

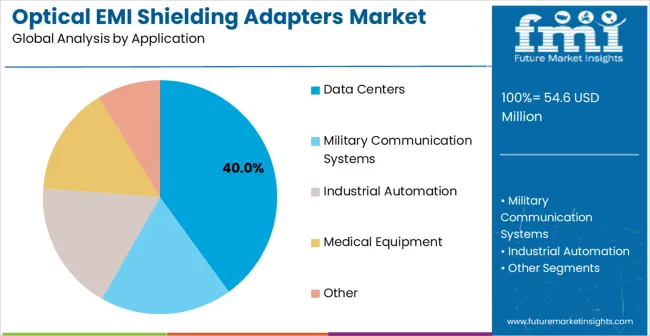

This market serves critical applications where standard fiber optic adapters are insufficient due to electromagnetic interference concerns, particularly in data centers with high-frequency switching equipment, military communication systems, and industrial automation environments. LC adapters dominate with 35.0% market share due to their space efficiency and high-density characteristics essential for modern data centers, while data center applications lead demand given the massive growth in cloud infrastructure requiring EMI protection. Geographic growth is strongest in China (10.1% CAGR), driven by data center expansion, though the overall market size remains relatively small and specialized.

Pathway A - Data Center Infrastructure Focus. The dominant application segment serves the rapidly expanding cloud and hyperscale data center market, requiring electromagnetic protection in high-density environments. Companies developing cost-effective EMI shielding solutions optimized for data center deployment will capture this primary market, driving overall industry growth. Expected revenue pool: USD 45-60 million.

Pathway B - LC Adapter Technology Leadership. The leading adapter type offers superior space efficiency essential for high-density fiber optic installations. Providers developing advanced LC adapter designs with enhanced EMI shielding effectiveness and improved installation characteristics will maintain leadership in this established market segment. Opportunity: USD 35-45 million.

Pathway C - 5G and Edge Computing Applications. Next-generation telecommunications infrastructure requires EMI protection in distributed, space-constrained environments. Developing specialized shielding adapters for 5G base stations and edge computing facilities addresses this emerging high-growth segment beyond traditional data centers. Revenue uplift: USD 20-35 million.

Pathway D - Geographic Expansion in High-Growth Markets. China and India's data center and telecommunications infrastructure expansion create substantial opportunities. Local partnerships with data center operators and telecommunications providers enable market penetration in these rapidly growing regions, driving global demand. Pool: USD 25-40 million.

Pathway E - Military and Defense Applications. Specialized defense communication systems require ruggedized EMI protection with enhanced security features. Developing military-grade shielding adapters with specialized certifications and enhanced protection capabilities serves this quality-sensitive, higher-margin market segment. Expected upside: USD 15-25 million.

Pathway F - Industrial Automation and Medical Equipment. Manufacturing environments and medical facilities require EMI protection for sensitive control systems and diagnostic equipment. Specialized adapters for industrial and medical applications create diversification opportunities beyond telecommunications and data center markets. USD 12-20 million.

Pathway G - Advanced Materials and Shielding Technology. Next-generation shielding materials and improved electromagnetic protection effectiveness create competitive differentiation. Companies investing in advanced shielding materials and enhanced protection capabilities will command premium pricing in this performance-sensitive market. Pool: USD 10-18 million.

Pathway H - Cost Reduction and Market Expansion. High costs relative to standard adapters limit market adoption in price-sensitive applications. Developing cost-effective manufacturing processes and simplified designs enables market expansion into broader fiber optic applications currently using standard adapters without EMI protection. Expected revenue: USD 8-15 million.

The market is segmented by adapter type, application, and region. By adapter type, the market is divided into LC adapters and SC adapters. Based on application, the market is categorized into data centers, military communication systems, industrial automation, medical equipment, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The LC adapters segment is projected to account for 35% of the optical EMI shielding adapters market in 2025, reaffirming its position as the leading adapter type category. Data center operators and telecommunications engineers increasingly utilize LC adapters for their superior space efficiency, high-density characteristics, and reliable performance across diverse fiber optic applications. LC adapter technology's compact form factor and established compatibility directly address the industry requirements for high-density connections and efficient rack space utilization in modern data center and telecommunications operations.

This adapter type segment forms the foundation of modern high-density optical applications, as it represents the technology with the greatest space efficiency and established reliability across multiple fiber optic systems. Manufacturer investments in LC adapter optimization and shielding enhancement continue to strengthen adoption among data center operators. With facilities prioritizing connection density and electromagnetic protection, LC adapters with EMI shielding align with both space optimization objectives and performance requirements, making them the central component of comprehensive high-density optical networking strategies.

Data center applications are projected to represent the 40% market share of optical EMI shielding adapters demand in 2025, underscoring their critical role as the primary application for protected fiber optic connections in data center infrastructure and cloud computing operations.

Data center operators prefer optical EMI shielding adapters for their exceptional electromagnetic protection capabilities, signal integrity characteristics, and ability to maintain consistent performance while supporting high-density connectivity requirements during data center operations. Positioned as essential components for high-performance data center infrastructure, optical EMI shielding adapters offer both electromagnetic protection and operational reliability advantages.

The segment is supported by continuous growth in data center expansion and the growing availability of specialized shielding technologies that enable enhanced electromagnetic compatibility and performance optimization at the facility level.

Additionally, data center operators are investing in advanced infrastructure technologies to support cloud computing growth and digital transformation initiatives. As data center infrastructure continues to expand and operators seek superior electromagnetic protection solutions, data center applications will continue to dominate the application landscape while supporting digital infrastructure advancement and performance optimization strategies.

The optical EMI shielding adapters market is advancing rapidly due to increasing data center investments and growing demand for electromagnetic protection solutions that emphasize superior signal integrity across telecommunications and defense applications. However, the market faces challenges, including higher costs compared to standard optical adapters, technical complexity in shielding integration, and limited awareness of EMI protection benefits in some market segments. Innovation in cost reduction technologies and application-specific solutions continues to influence market development and expansion patterns.

The growing adoption of optical EMI shielding adapters in 5G infrastructure and edge computing applications is enabling component manufacturers to develop products that provide distinctive electromagnetic protection capabilities while commanding premium positioning and enhanced performance characteristics. Advanced applications provide superior EMI protection while allowing more sophisticated deployment and development across various telecommunications categories and edge computing segments. Manufacturers are increasingly recognizing the competitive advantages of EMI protection positioning for premium component development and next-generation infrastructure market penetration.

Modern optical EMI shielding adapter suppliers are incorporating advanced shielding materials, enhanced connector designs, and improved manufacturing processes to strengthen electromagnetic protection, improve optical performance, and meet industry demands for reliable and high-performance protected connections. These programs improve component performance while enabling new applications, including high-frequency communications and sensitive measurement systems. Advanced technology integration also allows suppliers to support premium market positioning and performance leadership beyond traditional commodity optical components.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| Brazil | 7.9% |

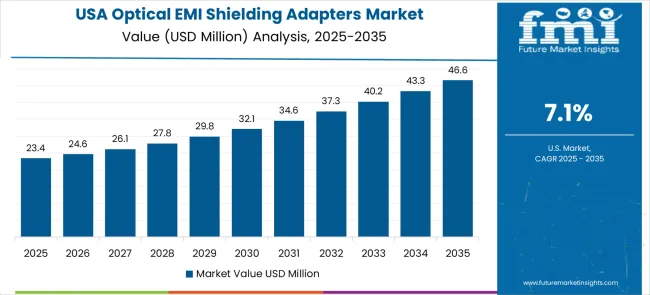

| USA | 7.1% |

| UK | 6.4% |

| Japan | 5.6% |

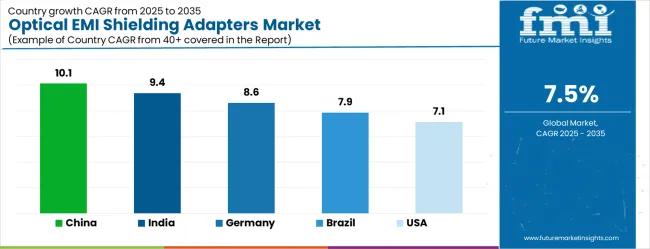

The optical EMI shielding adapters market is experiencing exceptional growth globally, with China leading at a 10.1% CAGR through 2035, driven by the rapidly expanding data center sector, massive investments in telecommunications infrastructure, and increasing adoption of fiber optic technologies. India follows at 9.4%, supported by growing digital infrastructure, rising telecommunications investments, and expanding data center capabilities.

Germany shows growth at 8.6%, emphasizing advanced engineering technology and premium telecommunications solutions. Brazil records 7.9%, focusing on emerging digital infrastructure applications and telecommunications development. The USA demonstrates 7.1% growth, prioritizing data center innovation and telecommunications advancement. The UK exhibits 6.4% growth, supported by digital infrastructure development and advanced telecommunications capabilities. Japan shows 5.6% growth, emphasizing precision manufacturing excellence and high-quality optical component production.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from optical EMI shielding adapters in China is projected to exhibit exceptional growth with a CAGR of 10.1% through 2035, driven by the rapidly expanding data center sector and massive government investments in digital infrastructure development across major technology hubs. The country's growing telecommunications infrastructure and increasing adoption of fiber optic technologies are creating substantial demand for EMI protection components in both established and emerging digital applications. Major optical component manufacturers and telecommunications companies are establishing comprehensive production and distribution capabilities to serve both domestic infrastructure needs and export markets.

Revenue from optical EMI shielding adapters in India is expanding at a CAGR of 9.4%, supported by growing digital infrastructure, increasing telecommunications investments, and expanding data center applications. The country's developing telecommunications ecosystem and expanding digital services are driving demand for reliable EMI protection components across both urban development and emerging technology applications. International optical component companies and domestic telecommunications equipment manufacturers are establishing comprehensive distribution and service capabilities to address growing market demand for advanced fiber optic solutions.

Revenue from optical EMI shielding adapters in Germany is projected to grow at a CAGR of 8.6% through 2035, driven by the country's advanced engineering technology sector, premium telecommunications capabilities, and leadership in precision optical solutions. Germany's sophisticated telecommunications infrastructure and willingness to invest in high-performance optical components are creating substantial demand for both standard and specialized EMI shielding adapter varieties. Leading technology companies and telecommunications equipment manufacturers are establishing comprehensive innovation strategies to serve both European markets and growing international demand.

Revenue from optical EMI shielding adapters in Brazil is projected to grow at a CAGR of 7.9% through 2035, supported by the country's expanding telecommunications sector, growing digital infrastructure applications, and increasing adoption of fiber optic technologies requiring reliable EMI protection solutions. Brazilian telecommunications providers and international companies consistently seek high-performance optical components that enhance system reliability for both enterprise and consumer markets. The country's position as a regional telecommunications hub continues to drive innovation in optical technology applications and performance standards.

Revenue from optical EMI shielding adapters in the United States is projected to grow at a CAGR of 7.1% through 2035, supported by the country's advanced data center sector, optical technology innovation capabilities, and established leadership in telecommunications solutions. American data center operators and telecommunications companies prioritize performance, reliability, and electromagnetic compatibility, making optical EMI shielding adapters essential components for both cloud infrastructure and communication networks. The country's comprehensive digital infrastructure and technical expertise support continued market development.

Revenue from optical EMI shielding adapters in the United Kingdom is projected to grow at a CAGR of 6.4% through 2035, supported by the country's digital infrastructure development sector, advanced telecommunications capabilities, and established expertise in optical networking solutions. British telecommunications operators' focus on performance, reliability, and service quality creates steady demand for high-performance optical EMI shielding components. The country's attention to digital transformation and infrastructure optimization drives consistent adoption across both traditional telecommunications and emerging digital applications.

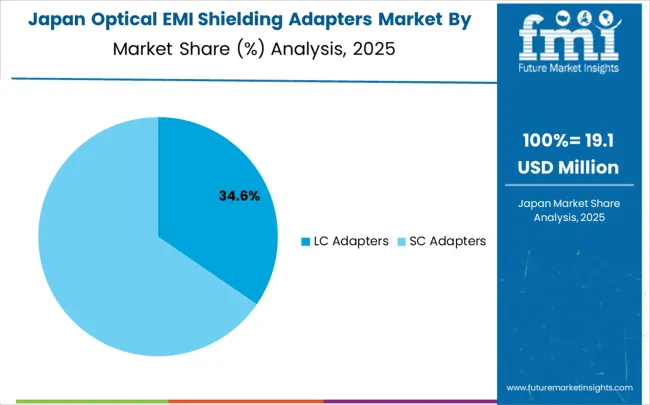

Revenue from optical EMI shielding adapters in Japan is projected to grow at a CAGR of 5.6% through 2035, supported by the country's precision optical manufacturing excellence, advanced component technology expertise, and established reputation for producing superior telecommunications equipment while working to enhance electromagnetic protection capabilities and develop next-generation optical technologies. Japan's optical component industry continues to benefit from its reputation for delivering high-quality precision products while focusing on innovation and manufacturing excellence.

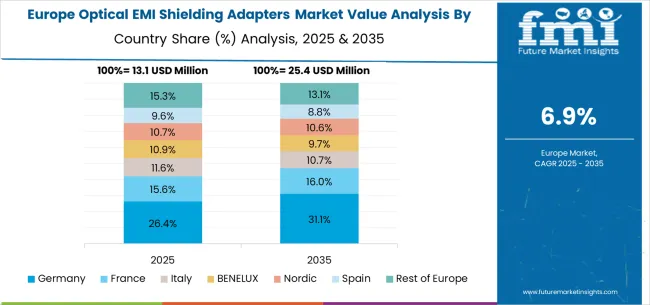

The optical EMI shielding adapters market in Europe is projected to grow from USD 14.2 million in 2025 to USD 27.4 million by 2035, registering a CAGR of 6.8% over the forecast period. Germany is expected to maintain its leadership position with a 28.9% market share in 2025, remaining stable at 28.7% by 2035, supported by its advanced engineering technology sector, precision optical component manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with a 21.1% share in 2025, projected to reach 21.3% by 2035, driven by digital infrastructure development programs, advanced telecommunications capabilities, and a growing focus on electromagnetic compatibility solutions for premium applications. France holds an 18.3% share in 2025, expected to maintain 18.1% by 2035, supported by telecommunications infrastructure demand and advanced optical applications, but facing challenges from market competition and technology investment considerations.

Italy commands a 14.7% share in 2025, projected to reach 14.9% by 2035, while Spain accounts for 9.2% in 2025, expected to reach 9.4% by 2035. The Netherlands maintains a 4.6% share in 2025, growing to 4.7% by 2035.

The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 16.8% in 2025, declining slightly to 16.5% by 2035, attributed to mixed growth patterns with moderate expansion in some advanced telecommunications markets balanced by slower growth in smaller countries implementing optical infrastructure development programs.

The optical EMI shielding adapters market is characterized by competition among established optical component companies, specialized EMI shielding manufacturers, and integrated telecommunications solution suppliers. Companies are investing in advanced shielding technologies, electromagnetic compatibility optimization systems, application-specific product development, and comprehensive technical support capabilities to deliver consistent, high-performance, and reliable optical EMI shielding adapter products. Innovation in electromagnetic protection enhancement, optical performance optimization, and customized telecommunications solutions is central to strengthening market position and customer satisfaction.

SENKO Advanced Components leads the market with a strong focus on optical connectivity innovation and comprehensive fiber optic solutions, offering sophisticated optical EMI shielding adapter products that emphasize electromagnetic protection and performance excellence. Corning provides integrated optical communication capabilities with a focus on telecommunications applications and global fiber optic networks. Molex delivers advanced connectivity technology with a focus on innovation and premium component development.

TE Connectivity specializes in connectivity solutions with emphasis on technical expertise and electromagnetic compatibility optimization. SANWA focuses on optical component technologies and advanced telecommunications systems with comprehensive electromagnetic protection capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 54.6 million |

| Adapter Type | LC Adapters, SC Adapters |

| Application | Data Centers, Military Communication Systems, Industrial Automation, Medical Equipment, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | SENKO Advanced Components, Corning, Molex, TE Connectivity, and SANWA |

| Additional Attributes | Dollar sales by adapter type and application, regional demand trends, competitive landscape, technological advancements in EMI shielding, electromagnetic compatibility development initiatives, optical performance optimization programs, and telecommunications integration strategies |

The global laser safety cloths market is estimated to be valued at USD 265.6 million in 2025.

The market size for the laser safety cloths market is projected to reach USD 416.4 million by 2035.

The laser safety cloths market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in laser safety cloths market are medium and high power laser protection cloth and low power laser protection cloth.

In terms of application, laser laboratories segment to command 42.0% share in the laser safety cloths market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Optical Lens Materials Market Size and Share Forecast Outlook 2025 to 2035

Optical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Component Tester Market Size and Share Forecast Outlook 2025 to 2035

Optical Connector Polishing Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Optical Lattice Clock Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade Lithium Tantalate Wafers Market Size and Share Forecast Outlook 2025 to 2035

Optical Grade LiTaO3 Crystal Substrate Market Size and Share Forecast Outlook 2025 to 2035

Optical Brighteners Market Size and Share Forecast Outlook 2025 to 2035

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Optical Communication and Networking Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA