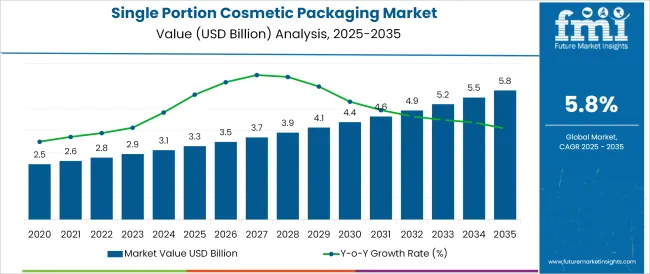

The Single Portion Cosmetic Packaging Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The single portion cosmetic packaging market is experiencing consistent growth, shaped by evolving consumer lifestyles, heightened hygiene expectations, and the demand for travel-friendly, trial-sized formats. The shift toward minimal-waste consumption and precise dosage control has fostered widespread adoption across personal care categories. Brands are increasingly embracing unit-dose formats to support premiumization, increase sampling efficiency, and align with e-commerce convenience.

Technical advancements in sealing technologies and barrier materials have enhanced shelf-life and product integrity, further legitimizing single-use formats for active ingredient-based formulations. Regulatory guidance emphasizing reduced contamination and enhanced product safety has accelerated the adoption of tamper-evident, single-use packaging.

With global beauty and wellness brands focusing on personalization and low-waste strategies, the market outlook remains favorable-particularly in premium hair care, skin care, and nutraceutical-infused cosmetic formulations where product freshness and controlled use are essential.

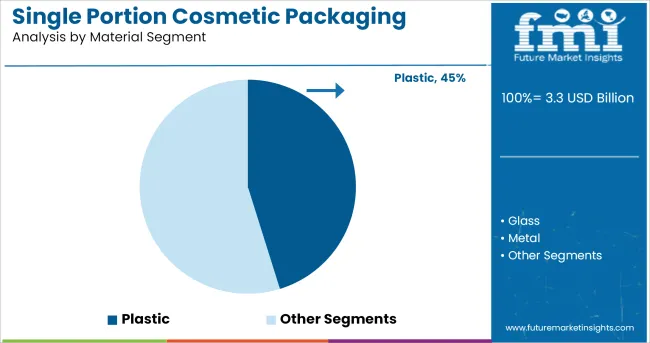

The plastic material segment is projected to account for 45.20% of total market revenue by 2025, establishing it as the leading material choice. This dominance is attributed to plastic’s adaptability, lightweight nature, and compatibility with high-speed filling systems. Plastic materials have offered design flexibility and cost-efficiency for unit-dose formats, enabling high barrier performance, extended shelf-life, and tamper resistance.

The capacity to incorporate recyclable or bio-based plastic variants has helped mitigate environmental concerns while maintaining functionality. Furthermore, plastic’s resilience under pressure and temperature changes makes it suitable for a variety of cosmetic formulations, especially those requiring secure containment

These advantages have contributed to the segment’s leadership, particularly in scalable packaging solutions tailored for travel, sampling, and single-use applications.

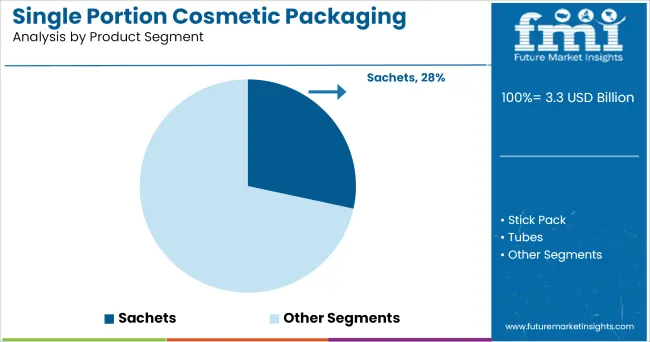

Sachets are expected to represent 28.40% of total market revenue within the product segment, marking them as the most prominent format. This preference is driven by the format’s cost-efficiency, portability, and ease of use for consumers seeking on-the-go cosmetic solutions. Sachets have offered brands an accessible platform for trial offerings, promotional sampling, and retail display in compact environments.

The format supports precise portioning, which reduces overuse and encourages controlled consumption. It also aligns with hygiene trends by eliminating cross-contamination risks in shared or open-use containers.

Compatibility with automated production lines and high output speeds has further reinforced sachets’ scalability. As cosmetic brands increasingly target convenience-driven and experiential shoppers, sachets continue to serve as the optimal intersection of efficiency, protection, and marketing adaptability.

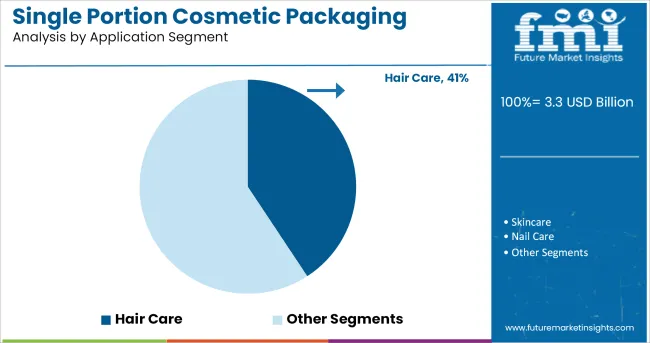

Hair care is anticipated to account for 40.75% of market revenue in the application segment, positioning it as the leading use-case. This growth has been influenced by rising consumer interest in personalized, targeted hair treatments and premium product sampling.

Single portion packaging allows for accurate dosing of conditioners, masks, and serums-supporting convenience and minimizing product waste. Increasing adoption of single-use formats in salons and travel retail has further elevated the segment’s prominence. Additionally, brands have utilized unit-dose hair care formats to offer trial experiences for high-end products without full-size commitment.

The growing frequency of scalp-specific and treatment-based hair care routines has reinforced demand for clean, tamper-proof, and portion-controlled packaging. As consumer preferences continue shifting toward functionally distinct and clean-label hair products, single portion packaging is set to play a critical role in product differentiation and user satisfaction in the hair care category.

Packaging is a vital marketing factor for cosmetic products as it attracts consumer attention and imitates the image of cosmetic products. The cosmetic packaging industry has observed an astonishing growth in the last decade and signifies the changing socio-economic and cultural trends.

It has been observed that the packaging of cosmetics products is directly proportional to the success of cosmetic products. Furthermore, the demand for single-portion packaging for cosmetics products is getting higher than ever. Single portion cosmetic pack

Kaging offers precise dose at any time and place which makes it easier for consumers and significantly improves the brand perception. On the back of all these factors, there is a positive impact on the sales of the target market and is anticipated to an exponential increase in future.

Maximum of the cosmetics products are sunlight sensitive and temperature, which creates a necessity for efficient packaging solutions for the cosmetic products. The shelf-life of the cosmetic products mainly be contingent on the cosmetic formulation and material of packaging. The packaging material is preferred according to its compatibility with formulation as well as customer needs.

Single portion cosmetic packaging helps the product to increase the shelf-life of the product which is escalating the growth of the target market.

The cosmetics industry is rapidly increasing in developing countries with the increasing demand also. Nowadays, consumers have become more open to the adoption of cosmetics as the number of organic products.

The increasing consumption of cosmetics products among millennials will create a growth opportunity for the single portion cosmetic packaging manufacturers to maximize theirs sales in the market.

Globally, the packaging industry is adapting various trends and in which ‘green’ has become a new packaging trend. The demand for ecological cosmetic packaging solutions is substantially increasing with increasing consumer awareness towards the environment.

The green packaging solution for cosmetic packaging is favouring a trend and is anticipated to fuel the demand for the single portion cosmetic packaging market.

The manufacturers in the cosmetic packaging market are producing cosmetics products in a larger quantity which are packaged in big jars, tubes. These larger quantity cosmetic products are commonly used by makeup professionals which helps them to use these products long time without buying them again and again. Therefore, consumption of products in larger quantities is projected to hamper the growth of the single portion cosmetic packaging market.

Global Players:

Asian Players:

The key players adopt various strategies such as product launch, merger & acquisition, innovation and others to survive the competition in the market. Key players are launching new and innovative single portion cosmetic packaging in the market to lure a major portion of the end-users and manufacturers.

Due to changing lifestyles and increasing awareness for skincare, emerging economies such as China is providing a huge opportunity for the growth of the single portion cosmetic packaging market. However, in China, the demand for cosmetics is increasing frequently which is directly impacting the growth of the single portion cosmetic packaging market. Rising innovation in packaging to gain a competitive advantage is propelling the global market growth in the forecast period.

Due to the pandemic consumers preferred buying cosmetic products through the e-commerce sector which has fuelled the sales and demand for single portion cosmetic packaging. Globally, the growing e-commerce industry is further expected to boost the demand for single portion cosmetic packaging.

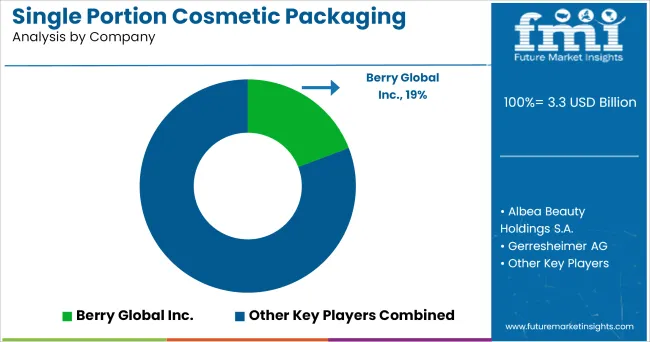

The global single portion cosmetic packaging market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the single portion cosmetic packaging market is projected to reach USD 5.8 billion by 2035.

The single portion cosmetic packaging market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in single portion cosmetic packaging market are plastic, glass, metal and paper.

In terms of product segment, sachets segment to command 28.4% share in the single portion cosmetic packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Single Portion Cosmetic Packaging Companies

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Machine Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Single Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA