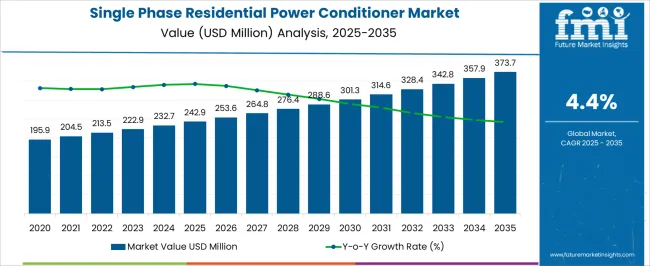

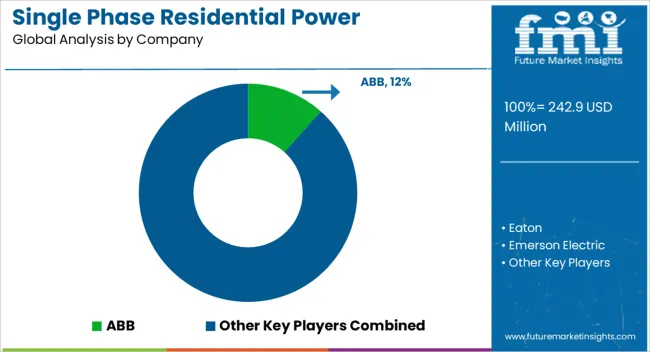

The single phase residential power conditioner market, estimated at USD 242.9 million in 2025 and projected to reach USD 373.7 million by 2035 with a CAGR of 4.4%, exhibits a growth trajectory indicative of a market transitioning through a late early adoption phase toward maturity. In the initial years, from 2025 to 2028, modest annual increases from USD 242.9 million to USD 276.4 million suggest a gradual uptake driven by consumer awareness of power quality issues and increasing reliance on sensitive home appliances.

Early adopters, including tech-savvy homeowners and regions with unstable grids, primarily fuel market expansion during this period. As adoption progresses toward the mid-term, from 2028 to 2032, the market expands more steadily, rising from USD 276.4 million to USD 328.4 million, reflecting growing penetration into mainstream residential segments.

Broader consumer recognition of the value of power conditioning and integration with home energy management solutions accelerates uptake, while distributors and retailers optimize supply chains to address increasing demand. By the late phase of the forecast period, 2032 to 2035, the market nears maturity with revenues reaching USD 373.7 million.

Saturation effects and competitive differentiation influence adoption rates, with innovations such as compact designs, enhanced surge protection, and energy efficiency features supporting incremental growth. The market demonstrates a structured adoption lifecycle transitioning from early adoption toward stable, widespread residential acceptance.

| Metric | Value |

|---|---|

| Single Phase Residential Power Conditioner Market Estimated Value in (2025 E) | USD 242.9 million |

| Single Phase Residential Power Conditioner Market Forecast Value in (2035 F) | USD 373.7 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The single phase residential power conditioner market represents a specialized segment within the global electrical equipment and home energy management industry, emphasizing voltage stabilization, appliance protection, and energy efficiency. Within the broader residential electrical solutions sector, it accounts for about 4.7%, driven by increasing adoption in homes facing voltage fluctuations and unreliable grid supply. In the power protection and conditioning segment, its share is approximately 5.1%, reflecting use in safeguarding sensitive electronics, home appliances, and HVAC systems.

Across the smart home and residential energy management market, it holds around 3.9%, supporting integration with inverters, UPS systems, and solar setups. Within the electrical safety and utility equipment category, it represents 3.4%, highlighting compliance with safety standards and consumer demand for reliable power. In the overall residential energy solutions ecosystem, the market contributes about 3.0%, emphasizing adoption in urban and semi-urban households. Recent developments in the market have focused on digital monitoring, smart integration, and energy-efficient designs. Innovations include microprocessor-controlled voltage regulation, surge protection, and real-time fault detection for improved reliability.

Key players are collaborating with home automation and solar inverter manufacturers to integrate power conditioning with smart energy management systems. Adoption of compact, low-noise designs and high-efficiency transformers is gaining traction to reduce operational losses and ensure compatibility with residential appliances. The remote monitoring and IoT-enabled diagnostic features are being deployed to enhance user convenience and maintenance scheduling.

The single phase residential power conditioner market is witnessing consistent growth due to increasing demand for stable and uninterrupted electricity supply in urban and semi-urban households. The rising adoption of sensitive electronic appliances such as smart televisions, high-efficiency refrigerators, and computing devices is amplifying the need for precise voltage regulation and power quality management. Power fluctuations, especially in developing economies and remote areas, are driving residential consumers to invest in reliable power conditioning equipment.

Additionally, growing concerns about equipment longevity and energy efficiency are influencing end users to adopt advanced power conditioning systems that provide not only voltage stabilization but also surge protection and harmonic filtration. Increasing consumer awareness about power quality and its effect on household appliances is contributing to sustained market demand.

With rapid residential electrification, particularly in emerging markets, and the proliferation of connected home devices, the single phase residential power conditioner market is expected to maintain strong growth momentum Product innovation focused on compact designs, noise-free operation, and IoT-enabled monitoring is further supporting market expansion across varied residential segments.

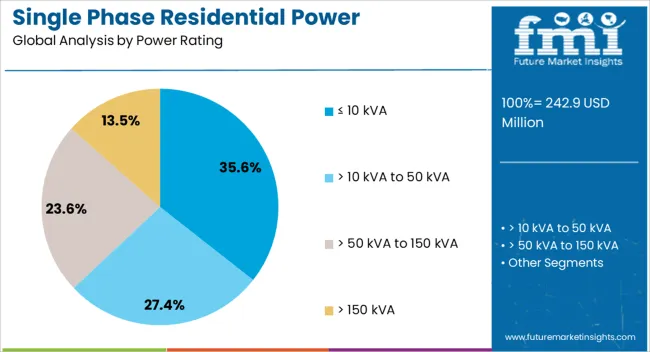

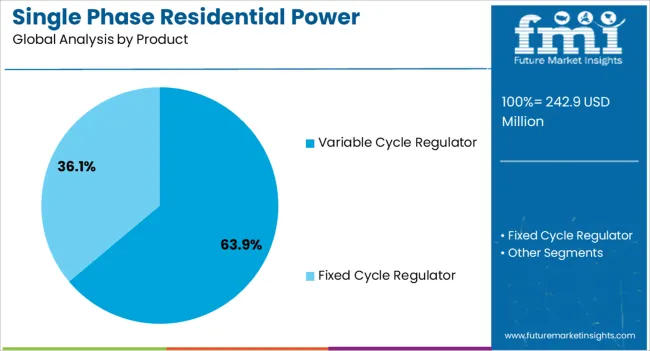

The single phase residential power conditioner market is segmented by power rating, product, and geographic regions. By power rating, single phase residential power conditioner market is divided into ≤ 10 kVA, > 10 kVA to 50 kVA, > 50 kVA to 150 kVA, and > 150 kVA. In terms of product, single phase residential power conditioner market is classified into Variable Cycle Regulator and Fixed Cycle Regulator. Regionally, the single phase residential power conditioner industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than or equal to 10 kVA power rating segment is expected to account for 35.6% of the single phase residential power conditioner market revenue share in 2025, positioning it as a major contributor within the market. This growth is being driven by the segment’s suitability for residential environments where energy consumption is typically moderate and distributed across a limited number of appliances. The capacity range is ideal for supporting typical household loads including lighting systems, entertainment electronics, kitchen appliances, and HVAC units without oversizing or unnecessary power wastage.

Ease of installation, lower operational noise, and cost-effective performance are strengthening its appeal among residential users. As urban dwellings become more compact and power-efficient, consumers are increasingly opting for systems that match actual load profiles without compromising on power quality.

The segment also benefits from compatibility with backup systems and solar inverters, further increasing its relevance in energy-conscious households As manufacturers continue to innovate in compact and intelligent design, the less than or equal to 10 kVA segment is anticipated to retain significant market share in the coming years.

The variable cycle regulator product segment is projected to dominate the single phase residential power conditioner market with a 63.9% revenue share in 2025, reflecting its strong acceptance among residential users. This leadership is attributed to its ability to regulate voltage fluctuations dynamically while maintaining continuous output through cycle-based correction rather than abrupt cutoffs. The technology allows for smoother power delivery, reduced stress on appliances, and minimized switching delays, making it well suited for environments with frequent minor voltage variations.

Its operational flexibility, lower maintenance requirements, and efficient energy usage contribute to its popularity in residential settings. Additionally, variable cycle regulators are often designed with compact and aesthetic housing, aligning with modern interior standards and home energy setups.

The increasing integration of smart functionalities, such as auto-sensing voltage conditions and adaptive correction modes, further enhances their value proposition. As homeowners become more conscious of power quality and energy efficiency, the variable cycle regulator segment is expected to sustain its dominant position, supported by continued advancements in performance, reliability, and user-friendly features.

The market has gained significant traction due to the increasing demand for a stable and reliable electricity supply in homes. Residential consumers are affected by voltage fluctuations, short circuits, and harmonic distortions, which can damage household appliances and electronics. Single-phase power conditioners are designed to regulate voltage, filter noise, and improve overall power quality, ensuring protection and enhanced appliance lifespan.

Rapid adoption of smart homes and connected devices has further increased the need for uninterrupted, stable power. Market expansion is supported by growing urban residential infrastructure, rising consumer awareness regarding electrical safety, and technological developments in energy-efficient and compact conditioning systems that integrate easily into household electrical networks.

Single phase residential power conditioners are widely used to protect sensitive appliances such as air conditioners, refrigerators, and smart devices from voltage surges and dips. Advanced systems utilize microprocessor-based control and automatic voltage regulation to maintain consistent output despite unstable input supply. Integration with surge protection, thermal monitoring, and energy metering modules enhances safety and efficiency. Consumers increasingly prefer conditioners with compact designs, low energy consumption, and minimal maintenance requirements. As households deploy more electronic devices, the risk of damage due to voltage irregularities has increased, driving adoption. Manufacturers emphasize improved reliability, faster response times, and durability to meet residential needs, strengthening the market globally across regions experiencing unstable power grids.

Energy-efficient single phase residential power conditioners are gaining popularity due to their ability to optimize power consumption while stabilizing voltage. Integration with smart home ecosystems allows remote monitoring, performance tracking, and automated response to voltage fluctuations. Features such as adaptive voltage correction, programmable alerts, and real-time energy feedback enhance user convenience and energy savings. Rising awareness of energy management and eco-friendly solutions in urban households is further boosting demand. Smart integration ensures that the systems not only protect devices but also contribute to optimized electricity usage, reducing energy wastage and utility costs. Such multifunctional solutions are emerging as preferred choices for modern residential installations.

Urban residential development has created the need for robust power conditioning solutions as electricity networks in cities face higher loads and frequent voltage variations. Renovation and expansion of electrical grids, alongside the deployment of renewable energy sources like solar panels, have added complexity to residential power quality. Single phase conditioners help maintain stable voltage in such environments, protecting household appliances from damage and ensuring uninterrupted operation. Government programs promoting safe and reliable electricity distribution have also reinforced adoption in urban areas. The increasing number of households adopting modern electrical appliances and home automation solutions further supports the demand for advanced conditioning systems capable of managing complex residential loads effectively.

The market exhibits strong growth in Asia Pacific due to rapid urban residential expansion and frequent voltage fluctuations in certain regions. North America and Europe demonstrate high adoption of advanced conditioning systems, driven by awareness of electrical safety, quality standards, and integration with smart home systems. Key manufacturers focus on product innovation, energy efficiency, compact design, and user-friendly interfaces to differentiate offerings. Strategic collaborations with utility companies and smart home solution providers enhance market penetration. Continuous R&D investments in voltage regulation technology, surge protection, and digital monitoring systems ensure that residential power conditioners remain relevant in evolving electricity distribution scenarios across different regions worldwide.

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| U.K. | 4.2% |

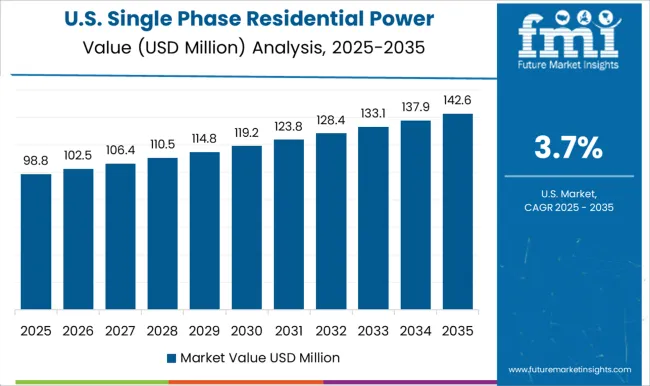

| U.S. | 3.7% |

| Brazil | 3.3% |

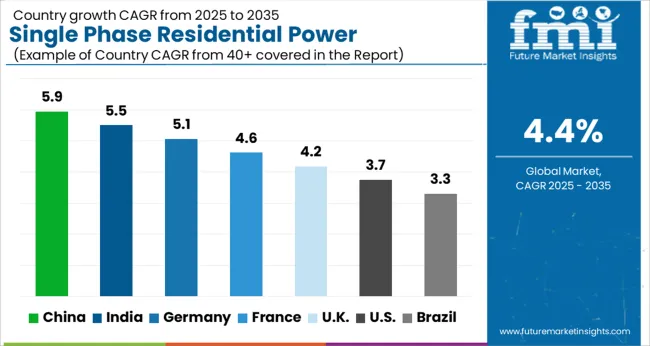

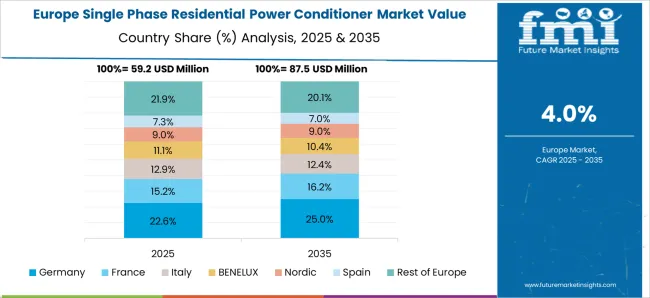

The market is expected to expand at a CAGR of 4.4% from 2025 to 2035. Germany contributed 5.1%, driven by adoption of energy-efficient power regulation systems. China led with 5.9%, fueled by increasing residential construction and demand for voltage stabilization solutions. India recorded 5.5%, reflecting investments in reliable power infrastructure and home automation technologies. The United Kingdom reached 4.2%, as residential upgrades and energy management initiatives support growth. The United States stood at 3.7%, with gradual replacement of older conditioning systems and emphasis on residential electrical safety. These countries are actively scaling, deploying, and innovating in residential power conditioning technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 5.9%, driven by rising residential electricity consumption, increasing reliance on sensitive household electronics, and expansion of urban housing developments. Power quality issues such as voltage fluctuations and harmonics create strong demand for single phase residential power conditioners. Domestic manufacturers are enhancing product efficiency, reliability, and compact design to suit apartment complexes and individual homes. Partnerships with electrical equipment suppliers and distributors further strengthen market penetration.

India is expected to grow at a CAGR of 5.5%, supported by increasing electrification, frequent voltage fluctuations, and rising household adoption of sensitive electrical appliances. Residential construction projects and small-scale housing developments are key drivers of demand. Companies are introducing cost-effective and compact units suitable for apartments and individual homes. Expansion of e-commerce channels and partnerships with electrical distributors enable wider product availability across urban and semi-urban regions.

Germany, with a CAGR of 5.1%, demonstrates steady adoption due to high household penetration of sensitive electrical equipment and appliances. Consumers prioritize energy-efficient and reliable solutions to maintain power quality, especially in older residential areas. Manufacturers emphasize durability, compliance with European electrical standards, and low-noise operation. Growing interest in smart homes and integrated energy management systems is encouraging adoption of advanced power conditioning units.

The United Kingdom is forecast to grow at a CAGR of 4.2%, influenced by increasing reliance on home electronics, rising awareness of power quality issues, and modernization of residential electrical infrastructure. Adoption of compact and energy-efficient power conditioners is gaining momentum in urban housing. Distributors focus on both offline retail and online platforms to reach end-users. Emerging demand from renewable-powered homes also supports market growth.

The United States, growing at a CAGR of 3.7%, is characterized by steady adoption in suburban and urban residences to protect sensitive electronics from voltage irregularities. Residential construction and home renovation projects create consistent demand. Manufacturers focus on high-reliability, plug-and-play models suitable for individual homes. Smart integration with home energy management systems and surge protection features enhances product appeal.

The market is dominated by a mix of global electrical giants and specialized power solutions providers, focusing on voltage stabilization, energy efficiency, and protection of residential appliances. Key players such as ABB, Eaton, Emerson Electric, Mitsubishi Electric, and Legrand leverage extensive R&D capabilities, strong distribution networks, and brand recognition to offer high-quality, reliable, and durable power conditioning solutions. These companies focus on product innovation, incorporating surge protection, smart monitoring, and compact designs to meet evolving residential energy needs. Mid-tier and regional manufacturers including Hubbell, Fuji Electric, AMETEK, Vishay, Trystar, GenTech Scientific, Helios Power Solutions, SERVOMAX, Arzoo Energy, Compact Systems, and Sollatek compete by offering cost-effective, modular, and customized solutions for residential consumers in emerging markets.

Market players differentiate themselves through quick after-sales service, local market adaptation, and flexible pricing strategies. Competitive strategies in the market revolve around technological advancement, energy-efficient designs, and integrated smart features. Partnerships with utility companies, distributors, and smart home technology providers strengthen market positioning. Growing residential demand for a stable power supply and rising adoption of smart energy solutions are driving intense competition, encouraging players to innovate and expand their service networks to capture broader market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 242.9 Million |

| Power Rating | ≤ 10 kVA, > 10 kVA to 50 kVA, > 50 kVA to 150 kVA, and > 150 kVA |

| Product | Variable Cycle Regulator and Fixed Cycle Regulator |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Eaton, Emerson Electric, Mitsubishi Electric Corporation, Legrand, Hubbell, Fuji Electric, AMETEK, Vishay, Trystar, GenTech Scientific, Helios Power Solutions, SERVOMAX, Arzoo Energy, Compact Systems, and Sollatek |

| Additional Attributes | Dollar sales by conditioner type and application, demand dynamics across residential, small commercial, and smart home segments, regional trends in voltage regulation adoption, innovation in surge protection, energy efficiency, and compact design, environmental impact of electronic component production and energy use, and emerging use cases in home energy management, renewable integration, and appliance protection. |

The global single phase residential power conditioner market is estimated to be valued at USD 242.9 million in 2025.

The market size for the single phase residential power conditioner market is projected to reach USD 373.7 million by 2035.

The single phase residential power conditioner market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in single phase residential power conditioner market are ≤ 10 kva, > 10 kva to 50 kva, > 50 kva to 150 kva and > 150 kva.

In terms of product, variable cycle regulator segment to command 63.9% share in the single phase residential power conditioner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single-Mode Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Single-Coated Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Single Superphosphate (SSP) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Electron Transistor Market Size and Share Forecast Outlook 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Use Pallet Market Size and Share Forecast Outlook 2025 to 2035

Single Serve Coffee Container Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA