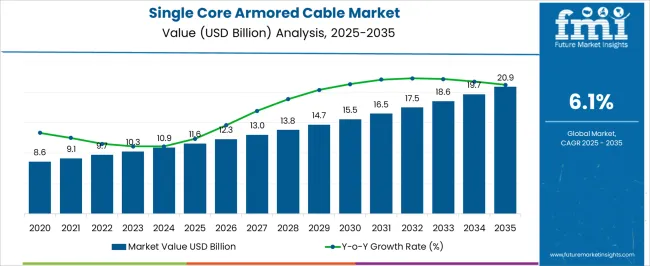

The single core armored cable sector is expected to expand from USD 11.6 billion in 2025 to USD 20.9 billion by 2035, advancing at a CAGR of 6.1%. The long-term value accumulation curve indicates steady growth, with values moving from 11.6 billion in 2025 to 13.8 billion in 2028 and 15.5 billion in 2030. This progression highlights the rising use of armored cables in power transmission, industrial networks, and infrastructure projects where durability and safety are essential. Curve reflects stable momentum, with demand being influenced by consistent upgrades in grid capacity and installation of new electrical systems.

By 2031, the industry value is projected at 16.5 billion, increasing to 18.6 billion in 2033 and closing at 20.9 billion in 2035. The accumulation curve underscores long-term adoption, supported by construction projects, energy distribution, and industrial automation where mechanical strength and protective sheathing are prioritized. Market observers suggest the steady incline validates armored cables as indispensable components that enhance reliability and operational safety. The curve demonstrates dependable expansion, reinforcing the position of single core armored cables as long-term infrastructure assets that provide both resilience and efficiency across global power and industrial applications.

| Metric | Value |

|---|---|

| Single Core Armored Cable Market Estimated Value in (2025 E) | USD 11.6 billion |

| Single Core Armored Cable Market Forecast Value in (2035 F) | USD 20.9 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The single core armored cable segment is estimated to account for nearly 20% of the electrical cables market, about 18% of the power transmission and distribution market, close to 14% of the industrial wiring solutions market, nearly 12% of the building and construction wiring market, and around 10% of the energy and utilities infrastructure market. This represents an aggregated share of approximately 74% across its parent categories. This proportion highlights the strong reliance on single core armored cables for applications requiring durability, safety, and uninterrupted current flow in harsh operating environments. Their importance has been established in both underground and overhead installations where mechanical protection and resistance to external stress are critical.

Analysts view this segment not simply as a subset of cables but as a defining element that supports large-scale infrastructure reliability, whether in power plants, industrial complexes, or commercial buildings. Demand has been reinforced by the expansion of utility-scale projects and the need for dependable distribution networks that guarantee long operational lifespans. Single core armored cables are considered strategic assets by project developers and contractors, as they reduce maintenance risks while ensuring compliance with stringent installation standards. Their role in shaping energy infrastructure positions them as a cornerstone within parent markets, making them indispensable in procurement, engineering, and execution strategies across the global electrical and utilities landscape.

The current market scenario reflects growing adoption in industries where mechanical protection, electrical safety, and long operational life are critical.

The ability of armored cables to resist physical damage, moisture ingress, and chemical exposure has reinforced their use in both industrial and infrastructure applications. Advancements in material engineering and manufacturing precision are enabling cables with improved flexibility, lighter weight, and higher resistance to environmental stress.

The growing investments in energy projects, industrial automation, and urban infrastructure are creating opportunities for specialized armored cables with enhanced performance characteristics. Future growth is expected to be shaped by the integration of fire-resistant and low-smoke zero-halogen materials, as well as increasing regulatory focus on safety compliance and operational reliability in cable installations.

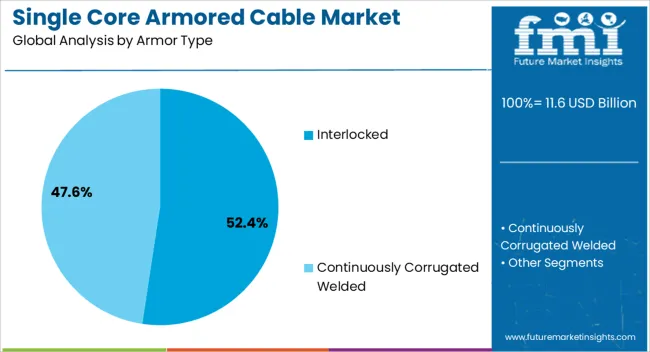

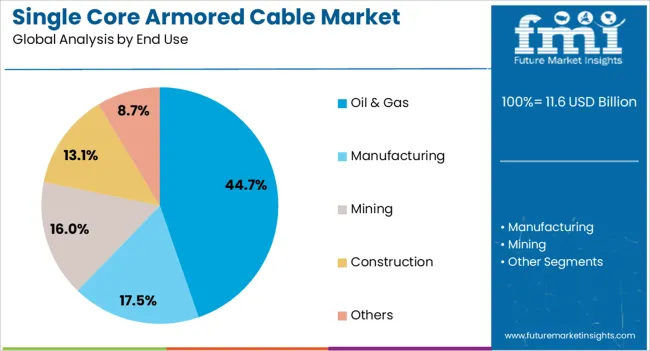

The single core armored cable market is segmented by armor type, end use, and geographic regions. By armor type, single core armored cable market is divided into Interlocked and Continuously Corrugated Welded. In terms of end use, single core armored cable market is classified into Oil & Gas, Manufacturing, Mining, Construction, and Others. Regionally, the single core armored cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Interlocked armor type is projected to hold 52.4% of the Single Core Armored Cable market revenue in 2025, making it the leading segment by armor type. This position is being supported by the superior mechanical protection and flexibility provided by interlocked designs, which are well-suited for installations in industrial and high-traffic environments.

The segment’s growth is being reinforced by its ability to combine robust protective qualities with ease of installation, reducing labor costs and downtime during maintenance. Its adaptability to both indoor and outdoor applications has expanded its use across multiple industries. The reduced need for additional conduit, due to the inherent strength of the interlocked structure, has further increased its adoption in cost-sensitive projects Demand has also been supported by increasing infrastructure development and the modernization of energy distribution systems, where cable protection and reliability are prioritized.

The Oil & Gas end-use segment is expected to account for 44.7% of the Single Core Armored Cable market revenue in 2025, establishing it as the leading end-use industry. This dominance is being driven by the sector’s high reliance on robust cabling systems capable of withstanding harsh operating conditions, including exposure to extreme temperatures, chemicals, and physical stress.

The use of armored cables in drilling operations, refineries, offshore platforms, and pipeline monitoring has been reinforced by their ability to ensure continuous performance under high mechanical and environmental strain. Safety requirements and strict compliance standards in the oil and gas industry have further encouraged the adoption of single core armored designs. As exploration and production activities increase in challenging locations, the demand for cables that can ensure operational reliability while minimizing downtime is expected to remain strong, thereby supporting the segment’s continued leadership.

The single core armored cable market is projected to expand steadily, driven by rising investments in power transmission, commercial construction, and industrial projects. Demand is reinforced by the need for reliable, high-strength cabling capable of withstanding mechanical stress and harsh environments. Opportunities are unfolding in renewable energy projects, infrastructure upgrades, and export-oriented cable production. Trends emphasize fire-resistant designs, improved insulation materials, and flexible installation formats. However, challenges such as volatile raw material prices, compliance with regional standards, and competition from low-cost alternatives continue to shape market performance globally.

Demand for single core armored cables has been reinforced by their reliability and durability in power transmission and industrial installations. These cables are widely used in commercial construction, mining, and oil and gas projects where resistance to mechanical stress and environmental hazards is critical. Opinions suggest that rising urban infrastructure projects and utility expansions have accelerated the preference for armored cabling over unarmored alternatives. The ability to provide enhanced protection against moisture, rodents, and external impacts makes them highly valued in demanding environments. Power distribution networks, especially in developing regions, have created consistent demand for armored cables capable of supporting high-voltage transmission. With industries prioritizing reliability and safety, single core armored cables are increasingly viewed as indispensable components in modern infrastructure and industrial systems.

Opportunities in the single core armored cable market are being shaped by renewable energy projects, export growth, and customized cabling solutions. Renewable energy installations such as solar farms and wind projects require armored cables for grid connectivity and long-distance transmission. Opinions highlight that opportunities are strongest in emerging economies where infrastructure modernization is a priority. Export potential is expanding as global demand for high-performance armored cables grows, particularly in Asia and the Middle East. Customization of armored cables with fire-retardant properties and advanced insulation is creating scope for differentiation in competitive markets. Partnerships with EPC contractors and government-backed projects are further strengthening opportunities. These factors indicate that suppliers focusing on renewable integration and international trade are well positioned to capture long-term growth in the single core armored cable industry.

Trends in the single core armored cable market focus on fire resistance, advanced insulation materials, and flexible installation options. Fire-retardant armored cables are trending as safety codes become stricter in commercial and industrial settings. Advanced insulation materials such as cross-linked polyethylene (XLPE) are being adopted for their superior thermal and electrical performance. Opinions suggest that lightweight yet durable armored cables are trending as installers demand easier handling without compromising safety. Modular installation practices are also influencing trends, with pre-terminated armored cables reducing labor time on-site. The adoption of cables with enhanced chemical and moisture resistance is also increasing, particularly in marine and underground applications. Collectively, these trends show how single core armored cables are evolving beyond traditional durability toward multi-featured designs that combine safety, flexibility, and performance.

Challenges in the single core armored cable market revolve around raw material volatility, regulatory compliance, and competitive pricing pressures. Copper and aluminum price fluctuations significantly impact production costs, creating margin instability for suppliers. Compliance with regional standards such as IEC, BS, and UL increases operational complexity, particularly for exporters. Opinions highlight that smaller firms face barriers in meeting certification costs, reducing their competitiveness against larger manufacturers. Competition from low-cost alternatives, including unarmored and composite cables, has intensified in price-sensitive markets. Supply chain disruptions in metal procurement have also delayed project timelines. These structural barriers emphasize that while demand for armored cables remains strong, growth will depend on effective cost control, regulatory navigation, and differentiation strategies that highlight the superior safety and durability of armored cabling solutions.

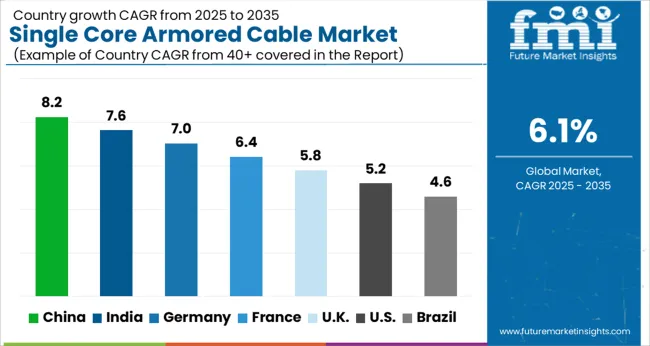

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

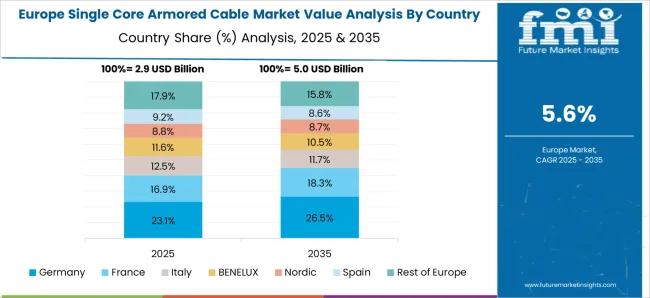

The global single core armored cable market is projected to grow at a CAGR of 6.1% between 2025 and 2035. China leads with 8.2%, followed by India at 7.6% and Germany at 7.0%. The United Kingdom is expected to expand at 5.8%, while the United States records 5.2%. Growth is fueled by rising demand from power transmission, industrial automation, renewable integration, and infrastructure modernization projects. Asian markets achieve faster growth through large scale industrialization and government backed grid expansion. European regions emphasize compliance with strict electrical safety standards and premium quality manufacturing. The USA market progresses steadily, shaped by replacement cycles, data center expansion, and deployment of armored cables in renewable and commercial power systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

The single core armored cable market in China is forecast to grow at a CAGR of 8.2%. Expansion is driven by large scale power grid development, urban infrastructure projects, and the rapid integration of renewables. Domestic manufacturers increase capacity, offering cost competitive armored cables suited for high voltage transmission and industrial use. Demand is also shaped by China’s expanding metro networks, manufacturing hubs, and smart city projects. Exports of armored cables further consolidate its position in global trade. Government backed programs on electrification and safety compliance ensure long term demand momentum in both domestic and international markets.

The single core armored cable market in India is projected to expand at a CAGR of 7.6%. Rising demand for reliable power distribution, infrastructure upgrades, and industrial automation drives market expansion. Government backed rural electrification programs, combined with smart city projects, increase cable installations across regions. Domestic producers expand capacity, investing in advanced materials and safety compliance to cater to large scale demand. With growing renewable energy projects and expanding data centers, India’s armored cable sector strengthens its role in power transmission and industrial applications.

The single core armored cable market in Germany is expected to grow at a CAGR of 7.0%. Expansion is fueled by demand from the automotive sector, industrial equipment, and renewable energy projects. German manufacturers emphasize premium quality armored cables that meet stringent EU safety standards. Strong investments in offshore wind projects and industrial modernization enhance adoption. Advanced engineering capabilities, combined with high demand for reliable and efficient power systems, position Germany as a leader in Europe’s armored cable market. Steady replacement demand in industrial facilities also supports long term growth.

The single core armored cable market in the UK is projected to grow at a CAGR of 5.8%. Market demand is shaped by infrastructure upgrades, renewable energy adoption, and steady replacement cycles in commercial and industrial facilities. Imports play an important role in meeting domestic demand, with distributors sourcing high performance cables from European and Asian producers. Adoption is reinforced by retrofitting of older networks, as well as integration of armored cables in commercial real estate and transport projects. While growth is moderate compared to Asia, policy backed modernization ensures a stable trajectory.

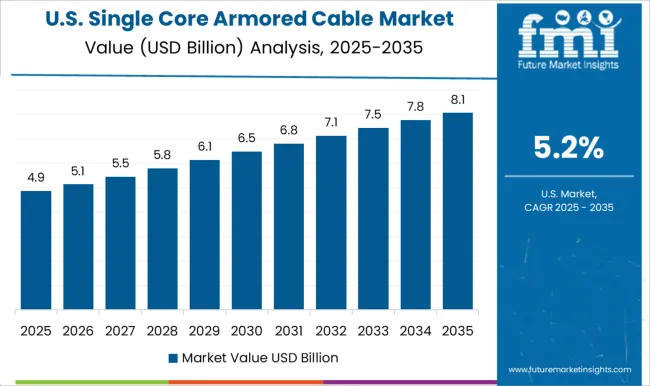

The single core armored cable market in the US is expected to expand at a CAGR of 5.2%. Growth is steady, driven by data center expansion, replacement demand in industrial facilities, and upgrades in transmission networks. Renewable integration, particularly solar and wind projects, strengthens the role of armored cables in ensuring durability and compliance. USA manufacturers focus on high performance materials and compliance with NEC standards to differentiate from imported alternatives. While overall growth is slower than Asia and Europe, the USA market remains important for specialized and high value applications in industrial and infrastructure segments.

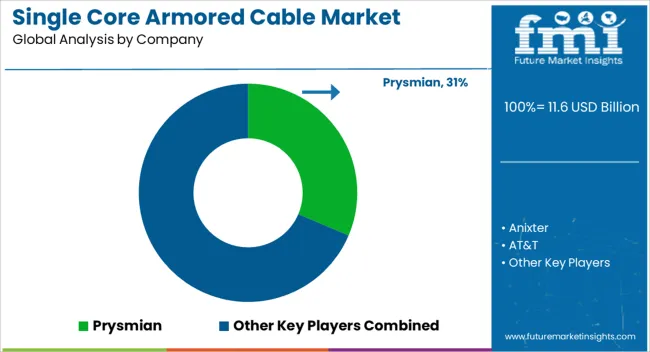

Competition in single-core armored cable has been anchored on how brochures translate mechanical protection and electrical reliability into clear specifications. Prysmian, Nexans, and LS Cable & System issue brochures that emphasize flame retardancy, steel wire armor durability, and compliance with IEC and BS standards. NKT and Riyadh Cables position brochures around medium- and high-voltage armored solutions, highlighting long service life, oil resistance, and reduced maintenance cycles. Anixter and Omni Cables differentiate through catalogues that stress distribution strength, customized cut lengths, and logistics support. Belden and Okonite promote brochures with tables on conductor size, dielectric strength, and bending radius, while Sumitomo Electric and Furukawa Electric stress high-performance insulation systems backed by global certifications. Helukabel, Havells, KEI Industries, Finolex, Polycab, and RR Kabel compete through brochures highlighting affordability, localized testing, and application coverage across commercial, residential, and utility projects.

Southwire rounds out the competition by presenting broad catalogues with a focus on safety ratings, reliability, and USA code compliance. Strategy is defined by how effectively brochures act as technical handbooks. Buyers compare voltage grades, armor type, short-circuit capacity, and sheath composition directly from brochure tables. Installers and procurement teams focus on warranty statements, fire testing results, and ease-of-installation diagrams. Competitive advantage is built when brochures combine detailed compliance markings with lifecycle cost benefits and installation guides. Success in this segment depends less on branding and more on clarity of tabulated data, mechanical test outcomes, and environmental resistance values. In this market, the product brochure becomes the decisive arena, where suppliers secure preference by providing precise, standards-backed documentation that helps contractors and utilities select armored cables with confidence for long-term projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.6 Billion |

| Armor Type | Interlocked and Continuously Corrugated Welded |

| End Use | Oil & Gas, Manufacturing, Mining, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian, Anixter, AT&T, Atkore, Belden, Finolex, Furukawa Electric, Havells, Helukabel, KEI Industries, Leoni Cables, LS Cable & System, Nexans, NKT, Okonite, Omni Cables, Polycab, Riyadh Cables, RR Kabel, Southwire, and Sumitomo Electric |

| Additional Attributes | Dollar sales by armor type (steel wire armored, aluminum wire armored, others), Dollar sales by application (power transmission, construction, industrial equipment, utilities, transportation), Trends in demand for high-strength and fire-resistant armored cables, Role of single core armored cables in ensuring reliability in harsh environments, Growth in renewable energy projects and large-scale infrastructure electrification, Regional installation patterns across Asia Pacific, Europe, and North America. |

The global single core armored cable market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the single core armored cable market is projected to reach USD 20.9 billion by 2035.

The single core armored cable market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in single core armored cable market are interlocked and continuously corrugated welded.

In terms of end use, oil & gas segment to command 44.7% share in the single core armored cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Machine Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Single Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA