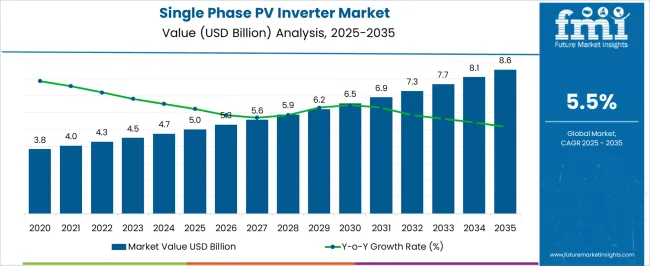

The single phase PV inverter market, valued at USD 5.0 billion in 2025 and projected to reach USD 8.6 billion by 2035 at a CAGR of 5.5%, demonstrates distinct contributions by technology segments in shaping market growth. Centralized inverters and string inverters constitute the primary technology categories, with string inverters dominating adoption due to their modularity, ease of installation, and compatibility with residential and small commercial solar systems. The segment’s incremental expansion from USD 5.0 billion in 2025 to USD 6.5 billion by 2030 highlights the preference for scalable, low-maintenance solutions that optimize power conversion efficiency at individual unit levels.

Centralized inverters, though less flexible, contribute to utility-scale applications and large distributed networks. This technology’s share gradually increases, reflecting the ongoing deployment in commercial installations and microgrid setups. The market progression from USD 5.3 billion in 2026 to USD 6.9 billion in 2030 illustrates the growing relevance of centralized configurations for high-capacity solar arrays, particularly in regions with supportive grid infrastructure and strong policy incentives.

Emerging hybrid inverter technologies, integrating storage capabilities and grid management functions, are beginning to influence the market, accounting for a smaller but accelerating contribution. By 2035, the combined impact of string, centralized, and hybrid technologies supports the overall market growth to USD 8.6 billion. Technological diversification underlines the critical role of inverter innovation in improving energy yield, reliability, and adoption efficiency across residential, commercial, and utility-scale applications.

| Metric | Value |

|---|---|

| Single Phase PV Inverter Market Estimated Value in (2025 E) | USD 5.0 billion |

| Single Phase PV Inverter Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The single phase PV inverter market represents a specialized segment within the global solar energy and photovoltaic systems industry, emphasizing residential and small-scale commercial power conversion, efficiency, and grid compatibility. Within the broader solar inverter market, it accounts for about 5.4%, driven by adoption in rooftop solar installations, off-grid residences, and small commercial setups. In the power electronics and energy conversion equipment sector, it holds nearly 4.8%, reflecting demand for reliable, compact, and high-efficiency inverters.

Across the distributed energy and smart home energy management segment, the market captures 4.2%, supporting grid synchronization, energy monitoring, and load management. Within the renewable energy system integration category, it represents 3.7%, highlighting use in hybrid setups and microgrid applications. In the residential energy storage and solar solutions sector, it secures 3.3%, emphasizing operational efficiency, longevity, and simplified installation. Recent developments in this market have focused on high-efficiency conversion, digital monitoring, and smart grid integration. Innovations include multi-level and string inverters, anti-islanding features, and IoT-enabled energy monitoring for real-time performance tracking.

Key players are collaborating with solar panel manufacturers, EPC companies, and smart home solution providers to enhance system reliability and customer experience. Adoption of hybrid inverter solutions, remote firmware updates, and predictive maintenance capabilities is gaining traction to optimize performance and reduce downtime. The compact and lightweight designs, high surge tolerance, and modular installation options are being deployed to meet diverse residential and small commercial requirements. These trends demonstrate how technological innovation, connectivity, and operational efficiency are shaping the market.

The single-phase PV inverter market is experiencing robust growth as solar photovoltaic systems increasingly penetrate residential and small commercial sectors. The current landscape is characterized by rising adoption of renewable energy solutions driven by favorable government policies, declining solar panel costs, and growing environmental awareness among consumers.

The ability of single phase inverters to efficiently convert DC power from solar panels into usable AC power for residential applications makes them highly attractive in distributed energy generation. Continued technological advancements in inverter efficiency, grid compatibility, and smart monitoring features shape the future outlook.

Moreover, the integration of these inverters with smart grid infrastructure is facilitating better energy management and reliability. Increasing electrification, decentralized power generation, and demand for sustainable energy solutions globally are expected to sustain market expansion over the coming decade.

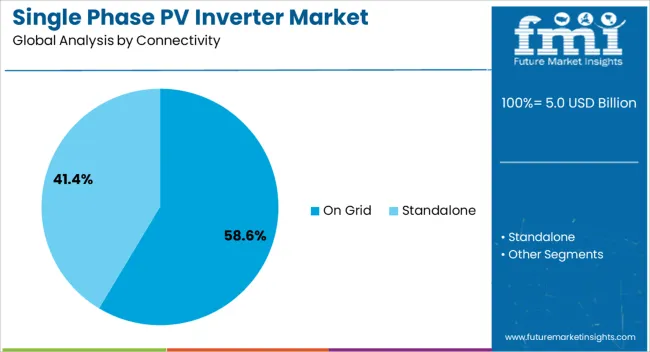

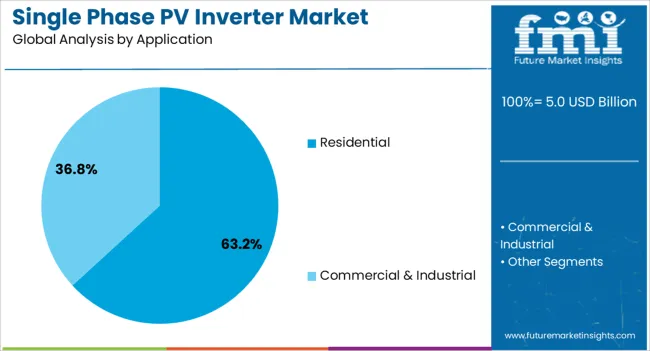

The single phase PV inverter market is segmented by connectivity, application, and geographic regions. By connectivity, the single-phase PV inverter market is divided into On-Grid and Standalone. In terms of application, the single-phase PV inverter market is classified into Residential and Commercial & Industrial. Regionally, the single-phase PV inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The On Grid connectivity segment is anticipated to hold 58.6% of the Single Phase PV Inverter market revenue in 2025, making it the dominant connectivity type. This leadership is explained by the widespread preference for grid-tied solar systems, which allow excess energy to be fed back into the electrical grid, enabling net metering benefits and reducing overall energy costs.

The segment’s growth has been propelled by expanding smart grid deployments and increasing utility support for renewable energy integration. On grid inverters offer enhanced system efficiency and reliability due to seamless synchronization with the utility grid.

Furthermore, regulatory frameworks promoting grid-connected solar installations have accelerated adoption. As residential consumers seek to optimize energy savings and contribute to cleaner power generation, the on-grid connectivity segment continues to lead market revenues.

The Residential application segment is projected to capture 63.2% of the single phase PV inverter market revenue in 2025, establishing it as the largest application area. This prominence is attributed to the increasing shift toward residential solar adoption fueled by declining equipment costs, growing environmental consciousness, and government incentives for clean energy use.

Single phase PV inverters are particularly suited for residential settings due to their compact design, ease of installation, and compatibility with smaller solar systems typical in homes. The segment’s expansion has also been supported by rising electrification in emerging markets and increased demand for energy independence and reliability at the household level.

As homeowners prioritize reducing electricity bills and carbon footprints, residential solar installations equipped with single phase inverters are expected to maintain strong growth momentum.

The market has experienced substantial growth as residential and small commercial solar installations continue to expand globally. Single phase inverters are designed to convert DC power from solar panels into AC power suitable for home or light commercial use, connecting directly to local electricity grids. The adoption of rooftop solar systems, net metering policies, and renewable energy incentives has accelerated demand. Technological advancements in inverter efficiency, reliability, and integration with smart energy management systems have enhanced their appeal. Consumers increasingly prefer systems that reduce electricity bills while ensuring consistent performance.

Residential installations have emerged as the primary driver for single phase PV inverter demand. Homeowners increasingly invest in rooftop solar systems to offset energy costs, leverage net metering, and reduce carbon footprints. Compact design, ease of installation, and low maintenance requirements make single phase inverters ideal for household applications. Growing awareness about energy independence and rising electricity tariffs in urban and suburban areas have further fueled adoption. Government incentives, rebates, and favorable financing options have encouraged homeowners to switch to solar energy. The rise of smart home technologies and integration with home energy management platforms has reinforced the utility and convenience of single phase PV inverter systems.

Advancements in inverter technology have significantly enhanced the efficiency, reliability, and lifespan of single phase PV inverters. Modern inverters feature maximum power point tracking (MPPT), anti-islanding protection, and advanced cooling systems that optimize energy conversion while preventing overheating. Integration with smart monitoring platforms allows real time performance tracking, fault detection, and predictive maintenance. Modular and lightweight designs simplify installation and reduce operational costs. The development of hybrid inverters capable of supporting limited energy storage further increases versatility. Continuous innovation in semiconductor devices, digital controllers, and protective circuitry has strengthened the competitiveness of single phase inverters, making them more reliable and attractive for residential and small commercial applications.

Government support has played a pivotal role in accelerating single phase PV inverter deployment. Policies such as feed-in tariffs, tax credits, net metering, and solar rebate programs provide strong financial incentives for residential and small commercial users. Utility companies often facilitate interconnection with the grid, ensuring streamlined integration and guaranteed compensation for surplus electricity. Renewable energy targets and decarbonization mandates in multiple countries have further stimulated adoption. These supportive frameworks not only reduce upfront costs for consumers but also increase confidence in long term investment returns. As policies continue to favor renewable energy adoption, single phase PV inverters are likely to benefit from sustained growth and wider market penetration.

Despite widespread adoption, the single phase PV inverter market faces challenges related to grid compatibility, product standardization, and price sensitivity. Variations in grid voltage, frequency, and interconnection standards across regions require inverters to meet multiple technical specifications, complicating manufacturing and certification. Market fragmentation, with numerous brands offering varying performance levels, creates confusion for end users. Price competition from low-cost imports can impact profitability for established manufacturers. The intermittent solar generation limits output reliability without supplementary energy storage or hybrid systems. Manufacturers are addressing these issues through standardized certification, robust technical support, and the development of versatile inverters capable of operating under diverse grid conditions.

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

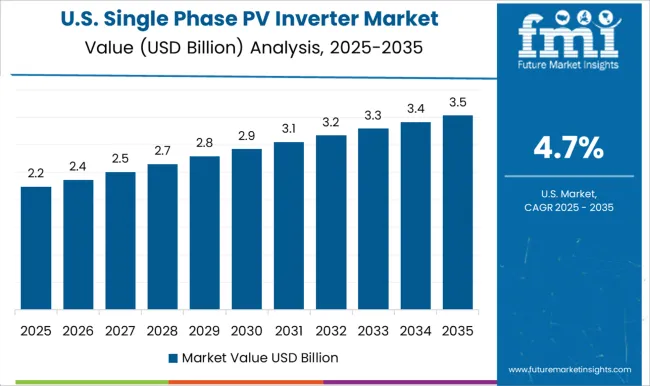

| USA | 4.7% |

| Brazil | 4.1% |

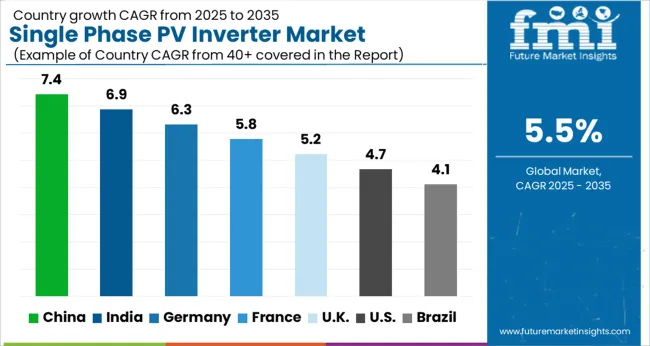

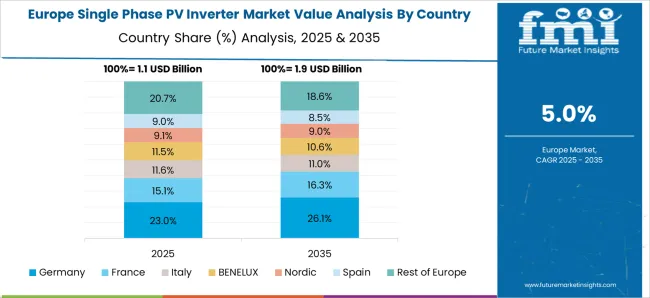

The market is projected to grow at a CAGR of 5.5% from 2025 to 2035, reflecting increased deployment in residential and small commercial solar installations. Germany at 6.3 and the UK at 5.2 are progressing through integration of smart inverters and grid modernization initiatives. China leads with 7.4, driven by high adoption in rooftop and distributed solar systems, while India at 6.9 shows strong expansion with supportive energy policies. The USA at 4.7 continues steady development, leveraging technological advancements and energy efficiency programs. These nations represent key centers of production, adoption, and innovation in the single phase PV inverter market. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 7.4%, driven by increasing rooftop solar installations, residential solar adoption, and small commercial projects. Adoption has been reinforced by demand for reliable grid connected inverters, high efficiency conversion, and smart monitoring features. Domestic manufacturers focus on compact, cost effective, and high performance inverter solutions compatible with residential and commercial systems. Export opportunities have further strengthened market growth. The market outlook remains robust as government incentives and renewable energy policies continue to support residential and small scale commercial solar projects in China.

India is expected to record a CAGR of 6.9%, supported by growing residential solar adoption, net metering policies, and incentive schemes for rooftop solar. Adoption has been reinforced by increasing demand for reliable and cost effective single phase inverters for small scale commercial and residential projects. Domestic manufacturers focus on integrating smart monitoring, overvoltage protection, and high efficiency modules. Market growth is expected to continue as residential rooftop adoption increases, supported by financing models and government initiatives.

Germany is projected to expand at a CAGR of 6.3%, influenced by adoption of rooftop solar and small scale residential projects. Adoption has been reinforced by demand for high reliability, smart grid integration, and energy monitoring solutions. German manufacturers such as SMA Solar Technology and KOSTAL focus on compact, efficient, and technologically advanced inverters compatible with residential solar systems. Market growth is further supported by distributed generation initiatives and energy efficiency policies.

The United Kingdom market is expected to grow at a CAGR of 5.2%, driven by residential rooftop solar adoption and demand for grid compatible inverter solutions. Adoption has been reinforced by policy support, feed in tariffs, and renewable energy incentives for homeowners. Imported high efficiency inverters are widely used alongside domestic solutions to meet residential and small commercial requirements. The market is expected to grow steadily as the U K continues to expand distributed generation and residential solar deployment.

The United States market is projected to expand at a CAGR of 4.7%, supported by residential rooftop solar, small commercial installations, and distributed generation. Adoption has been reinforced by demand for reliable, compact, and high efficiency inverters integrated with monitoring and safety features. Leading manufacturers such as SolarEdge, Enphase, and SMA provide technologically advanced single phase solutions. Market growth is expected to remain stable as rooftop solar adoption continues to rise across residential communities.

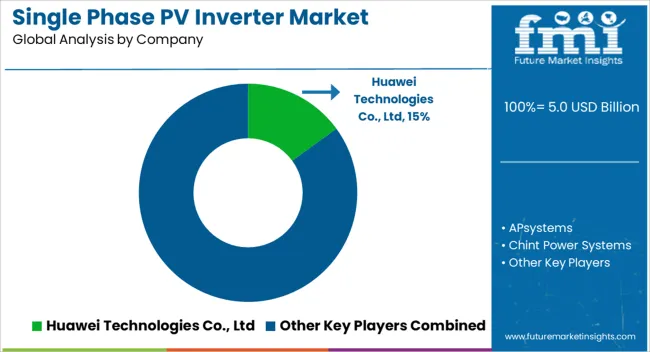

The market is characterized by intense competition among global technology leaders, regional specialists, and innovative startups. Huawei Technologies Co., Ltd, Enphase Energy, SolarEdge Technologies, and Fronius International GmbH lead the market through advanced inverter technologies, high efficiency ratings, and integrated smart energy management features. These companies leverage strong global distribution networks and established brand reputations to secure residential, commercial, and small-scale utility applications. Regional players such as APsystems, GOODWE, Sungrow, Chint Power Systems, INVTSolar, and NingBo Deye Inverter Technology Co., Ltd focus on cost-effective solutions, localized service support, and compliance with regional grid codes, enhancing accessibility in emerging markets.

Other companies like Eaton, Statcon Energiaa, UTL Solar, and Victron Energy B.V. differentiate through hybrid inverter capabilities, off-grid compatibility, and energy storage integration. Market competition is further intensified by continuous technological innovation, pricing strategies, after-sales service, and warranty programs. Companies are investing in R&D to enhance inverter efficiency, improve reliability, and integrate IoT-based monitoring platforms. Strategic partnerships with PV module manufacturers, EPC firms, and residential solar installers are pivotal for market penetration, long-term contracts, and maintaining competitive advantage in the growing single-phase PV inverter sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Connectivity | On Grid and Standalone |

| Application | Residential and Commercial & Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huawei Technologies Co., Ltd, APsystems, Chint Power Systems, Enphase Energy, Eaton, Fronius International GmbH, GOODWE, INVTSolar, NingBo Deye Inverter Technology Co.Ltd, Solaredge Technologies, Inc, Statcon Energiaa, SUNGROW, UTL Solar, and Victron Energy B.V. |

| Additional Attributes | Dollar sales by inverter type and application, demand dynamics across residential, small commercial, and rooftop solar installations, regional trends in distributed energy adoption, innovation in efficiency, grid compliance, and smart monitoring, environmental impact of manufacturing and energy use, and emerging use cases in home energy management, net-metering, and hybrid solar-battery systems. |

The global single phase pv inverter market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the single phase pv inverter market is projected to reach USD 8.6 billion by 2035.

The single phase pv inverter market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in single phase pv inverter market are on grid and standalone.

In terms of application, residential segment to command 63.2% share in the single phase pv inverter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single-Mode Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Single-Coated Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Single Superphosphate (SSP) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Electron Transistor Market Size and Share Forecast Outlook 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Use Pallet Market Size and Share Forecast Outlook 2025 to 2035

Single Serve Coffee Container Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA