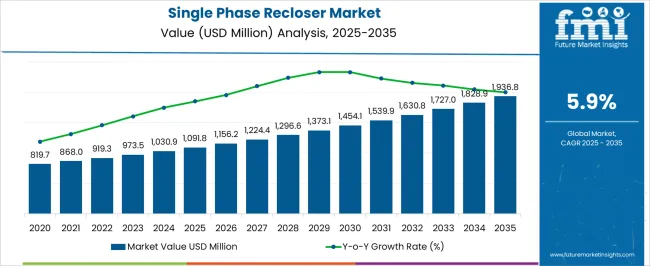

The single phase recloser market is estimated to be valued at USD 1091.8 million in 2025 and is projected to reach USD 1936.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The single phase recloser market is valued at USD 1,091.8 million in 2025 and is projected to grow to USD 1,936.8 million by 2035, with a CAGR of 5.9%. Between 2021 and 2025, the market shows steady growth, moving from USD 819.7 million to USD 1,091.8 million, with intermediate values passing through USD 868.0 million, 919.3 million, 973.5 million, and 1,030.9 million. This period marks a gradual acceleration in demand, driven by the increasing need for reliable power distribution systems, as utilities and industries prioritize grid reliability, protection, and automation.

From 2026 to 2030, the market continues to accelerate, reaching USD 1,454.1 million by 2030. Values progress from USD 1,156.2 million, 1,224.4 million, 1,296.6 million, and 1,373.1 million, fueled by the ongoing transition to smart grid technologies and the integration of reclosers with automated systems for improving network resilience.

Between 2031 and 2035, the market continues to expand, reaching USD 1,936.8 million, with values passing through USD 1,539.9 million, 1,630.8 million, 1,727.0 million, and 1,828.9 million. This growth trajectory is characterized by reduced volatility, as the market matures with increased adoption of reclosers in both developed and emerging markets. The growth rate volatility index decreases in the latter part of the forecast period, reflecting steady, consistent demand across various sectors.

| Metric | Value |

|---|---|

| Single Phase Recloser Market Estimated Value in (2025 E) | USD 1091.8 million |

| Single Phase Recloser Market Forecast Value in (2035 F) | USD 1936.8 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

The power distribution equipment market is a major contributor, accounting for approximately 25-30%, as reclosers are integral to power distribution systems, ensuring reliability by automatically restoring power after momentary faults. The electricity transmission and distribution market also plays a significant role, contributing around 20-25%, as single-phase reclosers are used to enhance grid reliability by isolating faults and minimizing downtime in transmission and distribution networks.

Additionally, the renewable energy market is becoming an important driver, contributing approximately 15-20%, as the integration of renewable energy sources like solar and wind increases the need for reclosers to manage fluctuating power inputs and maintain grid stability. The industrial automation and control market contributes about 10-12%, as reclosers are increasingly incorporated into automated systems for power management in industrial facilities, preventing extended outages and ensuring continuous operation in critical processes.

Finally, the smart grid and IoT market plays a crucial role, contributing around 8-10%, as the adoption of smart grids equipped with real-time monitoring and fault detection enhances the effectiveness of single-phase reclosers, improving overall grid efficiency and recovery time. These parent markets highlight the importance of single-phase reclosers in improving grid reliability, supporting renewable energy integration, and enhancing industrial and smart grid operations.

The single phase recloser market is experiencing steady expansion, driven by the global push toward grid modernization and improved distribution network reliability. Increasing electricity consumption across residential, agricultural, and remote rural regions is boosting the demand for intelligent fault management systems, where single phase reclosers play a critical role. These devices are gaining prominence due to their ability to detect, isolate, and automatically restore faults in single phase lines, reducing outage times and enhancing operational efficiency.

Rising integration of distributed energy resources, such as solar and wind, is further encouraging utilities to adopt reclosers capable of managing bidirectional power flows. Technological advancements in digital protection and communication capabilities are making reclosers more intelligent and adaptive, allowing seamless integration with SCADA and other grid automation platforms.

Governments and utilities across emerging and developed economies are investing in robust and self-healing grid infrastructure, creating long-term opportunities for the market As energy systems become more decentralized and reliability-focused, single phase reclosers are expected to remain a vital asset in ensuring system continuity and safety.

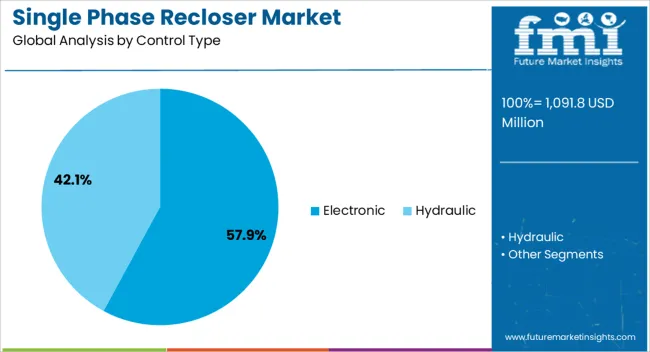

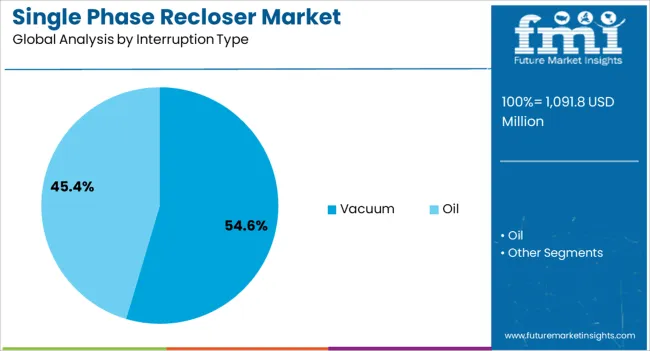

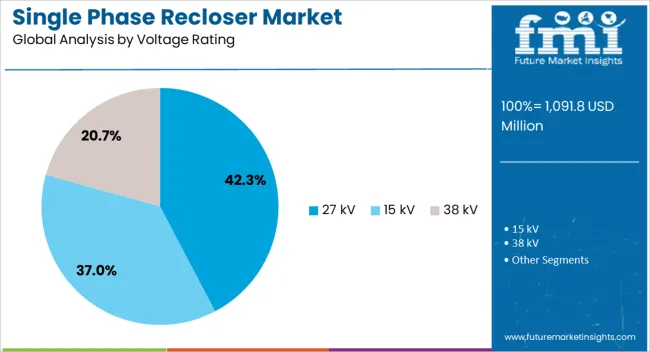

The single phase recloser market is segmented by control type, interruption type, voltage rating, and geographic regions. By control type, single phase recloser market is divided into electronic and hydraulic. In terms of interruption type, single phase recloser market is classified into vacuum and oil. Based on voltage rating, single phase recloser market is segmented into 27 kV, 15 kV, and 38 kV. Regionally, the single phase recloser industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electronic control type segment is projected to account for 57.9% of the single phase recloser market revenue share in 2025, making it the leading control mechanism. This dominance is being supported by the rapid adoption of smart grid technologies and growing requirements for remote monitoring and automated fault response. Electronic controls offer precise fault detection, flexible programming options, and communication compatibility with modern grid management systems.

Their ability to integrate with advanced protection schemes and real-time data analytics platforms is enhancing system responsiveness and reducing outage durations. Utilities prefer electronic controls due to their scalability and capacity to support grid automation strategies, especially in regions prone to transient faults and fluctuating loads.

Additionally, these controls enable seamless interoperability with distributed energy sources, supporting grid resilience and energy transition efforts As utilities prioritize real-time system visibility, asset optimization, and predictive maintenance, electronic control-based reclosers are expected to witness sustained demand across both new installations and retrofit projects.

The vacuum interruption type segment is expected to represent 54.6% of the single phase recloser market revenue share in 2025, positioning it as the dominant interruption technology. Its leadership is being driven by the superior arc-quenching capability, long service life, and minimal maintenance requirements offered by vacuum interrupters. The absence of insulating gases and the use of sealed vacuum chambers ensure environmental safety and reduce operational risks, aligning with modern grid sustainability goals.

Vacuum technology supports high interrupting performance and repeatable operation, making it highly suitable for distribution systems experiencing frequent transient faults. As power networks expand into remote and rural areas, the reliability of vacuum reclosers is supporting uninterrupted service delivery and reduced downtime.

Cost savings over the lifecycle, combined with compatibility with smart control units, further enhance the segment’s attractiveness to utilities and distribution companies Continued innovation in material science and compact vacuum chamber design is expected to maintain this technology’s leadership in recloser applications.

The 27 kV voltage rating segment is anticipated to hold 42.3% of the single phase recloser market revenue share in 2025, making it the leading voltage class. This dominance is being driven by its widespread suitability for medium-voltage distribution networks, particularly in suburban, rural, and agricultural regions where single phase configurations are common. The 27 kV class offers an optimal balance between fault handling capability and cost-effectiveness, making it a preferred choice for utilities seeking reliable and scalable protection systems.

Its compatibility with overhead line networks and ease of integration with standard pole-mount equipment are further supporting adoption. As power demand in remote and growing regions rises, utilities are increasingly deploying 27 kV reclosers to ensure consistent voltage regulation and minimize supply disruptions.

Regulatory mandates for improved power quality and system resilience are also encouraging investments in this voltage segment With expanding infrastructure and emphasis on minimizing transmission losses, 27 kV reclosers are expected to remain integral to medium-voltage protection strategies across global markets.

The single-phase recloser market is experiencing steady growth driven by the increasing demand for reliable, cost-effective solutions in electric power distribution systems. Single-phase reclosers are essential for restoring power after momentary faults, helping to reduce downtime and enhance grid reliability, especially in rural and remote areas. The rise in power grid modernization projects, increased focus on minimizing power outages, and adoption of advanced smart grid technologies are key drivers of the market. Challenges include high initial investment costs and the complexity of integrating reclosers into existing grid systems. Opportunities exist in the growing demand for automated reclosers, which offer enhanced monitoring and control capabilities. Trends indicate a shift towards integrating reclosers with IoT and advanced communication technologies, enabling real-time data analysis and predictive maintenance. Suppliers offering reliable, smart, and cost-effective single-phase recloser solutions are well-positioned for long-term market growth.

The single-phase recloser market is primarily driven by the need to improve grid reliability and reduce the frequency of power outages. Single-phase reclosers play a crucial role in restoring power quickly after transient faults, preventing extended outages and enhancing the overall stability of the distribution network. With growing urbanization, industrialization, and the increased reliance on electricity, especially in remote and rural areas, utilities are investing more in recloser technology to ensure an uninterrupted power supply. The demand for reclosers is also driven by the need to improve operational efficiency and reduce maintenance costs. As utilities continue to modernize their grids and adopt more advanced fault detection and response systems, the single-phase recloser market is expected to grow steadily.

The market for single-phase reclosers faces several challenges, particularly related to high initial capital costs, which may deter smaller utilities and distribution companies from adopting advanced recloser systems. The cost of advanced technologies, including automation and communication features, can further increase the overall expense. Additionally, integrating reclosers into existing grid infrastructures can be technically complex, requiring modifications to distribution systems and the training of personnel for effective operation. Regulatory constraints, such as grid security standards, require compliance with safety protocols, which can increase the complexity of installations. Moreover, the supply of key components, such as recloser switches and controllers, is subject to market fluctuations, which can impact production schedules and delivery times. Manufacturers must navigate these challenges while ensuring the reliability and efficiency of their products.

Opportunities in the single-phase recloser market are growing with the increasing adoption of smart grid technologies and automation in power distribution systems. The integration of reclosers with advanced monitoring systems and IoT devices enables real-time fault detection, automated decision-making, and remote control of power distribution systems. These automated systems improve grid management, reduce downtime, and lower operational costs by enabling predictive maintenance. As utilities and power providers prioritize grid resilience and automation, the demand for smart reclosers that offer remote monitoring and control is expected to rise. Furthermore, the shift toward renewable energy sources, which often require more robust grid management solutions, presents additional opportunities for recloser manufacturers to innovate and provide products tailored to these evolving needs.

The single-phase recloser market is trending toward the integration of remote monitoring capabilities, IoT technologies, and predictive maintenance solutions. By incorporating advanced sensors and communication systems, reclosers can provide real-time data on fault conditions, performance metrics, and maintenance needs. This data is crucial for utilities to perform predictive maintenance, reducing the likelihood of unexpected outages and improving system performance. IoT-enabled reclosers allow for seamless integration with central control systems, enabling utilities to remotely monitor and control reclosers across large geographic areas. This trend is driving the development of smarter, more efficient reclosers that can optimize grid performance, reduce operational costs, and improve service reliability. As the demand for smarter grid systems grows, the adoption of these technologies is expected to increase significantly.

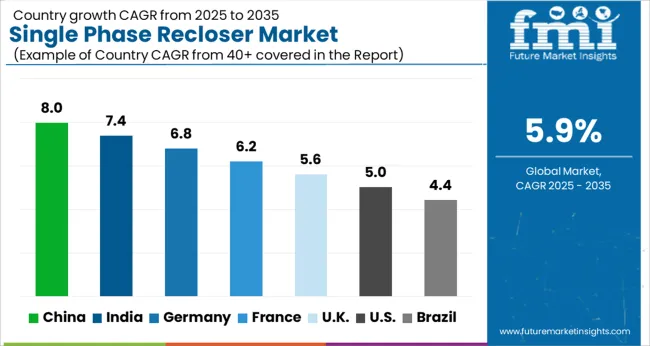

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The global single-phase recloser market is projected to grow at a CAGR of 5.9% from 2025 to 2035. China leads with a growth rate of 8.0%, followed by India at 7.4% and Germany at 6.8%. The UK and USA show moderate growth rates of 5.6% and 5.0%, respectively. The market is driven by increasing investments in power grid modernization, the integration of renewable energy, and the need for reliable and uninterrupted power supply across industries. Government initiatives and the rise of smart grid technologies are further supporting the adoption of single-phase reclosers in these regions. The analysis spans over 40+ countries, with the leading markets shown below.

The single-phase recloser market in China is expected to grow at a robust CAGR of 8.0% from 2025 to 2035. As China continues to modernize its electrical infrastructure and improve grid reliability, the demand for single-phase reclosers is on the rise. These devices are critical for maintaining power continuity and reducing service interruptions, particularly in rural and remote areas. The rapid growth of industrialization and urbanization in China is contributing to the increased need for reliable power distribution systems. with a focus on enhancing the quality of electricity supply across the country, China’s power utilities are adopting advanced grid management technologies, including single-phase reclosers. Government policies and initiatives aimed at improving energy infrastructure and the efficiency of electrical networks are further boosting the market. China’s vast manufacturing sector and its ability to produce cost-effective reclosers contribute to the availability and affordability of these products.

The single-phase recloser market in India is projected to grow at a CAGR of 7.4% from 2025 to 2035. As the country continues to develop its electrical infrastructure, especially in rural areas, the demand for reliable and efficient power distribution systems is increasing. Single-phase reclosers are vital for ensuring that power interruptions are minimized, particularly in areas prone to electrical faults. With the rapid expansion of renewable energy sources, such as solar and wind, integrated with the national grid, there is a growing need for intelligent grid systems that can manage power distribution effectively. India’s focus on increasing electrification in rural areas and improving grid reliability is contributing to the rise in demand for single-phase reclosers. The country’s increasing investment in smart grid technology and the modernization of electrical distribution networks also plays a key role in the market’s growth.

The single-phase recloser market in Germany is projected to expand at a CAGR of 6.8% from 2025 to 2035. The market is driven by the country’s strong commitment to enhancing the reliability and stability of its electrical grid. As the demand for consistent and uninterrupted power supply continues to rise, especially in industrial and urban areas, the need for advanced power distribution technologies like single-phase reclosers is increasing. Germany’s focus on smart grids and the integration of renewable energy sources into the national grid further supports the market growth. The growing adoption of automation and smart technologies in power utilities is contributing to the increased demand for reclosers that can automatically detect faults and restore power. Germany’s high standard of living and the need for reliable power supply in commercial and residential sectors drive further adoption of reclosers.

The UK single-phase recloser market is expected to grow at a CAGR of 5.6% from 2025 to 2035. The UK is focusing on modernizing its electrical infrastructure, with an emphasis on improving grid stability and reducing power outages. The rising demand for continuous and reliable power supply in both urban and rural areas is driving the adoption of reclosers. As part of its energy transition efforts, the UK is integrating more renewable energy sources into its grid, which requires advanced solutions like single-phase reclosers for efficient power management. Moreover, the country’s focus on smart grid systems and automation technologies is increasing the need for reclosers that can restore power automatically after an outage. The UK government’s investment in infrastructure and energy-efficient technologies is further boosting the demand for such solutions.

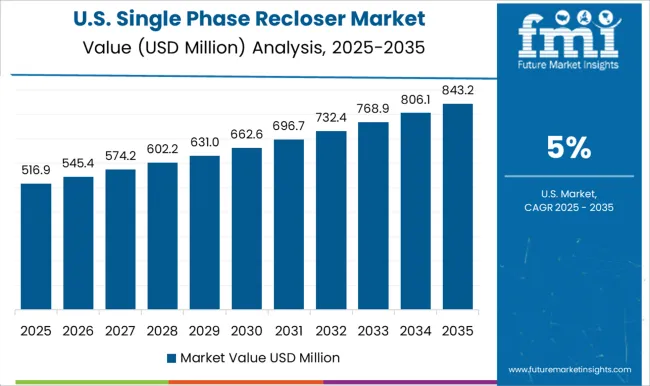

The USA single-phase recloser market is projected to grow at a CAGR of 5.0% from 2025 to 2035. With a large and diverse electrical grid, the USA is increasingly focusing on enhancing the reliability and efficiency of power distribution systems. The growing demand for uninterrupted power supply, particularly in critical sectors such as healthcare, manufacturing, and residential areas, is driving the need for advanced power protection technologies like single-phase reclosers. The integration of renewable energy sources, such as wind and solar, into the grid is further propelling the market, as it requires intelligent grid management systems to ensure consistent power delivery. As the USA invests in modernizing its aging infrastructure, there is an increasing demand for automated systems that can detect faults and quickly restore power, further supporting the growth of the single-phase recloser market.

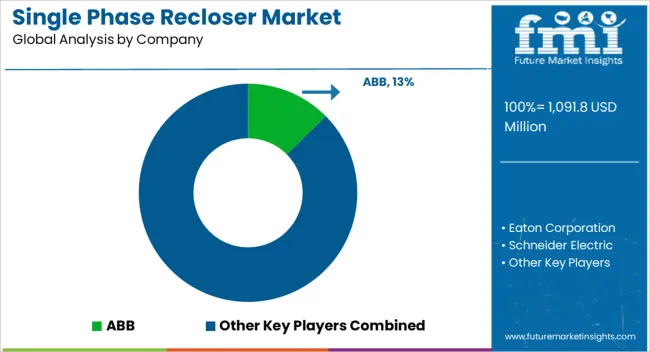

The single-phase recloser market is highly competitive, with several key players focusing on providing reliable and efficient solutions for electrical distribution systems. ABB is a market leader, offering advanced recloser products that are widely used for utility and industrial applications. The company emphasizes innovation in automation and protection, ensuring optimal reliability and safety for power distribution networks. Eaton Corporation competes strongly with its reclosers designed for grid modernization and improved operational efficiency.

Eaton's products focus on minimizing power interruptions, reducing downtime, and integrating with smart grid technologies to enhance the overall power distribution process. Schneider Electric also plays a significant role in the market by providing single-phase reclosers that integrate seamlessly into smart grids, contributing to energy efficiency and grid stability. The company focuses on offering scalable, durable, and high-performance products for both urban and rural infrastructure. Siemens, a global leader in electrical engineering, offers reclosers that combine advanced digital monitoring systems with cutting-edge protection technology, making them suitable for a wide range of applications, from distribution networks to renewable energy integration.

NOJA Power Switchgear Pty Ltd and S&C Electric Company are also strong competitors, with NOJA Power focusing on automation and reliability in its recloser designs. S&C Electric’s solutions are widely used for advanced protection and control in electrical grids, offering high-performance reclosers for quick fault isolation and restoration. G&W Electric, Hubbell, and Rockwill provide recloser products known for their durability and efficiency in power distribution systems, while ARTECHE, Tavrida Electric, and ENTEC Electric & Electronic focus on providing cost-effective recloser solutions suitable for various regional needs.

Smaller companies like Shinsung Industrial Electric, Hughes Power System, L&R Electric Group, and ENSTO offer specialized solutions for niche markets, emphasizing affordability and simplicity in design. Product brochures for these companies highlight features such as fault detection, quick restoration capabilities, automation, and integration with modern control systems, helping utilities ensure consistent, reliable service in power distribution systems. Competitive strategies focus on enhancing product durability, ease of maintenance, and integration with smart grid technologies.

| Items | Values |

|---|---|

| Quantitative Units | USD 1091.8 million |

| Control Type | Electronic and Hydraulic |

| Interruption Type | Vacuum and Oil |

| Voltage Rating | 27 kV, 15 kV, and 38 kV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Eaton Corporation, Schneider Electric, Siemens, NOJA Power Switchgear Pty Ltd, S&C Electric Company, G&W Electric, Hubbell, Rockwill, ARTECHE, Tavrida Electric, ENTEC Electric & Electronic, Shinsung Industrial Electric, Hughes Power System, L&R Electric Group, and ENSTO |

| Additional Attributes | Dollar sales by recloser type (mechanical, electronic, hybrid), voltage capacity (low, medium, high), and application (residential, industrial, utilities). Demand dynamics are driven by the growing need for grid automation, increasing focus on grid reliability, and the adoption of smart grid technologies. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with increasing investments in power grid modernization, renewable energy integration, and distribution automation technologies. |

The global single phase recloser market is estimated to be valued at USD 1,091.8 million in 2025.

The market size for the single phase recloser market is projected to reach USD 1,936.8 million by 2035.

The single phase recloser market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in single phase recloser market are electronic and hydraulic.

In terms of interruption type, vacuum segment to command 54.6% share in the single phase recloser market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single-Mode Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Single-Coated Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Single Superphosphate (SSP) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Electron Transistor Market Size and Share Forecast Outlook 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Use Pallet Market Size and Share Forecast Outlook 2025 to 2035

Single Serve Coffee Container Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA