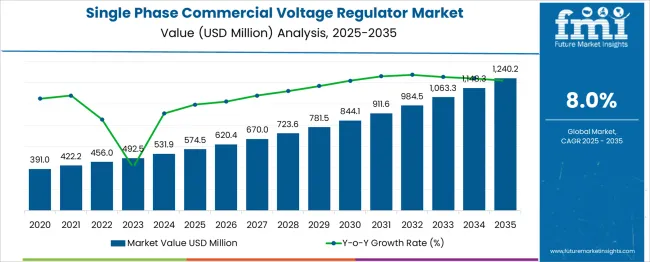

The single phase commercial voltage regulator market is estimated to be valued at USD 574.5 million in 2025 and is projected to reach USD 1240.2 million by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The single phase commercial voltage regulator market exhibits a classic technology adoption lifecycle. From 2020–2024, the market experiences early adoption, characterized by slower growth (USD 391–531.9 million) as end-users and utilities evaluate regulator technologies. During this phase, Hydraulic regulators dominate due to proven reliability, while Electric Hydraulic and EPS (Electro-Mechanical Power Systems) remain niche, with adoption limited to pilot installations and tech-savvy clients. Between 2025–2030, the market enters the scaling phase, with revenue growing from USD 574.5 million to around USD 844.1 million, reflecting a CAGR of 8%. Here, adoption accelerates as awareness, cost-efficiency, and grid modernization programs drive uptake.

Electric Hydraulic regulators gain traction due to operational flexibility, while EPS systems start moving into broader commercial deployment, capturing innovative, efficiency-focused customers. From 2030–2035, the market transitions to consolidation, reaching USD 1,240.2 million. Growth moderates as market penetration approaches saturation, and technology standards mature. During consolidation, Hydraulic systems maintain stable, large-scale deployment, Electric Hydraulic reaches widespread acceptance, and EPS solidifies its presence in advanced, efficiency-critical segments. Overall, the market maturity curve mirrors a sigmoid trajectory, with early experimentation, rapid expansion, and eventual stabilization as technologies settle into their respective lifecycle positions.

| Metric | Value |

|---|---|

| Single Phase Commercial Voltage Regulator Market Estimated Value in (2025 E) | USD 574.5 million |

| Single Phase Commercial Voltage Regulator Market Forecast Value in (2035 F) | USD 1240.2 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

The market is undergoing substantial growth as commercial facilities continue to prioritize power quality, operational efficiency, and equipment protection. A growing reliance on sensitive electronic systems across offices, retail units, healthcare, and hospitality facilities has underscored the need for consistent voltage regulation. Technological advancements in control systems and microprocessor integration are supporting smarter and more responsive voltage regulation solutions, which are now being preferred over traditional stabilizers.

In addition, the rising frequency of grid disturbances, voltage fluctuations, and power surges in developing regions has made these regulators critical to ensuring uninterrupted operations. Expansion in the commercial infrastructure landscape, particularly in developing economies, is also contributing to demand.

As commercial energy consumption patterns evolve with distributed energy systems and automation, voltage regulators are increasingly being deployed as part of integrated energy management strategies. With a heightened focus on sustainability, durability, and remote monitoring capabilities, the market is expected to expand steadily over the next decade..

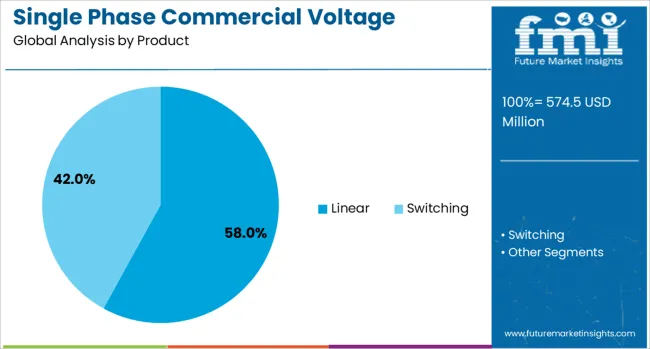

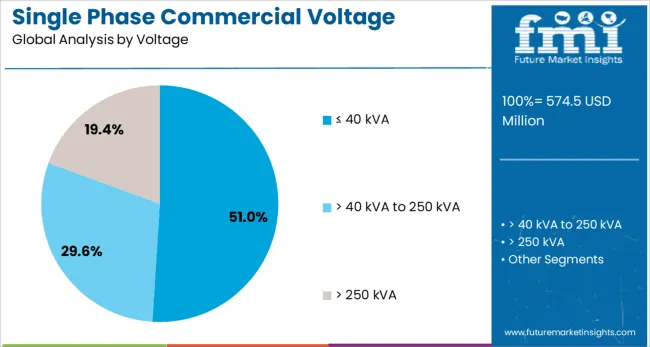

The single phase commercial voltage regulator market is segmented by productvoltage, and geographic regions. By product, the market is divided into linear and switching. In terms of voltage, the market is classified into ≤ 40 kVA, > 40 kVA to 250 kVA> 250 kVA. Regionally, the single phase commercial voltage regulator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The linear product segment is projected to hold 58% of the market revenue share in 2025, making it the leading product category. Growth in this segment has been supported by its ability to provide stable, continuous voltage output without the use of digital switching components. Linear voltage regulators have been recognized for their simplicity, low electromagnetic interference, and high reliability, which are critical features for commercial environments operating sensitive electronic equipment.

Their silent operation and minimal ripple voltage have contributed to wider acceptance in sectors like healthcare, retail, and office buildings. Furthermore, the absence of high-frequency switching circuitry has made linear regulators especially suitable for installations where power purity and stability are paramount.

Their comparatively lower cost of integration and ease of installation have further supported adoption, particularly in small to medium-sized facilities. As commercial users seek durable, low-maintenance voltage regulation solutions, the linear product category has maintained its dominant position in the overall market..

The ≤ 40 kVA voltage segment is expected to account for 51% of the market revenue share in 2025, establishing itself as the dominant voltage class. This leadership position has been attributed to the segment's compatibility with a wide range of low to medium load commercial applications. Systems within this capacity range have been widely deployed in retail outlets, restaurants, medical clinics, and small office buildings where moderate energy demands must be met with precision and reliability.

The compact size, cost-efficiency, and lower maintenance needs of these regulators have made them ideal for localized voltage management. Additionally, commercial users have favored these units for their straightforward installation and integration with existing electrical infrastructure.

The surge in small and medium commercial establishments, especially in emerging urban areas, has reinforced demand for ≤ 40 kVA regulators. Their ability to deliver consistent performance across fluctuating grid conditions has positioned this voltage class as a trusted solution in the commercial sector..

The single phase commercial voltage regulator market is expanding due to growing demand for stable electrical supply in commercial establishments. These regulators protect sensitive equipment from voltage fluctuations, reduce downtime, and improve operational efficiency. Increasing commercial infrastructure, industrial automation, and energy-intensive operations are driving adoption. Asia-Pacific leads due to rapid urbanization and industrial growth, while North America and Europe focus on high-precision and smart voltage regulation systems. Rising awareness about electrical safety and equipment longevity further supports market growth.

Voltage fluctuations can cause significant damage to electrical equipment, leading to downtime and financial losses. Single phase commercial voltage regulators ensure consistent voltage levels for offices, retail spaces, hospitals, and small industries. With rising adoption of energy-efficient equipment and automation systems, the need for reliable voltage regulation is becoming more critical. Regulators help prevent overvoltage or undervoltage conditions, safeguarding sensitive electronics and machinery. Businesses are increasingly investing in high-capacity, accurate regulators to maintain uninterrupted operations, reduce maintenance costs, and ensure compliance with safety standards. The rising awareness of these benefits is driving market expansion globally.

Modern single phase commercial voltage regulators integrate features such as digital displays, automatic voltage correction, and remote monitoring capabilities. Microprocessor-controlled designs provide faster response to voltage fluctuations and allow real-time diagnostics. Energy-efficient regulators minimize power loss while maintaining performance, and surge protection features add an additional layer of equipment safety. Smart connectivity enables integration with building management systems for monitoring and preventive maintenance. Continuous product improvements in design, accuracy, and durability make these regulators more reliable for commercial applications, attracting adoption in sectors with critical electrical infrastructure like healthcare, IT, and manufacturing.

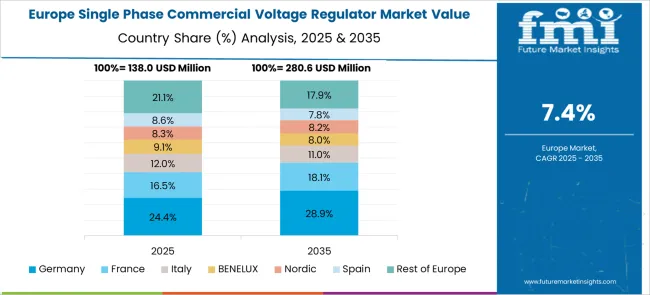

Asia-Pacific dominates the market due to growing industrialization, commercial infrastructure development, and government initiatives for electrical safety. Countries such as India, China, and Southeast Asia are witnessing increased construction of offices, retail complexes, and small-scale industries, creating steady demand. North America focuses on precision, reliability, and advanced monitoring features to support technologically dense commercial environments. Europe emphasizes compliance with stringent voltage regulation and safety standards. Regional market growth is strongly influenced by local commercial development trends, electricity network reliability, and industrial investment patterns, making the adoption of voltage regulators a strategic priority.

Manufacturers are entering partnerships with distributors, electrical equipment suppliers, and construction companies to expand their market presence. Collaboration enables better supply chain management, faster project deployment, and access to new commercial segments. Companies also work with R&D firms to enhance regulator features, such as load balancing, fault detection, and connectivity options. These alliances support product customization for specific regional requirements, including voltage range compatibility and regulatory compliance. By leveraging partnerships, manufacturers can increase market penetration, improve customer trust, and maintain competitiveness in an increasingly complex and technology-driven commercial electrical equipment landscape.

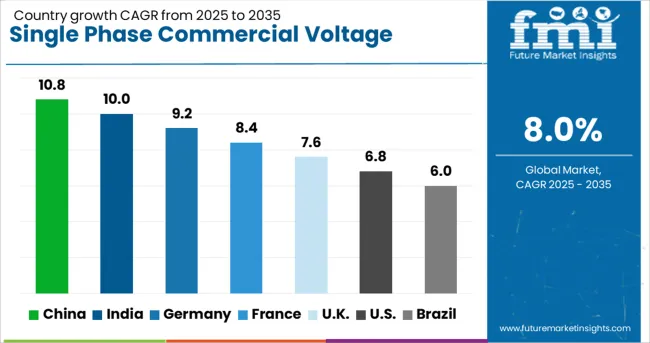

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

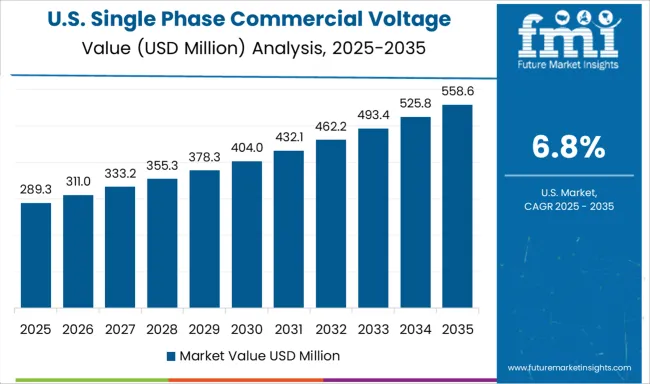

| USA | 6.8% |

| Brazil | 6.0% |

The single phase commercial voltage regulator market is projected to grow at a CAGR of 8.0%, driven by increasing demand for stable power supply in commercial establishments. China leads with a growth rate of 10.8%, reflecting significant industrial expansion and modernization of electrical infrastructure. India follows at 10.0%, fueled by rising commercial electrification and infrastructure upgrades. Germany, growing at 9.2%, leverages precision engineering and quality manufacturing to serve industrial and commercial sectors across Europe. The UK, expanding at 7.6%, focuses on ensuring reliable power solutions for commercial facilities. The USA, with 6.8% growth, benefits from demand in small and medium enterprises for efficient voltage regulation. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the single phase commercial voltage regulator market with a 10.8% growth rate. The market expansion is fueled by rapid industrialization, increasing commercial infrastructure, and growing demand for power stability in manufacturing plants. Compared to India, China benefits from large-scale industrial setups and widespread adoption of automated systems that require voltage regulation to prevent equipment damage. Government initiatives to modernize electrical grids and reduce downtime in power distribution further boost demand. The rise of small and medium enterprises adopting sensitive electronic equipment also increases reliance on commercial voltage regulators. Technological advancements in compact, efficient, and digitally controlled regulators make installations easier and more reliable. Additionally, collaborations between local manufacturers and international technology providers accelerate innovation, ensuring high-quality, cost-effective solutions for domestic and export markets. China remains a dominant player, with sustained growth prospects driven by infrastructure expansion and urbanization.

India’s single phase commercial voltage regulator market grows at 10.0%, driven by rapid urbanization, expansion of commercial spaces, and increasing adoption of electrical equipment. Compared to Germany, India focuses on affordable and scalable solutions suitable for small to medium-sized businesses. Rising electricity demand in tier-2 and tier-3 cities, coupled with inconsistent power quality in many regions, propels the need for reliable voltage regulators. Government programs supporting industrial parks and smart city initiatives further accelerate market adoption. Local manufacturers are expanding production capacities while integrating digital and automatic voltage regulation technologies. Businesses increasingly prioritize protecting sensitive electronics, HVAC systems, and machinery from voltage fluctuations. As India’s commercial and industrial sectors continue to grow, the market for single phase voltage regulators is expected to remain strong, supported by investments in modern electrical infrastructure and increased awareness of equipment longevity.

Germany experiences a 9.2% growth rate in the single phase commercial voltage regulator market, driven by the country’s high standards for energy efficiency and industrial automation. Compared to the United Kingdom, Germany emphasizes technologically advanced regulators with precise voltage control for sensitive commercial and industrial applications. Industries such as manufacturing, IT, and healthcare increasingly adopt high-quality regulators to ensure uninterrupted operations and equipment protection. The rise of renewable energy integration, like solar and wind, necessitates reliable voltage regulation to maintain stable power quality. Local R&D efforts focus on improving efficiency, safety, and digital monitoring capabilities. Export opportunities within the European Union further strengthen market performance. Overall, Germany maintains a strong demand for advanced single phase commercial voltage regulators due to strict industrial requirements and a focus on energy-efficient, high-performance electrical infrastructure.

The United Kingdom single phase commercial voltage regulator market grows at 7.6%, supported by commercial sector expansion and adoption of sensitive electronic equipment. Compared to the United States, the UK market places strong emphasis on reliable power supply for offices, hospitals, and retail chains. Voltage fluctuations in certain regions increase the need for efficient single phase regulators to prevent equipment downtime. Growing investments in commercial real estate and technology-driven infrastructure further accelerate adoption. Manufacturers in the UK are developing compact and automated solutions to simplify installation and enhance performance. Increased awareness about equipment longevity and operational continuity encourages businesses to prioritize voltage regulation. Despite a smaller market size than China or Germany, the UK maintains steady growth through technological upgrades and demand for high-quality, reliable voltage regulation systems.

The United States exhibits a 6.8% growth rate in the single phase commercial voltage regulator market, driven by commercial infrastructure growth and widespread use of sensitive electronic equipment. Compared to China, the US market emphasizes innovation in compact, energy-efficient regulators with digital monitoring capabilities. Businesses increasingly adopt voltage regulators to protect computers, HVAC systems, and manufacturing equipment from fluctuations and surges. Integration with smart grid technologies further enhances the appeal of modern voltage regulation solutions. Manufacturers focus on high-performance, cost-effective systems suitable for diverse commercial applications. Renovations and upgrades in commercial buildings, offices, and retail outlets continue to stimulate demand. As technology adoption and commercial expansion proceed, the United States market is expected to experience steady growth, with a focus on reliability, performance, and ease of installation.

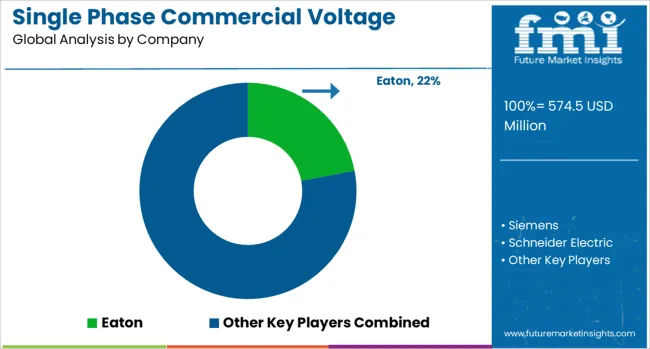

The single phase commercial voltage regulator market plays a critical role in stabilizing electrical supply, protecting sensitive equipment, and ensuring consistent voltage levels for commercial applications. With rising demand from commercial buildings, small industries, and retail outlets, these regulators are essential for minimizing voltage fluctuations, preventing equipment damage, and improving operational efficiency. Eaton is a prominent player in this market, offering reliable voltage regulation solutions with high precision and durability for diverse commercial applications. Siemens provides a broad range of voltage stabilizers and regulators that combine advanced technology with robust performance, catering to both small-scale and large-scale commercial operations. Schneider Electric is recognized for its innovative and energy-efficient voltage regulation systems, integrating safety features and smart monitoring capabilities to ensure stable power supply.

ABB contributes with high-quality single phase commercial voltage regulators designed for accuracy, reliability, and longevity, addressing the needs of various commercial sectors. V-Guard Industries, an established player in the Indian and regional markets, offers cost-effective and efficient voltage stabilizers tailored for small to medium commercial establishments. The market is driven by increasing urbanization, expansion of commercial infrastructure, and the growing need for uninterrupted power supply. Key players focus on enhancing product efficiency, durability, and user-friendliness while incorporating smart features such as real-time voltage monitoring and energy-saving functions. With the increasing sensitivity of commercial equipment to voltage fluctuations, the single phase commercial voltage regulator market is expected to witness steady growth globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 574.5 Million |

| Product | Linear and Switching |

| Voltage | ≤ 40 kVA, > 40 kVA to 250 kVA, and > 250 kVA |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eaton, Siemens, Schneider Electric, ABB, and V-Guard Industries |

| Additional Attributes | Dollar sales in the Single Phase Commercial Voltage Regulator Market vary by type including automatic and manual regulators, application across commercial buildings, small industries, and offices, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing demand for stable power supply, rising commercial infrastructure, and adoption of energy-efficient solutions. |

The global single phase commercial voltage regulator market is estimated to be valued at USD 574.5 million in 2025.

The market size for the single phase commercial voltage regulator market is projected to reach USD 1,240.2 million by 2035.

The single phase commercial voltage regulator market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in single phase commercial voltage regulator market are linear and switching.

In terms of voltage, ≤ 40 kva segment to command 51.0% share in the single phase commercial voltage regulator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single-Mode Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Single-Coated Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Single Superphosphate (SSP) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Electron Transistor Market Size and Share Forecast Outlook 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Use Pallet Market Size and Share Forecast Outlook 2025 to 2035

Single Serve Coffee Container Market Size, Share & Forecast 2025 to 2035

Single Wall Jars Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA