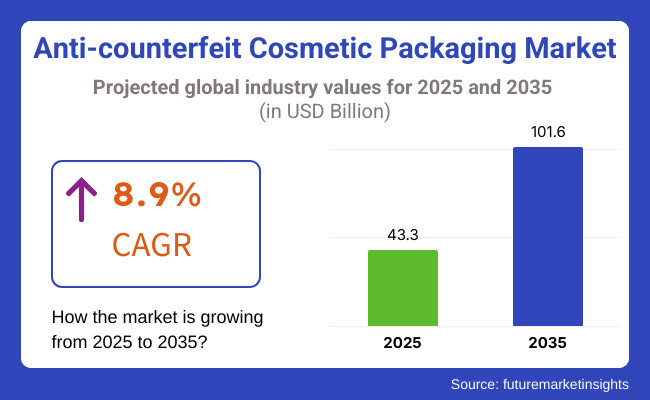

The global anti-counterfeit cosmetic packaging market is projected to reach USD 43.3 billion in 2025, and is expected to grow to USD 101.6 billion by 2035, at a compound annual growth rate (CAGR) of 8.9%, driven by rising product authentication concerns, brand protection efforts, and tighter regulations.

Anti-counterfeit technologies have been widely applied. These include QR-coded seals, RFID tags, holographic foils, and blockchain-backed traceability solutions. Manufacturers in 2024 to 2025 have increasingly embedded such features to ensure product authenticity and consumer safety.

This trend has gained considerable traction on e-commerce platforms, prompting cooperation among cosmetic brands, packaging firms, and regulators to enhance security. In a recent press release Avery Dennison announced opening of its first India based RFID opening facility "With the opening of our RFID inlay and label manufacturing facility in India, Avery Dennison is taking a significant step toward strengthening its presence in India.

” said Saurabh Agarwal, Vice President and General Manager, South Asia, Avery Dennison. “Local production will help us respond more efficiently to market needs, reduce lead times and better support our customers across industries. This aligns with our ongoing efforts to contribute meaningfully to the Indian ecosystem."

“India represents one of the fastest growing markets for RFID adoption, and this facility underscores our commitment to being closer to our customers. By localizing production and innovation, we’re not just enhancing our responsiveness and speed-to-market - we’re also partnering more deeply with Indian brands to unlock the full potential of smart supply chain solutions tailored to their unique needs," said Kelvin Tan, director, APAC, Intelligent Labels, sales and business development, Avery Dennison.

Regional policy initiatives have also compelled adoption of anti-counterfeit measures. The European Union’s Intellectual Property Action Plan 2024 introduced enhanced traceability requirements for cosmetics. In China, new NMPA regulations effective January 2025 mandated tamper-evident, serialization-capable packaging for imported and high-value local cosmetic products.

Technology integration is being scaled. Cloud-based AI-powered authentication systems and IoT-driven traceability networks are being introduced in production lines. Companies are also piloting biodegradable tamper-evident films and holographic seals across Europe and South Korea to align with ESG standards, without sacrificing brand protection.

Despite technological strides, challenges persist. High upfront costs, complex integration needs, and agile counterfeiting operations limit adoption by small and mid-sized enterprises. Interoperability across global markets remains a concern, and recyclability of anti-counterfeit materials is increasingly scrutinized.

Nonetheless, an incremental market opportunity of USD 58.3 billion is forecasted by 2035, driven by multi-stakeholder collaboration, regulatory enforcement, and technological maturation. Brands that adopt AI-based authentication, blockchain traceability, and sustainable verification materials are expected to secure market share and maintain consumer trust in the evolving cosmetic ecosystem.

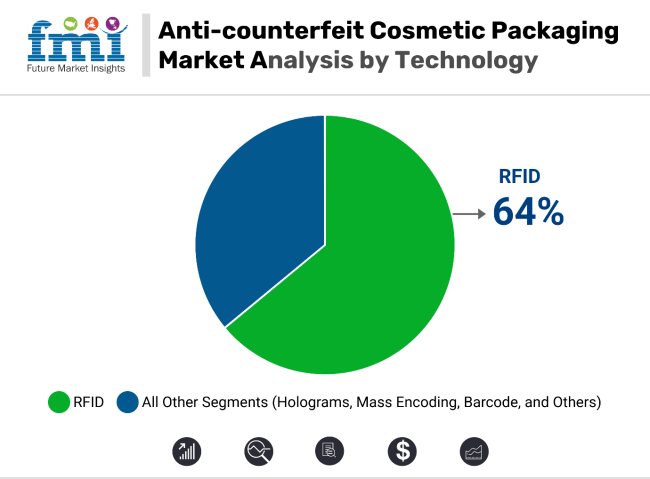

RFID (Radio Frequency Identification) technology is projected to command a dominant 64% share of the anti-counterfeit cosmetic packaging market by 2025. This leadership is fueled by its ability to offer real-time authentication, secure tracking, and dynamic data storage across the product lifecycle.

Unlike traditional labelling, RFID tags can store encrypted product information that can be verified at various checkpoints throughout the supply chain, offering a robust safeguard against counterfeit intrusion.

As counterfeit beauty and personal care products rise-especially in premium and online channels-top-tier brands are rapidly adopting RFID-embedded packaging. This technology enables consumers to verify product authenticity with a single scan on their smartphones, providing instant confidence and transparency.

RFID also integrates seamlessly with blockchain-based platforms, creating transparent and tamper-proof digital ledgers for every product journey. While upfront costs and infrastructure requirements remain challenges, developments in low-cost RFID tags and high-performance scanners are expected to accelerate adoption. By 2025, RFID’s widespread deployment will be reinforced by regulatory mandates and increasing demand for wire-free, verifiable product authentication.

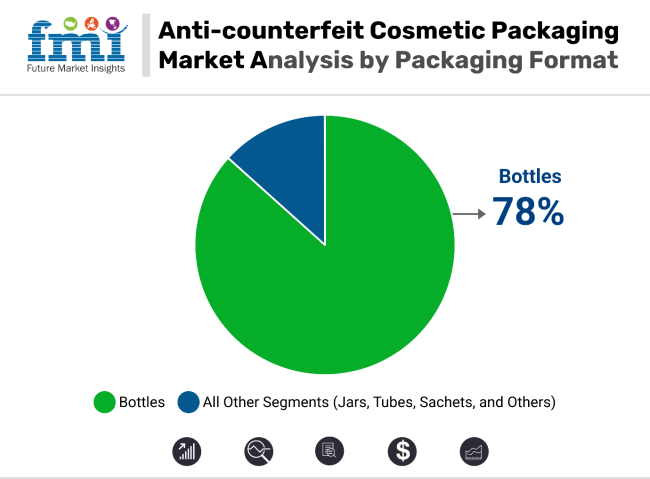

Bottles are anticipated to account for 78% of the anti-counterfeit cosmetic packaging market by 2025, making them the most dominant format across product types. From high-viscosity skincare serums and liquid foundations to perfumes and shampoos, bottles serve as the primary packaging format and consequently a frequent target for counterfeiting.

To combat this, brands are embedding multi-layered security solutions such as holographic foils, tamper-evident shrink sleeves, QR codes, UV-sensitive inks, and RFID-enabled closures. High-end cosmetic brands are investing in proprietary bottle designs, including custom embossing and hidden security markers, to further reduce the risk of duplication.

Intelligent bottles with QR or NFC-enabled authentication also allow consumers to validate product authenticity using mobile apps, increasing customer trust while reinforcing brand value. The surge in e-commerce beauty sales, which represented over 35% of total cosmetic retail in 2024, has made secure packaging even more essential.

While cost and scalability remain barriers for mass-market adoption, ongoing regulatory pressure and increasing consumer awareness about fake cosmetics are driving brands toward secure bottle solutions. Bottles will continue to be the preferred packaging format for high-integrity, tamper-proof cosmetic product delivery.

Challenge

Rising Counterfeiting Threats and Implementation Costs

The adoption of sophisticated security features by manufacturers to outwit counterfeiters can be costly, and this is what makes the anti-counterfeit cosmetic packaging market struggle. Counterfeit cosmetic items harm industry image and consumer health.

The tremor of integrating technologies such as RFID tags, holograms, and block chain authentication comes with a hefty price tag which can prove to be a deterrent for smaller cosmetic brands. In response, organizations need to prioritize scalable security measures, promote industry partnerships, and advocate for informed consumer choices.

Opportunity

Advancements in Smart Packaging and Authentication Technologies

Smart packaging solutions are becoming more advanced, leading to a significant opportunity for market growth. Real-time product authentication is facilitated with the help of these technologies such as QR code-based authentication, AI-driven package tracking, and block chain verification which in return helps provide brand protection and consumer trust.

Moreover, the growing need for sustainable and tamper-evident packaging solutions is accelerating the development of biodegradable security labels and smart ink technology. The increasing support from regulators coupled with rising consumer awareness is to accelerate adoption of anti-counterfeit packaging solutions over the coming years.

North America accounts for a dominant market share in the global anti-counterfeit cosmetics packaging market owing to the stringent regulations in place, high consumer awareness regarding the issue and advanced level of packaging technologies.

With the rise of major cosmetics brands and the increasing number of counterfeit beauty products, there is a great demand for secure packaging solutions such as RFID tags, holograms, tamper-evident seals, and block chain-based tracking systems.

The USA FDA (Food and Drug Administration) and FTC (Federal Trade Commission) are strict in implementing laws and regulations to ban counterfeit cosmetics, which in turn is bolstering the growth of the global market for cosmeceuticals. Also, luxury cosmetics brands are spending millions on anti-counterfeit technology to safeguard brand and consumer integrity.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.6% |

Growing demand for counterfeit cosmetic packaging in the United Kingdom due to implementation of various regulatory standards to provide clear supply chain as well as increasing risk of counterfeiting in beauty products imported and sold through various online channels.

UK Intellectual Property Office (IPO), Government agencies are working with cosmetic brands to implement next generation authentication tech such as digital watermarks, NFC enabled packaging, unique serialization codes. The rise of the premium cosmetics sector and an increase in consumer demand for product authenticity are driving the adoption of anti-counterfeit solutions in the United Kingdom.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.2% |

The anti-counterfeit cosmetic packaging market in the Europe holds significant share, with France, Germany, and Italy being the regions contributing heavily. Due to strict regulations imposed by the European Medicines Agency (EMA) and the European Union Intellectual Property Office (EUIPO), cosmetic companies are concentrating their efforts on high-tech authentication solutions.

The safety packaging demand has also increased as there are few luxury and organic cosmetic brands across Europe. Implementing block chain-based tracking systems combined with AI-enabled authentication technologies are bringing about improved transparency in the whole supply chain.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.3% |

The popularity of high-quality skincare and beauty products in Japan is driving a steady growth for anti-counterfeit cosmetic packaging in the country.

The rising incidence of counterfeit products, particularly on e-commerce platforms, has given rise to a greater need for secure packaging solutions, such as tamper-evident labels, intelligent packaging, and QR code verification. The government is further reinforcing the market with its proactive position on intellectual property protection.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

With a well-developed beauty and skincare industry, South Korea has the largest share in the anti-counterfeit cosmetic packaging market. The global k-beauty boom has also raised the concern of counterfeit products, and many of these companies are implementing state-of-the-art security features.

Invisible ink printing, forensic markers, and block chain authentication are among technologies being adopted increasingly for cosmetic packaging. Market growth is being fuelled by government initiatives to prevent intellectual property violations and collaborations with beauty conglomerates.

“We all know inseparable Chinese are tech-savvy consumers and we love verified product with digital information, it fuels the demand of smart packaging.”

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.4% |

Avery Dennison Corporation (20-25%)

Avery Dennison leads the anti-counterfeit cosmetic packaging market with advanced RFID and tamper-proof solutions that ensure product authenticity.

CCL Industries (15-20%)

CCL Industries is a major player in the security labelling sector, offering customized holograms, encrypted QR codes, and multi-layered authentication features.

3M Company (12-16%)

3M Company specializes in optical security technologies, such as micro-structured films and covert security markers, to combat counterfeit beauty products.

SICPA Holding SA (10-14%)

SICPA is at the forefront of high-security printing, developing colour-shifting inks and block chain powered verification systems for cosmetic packaging.

Zebra Technologies (8-12%)

Zebra Technologies provides serialization, smart packaging, and barcode-based anti-counterfeit solutions to improve brand protection in the beauty industry.

The anti-counterfeit cosmetic packaging market is evolving with the introduction of AI-powered tracking systems, cloud-based authentication, and eco-friendly security solutions. Notable contributors include:

The overall market size for the anti-counterfeit cosmetic packaging market was USD 43.3 billion in 2025.

The anti-counterfeit cosmetic packaging market is expected to reach USD 101.6 billion in 2035.

The anti-counterfeit cosmetic packaging market is expected to grow at a CAGR of 8.9% during the forecast period.

The demand for the anti-counterfeit cosmetic packaging market will be driven by increasing concerns over product authenticity, rising cases of counterfeit beauty products, advancements in smart packaging technologies, growing regulatory enforcement, and heightened consumer awareness regarding product safety.

The top five countries driving the development of the anti-counterfeit cosmetic packaging market are the USA, China, Germany, France, and Japan.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 44: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 46: East Asia Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 48: East Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 54: South Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 56: South Asia Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 58: South Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 64: Oceania Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 66: Oceania Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 68: Oceania Market Volume (Units) Forecast by Material, 2018 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: Oceania Market Volume (Units) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Packaging Format, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Packaging Format, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Material, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Technology, 2023 to 2033

Figure 27: Global Market Attractiveness by Packaging Format, 2023 to 2033

Figure 28: Global Market Attractiveness by Material, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Technology, 2023 to 2033

Figure 57: North America Market Attractiveness by Packaging Format, 2023 to 2033

Figure 58: North America Market Attractiveness by Material, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Packaging Format, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 117: Europe Market Attractiveness by Packaging Format, 2023 to 2033

Figure 118: Europe Market Attractiveness by Material, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 131: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 135: East Asia Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 139: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Packaging Format, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 161: South Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 165: South Asia Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 169: South Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 170: South Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 172: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: South Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 174: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 177: South Asia Market Attractiveness by Packaging Format, 2023 to 2033

Figure 178: South Asia Market Attractiveness by Material, 2023 to 2033

Figure 179: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Technology, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Material, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 191: Oceania Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 195: Oceania Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 199: Oceania Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: Oceania Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Technology, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Packaging Format, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Material, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Packaging Format, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Packaging Format, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Packaging Format, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging Format, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging Format, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Packaging Format, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Counterfeit Packaging for Food & Beverages Market Growth - Forecast 2025 to 2035

Anti-Counterfeit Packaging Market Trends - Growth & Forecast 2025 to 2035

Anti-Counterfeit NFC Packaging Market Size and Share Forecast Outlook 2025 to 2035

Anti-counterfeit Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Anti-Counterfeit Pharmaceutical Packaging Providers

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA