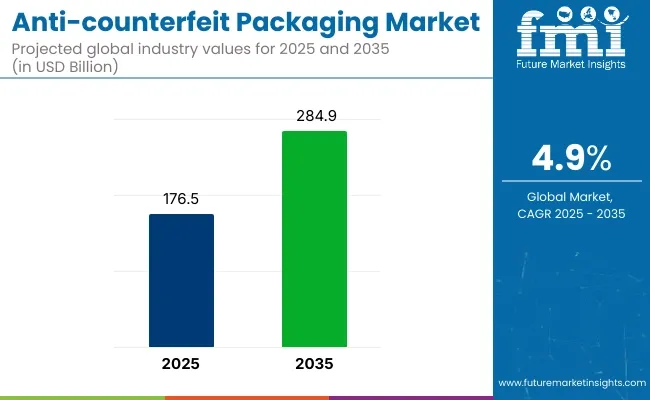

The global anti-counterfeit packaging market is projected to grow from USD 176.5 billion in 2025 to USD 284.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.90% over the forecast period.

Sales in 2024 reached USD 168.2 billion, reflecting a steady increase in demand across various industries. This growth has been attributed to the rising need for product authentication and brand protection in sectors such as pharmaceuticals, food and beverage, and electronics. The increasing prevalence of counterfeit goods has further propelled the adoption of advanced packaging solutions globally.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 176.5 billion |

| Industry Value (2035F) | USD 284.9 billion |

| CAGR (2025 to 2035) | 4.90% |

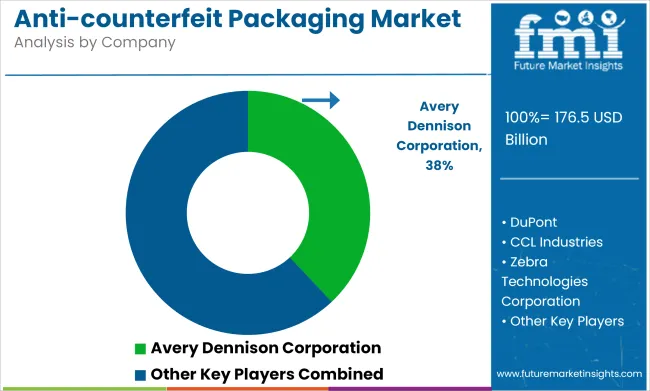

Significant investments have been made by leading companies to expand production capacities and develop innovative anti-counterfeit packaging solutions. For instance, Avery Dennison Corporation, a prominent manufacturer in the packaging industry, opens its first India-based RFID production facility. “Local production will help us respond more efficiently to market needs, reduce lead times and better support our customers across industries. This aligns with our ongoing efforts to contribute meaningfully to the Indian ecosystem” said, Vice President and General Manager, South Asia, Avery Dennison.

The growing emphasis on sustainability has profoundly shaped the evolution of the anti-counterfeit packaging market. Manufacturers are increasingly adopting environmentally friendly practices by developing packaging solutions that are not only secure but also sustainable. This includes the use of recyclable and biodegradable materials, such as plant-based polymers and recycled fibers, which help minimize ecological footprints. Lightweight and modular packaging designs are being embraced to reduce material consumption and improve transportation efficiency.

These innovations are driven by both consumer demand for greener alternatives and stricter international regulations focused on reducing plastic waste and promoting circular economies. By integrating anti-counterfeit technologies into sustainable packaging, companies are able to protect product authenticity while simultaneously aligning with global environmental goals, thus appealing to both regulators and eco-conscious consumers.

The shift towards sustainable and environmentally friendly solutions has significantly influenced the anti-counterfeit packaging market. Manufacturers have been focusing on developing packaging that is recyclable, lightweight, and made from renewable resources. Innovations include the integration of biodegradable materials, modular designs, and the use of recycled fibers to reduce environmental impact. These advancements align with global sustainability goals and regulatory requirements, making anti-counterfeit packaging an attractive option for environmentally conscious industries.

Jars segment projected to account for approximately 28.4% of the global anti-counterfeit packaging market by 2025 as they have been extensively used across pharmaceutical, personal care, cosmetics, and food & beverage industries. These formats have served as primary packaging solutions for liquids, powders, creams, capsules, and perishable goods where product authenticity, tamper resistance, and brand protection are considered critical.

Anti-counterfeit technologies such as serialized barcodes, tamper-evident seals, QR codes, RFID tags, and holographic labels have been effectively integrated into bottle and jar closures, caps, and outer labels. Such features have been used to deter counterfeiting attempts, provide product traceability, and support regulatory compliance across both over-the-counter and prescription product lines.

In the pharmaceutical sector, bottles and jars have been favored for oral solids and syrups due to their dosing accuracy and protective barrier properties. In cosmetics and personal care, their appeal has been enhanced through custom branding elements combined with authentication layers, ensuring both visual impact and consumer confidence.

Food and beverage applications have also relied on these containers to protect brand integrity and verify freshness claims. As global counterfeiting threats escalate across value chains, and as consumer awareness of product authenticity rises, the use of anti-counterfeit packaging in bottles and jars is expected to remain dominant driven by their structural adaptability and widespread use across multiple high-risk industries.

The healthcare sector is expected to dominate the anti-counterfeit packaging market by 2025, with an estimated 41.6% share, as rising concerns regarding counterfeit pharmaceuticals, biologics, and medical devices have driven widespread adoption of advanced packaging security measures. Strict regulations issued by agencies such as the FDA, EMA, and WHO have mandated serialization, track-and-trace systems, and tamper-evident features across primary and secondary pharmaceutical packaging.

Anti-counterfeit technologies have been implemented through a variety of formats including holographic seals, RFID tags, invisible inks, 2D barcodes, and block chain-based authentication, which have enabled real-time verification and supply chain transparency. These features have been embedded directly into labels, cartons, bottles, and vials used for medicines, vaccines, and injectable products.

Patient safety concerns and the increasing complexity of global pharmaceutical distribution networks have necessitated greater investment in packaging systems that can prevent substitution, diversion, and relabeling. Digital platforms and mobile apps have also been introduced to allow patients and providers to authenticate products at the point of use.

As the healthcare industry continues to expand in both developed and emerging economies, and as counterfeiting techniques become more sophisticated, anti-counterfeit packaging within the healthcare segment is expected to remain the most heavily invested and regulated area of application through 2025.

Evolving Counterfeit Tactics and High Implementation Costs

Ongoing innovation in counterfeiting techniques and exorbitant costs of incorporating advanced security features act as a challenge to the adoption of the anti-counterfeit packaging market. Fake products are a major blow to brand credibility and can also put consumers at health and safety risk.

On the other hand, novel technologies like RFID, holographic security labels, and blockchain verification come with a high price tag that may not be accessible to smaller companies, rendering such solutions a poor fit for them. Minimizing the threat from emerging technologies will escalate demand for solutions, necessitating a trade-off between economic security and high-tech mediations, alongside a tougher regulatory arm.

Advancements in Smart Packaging and Digital Authentication

The growing demand for smart packaging is one of the lucrative opportunities for anti-counterfeit packaging market. AI-driven product verification, QR code-based traceability, and blockchain-enabled transparency can help deliver greater security at the same time as streamlining operations in supply chains.

The growth of sustainable and tamper-proof packaging and growing demands for biodegradable security and digital watermarking also contributing towards market growth. With regulators tightening anti-counterfeit measures, businesses that implement these advanced solutions will stand out among competitors and increase consumer trust.

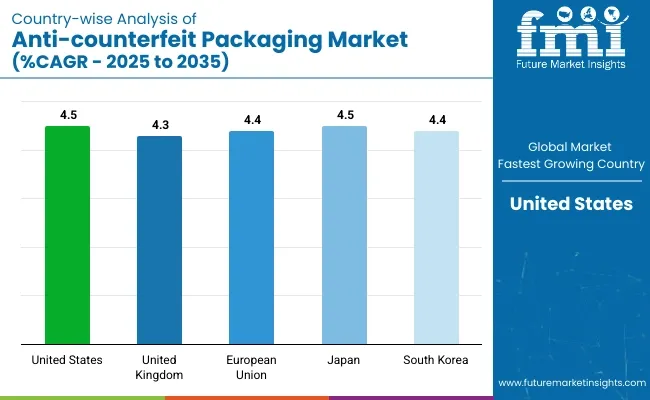

North America dominates the anti-counterfeit packaging market, especially due to the USA region, which has more stringent regulations and greater types of products getting counterfeited in other sectors.

In order to mitigate counterfeiting, the FDA, USA Customs and Border Protection (CBP), and Drug Supply Chain Security Act (DSCSA) have all come a long way with the application of track-and-trace solutions, tamper-evident seals and smart packaging.

In particular, the e-commerce boom, especially in pharmaceuticals, food and beverages, and luxury goods, topology being especially prone to counterfeiting, has led to the growth of demand for verification technologies (RFID, QR codes, holographic labels, blockchain-authentication, etc.). Which, in turn, has propelled the market in the United States due to active consumer awareness on the authenticity and safety of products.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

The UK anti-counterfeit packaging market has been growing at a steady pace, largely owing to government regulation of the same through UK Intellectual Property Office (IPO) and with the assistance of Food Standards Agency (FSA).

Companies increasingly invest in high-security packaging solutions such as forensic markers, serialized barcodes and NFC-enabled packaging in response to growing adulteration of pharmaceutical products, alcoholic beverages and luxury goods. Moreover, the rise of direct-to-consumer (DTC) sales channels through online marketplaces has aggravated the demand for anti-counterfeit packaging technologies to offer supply chain transparency and prevent fraudulent activities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

Significant opportunity is also for anti-counterfeit packaging solutions, which are the primary drivers of this market, in countries in the European Union (EU), where regulatory frameworks like the Falsified Medicines Directive (FMD) and methods of the European Anti-Fraud Office (OLAF) initiative remains a lodestone.

Key markets like Germany, France, and Italy have increased efforts to introduce advanced authentication measures such as digital watermarks, holographic security features, and blockchain-integrated tracking systems.

The increase of counterfeit food, beverages and personal care products has led major brands to use tamper-proof packaging and serialization technology. The EU’s focus on sustainable and smarter packaging solutions is also shaping the growth of the market, as manufacturers are emphasising on eco-friendly anti-counterfeit technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

Driven by rising concerns over product safety, especially in the pharmaceutical, cosmetics, and food sectors, the anti-counterfeit packaging market in Japan is expanding. To curb counterfeiting, the Japanese government has enforced strict regulations, which is fuelling the demand for tamper-proof packages, RFID-enabled tags, and blockchain technology based tracking systems.

As cross-border e-commerce has become more popular, manufacturers are adopting state-of-the-art authentication systems to uphold consumer trust and meet regulatory requirements. Moreover, the concentrated presence of technology-led packaging companies in Japan has accelerated the adoption of AI-powered anti-counterfeit solutions, thus, driving market growth in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The South Korean anti-counterfeiting packaging market is expanding as a result of the growing counterfeiting of electronics, cosmetics, and luxury food items. Measures by governments to impose more stringent labelling requirements and monitor online retail categorically has forced industries to adopt secure packaging technologies.

Regionally it is becoming a part of our daily practice as QR code verification and use of smart labels and NFC enabled tracking have become common. Drive for K-beauty and K-food "Packaging Makes the Brand" and enter the international market with a "greeting" secure packaging has entered the trend.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The anti-counterfeit packaging market is experiencing a surge in demand and growth driven by the growing emphasis on product safety, brand protection, and regulatory compliance across multiple sectors including food & beverages, pharmaceuticals, cosmetics, and consumer goods. Increasing instances of counterfeiting have created a demand for security-enhanced packaging solutions.

By using technology including RFID-based tracking, tamper-evident seals and holograms, serialization, forensic markers, and blockchain-enabled supply chain management, companies are improving product authenticity and traceability. Moreover, increasing environmental concerns are propelling the development of eco-friendly and recyclable Anti-Counterfeiting Packaging solutions.

The overall market size for the anti-counterfeit packaging market was USD 176.5 billion in 2025.

The anti-counterfeit packaging market is expected to reach USD 284.9 billion in 2035.

The anti-counterfeit packaging market is expected to grow at a CAGR of 4.90% during the forecast period.

The demand for the anti-counterfeit packaging market will be driven by increasing concerns over product authenticity, rising cases of counterfeit goods, advancements in smart packaging technologies, stringent regulatory frameworks, and growing consumer awareness regarding product safety.

The top five countries driving the development of the anti-counterfeit packaging market are the USA, China, Germany, France, and Japan.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Counterfeit Packaging for Food & Beverages Market Growth - Forecast 2025 to 2035

Anti-Counterfeit NFC Packaging Market Size and Share Forecast Outlook 2025 to 2035

Anti-counterfeit Cosmetic Packaging Market Growth - Demand & Forecast 2025 to 2035

Anti-counterfeit Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Anti-Counterfeit Pharmaceutical Packaging Providers

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA