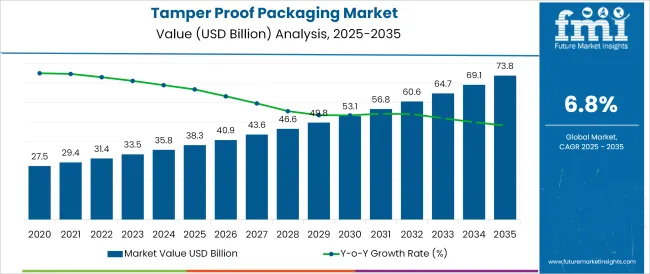

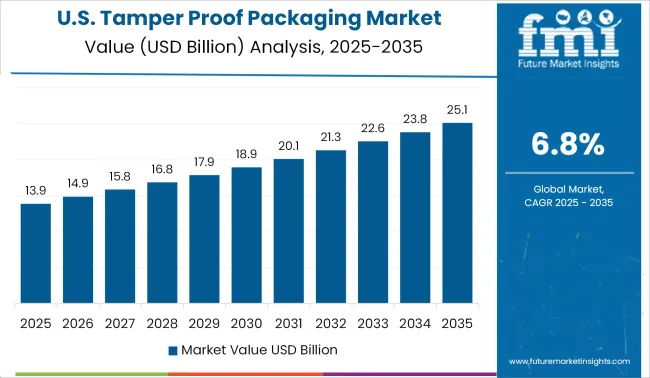

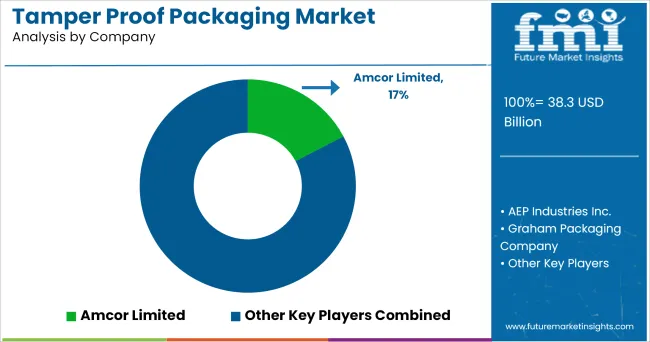

The Tamper Proof Packaging Market is estimated to be valued at USD 38.3 billion in 2025 and is projected to reach USD 73.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The tamper proof packaging market is advancing steadily, driven by heightened concerns over product integrity, safety compliance, and regulatory enforcement across industries. Industry publications and corporate announcements have emphasized the rising adoption of tamper evident solutions to combat counterfeiting and unauthorized access, particularly in the pharmaceutical and food sectors.

Manufacturers have developed innovative packaging formats that integrate visible tamper indicators without compromising packaging aesthetics or user convenience. Additionally, increasing consumer awareness regarding product authenticity and safety has influenced purchasing behavior, encouraging brands to adopt protective packaging formats as a trust building measure.

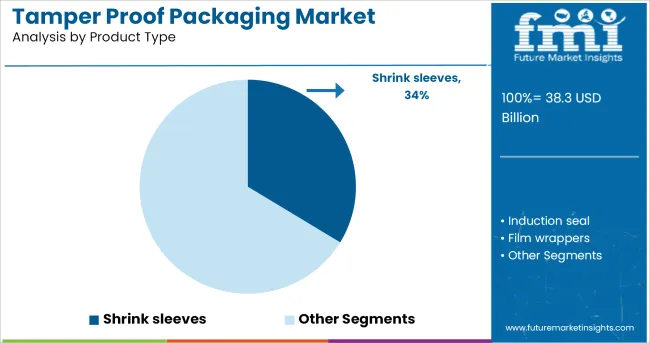

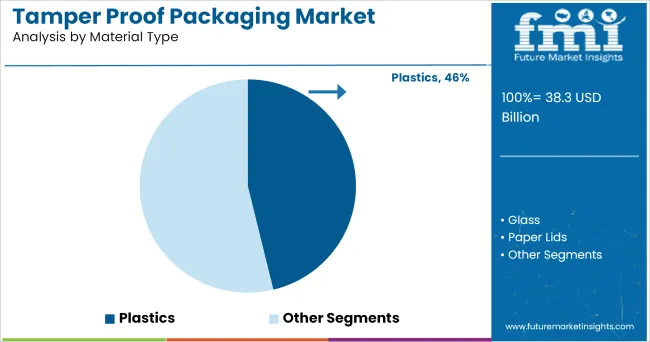

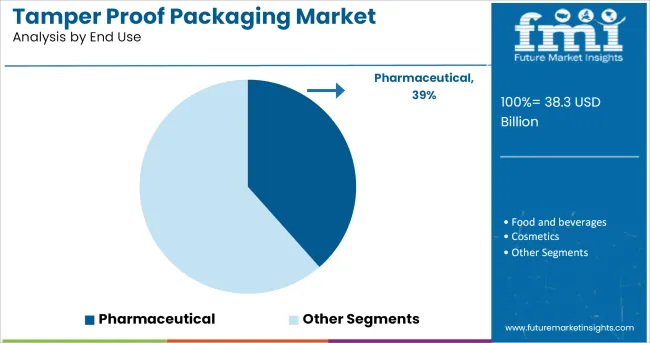

The growth of e commerce and global supply chains has further reinforced the need for packaging solutions that ensure product safety during transportation and distribution. Future growth is expected to be driven by material innovations and sustainability initiatives, such as recyclable plastics and biodegradable sealing materials. Segmental momentum is expected to be led by Shrink Sleeves as the preferred product type, Plastics as the dominant material and Pharmaceutical as the primary end use industry due to stringent regulatory requirements and safety standards.

The market is segmented by Product Type, Material Type, and End Use and region. By Product Type, the market is divided into Shrink sleeves, Induction seal, Film wrappers, Blister or strip packs, Bubble packs, and Others (Pouches, bottle mouth inner seals, tape seals). In terms of Material Type, the market is classified into Plastics, Glass, Paper Lids, Metal, and Others.

Based on End Use, the market is segmented into Pharmaceutical, Food and beverages, Cosmetics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Shrink Sleeves segment is projected to hold 33.7% of the tamper proof packaging market revenue in 2025, maintaining its lead in product type adoption. Growth in this segment has been supported by the versatility of shrink sleeves in providing full body coverage and clear tamper evidence without altering the product’s branding.

Manufacturers have adopted shrink sleeves for their compatibility with various container shapes and sizes, enhancing packaging security across different product lines. The segment has also benefited from advancements in heat shrinkable film technologies, allowing for tighter seals and faster application processes on automated production lines.

Additionally, brand owners have leveraged shrink sleeves to combine aesthetic appeal with protective functionality, driving dual purpose packaging solutions. As consumer product safety expectations continue to rise, and regulatory bodies mandate tamper evident labeling, the Shrink Sleeves segment is expected to sustain its market dominance.

The Plastics segment is projected to account for 46.2% of the tamper proof packaging market revenue in 2025 establishing itself as the leading material type. Growth in this segment has been driven by the flexibility, cost effectiveness, and scalability of plastics in tamper evident packaging applications.

Packaging manufacturers have favored plastics due to their lightweight properties, barrier protection capabilities, and adaptability to various tamper proof formats such as shrink sleeves, blister packs, and security seals. Advances in recyclable and bio based plastic materials have also addressed environmental concerns, encouraging sustainable innovation within the segment.

Industries such as pharmaceuticals and personal care have prioritized plastic based tamper evident solutions due to their ability to maintain product sterility and integrity throughout the distribution chain. As demand for safety compliant packaging solutions continues to rise across consumer and industrial sectors, the Plastics segment is expected to retain its dominant position in material adoption.

The Pharmaceutical segment is projected to contribute 38.5% of the tamper proof packaging market revenue in 2025 positioning it as the leading end use industry. Growth in this segment has been driven by stringent regulatory frameworks that mandate tamper evident packaging for prescription drugs, over the counter medications, and medical devices.

Pharmaceutical manufacturers have integrated tamper proof solutions into their packaging strategies to ensure patient safety, prevent product adulteration, and comply with drug safety regulations globally. Industry reports have highlighted the increasing complexity of pharmaceutical supply chains, necessitating secure packaging to protect against unauthorized access and contamination during transit.

Additionally, growing concerns about counterfeit drugs have prompted brand owners to implement multi layered packaging solutions that combine tamper evidence with authentication features. As global pharmaceutical production and distribution expand, particularly in emerging markets, the Pharmaceutical segment is expected to remain the primary driver of tamper proof packaging demand.

The global tamper proof packaging market is driven by changing preference towards flexible packaging solutions, low cost of storage, low use of material, and low transport cost. Rising concerns regarding safety are fueling the market growth across the globe positively. The growing food & beverage industries across the globe are estimated to drive the market during the forecast period.

However, the strict regulations especially in the pharmaceutical industry call for the testing of tamper-evident packaging and the observance of the packaging to guidelines that have been laid down. This is estimated to restraints the market growth in the forecast period.

The growing trend of ready to eat, as well as packaged food consumption on account of the changing lifestyles of the people and their increased income is benefiting the growth of this Market.

Rising demand for of Ready-to-Eat meals, packaged foods, frozen foods, and instant food products will help the market for intelligent tamper-proof packaging to grow. With supermarkets, hypermarkets, and utility stores changing the entire landscape of shopping for food and beverage products, there has been a rise in the need for intelligent tamper-proof packaging as this form of packaging boost the shelf life of the product within, by maintaining its freshness as well as its nutritional value throughout the supply chain.

The USA Food and Drug Administration has strictly enforced tamper-evident packaging for pharmaceutical manufacturers in various countries are driving the market growth in a positive way. The increasing expanding growth of the pharmaceutical industry, which is expected to fuel the global tamper-evident packaging market during the forecast period. The increasing concerns regarding healthcare and safety are thus also propelling the market growth.

The Asia Pacific is estimated to witness growth with the highest CAGR in the market during the forecast period owing to the strong expansion of the pharmaceutical, food & beverages, and cosmetics industry in this region. Rising disposable income of consumers and the growing urban population in developing countries such as India and China are projected to propel the tamper proof packaging market growth in the forecast period.

Growing consciousness regarding food safety among consumers and changing lifestyles of consumers are also anticipated to drive the tamper proof packaging market growth in a positive way.

North America is expected to hold the largest share in the market during the forecast period owing to regulatory mandates and high awareness regarding product safety among consumers. Rising demand for tamper-evident packaging is inevitable and several factors are already driving the market growth in a positive direction.

The FDA or USA Food and Drug Administration has imposed stringent rules and regulations on the pharmaceutical industry regarding the packaging of medicines and drugs along with the strict testing protocols which are estimated to stimulate the growth of the tamper-evident packaging market in coming years.

Some of the leading manufacturers and suppliers of tamper proof packaging

Key suppliers are focusing on increasing the manufacturing capacity and supply of the tamper proof packaging as increase in global demand of it. Consistent efforts are being taken by market players in order to reduce the cost of development.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global tamper proof packaging market is estimated to be valued at USD 38.3 billion in 2025.

The market size for the tamper proof packaging market is projected to reach USD 73.8 billion by 2035.

The tamper proof packaging market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in tamper proof packaging market are shrink sleeves, induction seal, film wrappers, blister or strip packs, bubble packs and others (pouches, bottle mouth inner seals, tape seals).

In terms of material type, plastics segment to command 46.2% share in the tamper proof packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tamper Evident Label Market Forecast and Outlook 2025 to 2035

Tamper Evident Labeler Market Size and Share Forecast Outlook 2025 to 2035

Tamper Evidence Machinery Market Size and Share Forecast Outlook 2025 to 2035

Tamper Band Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Leading Tamper Evident Label Manufacturers

Tamper Evident Pots & Tubs Market

Tamper Evident Shrink Bands Market

Tamper Evident Bag Sealers Market

Leading Providers & Market Share in Tamper Evident Packaging

Tamper Evident Packaging Market Trends, Growth, Forecast 2025-2035

Plastic Tamper Evident Closures Market

Ex Proof Absolute Encoders Market Size and Share Forecast Outlook 2025 to 2035

Ex Proof Incremental Encoders Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Flameproof Equipment Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Makeup Market Size and Share Forecast Outlook 2025 to 2035

Soundproof Drywall Materials Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Breathable Textiles WBT Size Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA