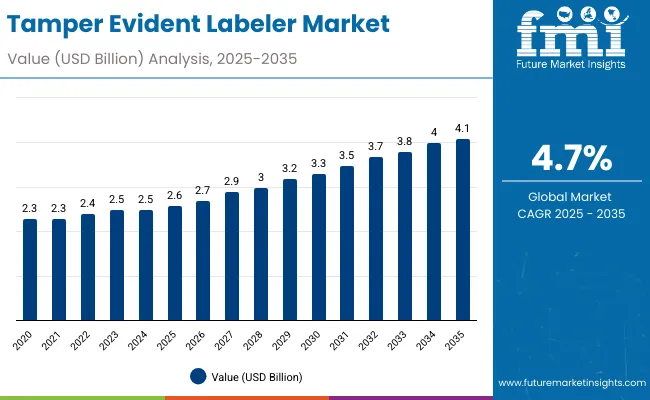

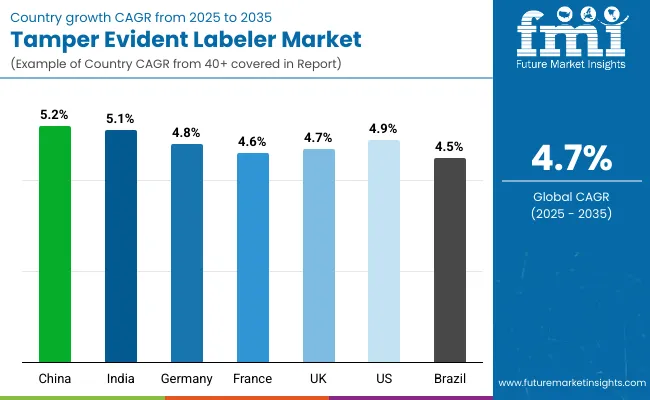

The tamper evident labeler market is expected to grow from USD 2.6 billion in 2025 to USD 4.1 billion by 2035, resulting in a total increase of USD 1.5 billion over the forecast decade. This represents a 57.7% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 4.7%. Over ten years, the market grows by a 1.6 multiple.

| Metric | Value |

|---|---|

| Tamper Evident Labeler Market Estimated Value in (2025 E) | USD 2.6 billion |

| Tamper Evident Labeler Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

In the first five years (2025-2030), the market progresses from USD 2.6 billion to USD 3.2 billion, contributing USD 0.6 billion, or 40.0% of total decade growth. This phase is shaped by regulatory enforcement in pharmaceuticals and food packaging, where safety and authenticity verification are critical. Growth is reinforced by adoption in cosmetics and electronics for brand protection.

In the second half (2030-2035), the market grows from USD 3.2 billion to USD 4.1 billion, adding USD 0.9 billion, or 60.0% of the total growth. This acceleration is supported by innovations in digital printing, smart labeling with NFC/RFID, and sustainable adhesive technologies. Expanding e-commerce trade of sensitive goods further strengthens demand, positioning tamper evident labelers as indispensable to global packaging security.

From 2020 to 2024, the tamper evident labeler market expanded from USD 2.1 billion to USD 2.4 billion, supported by regulatory compliance in pharmaceuticals, food, and cosmetics where product security and authenticity are essential. Nearly 70% of revenue was led by OEMs providing high-speed labeling equipment integrated with serialization features.

Leaders such as HERMA, Videojet Technologies, and Marchesini Group emphasized durability, seal integrity, and compatibility with diverse packaging formats. Differentiation focused on traceability, print clarity, and anti-tampering efficiency, while smart QR authentication remained secondary. Service-driven models such as validation and calibration services accounted for under 18% of market value, with capital investments dominating procurement.

By 2035, the tamper evident labeler market will reach USD 4.1 billion, growing at a CAGR of 4.70%, with smart labeling solutions and SaaS-based traceability platforms contributing over 40% of revenues. Competitive pressure will rise as providers introduce blockchain-linked serialization, AI-based defect detection, and cloud-integrated compliance tracking.

Established players are transitioning toward hybrid offerings that combine physical labeling systems with digital verification platforms. Emerging companies such as WLS (WeilerLabeling Systems), Accutek Packaging, and Advanced Labelling Systems are gaining traction with recyclable label materials, modular machine designs, and customizable solutions addressing sustainability, efficiency, and strict regulatory mandates worldwide.

The rising focus on product safety, authenticity, and regulatory compliance is driving growth in the tamper evident labeler market. These labelers play a critical role in preventing counterfeiting, ensuring traceability, and enhancing consumer trust, particularly in pharmaceuticals, food, and cosmetics. Expanding global trade and stricter packaging regulations are further accelerating adoption.

Labelers with advanced sealing technologies, serialization features, and compatibility with smart packaging are gaining popularity for their ability to provide visible proof of tampering. Integration with QR codes, RFID, and blockchain platforms enhances supply chain transparency. Eco-friendly label materials and efficient labeling systems also align with sustainability goals, boosting widespread market acceptance.

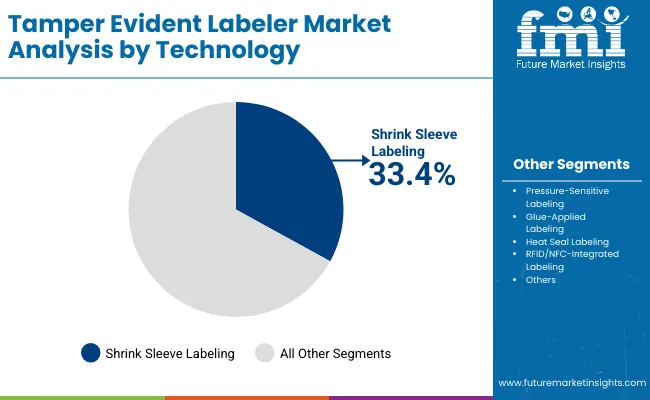

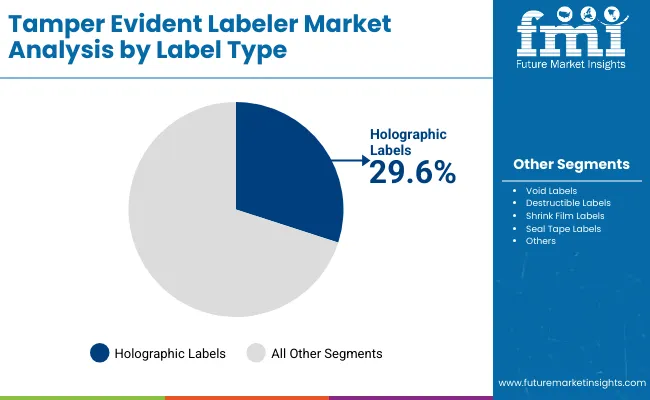

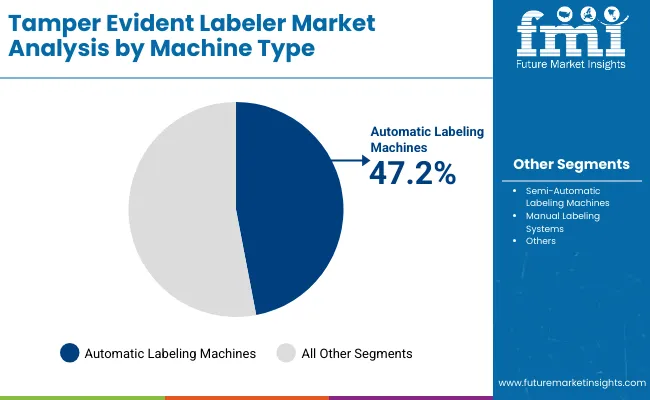

The market is segmented by technology, label type, machine type, application, end-use industry, and region. Technology segmentation includes pressure-sensitive labeling, glue-applied labeling, shrink sleeve labeling, heat seal labeling, and RFID/NFC-integrated labeling, ensuring secure product marking. Label type covers void labels, destructible labels, holographic labels, shrink film labels, and seal tape labels, offering multiple levels of tamper resistance. Machine type segmentation includes automatic labeling machines, semi-automatic labeling machines, and manual labeling systems, enabling scalability across production volumes.

Applications span product authentication, tamper detection, track and trace, and brand protection, addressing regulatory compliance and consumer trust. End-use industries include pharmaceuticals and healthcare, food and beverages, cosmetics and personal care, consumer electronics, industrial goods, and retail. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Shrink sleeve labeling is projected to account for 33.4% of the market in 2025, driven by its ability to provide 360-degree coverage and high tamper resistance. These labels conform tightly to container shapes, ensuring visibility of any attempt at removal or replacement. Their versatility across bottles, cartons, and specialty packs supports broad adoption.

Industries value shrink sleeves for combining security with branding opportunities through vibrant graphics and holographic effects. Adoption is particularly strong in pharmaceuticals and beverages, where shelf appeal and product protection are equally critical. Their growing use reflects the rising need for both functional and aesthetic label solutions.

Holographic labels are forecast to represent 29.6% of the market in 2025, as they provide strong deterrence against counterfeiting. Their 3D visual effects are difficult to replicate, giving consumers a quick and reliable means of authentication. These labels are used extensively in healthcare, electronics, and premium consumer goods.

Advances in micro-optic patterns and laser imaging enhance the security level of holographic labels. Their appeal is further strengthened by integration with QR codes or NFC features for multi-layered verification. The segment’s dual role in brand protection and consumer trust ensures its continued leadership.

Automatic labeling machines are expected to hold 47.2% of the market in 2025, reflecting demand for high-speed, precision labeling in large-scale production. These machines integrate vision systems to ensure label placement accuracy and detect misalignments in real time. Their ability to handle multiple label types enhances operational flexibility.

Adoption is reinforced by labor cost pressures and rising demand for consistent product security. Automatic systems also allow integration with serialization and coding modules, aligning with regulatory compliance needs. Their role in scaling tamper-evident solutions makes them the backbone of modern labeling operations.

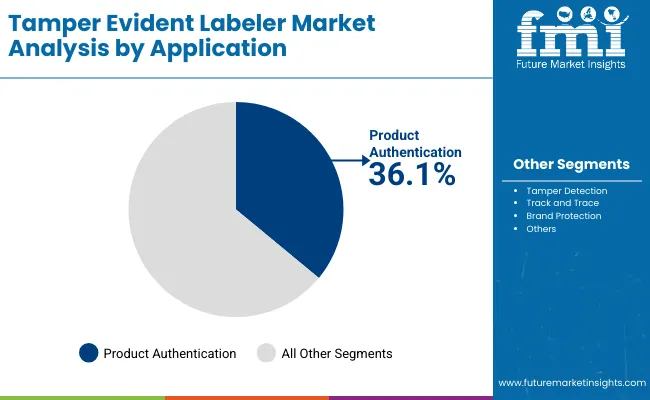

Product authentication is projected to account for 36.1% of the market in 2025, as tamper-evident labels play a central role in combating counterfeiting. By providing visible evidence of authenticity, these labels protect consumer trust and brand reputation across industries.

Pharmaceuticals and luxury goods lead adoption due to high counterfeiting risks. Labels incorporating serialization, barcodes, and holograms strengthen supply chain security. As regulatory demands for product verification increase, authentication-focused applications remain the top driver of market demand.

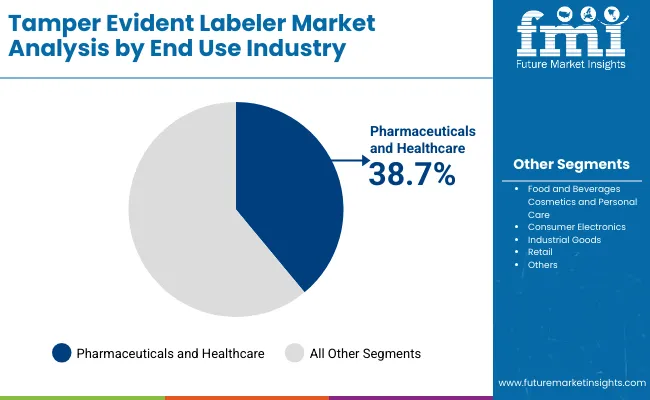

The pharmaceuticals and healthcare sector is expected to hold 38.7% of the market in 2025, reflecting stringent regulations mandating tamper-evident packaging for patient safety. Labels ensure medicines remain uncompromised from manufacturing through distribution.

Adoption is driven by rising global focus on serialization and traceability to prevent counterfeit drugs. The sector’s emphasis on compliance, quality assurance, and consumer protection makes it the largest end-use market. Continuous innovation in secure label formats further reinforces its leadership.

The tamper evident labeler market is growing as industries prioritize product security, regulatory compliance, and consumer trust. Rising demand from pharmaceuticals, food, and cosmetics for anti-counterfeiting solutions is fueling adoption. However, high equipment costs and integration challenges limit penetration among small players. Technological advancements in smart labels, serialization, and eco-friendly adhesives are reshaping the market’s trajectory.

Product Security, Compliance, and Consumer Confidence Driving Adoption

Tamper evident labelers are widely used in pharmaceuticals to meet strict regulatory requirements for drug safety and authenticity. Food and cosmetic sectors also adopt these solutions to protect against tampering and contamination risks. Their ability to provide visible evidence of interference helps prevent counterfeiting and reassures consumers about product integrity. Growing awareness of supply chain transparency and global safety standards further supports market expansion, making labelers an essential investment for brand protection.

High Costs, Technical Complexity, and Limited Awareness Restraining Growth

Adoption is slowed by the high cost of advanced labeler equipment and integration with high-speed packaging lines. Smaller firms face difficulties justifying capital investments, especially in cost-sensitive markets. Technical complexity, including compatibility with varied packaging formats and substrates, adds further challenges. Limited awareness among SMEs about the benefits of tamper evident labeling also impacts adoption rates. Additionally, ongoing maintenance requirements and skilled workforce training create operational burdens that restrict market growth.

Smart Labels, Serialization, and Eco-friendly Adhesives Trends Emerging

Key trends include the integration of smart labels with QR codes, RFID, and NFC technologies for authentication and consumer engagement. Serialization is gaining momentum in pharmaceuticals, allowing end-to-end product traceability across supply chains. Sustainability is also shaping innovation, with manufacturers developing biodegradable adhesives and recyclable label materials. Compact, modular labelers with higher automation capabilities are emerging to reduce downtime and improve efficiency. These advancements are positioning tamper evident labelers as both compliance tools and brand value enhancers.

The global tamper evident labeler market is expanding steadily, driven by rising concerns over product authenticity, regulatory compliance, and consumer safety. Asia-Pacific is emerging as a high-growth region, with China and India fueling adoption through increased demand in pharmaceuticals, food, and personal care. Developed economies like the USA, Germany, and Japan are leading in advanced automation, smart labeling systems, and eco-friendly adhesives, ensuring packaging integrity while enhancing traceability and trust across multiple industries worldwide.

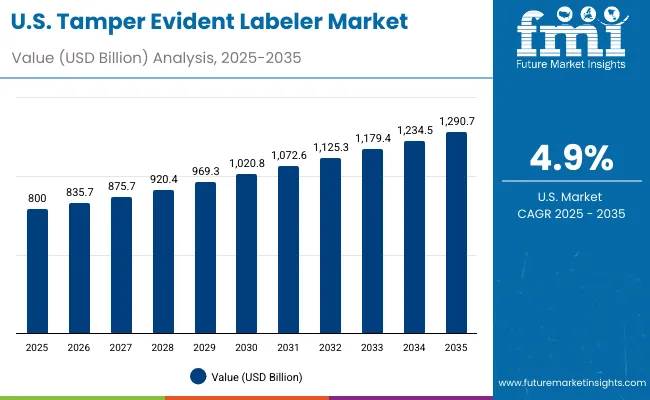

The USA market is projected to grow at a CAGR of 4.9% from 2025 to 2035, supported by strict FDA packaging regulations and rising pharmaceutical and food demand. Labelers with serialization, track-and-trace, and digital authentication features are gaining traction. Growth is also driven by consumer awareness around tamper resistance in everyday products. Manufacturers are focusing on automation-ready machines with integrated vision systems to ensure compliance, efficiency, and safety across large-scale production facilities.

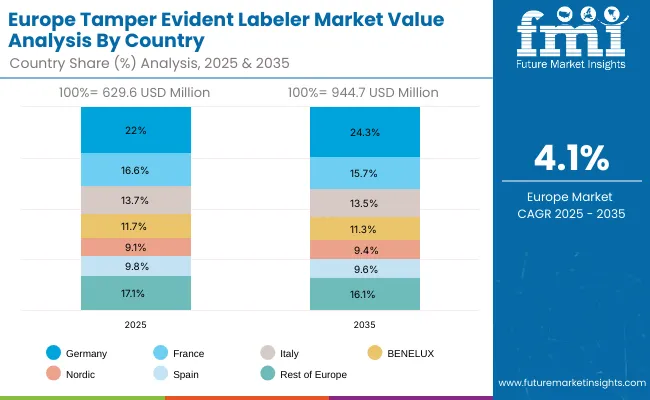

Germany’s market is expected to grow at a CAGR of 4.8%, fueled by strong demand in pharmaceuticals, chemicals, and premium beverages. Strict EU safety and labeling directives are driving adoption of tamper evident systems. German OEMs are innovating with modular labelers that feature recyclable adhesive solutions and smart sensors. Increasing demand for export compliance and consumer trust is reinforcing demand for tamper evident labeling systems across German industries.

The UK market is projected to grow at a CAGR of 4.7%, supported by increasing demand for secure labeling in healthcare, FMCG, and premium drinks. Adoption is being driven by compliance with FSMA standards and growing e-commerce demand for secure packaging. SMEs are adopting compact, cost-effective labeler solutions to meet safety and traceability needs. Rising emphasis on digital authentication is also fueling growth across the UK’s packaging sector.

China’s market is projected to grow at a CAGR of 5.2%, driven by rapid expansion in pharmaceuticals, food safety regulations, and cross-border e-commerce. Domestic manufacturers are producing affordable, scalable tamper evident labeling systems with smart tracking features. Government efforts to combat counterfeit goods are boosting demand. Adoption is also supported by export-oriented industries requiring compliance with global standards, making China a key hub for tamper evident packaging solutions.

India is forecast to grow at a CAGR of 5.1%, supported by rising demand in pharmaceuticals, FMCG, and food exports. Government initiatives to enhance drug traceability and food safety compliance are accelerating adoption. SMEs and mid-scale manufacturers are increasingly shifting to cost-effective, automated labelers. Export-driven sectors, including healthcare and beverages, are further driving investments in tamper evident packaging to align with international standards.

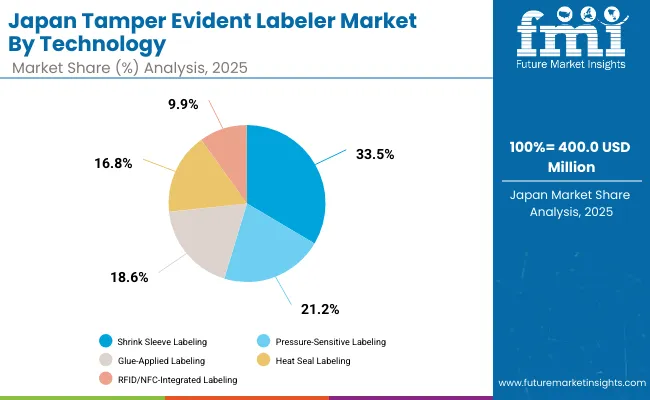

Japan’s market is projected to grow at a CAGR of 4.6%, led by demand in healthcare, electronics, and premium food packaging. Companies are focusing on compact, high-precision labelers designed for limited-space facilities. Innovation in recyclable adhesives and smart labels with QR authentication is a key trend. Rising demand for tamper evident solutions in premium and export-focused segments is ensuring stable adoption across Japan’s packaging industry.

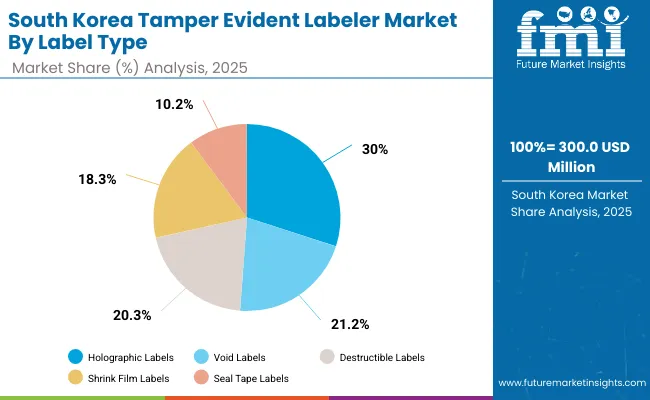

South Korea’s market is expected to grow at a CAGR of 4.7%, supported by its strong pharmaceutical, cosmetics, and beverage industries. Tamper evident labelers are being widely used for authenticity, safety, and compliance in both domestic and export markets. Local manufacturers are innovating with automation-ready, smart labelers integrated with digital tracking. Rising demand for K-beauty and K-food products abroad is further driving adoption of tamper evident labeling systems.

Japan’s tamper evident labeler market, valued at USD 400 million in 2025, is dominated by shrink sleeve labeling with 31.9% share, reflecting its popularity for full-package coverage and strong visual appeal. Pressure-sensitive labeling follows at 20.9%, while glue-applied labeling holds 19.2%. Heat seal labeling captures 17.3%, and RFID/NFC-integrated solutions stand at 10.7%. Shrink sleeves lead due to their adaptability across beverages, pharmaceuticals, and consumer goods, ensuring product authenticity and tamper resistance. RFID/NFC-integrated labels, although smaller, are expanding quickly as smart packaging demand grows, highlighting Japan’s move toward digital traceability, anti-counterfeit protection, and enhanced consumer trust through secure labeling technologies.

South Korea’s tamper evident labeler market in 2025, valued at USD 300 million, is led by holographic labels, capturing 28.7% share due to their visual security and difficulty to replicate. Void labels follow with 21.9%, while destructible labels account for 20.4%. Shrink film labels hold 17.9%, and seal tape labels represent 11.0%. Holographic labels dominate across food, beverage, and healthcare, providing reliable anti-counterfeit solutions. Void and destructible labels gain traction in electronics and high-value goods, offering immediate tamper evidence. Shrink film and seal tapes remain key in cost-sensitive applications. This distribution shows South Korea’s emphasis on layered, multi-technology packaging security.

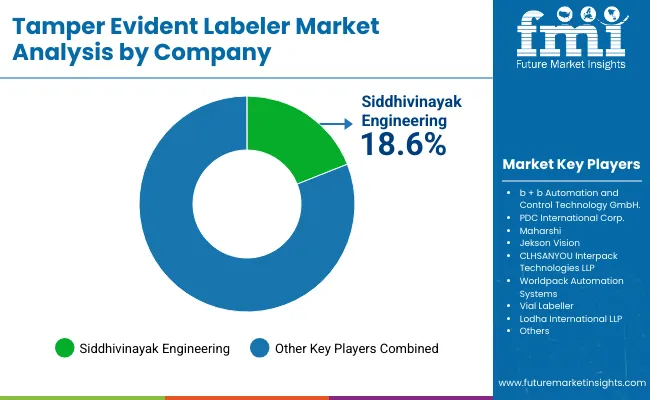

The tamper evident labeler market is moderately fragmented, with labeling machinery manufacturers, automation specialists, and vision inspection providers competing across pharmaceutical, food, and personal care sectors. Global leaders such as Siddhivinayak Engineering, b + b Automation and Control Technology GmbH, and PDC International Corp. hold notable market share, driven by high-speed labeling precision, integration with serialization systems, and compliance with FDA and EU regulatory standards. Their strategies increasingly emphasize anti-counterfeiting, digital traceability, and modular machine design.

Established mid-sized players including Maharshi, Jekson Vision, and CLHSANYOU are supporting adoption of tamper evident labeling machines featuring 2D code verification, holographic label compatibility, and servo-driven application systems. These companies are especially active in pharmaceutical and nutraceutical industries, offering compact layouts, automated rejection mechanisms, and advanced camera-based systems that ensure compliance and reduce counterfeit risks.

Specialized regional providers such as Interpack Technologies LLP, Worldpack Automation Systems, Vial Labeller, and Lodha International LLP focus on cost-effective solutions for emerging markets and small to mid-scale manufacturers. Their strengths lie in customizable designs, quick changeovers, and integration with packaging lines, enabling scalable deployment of tamper evident labeling while ensuring affordability and regulatory compliance.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| By Technology | Pressure-Sensitive Labeling , Glue-Applied Labeling , Shrink Sleeve Labeling , Heat Seal Labeling , RFID/NFC-Integrated Labeling |

| By Label Type | Void Labels, Destructible Labels, Holographic Labels, Shrink Film Labels, Seal Tape Labels |

| By Machine Type | Automatic Labeling Machines, Semi-Automatic Labeling Machines, Manual Labeling Systems |

| By Application | Product Authentication, Tamper Detection, Track and Trace, Brand Protection |

| By End-Use Industry | Pharmaceuticals and Healthcare, Food and Beverages, Cosmetics and Personal Care, Consumer Electronics, Industrial Goods, Retail |

| Key Companies Profiled | Siddhivinayak Engineering, b + b Automation and Control Technology GmbH, PDC International Corp., Maharshi , Jekson Vision, CLHSANYOU, Interpack Technologies LLP, Worldpack Automation Systems, Vial Labeller, Lodha International LLP |

| Additional Attributes | Shrink sleeve labeling is expected to account for a 33.4% share in 2025, driven by its ability to provide full-body coverage and high-security sealing. Increasing demand from pharma and food industries for authentication, growing adoption of holographic and destructible labels for brand protection, and rising integration of RFID/NFC technologies for enhanced track and trace applications further propel market expansion. |

The global tamper evident labeler market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the tamper evident labeler market is projected to reach USD 4.1 billion by 2035.

The tamper evident labeler market is expected to grow at a CAGR of 4.7% between 2025 and 2035.

The key technologies in the tamper evident labeler market include pressure-sensitive labeling, glue-applied labeling, shrink sleeve labeling, heat seal labeling, and RFID/NFC-integrated labeling.

Shrink sleeve labeling is expected to hold a significant share of 33.4% in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tamper Evidence Machinery Market Size and Share Forecast Outlook 2025 to 2035

Tamper Proof Packaging Market Size and Share Forecast Outlook 2025 to 2035

Tamper Band Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Tamper Evident Label Market Forecast and Outlook 2025 to 2035

Leading Providers & Market Share in Tamper Evident Packaging

Market Share Breakdown of Leading Tamper Evident Label Manufacturers

Tamper Evident Packaging Market Trends, Growth, Forecast 2025-2035

Tamper Evident Pots & Tubs Market

Tamper Evident Shrink Bands Market

Tamper Evident Bag Sealers Market

Plastic Tamper Evident Closures Market

Pallet Labeler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA