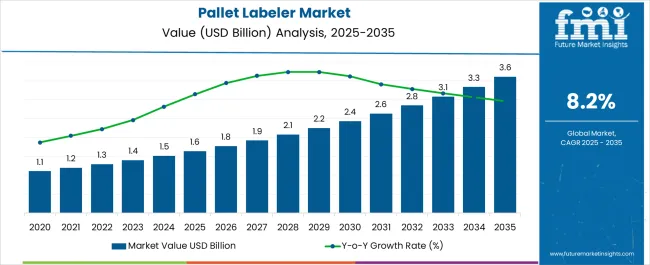

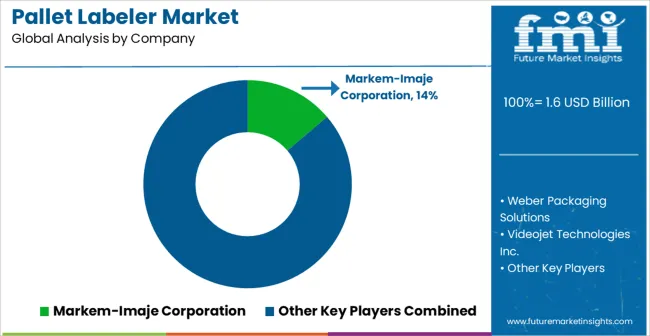

The Pallet Labeler Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

| Metric | Value |

|---|---|

| Pallet Labeler Market Estimated Value in (2025 E) | USD 1.6 billion |

| Pallet Labeler Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The Pallet Labeler market is experiencing robust growth, fueled by the rising need for automation, accuracy, and compliance in packaging and logistics operations across multiple industries. Businesses are increasingly adopting pallet labelers to ensure efficient identification, tracking, and traceability of goods throughout the supply chain. Automation in labeling is addressing the growing demand for high-speed operations, minimizing human error, and ensuring adherence to global labeling regulations.

The integration of advanced technologies such as barcode systems, RFID, and software-enabled controls is further enhancing functionality and adaptability. Companies are also leveraging pallet labelers to improve workflow efficiency, reduce operational costs, and meet customer expectations for timely deliveries. Growing demand in sectors such as food and beverages, pharmaceuticals, retail, and logistics is expanding market opportunities.

Increasing focus on sustainability, with the adoption of recyclable labeling materials and energy-efficient machines, is shaping new trends in this market With the continuous evolution of automated packaging solutions and strong emphasis on compliance and supply chain visibility, the Pallet Labeler market is positioned for sustained growth in the coming years.

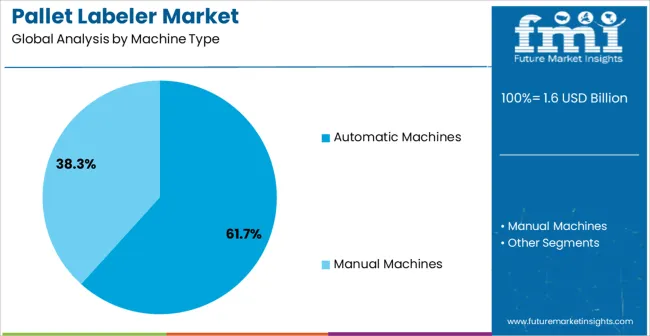

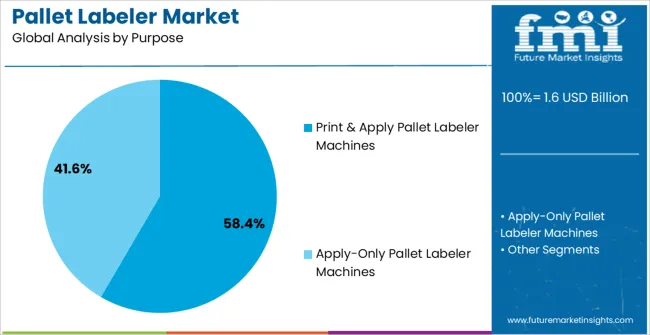

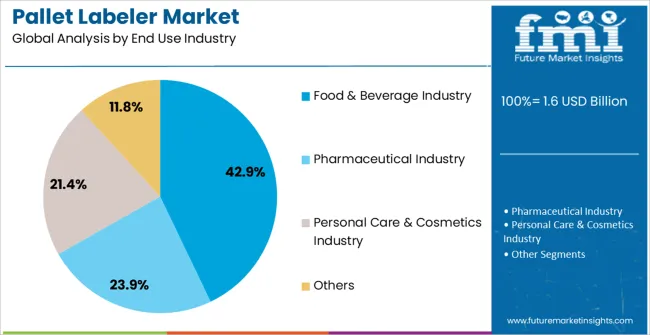

The pallet labeler market is segmented by machine type, purpose, end use industry, and geographic regions. By machine type, pallet labeler market is divided into Automatic Machines and Manual Machines. In terms of purpose, pallet labeler market is classified into Print & Apply Pallet Labeler Machines and Apply-Only Pallet Labeler Machines. Based on end use industry, pallet labeler market is segmented into Food & Beverage Industry, Pharmaceutical Industry, Personal Care & Cosmetics Industry, and Others. Regionally, the pallet labeler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic machines segment is projected to hold 61.7% of the Pallet Labeler market revenue in 2025, making it the dominant machine type. This leadership is being driven by the increasing demand for high-speed labeling solutions that ensure accuracy and efficiency in large-scale production environments. Automatic machines are capable of applying labels with minimal manual intervention, reducing labor costs and improving throughput.

Their integration with warehouse management systems and logistics software allows for real-time tracking and better synchronization with supply chain operations. Enhanced precision in label placement ensures compliance with industry regulations and minimizes the risk of errors that can disrupt distribution. The ability to handle high volumes consistently positions automatic machines as the preferred choice for companies looking to optimize operational performance.

Moreover, advancements in modular designs and user-friendly interfaces are increasing accessibility for businesses of different sizes As global supply chains expand and industries demand faster, more accurate labeling, automatic machines are expected to maintain their dominance in the market.

The print and apply pallet labeler machines segment is expected to account for 58.4% of the Pallet Labeler market’s revenue in 2025, reinforcing its position as the leading purpose category. Growth in this segment is driven by the ability to generate and apply customized labels in real time, ensuring adaptability to diverse operational requirements. These machines are highly valued for their capacity to reduce downtime by combining printing and labeling into a single streamlined process.

Businesses in logistics and manufacturing are increasingly leveraging this technology to ensure compliance with labeling standards while maintaining production efficiency. The integration of smart printing technologies, such as high-resolution thermal printing and variable data printing, is further enhancing performance and accuracy. By reducing the need for pre-printed labels, companies benefit from improved flexibility and cost savings.

The capability to provide consistent labeling across different pallet sizes and packaging configurations also strengthens demand As industries prioritize agility and compliance, print and apply pallet labeler machines are anticipated to remain the leading purpose-driven solution in the market.

The food and beverage industry segment is projected to hold 42.9% of the Pallet Labeler market revenue in 2025, making it the leading end-use industry. This dominance is primarily due to the stringent regulatory requirements for food safety, traceability, and accurate labeling across domestic and international supply chains. Pallet labelers in this sector play a critical role in ensuring compliance with food labeling standards, including expiration dates, nutritional information, and batch numbers.

Automation in pallet labeling is enabling food and beverage companies to enhance operational efficiency and reduce the risk of labeling errors that can lead to costly recalls. The need for high-speed labeling to match large-scale production volumes further drives demand in this industry. Integration with enterprise resource planning and supply chain management systems allows for real-time data synchronization and improved logistics tracking.

With increasing consumer demand for transparency and accountability, accurate labeling has become a business imperative As the food and beverage sector continues to grow globally, the adoption of pallet labelers is expected to strengthen further, supporting efficiency, compliance, and customer trust.

Pallets are mostly used in warehouses and manufacturing units, for the purpose of storage. Appropriate and accurate pallet labelling is the key to recognizing products conveniently. The task of labelling on the pallets is carried out using a pallet labeler. Pallet labelers eliminate the need to hand apply labels, unlike the conventional approach, in which, forklift operators were required to perform the entire process manually.

The continuous move in & out of forklift consumes lots of time. Pallet labeler overcomes this problem to some extent. Pallet labeler is available in a variety of lengths to cover the conveyer and apply the label on to the pallets. Pallet labelers can be integrated with label printing technology that contains both human readable text and symbols that can be scanned, which includes the serial shipping container code (SSCC).

Pallet labeler indirectly helps in shipping of products placed on pallets. In automated production lines and manufacturing industries, pallet labeler is installed immediately after location, where pallet is stretch wrapped. It facilitates workers to use pallet labeler instantly which overcomes product misunderstanding and helps conflict free delivery of the palletized products. Therefore, the global pallet labelers market is expected to expand at a healthy CAGR over the forecast period.

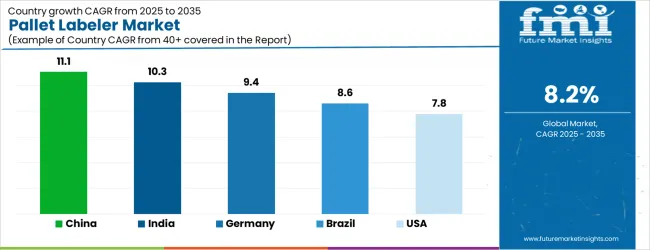

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| Brazil | 8.6% |

| USA | 7.8% |

| UK | 7.0% |

| Japan | 6.2% |

The Pallet Labeler Market is expected to register a CAGR of 8.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.1%, followed by India at 10.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 6.2%, yet still underscores a broadly positive trajectory for the global Pallet Labeler Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.4%. The USA Pallet Labeler Market is estimated to be valued at USD 606.4 million in 2025 and is anticipated to reach a valuation of USD 606.4 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 78.8 million and USD 44.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Machine Type | Automatic Machines and Manual Machines |

| Purpose | Print & Apply Pallet Labeler Machines and Apply-Only Pallet Labeler Machines |

| End Use Industry | Food & Beverage Industry, Pharmaceutical Industry, Personal Care & Cosmetics Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Markem-Imaje Corporation, Weber Packaging Solutions, Videojet Technologies Inc., Domino Printing Sciences plc, SATO Holdings Corporation, Zebra Technologies Corporation, Honeywell International Inc., Avery Dennison Corporation, Brother Industries, Ltd., Toshiba TEC Corporation, Epson America, Inc., Brady Corporation, and Cab Produkttechnik GmbH & Co KG |

The global pallet labeler market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the pallet labeler market is projected to reach USD 3.6 billion by 2035.

The pallet labeler market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in pallet labeler market are automatic machines and manual machines.

In terms of purpose, print & apply pallet labeler machines segment to command 58.4% share in the pallet labeler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Palletizer Market Size and Share Forecast Outlook 2025 to 2035

Pallet Displays Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Pallet Pooling Market Forecast and Outlook 2025 to 2035

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Pallet Stretch Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Pallet Box Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labelling System Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pallet Jacks Market Size and Share Forecast Outlook 2025 to 2035

Pallet Drum Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Pallets Market Analysis - Size, Share, and Forecast 2025 to 2035

Pallet Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pallet Shippers Market Size and Share Forecast Outlook 2025 to 2035

Pallet Racking Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Palletizing Machines Market Growth & Demand 2025 to 2035

Pallet Corner Boards Market from 2025 to 2035

Pallet Truck Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA