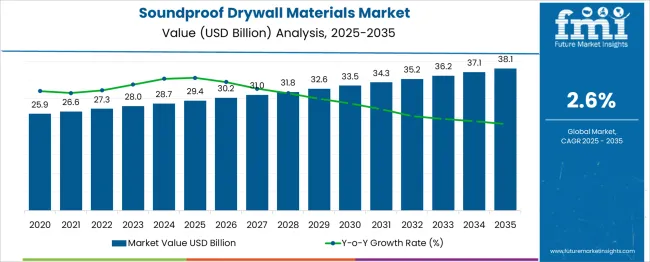

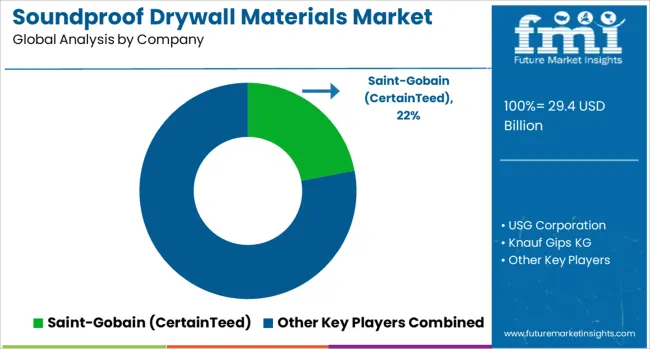

The soundproof drywall materials market is estimated to be valued at USD 29.4 billion in 2025 and is projected to reach USD 38.1 billion by 2035, registering a compound annual growth rate (CAGR) of 2.6% over the forecast period. Analyzing the period from 2020 to 2035, the market follows a steady but moderate growth pattern. In the initial five-year phase from 2020 (25.9 USD billion) to 2025, the market gains approximately 3.5 USD billion, marking consistent yearly additions of around 0.7 USD billion. This early-stage growth is fueled by ongoing demand in new construction, as well as retrofitting projects in both urban residential and commercial developments.

From 2026 onward, the market enters a middle growth stage, with yearly increases becoming slightly more pronounced in absolute value, albeit slowing in percentage gains. Between 2026 (30.2 USD billion) and 2030 (33.5 USD billion), the rise is steady, averaging close to 0.8 USD billion annually. From 2031 to 2035, the market edges up from 34.3 to 38.1 USD billion. The absence of sharp inflection points suggests minimal disruption or volatility in market behavior and instead signals a mature growth curve. This breakpoint analysis reflects a market driven by long-term construction trends, acoustic regulation standards, and broader architectural preferences for noise mitigation.

| Metric | Value |

|---|---|

| Soundproof Drywall Materials Market Estimated Value in (2025 E) | USD 29.4 billion |

| Soundproof Drywall Materials Market Forecast Value in (2035 F) | USD 38.1 billion |

| Forecast CAGR (2025 to 2035) | 2.6% |

The soundproof drywall materials market is closely tied to several influential parent markets, each contributing a specific share to its growth and application landscape. The drywall and ceiling systems market holds the largest share at approximately 50%, as soundproof drywall is a premium variant within this broader segment. The acoustic insulation market contributes around 35%, driven by the integration of noise-reducing materials such as viscoelastic polymers and gypsum composites. The building and construction industry, especially in commercial and institutional sectors, accounts for about 45% of demand due to increasing requirements for acoustic comfort in office buildings, hotels, schools, and healthcare facilities.

The interior fit-out and remodeling segment holds roughly 20%, fueled by renovation activities in urban areas where soundproofing is being retrofitted into existing walls. The general construction materials market contributes about 25%, with demand coming from architects and contractors seeking multifunctional wall assemblies. Commercial and institutional interiors generate approximately 15% of usage due to stringent noise control standards. Finally, residential construction, especially multi-family and high-rise housing, represents about 10% of demand, driven by growing occupant expectations for quieter living environments. These overlapping sectors shape the value chain and create a stable foundation for the long-term expansion of soundproof drywall technologies.

The Soundproof Drywall Materials market is undergoing significant growth driven by heightened demand for acoustic comfort across both residential and commercial settings. As urbanization intensifies and construction density increases, the need for materials that minimize noise transfer has become a critical specification in architectural planning.

Technological advancements in composite drywall structures and increasing awareness about the health and productivity impacts of noise pollution have further accelerated adoption. In addition, favorable building codes, sustainability goals, and rising renovation activities in developed and developing economies are reinforcing market expansion.

The integration of smart building solutions and enhanced indoor comfort standards is prompting contractors and developers to specify high-performance soundproofing solutions in both new projects and retrofits. Long-term growth is expected to be supported by innovations in material science and a growing emphasis on affordable noise mitigation across housing, healthcare, education, and hospitality sectors..

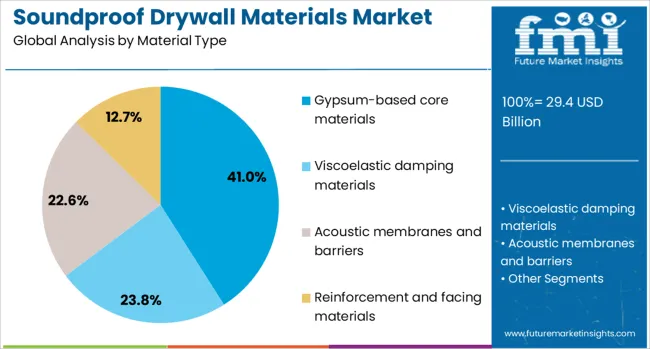

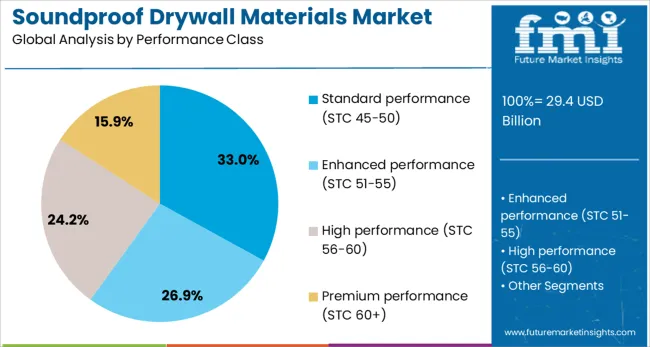

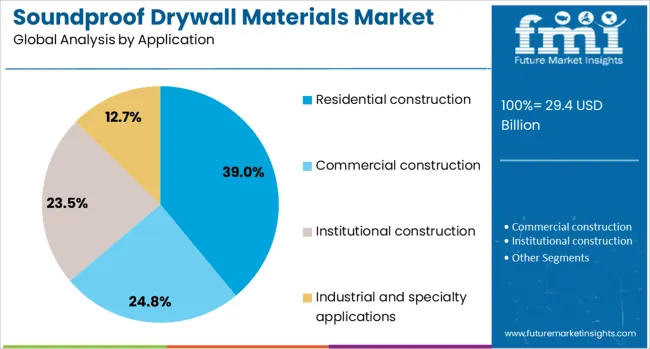

The soundproof drywall materials market is segmented by material type, performance class, application, and geographic regions. The soundproof drywall materials market is divided by material type into Gypsum-based core materials, Viscoelastic damping materials, Acoustic membranes and barriers, Reinforcement and facing materials, and Additives and performance enhancers. The soundproof drywall materials market is classified into Standard performance (STC 45-50), Enhanced performance (STC 51-55), High performance (STC 56-60), and Premium performance (STC 60+). Based on the application of the soundproof drywall materials market, it is segmented into Residential construction, Commercial construction, Institutional construction, and Industrial and specialty applications. Regionally, the soundproof drywall materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gypsum-based core materials segment is expected to account for 41% of the Soundproof Drywall Materials market revenue share in 2025, making it the leading material type. This segment’s dominance has been driven by the well-established compatibility of gypsum with standard construction practices and its inherent sound-dampening capabilities.

The widespread availability and cost-effectiveness of gypsum-based cores have facilitated their adoption in large-scale projects, especially where acoustic performance is prioritized alongside structural reliability. Enhanced formulations and the integration of viscoelastic polymers have further strengthened the segment’s ability to meet rising sound transmission class performance expectations.

Preference has also been observed for gypsum-based materials due to their ease of installation, fire resistance, and recyclability, aligning well with modern construction codes and green building certifications. As regulatory focus on indoor acoustic environments intensifies, this material type is expected to retain its leading position in upcoming residential and commercial projects..

The standard performance class segment, defined by sound transmission class ratings between STC 45 and 50, is projected to hold 33% of the market share in 2025. This segment has led the market as it meets baseline acoustic requirements for typical residential and mid-tier commercial applications without significantly increasing construction costs.

The ability to offer a balanced trade-off between affordability and effective noise reduction has contributed to widespread adoption across mainstream construction. Standard performance drywall systems have been recognized for their suitability in wall assemblies where average speech privacy and comfort are adequate, particularly in multifamily housing and office partitions.

Their compliance with local building codes and acoustic standards has made them a go-to choice for builders and architects seeking reliable performance without complex engineering. Continued preference for practical and cost-aligned solutions in medium-scale projects is expected to sustain the dominance of this performance class in the near term..

The residential construction segment is anticipated to represent 39% of the Soundproof Drywall Materials market revenue share in 2025, emerging as the most prominent application area. Growth in this segment has been influenced by rising consumer awareness regarding acoustic comfort and privacy, especially in urban dwellings and high-density housing. Demand for improved indoor sound quality has been further supported by lifestyle changes, including work-from-home trends and increased time spent indoors.

Builders and developers are increasingly incorporating soundproof drywall as a differentiating factor in project specifications to enhance occupant satisfaction and property value. In residential developments, minimizing airborne and impact noise between units has become a crucial factor in meeting building regulations and customer expectations.

Additionally, the growing adoption of sustainable construction materials and sound-insulated designs in multi-family homes, townhouses, and apartments has reinforced the use of specialized drywall systems. These trends are expected to continue driving the residential segment’s leadership in the market..

The soundproof drywall materials market is expanding steadily as noise pollution concerns and acoustic comfort priorities grow in residential, commercial, and institutional buildings. Builders and developers increasingly prioritize higher Sound Transmission Class (STC) products to deliver quiet interiors. Standard gypsum drywall remains prevalent, but premium materials incorporating damping polymers, acoustic membranes, and multilayer laminates are gaining traction in offices, hotels, and healthcare facilities. Adoption is strongest in urban regions dealing with dense population and stringent building regulations. Manufacturers are innovating with products offering combined fire resistance, moisture control, and multi-functionality. Retrofit and new construction both benefit from updated performance expectations, making soundproof drywall a preferred acoustic solution globally.

Product innovation in soundproof drywall materials is boosting market momentum. Manufacturers are enhancing gypsum cores with viscoelastic dampers, acoustic membranes, and performance additives to achieve higher STC ratings than standard boards. Such premium systems cater to mid‑range and high‑performance acoustic classes where developers require quiet interiors without excessive material layering. Reinforced facing materials and moisture or fire-resistant variants further improve applicability across indoor environments. These advancements allow multifunctional drywall that addresses sound insulation alongside safety and durability requirements. Acoustic plasterboard variants and perforated gypsum panels offer tailored performance for walls and ceilings. As end users forego basic options for more effective, code-compliant materials, these technically advanced drywall types become preferred choices for acoustic resilience in both new builds and retrofits, especially in high-end residential and hospitality segments

Stringent acoustic building codes and regulations are increasing demand for soundproof drywall solutions. Construction standards in residential, educational, healthcare, and office buildings now often require minimum STC performance. Developers and contractors adopt higher-rated drywall systems in multi-family housing, hotels, and auditoriums to meet occupant comfort requirements. Regulatory frameworks in advanced regions emphasize compliance with noise reduction mandates, amplifying adoption of sound-insulated wallboards. Renovation projects retrofitting older buildings with upgraded acoustic materials also respond to evolving code expectations. In emerging markets, awareness of quality indoor environments is prompting adoption of certified drywall systems. Manufacturers offering products tested to acoustic standards and documented performance data gain preference. As acoustic compliance becomes an integral part of design specifications, regulatory alignment effectively reinforces growth of soundproof drywall deployment across building segments

Achieving effective sound dampening with drywall requires precise installation methods alongside the right material choice. Industry practice recommends use of decoupling systems such as resilient channels, staggered studs, or double framing to reduce vibration transfer. Filling cavity insulation with mineral wool or rock wool further improves sound absorption before drywall installation. Applying damping compounds like sound‑deadening adhesives between layers enhances performance. Real‑world feedback highlights that incorrectly sealed penetrations around outlets, ducts, and floor transitions undermine overall results. Achieving target STC values depends on installation discipline, sealing protocols, and cavity design beyond product specs. Installers and architects are increasingly prioritizing system-level acoustic assemblies rather than single product grade. Successful projects combine high-STC boards, proper framing methods, insulation, and caulking systems to create true sound barriers and realize specified performance in real use scenarios

The soundproof drywall market faces constraints from raw material volatility and supply chain disruptions. Gypsum sourcing constraints or export limitations from producing regions may delay equipment delivery and increase production cost. Manufacturers may struggle to scale production of advanced materials like acoustic membranes or polymer-enhanced laminates due to input cost instability. In some environments, certain moisture or fiber-reinforced boards exhibit durability issues under humid or thermally unstable conditions, leading to cracking or edge degradation over time. Certification and approval delays in emerging regions further impede market accessibility. New premium products also face competition from alternate acoustic solutions such as panels or decoupled wall systems. Until improved resilience and supply stability are achieved, installation of acoustic drywall may remain concentrated in projects prioritizing performance or working through certified standards penetration.

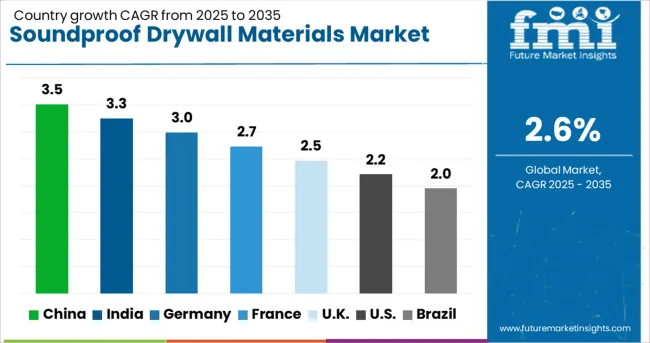

| Country | CAGR |

|---|---|

| China | 3.5% |

| India | 3.3% |

| Germany | 3.0% |

| France | 2.7% |

| UK | 2.5% |

| USA | 2.2% |

| Brazil | 2.0% |

The soundproof drywall materials market is projected to expand at a CAGR of 2.6% through 2035, driven by growing demand for acoustic comfort in urban housing, commercial spaces, and infrastructure projects. China leads the global growth with a rate of 3.5%, propelled by rapid urban development and increased use of noise-reducing building materials in residential construction. India follows with a 3.3% growth rate, driven by expansion in affordable housing and smart city initiatives where sound insulation is gaining traction.

Germany, at 3.0%, continues to adopt advanced drywall technologies under its stringent building efficiency regulations. The United Kingdom, growing at 2.5%, is witnessing a rise in acoustic retrofitting across older properties and new builds alike. In the United States, a 2.2% growth rate reflects steady integration of soundproofing solutions in both residential renovations and commercial real estate. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China reported a CAGR of 3.5% in the soundproof drywall materials market, primarily driven by the growth of high-density urban construction and expansion in mixed-use buildings. Developers of commercial spaces, hotels, and high-rise apartments prioritized materials with superior acoustic insulation to comply with updated noise control guidelines. Manufacturers responded by increasing output of gypsum boards enhanced with viscoelastic polymers and damping compounds.

Major urban centers like Beijing, Shanghai, and Shenzhen recorded high usage in newly constructed office towers and luxury residences. Demand was also supported by retrofitting in schools and healthcare institutions seeking better sound isolation. Supply chain partnerships enabled faster delivery of custom-sized panels for high-volume projects. Domestic brands collaborated with design firms to integrate noise control from early architectural stages. Provincial construction standards began emphasizing decibel reduction, making acoustic drywall a compliance requirement in select projects.

India recorded a CAGR of 3.3% in the soundproof drywall materials market, supported by demand from commercial real estate and infrastructure sectors. Metro cities like Delhi, Bengaluru, and Mumbai experienced increased installations in IT parks, medical centers, and educational buildings. Construction firms began specifying acoustic-rated drywall systems to address rising concerns about indoor noise levels in high-traffic environments. Manufacturers supplied boards incorporating core damping layers and specialty coatings to reduce sound transmission.

New regulations in some states began incorporating acoustic compliance into building approval processes, especially for structures near airports, highways, or industrial zones. The hospitality sector emerged as a strong end-user, with demand for partition systems offering superior noise insulation between guest rooms. Distributors began stocking modular drywall components for quicker on-site installation, reducing labor costs and project timelines. Institutional buyers increasingly favored ready-to-finish wall systems with tested noise attenuation properties.

Germany posted a CAGR of 3.0% in the soundproof drywall materials market, reflecting growing demand across residential refurbishments and sound-sensitive commercial buildings. The country’s emphasis on high building standards created consistent demand for drywall systems offering strong decibel reduction. Manufacturers focused on producing laminated boards with heavy cores and flexible membranes that met local acoustic certifications. Adoption was highest in schools, elderly care centers, and music venues where ambient noise control is critical.

Engineering consultancies partnered with drywall providers to tailor solutions to project-specific frequency requirements. German contractors often specified wall assemblies with resilient channels and double layers for enhanced isolation. Materials were also adopted in high-end residential apartments located near railways or city centers. Retrofit initiatives in older buildings, especially those lacking cavity wall designs, contributed significantly to the overall market size. Builders favored systems that balanced sound control with fire resistance and thermal insulation.

The United Kingdom recorded a CAGR of 2.5% in the soundproof drywall materials market, primarily influenced by renovation of existing structures and requirements in mixed-use developments. City planning departments introduced noise reduction thresholds in planning approvals for buildings near busy streets or entertainment zones. Acoustic drywall products were adopted in housing developments, hospitals, and university facilities to meet indoor comfort targets.

Installers utilized systems combining dense core sheets with polymeric damping layers to address mid- to high-frequency noise. Projects often paired soundproof drywall with acoustic sealants and isolation joints. Demand was higher in London and Manchester, driven by population density and concentration of multi-unit residential developments. Builders prioritized lightweight drywall systems that could be installed quickly and without altering load-bearing calculations. Local drywall suppliers expanded inventories of ready-cut acoustic boards for contractors serving the education and healthcare sectors.

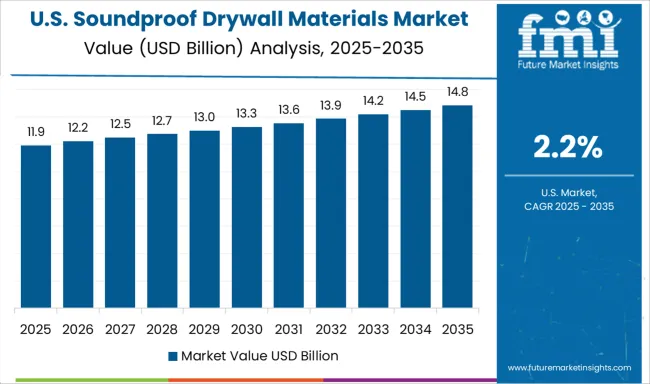

The United States posted a CAGR of 2.2% in the soundproof drywall materials market, with growth shaped by changing building codes and expanding demand from healthcare and hospitality construction. Building contractors increasingly specified wall assemblies tested for sound transmission class (STC) ratings. Markets such as New York, California, and Texas showed stronger adoption due to population density and stricter local requirements.

Drywall boards featuring composite cores with viscoelastic damping were used in hotels, dormitories, and multifamily buildings. Healthcare facilities adopted soundproof panels to reduce patient disturbance and ensure privacy in treatment rooms. Architectural firms integrated acoustic solutions during early-stage design for better cost control. Local manufacturing of pre-fabricated acoustic panels contributed to faster project turnaround. Government-funded buildings began requiring higher sound control ratings in schools and public housing. Acoustic consultants played a growing role in selecting the right wall assemblies for noise-sensitive zones.

The soundproof drywall materials market is expanding rapidly due to growing demand for acoustic comfort in residential, commercial, and institutional buildings. With rising urban density, stricter building codes, and heightened awareness around noise pollution, architects and contractors are prioritizing materials that combine noise reduction with structural performance and fire resistance. Soundproof drywall engineered with viscoelastic polymers, gypsum cores, and multi-layer composites offers a cost-effective and scalable solution for both new builds and retrofits. Saint-Gobain, through its CertainTeed brand, is a front-runner offering SilentFX® and other acoustically enhanced drywall solutions widely used in multifamily housing and offices.

USG Corporation, with its USG Sheetrock® Brand, delivers a strong portfolio of sound-rated gypsum panels, including systems compliant with STC (Sound Transmission Class) ratings for high-spec applications. Knauf Gips KG and Georgia-Pacific LLC also offer proprietary wallboard systems with superior acoustic insulation, leveraging advanced core materials and moisture resistance for use in hotels, schools, and healthcare facilities. National Gypsum Company supplies its Gold Bond® SoundBreak® line, designed for high-performance acoustic and fire-rated assemblies.

PABCO Gypsum, with its specialty line QuietRock, is notable for pioneering the original sound-reducing drywall offering premium solutions for media rooms, condos, and commercial buildings where noise isolation is critical. As building standards evolve, suppliers that offer high-STC-rated, lightweight, and installation-friendly soundproof drywall systems are positioned to lead in both developed and emerging markets.

As mentioned in PABCO® Gypsum’s official press release dated June 5, 2025, the company released its 2025 Sound Design Guide, featuring over 220 fire‑ and sound‑tested wall assemblies, including 50 new configurations highlighting QuietRock® sound‑reducing drywall. The guide also includes revised UL design listings and new 2½″ steel‑framed assembly sections, simplifying specification and ensuring improved acoustic performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.4 Billion |

| Material Type | Gypsum-based core materials, Viscoelastic damping materials, Acoustic membranes and barriers, Reinforcement and facing materials, and Additives and performance enhancers |

| Performance Class | Standard performance (STC 45-50), Enhanced performance (STC 51-55), High performance (STC 56-60), and Premium performance (STC 60+) |

| Application | Residential construction, Commercial construction, Institutional construction, and Industrial and specialty applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Saint-Gobain (CertainTeed), USG Corporation, Knauf Gips KG, Georgia-Pacific LLC, National Gypsum Company, PABCO Gypsum, and QuietRock (PABCO specialty brand) |

| Additional Attributes | Dollar sales by soundproof drywall type including gypsum-based core boards, viscoelastic damping materials, acoustic membranes/barriers, reinforcement/facing and performance-enhancing additives; by application in residential, commercial, hotel, and hospital construction; by geographic region including North America, Europe, and Asia‑Pacific; demand driven by urban noise pollution, acoustic comfort standards, and building code mandates; innovation in multi-layer core designs, mold/fire-resistant formulations, and eco-certified gypsum boards; costs influenced by raw gypsum, additives, and regulatory compliance; and emerging use cases in high-STC walls for multifamily housing, healthcare facilities, and hospitality acoustics. |

The global soundproof drywall materials market is estimated to be valued at USD 29.4 billion in 2025.

The market size for the soundproof drywall materials market is projected to reach USD 38.1 billion by 2035.

The soundproof drywall materials market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in soundproof drywall materials market are gypsum-based core materials, _standard density gypsum, _high-density gypsum, _lightweight gypsum formulations, viscoelastic damping materials, _polymer-based damping compounds, _bituminous damping materials, _hybrid damping systems, acoustic membranes and barriers, _mass-loaded vinyl (mlv), _polymer acoustic membranes, _composite barrier materials, reinforcement and facing materials, _paper facing materials, _fiberglass mat facing, _non-woven synthetic facings, additives and performance enhancers, _fire retardant additives, _moisture resistance additives and _acoustic performance enhancers.

In terms of performance class, standard performance (stc 45-50) segment to command 33.0% share in the soundproof drywall materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Facade Materials Market Size and Share Forecast Outlook 2025 to 2035

Solder Materials Market Size and Share Forecast Outlook 2025 to 2035

Sheath Materials Market Size and Share Forecast Outlook 2025 to 2035

Cathode Materials for Solid State Battery Market Size and Share Forecast Outlook 2025 to 2035

Exosuit Materials Market Size and Share Forecast Outlook 2025 to 2035

Stealth Materials and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Optical Materials Market - Trends & Forecast 2025 to 2035

Circuit Materials Market Analysis based on Substrate, Conducting Material, Outer Layer, Application, and Region: Forecast for 2025 and 2035

Graphite Materials Market Size and Share Forecast Outlook 2025 to 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Fluoride Materials Market

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Strapping Materials Market Size and Share Forecast Outlook 2025 to 2035

Smart Card Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA