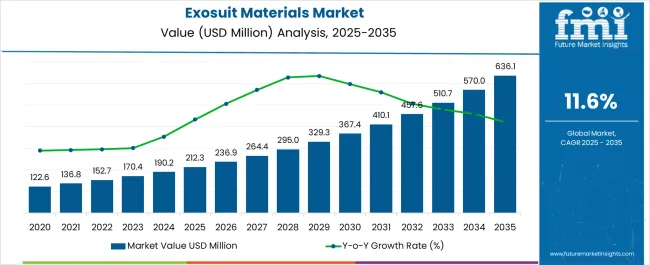

The exosuit materials market is estimated to be valued at USD 212.3 million in 2025 and is projected to reach USD 636.1 million by 2035, registering a compound annual growth rate (CAGR) of 11.6% over the forecast period.

Between 2025 and 2030, the market expands from USD 212.3 million to USD 367.4 million, delivering an absolute increase of USD 155.1 million, which represents about 39% of the total projected gains. This phase is characterized by increasing adoption of advanced composites, smart textiles, and lightweight polymers in defense, industrial, and healthcare applications, supported by government funding and industrial safety initiatives. Moving into the 2030–2035 period, the market climbs more rapidly from USD 367.4 million to USD 636.1 million, generating an absolute increase of USD 268.7 million, which accounts for nearly 61% of the overall growth.

This acceleration reflects mainstream commercialization of exosuits across manufacturing, logistics, rehabilitation, and consumer segments, with material innovations such as self-healing fabrics, embedded sensors, and nanostructured composites enhancing durability, adaptability, and efficiency. Strong investments in R&D, coupled with strategic partnerships between material science companies and exosuit developers, further drive late-stage growth. Overall, the exosuit materials market demonstrates a steeper growth curve post-2030, highlighting increasing scalability and expanding multi-sector adoption.

| Metric | Value |

|---|---|

| Exosuit Materials Market Estimated Value in (2025 E) | USD 212.3 million |

| Exosuit Materials Market Forecast Value in (2035 F) | USD 636.1 million |

| Forecast CAGR (2025 to 2035) | 11.6% |

The exosuit materials market registers a significant share within the broader wearable robotics and personal protective equipment industry, accounting for approximately 12–15% share of the global wearable robotics sector. Within the assistive technologies market, exosuit materials represent about 10–12% share, driven by their increasing use in rehabilitation, military applications, and labor-intensive industries. In the medical assistive devices domain, it holds nearly 15–18% share, as exosuits gain prominence for their ability to provide support to patients with mobility impairments and assist in physical therapy. In industrial settings, the market commands about 8–10% share, fueled by the rising adoption of exosuits to reduce strain and improve worker productivity in manual handling tasks.

Growth is driven by technological advancements in lightweight, flexible materials and enhanced designs that provide superior comfort, durability, and user safety. Exosuit materials are becoming increasingly crucial in applications ranging from healthcare to industrial sectors, where the demand for mobility assistance and injury prevention is on the rise. Future expansion is supported by ongoing innovations aimed at improving the performance, affordability, and accessibility of these materials, making them a key component of both assistive and wearable robotic technologies. As the global population ages and industries seek more efficient labor solutions, the demand for exosuit materials is expected to grow substantially in the coming years.

The market is gaining significant traction as advancements in wearable robotics and assistive technologies reshape the landscape of industrial, medical, and defense applications. Increasing demand for lightweight, durable, and high-performance materials is driving innovation, enabling exosuits to achieve greater mobility, comfort, and endurance.

The adoption of materials that combine strength with flexibility is expanding the potential use cases of exosuits, from rehabilitation and elder care to military operations and heavy-duty industrial work. Growing investments in research and development by manufacturers, coupled with collaborations between material scientists and robotics engineers, are accelerating the introduction of next-generation solutions.

Furthermore, the focus on energy efficiency and extended operational life is encouraging the integration of materials with superior fatigue resistance and environmental resilience As global labor challenges, workplace safety requirements, and healthcare needs intensify, the demand for advanced exosuit materials is projected to expand steadily, ensuring sustained growth and broad adoption across multiple sectors.

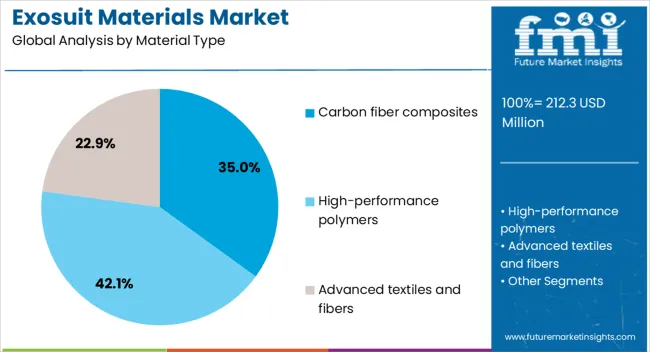

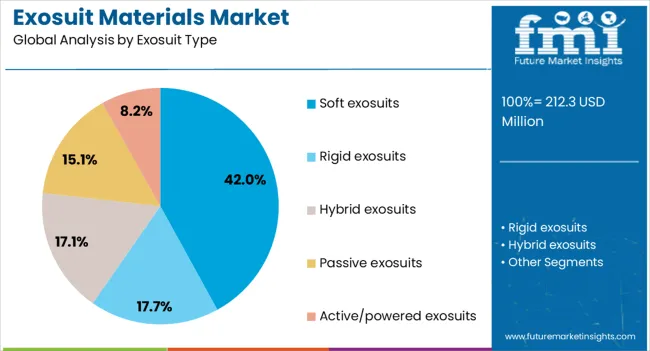

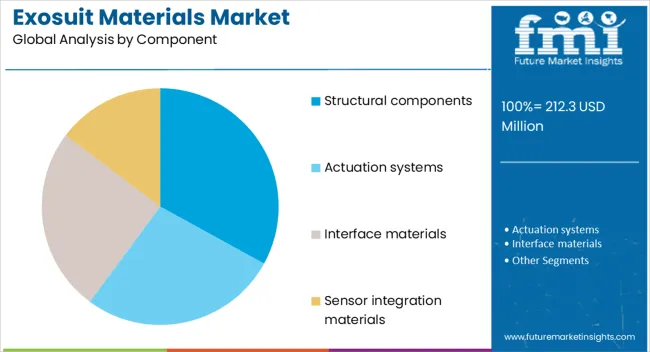

The exosuit materials market is segmented by material type, exosuit type, component, application, and geographic regions. By material type, exosuit materials market is divided into carbon fiber composites, high-performance polymers, advanced textiles and fibers, metals and alloys, smart and responsive materials, and hybrid and composite systems. In terms of exosuit type, exosuit materials market is classified into soft exosuits, rigid exosuits, hybrid exosuits, passive exosuits, and active/powered exosuits. Based on component, exosuit materials market is segmented into structural components, actuation systems, interface materials, sensor integration materials, and energy storage and management materials. By application, exosuit materials market is segmented into healthcare and rehabilitation, industrial and construction, military and defense, sports and fitness, aerospace and aviation, and others. Regionally, the exosuit materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The carbon fiber composites segment is estimated to hold 35% of the exosuit materials market revenue share in 2025, making it the leading material type. This dominance has been attributed to the exceptional strength-to-weight ratio of carbon fiber composites, which significantly reduces the weight of exosuits while maintaining structural integrity. The material’s resistance to fatigue and corrosion ensures extended service life, making it ideal for demanding applications.

Enhanced load-bearing capacity and design flexibility have further supported its adoption in medical, industrial, and defense-grade exosuits. Carbon fiber composites also allow for complex geometries and integration with embedded sensors without compromising durability.

The material’s ability to enhance user comfort through reduced bulk has been critical in improving wearability for extended periods As the performance expectations for exosuits continue to rise, carbon fiber composites are expected to remain a preferred choice due to their proven reliability and contribution to operational efficiency.

The soft exosuits segment is projected to account for 42% of the market revenue share in 2025, emerging as the leading exosuit type. This growth has been driven by the increasing need for wearable solutions that prioritize comfort, mobility, and adaptability. Soft exosuits use flexible fabrics and lightweight support structures, allowing natural body movement while providing targeted assistance.

These designs reduce user fatigue and enable prolonged use in rehabilitation, healthcare, and occupational settings. Advances in material science have introduced fabrics with integrated sensing capabilities, enabling real-time performance monitoring and adaptive support. Their discreet appearance and reduced mechanical complexity have encouraged adoption in non-industrial environments as well.

Additionally, the compatibility of soft exosuits with modular material upgrades supports continuous performance improvement The ability to deliver functional assistance without restricting mobility positions soft exosuits as a dominant choice in the evolving wearable robotics market.

The structural components segment is expected to represent 33% of the market revenue share in 2025, making it the leading component category. Growth in this segment has been influenced by the increasing emphasis on material optimization for load-bearing frameworks and motion-assist mechanisms. Structural components require materials that combine high tensile strength with minimal weight, enabling exosuits to deliver force assistance efficiently while ensuring user comfort.

Precision engineering and material customization have allowed manufacturers to enhance mechanical performance while reducing bulk. Integration of advanced composites, high-strength alloys, and engineered polymers has improved durability and environmental resistance.

The role of structural components in ensuring stability, distributing loads evenly, and supporting complex joint movements has been central to their market dominance As exosuit designs become more specialized, demand for advanced structural materials capable of meeting application-specific performance benchmarks is expected to rise steadily.

Exosuit materials are advancing through healthcare rehabilitation, military adoption, industrial applications, and user-focused comfort innovations. These factors collectively shape growth, making them a cornerstone of wearable support systems.

The use of exosuit materials is becoming increasingly vital in healthcare rehabilitation as hospitals and therapy centers adopt wearable systems to aid patient recovery. Materials designed for flexibility, strength, and lightweight performance are used to enhance comfort during prolonged sessions. Patients recovering from strokes, spinal injuries, or degenerative conditions benefit from exosuits that allow gradual restoration of mobility. The choice of material directly influences usability, ensuring suits can be worn for extended durations without fatigue or irritation. Healthcare providers are prioritizing solutions that blend durability with patient comfort, creating strong demand for advanced fabrics, composites, and polymers. This trend positions healthcare as a central growth driver for exosuit materials.

Military research and defense programs are adopting exosuit materials to design gear that enhances soldier endurance, load-bearing capacity, and protection. Exosuits rely on materials that can withstand extreme environments, provide ballistic resistance, and remain lightweight to ensure mobility. These requirements have spurred interest in composites, carbon-based fabrics, and advanced polymers that combine strength with resilience. Defense ministries are investing in large-scale pilot programs for combat and logistics applications, where exosuit materials play a pivotal role in reducing fatigue and injury risk. Military adoption not only validates performance but also accelerates research funding, making defense one of the most influential growth segments for the exosuit materials market.

Industries such as automotive, logistics, and construction are integrating exosuits to minimize workplace injuries and improve efficiency in manual handling tasks. This adoption has elevated the importance of materials capable of balancing strength with flexibility, allowing workers to operate machinery and perform tasks without restrictions. Exosuit materials must also deliver high resistance to wear and tear, given the intensive use in industrial environments. Companies are exploring blends of reinforced textiles and lightweight metals to improve comfort while extending durability. Growing awareness of occupational health and safety standards has encouraged businesses to invest in these solutions, reinforcing industry demand as a major contributor to market growth.

User adoption of exosuits depends heavily on materials that enhance comfort, reduce weight, and ensure ergonomic fit. The latest developments in fabrics and composites prioritize breathable structures, stretchability, and resistance to environmental conditions. These features ensure that exosuits remain functional across healthcare, military, and industrial settings while maintaining high user acceptance. Manufacturers are working to refine materials that support prolonged use without compromising mobility or safety. Comfort-focused innovations are becoming just as important as strength or durability, as end-users increasingly prioritize ease of wear. This emphasis on usability represents a key dynamic that will shape future adoption trends in exosuit materials.

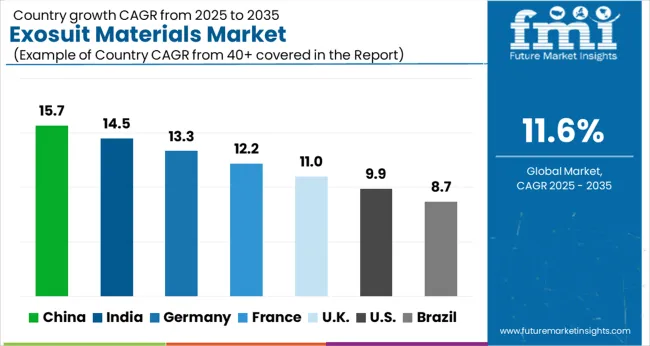

| Country | CAGR |

|---|---|

| China | 15.7% |

| India | 14.5% |

| Germany | 13.3% |

| France | 12.2% |

| UK | 11.0% |

| USA | 9.9% |

| Brazil | 8.7% |

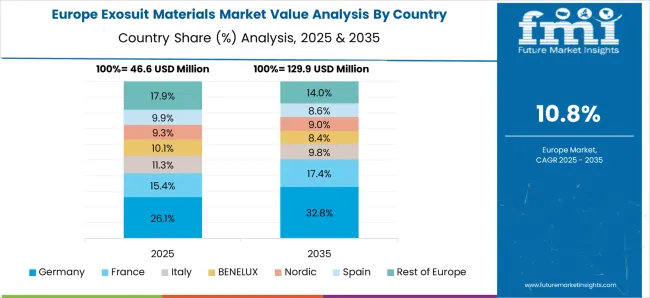

The exosuit materials market is expected to grow globally at a CAGR of 11.6% from 2025 to 2035, driven by increasing demand for wearable robotics in healthcare, industrial, and military applications. China leads with a CAGR of 15.7%, fueled by heavy investments in wearable technology for healthcare rehabilitation and military defense systems, alongside large-scale adoption in industrial sectors. India follows at 14.5%, supported by growing healthcare initiatives, expansion of labor-intensive industries, and increasing adoption of exosuit technology for worker safety and injury prevention. France posts a CAGR of 12.2%, benefiting from the rising integration of exosuit materials in medical rehabilitation and defense applications, alongside a supportive regulatory framework. The United Kingdom grows at 11.0%, driven by the adoption of exosuit materials in law enforcement and industrial sectors, as well as funding for R&D in wearable technology. The United States posts 9.9%, with strong growth driven by military demand, rehabilitation programs, and increasing awareness in industrial safety applications. The analysis spans over 40 global markets, with these five countries serving as benchmarks for evaluating innovation trends, regulatory environments, and strategic investments in the exosuit materials market.

China is projected to post a CAGR of 15.7% from 2025 to 2035, an increase from approximately 12.3% in 2020–2024, significantly outperforming the global CAGR of 11.6%. The earlier growth period was driven by substantial government investments in wearable robotics for defense and healthcare rehabilitation applications. As exosuit technologies expanded into industrial sectors, particularly in heavy manufacturing and logistics, adoption increased. Moving forward, China's focus on advancing exosuit capabilities in military defense and aging population rehabilitation, combined with growing demand for exosuits to reduce workplace injuries, will further fuel market expansion. High-volume production capabilities and ongoing partnerships with international tech firms are reducing costs, making exosuits more accessible for large-scale use in commercial applications.

India is expected to achieve a CAGR of 14.5% during 2025–2035, up from around 11.3% in 2020–2024, surpassing the global rate of 11.6%. The growth from 11.3% to 14.5% is supported by expanding healthcare infrastructure, increasing awareness of worker safety in industrial settings, and the adoption of exosuits for rehabilitation and mobility assistance. The earlier phase of growth was influenced by the need for cost-effective rehabilitation solutions in hospitals and healthcare centers. As India advances its industrial safety programs and focuses on improving worker protection in hazardous environments, the use of exosuits is expected to scale rapidly. Government policies encouraging injury prevention and safety equipment adoption will play a key role in accelerating this market’s expansion.

France is projected to post a CAGR of 12.2% for 2025–2035, up from 10.5% in 2020–2024, slightly higher than the global average of 11.6%. The early growth period was driven by steady adoption of exosuits in rehabilitation and healthcare settings, with a focus on providing physical support to patients recovering from spinal cord injuries and strokes. As France expands its defense sector, the use of exosuits in military applications has gained traction, further boosting the market. Moving forward, France’s focus on integrating exosuits into occupational health and safety programs for workers in high-risk sectors such as construction and logistics will drive increased market penetration. Exosuit manufacturers are leveraging collaborations with healthcare and defense ministries to expand use cases and scale operations.

The United Kingdom is expected to experience a CAGR of 11.0% from 2025 to 2035, improving from 9.2% in 2020–2024, closely aligned with the global CAGR of 11.6%. This growth is attributed to the steady integration of exosuits in law enforcement, military, and healthcare settings, with applications ranging from mobility support for injured officers to rehabilitation for military veterans. The rise in workplace injury awareness and demand for assistive devices has driven adoption in industrial sectors. The increase from 9.2% to 11.0% is largely due to the UK's expanding focus on using exosuits to prevent injury in high-stress environments, particularly for labor-intensive jobs. Partnerships with local and international players to scale production will further accelerate market growth.

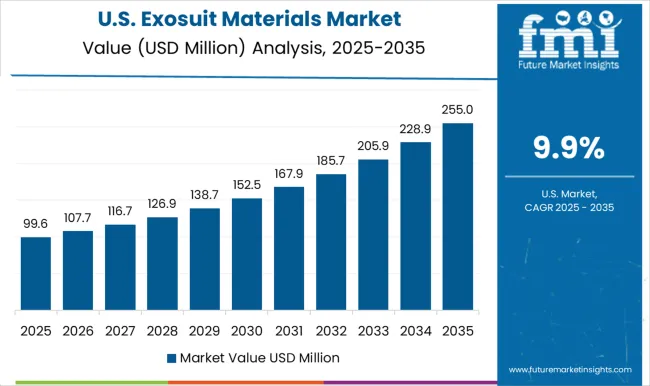

The United States is projected to grow at a CAGR of 9.9% for 2025–2035, up from 8.2% in 2020–2024, slightly below the global CAGR of 11.6%. This rise from 8.2% to 9.9% is attributed to increased investment in exosuit technologies for rehabilitation and military applications, as well as growing demand for injury prevention in industrial workplaces. The early growth phase was driven by government and defense contracts for exosuits used in military training and recovery programs for veterans. As the industrial sector recognizes the value of exosuits in reducing worker fatigue and improving efficiency, adoption in high-risk industries such as construction, logistics, and manufacturing is gaining momentum. The integration of exosuit technologies into clinical rehabilitation centers for spinal injury recovery and stroke rehabilitation is also contributing to market expansion. The USA market is expected to continue to thrive with government incentives, strong R&D investments, and an increasing focus on workplace safety and mobility assistance.

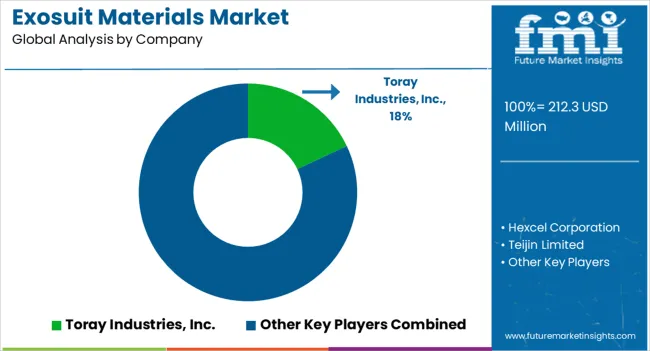

The exosuit materials market is highly competitive, shaped by global leaders such as Toray Industries, Inc., Hexcel Corporation, Teijin Limited, Solvay S.A., 3M, DSM / Avient (polymers), BASF SE, and various other materials suppliers. These companies compete through innovations in high-performance fabrics, shear-thickening fluids, and advanced composites to deliver materials that provide mobility assistance, injury prevention, and enhanced performance in exosuit designs. Toray Industries, Inc. leads with advanced composite materials used in exosuits for military and industrial applications, ensuring lightweight yet durable performance. Hexcel Corporation focuses on carbon fiber composites, providing flexibility and strength for both wearable robotics and defense applications. Teijin Limited offers innovative aramid fibers and composites, strengthening exosuit materials in terms of impact resistance and flexibility. Solvay S.A. is known for its high-performance polymers, improving the wearability and durability of exosuits.

3M capitalizes on its adhesive technologies to integrate materials that ensure secure fittings in dynamic environments. DSM / Avient specializes in polymer solutions that enhance comfort, fit, and resilience for extended use. BASF SE focuses on innovative chemical solutions, developing lightweight, flexible materials with enhanced protective properties for wearable robotics. Competitive strategies involve deep investments in material research, production scalability, and partnerships with exosuit manufacturers to refine performance. Geographic expansion and strategic acquisitions to access new markets are integral to sustaining growth. The future success of these players will depend on cost-efficient, scalable production and enhancing material properties to meet increasing demands in healthcare, industrial, and military applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 212.3 Million |

| Material Type | Carbon fiber composites, High-performance polymers, Advanced textiles and fibers, Metals and alloys, Smart and responsive materials, and Hybrid and composite systems |

| Exosuit Type | Soft exosuits, Rigid exosuits, Hybrid exosuits, Passive exosuits, and Active/powered exosuits |

| Component | Structural components, Actuation systems, Interface materials, Sensor integration materials, and Energy storage and management materials |

| Application | Healthcare and rehabilitation, Industrial and construction, Military and defense, Sports and fitness, Aerospace and aviation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toray Industries, Inc., Hexcel Corporation, Teijin Limited, Solvay S.A., 3M, DSM / Avient (polymers), BASF SE, and Other materials suppliers |

| Additional Attributes | Dollar sales, share, demand across healthcare, military, industrial sectors, material performance, cost reduction strategies, competitive positioning, R&D trends, market growth by region, and adoption in wearable robotics. |

The global exosuit materials market is estimated to be valued at USD 212.3 million in 2025.

The market size for the exosuit materials market is projected to reach USD 636.1 million by 2035.

The exosuit materials market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in exosuit materials market are carbon fiber composites, _carbon fiber reinforced polymers (cfrp), _carbon nanotubes (cnt) enhanced composites, _carbon-carbon composites, high-performance polymers, _polyethylene (pe), _polycarbonate (pc), _polysulfone (psu), _polyphenylene sulfide (pps), _polyetheretherketone (peek), _other high-performance polymers, advanced textiles and fibers, _aramid fibers, _ultra-high-molecular-weight polyethylene (uhmwpe), _polybenzoxazole (pbo) fibers, _technical textiles and functional fabrics, metals and alloys, _aluminum alloys, _titanium alloys, _magnesium alloys, _shape memory alloys, _other metals and alloys, smart and responsive materials, _electroactive polymers, _piezoelectric materials, _magnetorheological fluids, _other smart materials, hybrid and composite systems, _polymer-metal hybrids, _textile-reinforced composites and _multi-material systems.

In terms of exosuit type, soft exosuits segment to command 42.0% share in the exosuit materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Facade Materials Market Size and Share Forecast Outlook 2025 to 2035

Solder Materials Market Size and Share Forecast Outlook 2025 to 2035

Sheath Materials Market Size and Share Forecast Outlook 2025 to 2035

Stealth Materials and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Optical Materials Market - Trends & Forecast 2025 to 2035

Circuit Materials Market Analysis based on Substrate, Conducting Material, Outer Layer, Application, and Region: Forecast for 2025 and 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Fluoride Materials Market

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Strapping Materials Market Size and Share Forecast Outlook 2025 to 2035

Smart Card Materials Market Size and Share Forecast Outlook 2025 to 2035

Electronic Materials and Chemicals Market Analysis by Product, Application, End Uses, and Region through 2035

3D Printing Materials Market Analysis by Material Type, Form, Application, and Region from 2025 to 2035

Competitive Breakdown of Luminescent Materials Suppliers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA