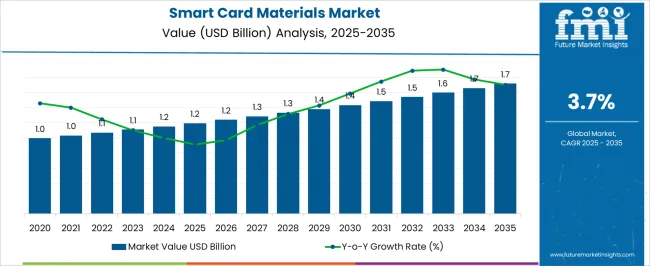

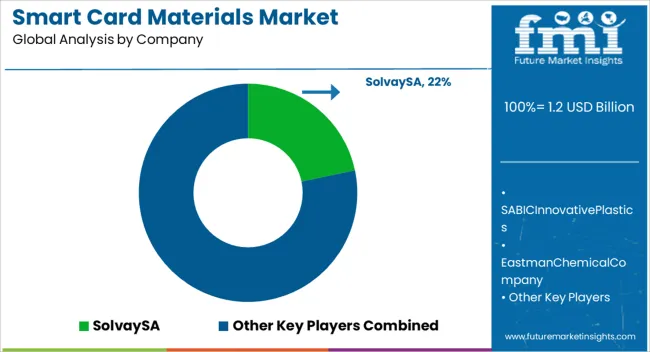

The Smart Card Materials Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period. The contribution of volume vs. price growth analysis shows that both factors play a role in this gradual market expansion.

From 2025 to 2029, the market grows from USD 1.0 billion to USD 1.2 billion, with volume growth being the primary driver. This period reflects the increasing demand for smart cards in various sectors such as payment systems, identification, and access control, where the need for secure, durable materials continues to rise.

Between 2029 and 2031, price growth begins to play a more significant role as manufacturers adopt advanced materials and technology to enhance the security and functionality of smart cards. During this phase, from USD 1.2 billion to USD 1.3 billion, the market sees incremental growth due to the higher value-added components in smart cards, such as contactless technology and embedded microchips.

From 2031 to 2035, both volume and price contribute to the market’s rise from USD 1.4 billion to USD 1.7 billion. The price growth is driven by advancements in smart card technologies, as the demand for more sophisticated, high-security applications increases.

| Metric | Value |

|---|---|

| Smart Card Materials Market Estimated Value in (2025 E) | USD 1.2 billion |

| Smart Card Materials Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The smart card materials market is experiencing stable expansion due to the global shift toward digital identity, cashless payments, and contactless authentication systems. The increasing deployment of smart cards in banking, public transport, government IDs, and enterprise security has created sustained demand for durable and secure materials that meet both functional and regulatory requirements.

Innovation in card manufacturing has focused on enhancing flexibility, environmental resilience, and compliance with EMV and ISO standards, particularly as cyber threats and physical wear challenge the long-term performance of cards. As biometric, NFC, and blockchain-based applications gain traction, material selection is being influenced by compatibility with embedded microcontrollers and antennas.

The continued migration toward contactless infrastructures, particularly across emerging economies and public sector digitization programs, is further strengthening the need for adaptive smart card substrates. Future market outlook remains positive, supported by the integration of advanced polymers, eco-friendly alternatives, and rising smart infrastructure investments from both private and government entities.

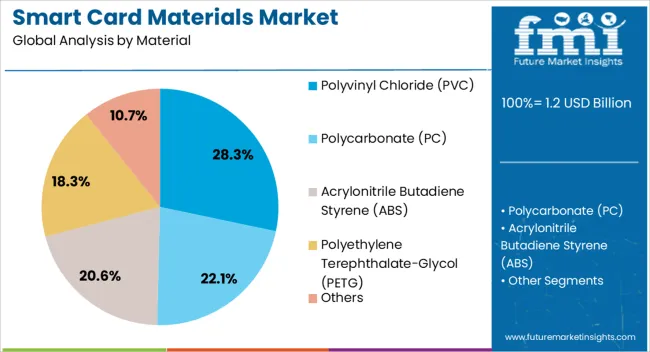

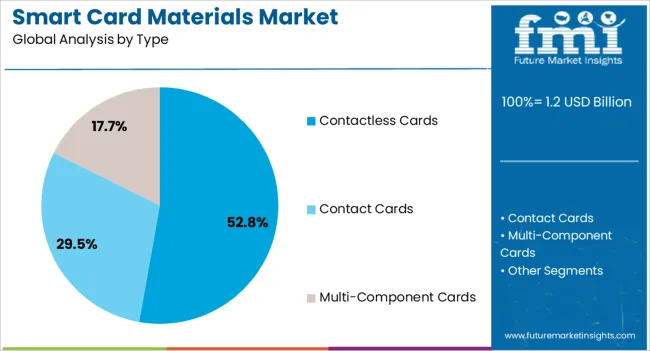

The smart card materials market is segmented by material, type, end use, and geographic regions. By material, the smart card materials market is divided into Polyvinyl Chloride (PVC), Polycarbonate (PC), Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate-Glycol (PETG), and Others. In terms of type, the smart card materials market is classified into Contactless Cards, Contact Cards, and Multi-Component Cards.

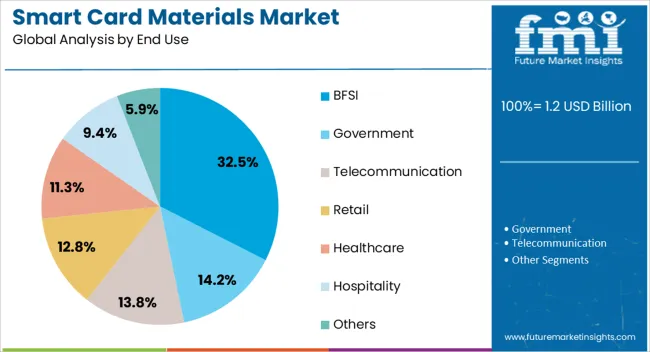

Based on end use, the smart card materials market is segmented into BFSI, Government, Telecommunication, Retail, Healthcare, Hospitality, and Others. Regionally, the smart card materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyvinyl chloride is expected to account for 28.3% of the total revenue share in the smart card materials market in 2025, maintaining its status as a leading material segment. The segment’s dominance has been supported by PVC’s cost efficiency, ease of processing, and compatibility with thermal transfer printing technologies, which are widely used in the production of ID cards, payment cards, and transit passes.

The material’s balanced physical properties including dimensional stability, printability, and resistance to moisture make it suitable for high-volume production environments. PVC is also well integrated into card lamination and overlay structures, ensuring durability over extended usage cycles.

Its adaptability for both contact and contactless formats further enhances its utility across multi-application cards. The material’s acceptance across global manufacturing ecosystems, along with ongoing improvements in formulation for better environmental performance, has solidified PVC’s role in supporting scalable and standardized card production.

The contactless cards segment is projected to contribute 52.8% of the overall revenue share in the smart card materials market in 2025, positioning it as the most dominant card type. Growth in this segment has been largely influenced by the surge in tap-to-pay technologies, public transportation access systems, and secure building entry mechanisms that require fast, frictionless user interactions.

The increasing reliance on NFC and RFID technologies has elevated demand for materials that support embedded antenna structures and maintain electromagnetic integrity during repeated scans. Contactless smart cards are being widely adopted in payment ecosystems due to their role in reducing transaction times and limiting physical contact, which has gained additional importance in post-pandemic environments.

Enhanced data security protocols and seamless integration with mobile ecosystems have further advanced the appeal of contactless solutions. As governments and enterprises accelerate digital transformation, the preference for contactless cards is expected to continue expanding across global markets.

The BFSI segment is forecast to account for 32.5% of the total revenue share in the smart card materials market by 2025, establishing it as the most prominent end-use category. This leadership position is driven by the financial sector’s continuous adoption of EMV-compliant cards, multi-factor authentication systems, and encrypted chip-based payment technologies.

Smart cards in BFSI are being used to facilitate secure digital banking, streamline in-person transactions, and reduce fraud through hardware-level encryption. The sector’s demand for materials that support tamper resistance, high durability, and compliance with global financial standards has significantly influenced product design and innovation.

Material compatibility with dual interface chips, magnetic stripes, and holographic overlays ensures both performance and brand security for financial institutions. As digital wallets, neobanks, and financial inclusion programs expand in both mature and emerging economies, the requirement for high-quality smart card materials in the BFSI domain is expected to remain strong and steadily increase.

The smart card materials market is growing as the demand for secure, efficient, and versatile payment and identification solutions increases. Smart cards, used in applications such as banking, transportation, access control, and healthcare, are made from a variety of materials that ensure durability, security, and functionality. The rise of digital payments, government initiatives for digital identification, and the adoption of contactless technologies are driving the growth of the market. As industries continue to integrate smart cards into their operations, innovations in materials, such as advanced plastics, metals, and conductive films, are playing a significant role in shaping the market.

The smart card materials market is driven by the increased adoption of digital payments and security solutions. As consumers and businesses shift towards digital payment methods, the need for secure and reliable payment systems has grown. Smart cards provide enhanced security features such as chip technology and encryption, making them a preferred choice for financial transactions. Additionally, governments and enterprises are adopting smart cards for identity verification, access control, and healthcare services, further expanding their use. The growing demand for contactless payment solutions, driven by convenience and speed, is also propelling the demand for high-performance smart card materials.

Despite its growth, the smart card materials market faces challenges related to high manufacturing costs and security concerns. The production of smart cards requires advanced materials such as polyvinyl chloride (PVC), polycarbonate, and integrated circuits, which can drive up costs. Additionally, as the use of smart cards increases, the risk of fraud and cyberattacks becomes more prevalent. Manufacturers must continuously improve security features to protect against counterfeit cards and data breaches. Ensuring the protection of sensitive information stored on smart cards while keeping production costs low remains a significant challenge for the market.

The smart card materials market presents significant opportunities, particularly with innovations in materials and the increasing variety of applications. Advancements in material technologies, such as the development of more durable and flexible substrates, are improving the performance and lifespan of smart cards. Additionally, the growing adoption of smart cards in sectors beyond payments, such as government identification, transportation, and healthcare, is expanding the market. The development of multi-functional smart cards that combine payment, identification, and access control capabilities is also creating new growth opportunities, making them more valuable and versatile in various industries.

A key trend in the smart card materials market is the integration of advanced technologies and the growing demand for contactless solutions. The shift towards contactless payments and secure access systems is driving the development of smart cards with enhanced features such as radio-frequency identification (RFID) and near-field communication (NFC). These technologies allow for faster transactions and improved user experience, particularly in sectors like retail, transportation, and healthcare. As consumer preferences for convenience and speed continue to evolve, smart card manufacturers are focusing on integrating these technologies into their products, further driving the growth of the market.

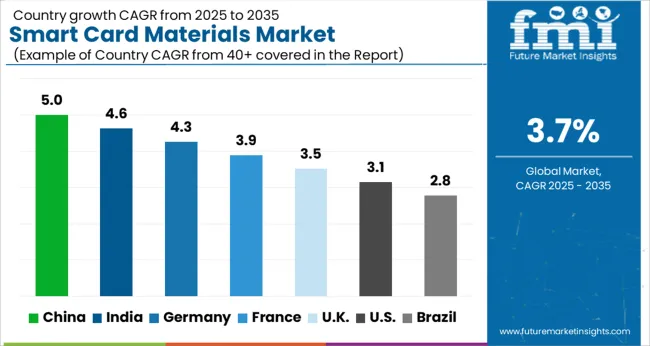

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

Global smart card materials market demand is projected to rise at a 3.7% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 5.0%, followed by India at 4.6%, and Germany at 4.3%, while the United Kingdom records 3.5% and the United States posts 3.1%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: expanding e-commerce, banking sector growth, and increasing government initiatives for digitalization in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established usage. The analysis includes over 40+ countries, with the leading markets detailed below.

The smart card materials market in China is growing at a CAGR of 5.0%, driven by the country’s increasing reliance on digital payments, banking services, and e-commerce. The government’s push for digitalization across various sectors, including transportation, healthcare, and banking, is significantly contributing to the demand for smart cards. China’s rapid growth in the use of mobile payments and smart cities has led to a greater demand for secure, high-performance smart cards. China’s advancements in technology and its extensive manufacturing base are supporting the market’s growth by reducing production costs and improving the quality of smart card materials.

The smart card materials market in India is expanding at a CAGR of 4.6%, supported by the country’s growing financial inclusion efforts and increasing adoption of digital payment solutions. The government’s push towards a cashless economy, particularly through initiatives like the Digital India campaign, is driving the demand for smart cards in banking and financial services. The growing need for secure identification in government services and transportation is fueling market growth. India’s increasing demand for mobile wallets and digital banking solutions, combined with its expanding urban population, further drives the need for smart card materials.

Germany’s smart card materials market is growing at a CAGR of 4.3%, supported by its strong banking and financial services sector, which continues to invest in secure payment technologies. The demand for smart card materials is increasing as the country embraces more secure forms of payment, particularly with the rising adoption of contactless payments in retail and transportation. Germany’s strict data protection regulations and emphasis on digital security also contribute to the demand for advanced smart cards. The focus on secure government IDs and access control systems drives the use of smart card materials.

The United Kingdom’s smart card materials market is growing at a CAGR of 3.5%, with steady demand driven by the financial services, healthcare, and transportation sectors. The increasing adoption of digital payments, especially contactless cards, is driving the demand for smart card materials. Additionally, the UK’s focus on secure identification, particularly in the healthcare sector for patient identification and in government services, is fueling the use of smart cards. Despite moderate growth compared to emerging markets, the UK remains a key market for smart cards, supported by a mature financial sector and advanced infrastructure.

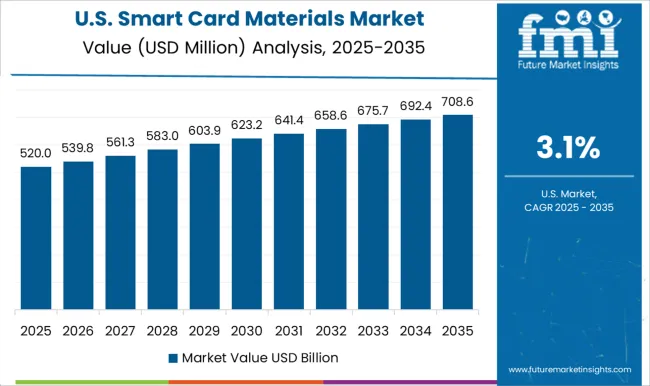

The USA smart card materials market is growing at a CAGR of 3.1%, with steady demand primarily from the banking, transportation, and government sectors. The USA market continues to rely heavily on secure payment technologies, particularly in the form of contactless cards and chip-enabled credit cards. Government initiatives to digitize identification systems, such as driver’s licenses and national IDs, are contributing to the increased use of smart cards. While the market is mature, the rising demand for secure and efficient transactions, particularly in the e-commerce and mobile payment sectors, supports continued growth.

The smart card materials market is driven by key players offering advanced materials for the production of smart cards, which are widely used in applications such as payment systems, identification, and access control. Solvay SA is a major player in the market, providing high-performance polymer materials used in smart cards, focusing on durability, security, and ease of processing. SABIC Innovative Plastics, a division of SABIC, offers specialized plastic materials used in the manufacture of smart cards, emphasizing strength, flexibility, and security.

Eastman Chemical Company is recognized for its advanced polymer solutions, supplying materials that enhance the security and functionality of smart cards, particularly in banking and identification systems. BASF SE offers a wide range of materials for smart card production, including high-quality polymers and additives that provide excellent performance and durability, ensuring long-term use in payment and identification cards. Teijin Ltd. is known for providing innovative materials, including high-performance resins and coatings, designed to enhance the security and functionality of smart cards. LG Chemicals (LG Corp.) manufactures high-quality polymer materials for smart card production, offering solutions that focus on enhancing the performance and security features of the cards. PetroChina Company Limited supplies raw materials, including resins, used in the production of smart cards, with a focus on quality, cost-effectiveness, and performance optimization for large-scale production.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Material | Polyvinyl Chloride (PVC), Polycarbonate (PC), Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate-Glycol (PETG), and Others |

| Type | Contactless Cards, Contact Cards, and Multi-Component Cards |

| End Use | BFSI, Government, Telecommunication, Retail, Healthcare, Hospitality, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SolvaySA, SABICInnovativePlastics, EastmanChemicalCompany, BASFSE, TeijinLtd, LGChemicals(LGCorp), and PetroChinaCompanyLimited |

| Additional Attributes | Dollar sales by product type (polymer materials, additives, coatings, resins) and end-use segments (payment cards, identification cards, access control, healthcare). Demand dynamics are driven by the growing use of smart cards in payment systems, identity verification, and government applications, as well as innovations in card security features and materials. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with increasing demand for secure and durable smart cards contributing to market expansion. |

The global smart card materials market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the smart card materials market is projected to reach USD 1.7 billion by 2035.

The smart card materials market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in smart card materials market are polyvinyl chloride (pvc), polycarbonate (pc), acrylonitrile butadiene styrene (abs), polyethylene terephthalate-glycol (petg) and others.

In terms of type, contactless cards segment to command 52.8% share in the smart card materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Smart Cold Therapy Machine Market Size and Share Forecast Outlook 2025 to 2035

Smart Personal Assistance Devices Market Size and Share Forecast Outlook 2025 to 2035

Smart Speaker Market Size and Share Forecast Outlook 2025 to 2035

Smart Vehicle Architecture Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Smart Doorbell Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Smart Welding Monitoring Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA