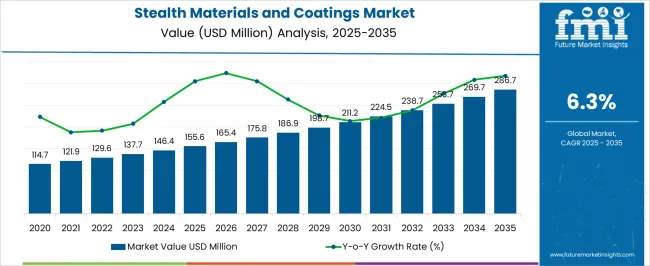

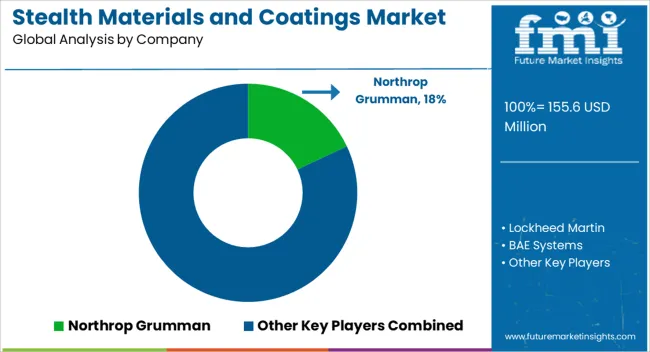

The stealth materials and coatings market is estimated to be valued at USD 155.6 million in 2025 and is projected to reach USD 286.7 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

The stealth materials and coatings market, estimated at USD 155.6 million in 2025 and advancing to USD 286.7 million by 2035 at a CAGR of 6.3%, demonstrates a steady acceleration pattern followed by moderated yet consistent growth. In the initial phase from 2020 to 2025, the market moved from USD 114.7 million to USD 155.6 million, indicating a gradual acceleration as military modernization programs prioritized radar-absorbing coatings and low-observable materials for next-generation aircraft and naval platforms. From 2026 to 2030, the trajectory steepens, expanding from USD 165.4 million to USD 211.2 million, capturing more than one-third of the decade’s incremental value.

This acceleration is attributed to widespread deployment of stealth retrofits on legacy fleets and new procurement of unmanned systems requiring advanced signature reduction solutions. Beyond 2030, growth continues but begins to show a slight deceleration in pace, with the market rising from USD 224.5 million in 2031 to USD 286.7 million by 2035. While still robust, this slower curve reflects a shift from aggressive procurement cycles toward steady replacement demand and coating maintenance programs, as many fleets would already be equipped with stealth-compatible materials. The overall growth path highlights an acceleration phase during mid-decade followed by a measured deceleration, marking the transition from adoption to consolidation.

| Metric | Value |

|---|---|

| Stealth Materials and Coatings Market Estimated Value in (2025 E) | USD 155.6 million |

| Stealth Materials and Coatings Market Forecast Value in (2035 F) | USD 286.7 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The stealth materials and coatings market occupies a significant position within the broader defense and aerospace materials sector, accounting for approximately 18–20% of overall material and component sales, reflecting increasing investment in low-observable technologies. Within advanced aerospace surface treatments, stealth coatings represent about 12–14% of the share, driven by adoption in fighter jets, unmanned aerial vehicles (UAVs), and military transport aircraft requiring radar cross-section reduction and infrared signature management. In naval applications, stealth materials contribute close to 8–10% of surface treatment systems, as naval vessels integrate radar-absorbing panels and specialized paints to enhance survivability. The share within defense procurement for next-generation platforms stands at roughly 6–8%, supported by demand from government programs emphasizing reduced detectability and enhanced mission effectiveness.

Growth is underpinned by evolving military doctrines prioritizing electronic warfare resistance, multi-domain operations, and enhanced survivability of high-value assets. Material innovations in radar-absorbing composites, polymer-based coatings, and multifunctional surface layers improve durability, reduce maintenance cycles, and allow integration with advanced sensors. Expansion is also driven by partnerships between defense contractors and specialized material suppliers to scale production and localize critical supply chains. Rising global defense budgets and modernization initiatives across North America, Europe, and Asia-Pacific further strengthen market adoption and long-term growth prospects.

The market is experiencing accelerated growth, driven by increasing investments in advanced defense technologies and the rising need for radar evasion capabilities. Nations are prioritizing stealth technology development to enhance survivability and operational efficiency in both aerial and naval platforms. The market is benefiting from advancements in composite materials, nanotechnology, and electromagnetic wave absorption techniques that enable higher performance and durability.

Growing defense budgets, combined with heightened geopolitical tensions, are fostering demand for stealth solutions across military programs. The adaptability of these materials for different platforms and their capability to reduce detection by radar, infrared, and other tracking systems are key growth enablers.

Furthermore, collaborations between defense agencies and material science companies are fostering innovation, allowing for the development of coatings and materials with superior thermal resistance and environmental durability The future outlook is supported by continuous R&D investments, making stealth materials and coatings an integral component of next-generation defense systems globally.

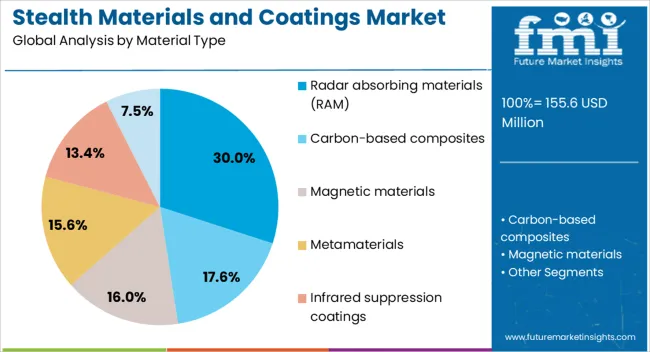

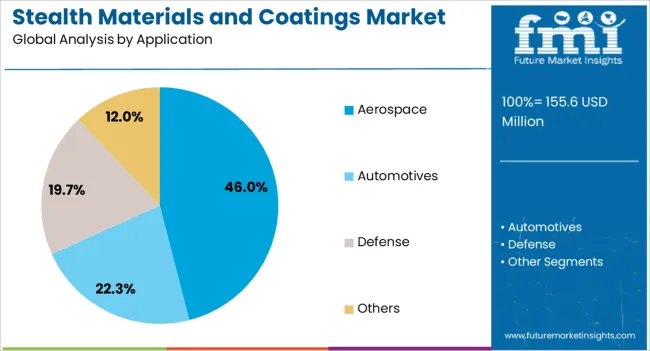

The stealth materials and coatings market is segmented by material type, application, and geographic regions. By material type, stealth materials and coatings market is divided into radar absorbing materials (RAM), carbon-based composites, magnetic materials, metamaterials, infrared suppression coatings, and others (ceramic materials, nanomaterials, polymer composites, etc). In terms of application, stealth materials and coatings market is classified into aerospace, automotives, defense, and others. Regionally, the stealth materials and coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The radar absorbing materials (RAM) segment is projected to hold 30% of the Stealth Materials and Coatings market revenue share in 2025, making it the leading material type. Growth in this segment has been supported by its critical role in reducing radar cross-section, thereby enhancing the stealth capabilities of aircraft, ships, and ground vehicles.

RAM is favored for its ability to attenuate electromagnetic waves through advanced material compositions that convert radar energy into heat or scatter it away from detection systems. Its adoption has been further strengthened by ongoing improvements in lightweight and high-durability formulations, enabling better fuel efficiency and performance in military platforms.

The scalability of RAM for integration into various structural components has made it a preferred choice in defense manufacturing Additionally, advancements in polymer and composite technologies have allowed for the creation of materials that maintain high stealth performance even in extreme operational environments, ensuring their continued dominance in the market.

The aerospace segment is expected to command 46% of the Stealth Materials and Coatings market revenue share in 2025, establishing itself as the leading application. Its growth has been driven by the increasing deployment of stealth-enabled aircraft for both defense and strategic reconnaissance missions. Aerospace applications require materials and coatings that can withstand high-speed aerodynamic conditions while maintaining superior radar and infrared signature reduction.

Investments in next-generation fighter jets, unmanned aerial vehicles, and long-range bombers have accelerated the demand for high-performance stealth solutions in this segment. The ability of stealth materials to integrate seamlessly with advanced avionics and airframe structures has further supported their adoption.

Additionally, stringent defense requirements for survivability in contested airspaces have placed a premium on aerospace stealth capabilities Continuous advancements in coating formulations and structural integration methods are expected to reinforce the aerospace sector’s dominant position in the market, ensuring sustained demand over the forecast period.

Stealth materials and coatings are central to enhancing aircraft, naval, and vehicle survivability through signature reduction. Growth is supported by expanding defense procurement, multi-domain deployment, and advanced material adoption.

Stealth materials and coatings are increasingly applied to reduce radar, infrared, and acoustic signatures of military aircraft. Low-observable technologies such as radar-absorbing composites, nanostructured coatings, and hybrid polymer layers are adopted across fighter jets, bombers, and UAVs. These materials contribute to improved mission effectiveness by enabling aircraft to operate in contested environments while reducing detection probability. Integration with structural components allows for weight optimization without compromising performance. Procurement programs emphasize lightweight, multifunctional coatings that can endure harsh operational conditions. Partnerships between OEMs and specialty material suppliers facilitate customization for platform-specific requirements. The growing complexity of aerial threats drives adoption of coatings that mitigate multiple detection modes simultaneously, enhancing tactical advantages. Maintenance-friendly formulations are also being prioritized to reduce downtime and lifecycle costs.

Stealth coatings are critical for naval vessels, including frigates, destroyers, and submarines, to minimize radar cross-section and infrared signatures. Radar-absorbing paints, anechoic tiles, and specialized polymer coatings are applied to hulls, masts, and control surfaces. This enhances survivability in high-threat maritime zones and supports multi-domain naval operations. Demand is driven by modernization initiatives, especially for fleets operating in contested waters or alongside allied forces. Coating solutions are engineered for durability against corrosion, saltwater exposure, and mechanical wear. OEMs and naval contractors invest in modular and scalable solutions to accelerate deployment across multiple vessel classes. Operational efficiency benefits from extended maintenance cycles and improved detection avoidance. Regional defense budgets and strategic procurement programs further reinforce the adoption of these materials.

Stealth materials are being incorporated into armored vehicles, tanks, and military transport units to reduce detectability across electromagnetic and thermal spectrums. Radar-absorbing composites, infrared suppressive paints, and multi-layer coatings improve survivability in battlefield operations. Integration extends to turrets, weapon mounts, and auxiliary systems without compromising mobility or payload. Defense contractors focus on lightweight and durable coatings that withstand abrasions, chemical exposure, and high-speed deployment. Collaborative research programs with material science companies ensure tailored solutions for specific threat profiles. Lifecycle management is simplified through coatings that maintain performance over repeated missions. Adoption is further supported by government programs seeking fleet-wide standardization of low-observable materials to maintain tactical parity with advanced adversaries.

Rising defense budgets, modernization of air, naval, and ground platforms, and multi-national procurement programs drive steady expansion of stealth materials and coatings. Investments are focused on next-generation platforms requiring integrated signature management, including UAVs, next-gen fighters, and advanced naval vessels. Suppliers are scaling production capabilities and entering strategic partnerships to meet global demand. Multi-functional coatings that combine radar absorption, infrared suppression, and corrosion resistance are increasingly prioritized. Governments emphasize localized manufacturing and strategic stockpiling to ensure uninterrupted supply for critical defense programs. The competitive landscape is shaped by innovation in material chemistry, coating application processes, and adherence to military standards. Ongoing R&D ensures incremental performance improvements while minimizing operational costs and maintenance requirements.

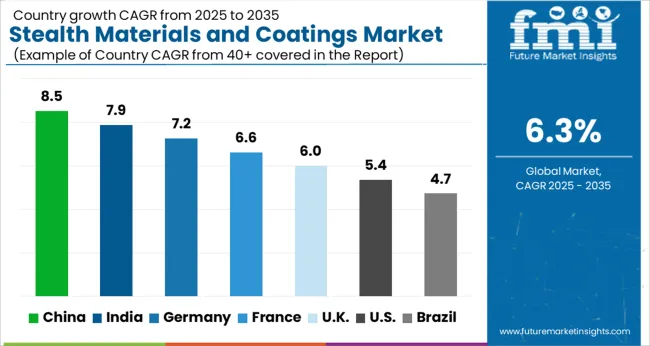

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

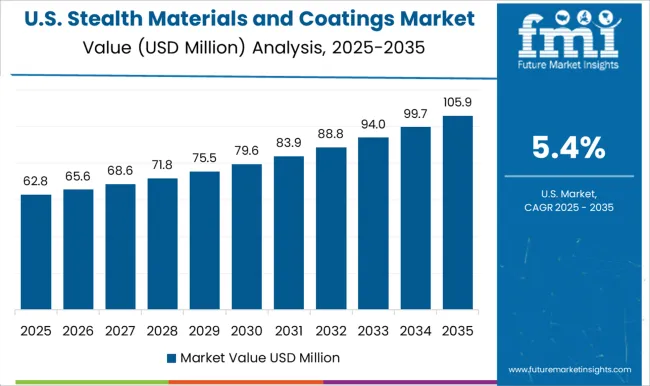

| USA | 5.4% |

| Brazil | 4.7% |

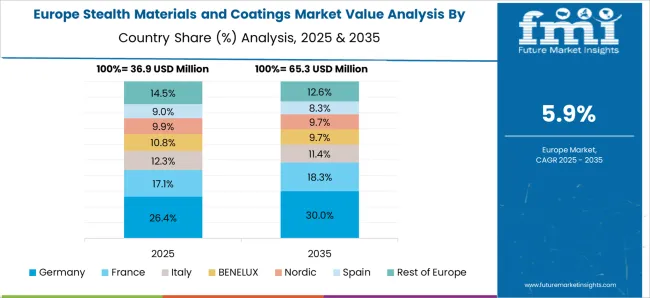

The stealth materials and coatings market is projected to grow globally at a CAGR of 6.3% between 2025 and 2035, supported by increasing defense modernization programs, adoption of low-observable technologies, and expansion in aerospace, naval, and ground platforms. China leads with a CAGR of 8.5%, driven by rapid military platform upgrades, investment in next-generation aircraft and UAVs, and increased demand for radar-absorbing and infrared-suppressive coatings. India follows at 7.9%, fueled by defense procurement initiatives, modernization of fighter jets and naval vessels, and partnerships with specialized material suppliers. France posts 6.6%, benefiting from the refurbishment of air and naval assets and integration of advanced coatings in new defense projects. The United Kingdom grows at 6.0%, supported by fleet modernization, stealth integration in next-gen aircraft, and regional defense R&D programs, while the United States records 5.4%, reflecting steady demand from defense budgets, upgrades to existing platforms, and signature reduction initiatives. The analysis spans over 40 countries, with these six markets serving as benchmarks for technology adoption, material standardization, and strategic procurement planning in the global stealth materials and coatings sector.

China is expected to post a CAGR of 8.5% during 2025–2035, slightly higher than the 7.2% recorded between 2020–2024, reflecting accelerated defense modernization programs and adoption of radar-absorbing and infrared-suppressive coatings. The initial phase saw moderate growth due to incremental upgrades of legacy aircraft, naval vessels, and armored platforms. The next decade will witness more aggressive expansion driven by next-generation fighter aircraft, UAV deployments, and increased domestic production of low-observable coatings. Partnerships between global material suppliers and Chinese defense contractors are expected to facilitate technology transfer and localized production capacity. Rising investment in aerospace R&D and indigenous stealth platforms will further enhance penetration.

India is projected to register a CAGR of 7.9% between 2025–2035, higher than the 6.4% achieved during 2020–2024, reflecting increasing defense procurement and modernization of air and naval fleets. Early growth was driven by incremental retrofits on fighter jets and naval vessels using imported stealth materials. Growth over the next decade is supported by indigenous aircraft programs, wider adoption of radar-absorbing coatings, and government-driven offset programs with global suppliers. Strategic collaborations with European and American firms are expected to enhance technology access, while increasing domestic production will reduce dependency on imports. Expansion in UAV fleets and defense R&D initiatives will further strengthen demand.

France is forecasted to record a CAGR of 6.6% during 2025–2035, improving from 5.9% during 2020–2024, supported by modernization programs for air force and naval platforms. Earlier growth was constrained by limited retrofits and selective application in defense prototypes. Expansion in the coming decade will be driven by integration of advanced radar-absorbing coatings in fighter aircraft, frigates, and armored vehicles, alongside continuous upgrades of existing fleets. Partnerships with European suppliers and domestic material developers will accelerate adoption. France’s investment in stealth materials R&D and experimental low-observable coatings is expected to enhance market penetration and maintain technological leadership in specialized defense segments.

The UK stealth materials and coatings market is projected to post a CAGR of 6.0% during 2025–2035, up from 5.2% recorded between 2020–2024. Earlier growth reflected selective retrofits in legacy aircraft and naval platforms, while next-decade expansion will be driven by the integration of low-observable technologies in fighter jets, UAVs, and next-generation frigates. Domestic R&D programs, strategic collaborations with North American and European suppliers, and fleet modernization initiatives are key growth drivers. Increasing adoption of radar-absorbing and infrared-suppressive coatings for both manned and unmanned platforms is expected to enhance penetration. Production scaling and material standardization will improve delivery times and unit economics, supporting broader fleet coverage.

The USA is expected to record a CAGR of 5.4% during 2025–2035, slightly higher than 4.7% achieved between 2020–2024, reflecting steady adoption of stealth coatings across air, naval, and ground defense platforms. Growth during the early period was supported by selective retrofits on high-priority aircraft and naval vessels. In the next decade, the market will benefit from continued investment in next-generation aircraft programs, UAVs, and the replacement of aging fleet platforms. Defense material suppliers are enhancing production capacity, developing cost-efficient coating processes, and expanding partnerships with prime contractors. Integration of radar-absorbing and infrared-suppressive materials will increase platform survivability while aligning with evolving defense requirements.

The stealth materials and coatings market is characterized by fierce competition among global defense contractors, specialized material innovators, and regional suppliers targeting military aircraft, naval vessels, and armored platforms. Northrop Grumman maintains a leadership position with advanced low-observable technologies, focusing on radar-absorbing materials, infrared suppression, and integration across fighter jets, UAVs, and tactical platforms. Lockheed Martin provides end-to-end stealth solutions for next-generation aircraft, leveraging proprietary coatings, multi-layer material systems, and platform-level optimization to reduce detectability. BAE Systems emphasizes naval and air applications, combining advanced polymeric and composite coatings with platform-specific engineering expertise to meet stringent operational requirements. Raytheon Technologies delivers radar- and infrared-suppressive coatings supported by extensive defense R&D, ensuring high performance across multiple environments and mission profiles. Intermat Defense specializes in lightweight, durable stealth coatings for tactical vehicles, drones, and unmanned systems, prioritizing rapid application and material adaptability. HyperStealth focuses on camouflage and adaptive coating innovations, offering modular solutions suitable for experimental and operational deployment.

Strategic market approaches include expansion of domestic manufacturing, securing long-term government defense contracts, advancing multi-spectral low-observable materials, forming partnerships with defense agencies, and integrating coatings with emerging platform technologies. Companies are increasingly investing in research to improve thermal management, durability, and application efficiency, while targeting growing defense budgets across North America, Europe, and Asia-Pacific. As defense platforms evolve, the adoption of sophisticated stealth materials and coatings is projected to rise, emphasizing material performance, operational survivability, and alignment with multi-domain warfare requirements. Competitive differentiation stems from proprietary formulations, certification capabilities, rapid production scalability, and strategic alliances with government and prime contractors to ensure platform-specific integration and global reach.

| Item | Value |

|---|---|

| Quantitative Units | USD 155.6 Million |

| Material Type | Radar absorbing materials (RAM), Carbon-based composites, Magnetic materials, Metamaterials, Infrared suppression coatings, and Others (ceramic materials, nanomaterials, polymer composites, etc) |

| Application | Aerospace, Automotives, Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Northrop Grumman, Lockheed Martin, BAE Systems, Raytheon Technologies, Intermat Defense, and HyperStealth |

| Additional Attributes | Dollar sales, share by platform (aircraft, naval, armored), regional adoption trends, defense budget allocations, contract wins, growth by application (radar, infrared, multi-spectral), material type, supplier landscape, and innovation pipelines. |

The global stealth materials and coatings market is estimated to be valued at USD 155.6 million in 2025.

The market size for the stealth materials and coatings market is projected to reach USD 286.7 million by 2035.

The stealth materials and coatings market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in stealth materials and coatings market are radar absorbing materials (ram), carbon-based composites, magnetic materials, metamaterials, infrared suppression coatings and others (ceramic materials, nanomaterials, polymer composites, etc).

In terms of application, aerospace segment to command 46.0% share in the stealth materials and coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stealth Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Facade Materials Market Size and Share Forecast Outlook 2025 to 2035

Solder Materials Market Size and Share Forecast Outlook 2025 to 2035

Sheath Materials Market Size and Share Forecast Outlook 2025 to 2035

Exosuit Materials Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Optical Materials Market - Trends & Forecast 2025 to 2035

Circuit Materials Market Analysis based on Substrate, Conducting Material, Outer Layer, Application, and Region: Forecast for 2025 and 2035

Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Fluoride Materials Market

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Strapping Materials Market Size and Share Forecast Outlook 2025 to 2035

Smart Card Materials Market Size and Share Forecast Outlook 2025 to 2035

Electronic Materials and Chemicals Market Analysis by Product, Application, End Uses, and Region through 2035

3D Printing Materials Market Analysis by Material Type, Form, Application, and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA