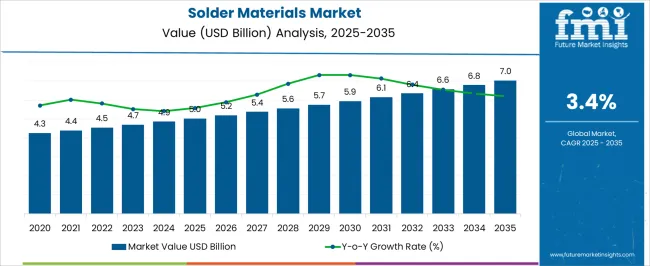

The solder materials market is anticipated to expand from USD 5 billion in 2025 to USD 7 billion by 2035, reflecting a CAGR of 3.4%. This growth is being influenced by the steady demand for reliable and high-performance solder solutions across electronics manufacturing, automotive, and industrial applications. Market expansion is being facilitated by the increasing production of electronic devices, which requires consistent quality and precision in soldering processes.

The focus on minimizing defects and enhancing joint reliability has led to a greater adoption of advanced solder alloys and formulations. Value accumulation in the market is being reinforced by rising requirements for thermal and mechanical performance in end-use applications. Over the forecast period, incremental gains in the solder materials market are being observed as manufacturers prioritize performance, compliance, and cost efficiency. The deployment of specialty alloys, lead-free solutions, and flux-integrated materials is being recognized as a key factor in maintaining product reliability while meeting regulatory standards. Market participants are benefiting from process optimization, supply chain management, and technical support services that enhance adoption rates.

Competitive positioning is being strengthened by suppliers offering tailored solutions for specific applications, ensuring consistency in thermal, electrical, and mechanical properties. Overall, the market is being shaped by steady industrial demand and the need for precision soldering in modern electronic assembly.

| Metric | Value |

|---|---|

| Solder Materials Market Estimated Value in (2025 E) | USD 5.0 billion |

| Solder Materials Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The solder materials market is estimated to hold a notable proportion within its parent markets, representing approximately 12-14% of the electronic materials market, around 15-16% of the electronics assembly materials market, close to 10-11% of the printed circuit board (PCB) materials market, about 8-9% of the semiconductor packaging materials market, and roughly 5-6% of the industrial alloys market.

The cumulative share across these parent segments is observed in the range of 50-56%, reflecting a significant presence of solder materials across electronics assembly, semiconductor packaging, and industrial applications. The market has been influenced by the critical need for reliable electrical and thermal connectivity, where joint strength, material compatibility, and process efficiency are highly prioritized. Adoption is guided by procurement decisions that emphasize lead-free formulations, melting point precision, and flux compatibility to ensure optimal performance in high-density electronics and industrial systems. Market participants have focused on alloy composition, quality control, and production consistency to maintain performance and reliability across diverse electronic and industrial applications.

As a result, the solder materials market has not only captured a substantial share within electronics assembly and PCB materials segments but has also influenced semiconductor packaging and industrial alloy markets, highlighting its strategic role in ensuring device reliability, operational efficiency, and high-quality assembly outcomes across multiple technology and industrial sectors.

The solder materials market is experiencing consistent growth, supported by the accelerating demand for miniaturized and high-performance electronic devices across consumer electronics, automotive, and industrial sectors. The growing complexity of electronic assemblies and the ongoing push toward higher functionality and reliability are increasing the consumption of advanced solder materials.

Rising adoption of lead-free and environmentally compliant solder compositions is being encouraged by regulatory mandates such as RoHS and WEEE, particularly in North America, Europe, and parts of Asia.

Additionally, the expansion of surface-mount technology, combined with increasing automation in electronic assembly lines, is reinforcing demand for paste-based and high-efficiency solder materials. The need for thermal and mechanical stability in solder joints across high-density packaging formats is driving innovation in solder formulations.

With the growing use of electronics in harsh operating environments, solder materials that offer improved wetting, low voiding, and resistance to thermal cycling are gaining preference. As electronic product lifecycles shorten and production scales expand, the market is positioned for steady growth, with manufacturers focusing on performance enhancement and compliance with global sustainability standards.

The solder materials market is segmented by product type, form, process, application, and geographic regions. By product type, solder materials market is divided into Lead-free solder and Lead-based solder. In terms of form, solder materials market is classified into Paste, Wire, Bar, Preforms, and Powder. Based on process, solder materials market is segmented into Wave,reflow, Screen printing, and Selective soldering. By application, solder materials market is segmented into Electronics, Automotive, Aerospace, and Industrial. Regionally, the solder materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

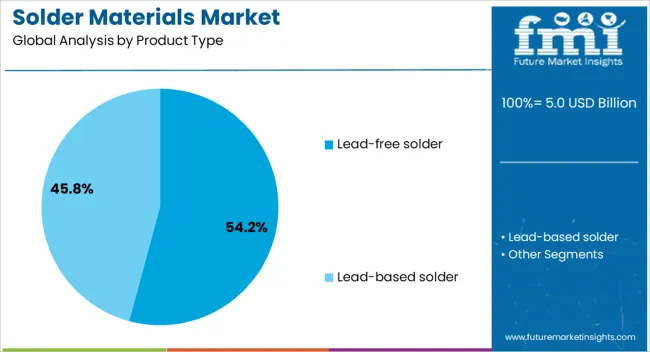

The lead-free solder segment is projected to account for 54.2% of the solder materials market revenue share in 2025, making it the dominant product type. This leadership is being driven by global regulatory frameworks that mandate the reduction or elimination of hazardous substances from electronic products. Lead-free solder materials, particularly those based on tin-silver-copper compositions, offer improved thermal fatigue resistance and mechanical reliability, making them suitable for a wide range of applications.

The increasing preference for environmentally sustainable solutions among original equipment manufacturers is reinforcing the shift toward lead-free alternatives. Enhanced process control technologies and refined alloy formulations have improved the wettability and compatibility of lead-free solders with modern component finishes and substrates.

As high-reliability sectors such as automotive, aerospace, and healthcare electronics demand greater long-term performance, lead-free solders are emerging as the standard Their compliance with international environmental regulations and proven reliability in demanding thermal cycles are expected to support continued adoption across both high-volume consumer electronics and mission-critical industrial applications.

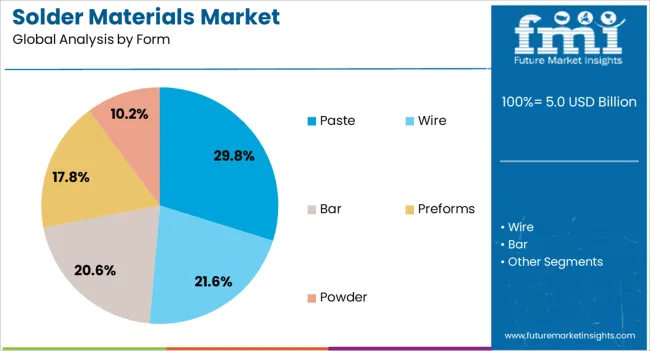

The paste form segment is anticipated to hold 29.8% of the solder materials market revenue share in 2025, making it a leading form category. This segment's growth is being supported by the increasing adoption of surface-mount technology in electronic manufacturing, where solder paste plays a vital role in ensuring precise and reliable component placement. Solder pastes provide a combination of flux and solder particles, enabling effective reflow processes with consistent joint formation and reduced defects.

The segment is also benefiting from advancements in stencil printing, dispensing, and jetting technologies that improve throughput and precision. Enhanced formulations are addressing challenges related to slump, voiding, and oxidation, ensuring superior performance across high-density and fine-pitch assemblies. As demand rises for miniaturized electronics with tighter assembly tolerances, solder paste's role becomes increasingly critical.

The segment's compatibility with a wide range of board finishes and component metallizations adds to its flexibility Its widespread use in consumer electronics, telecom, automotive, and industrial automation is expected to continue driving market dominance.

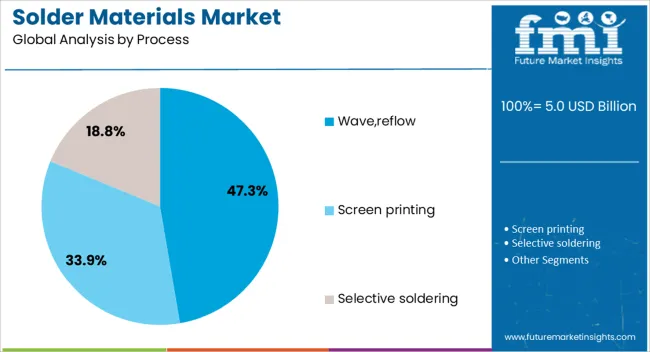

The wave and reflow segment is expected to contribute 47.3% to the solder materials market revenue share in 2025, positioning it as the leading process segment. This dominance is being driven by its extensive use in both through-hole and surface-mount assembly processes. Reflow soldering is particularly vital in high-speed production environments due to its ability to form strong, uniform joints with minimal thermal damage to components.

Wave soldering, on the other hand, remains essential for dual-in-line packages and mixed-technology assemblies. The segment benefits from ongoing advancements in process control, including nitrogen-assisted environments, selective wave soldering, and dynamic profile optimization. These improvements help reduce solder defects, improve wetting, and ensure better process repeatability.

The growing use of complex multilayer PCBs in automotive electronics, medical devices, and telecom equipment is increasing the need for reliable mass soldering techniques, further supporting this segment. As assembly lines continue to evolve with automation and increased throughput, wave and reflow soldering processes are expected to maintain their leadership due to their adaptability, efficiency, and proven reliability across diverse application environments.

The solder materials market is being fueled by rising demand from electronics manufacturing and opportunities in automotive and renewable energy applications. Lead-free and high-performance solder solutions are emerging as prevailing trends, while raw material volatility and process compatibility are being managed as significant challenges. The market is being reinforced by the critical role of solder materials in ensuring reliable interconnections, supporting the growth of miniaturized and high-performance electronic devices, and enabling manufacturers to meet industry standards and sector-specific requirements.

The demand for solder materials is being driven by the expansion of electronics manufacturing across consumer, automotive, and industrial sectors. Printed circuit board (PCB) assembly, electronic packaging, and microelectronics applications are increasingly relying on high-performance solder alloys to ensure reliable electrical connections. Lead-free and low-residue solders are being adopted to meet environmental standards and reduce operational hazards. Manufacturers are being compelled to source materials with superior thermal and mechanical properties, as device miniaturization and higher component densities require precise soldering. Consequently, the growth of electronic device production and advanced assembly techniques is being directly linked to rising solder material consumption, reinforcing the market’s significance in supporting global electronics supply chains.

Opportunities in the solder materials market are being driven by automotive electronics, electric vehicles (EVs), and renewable energy sectors. Electric powertrain components, battery management systems, and solar modules are requiring specialized solder alloys with high conductivity and thermal stability. Market participants are being encouraged to develop advanced solder pastes, wires, and preforms to address sector-specific demands. The integration of solder solutions in industrial automation and IoT devices is also being recognized as a growth avenue. Companies are leveraging this trend to expand portfolios, cater to high-performance applications, and establish partnerships with automotive and energy system manufacturers seeking reliable interconnect solutions.

Trends indicate that lead-free and high-performance solder materials are being increasingly preferred by manufacturers due to regulatory compliance and product reliability requirements. Solder alloys with low melting points, superior wetting properties, and enhanced thermal fatigue resistance are being adopted for miniaturized electronic assemblies. Automated soldering and selective soldering techniques are being paired with advanced materials to ensure consistency in manufacturing processes. Material innovation is being guided by the need to balance mechanical strength with environmental compliance. The rising adoption of surface-mount technology (SMT) and complex component architectures is positioning advanced solder materials as a critical component in modern electronic assembly operations worldwide.

Challenges in the solder materials market are being caused by fluctuations in raw material prices, supply chain uncertainties, and process compatibility issues. Variations in tin, silver, copper, and alloy costs are being reflected in product pricing, affecting manufacturer margins. Differences in soldering temperatures, component types, and flux compatibility are being reported as technical hurdles for end-users. Manufacturers are investing in quality control, alloy standardization, and training to overcome operational challenges. Resistance to adopting new solder compositions and adjusting legacy assembly lines is also slowing market penetration in certain regions, emphasizing the need for solutions that balance performance, cost, and integration flexibility.

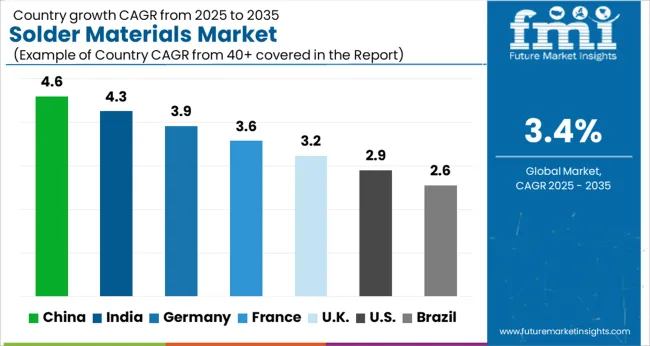

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

The global solder materials market is projected to grow at a CAGR of 3.4% from 2025 to 2035. China leads with a growth rate of 4.6%, followed by India at 4.3%, and Germany at 3.9%. The United Kingdom records a growth rate of 3.2%, while the United States shows the slowest growth at 2.9%. Rising demand for electronics manufacturing, increasing adoption of lead-free solder solutions, and growing need for efficient thermal and electrical conductivity drive market expansion. Emerging economies like China and India experience higher growth due to rapid industrialization, electronics production, and government support for smart manufacturing. Developed markets focus on compliance, sustainability initiatives, and advanced assembly technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The solder materials market in China is projected to grow at a CAGR of 4.6%, driven by the country's robust electronics manufacturing sector, increasing adoption of lead-free and environmentally compliant solder materials, and government support for smart manufacturing initiatives. The electronics assembly industry demands high-reliability materials for applications in consumer electronics, automotive electronics, and industrial devices. Rising awareness about environmental regulations and RoHS compliance encourages manufacturers to adopt advanced solder materials. Investments in R&D and the expansion of electronics production hubs further boost market growth. The increasing use of solder materials in high-performance printed circuit boards and semiconductor devices strengthens market demand.

The solder materials market in India is expected to grow at a CAGR of 4.3%, supported by the expansion of consumer electronics, automotive, and industrial electronics sectors. Demand for high-quality soldering solutions is rising as manufacturers focus on thermal and electrical reliability. Adoption of lead-free and environmentally friendly solder materials is being accelerated by regulatory compliance initiatives. Investments in smart manufacturing, R&D for advanced solder alloys, and growth of domestic electronics assembly units contribute to market expansion. Rising awareness among electronics manufacturers about durability and performance requirements further encourages the use of specialized solder materials.

The solder materials market in Germany is projected to grow at a CAGR of 3.9%, driven by advanced electronics manufacturing, automotive electronics, and industrial automation industries. Adoption of lead-free and environmentally compliant solder materials is being accelerated by strict EU RoHS and REACH regulations. Manufacturers increasingly rely on high-performance solder materials for durable printed circuit boards, automotive electronic assemblies, and renewable energy applications. Investments in research for high-reliability solder alloys and automation-friendly solutions further enhance market growth. Awareness of environmental and performance standards continues to influence adoption trends across the country.

The solder materials market in the UK is expected to grow at a CAGR of 3.2%, supported by growing demand in electronics manufacturing, industrial devices, and automotive sectors. Adoption of lead-free, eco-friendly solder materials is increasing in compliance with EU and local environmental regulations. Manufacturers are integrating advanced soldering solutions to improve electrical conductivity, thermal reliability, and assembly efficiency. Investments in research and development of high-performance alloys and advanced flux materials support market growth. Awareness of environmental and safety standards continues to guide adoption decisions among UK electronics manufacturers.

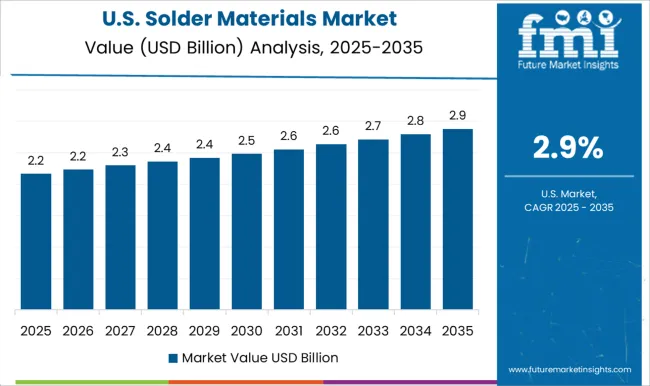

The solder materials market in the USA is projected to grow at a CAGR of 2.9%, driven by demand from consumer electronics, aerospace, and automotive sectors. Adoption of high-reliability and lead-free solder solutions is increasing due to regulatory compliance, RoHS initiatives, and sustainability standards. Manufacturers are investing in advanced solder alloys and flux materials to enhance thermal and electrical performance. Growth in industrial automation, semiconductor assembly, and renewable energy electronics further fuels market demand. Awareness of performance, durability, and environmental compliance continues to guide adoption trends across the USA market.

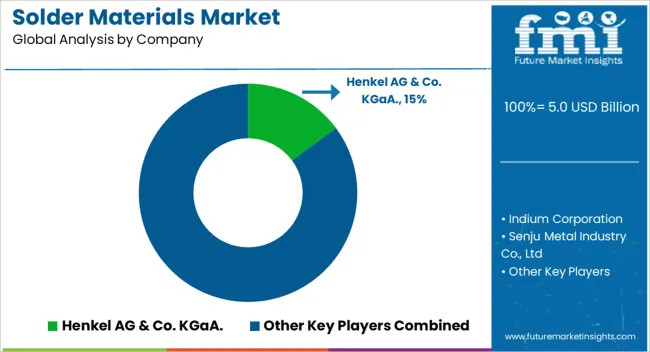

The solder materials market is highly competitive, driven by the increasing demand for reliable electronic interconnections across automotive, consumer electronics, and industrial applications. Key players such as Henkel AG & Co. KGaA, Indium Corporation, and Senju Metal Industry Co., Ltd emphasize high-performance alloys, fluxes, and solder pastes designed for advanced PCB assembly and surface-mount technology. Companies like Element Solution Inc, Koki Company Limited, and Fusion, Inc focus on environmentally compliant solutions, offering lead-free and low-residue options to meet global regulatory standards. Product brochures highlight key attributes such as high thermal conductivity, excellent wetting, and superior mechanical strength. Lucas Milhaupt and Qualitek International, Inc differentiate through specialty alloys and custom formulations tailored for aerospace, automotive, and medical electronics, while Stannol GmbH Co. KG, Premier Industries, and Shital Metals Pvt Ltd stress consistent quality, reliable supply chains, and technical support for end-users.

Competition is intensified by technological advancements, material innovation, and sustainability regulations. Firms prioritize research and development to introduce new solder formulations that enhance joint reliability, reduce voids, and enable miniaturization of electronic components. Strategic partnerships, global distribution networks, and product certifications are highlighted in brochures to strengthen market positioning. Market growth is reinforced by the expansion of IoT, automotive electronics, and industrial automation, which demand high-precision, durable solder materials. The market is characterized by innovation-driven differentiation, regulatory compliance, and strong technical support, ensuring the consistent delivery of high-quality solder solutions across industries worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Product Type | Lead-free solder and Lead-based solder |

| Form | Paste, Wire, Bar, Preforms, and Powder |

| Process | Wave,reflow, Screen printing, and Selective soldering |

| Application | Electronics, Automotive, Aerospace, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Henkel AG & Co. KGaA., Indium Corporation, Senju Metal Industry Co., Ltd, Element Solution Inc, Koki Company Limited, Fusion, Inc, Lucas Milhaupt, Qualitek International, Inc, Stannol GmbH Co. KG, Premier Industries, and Shital Metals Pvt Ltd |

| Additional Attributes | Dollar sales by material type (tin-lead, lead-free, silver-based, fluxed) and form (wire, paste, bar, preforms) are key metrics. Trends include rising demand for electronics manufacturing, growth in automotive and consumer electronics, and adoption of lead-free and high-reliability solder solutions. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global solder materials market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the solder materials market is projected to reach USD 7.0 billion by 2035.

The solder materials market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in solder materials market are lead-free solder and lead-based solder.

In terms of form, paste segment to command 29.8% share in the solder materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Solder Flux Market Size and Share Forecast Outlook 2025 to 2035

Soldering Equipment Market

LED Solder Paste Market Size and Share Forecast Outlook 2025 to 2035

SMT Solder Powder Market Size and Share Forecast Outlook 2025 to 2035

Mini LED Solder Pastes and Fluxes Market Size and Share Forecast Outlook 2025 to 2035

Electric Soldering Iron Gun Market

Selective Soldering Market Growth - Trends & Forecast 2025 to 2035

Demand for SMT Solder Powder in UK Size and Share Forecast Outlook 2025 to 2035

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Facade Materials Market Size and Share Forecast Outlook 2025 to 2035

Sheath Materials Market Size and Share Forecast Outlook 2025 to 2035

Cathode Materials for Solid State Battery Market Size and Share Forecast Outlook 2025 to 2035

Exosuit Materials Market Size and Share Forecast Outlook 2025 to 2035

Stealth Materials and Coatings Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Optical Materials Market - Trends & Forecast 2025 to 2035

Circuit Materials Market Analysis based on Substrate, Conducting Material, Outer Layer, Application, and Region: Forecast for 2025 and 2035

Graphite Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA